Introduction

Navigating the complexities of financial management requires not only expertise but also a strategic approach tailored to an organization’s unique needs. As businesses face a myriad of challenges—from cash flow management to compliance obligations—engaging an interim CFO can provide the necessary leadership and direction. This article delves into the critical steps for identifying the right interim CFO services, highlighting key qualifications to seek, and exploring the various types of engagements available.

By understanding the importance of cultural fit and establishing clear communication channels, organizations can maximize the impact of their interim financial leadership, ensuring that they are well-equipped to tackle immediate challenges while positioning themselves for long-term success.

Identifying Your Business Needs for Interim CFO Services

To effectively navigate the complexities of interim management, begin by conducting a comprehensive assessment of your organization's current economic landscape and operational hurdles. This assessment is crucial for identifying underlying business issues and creating a strategic plan to address them. A fractional CFO, usually working about 20 hours a week, can greatly impact the extent of support offered, making it essential to prioritize the assessment of key factors such as:

- Cash flow management

- Compliance obligations

- The need for strategic planning

Engaging with key stakeholders—from department heads to board members—will yield valuable insights into their expectations and requirements of an interim CFO. For example, one stakeholder expressed, 'It is helpful with some of our AP functions; just need to find the time to evaluate it for other areas.' This collaborative approach ensures alignment and facilitates the identification of specific monetary needs, while also fostering relationship-building through ongoing communication supported by real-time analytics.

Additionally, consider a case study on reducing costs through outsourcing and technology, illustrating how small business owners can reclaim valuable time by identifying low-value, recurring tasks. Documenting these insights meticulously will form the essential foundation for evaluating potential candidates and their services. Furthermore, it is essential to test every hypothesis and measure the outcomes of implemented strategies to ensure maximum return on investment.

By clarifying your organization's goals and challenges, you will be better positioned to utilize interim CFO services Wisconsin, enhancing your fiscal strategy and operational efficiency while applying turnaround lessons for ongoing improvement.

Key Qualifications to Look for in an Interim CFO

When seeking interim CFO candidates, prioritize those with a solid foundation in management of finances, particularly in budgeting, forecasting, and cash flow management. Industry-specific expertise is paramount; ensure that the candidate has substantial experience within your sector—be it retail, hospitality, or any other field. For instance, Bob Swan's successful tenure as CFO at Intel from 2016 to 2019 exemplifies strong leadership in managing finances.

Moreover, evaluate their history in leading turnaround initiatives and their effectiveness in implementing strategic changes. As Sabrinthia Donnelly notes,

By articulating the why behind decisions and painting a clear picture of the end goal, a CFO can rally their team to push through challenges and achieve great results.

This skill is increasingly crucial as the trend toward interim CFO services Wisconsin grows, particularly among Series A-C companies that are seeking flexible, high-caliber financial leadership.

Successful temporary CFOs not only excel in team management and recruitment to drive significant results but also embrace a pragmatic approach to data. They should implement a system for testing hypotheses, facilitating a streamlined decision-making cycle that enables decisive action—what we refer to as 'Decide & Execute.' Additionally, leveraging real-time analytics through client dashboards can continuously diagnose business health, allowing for the 'Update & Adjust' process, ensuring they operationalize the lessons learned throughout the turnaround process to optimize the cash conversion cycle and enhance overall business performance.

Furthermore, they must be committed to developing strong lasting relationships, which is essential for effective operationalization of strategies.

Exploring Different Types of Interim CFO Services

Interim CFO services Wisconsin encompass a broad spectrum, ranging from full-time positions to part-time advisory roles. Some temporary CFOs who offer interim CFO services in Wisconsin focus on specialized initiatives, such as budget restructuring, which can be crucial during transitional phases, while others provide extensive operational assistance. It's essential to assess whether your organization requires interim CFO services Wisconsin for a short-term crisis—such as navigating cash flow challenges—or a longer-term engagement aimed at strategic transformation.

Additionally, consider what specific responsibilities you need the temporary CFO to undertake: will they be tasked with leading financial strategy, managing day-to-day operations, or both? By clearly defining these requirements, you can customize your search for interim CFO services Wisconsin to effectively meet your organization's specific needs. Notably, fractional CFOs can lead to a 5% increase in available working capital, illustrating the tangible benefits of hiring interim CFO services Wisconsin.

One client noted, 'It is helpful with some of our AP functions; just need to find the time to evaluate it for other areas.' This highlights the real-world impact that interim CFO services Wisconsin can provide. Furthermore, our team providing interim CFO services Wisconsin supports a shortened decision-making cycle throughout the turnaround process, allowing you to take decisive action to preserve your enterprise.

With real-time business analytics available through our client dashboard, we continually monitor the success of our plans and teams, ensuring a proactive approach to business health. We are committed to developing strong lasting relationships with our clients, operationalizing the lessons learned throughout the turnaround process to enhance future performance. The cautious approach many CFOs are taking towards the integration of AI in accounting reflects the evolving landscape of the role, underscoring the importance of adapting to new technologies in financial management.

Our methodologies include regular performance assessments and data-driven decision-making processes, particularly through interim CFO services Wisconsin, that ensure our clients are well-equipped to navigate challenges effectively.

