Introduction

In the rapidly evolving landscape of financial management, the role of Chief Financial Officers (CFOs) has never been more critical. As organizations strive for recovery and stability, cultivating a healthy relationship with money becomes a foundational element of success. This article delves into essential strategies for CFOs, from self-reflection and establishing financial goals to leveraging technology and building supportive networks.

By understanding and addressing their own financial attitudes, CFOs can lead their organizations with confidence, ensuring that every financial decision aligns with a clear vision for the future. With practical insights and actionable steps, this guide equips financial leaders to navigate the complexities of today's financial challenges and emerge stronger.

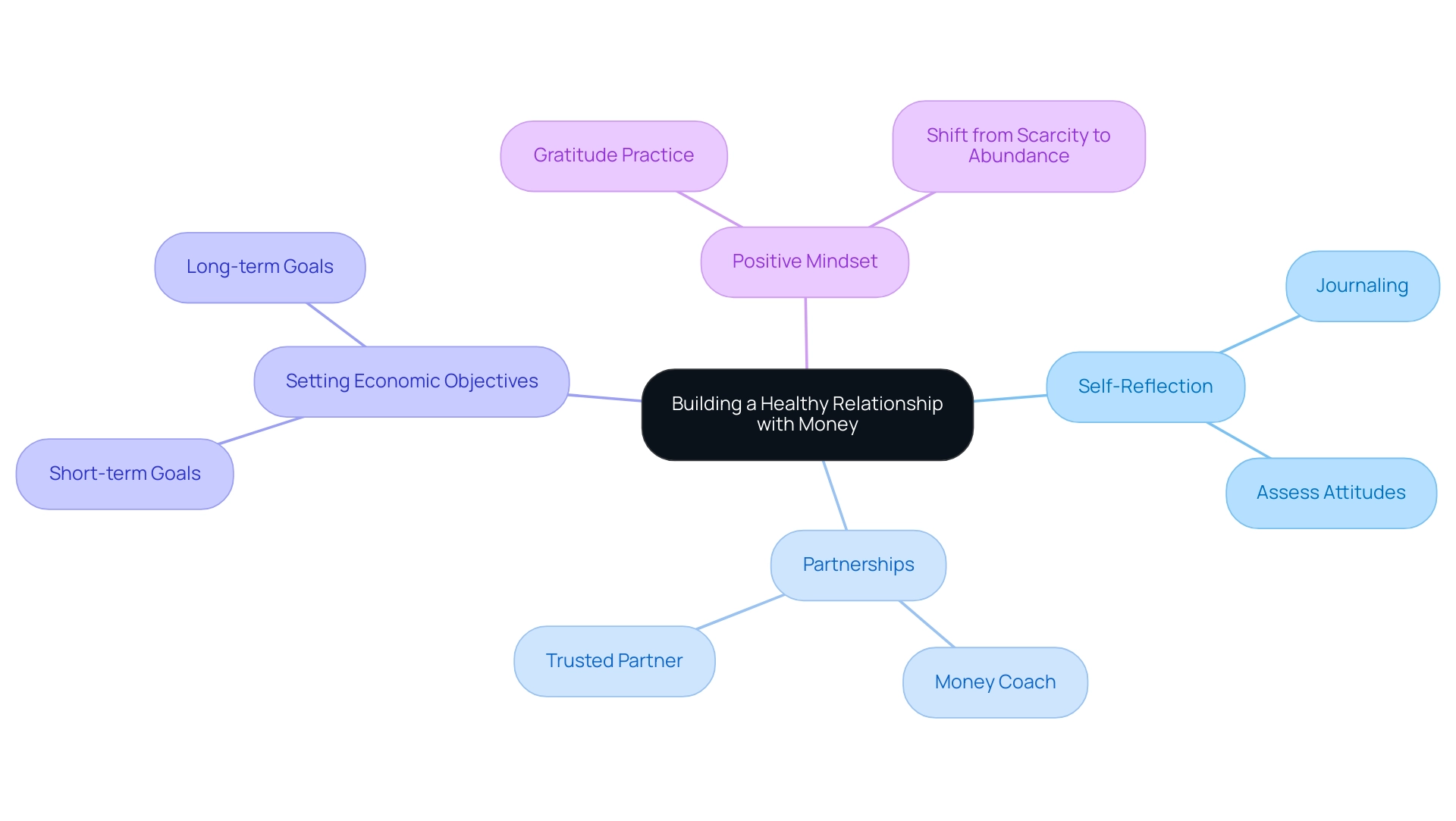

Building a Healthy Relationship with Money

Establishing a healthy connection with money starts with deep self-reflection, particularly for Chief Financial Officers (CFOs) responsible for guiding their organizations toward economic recovery. A critical first step is to assess your current attitudes toward money: Is it a source of stress or a tool for empowerment? Recognizing harmful beliefs or habits that may hinder your monetary progress is essential. Research shows that 60% of individuals find it more challenging to discuss their economic situation than their romantic life, indicating a deep-rooted discomfort around money.

