Overview

To choose the right turnaround and restructuring consulting firm, CFOs should evaluate criteria such as industry expertise, proven track record, and the ability to provide tailored solutions that align with specific business needs. The article supports this by outlining essential steps in the selection process, emphasizing the importance of assessing each firm's capabilities and past performance to ensure a successful partnership aimed at recovery and growth.

Introduction

In the dynamic landscape of business today, organizations often face the daunting challenge of navigating financial distress and operational inefficiencies. For CFOs, the stakes are high, as the right turnaround and restructuring consulting services can be the key to revitalizing a struggling enterprise.

With the market for these services expected to grow significantly, understanding the fundamental strategies and criteria for selecting the right consulting partner is crucial. From conducting thorough financial assessments to implementing tailored solutions and ensuring long-term sustainability, this article delves into the essential components of effective turnaround strategies.

By exploring the engagement process and the metrics for measuring success, CFOs can equip themselves with the insights needed to drive meaningful change and secure a prosperous future for their organizations.

Understanding Turnaround and Restructuring Consulting Services

Turnaround and restructuring consulting firm services consist of a wide range of strategies aimed at assisting entities in regaining stability and fostering growth. As the market for turnaround & restructuring consulting firm services is projected to expand at a CAGR of 6.2% from 2024 to 2030, understanding the key components of these services is essential for CFOs and other decision-makers. Key strategies include:

- Financial Assessment: This critical first step involves a comprehensive evaluation of the company’s financial health, pinpointing areas ripe for improvement, such as cash flow management and reduction of liabilities. A thorough financial review can help identify opportunities to preserve cash and reduce liabilities, which is vital, given that 82% of small businesses fail due to cash flow issues. Successful turnarounds, driven by a turnaround & restructuring consulting firm, can lead to significant cost savings and improved capital management, justifying the investment in these solutions. Additionally, effective bankruptcy case management from a turnaround & restructuring consulting firm can be crucial for entities facing severe financial distress, providing a structured approach to navigate through challenging times.

- Operational Streamlining: By implementing processes aimed at enhancing operational efficiency and minimizing costs, advisory services play a crucial role in stabilizing businesses facing financial adversity. Streamlined operations not only reduce expenditure but also enhance responsiveness to market changes, allowing entities to navigate challenges effectively.

- Interim Management: Engaging experienced professionals for hands-on executive leadership during transitional periods ensures continuity and stability. This approach, particularly through the Rapid-30 process, is essential for a turnaround & restructuring consulting firm when swift action is necessary to avert further decline and identify critical business issues.

- Tailored Solutions: Acknowledging that every entity encounters distinct challenges, a turnaround & restructuring consulting firm provides personalized strategies. This is especially pertinent in sectors like retail and hospitality, where market dynamics can shift rapidly. As noted by turnaround expert Rob O’Byrne, "I urge you not to be deterred from launching your advisory startup, or from starting out again if your first venture failed," emphasizing the importance of resilience in the face of challenges.

- Long-term Planning: Beyond tackling urgent issues, effective advisory services provide entities with actionable strategies that establish the groundwork for sustainable growth. This includes emphasizing innovation, digital transformation, and strategic initiatives such as mergers and acquisitions, which are critical components of the broader strategy landscape.

- Real-time Analytics and Continuous Monitoring: Leveraging real-time analytics and continuous performance monitoring ensures that organizations can track their progress and make informed decisions. This aspect of advisory services is crucial for continuous success and enables the implementation of lessons learned throughout the recovery process.

These elements are crucial for CFOs looking to collaborate with a turnaround & restructuring consulting firm that can meet their specific requirements and create a route toward recovery and growth.

Key Criteria for Choosing the Right Consulting Firm

When choosing a turnaround and restructuring consulting firm, CFOs should evaluate several critical criteria to ensure effective engagement:

- Industry Expertise: Seek companies that specialize in your industry. With the management consulting market valued at 1 trillion USD and expanding, and with companies like EY employing 119,881 consultants globally, those that comprehend specific sector challenges can offer customized insights that lead to effective solutions.

- Proven Track Record: Investigate the company's history and success stories. A robust portfolio showcasing previous engagements and outcomes is indicative of their capability to deliver impactful results. For instance, one client noted how the SMB team, through their innovative 'Rapid30' plan, transformed their business within 100 days, leading to a 30% increase in revenue and a significant improvement in operational efficiency.

