Overview

This article serves as a comprehensive guide for businesses in Seattle aiming to select the most suitable interim CFO services. It underscores the necessity of a clear understanding of specific business needs and challenges when choosing an interim CFO. A structured hiring process is essential, one that encompasses:

- Defining roles

- Sourcing candidates

- Conducting thorough interviews

These steps are crucial to ensure that the selected CFO can effectively steer the organization through transitional phases.

Introduction

In a business landscape characterized by rapid change and uncertainty, the role of an interim CFO has become increasingly vital. These financial leaders step in during critical transitions, offering expertise that ensures stability and strategic direction when organizations confront challenges such as unexpected departures, financial distress, or significant restructuring.

As the demand for interim CFO services continues to surge—reflecting a growing recognition of their importance—companies must navigate the complexities of selecting the right candidate to meet their unique needs.

This article delves into the essential aspects of interim CFO services, including:

- When to consider hiring one

- The qualifications to look for

- The long-term benefits that can be gained from engaging these seasoned professionals

With insights into the evolving financial landscape, this exploration aims to equip businesses with the knowledge necessary to make informed decisions regarding interim leadership.

Understanding Interim CFO Services: What They Are and Why They Matter

Interim CFO services in Seattle represent the strategic appointment of a Chief Financial Officer who delivers vital monetary leadership and direction during pivotal transitional phases. These services are indispensable for businesses confronting leadership voids, economic challenges, or significant organizational changes. Interim CFO services in Seattle are instrumental in stabilizing operations, establishing necessary controls, and steering the company through critical transitions, thereby guaranteeing continuity alongside a strategic focus.

As we look to 2025, the demand for temporary CFO services is underscored by prominent trends within the economic landscape. Notably,

- 37% of search efforts in the nonprofit and government sectors have targeted temporary leadership for traditional finance roles, reflecting an increasing recognition of the need for experienced financial oversight during turbulent times.

- In the private equity sector, where talent retention is paramount, interim leadership initiatives constituted 62% of projects, as highlighted by Ruth Singleton, emphasizing the strategic significance of these roles.

The global finance and accounting outsourcing market, valued at $60 billion, illustrates a broader trend towards outsourcing as a strategy to enhance operational efficiency and concentrate on core functions. This shift holds particular relevance for companies in Seattle, where the dynamic corporate environment demands agility and adaptability, making interim CFO services essential. A case study titled "What Are Outsourced Accounting Services?" underscores how organizations are increasingly utilizing outsourced services to improve efficiency and focus on primary operations, further reinforcing the importance of interim CFO services in Seattle.

Moreover, Transform Your Small/Medium Business's technology-enabled consulting services play a critical role in how temporary CFOs can leverage technology to boost operational efficiency during transitions. Our Rapid-30 process swiftly identifies underlying organizational issues and initiates transformational change. Real-world examples illustrate the impact of temporary CFOs on organizational stability during crises.

These professionals not only provide immediate financial expertise but also facilitate long-term strategic planning, ensuring organizations can navigate transitions effectively. As companies continue to encounter evolving challenges, the role of temporary CFOs will remain essential in fostering resilience and driving sustainable growth.

When to Consider Hiring an Interim CFO: Key Situations and Triggers

Businesses should contemplate hiring an interim CFO in several pivotal scenarios:

- Unexpected Departure: When a permanent CFO leaves unexpectedly, it creates a significant leadership gap that can disrupt financial operations. As Kevin Briscoe, Managing Partner of CFO Selections®, notes, "If you need help, consider a search and recruiting firm that specializes in hiring accounting and finance talent."

- Financial Distress: During challenging times, such as cash flow crises or declining revenues, a temporary CFO can provide the expertise needed to stabilize the situation. With the average tenure of CFOs in major U.S. companies being notably short, the need for interim CFO services in Seattle becomes even more critical during these periods. They can implement strategies to master the cash conversion cycle, ensuring optimal performance. The services related to mastering the cash conversion cycle are available for $99.00, providing a valuable resource for businesses in distress.

- Organizational Changes: Significant transitions, including mergers, acquisitions, or restructuring efforts, often necessitate specialized fiscal oversight to navigate complexities effectively. The challenges faced by CFOs, particularly in the retail sector, highlight the economic pressures that can arise during such changes. A temporary CFO can streamline decision-making processes and utilize real-time analytics to monitor performance and adjust strategies accordingly.

- Project Management: For particular projects that require advanced monetary expertise, a temporary CFO can provide specialized skills to guarantee successful execution. Their ability to test hypotheses and operationalize lessons learned from previous experiences can significantly enhance project outcomes, ensuring that strategies are effectively implemented and adjusted as necessary.

- Major Monetary Events: Preparing for an initial public offering (IPO) or other significant economic milestones requires strategic fiscal leadership, making a temporary CFO an invaluable asset. They can provide the necessary oversight and analytics to ensure that the organization is well-prepared for these critical events.

Recognizing these triggers enables organizations to act decisively by securing interim CFO services in Seattle, which are necessary to guide them through critical periods. Additionally, 64% of CFOs express confidence in the near-term U.S. economic environment's positive effect on their companies, but this optimism is tempered by macroeconomic instability, labor market challenges, and rising inflation. Recognizing when to utilize CFO services from Transform Your Small/Medium Business is crucial for sustaining operational continuity and attaining long-term success.

