Introduction

In the wake of financial upheaval, establishing a solid recovery plan is not just a necessity—it's a strategic imperative. Organizations and individuals alike must embark on a thorough evaluation of their financial landscapes, identifying strengths and vulnerabilities to craft a resilient financial strategy. This journey involves:

- Setting achievable goals

- Implementing smart budgeting techniques

- Embracing the fundamentals of saving and investing for long-term stability

Moreover, for those navigating the aftermath of bankruptcy, it’s crucial to shift from a mindset of limitation to one of opportunity, leveraging past experiences to forge a path toward financial freedom. This article outlines actionable steps and strategies to not only recover but thrive in a post-crisis environment, ensuring a robust financial future.

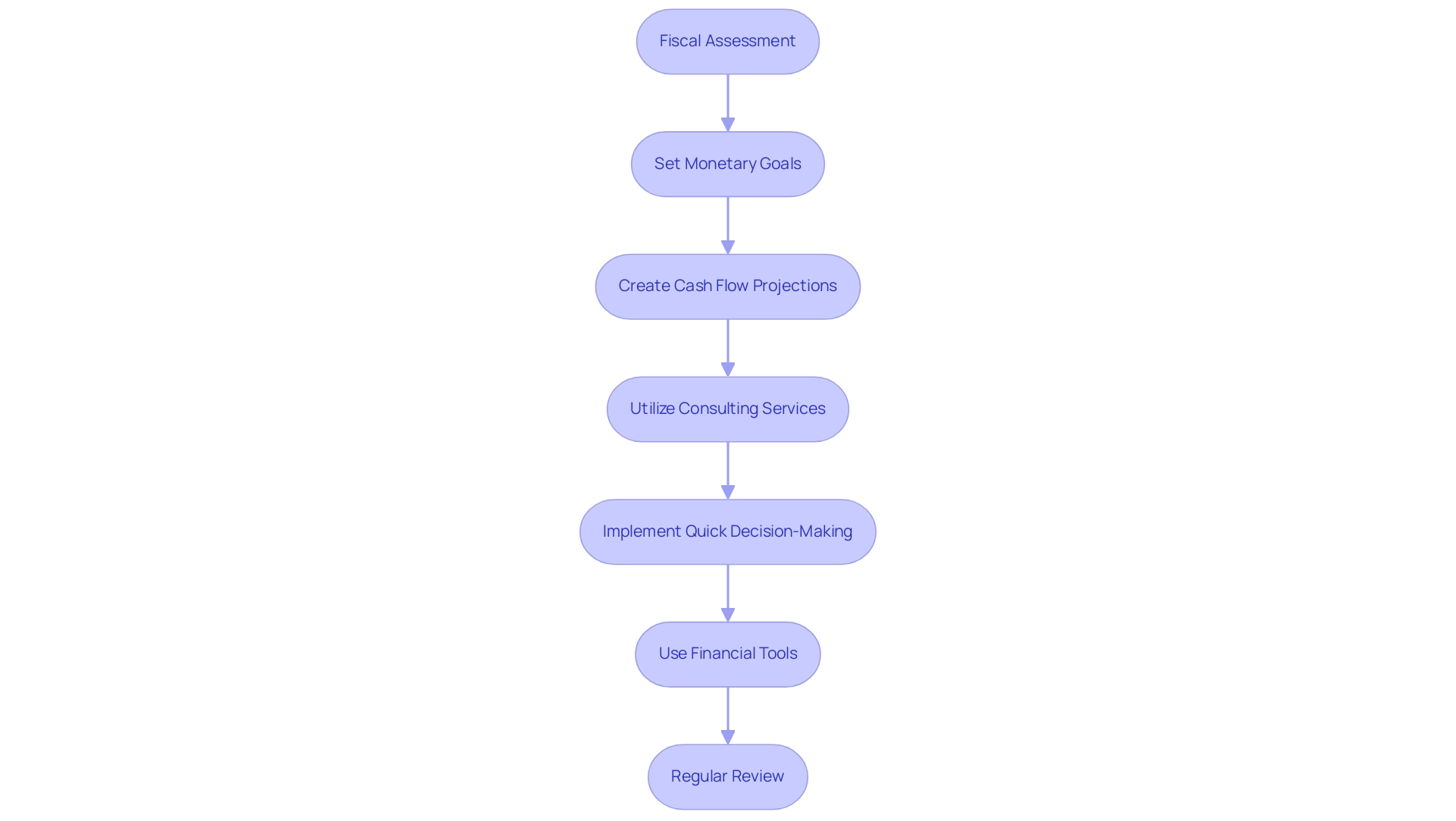

Establishing a Strong Financial Plan for Recovery

To establish a robust monetary plan for recovery, begin with a comprehensive fiscal assessment. This essential step entails assessing your present monetary condition, including assets, liabilities, income, and costs, to reveal chances for cash preservation and liability reduction. Next, set clear, achievable monetary goals for both the short and long term, prioritizing essential expenses while identifying areas for cost reduction.

Create a cash flow projection for the upcoming months to guide your decisions. Additionally, our turnaround consulting services can provide professional insights to enhance your strategy, allowing for quick decision-making and implementation of solutions. We emphasize a quick decision-making cycle and the importance of testing hypotheses to ensure maximum return on invested capital.

Utilize financial planning tools and software to track your progress, and leverage our client dashboard for real-time analytics and continuous monitoring of your business health. Regularly review and adjust your plan as your situation evolves, ensuring you remain on track toward recovery while operationalizing lessons learned for future improvements. For more information on how to engage with our services, contact us today.

