Introduction

Navigating a financial turnaround requires a strategic approach, integrating comprehensive planning and precise execution. The journey begins with a clear understanding of the financial landscape and setting realistic expectations. This involves meticulous financial data preparation, including crafting detailed financial models and customer data analysis.

Assessment of current market conditions and competitive analysis is crucial. Moreover, there's a need to stay abreast of industry-wide factors that may influence financial decisions. In practice, addressing vulnerabilities within the financial system is critical.

A business's ability to innovate and adapt is also a determining factor in a successful financial turnaround. In summary, the first stage of a financial turnaround is not just about understanding the steps but also about preparing and positioning the business to respond to both internal and external pressures. By focusing on data preparation, market analysis, and risk management, businesses can lay a solid foundation for recovery and growth.

Understanding the Turnaround Process

Navigating a monetary turnaround requires a strategic approach, integrating comprehensive planning and precise execution. The journey starts with a clear comprehension of the economic landscape and setting practical expectations. This involves careful data preparation, including crafting detailed models and customer data analysis. An outstanding instance from GrowthPoint highlights the significance of arranging monetary materials, technology descriptions, and market positioning to address potential investor inquiries effectively and to distinguish the organization in a competitive landscape.

Assessment of current market conditions and competitive analysis is crucial. As experienced by an organization that overhauled its technical stack with Django, Tailwind, and HTMX, the process included starting SEO efforts from ground zero. This entailed analyzing competitor traffic and keywords, which informed the creation of a targeted content roadmap. The iterative approach of refining articles and optimizing call-to-actions upon gaining traction in search rankings exemplifies the dynamic nature of turnaround strategies.

Furthermore, it is important to keep up to date with industry-wide factors that may impact monetary choices. For example, the automotive industry, represented by companies like Polestar, projects metrics related to money and anticipates future funding needs through forward-looking statements. These projections are filled with uncertainties, varying from supply chain challenges to regulatory changes, underscoring the importance of adaptability in planning.

In practice, addressing vulnerabilities within the economic system is crucial. The Federal Reserve's emphasis on monitoring four categories of vulnerabilities underscores the need for organizations to comprehend and handle risks proactively. This includes keeping an eye on valuation pressures, which could lead to significant market corrections if not appropriately managed.

An organization's capacity to innovate and adjust is also a key element in a prosperous monetary transformation. As noted in the medical field, companies that achieve successful exits, whether through acquisition or IPO, often share traits such as perseverance and the ability to form strategic alliances or partnerships.

To summarize, the initial phase of a monetary transformation is not only about comprehending the actions but also about getting ready and arranging the organization to react to both internal and external pressures. By concentrating on data preparation, market analysis, and risk management, companies can establish a strong basis for recovery and growth.

Assessment and Diagnosis

A thorough examination of statements related to finances is a crucial initial action in any business recovery plan. This process should include identifying areas of concern and exploring the underlying reasons for money problems. For instance, CoreLogic's data unveils that numerous American families neglect to assert over $60 billion a year in federal benefits, highlighting the necessity for efficient and accessible support systems. In the same way, reports from the banking sector demonstrate strategic shifts in business models, such as reclassifying corporate bond portfolios to ensure stability. Furthermore, healthcare organizations like LifeBridge Health, confronting economic challenges from the pandemic and other factors, emphasize the significance of enhancing operational aspects, such as patient flow and value-based care contracts. As Daniel Durand from LifeBridge Health outlines, aligning clinical and economic strategies is essential for navigating the complexities of healthcare funding. Thus, by thoroughly evaluating the economic landscape, organizations can make informed decisions to navigate towards stability and growth.

Strategy and Planning

Creating a strong turnaround plan is essential after conducting a comprehensive evaluation of the current economic condition. Crafting this strategy involves a clear-eyed view of the end goals, precise actions tailored to those goals, and a well-defined timeline for execution. The blueprint for success often includes leveraging existing strengths, as seen in the case of a city center hotel that capitalized on its prime location to enhance food and beverage sales dramatically. A tailored, location-specific approach, underpinned by a deep understanding of the market, can lead to impressive results in a short period, as evidenced by positive reviews and a surge in sales.

As part of the strategy, reevaluating all expenditures is essential, but not just to cut costs. A holistic view of the company's financials, aligning with long-term objectives, can reveal smarter spending and investment opportunities. Furthermore, staying informed about various options before considering bankruptcy is vital. Experts like James Mohs from Pompea College of Business emphasize exploring all avenues, such as refinancing, issuing stock, or even turning to personal networks for support, before taking such a significant step.

To ensure success, the strategy must be actionable. This means identifying accountable teams or leaders, ensuring sufficient capital allocation, and keeping the initiative at the forefront of senior management's attention. Goals should be categorized by their time horizon—short, medium, or long-term—with each accompanied by a specific target amount and deadline. This type of organized planning can offer a clear pathway from the current state to a desired future position, avoiding the potential $60 billion in unclaimed benefits due to complex systems and processes, as reported by Benefits Data Trust. In conclusion, an effective turnaround strategy is not just about setting goals but also about creating a detailed road map to achieve them, backed by a commitment from the top and an understanding of the broader landscape.