Essential Qualifications and Skills to Look for in an Interim CFO

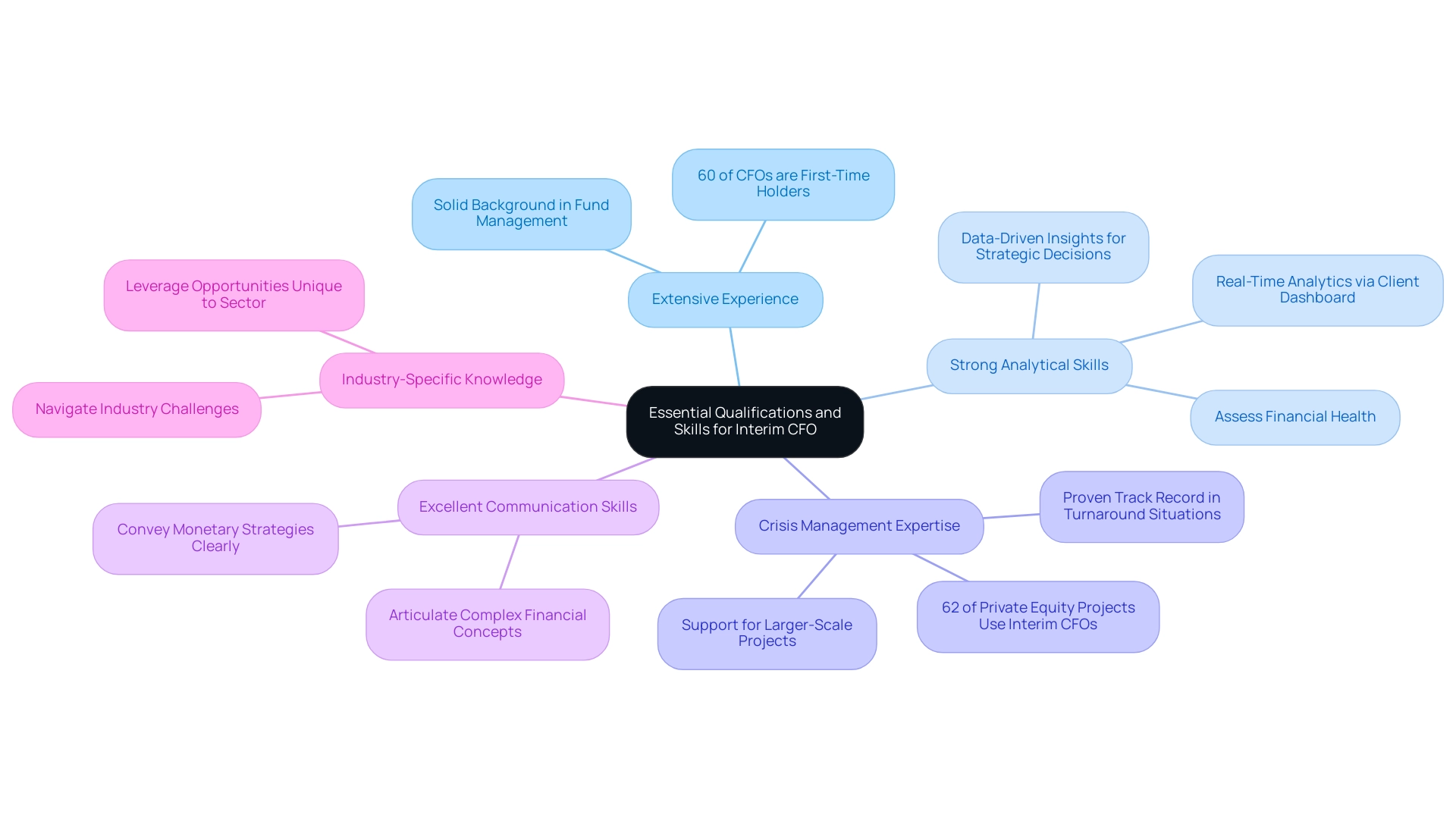

When selecting interim CFO services in Seattle, businesses should prioritize candidates who possess a robust set of qualifications to effectively steer the organization through transitional phases. Key qualifications include:

- Extensive Experience: Candidates should have a solid background in management of funds and leadership roles, ideally with a history of serving as CFOs in various capacities. This experience is crucial as 60% of CFOs are first-time holders of the position, underscoring the need for seasoned professionals who can provide stability.

- Strong Analytical Skills: The ability to assess financial health and pinpoint areas for improvement is vital. Interim CFOs must leverage data-driven insights to guide strategic decisions, particularly during periods of uncertainty. This aligns with the need for continuous performance monitoring, ensuring that decisions are informed by real-time analytics provided through a client dashboard.

- Crisis Management Expertise: A proven track record in crisis management and turnaround situations is essential. Case studies reveal that temporary CFOs play a pivotal role in diverse industries, with private equity firms assigning temporary leaders to 62% of their projects, highlighting the critical nature of this skill set. Furthermore, temporary leadership can provide critical support for larger-scale projects and initiatives during transitions or major changes, allowing for a shortened decision-making cycle that preserves business health.

- Excellent Communication Skills: Effective communication is key for conveying monetary strategies to stakeholders. A temporary CFO must articulate complex financial concepts clearly to ensure alignment and understanding across the organization, operationalizing lessons learned to foster strong relationships.

- Industry-Specific Knowledge: Familiarity with the specific sector in which the company operates enhances the temporary CFO's ability to navigate industry challenges and leverage opportunities. This knowledge allows for tailored strategies that resonate with the unique dynamics of the business environment.