Evaluating Cultural Fit and Team Dynamics

When evaluating candidates for interim CFO services in Wisconsin, it is crucial to assess their alignment with your organization's values and culture. This goes beyond a mere checklist; understanding a candidate's communication style and leadership approach is essential. Utilize behavioral interview techniques to explore how they have navigated team dynamics in previous roles.

For instance, asking candidates to 'describe a time when a different perspective influenced your decision-making' can reveal their adaptability and openness to diverse viewpoints. Such inquiries not only reveal their previous experiences but also offer insight into their potential for fostering a cohesive work environment. Our team includes top professionals recognized in their fields, such as those with extensive experience in manufacturing and technology, who reinforce the value of diverse and culturally-aligned teams, as they are significantly better equipped to tackle challenges and achieve high performance.

Therefore, explicitly considering this aspect during the interview process is vital. Additionally, to evaluate cultural fit effectively, organizations should:

- Define their culture and values

- Employ behavioral and situational interview questions

- Involve multiple team members in assessments

- Conduct reference checks, as outlined in the case study 'Strategies for Evaluating Cultural Fit'

Ensuring that the temporary CFO can seamlessly integrate into your existing team while utilizing interim CFO services Wisconsin will enhance collaboration and expedite desired outcomes.

Remember, with our seasoned professionals at the helm, including former MBB consultants and proven operators, you can trust that your temporary management needs will be met with expertise and agility. Furthermore, 58% of employees indicate they would switch jobs for a better company culture, underscoring the importance of cultural fit in retaining talent and driving engagement.