Crisis Stabilization

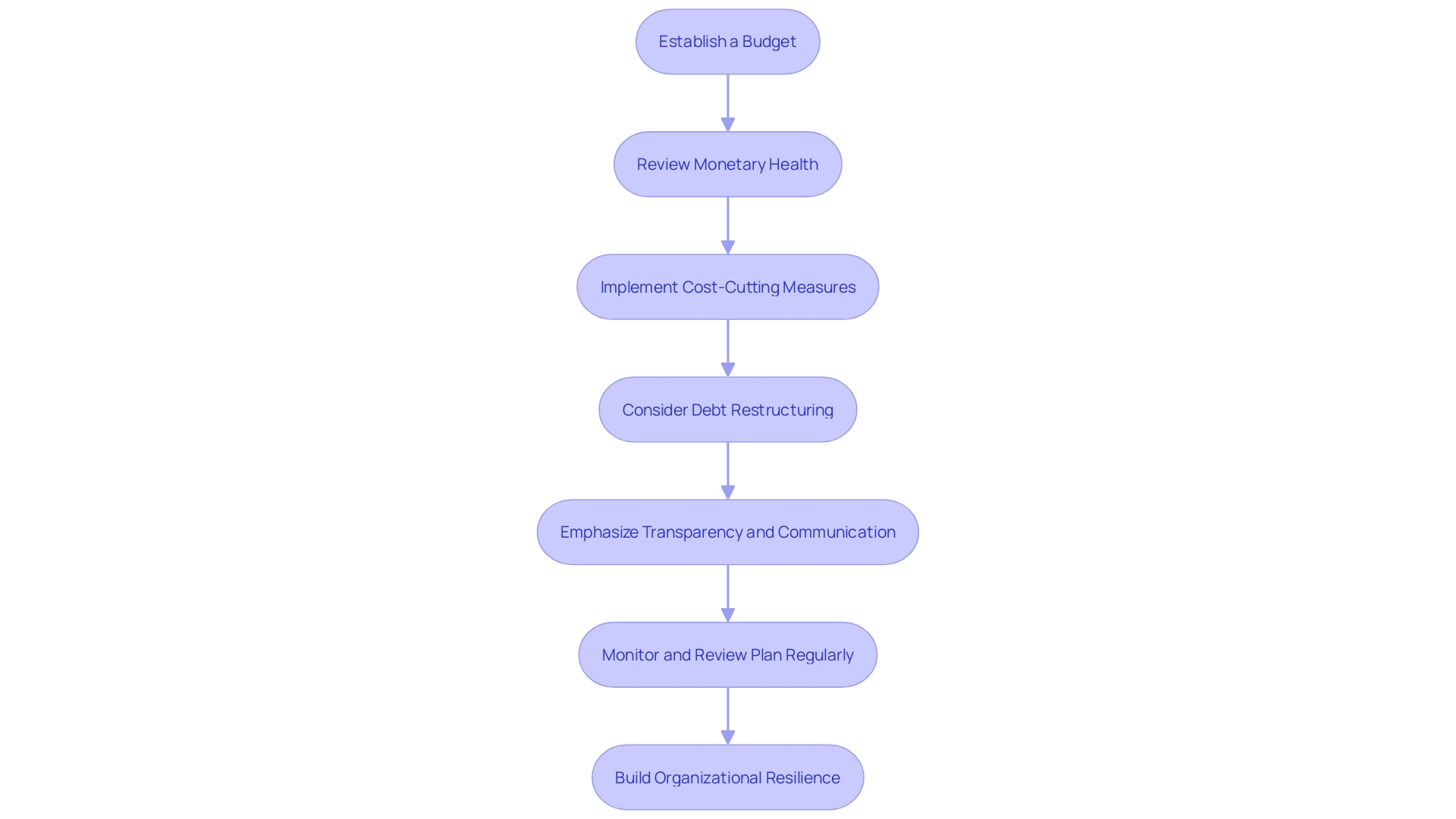

When addressing turmoil within an organization, the first step is to establish a well-defined budget that serves as a strategic framework for recovery. This involves a thorough review of the company's monetary health, identifying all income sources, and categorizing expenses to gain a comprehensive understanding of its fiscal position. Efficient cash flow management is a crucial element of this procedure, necessitating careful monitoring and optimization of cash inflows and outflows to sustain operational fluidity and fulfill monetary obligations.

Implementing emergency cost-cutting measures can be a necessary course of action to stabilize a crisis. This might include reevaluating non-discretionary spending and making tough decisions to reduce overheads. When implemented accurately, these measures can maintain crucial operational functions while evading additional economic pressure.

Moreover, debt restructuring may present itself as a viable option to alleviate immediate pressures. This strategic maneuver allows businesses to renegotiate terms with creditors, potentially lowering interest rates or extending payment timelines, contributing to the preservation of liquidity and the continuation of operations.

Crucially, transparency and proactive communication with stakeholders play an indispensable role during these challenging times. Avoiding phrases that can be perceived as evasive or uncooperative, such as 'no comment' or 'unforeseen circumstances,' is essential. It's about demonstrating accountability and fostering trust, even amidst adversity.

Together, these crisis stabilization techniques lay the foundation for a turnaround process, which, when aided by skilled monetary guidance and compliance with regulatory standards, can guide an organization back to the trajectory of stability and expansion.

Improved Leadership and Management

Leadership and management excellence play pivotal roles in guiding a company through the turbulent waters of a turnaround. A leader's capacity to drive transformative change, refine decision-making mechanisms, and instill a culture that values accountability and transparency can make or break the recovery process.

For instance, Strategic Solution Partners, a leader in operational problem-solving within the hospitality sector, emphasizes strategic planning and revenue enhancement. They tailor their approach to each client's unique needs, demonstrating how dynamic leadership can yield positive results in even the most challenging scenarios.

Similarly, Pacific Steel's approach to overhauling their healthcare expenses showcases decisive leadership. By examining insurance claims data and severing ties with traditional provider networks, they moved to a reference-based pricing strategy, leading to significant cost savings.

Effective leadership is also underscored by the narrative of Nissan's resurgence under CEO Carlos Ghosn. His strategy involved producing market-responsive vehicles, optimizing costs, and mitigating currency fluctuation risks. Ghosn's leadership was instrumental in Nissan's goal of returning to its former glory as a leading car manufacturer.

Moreover, the financial arena requires a 'learning' organization, as Chris Festog of Mutual of America Financial Group illustrates. Creating a team that has a profound understanding of operational activities is essential for attaining higher levels of performance.

All these examples reflect the essence of Peter Drucker's philosophy: to perform from strength, especially during disruptive times. As the corporate world continues to evolve rapidly, with challenges from economic crisis to the advent of AI, drawing upon an organization's core competencies becomes more important than ever. Leaders who can navigate these changes successfully are those who can leverage their organization's strengths while remaining adaptable and forward-thinking.

