Introduction

Comprehending financial statements and performing effective financial analysis are essential skills for CFOs in steering a company's financial helm. These documents, such as the income statement, balance sheet, and cash flow statement, form a puzzle that, when pieced together, reveals the company's overall financial narrative. Each financial document serves a significant purpose, from measuring profitability to evaluating liquidity.

However, despite the digitization of data-driven decision-making, CFOs still face challenges in safely and skillfully handling financial analytics. This article explores the importance of financial analysis, the types of analysis methodologies available, tools and techniques for conducting analysis, common ratios and metrics used, real-world examples of financial analysis, best practices to follow, and common mistakes to avoid. By delving into these topics, CFOs can gain practical insights and strategies for effectively analyzing financial data, ensuring informed decision-making and long-term financial stability and growth.

Understanding Financial Statements

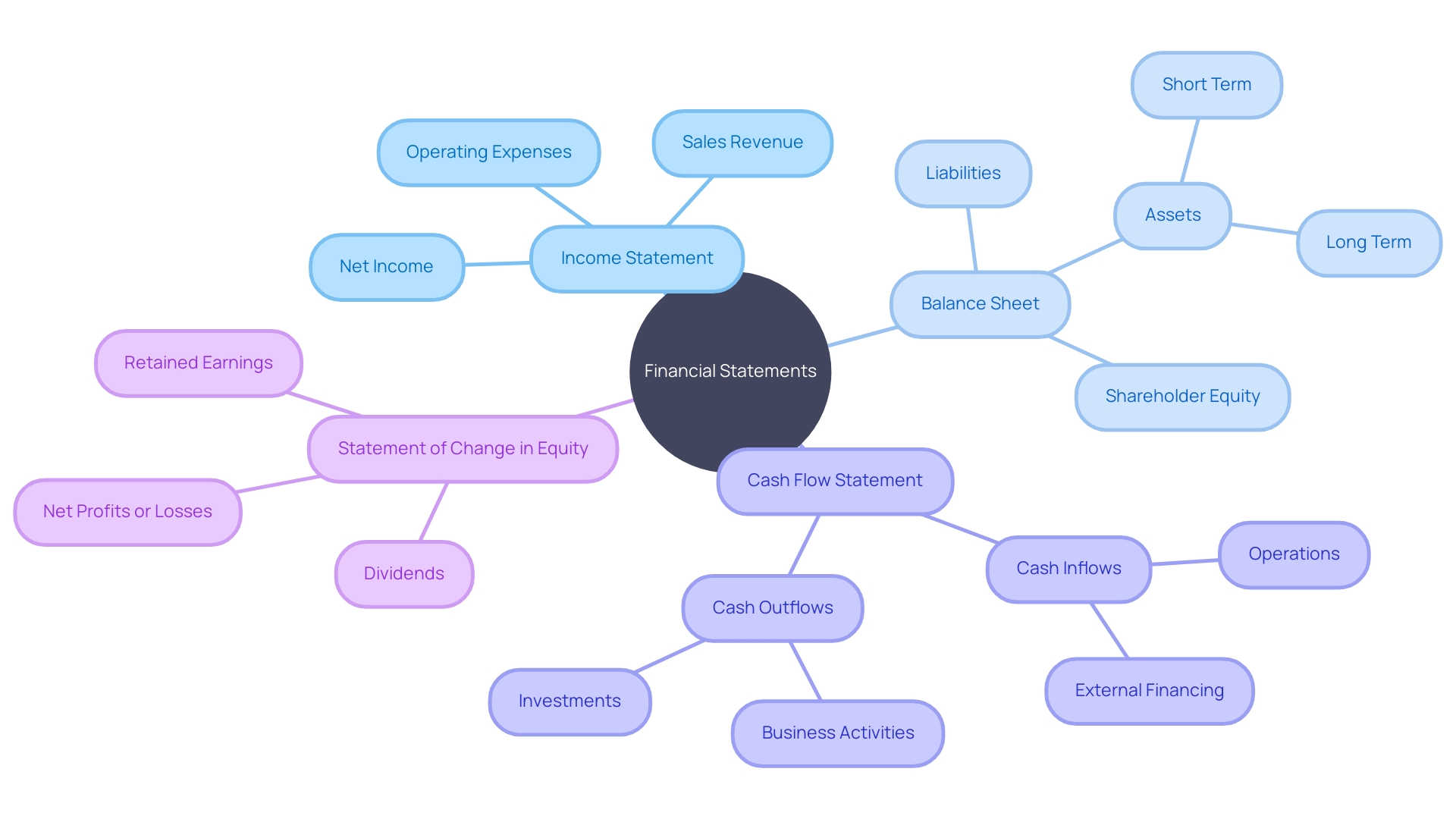

Comprehending financial statements is akin to understanding the lifeblood of a company's finances. These documents—the income statement, balance sheet, and cash flow statement—are meticulously interwoven, reflecting the heritage of the double-entry accounting system pioneered in the 15th century. They serve as a puzzle that, when pieced together, reveals the company’s overall financial narrative.

Experts attest to the significance of each financial document. The income statement, or the profit and loss account, delineates the company's profitability over a certain period, enumerating revenues and expenses. The balance sheet provides a snapshot of the company’s fiscal health at a particular moment in time, visualizing the accounting equation 'Assets = Equity + Liabilities' for clear insights into the entity’s financial competence and liabilities.

Of equal consequence is the cash flow statement, which tracks the actual cash coursing in and out of the business, detailing its liquidity and solvency and showcasing its capacity to generate cash, meet obligations, and maintain resilience in financial uncertainties.

Analyzing the statement of cash flows can unravel the intricate dance between net income and associated cash movements, offering key insights into a company's financial maneuvers. Case in point, it has been identified that financial statement restatements often pivot on the intricacies of cash flow declarations, urging executives to practice stringent internal controls and audits to ensure commensurate quality and oversight on par with other financial statements.