To gain deeper insights, consider:

- Journaling your monetary thoughts

- Seeking guidance from a money coach

Michael Liersch, head of Advice and Planning for Wells Fargo, notes that finding a trusted partner to discuss money can significantly increase accountability and help you stay aligned with your monetary goals. For CFOs, this partnership can be especially crucial in navigating the complexities of recovery.

Establishing clear economic objectives—both short-term and long-term—is the next step, directly aligning with the strategies outlined in our whitepaper, “Mastering the Cash Conversion Cycle: 20 Strategies for Optimal Business Performance.” This guide provides actionable insights to enhance your cash flow and profitability. Defining a purpose for your money can drive better monetary decisions and provide motivation. Reflecting on your monetary goals can be particularly empowering; despite current challenges, 73% of Americans express optimism about their future economic prospects. An instance of achievement in this field can be observed in a situation where a CFO worked with a monetary coach, resulting in a clearer vision and enhanced fiscal plans that improved overall business stability.

Finally, practice gratitude for what you have. Shifting your mindset from scarcity to abundance fosters a more positive relationship with your finances. This positive perspective not only improves personal satisfaction but also aids in better monetary behaviors and attitudes moving ahead. By embracing these strategies and integrating the proven techniques from our whitepaper, CFOs can effectively lead their organizations toward a more secure economic future.

