Overview

This article examines how CFOs can adeptly address stakeholder management challenges to bolster organizational success. It underscores the significance of comprehending stakeholder interests and employing strategic communication and engagement techniques. By incorporating feedback into financial strategies, organizations can align their goals with stakeholder expectations. This alignment ultimately fosters improved financial outcomes and sustainable growth.

Introduction

In the intricate world of corporate finance, stakeholder management emerges as a pivotal component that shapes organizational success. For CFOs, understanding the diverse interests of stakeholders—from investors and employees to customers and regulatory bodies—is not merely beneficial; it is essential.

As the financial landscape evolves, particularly in 2025, the stakes are higher than ever. With pressing issues such as cyber resilience and tax reforms, CFOs must adeptly navigate these complexities while aligning financial strategies with stakeholder expectations.

This article delves into the critical role of stakeholder management, offering insights on:

- Effective engagement

- Communication strategies

- The integration of stakeholder perspectives into financial planning

Ultimately, it guides CFOs toward sustainable growth and enhanced financial performance.

Understanding Stakeholder Management: A CFO's Perspective

Stakeholder management problems can arise during the crucial process of identifying, analyzing, and engaging individuals or groups with vested interests in an organization's operations. For chief financial officers, mastering this concept is crucial, as it greatly influences budgetary decision-making and overall organizational achievement. Key participants typically include investors, employees, customers, suppliers, and regulatory bodies.

By understanding their interests and concerns, chief financial officers can address stakeholder management problems while aligning financial strategies with the expectations of involved parties, fostering a collaborative and productive environment.

In 2025, the significance of managing involved parties is emphasized by the evolving landscape of corporate finance. With only 2% of global finance and tech leaders having implemented cyber resilience actions, the urgency to tackle stakeholder management problems through proactive engagement with involved parties has never been more pressing. Furthermore, a suggested decrease in the corporate tax rate from 21% to 15% for U.S.-produced goods emphasizes the need for financial executives to manage regulatory changes while taking into account the views of interested parties.

This reduction could significantly impact stakeholders' interests, resulting in stakeholder management problems that make it imperative for CFOs to communicate effectively and manage expectations. To effectively engage stakeholders, CFOs should first familiarize themselves with the various types of stakeholders and their roles within the organization. This foundational knowledge is vital for developing effective engagement and communication strategies to overcome stakeholder management problems. For instance, the transition of Financial Planning and Analysis (FP&A) into a proactive role emphasizes the necessity for cross-departmental collaboration.

AI tools can empower FP&A teams to integrate insights into broader business strategies, fostering partnerships across departments. This strategic business collaboration improves decision-making, enabling a unified planning process that aligns with organizational objectives. Furthermore, performing comprehensive financial evaluations can reveal chances for cash conservation and liability diminishment, which are essential for upholding trust among investors and organizational stability.

As observed, 43% of financial executives report being approached for new leadership roles more frequently, indicating the increasing significance of investor engagement in career progression and organizational success. Streamlined decision-making processes and real-time analytics can further assist financial leaders in monitoring business performance and implementing turnaround lessons, thereby helping to mitigate stakeholder management problems and ensuring that the interests of all parties are continuously addressed. As we look forward, developments in financial leadership for 2025 will likely emphasize the significance of human-machine collaboration and the necessity for distinct human abilities in automation.

By prioritizing participant involvement and leveraging thorough monetary assessments, CFOs can not only enhance fiscal outcomes but also promote sustainable growth and resilience in their organizations.

The Critical Role of Stakeholder Management in Financial Success

Addressing stakeholder management problems is essential for promoting economic success in today's evolving business environment. Involving interested parties and meeting their varied needs can yield better economic outcomes, enhance organizational reputation, and increase loyalty. By 2025, chief financial officers must recognize that interested parties often possess differing priorities; for instance, investors may pursue short-term gains, while employees emphasize job security and a positive workplace culture.

By actively managing these connections and utilizing real-time analytics, chief financial officers can cultivate a balanced environment that aligns immediate economic goals with long-term sustainability. Transform Your Small/ Medium Business supports a shortened decision-making cycle throughout the turnaround process, enabling financial leaders to take decisive action to preserve their business. This proactive approach not only mitigates potential risks but also cultivates opportunities for collaboration and innovation.