These qualifications not only enable temporary CFOs to manage complex financial landscapes but also empower them to provide strategic insights through interim CFO services in Seattle that drive organizational success during critical transitions. As Elliot Fuhr aptly stated, "When they depart, they leave behind more than balance sheets—they leave an indelible mark on the organization's trajectory." Furthermore, with a 238% rise in references to AI in CFO job postings, the changing environment of CFO positions highlights the significance of temporary leadership in adjusting to these developments.

By integrating these elements, organizations can ensure they select an interim CFO through interim CFO services in Seattle who is not only qualified but also equipped to lead effectively during times of transition. Transform Your Small/Medium Business is committed to supporting organizations in this critical selection process.

Exploring Different Types of Interim CFO Services: Which One is Right for You?

Interim CFO services in Seattle offer a comprehensive array of options designed to address the unique needs of businesses in 2025. These include:

- Full-time Interim CFOs: Engaged temporarily, these professionals oversee daily monetary operations, ensuring stability during transitions and facilitating streamlined decision-making processes.

- Part-time or Fractional CFOs: Providing strategic oversight, these CFOs work with multiple clients, offering flexibility and cost-effectiveness while leveraging their extensive experience to implement innovative solutions.

- Project-based CFOs: Focused on specific initiatives such as monetary restructuring or system implementations, these experts bring targeted expertise to critical projects, rigorously testing hypotheses to maximize return on investment.

- Virtual CFO Services: Offering remote leadership, virtual CFOs utilize technology to provide comprehensive support without the need for physical presence, ensuring real-time analytics are accessible for ongoing performance monitoring.

As the demand for seasoned temporary leaders continues to rise—43% of CFOs report increased inquiries for new opportunities—businesses must carefully evaluate their specific needs, budget constraints, and the complexity of their financial challenges when seeking interim CFO services in Seattle. This assessment is essential in guiding them to select the most suitable type of temporary CFO service.

Understanding the effectiveness of full-time versus part-time temporary CFOs is crucial. While full-time CFOs provide dedicated attention, part-time CFOs offer a breadth of experience across various industries, often leading to innovative solutions. As Sunny Ackerman, global managing partner of on-demand talent for Heidrick & Struggles, observes, "The demand for seasoned temporary leaders is soaring across industries to address critical challenges and maintain stability during transitions."

Basic qualifications for outsourced CFO services typically include a Bachelor's degree in finance or related fields, a Master's degree in accounting or administration, prior CFO experience, and over 10 years of progressively responsible experience. This context is vital for companies to consider when choosing a temporary CFO.

Case studies demonstrate that companies employing project-based temporary CFOs have successfully navigated restructuring, highlighting the importance of specialized expertise. For example, Ascension CPA provides specialized CFO services aimed at assisting business owners in focusing on their core passions rather than fiscal management, emphasizing consulting on profitability and tax reduction.

Ultimately, selecting the appropriate temporary CFO service requires aligning the service type with the organization's goals and challenges, ensuring that the chosen expert can drive meaningful results through effective decision-making and operationalizing lessons learned.

