Overview

This article presents an authoritative, step-by-step guide for CFOs aiming to achieve operational cost reduction. By focusing on strategies such as:

- Optimizing supply chain management

- Leveraging technology

- Enhancing workforce management

it underscores the critical importance of understanding operational costs. Furthermore, it outlines actionable steps—such as:

- Setting clear objectives

- Establishing key performance indicators

that are essential for ensuring sustainable financial health and growth in the face of economic pressures.

Introduction

In the dynamic realm of business, operational costs emerge as a pivotal focus for CFOs committed to financial optimization. As organizations confront escalating expenses fueled by inflation and market fluctuations, a thorough grasp of operational costs—spanning fixed and variable expenses, as well as direct and indirect costs—becomes essential.

This article explores the complexities of operational costs, providing insights into effective cost reduction strategies that empower CFOs to elevate financial performance. By examining critical areas such as:

- Supply chain management

- Labor costs

- Technology integration

Businesses can identify actionable measures to streamline operations and promote sustainable growth. As the economic landscape continues to evolve, adapting these strategies will be vital for organizations seeking to sustain a competitive advantage while navigating forthcoming challenges.

Understanding Operational Costs: Definitions and Categories

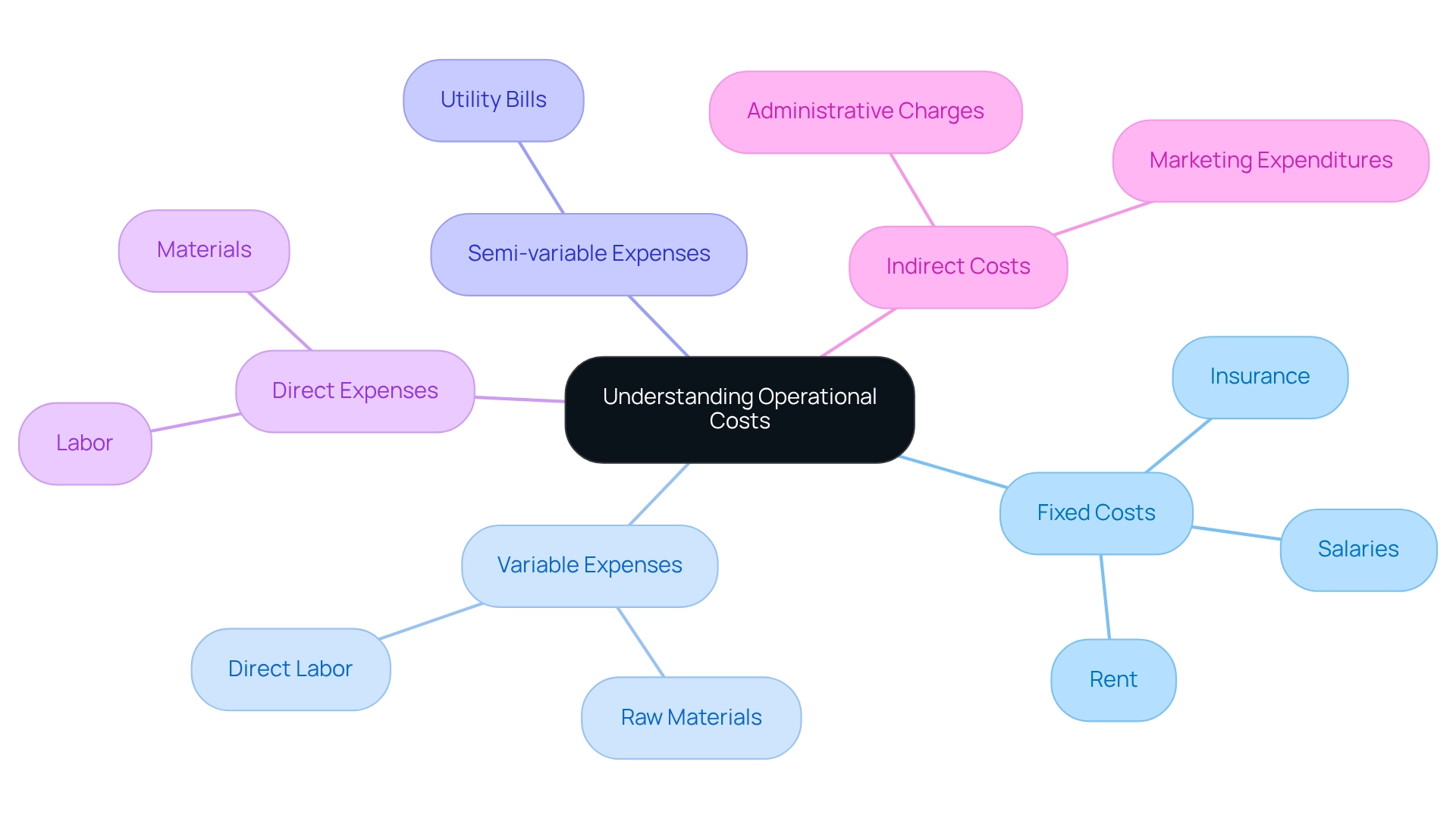

Operational expenses, often referred to as operating expenditures (OpEx), signify the ongoing outlays that businesses face in their daily activities. Grasping these expenses is essential for CFOs seeking to enhance financial performance and achieve operational cost reduction. Operational costs can be categorized into several distinct types:

- Fixed Costs: These expenses remain constant regardless of production levels. Common examples include rent, salaries, and insurance premiums, which provide stability in budgeting.

- Variable Expenses: Unlike fixed expenses, variable expenses fluctuate with production volume. This category encompasses expenses such as raw materials and direct labor, which can significantly impact overall operational efficiency.

- Semi-variable Expenses: These expenses include both fixed and variable components. For instance, utility bills often have a base charge plus additional fees based on usage, making them partially predictable yet variable.

- Direct Expenses: Directly linked to the creation of products or services, direct expenses encompass materials and labor that are vital for manufacturing or service provision.