This analysis can be startlingly revelatory: a recent report highlighted a bank modifying its business model to ensure capital stability, which crucially impacted its financial reporting and practices, such as reclassifying bonds to adjust for fair value. A lack of such due diligence can signal alarming underlying issues—sometimes systemic, as observed in financial debacles where overlooked risks led to near insolvency. These real-world examples underscore the perils of ignoring the detailed forensic potential that financial statements harbor.

Yet, despite the ongoing digital advancement and data-backed decision-making—where according to S&P Global survey, over two-thirds of decisions are either mostly or entirely data-driven—the challenge of maintaining impeccably safe and skilled handling of financial analytics persists. Every CFO faces the critical task to interpret and harmonize these reports' data, ensuring decisions are devoid of biases and are secured against cyber threats. It's a demanding yet indispensable part of steering a company's financial helm, invariably shaping its future stability and growth.

Types of Financial Analysis

Businesses have a repertoire of financial analysis methodologies at their disposal to scrutinize their financial wellbeing and guide strategic initiatives. These methodologies, such as ratio analysis, trend analysis, and comparative analysis, delve deeper into the fiscal aspects of a company, providing nuanced insights that are crucial for astute financial navigation.

Ratio analysis dissects financial data, offering a quantifiable view of a company's efficiency, liquidity, and profitability, enabling them to make informed decisions about resource allocation. For Nets, a digital payment solutions company, applying such tools signified a transformative step in making intricate technical data comprehensible and accessible, allowing stakeholders to independently explore and understand financial health.

Trend analysis, meanwhile, goes beyond static snapshots of financial data, charting out patterns and trajectories that signal shifts in a company's performance over time. It's akin to the experience of a financial market expert who, over 12 years of industry engagement, identified that transparent and systematic performance analysis is instrumental to understand and respond to the market dynamics effectively.