Strategies for Rebuilding Your Credit Score

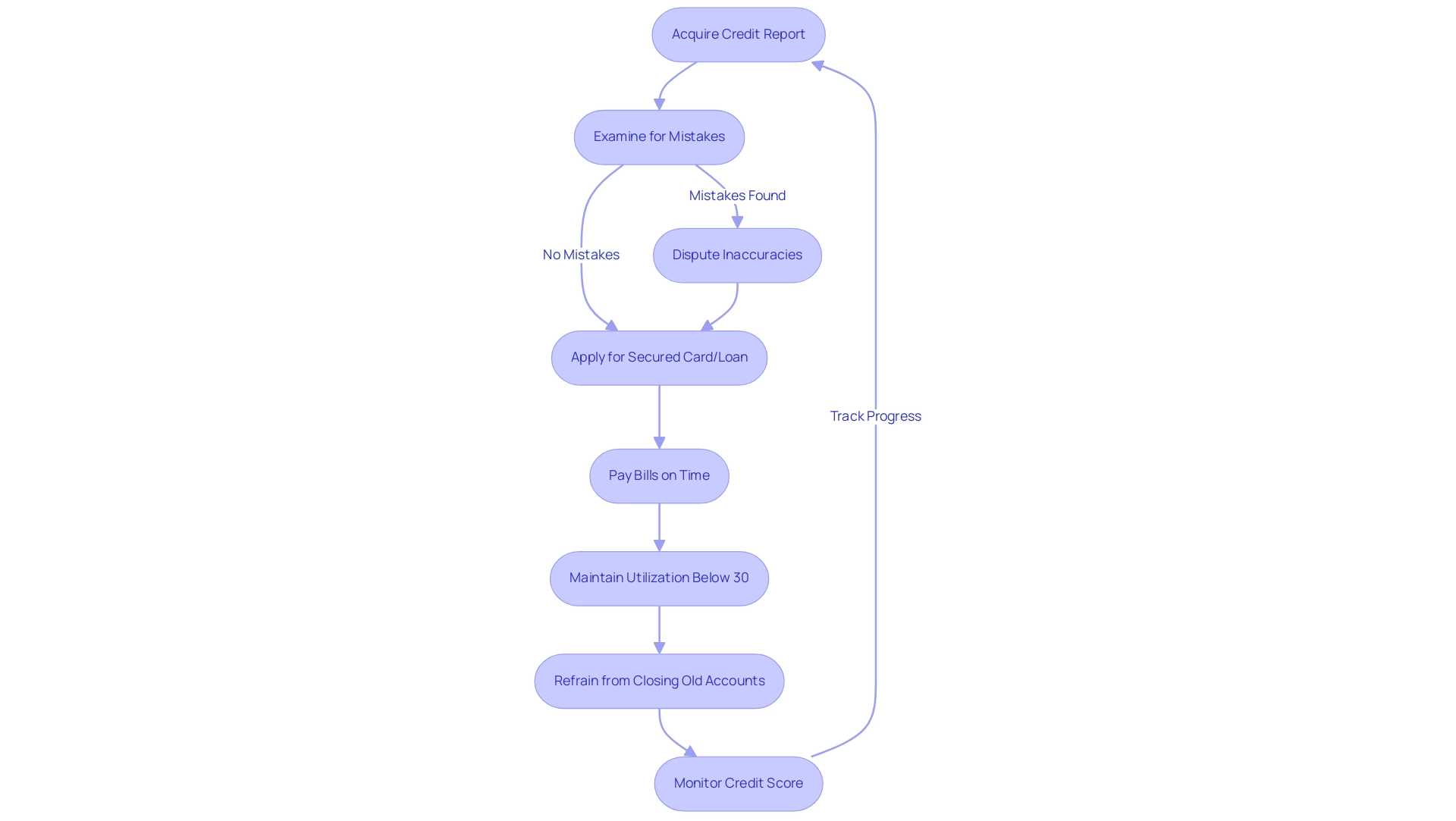

To restore your score, begin by acquiring a copy of your report and examining it for mistakes. Dispute any inaccuracies you find, as correcting these can positively impact your score. Next, consider applying for a secured card or a loan designed to build your financial reputation, which can assist you in establishing a positive payment history.

Ensure to pay all bills punctually and maintain your utilization ratio below 30%. Furthermore, refrain from closing old accounts, as they add to your history length, which is advantageous for your score. Regularly monitor your credit score to track your progress and make adjustments as necessary.