- Indirect Costs: These expenses are not directly tied to production activities. They encompass administrative charges, marketing expenditures, and other overheads that sustain the enterprise but do not directly contribute to output.

In 2025, small to medium enterprises are anticipated to observe an average operating expense distribution that mirrors persistent economic pressures, including inflation and hiring difficulties. Recent statistics show that operational expenses are increasing, with inflation being a major concern for many entrepreneurs. According to a case study by Guidant Financial, inflation and price rises are the primary concerns for small enterprise owners, followed by recruitment and retention challenges, indicating ongoing pressures in the current economic climate.

This trend underscores the importance for financial leaders to enhance their comprehension of operational cost reduction to tackle these challenges efficiently.

Moreover, as companies direct a larger portion of their budget towards online advertising, especially on social platforms, they are likely to experience improved ROI, which can impact operational expense strategies. The transition to online and mobile-first methods in the small enterprise environment further highlights the necessity for CFOs to adjust their operational expenditure management strategies to satisfy changing customer expectations.

To achieve this, Transform Your Small/ Medium Business will identify underlying business issues and work collaboratively to create a plan that mitigates weaknesses, allowing businesses to reinvest in key strengths. By employing a pragmatic approach to data, we test every hypothesis to deliver maximum return on invested capital in both the short and long term. This encompasses a 'Test & Measure' approach where we examine data to evaluate the effectiveness of expense reduction initiatives, ensuring that decisions are guided by real-time analytics.

This continuous performance monitoring and relationship-building through real-time analytics will enable financial leaders to operationalize turnaround lessons effectively.

As Kelly Main, a Marketing Editor and Writer, notes, "The opinions expressed are the author’s alone and have not been provided, approved, or otherwise endorsed by our partners." This emphasizes the significance of improving marketing strategies and embracing new technologies, which relates to operational expense management.

By classifying and examining these expenses, financial officers can gain valuable insights into their financial statements, allowing them to identify potential savings and implement operational cost reduction strategies. Grasping operational expenses will be crucial in attaining sustainable growth as the business environment continues to evolve.

