Introduction

ROIC, or Return on Invested Capital, is a crucial metric that assesses a company's ability to generate value from capital investments. This article explores the concept of ROIC, its significance, and how to calculate it step-by-step.

Practical examples and case studies are included to provide insights into interpreting ROIC and using it to make informed investment decisions. Whether you're a CFO or an investor, understanding ROIC will help you navigate the financial landscape with confidence and strategic intent.

What is ROIC?

ROIC, an abbreviation for Return on Investment Capital, delves deep into the realm of corporate finance by assessing a firm's adeptness at crafting value from capital investments. Essentially, this metric evaluates both a company's profitability and the judicious use of capital to drive shareholder gains.

To unpack this further, consider the process of gauging the ROI, especially when probing for a lucrative 10% return on an investment portfolio. While attaining this threshold isn't a certainty, it embodies the objective of discerning the efficacy of your financial engagements.

ROI is not merely a number; it is a narrative about the astute deployment of resources. Calculating ROI requires you to deduct the initial outlay from an investment's current worth, subsequently dividing by the original investment cost.

This quotient reveals the strength of past investments and guides future fiscal decisions amid fluctuating market dynamics. Such financial nuances might compel one to seek expertise from seasoned advisors. Taking a step back to view the proverbial forest for the trees, ROI encapsulates a crucial question: Are the funds you're dedicating to investments being allocated sagaciously? This question underpins the strategic choices of any business, whether one is eyeing the immediate fulfillment of profit maximization or the long-term pursuit of value maximization. Indeed, for burgeoning entities focused on expansion, sacrificing immediate profit for future growth isn't just a tactic; it's often a necessity, despite critiques leveled against certain modern companies in sectors like tech and green energy for excessively magnifying scale over sustainable profitability.

Why is ROIC Important?

Return on Invested Capital (ROIC) is a pivotal metric that serves as a testament to a company's prowess in maximizing capital efficiency and profitability. Insightful and influentially, ROIC lays the groundwork for stakeholders to dissect a company's track record in producing fruitful returns from its capital investments.

Its significance escalates when investors and industry analysts harness it as a tool to pit peer companies against one another, spotlighting stellar performers in capital allocation. Succinctly put, ROIC doesn't just reflect operational competence, it shapes investment discourse, opening up avenues for critique, and fostering a culture of accountability and growth. Ted Sturgeon's assertion that "Ninety percent of everything is crap" throws down the gauntlet, challenging entities to rise above mediocrity, a feat aptly captured through an impressive ROIC.

The ROIC Formula

When assessing the efficiency of a company's use of invested capital, Return on Invested Capital (ROIC) serves as a critical compass. The calculation is straightforward yet revealing:

ROIC = Net Operating Profit After Tax (NOPAT) / Invested Capital

Here, NOPAT reflects the company's operating profit after all taxes have been paid, a pure measure of operating efficiency irrespective of financial structure. Invested Capital is the sum total of equity and long-term debt, representing the cumulative funds that a company operates with.

In understanding this metric, it's vital to consider the wide spectrum of investment returns and their implications for business strategy and shareholder value. A compelling ROIC figure often varies by industry and capital structure. It transcends the mere pursuit of profits; value maximization becomes the ultimate goal influencing investment choices, financing decisions, and shareholder distributions as emphasized by financial scholars.

For businesses, particularly those that have secured a steady foothold in their market, profitability and value creation tend to align more closely. Yet, emerging companies, especially those in rapidly evolving sectors like technology and renewable energy, may accept lower immediate profits or operate at a loss to fuel their growth trajectory and expand their market presence. One mustn't overlook the intrinsic nuances of growth potential and business models when interpreting ROIC figures.