Setting Clear Expectations and Communication Channels

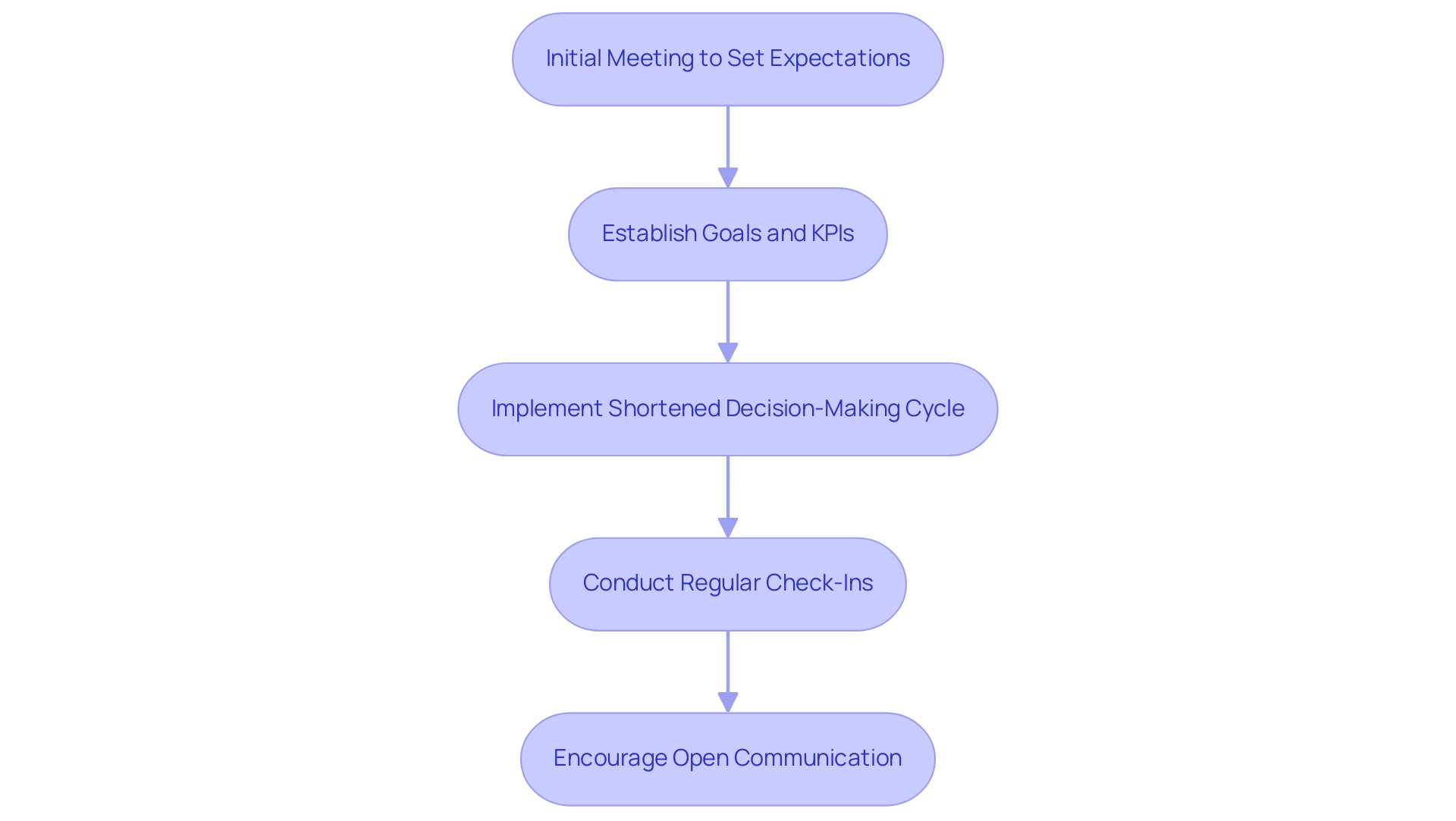

Starting the engagement with a temporary CFO requires a structured approach to establish mutual expectations, goals, and key performance indicators (KPIs). Schedule an initial meeting to clarify these elements, ensuring both parties are aligned from the outset. Throughout the turnaround process, our team supports a shortened decision-making cycle, allowing for decisive actions that protect your enterprise.

This cycle is achieved through streamlined communication and efficient data analysis. Regular check-ins should be a staple throughout the engagement, facilitating ongoing discussions regarding progress and challenges encountered. This aligns with the key point that regularly monitoring progress towards established priorities enables timely adjustments and addresses new issues effectively.

Encouraging open lines of communication is essential; the temporary CFO should feel empowered to share feedback and insights on financial strategies. Our client dashboard provides real-time business analytics, allowing for immediate insights into performance metrics and trends, ensuring continuous monitoring of business performance and fostering relationship-building through operationalizing turnaround lessons. This proactive communication strategy not only fosters a productive working relationship but also aligns with industry findings, as organizations using temporary leadership often see a higher rate of successful outcomes.

According to the Nonprofit Leadership Alliance, "Nonprofits that employed Interim Executive Directors during transitions had a higher rate of successful leadership placements within 12 months compared to those that did not use interim leadership." Additionally, referencing the case study on managing restructuring conflicts, effective change management strategies can mitigate conflicts during transitions, thereby reinforcing the importance of establishing clear communication channels and setting realistic expectations. For more information, don't hesitate to reach out!

Let's talk! Contact us at +1 (239) 428-9074 or visit us at 3200 Bailey Ln, Naples, FL 34105.

Conclusion

Engaging an interim CFO can be a transformative decision for an organization, especially during times of financial uncertainty or strategic transition. By first identifying specific business needs through a thorough assessment, companies can align their objectives with the right financial leadership. Prioritizing qualifications such as industry expertise and a proven track record in financial management is essential to ensure that the interim CFO can effectively steer the organization towards its goals.

Different types of interim CFO services cater to various organizational requirements, from short-term crisis management to long-term strategic planning. Clearly defining these needs allows businesses to tailor their search for the right candidate, maximizing the potential benefits of hiring an interim CFO. Furthermore, evaluating cultural fit and team dynamics is crucial, as a cohesive working relationship can significantly enhance collaboration and drive performance.

Establishing clear expectations and communication channels from the outset is vital for the success of the engagement. By fostering open lines of communication and utilizing real-time analytics, organizations can effectively monitor progress and make timely adjustments. Ultimately, the right interim CFO can not only address immediate challenges but also lay the groundwork for sustainable financial health and strategic growth, empowering businesses to navigate the complexities of their financial landscapes with confidence.

Frequently Asked Questions

What is the first step in navigating interim management effectively?

The first step is to conduct a comprehensive assessment of your organization's current economic landscape and operational hurdles to identify underlying business issues and create a strategic plan.

What key factors should be prioritized during the assessment for interim management?

Key factors to prioritize include cash flow management, compliance obligations, and the need for strategic planning.

How can engaging with stakeholders benefit the interim management process?

Engaging with stakeholders, such as department heads and board members, yields valuable insights into their expectations and requirements, ensuring alignment and facilitating the identification of specific monetary needs.

What role does a fractional CFO play in interim management?

A fractional CFO, typically working about 20 hours a week, can significantly impact the support offered to the organization, making their role essential in the assessment and strategic planning process.

Why is it important to document insights during the interim management process?

Documenting insights meticulously forms the foundation for evaluating potential candidates and their services, ensuring a structured approach to interim management.

What should organizations do after implementing strategies in interim management?

Organizations should test every hypothesis and measure the outcomes of implemented strategies to ensure maximum return on investment.

What qualifications should be prioritized when seeking interim CFO candidates?

Candidates should have a strong foundation in financial management, particularly in budgeting, forecasting, and cash flow management, as well as industry-specific expertise.

What is the importance of a CFO's leadership in turnaround initiatives?

A CFO's history in leading turnaround initiatives and their ability to articulate the rationale behind decisions are crucial for rallying their team to overcome challenges and achieve results.

How do successful interim CFOs approach decision-making?

Successful interim CFOs implement a system for testing hypotheses and facilitate a streamlined decision-making cycle, enabling decisive action through a process called 'Decide & Execute.'

Why is real-time analytics important for interim CFOs?

Real-time analytics allow interim CFOs to continuously diagnose business health and operationalize lessons learned throughout the turnaround process, optimizing the cash conversion cycle and enhancing overall business performance.

What is the significance of relationship-building for interim CFOs?

Developing strong, lasting relationships is essential for the effective operationalization of strategies and for driving significant results within the organization.