Identifying Key Areas for Cost Reduction: Where to Focus Your Efforts

To efficiently decrease operational expenses, CFOs should focus on the following essential areas:

- Supply Chain Management: Conduct a thorough analysis of procurement processes and engage in negotiations with suppliers to secure more favorable terms. Streamlining transportation and logistics, along with improving supplier collaboration, can achieve operational cost reduction and result in significant savings. For example, firms employing AI-driven tools such as Throughput have indicated increased insight into their supply chains, leading to lowered expenses and better operational efficiency. This demonstrates the tangible benefits of leveraging technology in supply chain management, particularly in achieving operational cost reduction.

- Labor Costs: Evaluate current staffing levels and explore automation for repetitive tasks. The average labor expense savings through automation in small enterprises is anticipated to be substantial in 2025, with estimates indicating savings of up to 30%. As automation technologies become more accessible and effective, this shift not only facilitates operational cost reduction by lowering payroll expenses but also enables employees to concentrate on higher-value tasks.

- Overhead Expenses: Examine fixed expenditures, including rent and utilities. Consider renegotiating leases or implementing energy-saving measures to lower these expenses. With increasing expenses, such as the 7% rise in the price of goods sold attributed to supply chain disruptions, material input price hikes, and high inflation, operational cost reduction and managing overhead have become more crucial than ever. This statistic from IHS Markit underscores the urgency for CFOs to take action.

- Inventory Management: Optimize inventory levels to reduce holding expenses and minimize waste. Effective inventory management can lead to a more agile supply chain, facilitating operational cost reduction by allowing businesses to respond swiftly to market changes while reducing excess stock.

- Technology Utilization: Assess existing technology and software to identify underutilized resources that can be eliminated or consolidated. The adoption rate of artificial intelligence in supply chain management is expected to grow by 45.55% by 2025, indicating a shift towards more technology-driven solutions that can enhance efficiency and support operational cost reduction. By embracing these advancements, financial leaders can position their organizations for greater financial success.

- Financial Assessment: A thorough financial review is essential for identifying opportunities to preserve cash and reduce liabilities. By collaborating with financial experts at Transform Your Small/ Medium Business, chief financial officers can uncover value and implement strategies that enhance efficiency and mitigate risks. This proactive strategy not only aids in immediate expense trimming initiatives but also establishes the foundation for sustainable growth. To discover more regarding our financial evaluation services, click the button below.

Furthermore, it is essential to acknowledge that 70% of US supply chain managers possess a bachelor's degree, emphasizing the importance of skilled personnel in attaining effective savings.

By systematically examining these areas, financial leaders can reveal significant opportunities for operational cost reduction, ultimately resulting in enhanced financial health and sustainable growth.

Leveraging Technology: Tools and Solutions for Cost Reduction

CFOs can strategically leverage a variety of technologies to drive significant cost reductions across their organizations, including:

- Automation Tools: Utilizing software solutions that streamline repetitive tasks—like invoicing, payroll, and data entry—can lead to substantial decreases in labor expenses and reduce the likelihood of human error. Businesses employing automation tools have reported labor savings of up to 30%, underscoring the potential for efficiency improvements. A notable example is the Nomic Foundation, which saved over $120k in HR admin processes after switching to Deel, illustrating the financial impact of adopting automation tools.

- Cloud Computing: Utilizing cloud services enables companies to reduce IT infrastructure expenses while enhancing scalability. This shift not only eliminates the need for hefty upfront investments in hardware but also provides flexibility in resource allocation. Small enterprises, in particular, have achieved savings of around 20-30% by transitioning to cloud solutions, allowing them to distribute resources more efficiently. However, 56% of HR leaders find their current technology solutions inadequate for future business needs, indicating a pressing need for financial executives to consider cloud options.

- Data Analytics: Employing advanced analytics tools allows organizations to gain valuable insights into spending patterns and operational inefficiencies. By identifying areas suitable for savings, CFOs can make informed decisions that enhance financial performance. Firms that have integrated data analytics into their financial procedures have observed an average reduction of 15% through optimized spending strategies. This aligns with the necessity for continuous business performance monitoring and operationalizing turnaround lessons.