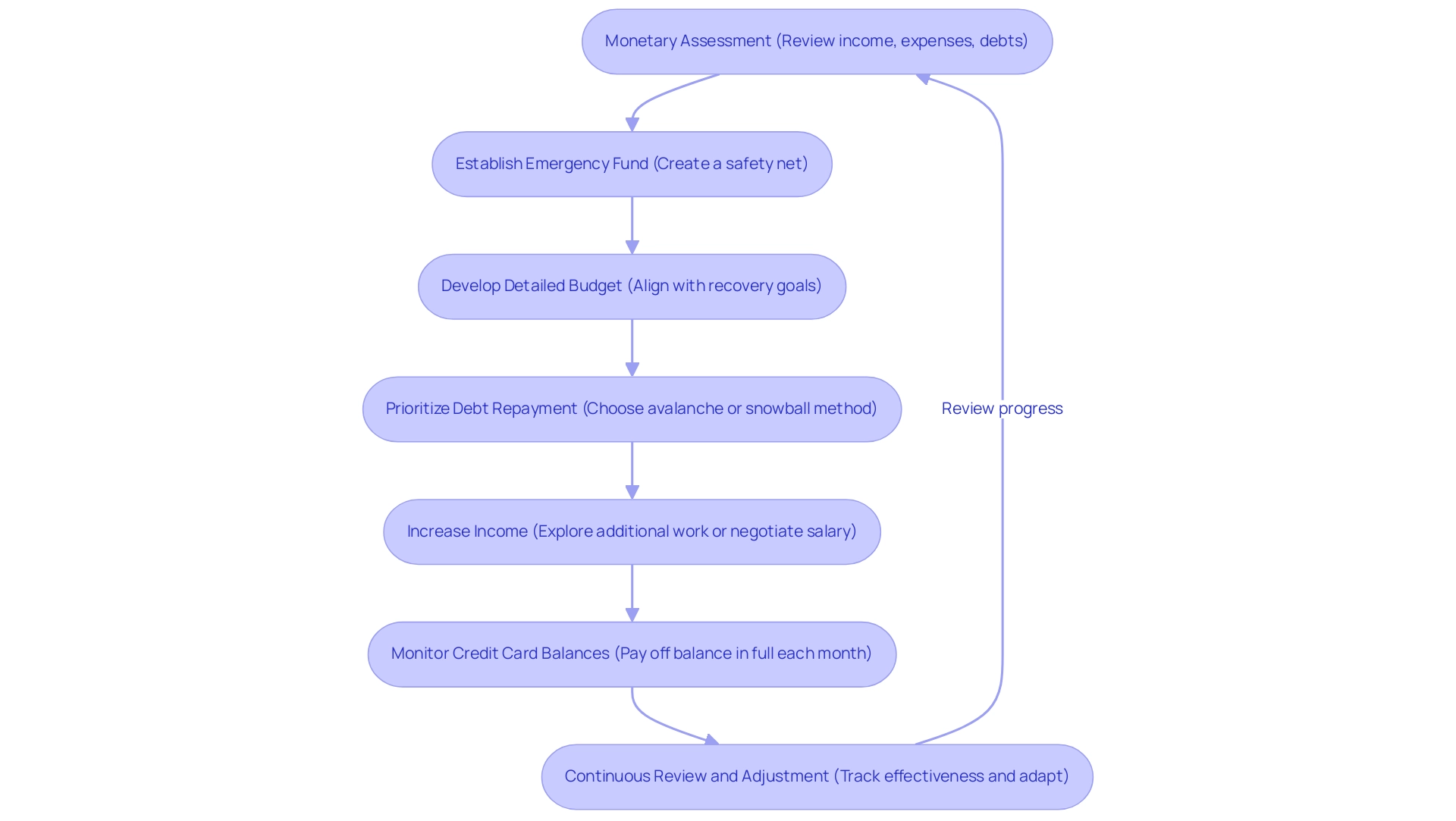

Practical Steps for Effective Financial Recovery

In today's challenging economic landscape, the urgency of recovery for distressed businesses is paramount. Begin with a thorough monetary assessment to identify underlying issues by reviewing your income, expenses, and existing debts. This will provide a clear understanding of your monetary status. Establishing an emergency fund is essential for creating a safety net during uncertain times, as highlighted by experts like Jennifer Streaks. Additionally, develop a detailed budget aligned with your recovery goals, ensuring meticulous tracking of every expense and applying lessons learned from previous financial assessments.

Prioritize paying down high-interest debts using strategies such as:

- The 'avalanche' method, which focuses on clearing debts from highest to lowest interest rate.

- The 'snowball' method, which targets debts from smallest to largest to build momentum.

Choose the method that keeps you motivated. Furthermore, explore options to increase your income through additional work, freelance opportunities, or negotiating salary increases. Significantly, data indicates that less than half of adult credit cardholders (47%) maintained a balance on a credit card for at least one month in the past year, emphasizing the importance of effective debt control.

As of the second quarter of 2024, 3.25% of Americans' total outstanding credit card balances were at least 30 days delinquent, marking the highest delinquency rate since 2011. Despite this rise, these rates remain near historic lows compared to averages tracked since 1991. Such statistics underscore the necessity of a proactive approach to debt management. As Matt Schulz advises, 'Job No. 1 for anyone with a credit card is to pay off that balance in full at the end of each month.' This principle is vital for maintaining economic health and avoiding the pitfalls of rising delinquency rates.

Ultimately, embrace a practical method to data by consistently tracking the effectiveness of your monetary plans through . Regularly revisit and adjust your budget plan to stay adaptable and informed as your situation evolves. This continuous review ensures that your strategies remain effective and aligned with your recovery objectives, ultimately delivering maximum return on invested capital.