- Tailored Approach: Ensure the organization is prepared to customize their strategies to align with your unique circumstances, rather than applying a generic framework. Given the growing cybersecurity threats that clients are concerned about, this adaptability is crucial in navigating complex business environments and ensuring a long-term commitment to trusted consultancy advisors.

- Financial Acumen: Assess their expertise in financial management and planning. This knowledge is vital for steering your organization through challenging transitions and achieving long-term stability.

- Interim Management Capabilities: Verify if the organization can provide interim management support. This resource can be essential in stabilizing operations during the restructuring phase, allowing for a smoother transition.

- Communication and Collaboration: Choose an organization that emphasizes open dialogue and teamwork. A collaborative approach will ensure they work closely with your internal team to meet shared objectives. The SMB team exemplifies this commitment, continually monitoring success through real-time analytics and operationalizing lessons learned, ensuring that decision-making cycles are shortened and data-driven insights are utilized effectively.

As highlighted by IBISWorld, a trusted provider of industry insights, "IBISWorld prides itself on being a trusted, independent source of data, with over 50 years of experience building and maintaining rich datasets and forecasting tools." By rigorously assessing these criteria, CFOs can confidently choose a turnaround & restructuring consulting firm that can effectively handle their organization’s transformation and restructuring requirements. The right partner can significantly influence the trajectory of recovery and growth.