Cost Considerations: Understanding the Financial Impact of Hiring an Interim CFO

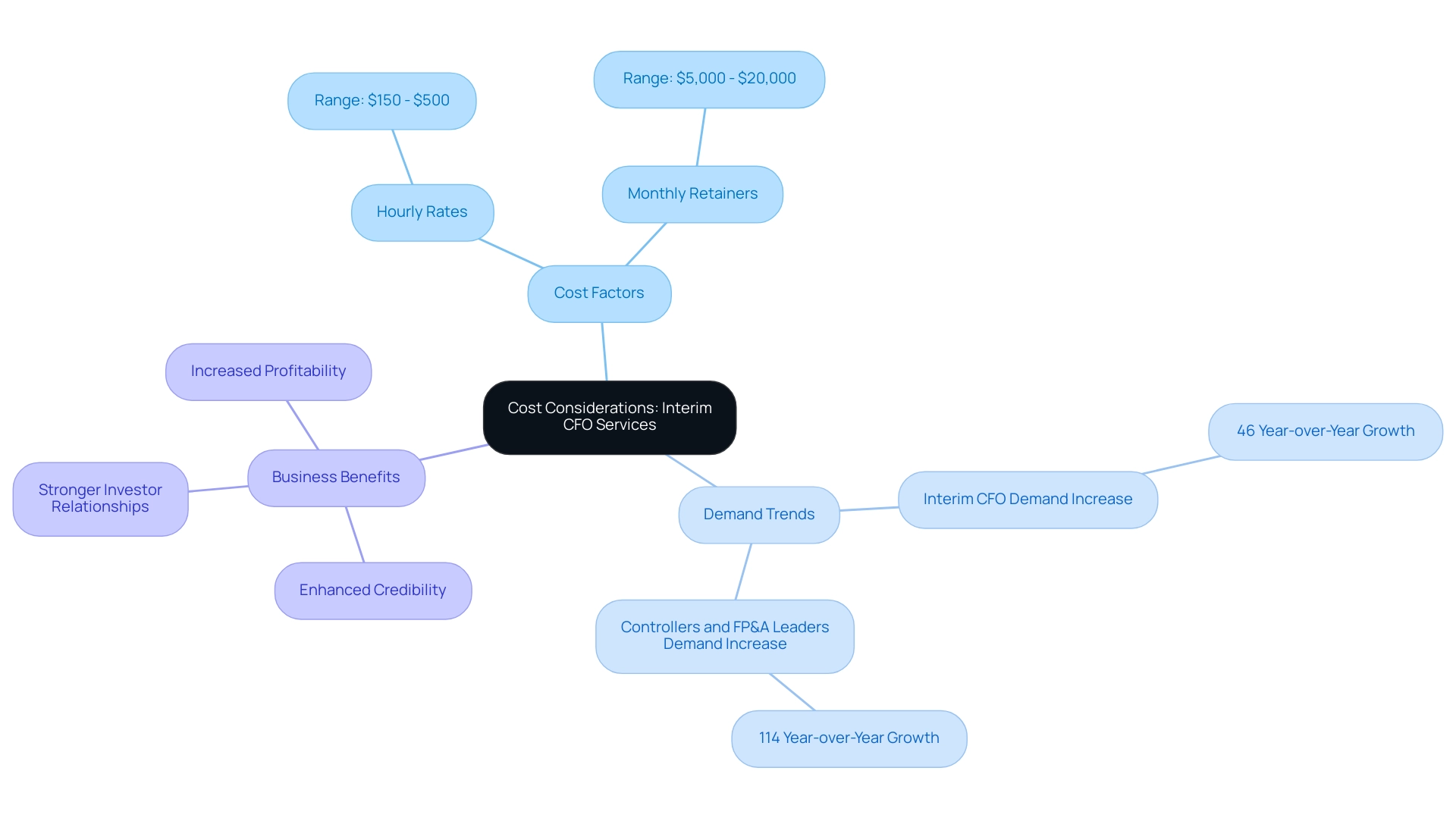

The cost of hiring a temporary CFO can vary widely, influenced by factors such as the scope of services required, the complexity of the financial landscape, and the candidate's level of expertise. Businesses should generally anticipate hourly rates ranging from $150 to $500, or a monthly retainer between $5,000 and $20,000. While these figures may seem steep, the potential return on investment is significant.

In 2023, the demand for interim CFO services in Seattle surged by 46% year-over-year, with a remarkable 103% increase in demand for fractional CFO services. This reflects a growing recognition of their value in stabilizing finances and driving strategic initiatives through streamlined decision-making and real-time analytics.

Utilizing interim CFO services in Seattle can lead to significant cost reductions and enhanced economic well-being. Companies that have engaged interim CFO services often report enhanced credibility and stronger investor relationships. As highlighted by Alec Borlin, a CPA, "In 2023, demand for temporary CFOs rose by 46% YOY, and demand for Controllers and FP&A leaders grew by 114% according to a report by Business Talent Group."

With high-quality economic leadership, CEOs can confidently articulate their monetary strategies, attracting new funding sources and fostering growth. A case study titled "Greater Credibility and Better Investor Relationships" emphasizes how an organization that utilized interim CFO services in Seattle optimized operations and lowered overhead, leading to a significant rise in profitability.

Furthermore, the economic impact of temporary CFO services is underscored by data showing that the need for Controllers and FP&A leaders rose by 114% in 2023. This trend indicates that companies are increasingly acknowledging the significance of strong fiscal oversight during challenging times. By leveraging the expertise of a temporary CFO, organizations can not only manage urgent monetary challenges but also prepare themselves for sustainable long-term growth, continuously assessing performance and applying lessons learned for ongoing success.