Financial Restructuring

To orchestrate a successful business turnaround, restructuring is a crucial strategy. It involves a thorough overhaul of a company's fiscal structure to enhance its balance sheet and return to profitability. This may include a variety of tactics such as debt refinancing, where existing debt is replaced with new debt often at more favorable terms; equity infusion, where new capital is introduced by current owners or new investors to reduce leverage; and asset revaluation, which adjusts the book value of assets to reflect their current values and potentially improve ratios.

For example, the case of Nets, a leading provider of digital payment solutions, demonstrates the significance of efficient management. Through reassessing their technical data presentation, they improved user engagement, an approach that indirectly promotes fiscal well-being by prioritizing operational efficiency and client contentment. In the same way, Rite Aid's recent restructuring of its finances, through Chapter 11, aimed to decrease debt and enhance flexibility, highlighting the importance of sustaining operations and customer service throughout the restructuring process.

Additionally, in the wider industry context, areas such as food and beverage and healthcare services serve as measures for economic stability. The former thrives due to its essential nature, with U.S. food retail sales surpassing $6.22 trillion between 1992 and 2019. The healthcare sector remains strong due to increasing demand and scientific progress, highlighting the importance of industry-specific strategies in restructuring.

A comprehensive performance analysis is crucial, as it reveals whether a company has achieved its monetary objectives. This is achieved by examining income statements, balance sheets, and cash flow statements, focusing on key indicators such as revenue growth, profit margins, and cost management. Furthermore, marketing and customer engagement strategies must be scrutinized to ensure they effectively reach target audiences and achieve business goals.

Finally, the rising number of insolvencies, with 25,158 recorded in 2023, the highest since 1993, emphasizes the urgent requirement for strong restructuring strategies. By tackling these approaches, organizations can navigate economic challenges and position themselves for long-term growth and achievement.

Cost Reduction and Efficiency

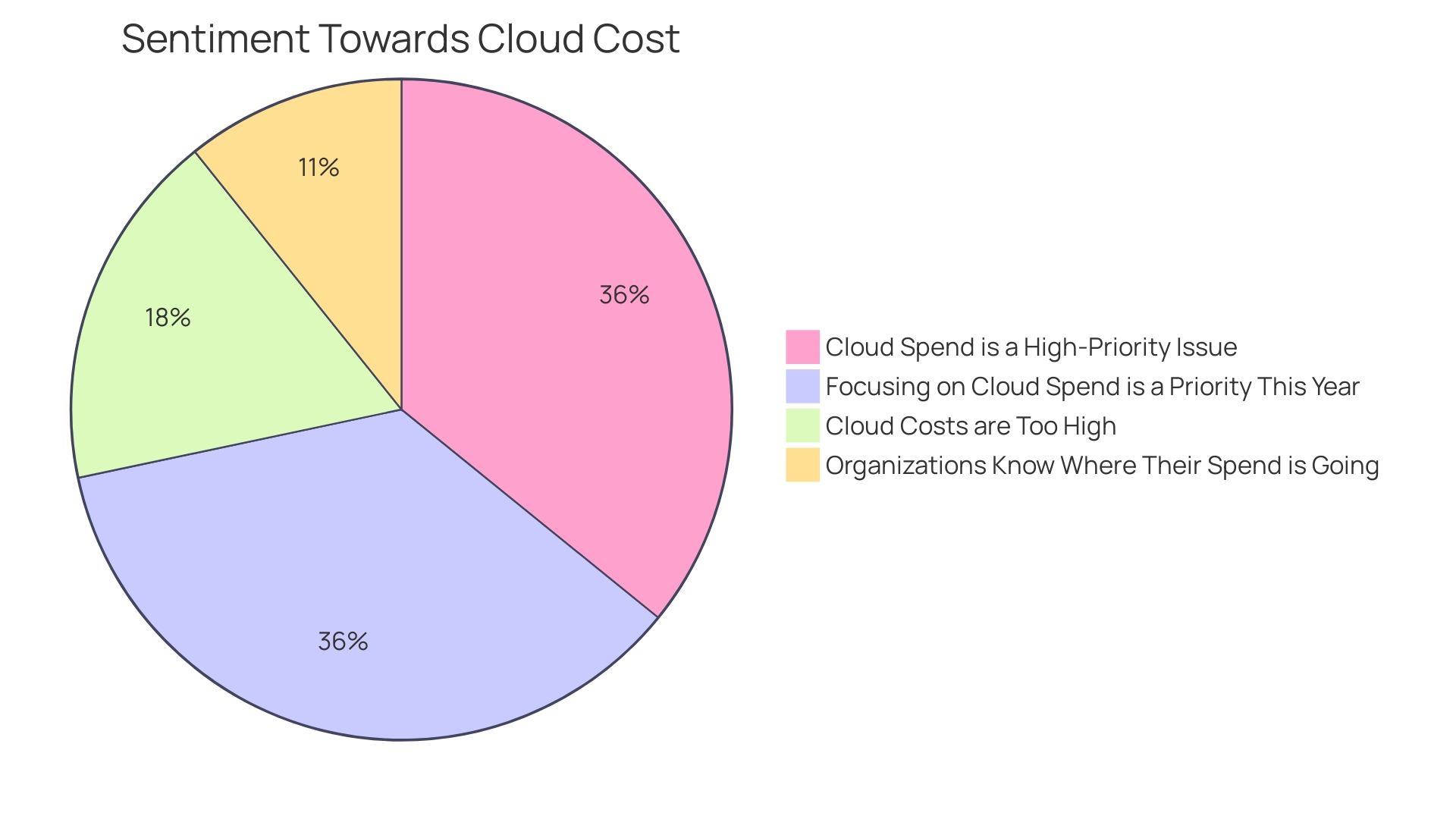

A strategic approach to cost reduction and operational efficiency is not just a matter of financial necessity but a key factor in defining the resilience and future success of organizations. Effective cost management involves a multifaceted analysis, starting with a reevaluation of all expenses in alignment with long-term goals. This includes a thorough examination of resource allocation, ensuring that every dollar spent contributes to the organization’s agility and efficiency.