Evaluating Potential Consulting Firms

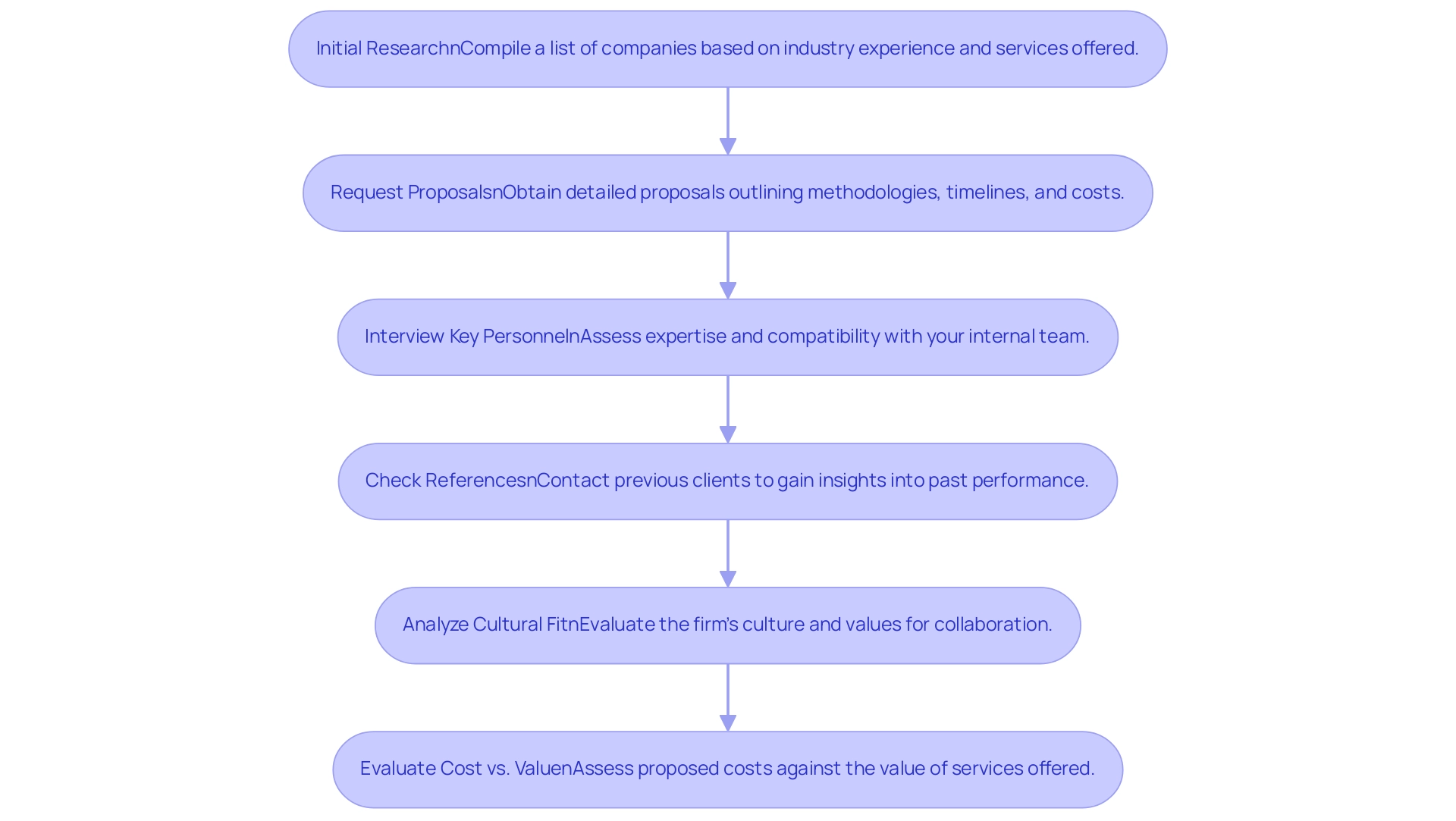

To effectively assess potential consulting organizations for restructuring and turnaround initiatives, CFOs should adopt a systematic approach that includes the following steps:

-

Initial Research: Begin by compiling a comprehensive list of companies that align with your specific needs. Focus on their industry experience and the range of services they offer as a turnaround & restructuring consulting firm, ensuring they have a proven track record in your sector. Significantly, only 0.13% of consultants with full-time employees have between 51-100 workers, which may affect your decisions regarding company size.

Request Proposals: Reach out to the chosen companies to obtain detailed proposals. These should outline their methodologies, timelines, and associated costs, providing a clear picture of what to expect.

-

Interview Key Personnel: Conduct interviews with the consultants who will be directly engaged in your project. This is crucial for assessing their expertise and ensuring compatibility with your internal team, which is essential for a successful partnership.

-

Check References: Request and contact references from previous clients. Gaining insights into the company's past performance and effectiveness can significantly influence your decision-making process.

Analyze Cultural Fit: Evaluate the firm’s culture and values. A strong cultural fit can enhance collaboration and increase the likelihood of achieving successful outcomes in your restructuring efforts.

-

Evaluate Cost vs. Value: Finally, assess the proposed costs against the value of the services offered. Grasping the fear of losing clients that may cause consultants to hesitate in increasing their fees can offer insight into their pricing strategies, which is essential in making a sound financial decision, particularly in an industry where the advisory landscape is evolving rapidly.

By systematically following these steps, CFOs can make informed decisions when selecting a turnaround & restructuring consulting firm as their partner. This will pave the way for successful recovery and restructuring outcomes, backed by a commitment to operationalizing lessons learned from the process. Notably, a shortened decision-making cycle is vital during this evaluation process to ensure timely actions are taken.

For instance, the Consulting Success® team demonstrates how structured programs can effectively raise consultants' fees and showcase value, leading to substantial revenue growth—illustrated by the $117K total revenue generated from a structured fee approach over a year. This emphasizes the significance of continuous performance monitoring and relationship-building through real-time analytics, ensuring that your partnership is not just effective but also sustainable. Moreover, working with your advisory team to pinpoint and tackle fundamental business challenges can greatly improve the efficiency of your recovery strategy.