Implementing Smart Budgeting Techniques

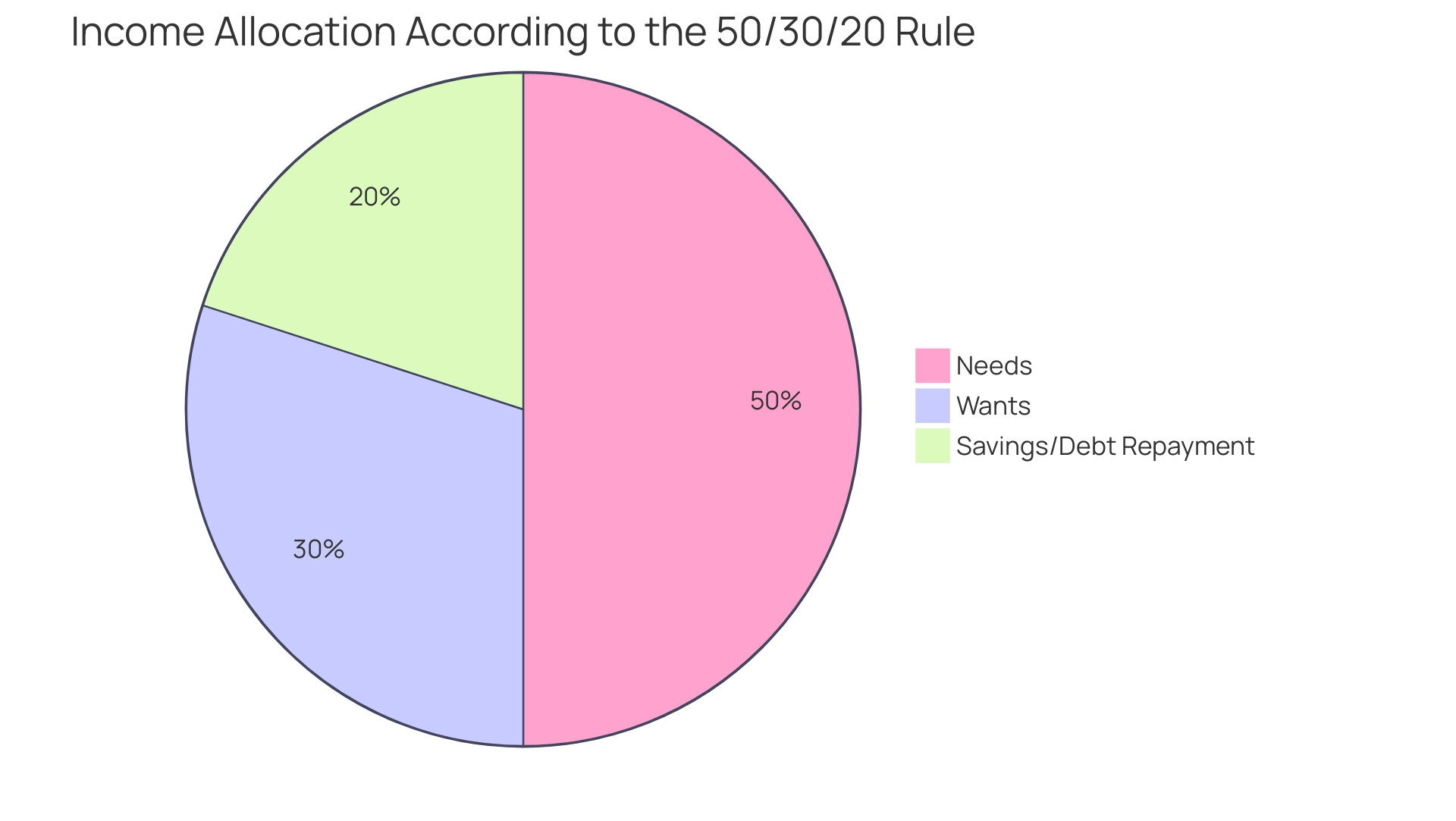

To implement smart budgeting techniques, begin by categorizing your income and outlays into fixed, variable, and discretionary categories. Use budgeting methods such as the 50/30/20 rule, which allocates:

- 50% of your income to needs

- 30% to wants

- 20% to savings or debt repayment

Track your spending using budgeting apps or spreadsheets to identify areas where you can cut back.

Additionally, set aside a small emergency fund to cover unexpected expenses, which can help prevent future monetary strain. Consistently assess and modify your budget to represent shifts in your financial circumstances and objectives.