- Project Management Software: Utilizing project management tools enhances teamwork and productivity among groups, which can significantly shorten project timelines and related expenses. By streamlining workflows and improving communication, organizations can decrease project delivery times by up to 25%, leading to quicker revenue realization. As Charles Cook, VP of Operations and Marketing, noted, "Having all these different tools wasn’t working for us. It was a real hassle trying to juggle all these separate processes on different platforms within the same team, consuming a ton of our time."

- Energy Management Systems: Implementing technology that monitors and optimizes energy usage can yield significant reductions in utility expenses. Companies that have adopted energy management systems report savings of 10-20% on energy costs, contributing to overall operational efficiency.

By integrating these technologies into their operational frameworks, financial leaders can foster a culture of continuous improvement and operational cost reduction, ultimately supporting sustainable growth and enhanced profitability. Additionally, the high expectation of job changes in sectors like advertising and marketing due to AI underscores the need for ongoing training and development, which is essential for financial leaders considering new technologies. Furthermore, Transform Your Small/ Medium Enterprise will identify underlying challenges and collaborate to create a plan that mitigates weaknesses, allowing organizations to reinvest in key strengths while testing every hypothesis to deliver maximum return on invested capital in both the short and long term.

Outsourcing and Vendor Management: Strategies for Cost Efficiency

CFOs can significantly enhance cost efficiency by leveraging strategic outsourcing and effective vendor management through the following approaches:

- Identifying Non-Core Functions: Assess and pinpoint tasks that can be outsourced, such as IT support, customer service, or accounting. This not only lowers labor expenses but also enables internal teams to concentrate on essential activities that promote growth. As noted by The Hackett Group, "Outsourcing empowers businesses to scale operations up or down quickly by adjusting outsourced resources."

- Vendor Negotiation: Regularly review and renegotiate contracts with suppliers to secure more favorable pricing and terms. Efficient bargaining methods can result in significant savings, as demonstrated by many financial executives who have effectively lowered expenses through strategic conversations with suppliers.

- Consolidating Vendors: Streamline vendor management by reducing the number of suppliers. This consolidation can lead to bulk purchasing discounts and simplified communication, ultimately enhancing operational efficiency.

- Performance Monitoring: Implement robust metrics to evaluate vendor performance. Routine evaluations guarantee that suppliers adhere to set pricing and quality benchmarks, promoting responsibility and ongoing enhancement. Utilizing real-time analytics through a client dashboard can further enhance this process, enabling financial executives to monitor vendor performance dynamically and make informed decisions quickly.

- Building Strategic Partnerships: Cultivate long-term relationships with key vendors. These collaborations can foster teamwork and creativity, leading to savings and enhanced service delivery. By operationalizing lessons learned from past vendor interactions, financial leaders can strengthen these relationships and enhance overall business performance.

By adopting these strategies, CFOs can optimize vendor relationships, resulting in substantial operational cost reductions and improved operational efficiency. The U.S. outsourcing market, which holds a 38% share of the global industry, exemplifies the potential for cost savings through effective outsourcing strategies. Notably, 42% of cybersecurity companies plan to increase their level of outsourcing, reflecting a growing trend in the industry.

As businesses increasingly turn to digital outsourcing methods like cloud computing and robotic process automation (RPA), they can achieve scalable and cost-efficient solutions that enhance productivity and strategic focus. The case study titled "Conclusion on Outsourcing Trends" illustrates how these approaches can optimize operations in a rapidly changing environment.

Optimizing Workforce Management: Training and Smart Hiring Practices

To optimize workforce management effectively, CFOs should adopt the following practices:

- Smart Hiring: Establish a comprehensive hiring process that prioritizes candidates who not only possess the necessary skills but also resonate with the company culture. This alignment is essential, as research shows that turnover expenses can be significant, with estimates indicating that replacing an employee can require up to 150% of their yearly salary. By emphasizing cultural alignment, organizations can significantly lower these expenses and improve employee retention.