Optimizing operations often necessitates renegotiating contracts to secure more favorable terms and adopting lean management practices that streamline processes, eliminate waste, and enhance productivity. Moreover, technology should be integrated judiciously—employing it as the final piece of the puzzle after establishing a clear results timeline. This ensures that the focus remains on aligning people and processes, rather than simply justifying costs through IT projects.

The long-term viability of cost-cutting measures is imperative; reductions should not compromise core operations or the quality of products and services. These measures should be sustainable, maintaining operational efficiency and ensuring the company remains attractive to customers, partners, and employees. It is these well-managed and profitable companies that will define the decades following economic disruptions.

Furthermore, implementing forecasting tools can offer deeper insights into operational activities, enabling more strategic decision-making. As the U.S. economy reaches an inflection point, businesses should prepare for sustained economic recovery by making necessary investments and divestments, and leveraging technology to improve efficiency.

Real-world figures highlight the importance of resilience; the aviation industry, for example, is expected to achieve a net profit of $30.5 billion in 2024 despite recent pandemic losses. This projected profitability is evidence of the industry's dedication to enhancing resilience through careful cost management and operational efficiency.

Asset Optimization and Disposal

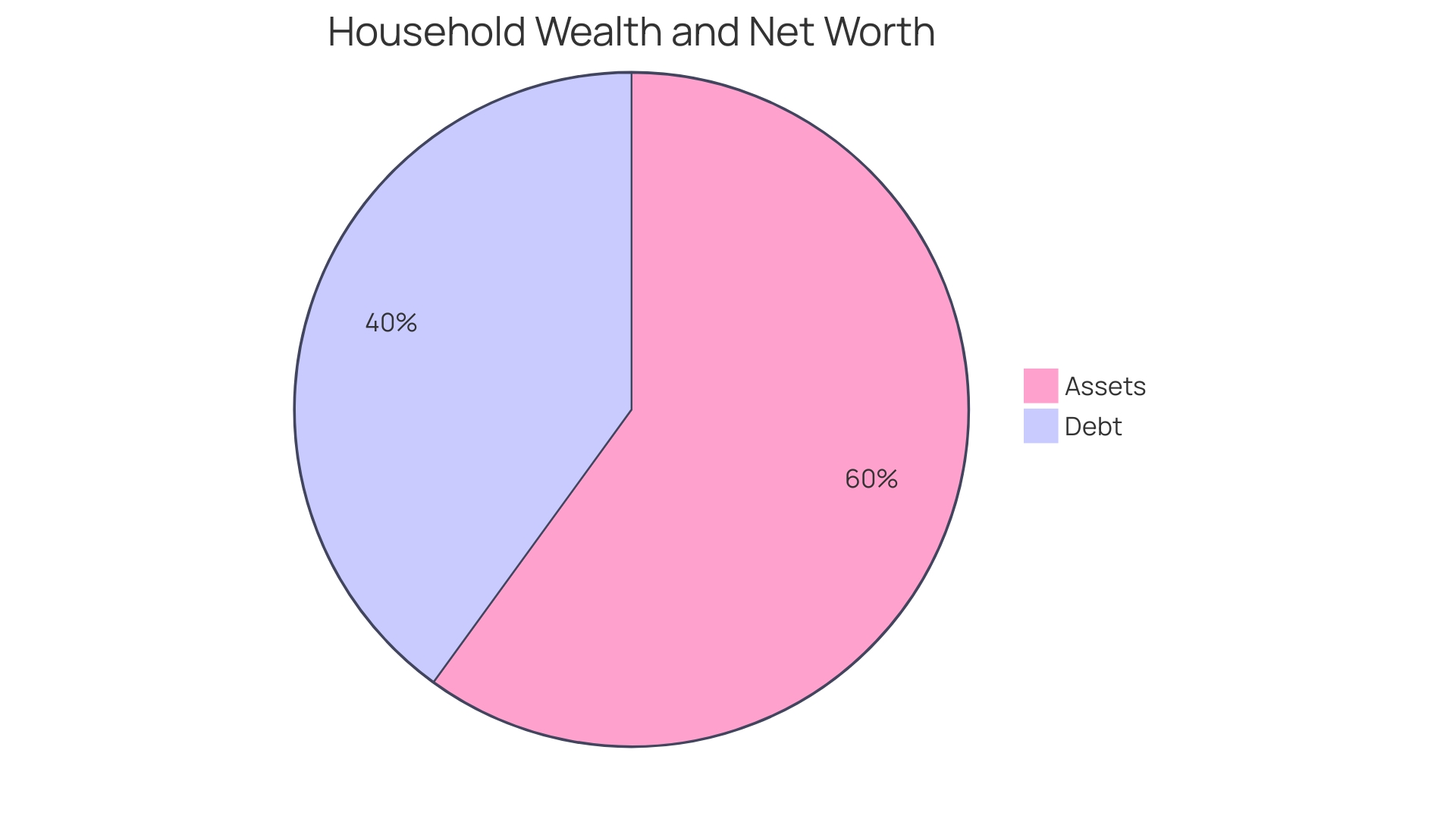

To improve the financial standing of an organization, strategically managing assets is crucial. This involves not only leveraging but also potentially divesting underperforming assets to bolster cash reserves. Assets, including cash, equipment, and even intangible elements like brand reputation, contribute to the value of your organization. Liabilities represent obligations such as loans, and equity is the residual interest in the assets of the organization after deducting liabilities. Ensuring that assets equate to liabilities plus equity is fundamental in accounting, guided by the accounting equation.

When tackling asset optimization, it's important to understand that an optimizer is an advanced computational tool designed to maximize utility functions while considering both positive and negative constraints. This echoes the historical reliance on human decision-making for asset management, which now can be augmented by sophisticated software solutions. For instance, employing a customizable presentation tool can initiate discussions on asset management within your organization, increasing awareness and alignment on the subject.

