Introduction

In the competitive landscape of today’s business world, organizations frequently face challenges that threaten their stability and growth. Turnaround management services offer a lifeline, providing essential strategies and interventions designed to restore struggling enterprises to health.

Understanding the core concepts of turnaround management—from crisis management and financial restructuring to operational improvements—is crucial for organizations seeking to navigate complex recovery processes.

This article delves into the essential elements of effective turnaround management, guiding CFOs through a structured approach to:

- Selecting the right service providers

- Tailoring strategies to meet industry-specific needs

By establishing clear goals and continuously monitoring performance, businesses can enhance their resilience and drive sustainable growth, even in the face of adversity.

Understanding Turnaround Management Services: Key Concepts and Definitions

Turnaround management Sydney services include a range of comprehensive approaches and interventions aimed at revitalizing struggling businesses. For organizations aiming to assess their specific needs and implement effective recovery measures, understanding these key concepts is essential:

- Crisis Management: This approach addresses immediate operational challenges to stabilize the business, ensuring that customer and stakeholder expectations are continuously met, even as they evolve throughout project completion. Effective project supervision is crucial for decreasing project failure rates, as these expectations can shift during the turnaround process.

- Financial Restructuring: Focused on reorganizing a company's debt and financial obligations, this strategy is vital for improving cash flow and reducing liabilities. The online project coordination software market is anticipated to expand to $13.7 billion by 2030, offering a chance to utilize innovative tools that improve financial oversight. As Marc G., a project manager, notes, "Easy to use, it ensures a quick start without constraining training."

- Operational Improvements: Enhancing efficiency and effectiveness in business processes is critical for driving profitability. Intuitive project management software, such as Visual Planning, exemplifies the industry's commitment to fostering innovation and operational excellence. Additionally, our client dashboard provides real-time business analytics, enabling continuous monitoring of business health and the operationalization of lessons learned throughout the recovery process.

- Interim Management: This concept involves deploying temporary leadership solutions that bring expertise during critical transitional periods, allowing for swift stabilization of operations.

- Stakeholder Engagement: Successful recovery efforts hinge on effective communication and negotiation with all parties affected, including employees, creditors, and suppliers. Notably, 62% of successful projects had sponsors, underscoring the importance of securing external support and fostering a collaborative environment before initiating new initiatives.

By mastering these foundational concepts, entities can strategically align their recovery efforts through turnaround management Sydney, enhancing business performance while navigating the complexities of crisis oversight through continuous monitoring and relationship-building. Additionally, understanding the cash conversion cycle is crucial for optimizing financial performance, ensuring that businesses can effectively manage their liquidity and operational efficiency.