Saving and Investing for Long-Term Stability

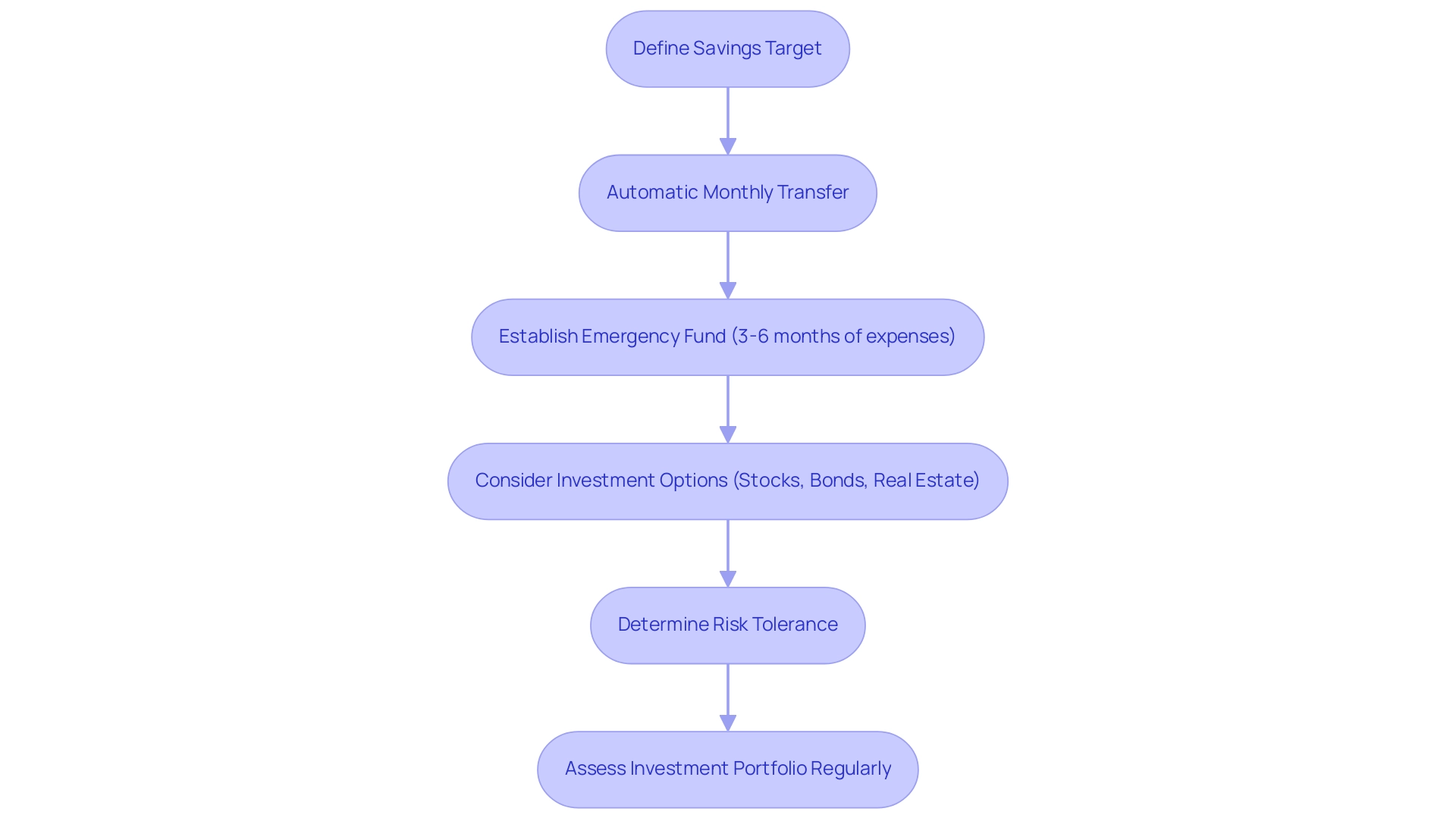

To save and invest for long-term stability, begin by defining a savings target and arranging an automatic transfer to a savings account each month. Aim to save at least three to six months' worth of living expenses in an emergency fund. Once you have a solid savings foundation, consider investing in low-cost index funds or ETFs to build wealth over time.

Educate yourself about different investment options, such as:

- Stocks

- Bonds

- Real estate

Determine your risk tolerance. Frequently assess your investment portfolio and make changes according to your monetary objectives and market conditions.