A Step-by-Step Guide to Selecting the Right Interim CFO for Your Business

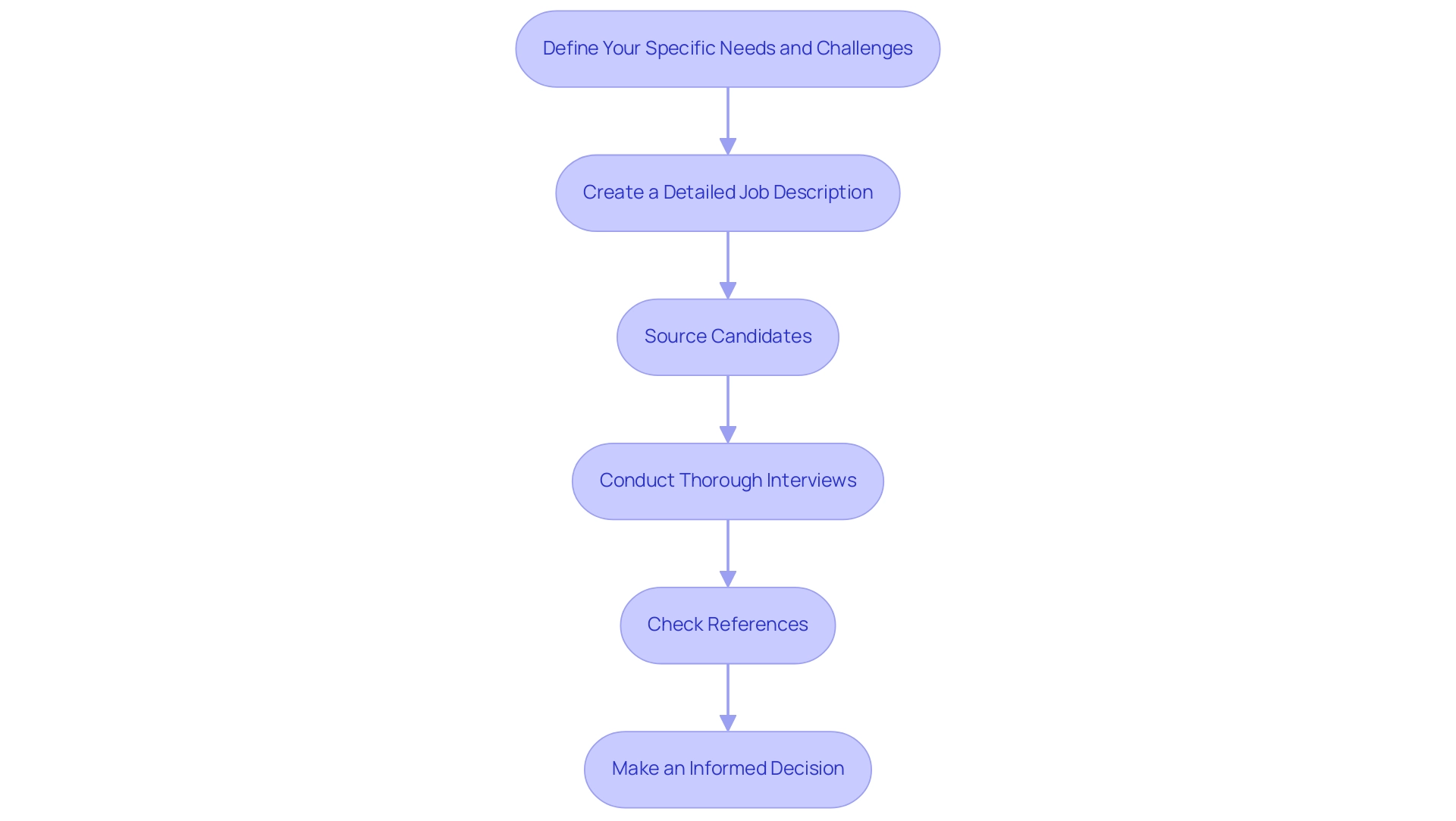

Choosing the appropriate interim CFO services in Seattle is a critical procedure that can significantly impact your organization's economic well-being. To ensure a successful hire, follow these structured steps:

- Define Your Specific Needs and Challenges: Begin by assessing your organization's current financial situation and identifying the specific challenges that necessitate interim leadership. This clarity will guide your search and ensure alignment with your strategic goals. Remember, 89% of industry leaders say AI without process intelligence fails to deliver, underscoring the importance of structured processes in hiring.

- Create a Detailed Job Description: Outline the required skills, qualifications, and experience necessary for the role. This should encompass technical expertise, industry knowledge, and leadership capabilities tailored to your organization's unique context. Clearly defining the role's responsibilities and scope is crucial for a successful hiring process.

- Source Candidates: Utilize referrals, professional networks, and specialized recruitment firms to identify potential candidates. Engaging with a network of private equity-grade CFOs can provide access to top-tier talent. As Scott noted, "Of the several hundred PE-grade CFOs in our network, we select the top two or three choices for a company, and once the negotiation is finalized, they can get to work very fast."

- Conduct Thorough Interviews: Focus on candidates' past experiences and problem-solving abilities during interviews. Ask situational questions that reveal how they have navigated similar challenges in previous roles. This is where their ability to test hypotheses and make quick decisions can be assessed, ensuring they can adapt to your organization's needs.

- Check References: Validate candidates' claims by checking references. This step is crucial for assessing their fit with your company culture and ensuring they have a proven track record of success.

- Make an Informed Decision: Weigh qualifications, experience, and interpersonal skills when making your final choice. A well-rounded candidate who can adapt quickly to your organization will be invaluable. Their capability to utilize real-time analytics and implement lessons learned will be crucial in advancing your enterprise. Additionally, their experience with continuous monitoring through a client dashboard will enhance decision-making and ensure ongoing business health assessment.

By following this structured approach, you can enhance the likelihood of utilizing interim CFO services in Seattle that not only meet your immediate needs but also contribute to long-term growth and stability. The case study titled 'Right-Size Financial Leadership to Your Business' illustrates how tailored finance solutions can transform challenges into growth opportunities, reinforcing the importance of choosing the appropriate temporary CFO. Remember, a clear onboarding process is essential to assess the company's financial health and set expectations effectively.

Setting Expectations: How to Define Goals and Objectives with Your Interim CFO

Establishing clear expectations with your interim CFO services in Seattle is vital for cultivating a productive working relationship. Begin by defining specific, measurable goals that not only address your organization's immediate needs but also align with long-term objectives. Research indicates that 58% of CFOs are increasingly focused on technology investments, underscoring the necessity for interim CFO services in Seattle to effectively leverage data analytics.

As Jeremy Hanson observes, there is a pressing demand for CFOs who can harness customer data and analytics to enhance operations and marketing strategies. This is particularly crucial in the context of turnaround strategies, where testing hypotheses and making swift decisions based on real-time analytics can significantly influence performance. It is essential to discuss the key performance indicators (KPIs) that will be employed to evaluate success, ensuring they are pertinent to your strategic vision for 2025. Regular check-ins are imperative to assess progress and recalibrate goals as necessary.

Open communication is essential; both parties must possess a clear understanding of their roles and responsibilities. This clarity not only enhances collaboration but also empowers the temporary CFO to make substantial contributions to your organization’s financial well-being. Expert opinions suggest that exceptional temporary CFOs can leave a lasting positive impact on company culture, influencing team collaboration and innovation.