Step-by-Step Calculation of ROIC

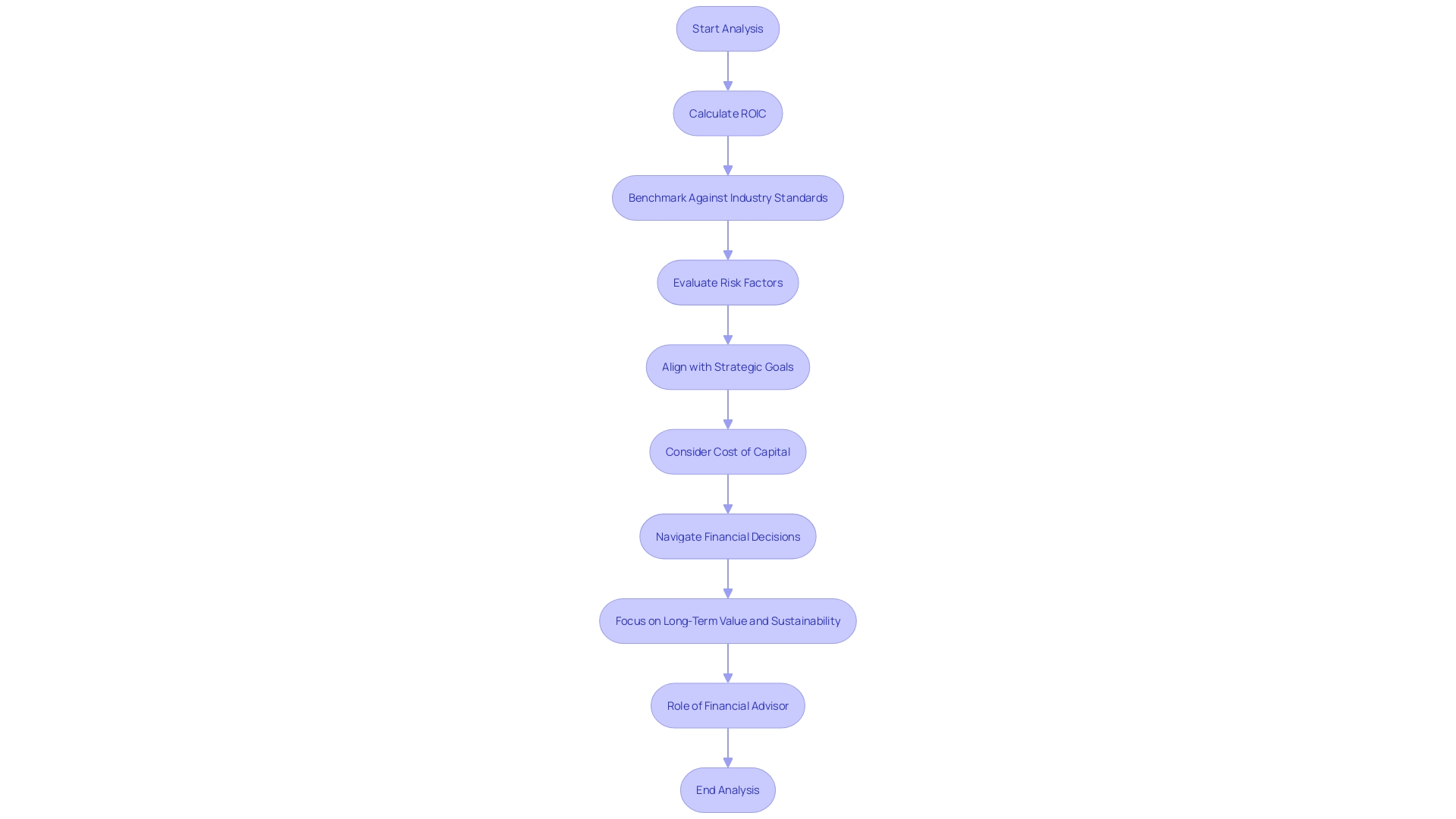

Understanding Return on Invested Capital (ROIC) provides insights akin to using radar technology developed during World War II; it necessitates a fine calibration to evaluate an investment's effectiveness. ROIC measures how effectively a company uses its capital to generate profits.

To compute ROIC, first identify the Net Operating Profit After Tax (NOPAT) by deducting taxes from operational gains. Next, consider the Invested Capital, which encompasses equity along with long-term debts.

Finally, the ROIC is revealed by dividing NOPAT by Invested Capital. For example, if NOPAT is $1,000,000 and Invested Capital amounts to $5,000,000, the ROIC would be $1,000,000 divided by $5,000,000, resulting in a rate of 0.2, or 20%. This analytical approach is not merely about profitability in the short run; it's about understanding the long-term value maximization, as emphasized by financial strategies that leverage profits to foster growth and advance a company's value proposition. ROIC provides a crucial snapshot of financial health, serving as a gauge for efficient investment and guiding strategic decisions toward overall value maximization.

Practical Examples of ROIC Calculation

Let's look at a couple of practical examples to understand how to calculate ROIC:Example 1:- Company A has an operating profit of $500,000 and pays $100,000 in taxes. - Its invested capital is $2,000,000.

- ROIC = ($500,000 - $100,000) / $2,000,000 = 0.2 or 20%Example 2:- Company B has an operating profit of $1,200,000 and pays $300,000 in taxes. - Its invested capital is $6,000,000. - ROIC = ($1,200,000 - $300,000) / $6,000,000 = 0.15 or 15%

Interpreting ROIC: What Makes a Good Return on Investment Capital?