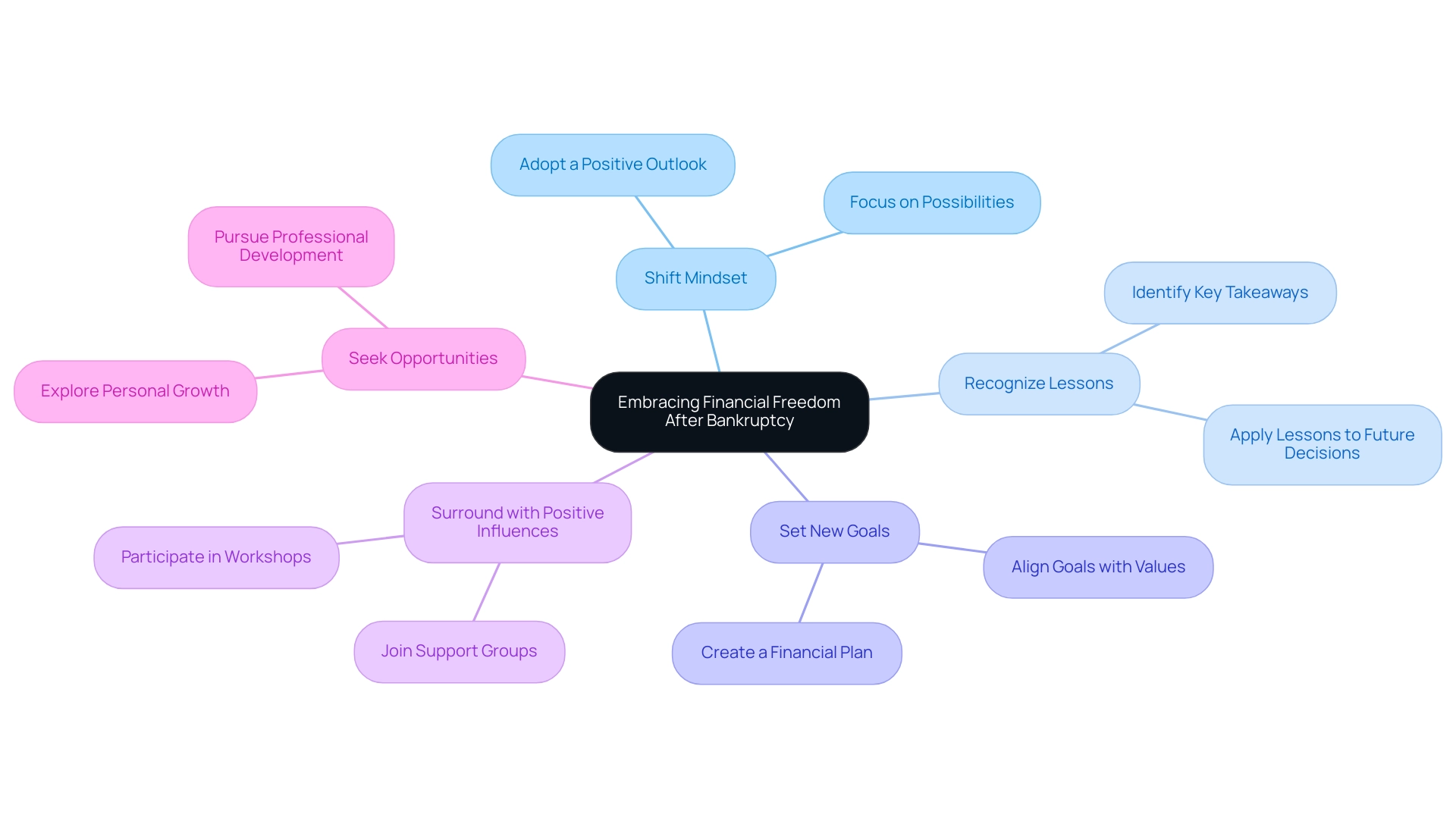

Embracing Financial Freedom After Bankruptcy

Embracing monetary freedom after bankruptcy involves shifting your mindset from one of limitation to one of possibility. Begin by recognizing the lessons gained from your experience and apply them to guide your future monetary decisions. Set new goals that align with your values and aspirations, and actively seek opportunities for personal and professional growth.

- Surround yourself with positive influences.

- Think about joining support groups or education workshops to stay motivated.

Remember that post-bankruptcy recovery is a journey, and each step forward reflects your resilience and commitment to a brighter financial future.

Conclusion

Establishing a solid recovery plan is essential for navigating the complexities of post-crisis finances. By conducting a thorough financial assessment, setting achievable goals, and implementing smart budgeting techniques, individuals and organizations can create a roadmap toward financial stability. Addressing credit score rebuilding through accurate reporting and responsible credit use further enhances this journey, empowering individuals to regain their financial footing.

Moreover, the importance of saving and investing for long-term stability cannot be overstated. By prioritizing emergency savings and understanding investment options, a sustainable financial future becomes attainable. Embracing a mindset of opportunity, especially after setbacks like bankruptcy, paves the way for growth and resilience. Learning from past experiences and setting new aspirations fosters a proactive approach to financial management.

In conclusion, the path to recovery is not merely about bouncing back; it’s about building a robust financial foundation that promotes long-term success. By taking decisive action and remaining committed to ongoing financial education, it is possible to transform challenges into opportunities, ensuring a brighter and more secure financial future.