- Training Programs: Investing in robust employee training initiatives is essential for enhancing skills and productivity. Successful training initiatives have demonstrated the ability to enhance performance and may lead to operational cost reduction. For instance, companies that prioritize training report a 24% higher profit margin compared to those that do not. Additionally, the disruption from experienced employee departures increases training needs for the entire team, making it imperative to invest in training. This investment not only boosts employee morale but also fosters a culture of continuous improvement. Furthermore, 54% of employees who felt unappreciated reported that their work stress was unmanageable, highlighting the importance of appreciation in reducing turnover and enhancing productivity.

- Flexible Work Arrangements: Embracing flexible work options, such as remote work, can lead to substantial overhead savings associated with maintaining physical office spaces. A recent study revealed that 51% of employees prefer more flexible work arrangements, with 84% of working parents considering flexibility a top priority when evaluating job opportunities. By accommodating these preferences, organizations can enhance employee satisfaction and retention, ultimately contributing to savings.

- Performance Management: Implementing clear performance metrics and conducting regular reviews ensures that employees are aligned with organizational goals and are actively contributing to cost-saving initiatives. This structured approach not only holds employees accountable but also identifies high performers who can drive efficiency within the organization. As noted by Inspirus, "If you're struggling with turnover, chat with an Inspirus specialist to see how a strategic recognition program can help you build a workplace where employees feel valued — and want to stay."

- Workforce Analytics: Leveraging data analytics to assess workforce productivity is vital for identifying areas ripe for improvement. By analyzing performance metrics, financial leaders can make informed decisions that enhance operational efficiency, leading to operational cost reduction. This data-driven approach allows for targeted interventions that can lead to significant savings over time. Moreover, Transform Your Small/ Medium Enterprise facilitates a reduced decision-making cycle during the turnaround process, enabling financial officers to take decisive action based on real-time analytics. This continual monitoring through our client dashboard helps diagnose business health effectively.

By focusing on these strategic workforce management methods, financial leaders can develop a more effective workforce that plays a crucial role in attaining overall savings. The partnership between ATCC and Inspirus to implement a structured recognition program resulted in a 10% increase in employee retention, demonstrating the positive impact of recognition on retention strategies.

Implementing Energy Efficiency and Sustainability Initiatives

CFOs can lead substantial operational expense savings and improve sustainability by executing the following energy efficiency initiatives:

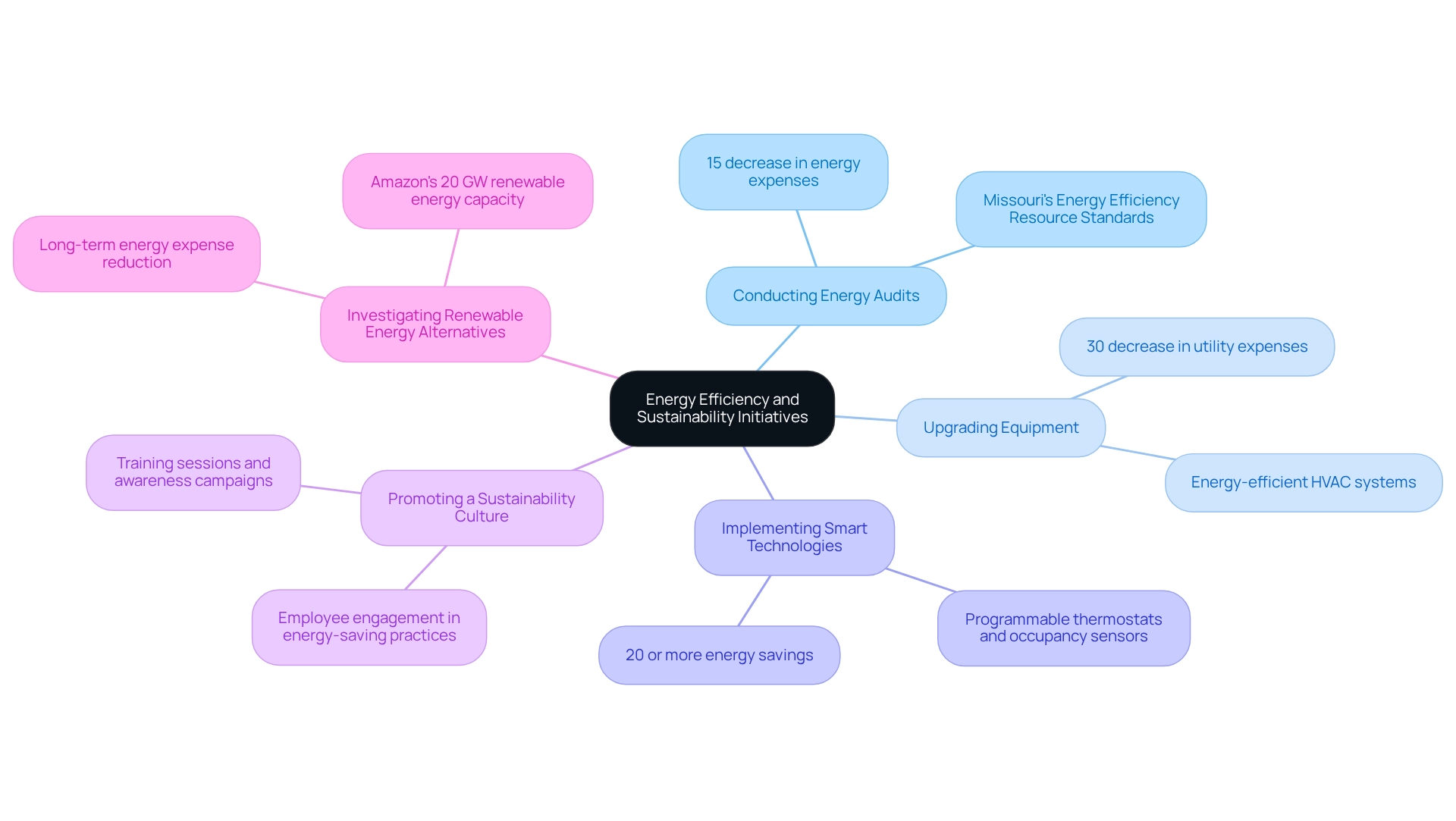

- Conducting Energy Audits: Begin with a comprehensive assessment of current energy usage. Energy audits can reveal inefficiencies and highlight areas where improvements can lead to substantial savings. In 2025, companies that performed energy audits reported an average decrease of 15% on their energy expenses. A prominent instance is Missouri's Energy Efficiency Resource Standards, which set voluntary targets for electric utilities to reach gradual yearly energy savings, demonstrating the potential for substantial savings through organized energy initiatives.

- Upgrading Equipment: Investing in energy-efficient appliances and systems is crucial. Upgrading to contemporary, energy-efficient equipment can result in a decrease in utility expenses by up to 30% over time. For instance, small enterprises that transitioned to energy-efficient HVAC systems experienced operational cost reduction, illustrating the long-term financial advantages of such investments.

- Implementing Smart Technologies: The integration of smart technologies, such as programmable thermostats and occupancy sensors for lighting, can drastically minimize energy waste. These systems adjust automatically based on usage patterns, leading to further savings. Companies that adopted smart technologies reported energy savings of 20% or more. Additionally, the Energy Storage TCP focuses on optimizing energy efficiency and integrating renewable energy technologies, which can further enhance these initiatives.

- Promoting a Sustainability Culture: Cultivating a culture of sustainability within the organization encourages employees to adopt energy-saving practices in their daily routines. Training sessions and awareness campaigns can empower staff to contribute to energy efficiency goals, ultimately enhancing overall performance and reducing costs.

- Investigating Renewable Energy Alternatives: Investing in renewable energy sources, like solar panels, not only lowers long-term energy expenses but also aligns with global sustainability objectives. Organizations that have made this transition are not only saving on energy bills but also benefiting from tax incentives and improved public perception. As Amazon has shown by securing agreements for over 20 GW of renewable energy capacity, corporate dedication to sustainability can result in significant operational advantages.

By focusing on these initiatives, financial leaders can attain operational cost reduction while also supporting environmental sustainability, establishing their organizations as pioneers in responsible corporate practices. Furthermore, with Australia's New Vehicle Efficiency Standard aiming to reduce emissions from new passenger vehicles by over 60% by 2030, the urgency for businesses to adopt energy-efficient practices has never been more critical.