Understanding ROIC—return on investment capital—is akin to a seasoned sailor using a compass to navigate. A strong ROIC signals that a company is skillfully converting dollars of investment into profits.

However, what constitutes a 'good' ROIC can be as varied as the seas. Within the tech industry, for instance, the benchmark for a robust ROIC is often higher due to the sector's inherent risk and the relentless pursuit of innovation.

Across different markets, though, any ROIC that surpasses a company's cost of capital typically marks a discerning investment strategy. It's important to recognize that while striving for the ideal ROIC, financial decisions must be steered by overarching strategic goals rather than the short-lived allure of profit alone. Careful navigation by a financial advisor might be imperative to chart a course towards the desired financial landmark of strong, viable returns. The mantra remains: knowing your end game will not only guide your investment decisions but also underscore when to realize gains and recalibrate your strategies to enhance long-term value and sustainability.

ROIC Case Study: Analyzing Companies for Investment Opportunities

Return on Invested Capital (ROIC) serves as a vital indicator of a company's efficiency at turning capital into profits. Take the MRO sector, for example, often overlooked for its lack of glamor, yet a company we'll call 'MRO Innovators Inc.' stands out.

With a business model that incorporates groundbreaking technology to offer distinct services, it boasts competitive advantages and a strong potential for upselling, leading to an impressive ROIC. Their customer loyalty is exceptional, which reflects on sustained financial performance.

Additionally, significant insider ownership - at 67% - aligns management's interests with those of the shareholders, a factor often indicative of a focused and motivated leadership aiming to boost ROIC. Although 'MRO Innovators Inc.' operates beneath the radar of many large institutional investors due to its market size, this very aspect could spell opportunity for discerning investors seeking high-ROIC prospects. The analysis here is two-pronged: understanding the business model and competitive landscape first, and examining the hard financial data thereafter. This comprehensive, two-part approach allows for a nuanced investment decision based on both qualitative insights and quantitative analytics.

Investing Wisely: Using ROIC to Make Informed Decisions

ROIC, or Return on Invested Capital, serves as a pivotal metric for investors, who leverage it to peer into a firm’s profit-generating prowess and operational efficacy. This gauge of financial performance stands particularly significant for companies like the one dubbed ‘The Berkshire Hathaway of Insurance.’ This firm, attaining its stature as the fifth-largest independent insurance brokerage in the United States, relied heavily on a unique decentralized model and a vibrant company ethos.

The bulk of its revenues, accounting for over 90%, emanated from within U.S. borders, chiefly through commissions constituting around 70% of its income. Brokers at this firm enjoyed commissions from each insurance sale, amounting to 10%-15% of the annual premium.

The business attributes its growth to a composite of fluctuations in premium rates, influencing 25%-35% of its expansion, and variations in exposure units, which impact the remaining 65%-75%. These figures underline the importance of considering a myriad of elements, such as sector dynamics, the company’s competitive edge, and the proven execution by management, in analyzing investment prospects. Employing ROIC as one segment of a comprehensive investment assessment empowers investors to pinpoint entities geared to deliver enticing returns, thereby sharpening the acumen of their investment choices.

Conclusion

In conclusion, ROIC (Return on Invested Capital) is a crucial metric that assesses a company's ability to generate value from capital investments. By evaluating the judicious use of resources and driving shareholder gains, ROIC goes beyond profitability.

Understanding ROIC empowers CFOs and investors to navigate the financial landscape confidently and strategically. The formula to calculate ROIC is simple: divide the Net Operating Profit After Tax (NOPAT) by the Invested Capital.

This metric varies by industry and capital structure, and its implications on business strategy and shareholder value should be carefully considered. ROIC guides efficient investment decisions and promotes overall value maximization.

Interpreting ROIC requires recognizing the benchmark for a "good" return on investment capital, which varies across industries. It's crucial to steer financial decisions based on overarching strategic goals rather than short-term profits alone.

Leveraging ROIC allows for enhanced long-term value and sustainability. Practical examples demonstrate the step-by-step calculation of ROIC, providing a clear understanding of its application. ROIC case studies highlight the efficiency of turning capital into profits and emphasize the importance of qualitative insights and quantitative analytics in making informed investment decisions. Ultimately, understanding ROIC enables CFOs and investors to identify companies that generate fruitful returns from capital investments. By prioritizing efficiency and accountability, companies can drive value maximization, fuel growth, and shape an investment discourse that aligns with strategic goals. With ROIC as a guiding compass, CFOs and investors can confidently navigate the financial landscape, making informed decisions for long-term success.