Statistics show that organizations effectively addressing stakeholder management problems through engagement strategies are more likely to experience a substantial increase in economic performance. This reinforces the notion that interaction with interested parties is not merely a compliance requirement but a strategic necessity. Significantly, over 60% of projects in organizations are IT-related, highlighting the essential role of addressing stakeholder management problems in overseeing participants in these initiatives, which are often crucial for economic success. Furthermore, ongoing business performance tracking via client dashboards offers real-time business analytics, allowing CFOs to assess their business health efficiently.

Our team identifies underlying business issues and collaborates to create a plan to mitigate weaknesses, allowing the business to reinvest in key strengths. We are pragmatic in our approach to data, testing every hypothesis to deliver maximum return on invested capital in both the short and long term. Case studies reveal that companies prioritizing engagement with interested parties can overcome stakeholder management problems and often experience enhanced financial outcomes.

For instance, establishing a Gen AI Center of Excellence has proven beneficial for investment firms, as it not only upskills employees but also builds trust in AI processes, ensuring compliance and empowering teams to contribute meaningfully to scaling efforts. Doug Dannemiller, a senior research leader in investment management, emphasizes that overcoming stakeholder management problems through effective participant engagement is essential for driving organizational success. By acknowledging and balancing the diverse priorities of involved parties, financial leaders can guide their organizations toward sustainable growth and financial success.