Actionable Steps for CFOs: Implementing Your Cost Reduction Strategy

To implement a successful cost reduction strategy, CFOs must adhere to the following actionable steps:

- Set Clear Objectives: Establish specific, measurable targets for expense reduction initiatives. This clarity not only facilitates tracking progress but also aligns the team’s efforts towards common targets, enhancing accountability. In 2025, CFOs are encouraged to explore new roles to drive organizational success, making it essential to set objectives that reflect these evolving responsibilities.

- Engage Stakeholders: Actively involve key stakeholders in the planning process. Their insights and support are crucial for fostering buy-in, significantly increasing the likelihood of successful implementation. Engaging stakeholders early can also help identify potential challenges and opportunities. For instance, the case of the former Just Salad CFO lawsuit illustrates the importance of clear performance expectations and compensation structures in stakeholder engagement.

- Develop a Detailed Plan: Craft a comprehensive plan that delineates the steps, timelines, and resources required for execution. This plan should include innovative workforce management strategies, such as leveraging telemedicine and nurse practitioners, to effectively address rising labor costs. These strategies can provide concrete solutions to manage expenses while maintaining quality service. Furthermore, incorporating real-time analytics into this plan allows for ongoing evaluation of organizational health, enabling timely adjustments to strategies as necessary. Utilizing the client dashboard from Transform Your Small/Medium Business can enhance this process by providing real-time business analytics.

- Communicate Changes: Clearly explain the reasoning and advantages of the expense-cutting initiatives to all employees. This communication promotes a culture of financial awareness and encourages involvement at all levels, which is vital for maintaining momentum. As a reminder, "Your financial strength is a clear indicator of your overall progress," emphasizing the importance of financial performance in these initiatives.

- Monitor Progress: Regularly assess the effectiveness of the implemented strategies. Ongoing observation via real-time business insights, like those offered by Transform Your Small/Medium Business, facilitates prompt adjustments, guaranteeing that the organization stays aligned with its expense-cutting objectives. Statistics show that organizations with strong monitoring processes achieve higher success rates in their expense management goals. By operationalizing turnaround lessons and maintaining a focus on performance metrics, financial leaders can enhance their strategic decision-making processes.

By following these steps, financial leaders can effectively carry out their expense trimming strategies, driving significant change and improving financial performance within their organizations. For additional insights and networking opportunities related to expense cutting strategies, participants can follow updates from the conference using the hashtag #GartnerFinance.

Monitoring and Adjusting Strategies: Ensuring Long-Term Cost Reduction Success

To secure the long-term success of cost reduction strategies, CFOs at Transform Your Small/ Medium Business should adopt the following practices:

- Establish Key Performance Indicators (KPIs): Clearly define KPIs that align with organizational objectives to assess the effectiveness of expense management initiatives. These indicators should provide actionable data that enables real-time decision-making and predictive insights to anticipate potential challenges. Effective KPIs are characterized by strategic alignment with key objectives, actionable data for real-time decisions, and predictive value to foresee potential issues, avoiding vanity metrics.

- Conduct Regular Reviews: Establish a timetable for routine evaluations of expense trimming strategies. This practice allows for the assessment of their impact and the identification of areas needing improvement, ensuring that strategies remain relevant and effective in a changing economic landscape. Regular reviews can also help in monitoring working capital, which indicates the health of a company's balance sheet and its ability to meet short-term obligations.

- Solicit Employee Feedback: Actively encourage employees to share their insights on expense reduction initiatives. Their feedback can unveil practical viewpoints on effectiveness and emphasize areas for modification, promoting a cooperative strategy for resource management.

- Stay Informed on Market Trends: Continuously monitor industry trends and economic changes that could impact operational expenses. By staying informed, CFOs can adapt their strategies proactively, ensuring alignment with market conditions and maintaining competitive advantage.

- Foster a Culture of Continuous Improvement: Cultivate an organizational culture that prioritizes ongoing cost management and innovation. Encouraging employees to contribute ideas for further savings not only enhances engagement but also drives sustainable financial health.