Comparative analysis offers a Third Avenue, benchmarking an organization's performance against peers or industry standards to determine competitive standing. It's exemplified by the notion of dividend potential, a key metric used to gauge a firm's capacity to generate profits and secure shareholder returns, offering insights into a company's comparative advantage in the marketplace.

The use of such diverse financial analysis types is not merely a technical exercise but a strategic imperative in today's data-driven decision-making landscape. Recent surveys by S&P Global showcase that approximately 25% of respondents make almost all decisions based on data, and it is clear that being adept at these techniques is essential. However, the growth of financial data analysis is tempered by challenges such as data security concerns, especially as the cloud becomes a popular data storage solution, and a pressing shortage of data science professionals skilled in translating data into actionable strategies.

Regulatory compliance remains a pivotal concern for organizations, further underscoring the need for competent financial analyses.

Employing these analytical techniques predisposes business leaders to deepen their comprehension of financial complexities and fortify strategic decision-making, ultimately strengthening the company's financial fortitude and ensuring sustainable growth.

Tools and Techniques for Financial Analysis

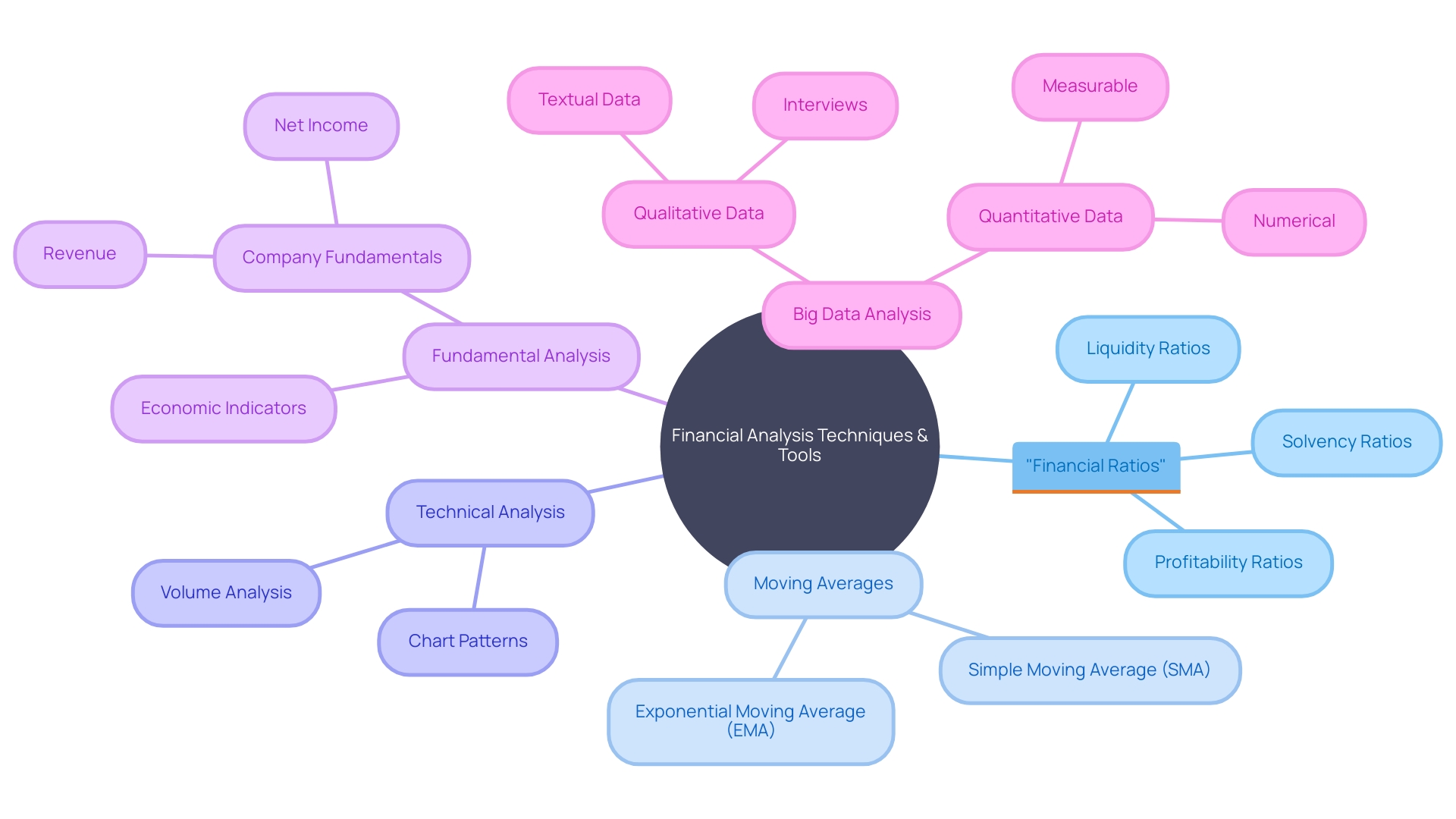

- Executing robust financial analysis necessitates the adept application of a range of tools and methodologies tailored to dissecting a company's financial health. For instance, financial ratios—be it liquidity, profitability, or solvency ratios—offer a quantifiable glance into the company's financial capabilities and limitations. These ratios, by portraying financial data as relative values rather than absolute numbers, allow for meaningful comparisons within or across industries.

- Delving deeper, trend analysis stands out as a potent technique. Moving averages, such as the Simple Moving Average (SMA) and Exponential Moving Average (EMA), serve as the linchpin here. Primarily, they are exploited to level out market price fluctuations, providing a clarified perspective on underlying patterns.

- Recognizing that financial assets like equities and bonds possess unique characteristics makes their analysis particularly intriguing. Equities, for example, represent a stake in a company's ownership, while bonds are more akin to loans extended to governments or companies, rewarding lenders with a fixed interest payout.