Identifying assets for optimization or disposal requires a thorough calculation of total assets. This involves not only quantifying liquid assets like cash and receivables but also long-term assets like stocks and bonds. Valuing intangible assets may require additional research, for example, using a social media following calculator to determine an asset's worth.

In the current economic environment, businesses, especially those in the real estate and construction sectors, are experiencing decreases in income and difficulties with their cash flow, as stated in VnExpress/Ngoc Thanh's report. This underscores the necessity for effective asset management, especially in times when capital markets are less accessible for raising funds.

Furthermore, the corporate lifecycle mirrors human financial stages, where businesses initially consume cash before reaching a stage where they generate surplus. Efficiently managing this transition can result in either significant growth or the elegant management of decline. As experts suggest, the goal should be value maximization, which may involve sacrificing short-term profits for long-term growth potential. This approach has been crucial to the success of numerous contemporary enterprises in fields such as social media, technology, and renewable energy.

In summary, evaluating your organization's reaction to market changes, consumer choices, and technological progress is crucial. It not only reflects on your company's agility but also its innovative capacity, which is critical for enduring competitiveness. Operational efficiency and supply chain management should be reviewed to ensure they are not only effective but also resilient in the face of disruptions.

Customer Retention and Market Analysis

Nurturing loyalty among current clients and identifying growth prospects are crucial to revitalizing a company's financial well-being. To maintain clientele, businesses must delve into consumer behavior analytics and understand the ongoing value each patron brings post-acquisition. Such diligence in evaluating value to buyers is not just an exercise in data mining, but a strategic imperative in the current cutthroat e-commerce climate.

For instance, evaluating the post-acquisition value (PAV) of clients—essentially the net present value of their purchases minus the initial client acquisition costs—can shed light on which individuals are most valuable over time. This metric can guide investment decisions in client acquisition, ensuring a focus on those who promise the greatest lifetime value.

The case of Shake Shack, with its early adoption of Qualtrics' AI, showcases how leveraging insights from data can streamline product launches and enhance user experiences. By comprehending clients at a detailed level, the organization could shift from a poorly received product launch to effectively introducing new products that resonated with their consumer base.

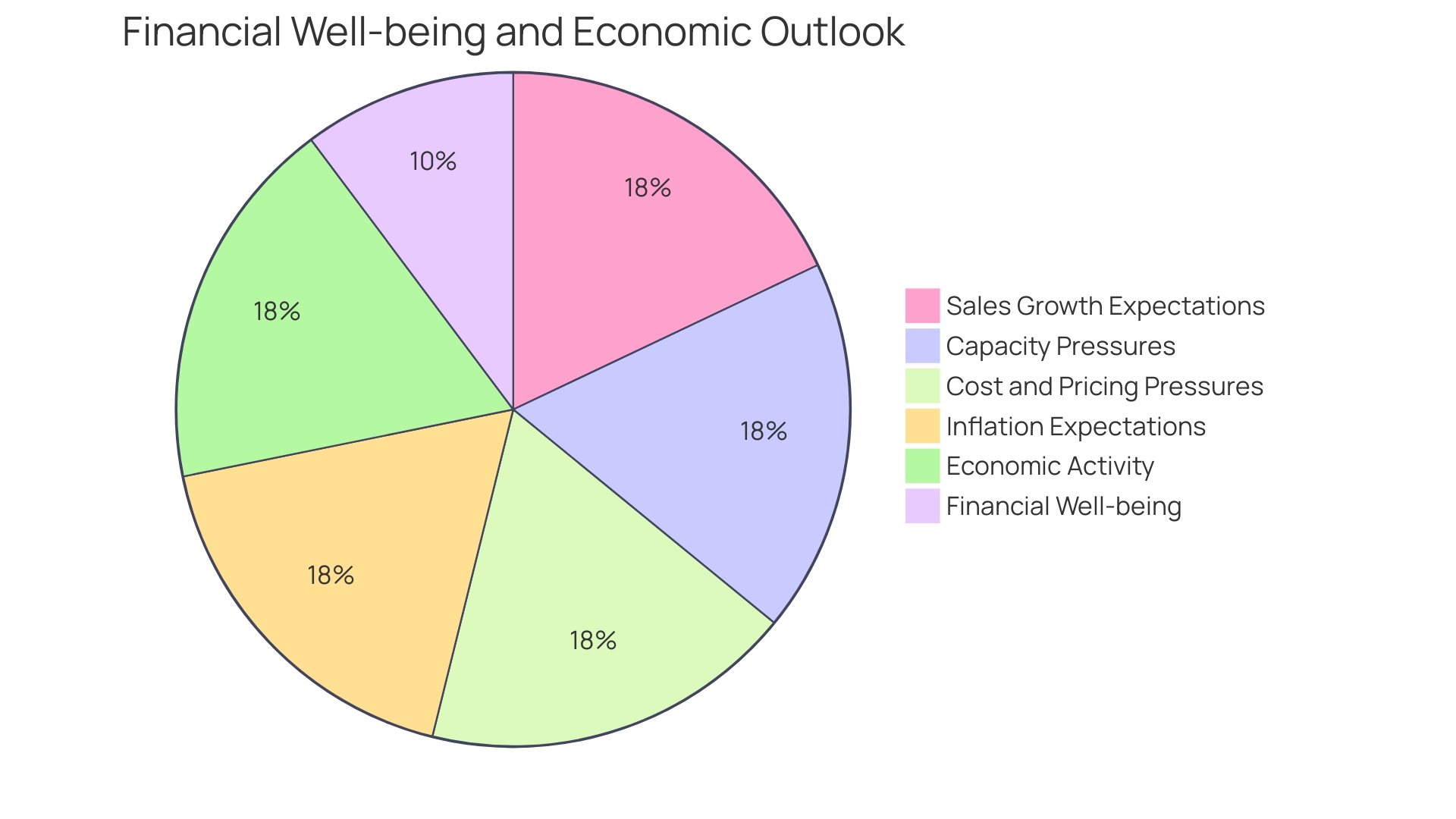

Businesses must also be adept at market segmentation, categorizing customers with shared characteristics to tailor experiences and maximize engagement. The dynamic nature of commerce today demands that companies stay agile, leveraging data-driven decision-making to stay competitive. Indeed, survey data from S&P Global in 2022 highlights that a significant portion of corporate decisions are now underpinned by data analysis.