- Utilize Performance Dashboards: Implement effective performance dashboards that provide real-time analytics to enhance KPI understanding and speed up decision-making. These dashboards improve the capacity of organizations to track their performance consistently, enabling prompt adjustments and knowledgeable decisions that promote overall organizational health.

By applying these strategies, CFOs at Transform Your Small/ Medium Business can ensure that their initiatives for operational cost reduction are not only effective but also contribute significantly to the organization's long-term financial stability and growth. As Dennis Najjar aptly stated, "By keeping an eye on these indicators, you can ensure that your business is on the right path to achieving its goals." Additionally, understanding the debt-to-equity ratio can provide crucial insights into financial health, further supporting effective cost management.

Conclusion

Understanding and managing operational costs is crucial for CFOs aiming to enhance financial performance and navigate the complexities of today’s business landscape. By categorizing costs into fixed, variable, semi-variable, direct, and indirect, CFOs can identify key areas for potential savings and implement effective cost reduction strategies. Focus areas such as supply chain management, labor costs, and technology integration emerge as critical components for driving efficiency and fostering sustainable growth.

Moreover, leveraging technology plays a pivotal role in this endeavor. Automation tools, cloud computing, data analytics, and energy management systems not only streamline operations but also lead to significant cost reductions. By employing these technologies, organizations can enhance their operational frameworks and position themselves for long-term financial success. Additionally, strategic outsourcing and effective vendor management provide avenues for further cost efficiency, allowing businesses to concentrate on core activities while optimizing resource allocation.

Ultimately, the proactive implementation of workforce management practices, energy efficiency initiatives, and continuous monitoring of cost reduction strategies ensures that organizations remain agile and competitive. CFOs must establish clear objectives, engage stakeholders, and foster a culture of continuous improvement to achieve sustainable financial health. As the economic landscape continues to evolve, adapting these strategies will be essential for organizations seeking to thrive amidst challenges and capitalize on opportunities for growth. Now is the time for CFOs to take decisive action and refine their operational cost management approaches to secure a prosperous future.

Frequently Asked Questions

What are operational expenses?

Operational expenses, or operating expenditures (OpEx), are the ongoing costs that businesses incur in their daily activities. Understanding these expenses is crucial for CFOs aiming to improve financial performance and reduce operational costs.

What are the different types of operational costs?

Operational costs can be categorized into five types: 1. Fixed Costs - remain constant regardless of production levels (e.g., rent, salaries, insurance). 2. Variable Expenses - fluctuate with production volume (e.g., raw materials, direct labor). 3. Semi-variable Expenses - include both fixed and variable components (e.g., utility bills). 4. Direct Expenses - directly linked to the production of goods or services (e.g., materials, labor). 5. Indirect Costs - not directly tied to production (e.g., administrative charges, marketing expenditures).

What trends are affecting operational expenses for small to medium enterprises in 2025?

Small to medium enterprises are expected to face persistent economic pressures such as inflation and hiring difficulties, which will influence their operating expense distribution. Recent statistics indicate that operational expenses are rising, with inflation being a primary concern for many business owners.

How can CFOs reduce operational expenses effectively?

CFOs can focus on several key areas to reduce operational expenses: - Supply Chain Management: Analyze procurement processes and negotiate better terms with suppliers. - Labor Costs: Evaluate staffing levels and explore automation for repetitive tasks. - Overhead Expenses: Examine fixed costs like rent and utilities, and consider renegotiating leases. - Inventory Management: Optimize inventory levels to reduce holding costs and waste. - Technology Utilization: Assess and consolidate underutilized technology and software. - Financial Assessment: Conduct thorough financial reviews to identify cash preservation opportunities.

What role does technology play in operational cost reduction?

Technology, particularly AI-driven tools, can enhance supply chain management and improve operational efficiency, leading to reduced expenses. The adoption of technology solutions is expected to grow, enabling businesses to streamline processes and achieve significant savings.

Why is understanding operational expenses important for financial leaders?

By classifying and examining operational expenses, financial leaders can gain insights into their financial statements, identify potential savings, and implement strategies for operational cost reduction, which is crucial for achieving sustainable growth in an evolving business environment.