Understanding the Engagement Process

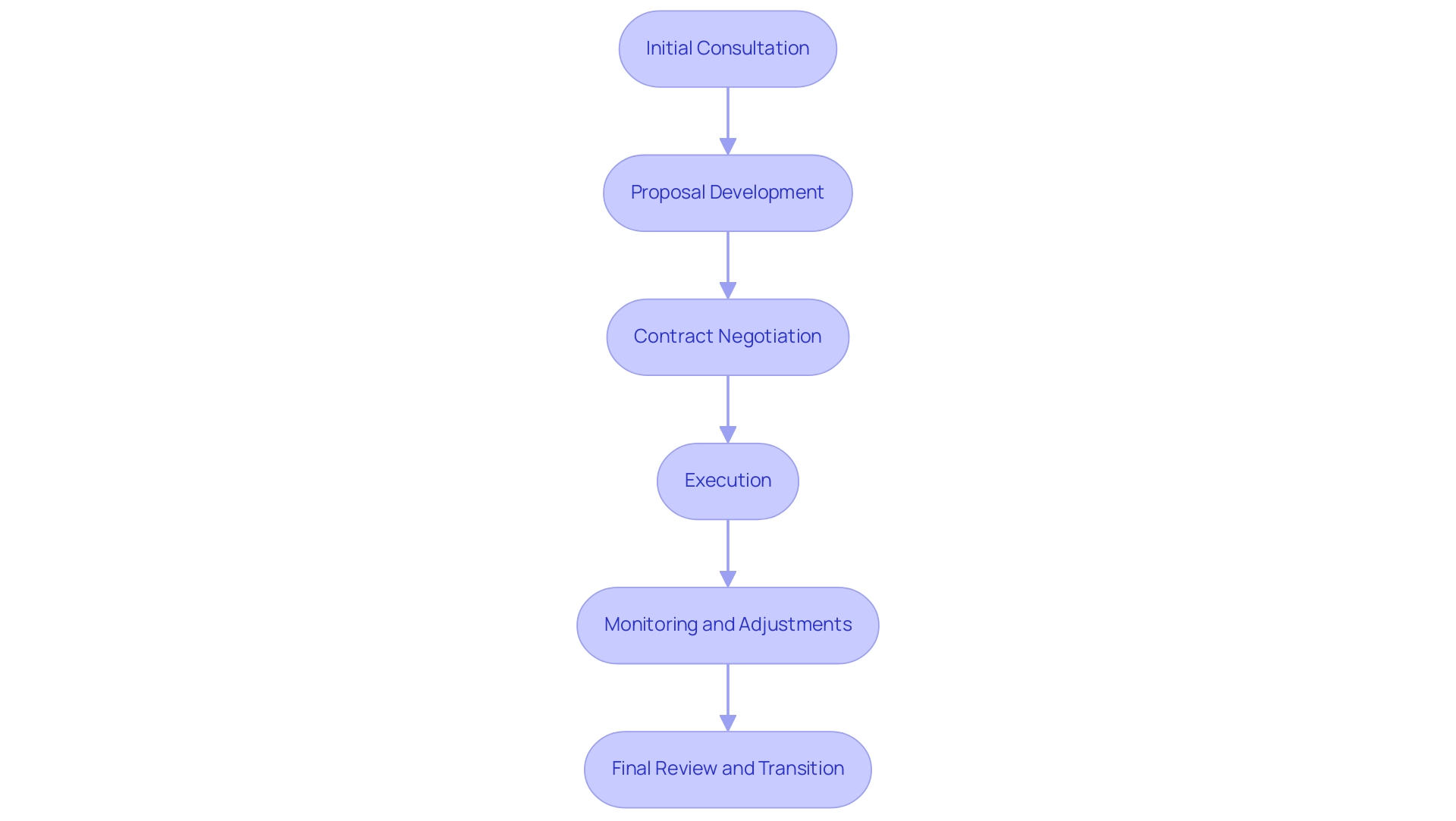

The engagement process with a turnaround and restructuring advisory organization is critical for driving effective change and typically unfolds in several key stages:

- Initial Consultation: This foundational stage involves in-depth discussions aimed at uncovering the entity’s challenges and goals. By establishing a clear understanding of the client's needs, consultants can propose tailored solutions that align with business objectives. Building trust with clients during this phase is essential, as it sets the tone for a successful partnership.

- Proposal Development: After the initial consultation, the advisory group creates a tailored proposal that details their strategy, timeline, and cost structure. This ensures that both parties have aligned expectations moving forward. Utilizing comprehensive data analysis during this stage can help in creating more informed proposals, ultimately supporting streamlined decision-making.

- Contract Negotiation: Once the proposal is accepted, the negotiation phase begins. This includes discussing the terms of engagement such as deliverables, timelines, and any specific metrics for success. Effective negotiation is essential to set the stage for a productive partnership.

- Execution: At this stage, the advisory group initiates the implementation of the agreed strategies, collaborating closely with the organization’s internal team to ensure seamless integration of new processes. This hands-on approach is vital for achieving the desired outcomes. As observed in a collaboration with Smartmatic, addressing issues such as scattered information can lead to significant improvements, including optimizing staff schedules to enhance peak-hour sales.

- Monitoring and Adjustments: Continuous engagement is crucial. Throughout the engagement, the company actively monitors progress through real-time business analytics via a client dashboard, soliciting feedback to make necessary adjustments based on performance indicators. As noted in industry best practices, fostering ongoing communication helps adapt strategies to changing circumstances, ensuring that the advisory organization can effectively respond to the client's evolving needs and operationalize lessons learned for future success. This commitment to a shortened decision-making cycle allows for swift adjustments to strategies as needed.