- The scope of technical analysis stretches beyond mere examination of past and present stock prices to extricate insights into future market behavior. Through this premise, it postulates that all market-related decisions collectively mirror the comprehensive spectrum of available information.

- An illustrious illustration of financial analysis in action is underpinned by the praise directed towards Financial Engineer Alan Galecki's analytical acumen. His peerless evaluations, lauded for their precision and clarity, demonstrate the caliber of analysis that drives informed investment decisions.

- Pertinently, fundamental analysis augments the arsenal of financial tools, evaluating whether current market prices authentically embody anticipated future values. This approach incorporates intrinsic valuation measures such as Price-to-Earnings (PE), Price-to-Earnings-Growth (PEG), and Price-to-Book (P/B) ratios.

- Emphasizing the vital role financial ratios play, they are distinguished as decluttering instruments, stripping away the extraneous to spotlight the German details in a company's financial narrative. This capability to benchmark against peers and industry standards underscores their indispensability in financial evaluation and strategic decision-making processes.

These practices form the bedrock of a comprehensive financial analysis, empowering the assessor to draw informed conclusions and chart strategic financial courses with confidence.

Common Financial Ratios and Metrics

Understanding and applying financial ratios proficiently can shed light on a company's operational effectiveness, liquidity, and profitability. For instance, the current ratio offers a quick glimpse at the firm's capacity to cover short-term liabilities with short-term assets, which is fundamental for maintaining liquidity. Delving into return on investment (ROI) can indicate the efficiency of invested capital in generating profits, while an analysis of the gross margin reveals how well a company manages production costs against sales revenue.

The practical application of these metrics is well illustrated by the case of Monday.com. Having grown efficiently, it reached free cash flow positivity rapidly post-growth slowdown, showcasing the power of robust gross margins. The company has adeptly demonstrated that not all revenue is equal, and the judicious management of gross margins can significantly impact the creation of shareholder value over time.