Staying current with economic trends is also important. Despite predictions of a downturn, the resilience of the financial markets and absence of a recession in 2023 underscore the importance of being prepared for a range of outcomes. Companies such as Nokia, which concentrate on forward-thinking declarations, emphasize the necessity for enterprises to foresee and adjust to evolving market circumstances and client requirements.

In the end, comprehending clients and the market is not only about maintaining stability—it's about seizing growth. By merging client retention techniques with perceptive market analysis, companies can unlock fresh revenue channels and guarantee ongoing success in a constantly changing economic environment.

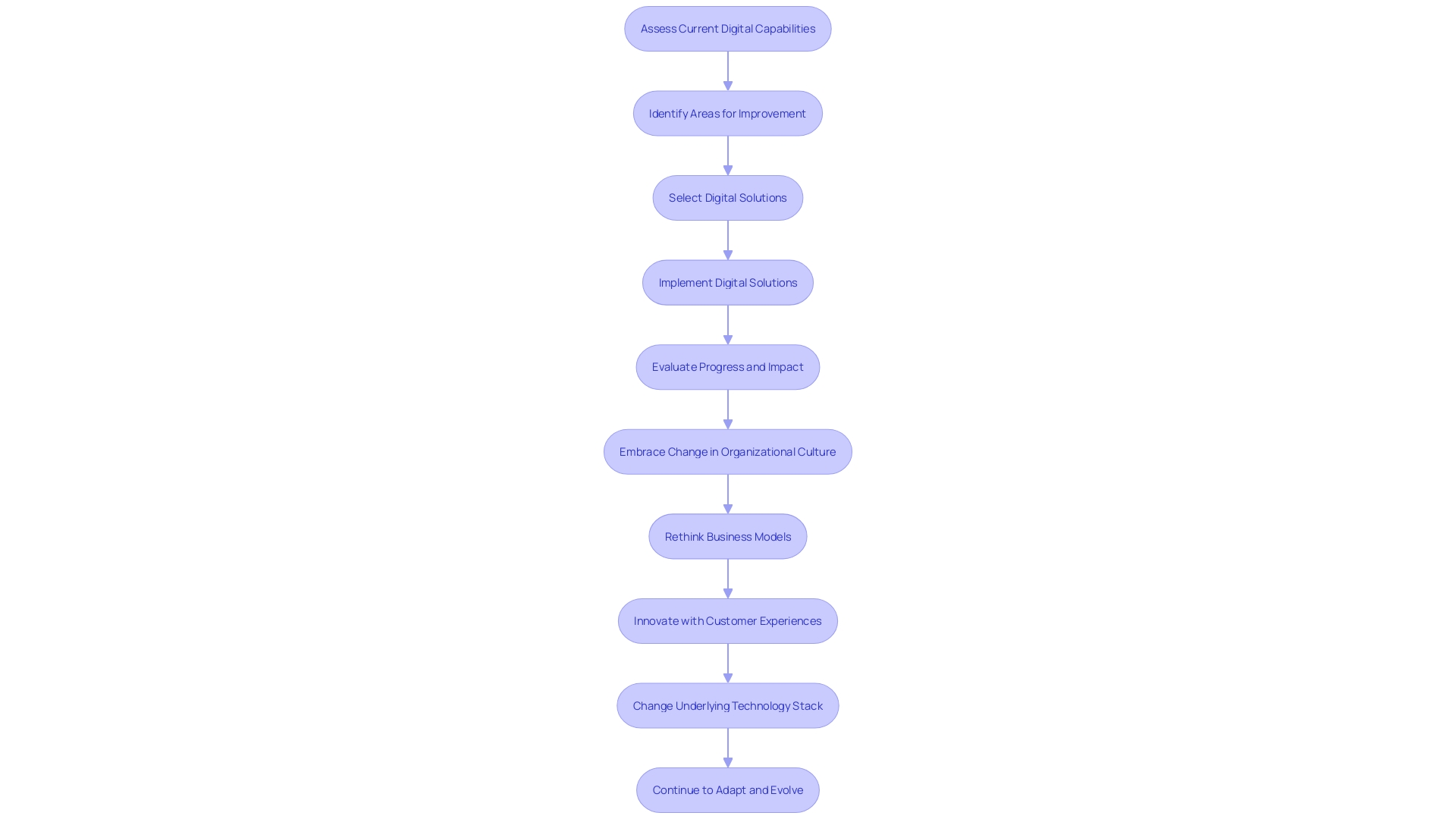

Process Improvement and Technology Adoption

Embracing digital transformation is essential for an enterprise to effectively navigate through financial challenges. A robust digital core, especially in service to clients and internal cooperation, is essential as it establishes the basis upon which businesses can adjust to ongoing technological and market changes. For instance, customer relationship management (CRM) platforms not only streamline operations but are pivotal in revenue generation—with Salesforce, Microsoft, and NetSuite being notable leaders in this space.

The integration of advanced technologies like artificial intelligence (AI) is not without its challenges. According to the Crowe Executive Outlook Study, while 58% of respondents are exploring AI investments to manage volatility, the success of these technologies hinges on the quality and structure of underlying data. Organizations must ensure their data is well-organized and sensitive information is properly identified to leverage AI effectively.

In practice, companies like Rivian are working towards net-zero emissions by 2040, which includes optimizing sustainable processes across their global operations. Similarly, AT&T recognized the need to modernize its legacy systems to address employee frustrations with outdated processes. TBC Bank embarked on an agile transformation to reduce complexity and accelerate digital product deployment. These cases demonstrate that streamlining operations and reducing technical debt are essential steps in a turnaround strategy.