Identifying and Analyzing Key Stakeholders for Effective Engagement

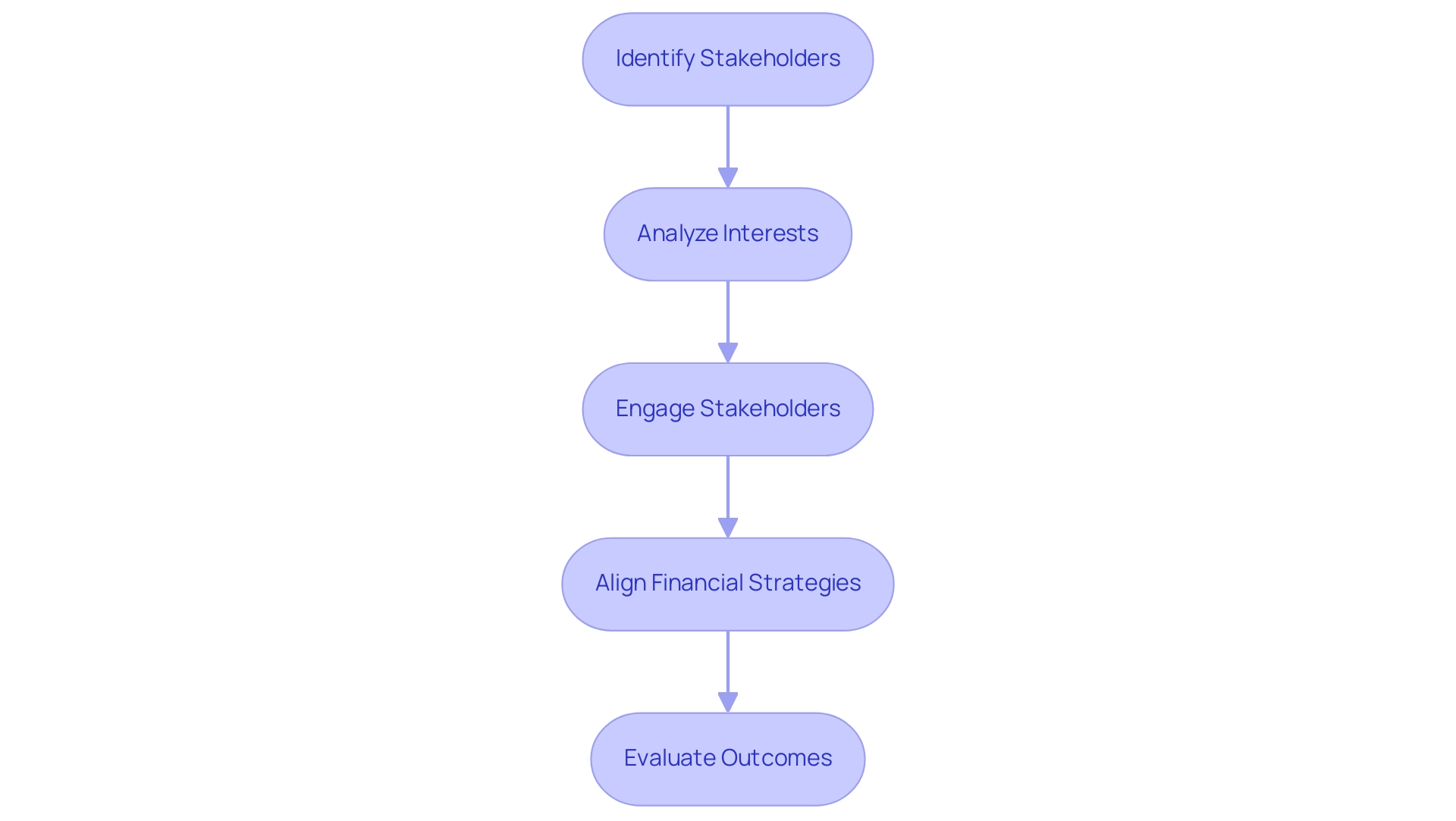

To effectively involve interested parties, CFOs must first determine who they are. This process begins with developing a map of interested parties, classifying them according to their levels of influence and interest. Here are the essential steps to follow:

- Clarify Project Focus: Before creating a participant map, it is crucial to define the project’s scope and goals. This foundational step ensures that the mapping process aligns with the organization’s objectives.

- List Interested Parties: Compile a comprehensive list of all potential interested parties, encompassing both internal groups (such as employees and management) and external entities (including investors, customers, and suppliers).

- Assess Influence and Interest: Utilize a Power/Interest Grid to categorize participants according to their influence and interest in the organization. This strategic categorization aids in prioritizing engagement efforts, ensuring that those with the most significant impact are addressed first.

- Analyze Needs and Expectations: Gain a thorough understanding of what each group values and expects from the organization. This analysis is crucial for developing tailored communication strategies that resonate with each group’s unique concerns.

- Develop Engagement Strategies: Based on the insights gathered, formulate specific strategies for involving each group. This ensures that their concerns are addressed and their interests are aligned with the organization’s goals.

Incorporating streamlined decision-making processes can significantly enhance stakeholder engagement. By supporting a shortened decision-making cycle throughout the turnaround process, financial leaders at Transform Your Small/Medium Business can take decisive action to preserve their business. Additionally, utilizing real-time analytics through client dashboards allows for continuous monitoring of business performance, enabling CFOs to adjust strategies based on current data.

For those looking to implement mapping of interested parties, tools with easy drag-and-drop functionality can simplify the process, making it accessible even for non-designers. Regular mapping of interested parties is recommended, ideally every six months or before the initiation of new project stages. This practice not only keeps the participant map current but also enhances the effectiveness of engagement strategies.

A thorough strategy for addressing stakeholder management problems, which encompasses mapping, analysis, and engagement, greatly impacts project results and decision-making procedures. As noted in the case study titled "Comprehensive Stakeholder Management" by Transform Your Small/Medium Business, effective management of involved parties addresses stakeholder management problems through mapping, analysis, and engagement, which can lead to improved project outcomes. By applying these approaches, finance leaders can manage relationships with interested parties more efficiently, ultimately resulting in enhanced monetary strategies and organizational achievement.

As Kelsey J. states, "Canva helps even the least experienced designer (me) make simple and professional-looking social media posts, and diagrams for my clients," highlighting the accessibility of tools available for creating mapping diagrams.