Moreover, amidst today's increasing corporate bankruptcies—a peak since 2010 led by entities such as Bed Bath & Beyond, and Yellow—it's crucial to closely monitor financial health indicators like the debt to equity ratio. This metric is essential when evaluating and comparing the debt levels of different companies within the same industry, offering a standardized view of leverage and potential financial risk.

Further examining financial ratios, they go beyond mere numbers on financial statements. As articulated by experts, their transformation into percentages allows for a commensurate analysis of businesses within the same sector or across different industries. This standardized metric serves professionals across various business domains—not limited to accountants and consultants—in identifying potential concerns and assessing overall financial stability, which informs strategic decisions and risk or credit assessments.

In applying these tools, remember the historical context of accounting, with its origin tracing back to Ancient Mesopotamia, and how it has evolved to track financial assets and obligations. Insight into dividend potential—especially important to income investors—adds another layer to assessing a business's performance, considering not only current profitability but also factors like management prowess and competitive edge.

Leveraging this broad spectrum of financial ratios enables a deeper understanding of a company's economic tapestry, serving as a gateway to informed decision-making that ensures both immediate operational needs and long-term financial ambitions are appropriately balanced.

Case Studies: Real-World Examples of Financial Analysis

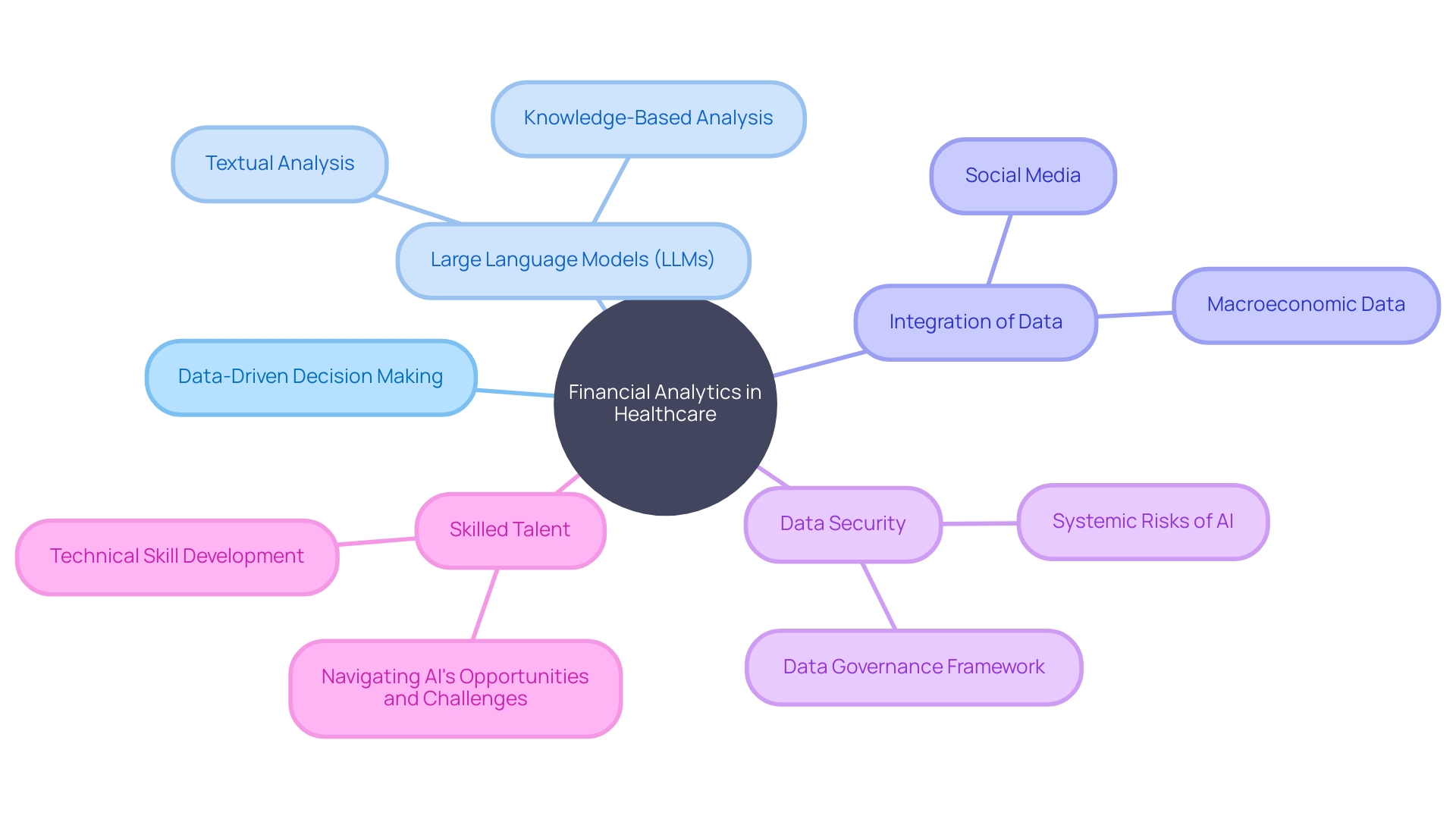

Delving into practical case studies of financial analytics within the healthcare sector offers CFOs a blueprint for leveraging such insights back into their own organizations. Real-world scenarios from healthcare, an industry that juggles with extensive yet fragmented data and suffers from convoluted administrative bureaucracy, shine a spotlight on the pertinent need for adept financial analysis. Consider this: healthcare companies function on two levels – a corporate framework which encompasses departments such as engineering and growth, and a more direct patient care level which includes clinicians and generates revenue through insurance and patient collections.

The key is identifying strategies to boost fundamental financial performance across these tiers.