For instance, during the pandemic, many CFOs assumed co-leadership roles in business transformations, demonstrating the critical nature of their involvement during transitional periods. Notably, the industrial goods and services sector allocated nearly a quarter (23%) of project resources to temporary leadership, emphasizing the growing importance of these roles. By establishing clear expectations and defining KPIs, you can ensure that your CFO is positioned to drive meaningful results and navigate your organization through challenges effectively.

The case study titled 'Widespread Transformation and Critical Transitions' illustrates how interim CFO services in Seattle can provide strong leadership during critical transitions when companies are not prepared to hire a full-time CFO, operationalizing the lessons learned to foster lasting relationships and continuous performance monitoring.

Navigating Challenges: Common Pitfalls When Hiring an Interim CFO and How to Avoid Them

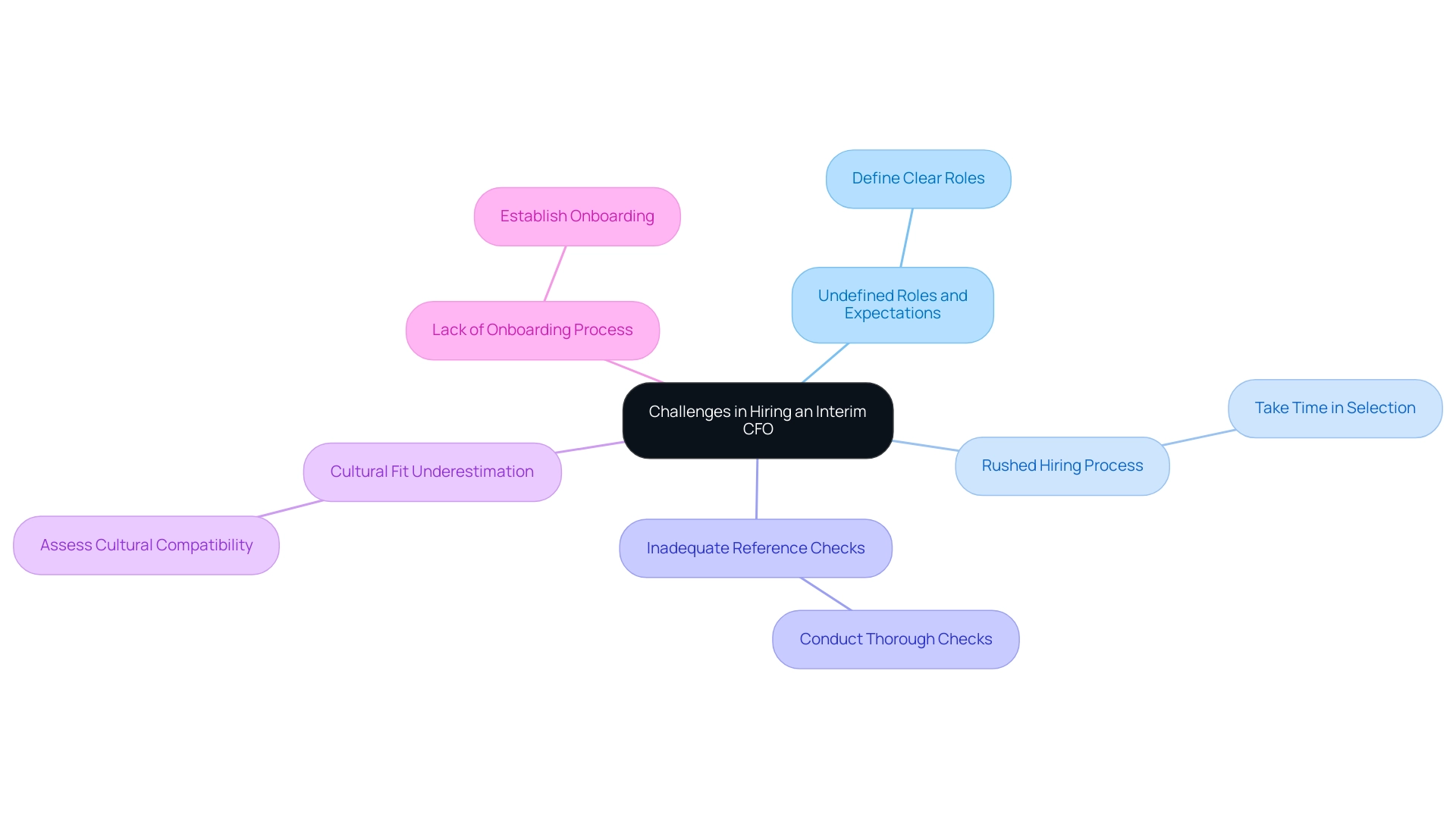

When engaging a temporary CFO, businesses frequently encounter several critical pitfalls that can undermine their objectives:

- Undefined Roles and Expectations: A lack of clarity regarding the temporary CFO's responsibilities can lead to misalignment between the CFO and the organization, resulting in inefficiencies.

- Rushed Hiring Process: Hasty decisions often lead to poor candidate selection. The demand for temporary leadership roles has surged by 116% year-over-year, particularly in sectors like private equity and technology. It is essential to take the time to find the right fit. As Adam Zaki observed, the overall demand for C-suite roles has increased significantly, with requests for temporary positions rising sharply.