Strategies for Effective Stakeholder Communication and Engagement

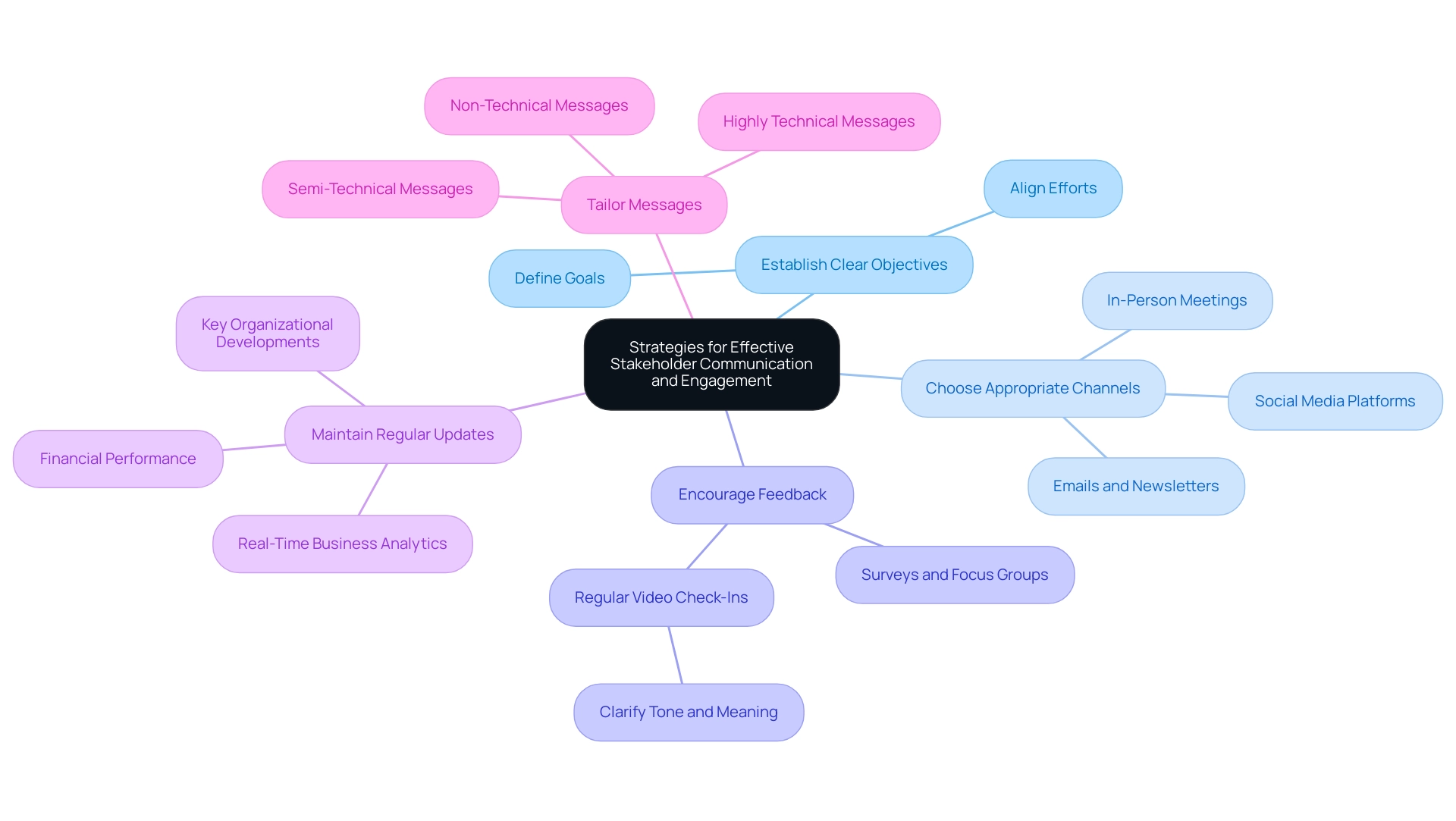

Effective communication forms the cornerstone for addressing stakeholder management challenges, particularly for CFOs navigating intricate financial landscapes. To enhance engagement with stakeholders, consider these strategic approaches:

- Establish Clear Objectives: Clearly define the goals you aim to achieve with each group involved. Articulating these objectives ensures that all parties understand the intended outcomes and can align their efforts accordingly.

- Choose Appropriate Channels: Select communication methods that resonate with each group of interest. Whether through in-person meetings, emails, newsletters, or social media platforms, the right channel can significantly enhance message reception and engagement.

- Encourage Feedback: Foster an environment where participants feel comfortable providing feedback. This can be accomplished through surveys, focus groups, or individual discussions, enabling participants to share their opinions and feel appreciated in the process. Given that digital feedback can often be misinterpreted as harsh, regular video check-ins are recommended to facilitate open discussions about feedback, helping to clarify tone and meaning.

- Maintain Regular Updates: Keep interested parties informed about key organizational developments, financial performance, and strategic initiatives. Regular updates not only establish trust but also encourage transparency, which is essential for effective relationships with interested parties. Utilizing real-time business analytics through the client dashboard provided by Transform Your Small/ Medium Business can enhance these updates, enabling participants to see the impact of decisions and adjustments made during the turnaround process.

- Tailor Messages: Customize your communication to address the specific interests and concerns of each group involved. For instance, employing a mix of highly technical, semi-technical, and non-technical messages for incident notifications can significantly improve understanding and engagement among involved parties. By ensuring that messages are relevant and engaging, you enhance the likelihood of positive responses and collaboration.

In 2025, adopting these best practices for communication with interested parties is essential for CFOs aiming to foster strong relationships and drive organizational success. A recent case study titled 'Disaggregating Incident Participants' highlighted the necessity of customizing messaging for different groups, demonstrating that this approach enhances the effectiveness of incident response by ensuring involved parties receive pertinent information without unnecessary distractions. This ultimately aligns communication with their expertise and needs.