Mario Schlosser, co-founder of Oscar Health, speaks to the power of Large Language Models (LLMs) in distilling unstructured data into actionable insights, a capability that's transforming healthcare financial administration. A quintessential example is a physician organization beleaguered by the cumbersome task of creating key management reports. By reconfiguring disjointed report creation – once the purview of a trio of business analysts – through the application of LLMs, the process has exemplified automation's benefits in real-time financial data handling.

Moreover, a 2023 survey by S&P Global illustrated the burgeoning trend towards data-driven decision-making, with 69% of respondents saying most, if not all, of their choices are influenced by data metrics. This pivot highlights the avoidance of bias, increases the reliance on evidence-based strategies, thereby enhancing the competitiveness of the organization.

The paper on the arXiv preprint server also echoes our current understanding; integrating social media and macroeconomic data has the potential to pivot stock market analysis. This fusion hints at a future where financial insights could be increasingly gleaned from an amalgamation of data sources beyond the traditional scope.

Yet, with the influx of data into such analytics, CFOs must remain vigilant about cybersecurity risks and anticipate professional expertise shortages, with the deficit nearing 200,000 skilled data professionals in 2022. Fortifying data security protocols and nurturing skilled talent becomes crucial to the sustainable utilization of financial analytics tools.

In essence, CFOs observing the healthcare sector’s foray into sophisticated data analytics, with LLMs spearheading the charge, can extract powerful strategies for adoption within their diverse business landscapes. It's not merely the aggregation of data but the conversion of voluminous data streams into discernible insights that will mark the next frontier in financial analysis excellence.

Best Practices for Conducting Financial Analysis

CFOs aiming for financial precision are increasingly turning to data science and machine learning for insights. High-quality financial analytics is foundational to effective decision-making. Adopting a structured and systematic approach to data analysis, as recommended by experts, is crucial.

Modern CFOs utilize robust methodologies including machine learning algorithms to wrangle financial datasets and identify hidden patterns and trends.

When it comes to understanding company financials, CFOs delve deep into statements, assessing profitability, liquidity, and financial flexibility. Financial models such as the Three Statement Model and the Discounted Cash Flow Model are standard tools in the arsenal, employed to estimate potential future financial conditions and valuations based on current data.