- Inadequate Reference Checks: Failing to conduct thorough reference checks can result in hiring individuals who lack the requisite experience or skills.

- Cultural Fit Underestimation: Ignoring the significance of cultural compatibility can hinder collaboration and integration within the existing team. Data suggests that cultural fit plays a pivotal role in the success of temporary CFOs, impacting their ability to drive change effectively.

- Lack of Onboarding Process: Not establishing a structured onboarding process can delay the temporary CFO's effectiveness, preventing them from making an immediate impact.

Moreover, while the daily or hourly fee for a temporary CFO may be higher, the total expenses can be reduced due to the short-term nature of the engagement, making it a budget-friendly option for many companies. A growing trend in outsourced accounting services shows that companies are enhancing efficiency and focusing on core operations, which aligns with the theme of avoiding pitfalls in hiring temporary CFOs. To mitigate these pitfalls, organizations should invest time in meticulously planning the hiring process.

This involves recognizing fundamental organizational challenges, defining clear roles and expectations, promoting open communication, and ensuring alignment on goals between the temporary CFO and the organization. By implementing turnaround lessons and continuously tracking business performance through real-time analytics, companies can improve the chances of a successful temporary engagement, ultimately leading to sustainable growth. Transform Your Small/ Medium Business emphasizes a pragmatic approach to data, testing every hypothesis to deliver maximum return on invested capital in both the short and long term.

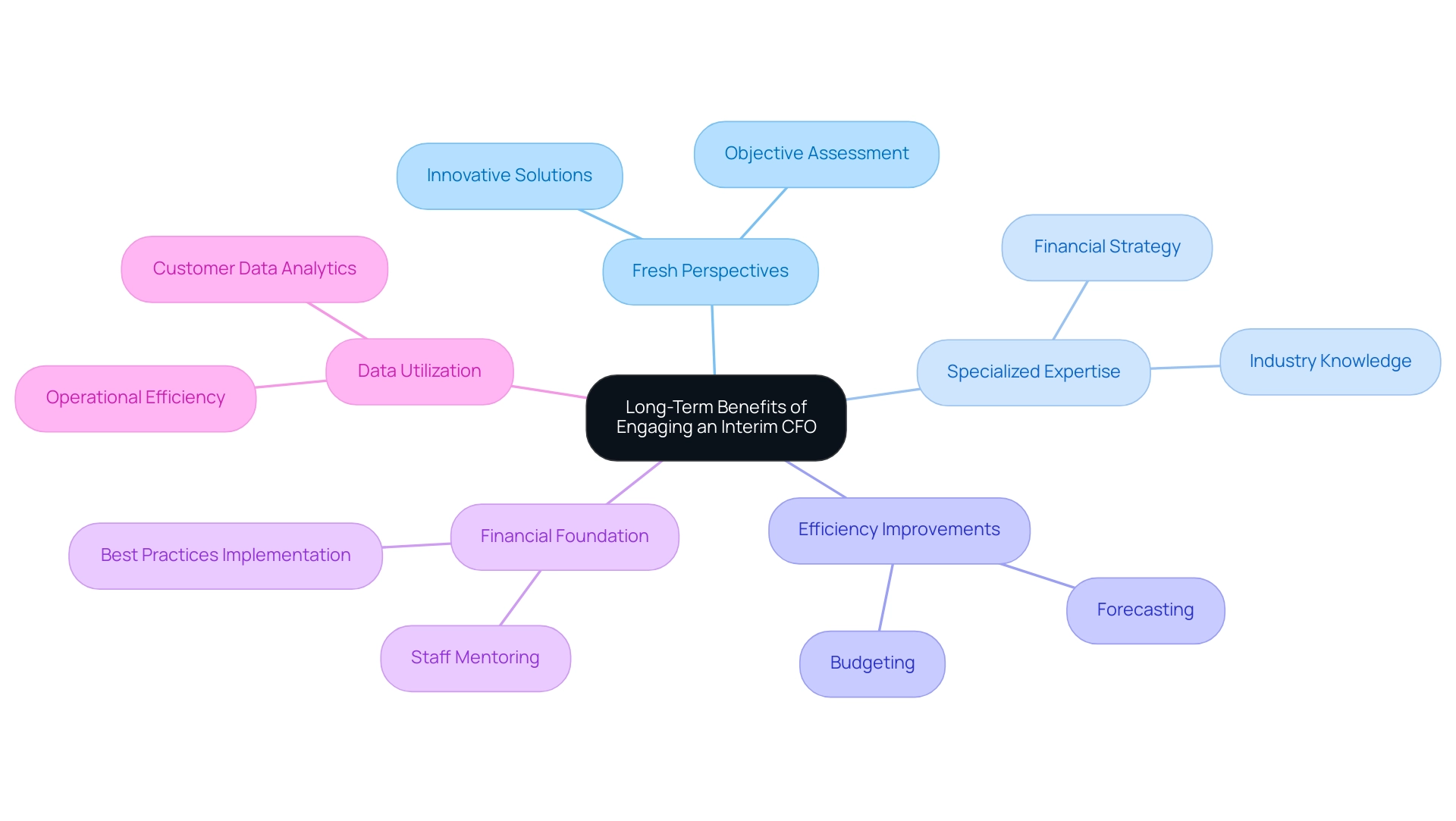

The Long-Term Benefits of Engaging an Interim CFO: Beyond Immediate Needs

Hiring interim CFO services in Seattle from Transform Your Small/Medium Business presents numerous long-lasting advantages that extend well beyond mere short-term economic stabilization. These professionals introduce fresh perspectives and specialized expertise, significantly enhancing monetary processes, strategic planning, and risk management. Companies employing temporary CFOs frequently report substantial improvements in their operations, with many discovering a more efficient approach to budgeting and forecasting.