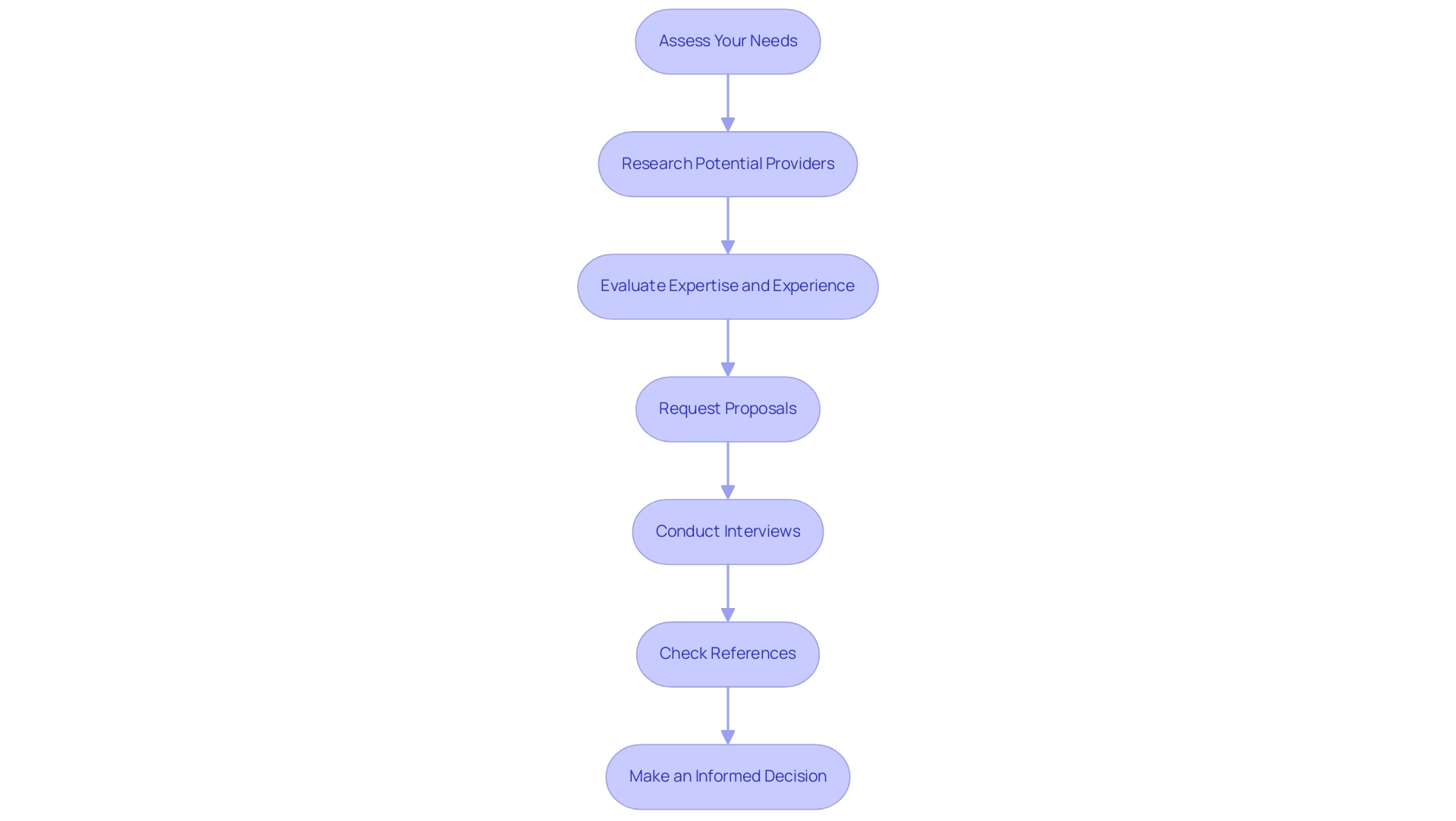

A Step-by-Step Approach to Choosing the Right Service Provider

Choosing the appropriate turnaround management Sydney service provider is a vital responsibility for CFOs, particularly in today's dynamic business landscape. To navigate the turnaround management Sydney process effectively, consider the following key steps:

-

Assess Your Needs:

Begin by thoroughly evaluating the specific challenges your organization is facing.

Identify key areas requiring immediate attention, such as cash flow issues, operational inefficiencies, or stakeholder management. -

Research Potential Providers for turnaround management Sydney:

Look for companies with a demonstrated history in recovery strategies, particularly those with expertise in your industry sector.

Scrutinize case studies and client testimonials to assess their effectiveness in similar situations.

Significantly, statistics indicate that 3.3% of participants in restructuring have 0–1 year of experience, 36.7% possess 1–3 years, 20% hold 4–6 years, and 40% exceed 6 years, implying a variety of expertise among providers. -

Evaluate Expertise and Experience:

Consider the qualifications and backgrounds of the consulting teams you’re evaluating.

Look for professionals with extensive experience and a deep understanding of various recovery strategies, as their insights will be invaluable.

As noted by Coetzer (2020), turnaround management Sydney in recovery situations, particularly during COVID-19 restrictions, requires adept handling of operational challenges and stakeholder engagement. -

Request Proposals:

Engage with shortlisted providers to request detailed proposals that outline their methodologies, timelines, and anticipated outcomes.

This step is vital for comparing different firms effectively. -

Conduct Interviews:

Arrange meetings with potential providers to discuss their approaches and how they plan to tackle your specific challenges.

Pay attention to their communication style and willingness to collaborate, as these factors can influence the success of the partnership.

This is where the 'Decide & Execute' aspect comes into play, as understanding their decision-making process is crucial. -

Check References:

Before finalizing your decision, contact references provided by the firm to glean insights into their performance, reliability, and client satisfaction. -

Make an Informed Decision:

Carefully weigh the advantages and disadvantages of each provider based on your evaluations.

Choose the firm that not only meets your immediate needs but also aligns with your organization’s long-term goals and culture.

Additionally, consider the significance of operationalizing the lessons learned throughout the recovery process and leveraging real-time analytics for continuous performance monitoring.

This encompasses the 'Update & Adjust' process, which ensures that plans remain relevant and effective.

As noted, 31% of firms are utilizing robotic process automation (RPA) to enhance operational efficiency.