A meticulous examination of the statements that sum up a company's financial health, including the cash flow statement and the statement of changes in equity, provides crucial insights into operational efficiency and shifts in shareholder value. Equipped with these analyses, CFOs forecast future financial scenarios, bolstered by economic conditions and market trends.

However, the quest for precision in financial analysis doesn't end with existing datasets and models. CFOs must also keep a finger on the pulse of the latest machine learning techniques and datasets. Services like Google Dataset Search offer a portal to extensive datasets and innovative approaches to financial data science.

Budgeting and forecasting, although intertwined, serve different purposes and require different methods. Nevertheless, forecasts based on rigorous analysis feed into the budgeting process, aligning financial goals with anticipated performance. Thus, CFOs are better positioned to guide strategic planning and investment opportunities, steering their companies towards financial stability and growth.

Common Mistakes to Avoid in Financial Analysis

Navigating the complexities of financial analysis is no small feat, with pitfalls awaiting CFOs who aren't vigilant. Common missteps often include omission or misinterpretation of data, resorting to unfit tools, or disregarding the nuances of the industry and non-quantifiable elements that could sway a company's fiscal future.

To sidestep such errors, it is crucial to engage with a full spectrum of economic indicators. Leading indicators could serve as the proverbial 'sign up ahead,' signaling possible future economic trajectories, while lagging indicators might resemble a rear-view mirror, confirming past economic happenings, which includes shifts in interest rates after inflation changes.

Further, staying informed about market activities through resources like New York Life Investments' infographics on economic indicators and media coverage of company earnings can bolster one's analytical acumen. For instance, understanding when interest rates rise as a reaction to inflation could provide insights into economic trends and influence one's financial planning.

Garnering robust financial analysis also involves adhering to known best practices—the careful planning of your data analysis, for example, can prevent time-consuming corrections down the line. As the saying goes, “Ninety percent of everything is crap” –Ted Sturgeon—a healthy skepticism towards data and outcomes keeps analysts vigilant against accepting substandard conclusions.

Confronting the challenges of financial analysis requires a well-structured approach, relying on statistical methodologies that account for both Type I and Type II errors, as highlighted by economist Thomas Sowell's mention of 'trade-offs'. These statistical concepts serve as a guardrail for analysts to avoid proclaiming strong evidence when it might be absent or overlooking substantial evidence when it is indeed present.

In this relentless pursuit of fiscal clarity, financial analysts serve as pivotal figures within an organization. They dive deep into financial statements and market data, scrutinizing the company's fiscal health, and laying the groundwork for strategic planning based on accurate forecasting and sound analysis. By employing these multiple strategies, CFOs can ensure their financial analysis remains not only accurate but also a reliable compass for their company's fiscal journey.

Conclusion

In conclusion, effective financial analysis is crucial for CFOs to steer their company's financial trajectory. Understanding the interwoven financial statements reveals the overall financial narrative. Utilizing methodologies like ratio analysis and trend analysis provides nuanced insights into efficiency, liquidity, and profitability.

CFOs should employ a range of tools, including financial ratios and trend analysis, to assess financial capabilities and limitations. Fundamental analysis aids in evaluating market prices and intrinsic value. Real-world examples highlight the power of data-driven decision-making and technologies like Large Language Models (LLMs).

A structured and systematic approach, leveraging data science and machine learning, enhances financial analysis. Financial models like the Three Statement Model and Discounted Cash Flow Model estimate future conditions and valuations. CFOs should also be aware of common mistakes, such as misinterpretation and reliance on unfit tools.

To summarize, mastering financial analysis empowers CFOs to make informed decisions for long-term stability and growth. Utilizing tools, understanding financial ratios, embracing data-driven techniques, and avoiding common mistakes are essential for accurate and reliable analysis. By following best practices, CFOs can navigate the complexities of financial analysis with confidence, ensuring their company's success.