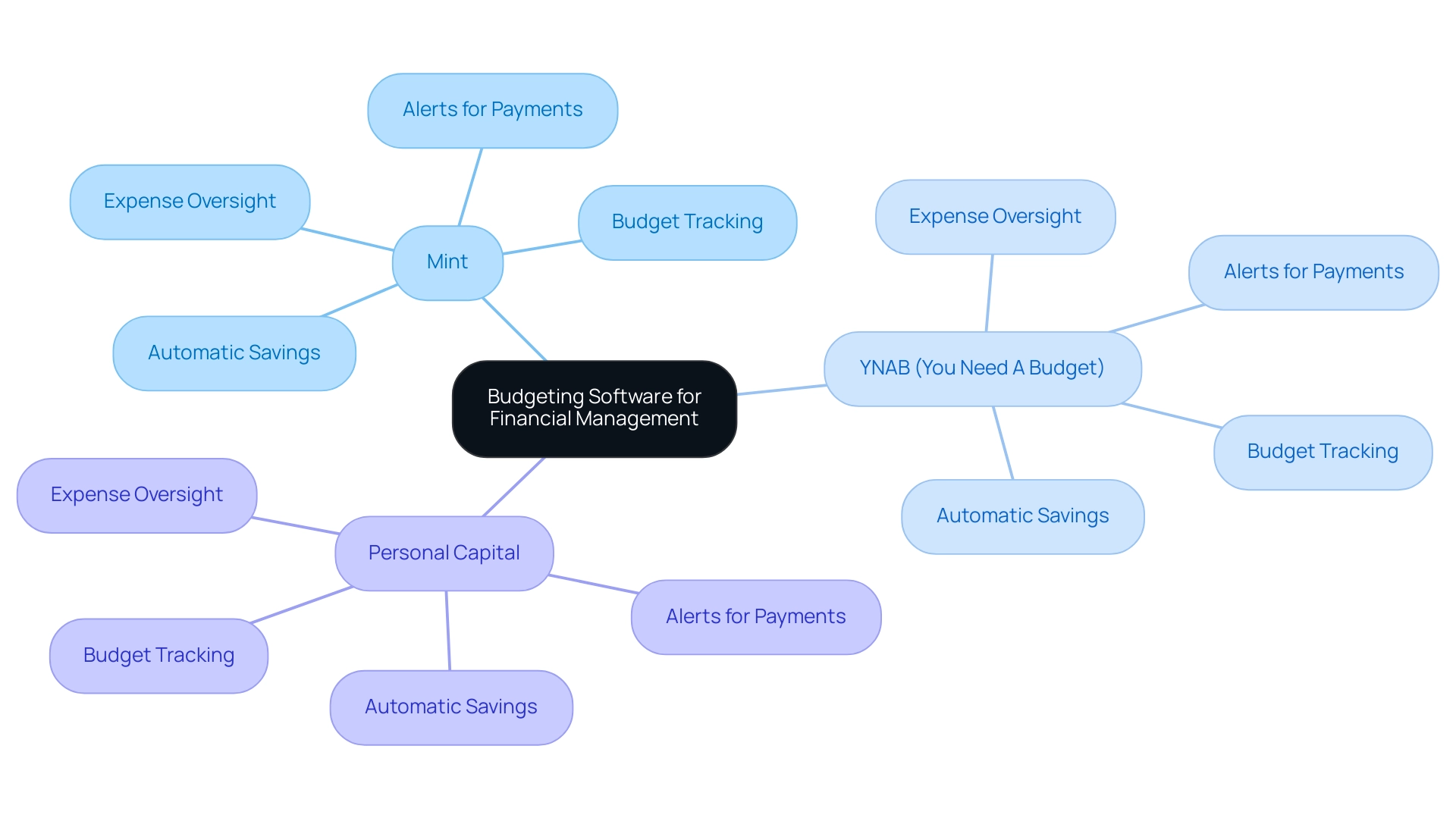

Leveraging Technology for Financial Management

Utilizing budgeting software or applications can greatly simplify budget tracking and expense oversight, especially for improving cash flow and profitability according to the insights from Mastering the Cash Conversion Cycle: 20 Strategies for Optimal Business Performance. Tools such as Mint, YNAB (You Need A Budget), and Personal Capital provide detailed insights into spending patterns, identifying areas for optimization and assisting in maintaining fiscal accountability. For instance, setting up alerts for bill payments is crucial to avoid late fees, while automatic savings features can effortlessly build an emergency fund.

With over 51% of individuals investigating brands online prior to making buying choices, it's evident that digital tools in budget oversight play a crucial role in today's business environment. Financial tracking apps have experienced a surge in usage, with 56.1% of internet users making online purchases weekly, driven by the convenience and features these tools offer. As emphasized in our expert guide to transforming SMB operations with AI/ML, these technologies are revolutionizing management, making it more accessible and efficient.

Recent evaluations of budgeting software in 2024 emphasize the strong features of these applications in delivering real-time monetary insights and personalized guidance. Users often commend the user-friendly interfaces and customization choices offered in budgeting applications, which address various economic situations. Expert opinions from technology authorities emphasize that budgeting applications are transforming management by making it more accessible and efficient. As noted by PwC, while 'integration issues in cloud computing present governance challenges,' the advantages of adopting advanced monetary tools far outweigh these obstacles, particularly in enhancing cash flow and operational effectiveness.

Staying knowledgeable through online resources—such as webinars, podcasts, and articles—can further improve monetary understanding and introduce new approaches for recovery. Embracing technology not only simplifies fiscal oversight but also empowers CFOs to make informed choices that drive sustainable economic health, echoing the strategies outlined in our whitepaper. Case studies demonstrate the successful application of budgeting apps, showcasing their impact on personal finance management and overall economic stability.