By adhering to these organized steps and highlighting the evaluation of hypotheses during decision-making, CFOs can guarantee they choose a recovery support service that will effectively aid their organization's revival, promote turnaround management in Sydney, and improve operational resilience during difficult periods.

Identifying Industry-Specific Needs

Industries face particular obstacles that greatly affect their recovery plans. For instance:

- Retail: The rise of e-commerce and shifting consumer behaviors compel retailers to adopt innovative marketing and operational approaches.

To maximize efficiency, our approach involves testing hypotheses about flexible work arrangements, which research indicates can enhance productivity—73% of U.K. workers reported improved efficiency while working from home during the pandemic. This insight emphasizes the significance of real-time analytics in recognizing effective approaches vital for management recovery. By continually testing and measuring these hypotheses, we ensure that our approaches are data-driven and responsive to market changes.

- Hospitality: Variability in tourism trends and evolving customer expectations place an imperative on enhancing service quality and managing costs effectively. Engaging in professional development can yield substantial benefits; when offered to employees, engagement increases by an average of 15%, while retention improves by 34%. Our emphasis on continuous performance monitoring enables us to customize approaches that encourage a motivated workforce, which is crucial for successful turnaround management in Sydney's hospitality sector.

We also emphasize the 'Update & Adjust' approach, ensuring that our strategies evolve based on real-time feedback and analytics.

- Manufacturing: Turnaround efforts in manufacturing must tackle critical issues such as supply chain disruptions and production efficiency. As businesses strive to optimize these areas, it is crucial to recognize that only 11% of entities rate their contract processes as 'very effective.'

Our commitment to operationalizing lessons learned from past challenges in contract oversight highlights the need for effective systems; a case study revealed that unclear roles and weak storage solutions often hinder effectiveness, emphasizing the necessity for improvement. We consistently evaluate and assess our approaches to adjust and react to the distinct obstacles encountered in this field.

By comprehending these sector-specific requirements and utilizing real-time analytics, firms can choose service providers equipped with the essential expertise and customized strategies to efficiently tackle their unique challenges. Our dedication to fostering strong relationships guarantees that we stay in tune with our clients' changing requirements during the transformation process.

Evaluating Financial Health and Performance Metrics

Before utilizing turnaround management Sydney services, entities must perform a comprehensive evaluation of their financial status through key performance metrics. This foundational analysis not only clarifies the current standing but also enables a more productive dialogue with potential service partners. Key metrics to evaluate include:

- Cash Flow Analysis: Scrutinize cash inflows and outflows to pinpoint liquidity challenges that could impede operational stability. Significantly, 33% of women aged 18-29 indicated postponing home purchases because of debt, highlighting the essential requirement for effective cash flow oversight as part of a streamlined decision-making process.

- Profitability Ratios: Investigate gross and net profit margins to gauge overall financial performance and identify profitability trends. Grasping these ratios can assist entities in aligning their approaches with market expectations and financial realities, thus enabling real-time performance monitoring.

- Debt Levels: Assess the entity’s debt-to-equity ratio to understand financial leverage and risk exposure, informing strategic debt management decisions. This is especially relevant in light of research indicating that women take two additional years to pay off student debt compared to men, highlighting the importance of tailored financial strategies that promote continuous financial health monitoring.

- Operational Efficiency: Analyze metrics such as inventory turnover and return on assets to pinpoint areas ripe for improvement, maximizing resource utilization. Real-world examples, such as the financial health disparities illustrated in the case study on marital status, reveal that married and partnered women report better financial health than their single counterparts, suggesting that demographic factors can significantly influence financial stability.

By systematically evaluating these financial indicators and utilizing real-time analytics through our client dashboard, entities can articulate their specific needs and challenges to providers of turnaround management Sydney. This dashboard provides real-time business analytics, enabling continuous monitoring of business health and supporting a shortened decision-making cycle. By ensuring they choose a partner capable of customizing solutions that align with their unique circumstances, organizations can improve their recovery efforts.

Establishing Clear Goals and Expectations

To ensure a successful change, establishing clear goals and expectations is paramount. Here are essential steps to guide the process:

- Define Success Metrics: Start by identifying specific and measurable outcomes that signify progress, such as revenue growth, cost reductions, or enhancements in customer satisfaction. This clarity will facilitate tracking success and making informed decisions.

- Set Timelines: Realistic timelines are crucial for achieving these goals. Consider the complexity of the recovery process and establish deadlines that are achievable while still challenging. Our proven approach emphasizes the need for quick decision-making, enabling your team to take decisive action.