Furthermore, recent research in 'Management Science' by Chris Forman and colleagues points to the transformative impact of internet technology on production chains. Firms that have adopted digital technologies are not only reshaping their production processes but are also better positioned for future success.

By setting specific targets and performance indicators (KPIs) for speed, quality, and value at the start of transformation initiatives, companies can evaluate progress and make informed choices on process enhancements and technology implementation, guaranteeing alignment with both long-term objectives and immediate economic stability.

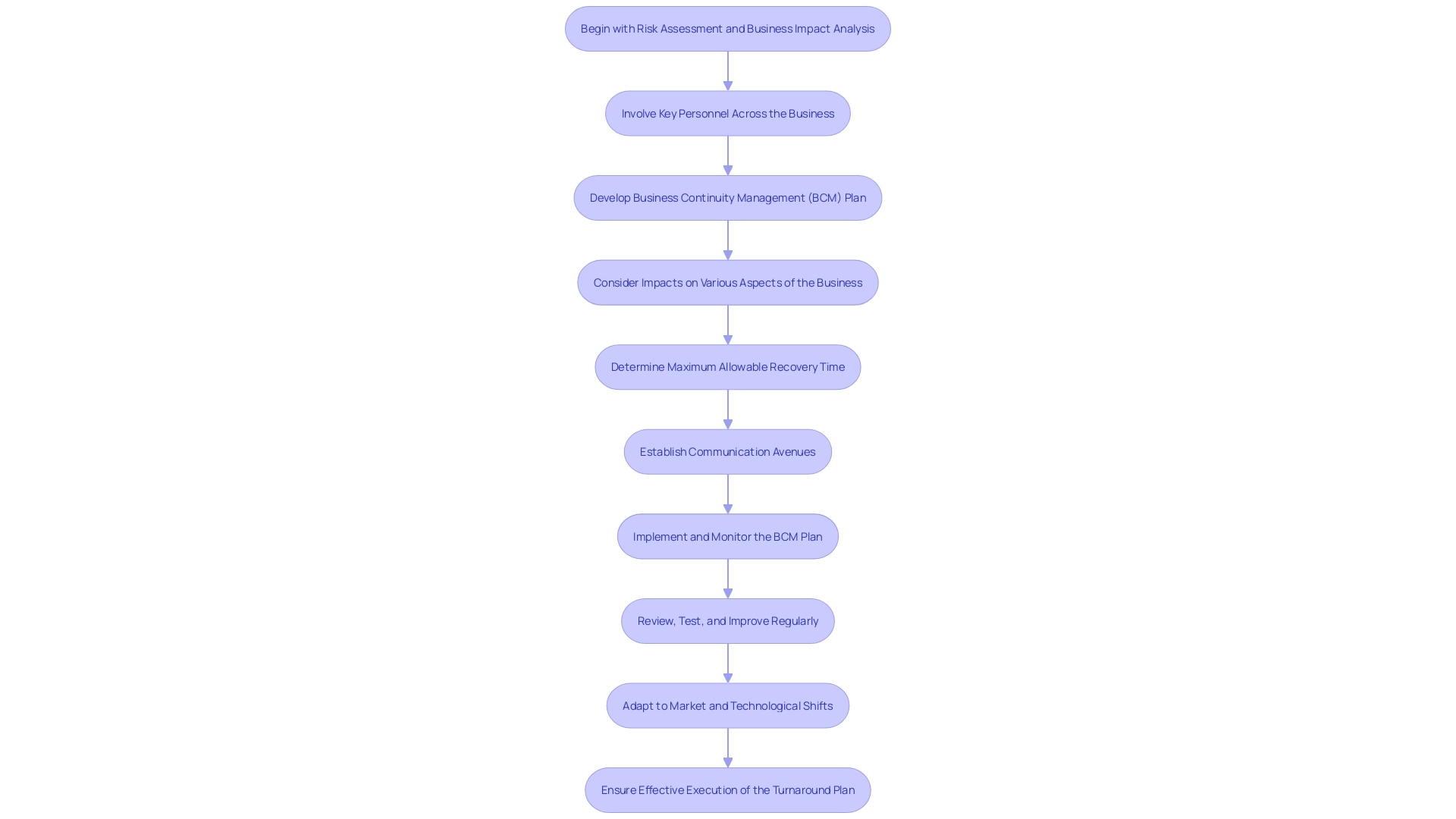

Implementation and Monitoring

To steer an enterprise through turbulent economic conditions towards stability, it's crucial to devise and meticulously implement a turnaround plan. This involves devising a robust implementation plan, delineating clear responsibilities among team members, and monitoring progress through well-defined key performance indicators (KPIs).

For instance, consider the plight of American families hit by financial shocks, such as unexpected expenses or income loss. They often struggle to access support due to complex systems and inefficient processes. A study by the Benefits Data Trust revealed that over $60 billion a year in federal benefits goes unclaimed due to these hurdles. Likewise, companies must streamline their turnaround efforts to avoid missed opportunities and maximize available resources.

In the corporate realm, the Woven Planet saga of Toyota offers a stark lesson. Despite its ambitious software development plans for its vehicles, the company faltered in execution. This underscores the importance of realistic goal-setting and agility in adapting to market and technological shifts. As Peter Drucker wisely stated, "What gets measured gets managed." Therefore, identifying and tracking the right KPIs is not just a matter of record-keeping but a critical component of strategic management.

Considering the company's performance is equally crucial. Omar Choucair of Trintech advises a reevaluation of all spending and prioritizing accordingly, not just defaulting to cost-cutting. Precise statements, which depend on solid reporting and analysis, are the basis of a successful turnaround.

Indeed, the journey to recovery may be complex, as illustrated by the banking sector, which saw 566 failures from 2001 through 2024. This statistic emphasizes the necessity for proactive and responsive monetary strategies. By using creative methods, enhancing operational effectiveness, and making sure that performance aligns with set targets, businesses can navigate through economic turbulence and sail towards calmer seas.