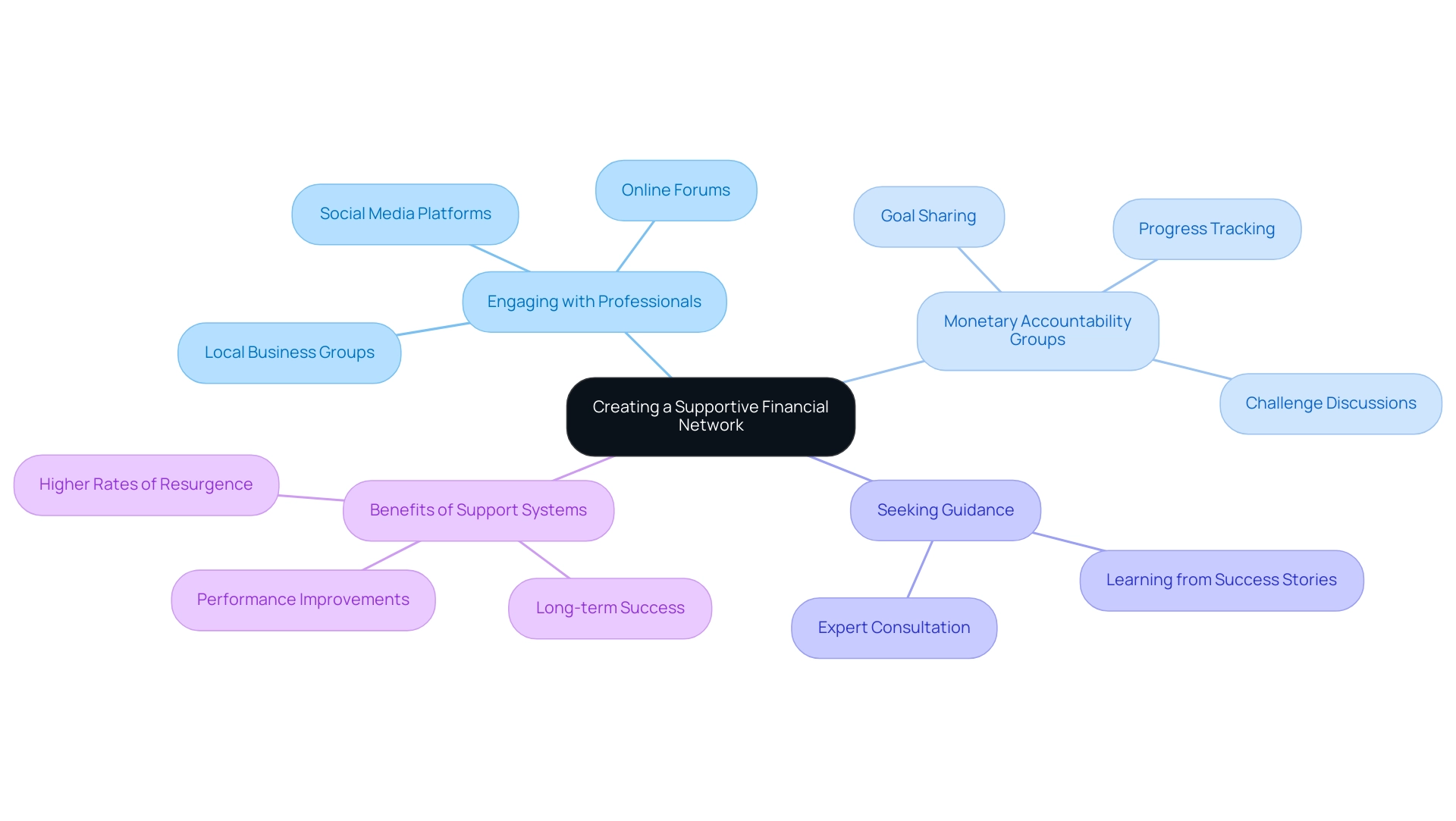

Creating a Supportive Financial Network

Engaging with like-minded professionals is a crucial step in financial restoration. Engage with local business groups, participate in online forums, or leverage social media platforms to share experiences and strategies. This collaboration can provide both motivation and practical insights essential for your recovery journey. Our extensive [turnaround and restructuring consulting services](https://smbdistress.com/premier-partner-program) emphasize thorough evaluations that preserve cash and reduce liabilities, ensuring your business is positioned for enhancement.