Moreover, Richard King, Founder & CEO of Finance Alliance, emphasizes the significance of effective participant coordination, stating, "Understanding the unique needs of each group is crucial for fostering collaboration and achieving organizational objectives." By applying these tactics, together with efficient decision-making and ongoing performance evaluation, financial leaders can successfully tackle stakeholder management problems and contribute to sustainable growth.

Integrating Stakeholder Management into Financial Strategy

Incorporating interest group management into monetary strategy is crucial for achieving unified organizational objectives. CFOs at Transform Your Small/Medium Business should implement the following strategies to ensure alignment and effectiveness:

- Align Monetary Goals with Interested Parties: Ensuring that monetary objectives resonate with the needs and expectations of key participants is essential. This alignment not only fosters support but also diminishes resistance, thereby alleviating stakeholder management challenges and creating a more favorable environment for economic initiatives.

- Incorporate Contributor Feedback into Financial Planning: Leveraging insights from contributors can significantly enhance budgeting, forecasting, and investment decision-making processes. By actively seeking and integrating this feedback, CFOs can formulate strategies that address stakeholder management issues, making them more relevant and effective, ultimately driving superior outcomes.

- Monitor Investor Sentiment: Regularly evaluating perceptions regarding financial decisions is vital. Utilizing surveys and feedback systems allows organizations to assess sentiment and promptly adjust strategies, ensuring alignment with the expectations of interested parties. Continuous business performance evaluation through real-time analytics, supported by our client dashboard, can further refine this process, enabling swift adjustments based on feedback from involved parties.

- Foster Collaborative Decision-Making: Involving key participants in financial decision-making processes can lead to innovative solutions and stronger buy-in. This collaborative approach not only enhances the quality of decisions but also mitigates stakeholder management issues by reinforcing participant commitment to organizational goals. Streamlined decision-making cycles, as emphasized in turnaround strategies, can facilitate this collaboration, enabling teams to take decisive actions that preserve business value.

The fact that only 52% of employees believe their companies will adopt AI in a trustworthy and responsible manner underscores the demand for improved engagement, revealing significant stakeholder management challenges. This statistic highlights the necessity for transparency and trust in relationships with involved parties to mitigate stakeholder management problems, which is crucial for effective oversight. Furthermore, merely 2% of finance and tech executives have enacted cyber resilience measures throughout their organizations, signifying a growing need for improved cybersecurity that pertains to interest group relations.

Firms that develop robust governance frameworks and conduct detailed internal analyses are better positioned to manage regulatory and ESG risks, ensuring compliance and meeting client expectations regarding sustainability. By emphasizing the engagement of interested parties and establishing strategic business alliances, financial leaders can align monetary strategies with broader organizational goals, paving the way for sustainable growth.

Best Practices and Tools for Effective Stakeholder Management

To enhance the management of interested parties, financial executives should implement the following best practices and tools:

- Utilize Management Software: Investing in robust software solutions is essential for effective participant mapping, communication tracking, and engagement analytics. These tools not only streamline processes but also significantly improve operational efficiency, allowing CFOs to focus on strategic decision-making. For instance, Quorum Copilot monitors participant statements in real time, including legislative actions and social media posts, providing valuable insights into participant sentiment.

- Establish a Comprehensive Stakeholder Engagement Plan: A well-structured engagement plan is crucial. This plan should outline engagement strategies, preferred communication channels, and timelines customized for each group, ensuring that all parties are aligned and informed. By operationalizing lessons learned from previous engagements, financial executives can enhance the effectiveness of their strategies.

- Conduct Regular Participant Assessments: Periodic reviews of participant relationships are vital. These assessments should include gathering feedback and evaluating the effectiveness of current strategies, enabling CFOs to make necessary adjustments and strengthen connections. Continuous monitoring of participant engagement through real-time analytics can provide insights into the health of these relationships.

- Provide Training on Engagement with Stakeholders: Equipping finance teams with training on effective engagement techniques fosters a consistent approach across the organization. This training should cover best practices and the use of management tools to enhance overall engagement, ensuring that teams can make quick decisions based on real-time data.

- Utilize Data Analytics for Insights: Data analytics plays a pivotal role in understanding the behavior and preferences of involved parties. By leveraging these insights, CFOs can tailor their engagement efforts, making them more targeted and effective. Examining theories regarding participant needs and preferences can result in optimal returns on investment in engagement strategies.