In fact, nearly a quarter (23%) of project resources in the industrial goods and services sector are now allocated to temporary leadership initiatives, underscoring the crucial role these executives play in navigating complex economic landscapes.

The demand for temporary leadership has surged, with an astonishing 116% year-over-year growth observed across various industries, particularly in private equity and technology sectors. This trend signifies a growing recognition of the value that interim CFO services in Seattle offer to organizations experiencing rapid expansion or financial challenges. A significant case study from Business Talent Group illustrates this point: they connect companies with over 10,000 finance executives, assisting them in sourcing the right temporary talent to address critical challenges and ensure stability during transitions.

This connection is vital, as it enables organizations to effectively manage their financial processes and navigate periods of uncertainty.

Moreover, interim CFO services in Seattle are instrumental in establishing a robust financial foundation for future growth. They implement best practices and mentor existing finance staff, ensuring that the knowledge and skills acquired during their tenure continue to benefit the organization long after their departure. By identifying fundamental organizational challenges and collaboratively developing strategies to address shortcomings, temporary CFOs empower companies to reinvest in essential strengths.

As companies strive for sustainable success in 2025 and beyond, the insights and changes introduced by temporary CFOs can position them advantageously in an increasingly competitive market. By leveraging data and analytics, as emphasized by Jeremy Hanson, who pointed out the necessity for CFOs to skillfully utilize customer data to enhance operations, these leaders can refine marketing strategies and operational efficiencies, ultimately contributing to a more resilient and prosperous business model. Additionally, it is crucial to recognize that 89% of industry leaders assert that AI without process intelligence fails to deliver, highlighting the importance of effective financial processes that interim CFOs can help establish.

Their pragmatic approach to data ensures continuous business performance monitoring and relationship-building, operationalizing turnaround lessons for maximum return on invested capital.

Conclusion

In today's fast-paced and ever-evolving business environment, the role of an interim CFO has become indispensable for organizations facing critical transitions. The insights shared in this article underscore the importance of understanding when to engage interim CFO services, the qualifications to look for in candidates, and the long-term benefits these professionals can bring to an organization.

Recognizing scenarios such as unexpected departures, financial distress, and major organizational changes is vital for businesses to act swiftly and secure the financial leadership necessary for stability. Selecting the right interim CFO involves considering their extensive experience, strong analytical skills, and crisis management expertise. Moreover, understanding the different types of interim CFO services available allows companies to tailor their approach to meet specific needs.

The financial implications of hiring an interim CFO should not be overlooked. While the costs may vary, the potential return on investment can be significant, leading to enhanced credibility, improved financial health, and sustainable growth. Establishing clear expectations and objectives with an interim CFO is crucial for fostering a productive relationship that drives measurable results.

Ultimately, engaging an interim CFO is not merely a stopgap measure; it is a strategic decision that can transform challenges into opportunities for growth. By leveraging the specialized skills of these financial leaders, organizations can navigate complexities, implement best practices, and position themselves for long-term success in an increasingly competitive landscape.

Frequently Asked Questions

What are interim CFO services in Seattle?

Interim CFO services in Seattle involve the strategic appointment of a Chief Financial Officer who provides essential financial leadership during transitional phases, helping businesses stabilize operations, establish controls, and navigate significant changes.

Why are interim CFO services important for businesses?

These services are crucial for organizations facing leadership gaps, economic challenges, or major transitions, ensuring continuity and a strategic focus during critical periods.

What trends are driving the demand for interim CFO services?

Key trends include a 37% increase in search efforts for temporary leadership in nonprofit and government sectors, and 62% of projects in private equity involving interim leadership, highlighting the growing need for experienced financial oversight.

How does outsourcing relate to interim CFO services?

The global finance and accounting outsourcing market, valued at $60 billion, reflects a trend towards outsourcing to enhance efficiency. This is particularly relevant in Seattle's dynamic corporate environment, making interim CFO services essential for agility and adaptability.

In what scenarios should a business consider hiring an interim CFO?

Businesses should consider hiring an interim CFO during unexpected departures, financial distress, organizational changes, project management needs, or major monetary events like preparing for an IPO.

What qualifications should businesses look for when selecting an interim CFO?

Key qualifications include extensive experience in financial management, strong analytical skills, crisis management expertise, excellent communication abilities, and industry-specific knowledge.

How can interim CFOs assist during financial distress?

A temporary CFO can provide expertise to stabilize financial situations during crises, implement strategies to manage cash flow, and ensure optimal financial performance.

What role do interim CFOs play in project management?

They provide specialized financial expertise for specific projects, enhancing outcomes by operationalizing lessons learned from previous experiences and ensuring effective strategy implementation.

How do interim CFOs contribute to long-term strategic planning?

They not only offer immediate financial expertise but also facilitate long-term planning to help organizations navigate transitions effectively and drive sustainable growth.

Why is it important to recognize the right time to utilize interim CFO services?

Recognizing critical triggers for hiring interim CFOs is essential for maintaining operational continuity and achieving long-term success, especially in the face of economic instability and organizational changes.