Consider establishing a monetary accountability group where members can openly share their goals, track progress, and discuss challenges. Such groups promote , which are essential for ongoing economic improvement. Research indicates that businesses that participate in organized support systems experience significantly higher rates of resurgence and growth. This mirrors the structured support we provide in our consulting services.

Furthermore, seek guidance from individuals who have successfully managed economic restoration. Learning from their experiences can provide valuable lessons and inspiration. For instance, our experienced team, with over 100 years of combined expertise, has successfully guided numerous small to medium businesses through crisis resolution and transformational change using our proven Rapid-30 process.

A strong financial network serves as a catalyst for growth, helping you stay focused and committed. Data indicates that structured support systems and accountability measures lead to significant improvements in business performance. By building a supportive network, you not only enhance your recovery journey but also position yourself for long-term success. The collective wisdom and shared experiences within these groups can drive performance improvements, echoing the operational efficiency we aim to achieve through our consulting services.

Conclusion

Building a healthy relationship with money is essential for CFOs navigating the complexities of financial recovery. It begins with self-reflection to identify attitudes toward finances, setting clear financial goals, and fostering a mindset of abundance. By understanding personal financial behaviors and collaborating with trusted partners, CFOs can align their decisions with a forward-looking vision that enhances organizational stability.

The practical steps outlined for effective financial recovery emphasize the importance of thorough assessments, budgeting, and proactive debt management. Establishing an emergency fund and continuously monitoring financial strategies are vital for adapting to changing circumstances. Utilizing technology streamlines these processes, offering valuable insights and fostering accountability, ultimately leading to improved cash flow and profitability.

Creating a supportive network amplifies these efforts, providing motivation and shared experiences that drive recovery. Engaging with peers, forming accountability groups, and seeking mentorship can significantly enhance the recovery journey. Together, these strategies empower CFOs to lead their organizations confidently and effectively, transforming financial challenges into opportunities for growth and success.

Embracing these actionable insights will not only facilitate recovery but also lay the groundwork for a resilient financial future.

Frequently Asked Questions

What is the first step for CFOs to establish a healthy connection with money?

The first step is to assess current attitudes toward money, determining whether it is a source of stress or a tool for empowerment, and recognizing harmful beliefs or habits that may hinder monetary progress.

How can CFOs gain deeper insights into their monetary beliefs?

CFOs can gain insights by journaling their monetary thoughts or seeking guidance from a money coach.

Why is it important for CFOs to find a trusted partner to discuss money?

Having a trusted partner can significantly increase accountability and help CFOs stay aligned with their monetary goals, especially during complex recovery processes.

What should CFOs do to establish clear economic objectives?

CFOs should define both short-term and long-term economic objectives, aligning them with strategies outlined in resources like the whitepaper 'Mastering the Cash Conversion Cycle: 20 Strategies for Optimal Business Performance.'

How does reflecting on monetary goals impact CFOs?

Reflecting on monetary goals can be empowering and motivate better monetary decisions, despite current challenges.

What mindset shift is recommended for improving financial relationships?

Practicing gratitude and shifting from a scarcity mindset to an abundance mindset fosters a more positive relationship with finances.

What is the recommended approach for businesses facing economic distress?

Begin with a thorough monetary assessment to identify underlying issues, establish an emergency fund, and develop a detailed budget aligned with recovery goals.

What methods can be used to prioritize paying down high-interest debts?

CFOs can use the 'avalanche' method, which focuses on clearing debts from highest to lowest interest rate, or the 'snowball' method, which targets debts from smallest to largest.

How can individuals increase their income during recovery?

Individuals can explore additional work, freelance opportunities, or negotiate salary increases.

What is the importance of tracking credit card balances?

Maintaining low or no credit card balances is crucial for economic health, especially given the recent rise in delinquency rates.

How can budgeting software assist in financial management?

Budgeting software simplifies budget tracking and expense oversight, providing insights into spending patterns and helping maintain fiscal accountability.

What resources can CFOs utilize to improve their monetary understanding?

CFOs can engage with online resources such as webinars, podcasts, and articles to enhance their financial knowledge and introduce new recovery approaches.

Why is engaging with a network of professionals important for financial restoration?

Engaging with like-minded professionals provides motivation, practical insights, and accountability essential for the recovery journey.

What benefits do monetary accountability groups offer?

These groups promote mutual assistance and responsibility, which are vital for ongoing economic improvement and can lead to higher rates of resurgence and growth.

How can learning from others' experiences aid in economic restoration?

Learning from individuals who have successfully managed economic restoration can provide valuable lessons and inspiration for CFOs navigating their own recovery.