- Communicate Expectations: It is vital to clearly convey these goals and expectations to the selected service provider. Ensuring alignment from the outset fosters collaboration and accountability, essential for effective consulting services. This includes a clear understanding of the interim management and financial assessment services that will be utilized throughout the process.

- Monitor Progress: Implement regular check-ins to evaluate progress against the defined metrics. Our client dashboard offers real-time business analytics, enabling prompt modifications to strategies if required, maintaining the process on schedule. Ongoing monitoring guarantees that the lessons learned during the recovery process are implemented for future success.

By following these steps, organizations can foster a collaborative framework that significantly increases the likelihood of a successful recovery. As mentioned by Solomon Ighodalo Edokpa, "private companies experiencing a downturn should not adopt asset reduction strategies because the impact on performance is counterproductive but concentrate on recovery strategies that tackle the underlying causes of the decline." This approach resonates with the findings from a study involving 308 business administration students, which emphasizes the importance of understanding failure to reduce high failure rates in entrepreneurial ventures.

Moreover, the idea of collective responsibility in education emphasizes the importance of teamwork and active participation, making connections to the collaborative structures essential in recovery efforts. Establishing clear goals not only facilitates effective execution but also aligns with the latest best practices in turnaround management Sydney, setting the stage for sustainable recovery.

Conclusion

Turnaround management services present a vital resource for organizations facing significant challenges in today’s competitive landscape. By understanding the core strategies—ranging from crisis management to financial restructuring and operational improvements—businesses can position themselves for recovery and growth. Selecting the right service provider is a critical step in this process, requiring a thorough assessment of needs, research, and careful evaluation of potential partners to ensure a successful collaboration.

Moreover, recognizing industry-specific needs and leveraging real-time analytics allows organizations to tailor their turnaround strategies effectively. This targeted approach enhances the likelihood of success by addressing the unique challenges of each sector, whether in retail, hospitality, or manufacturing. Continuous monitoring of financial health through key performance metrics further strengthens this foundation, enabling informed decision-making that aligns with organizational goals.

Establishing clear goals and expectations is essential for guiding turnaround efforts. By defining success metrics, setting realistic timelines, and maintaining open communication with service providers, organizations can create a collaborative framework that fosters accountability and progress. The journey of recovery is complex, but with the right strategies in place, businesses can emerge more resilient and better equipped to thrive in the face of future challenges. Taking decisive action now is crucial for transforming potential setbacks into opportunities for sustainable growth.

Frequently Asked Questions

What services are included in turnaround management Sydney?

Turnaround management Sydney services encompass crisis management, financial restructuring, operational improvements, interim management, and stakeholder engagement, all aimed at revitalizing struggling businesses.

What is crisis management in the context of turnaround management?

Crisis management addresses immediate operational challenges to stabilize the business, ensuring that customer and stakeholder expectations are met throughout the turnaround process.

How does financial restructuring help a struggling business?

Financial restructuring reorganizes a company's debt and financial obligations, which is crucial for improving cash flow and reducing liabilities.

What role do operational improvements play in turnaround management?

Operational improvements enhance efficiency and effectiveness in business processes, which is critical for driving profitability and overall business health.

What is interim management, and why is it important?

Interim management involves deploying temporary leadership solutions during critical transitional periods to stabilize operations swiftly.

Why is stakeholder engagement vital in turnaround management?

Effective communication and negotiation with all parties affected, including employees, creditors, and suppliers, are essential for successful recovery efforts.

What steps should CFOs take when choosing a turnaround management service provider?

CFOs should assess their needs, research potential providers, evaluate expertise and experience, request proposals, conduct interviews, check references, and make an informed decision based on their evaluations.

How can organizations assess their specific needs during a turnaround?

Organizations can start by evaluating challenges such as cash flow issues, operational inefficiencies, and stakeholder management that require immediate attention.

What should organizations look for when researching potential turnaround management providers?

Organizations should seek companies with a proven history in recovery strategies relevant to their industry, reviewing case studies and client testimonials for effectiveness.

How important is the experience of consulting teams in turnaround management?

The qualifications and backgrounds of consulting teams are crucial, as extensive experience and understanding of recovery strategies can significantly impact the success of the turnaround.

What is the significance of requesting proposals from turnaround management providers?

Requesting detailed proposals allows organizations to compare methodologies, timelines, and anticipated outcomes among different firms effectively.

How can organizations ensure they choose the right turnaround management provider?

Organizations should weigh the advantages and disadvantages of each provider, ensuring alignment with their immediate needs and long-term goals, while also considering operational lessons learned during recovery.