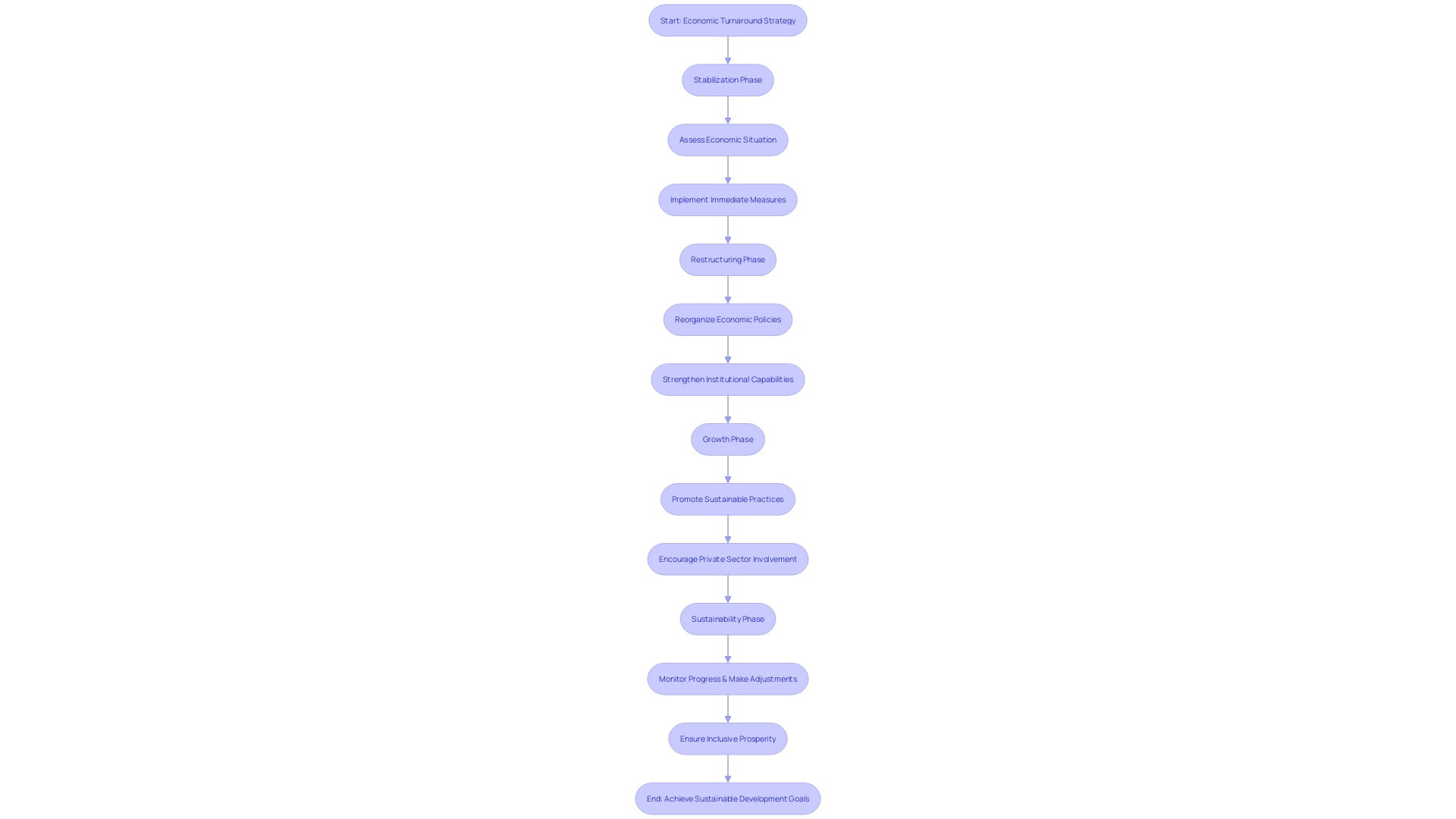

Phases of a Financial Turnaround Strategy

A strong economic turnaround strategy is a multi-phase process that encompasses stabilization, restructuring, followed by growth, and ultimately aims for sustainability. Throughout the stabilization phase, the primary objective is to cease adverse patterns and stabilize the organization's economic condition. Restructuring involves reassessing and realigning organizational strategies, often requiring budget reviews and cuts to non-essential expenses. As the organization regains its footing, the growth phase focuses on capitalizing on sustainable finance opportunities and implementing actions such as climate transition action plans (Caps) to address financial risks and seize low-carbon future opportunities. Finally, sustainability is achieved by embedding resilience and adaptability into the business model, allowing the organization to navigate future disruptions and maintain steady growth. By adhering to these structured phases, companies can navigate through challenging times, as evidenced by case studies from industry leaders who have successfully weathered economic downturns and emerged stronger.

Conclusion

In conclusion, a successful financial turnaround requires a strategic approach that integrates comprehensive planning, risk management, and adaptability. By focusing on data preparation, market analysis, and addressing vulnerabilities within the financial system, businesses can lay a solid foundation for recovery and growth.

Developing a robust turnaround strategy involves setting realistic expectations, reevaluating expenditures, and exploring all options before considering bankruptcy. Effective leadership and management excellence are crucial in driving transformative change and instilling a culture of accountability and transparency.

Financial restructuring plays a vital role in improving a company's balance sheet and returning to profitability. By leveraging assets, considering debt refinancing, and adopting cost-cutting measures, businesses can bolster cash reserves and position themselves for sustainable growth.

Fostering customer loyalty and identifying expansion opportunities are key to reviving a company's financial health. By analyzing customer behavior, segmenting the market, and embracing digital transformation, businesses can adapt to evolving market conditions and unlock new revenue streams.

In summary, a successful financial turnaround requires a strategic mindset, proactive decision-making, and a commitment to continuous improvement. By following these practical steps and strategies, businesses can navigate through financial challenges and position themselves for long-term success.