In 2025, the incorporation of participant oversight software with project coordination tools is becoming more prevalent, enabling smooth communication and task monitoring. For instance, Omegle is a software for overseeing interests that integrates with project coordination tools, enhancing collaboration and efficiency. Additionally, Jambo emphasizes security in managing consultation data, allowing users to create detailed contact profiles and track interactions comprehensively.

While it offers robust tracking and reporting tools, feedback indicates that improvements in customer support and customization options for surveys are needed.

Moreover, the financial consequences of efficient participant oversight are considerable; the typical project supervisor in Europe earns approximately $95,000 each year, emphasizing the necessity of investing in effective engagement strategies. By adopting these best practices and utilizing advanced tools, CFOs can effectively navigate the complexities of stakeholder management problems, ultimately driving better outcomes for their organizations.

Conclusion

Effective stakeholder management stands as a cornerstone of financial success for CFOs navigating the increasingly complex corporate landscape of 2025. By prioritizing the diverse interests of stakeholders—from investors to employees—CFOs can cultivate a collaborative environment that not only enhances financial performance but also fortifies organizational resilience. This article delineates essential strategies for effective engagement, emphasizing the importance of:

- Identifying stakeholders

- Developing tailored communication plans

- Integrating their feedback into financial strategies

As organizations confront challenges such as regulatory changes and technological advancements, the significance of real-time analytics and continuous performance monitoring cannot be overstated. These tools empower CFOs to make informed decisions that align with stakeholder expectations, ultimately driving sustainable growth. Moreover, fostering a culture of collaboration and transparency strengthens stakeholder relationships, ensuring that conflicting priorities are managed effectively.

In conclusion, embracing a proactive approach to stakeholder management transcends mere compliance; it emerges as a strategic imperative for achieving long-term financial success. By implementing best practices, utilizing advanced tools, and maintaining open lines of communication, CFOs can adeptly navigate the complexities of stakeholder dynamics, paving the way for enhanced organizational performance and enduring financial health. The future of corporate finance hinges on the ability to balance stakeholder interests while pursuing cohesive financial strategies that support both immediate goals and sustainable growth.

Frequently Asked Questions

What are stakeholder management problems?

Stakeholder management problems arise during the process of identifying, analyzing, and engaging individuals or groups with vested interests in an organization. These issues can affect budgetary decision-making and overall organizational success.

Who are the key participants in stakeholder management?

Key participants typically include investors, employees, customers, suppliers, and regulatory bodies.

Why is stakeholder management important for chief financial officers (CFOs)?

Mastering stakeholder management is crucial for CFOs as it influences budgetary decisions and helps align financial strategies with the expectations of involved parties, fostering a collaborative environment.

What is the significance of managing stakeholders in 2025?

The significance is highlighted by the evolving landscape of corporate finance, where proactive engagement with stakeholders is essential, especially given the low percentage of finance and tech leaders who have implemented cyber resilience actions.

How might changes in corporate tax rates impact stakeholder management?

A proposed decrease in the corporate tax rate from 21% to 15% for U.S.-produced goods may significantly affect stakeholders' interests, necessitating effective communication and expectation management by CFOs.

What is the role of Financial Planning and Analysis (FP&A) in stakeholder management?

FP&A is transitioning into a proactive role that emphasizes cross-departmental collaboration, improving decision-making and aligning financial strategies with organizational objectives.

How can AI tools assist in stakeholder management?

AI tools can empower FP&A teams to integrate insights into broader business strategies, fostering partnerships across departments and enhancing decision-making processes.

What are the benefits of addressing stakeholder management problems?

Effectively addressing these problems can lead to better economic outcomes, enhanced organizational reputation, and increased loyalty among stakeholders.

How do differing priorities among stakeholders affect management strategies?

Stakeholders often have differing priorities, such as investors focusing on short-term gains and employees prioritizing job security, which requires CFOs to actively manage these connections to balance immediate and long-term goals.

What impact does real-time analytics have on stakeholder management?

Real-time analytics allows CFOs to track business performance and assess the health of their organization, facilitating timely decisions that align with stakeholder interests.

How can organizations overcome stakeholder management problems?

Organizations that prioritize engagement with stakeholders are more likely to experience improved financial outcomes. Strategies may include establishing centers of excellence and upskilling employees to foster trust and compliance.

What is the importance of balancing stakeholder priorities?

Acknowledging and balancing the diverse priorities of involved parties is essential for guiding organizations toward sustainable growth and financial success.