- Final Review and Transition: As the engagement concludes, a comprehensive review assesses the outcomes achieved against initial objectives. A transition plan is also created, ensuring that the organization can maintain enhancements beyond the advisory engagement.

By understanding and embracing this structured process, CFOs can cultivate a productive partnership with their advisory team, ultimately driving more effective restructuring and recovery strategies. As Arthur N. Turner aptly stated, > Consulting is more than giving advice <, emphasizing the collaborative nature of this work. This collaborative approach, supported by best practices such as building trust and utilizing real-time analytics through tools like the client dashboard, is essential for achieving successful outcomes.

Measuring Success and Outcomes

To effectively assess the success of your interaction with a restructuring advisory firm, concentrate on the following essential metrics:

-

Financial Performance: Scrutinize improvements in critical financial metrics such as revenue growth, profit margins, and cash flow. Recent trends indicate that proposals aimed at increasing conversion rates can position 70% of prospects in the 'WIN' column, emphasizing the financial impact of effective consulting. This statistic underlines the potential for significant revenue enhancement through well-crafted proposals.

-

Operational Efficiency: Evaluate enhancements in operational metrics, including cost reductions, process improvements, and optimal resource utilization. Our team, as a turnaround & restructuring consulting firm, supports a shortened decision-making cycle throughout the turnaround process, allowing decisive actions that preserve your business. We work collaboratively with clients to identify underlying issues and create tailored plans for improvement. Leading KPIs for service organizations, such as sales pipeline and scheduled billable hours, are essential indicators of operational efficiency and are vital for establishing a financial buffer, ultimately leading to increased productivity and profitability.

-

Stakeholder Satisfaction: Collect feedback from employees, management, and other stakeholders to gauge their satisfaction with the changes implemented. Insights from Patricia Davis, Manager of the PMO at F5, highlight the significance of responsiveness in advisory engagements:

The support team at Wrike was on top of it. Every single thing we asked on our wish list is being addressed now, or was addressed within a matter of weeks.

-

Achievement of Goals: Assess whether the specific goals outlined at the beginning of the engagement have been met, including turnaround milestones and restructuring targets. This evaluation is crucial in determining whether the advisory group has delivered on its promises, operationalizing lessons learned to build strong, lasting relationships.

-

Sustainability of Changes: Investigate whether the adjustments made during the engagement are maintained over time, which is a strong indicator of a successful transformation. The sustainability of these changes often reflects the depth of the advisory group's impact. Additionally, we adopt a pragmatic approach to testing every hypothesis to ensure maximum return on invested capital. Examining real-time business analytics through a client dashboard can provide insights into continuous performance monitoring. Case studies showcasing average project revenue generated from consulting projects can illustrate how value-based pricing and task delegation contribute to enhanced financial performance.

By rigorously measuring these outcomes, CFOs can ascertain the effectiveness of the consulting firm’s interventions, operationalize successful turnaround lessons, and make informed decisions regarding future partnerships, ultimately enhancing their organization’s financial performance.

Conclusion

In the ever-evolving business environment, the ability to navigate financial distress and operational inefficiencies has never been more critical. For CFOs, the selection of a turnaround and restructuring consulting partner is paramount. As outlined in this article, key strategies such as:

- Comprehensive financial assessments

- Operational streamlining

- Tailored solutions

provide a solid foundation for revitalizing struggling enterprises. By prioritizing these elements, organizations can effectively confront challenges and pave the way for sustainable growth.

Choosing the right consulting firm involves careful consideration of:

- Industry expertise

- Proven track records

- A tailored approach to meet unique organizational needs

The engagement process—from initial consultation to final review—demonstrates the importance of collaboration and continuous monitoring in achieving successful outcomes. By systematically evaluating potential partners and focusing on metrics that measure success, CFOs can ensure that their organizations are well-positioned for recovery.

Ultimately, the journey through turnaround and restructuring is not merely about overcoming immediate hurdles; it is about laying the groundwork for a resilient future. Armed with the right insights and strategies, CFOs can drive meaningful change that not only addresses current challenges but also fosters long-term sustainability and success. Taking decisive action now can lead to a prosperous tomorrow, ensuring that organizations thrive in an increasingly competitive landscape.

Frequently Asked Questions

What services do turnaround and restructuring consulting firms provide?

Turnaround and restructuring consulting firms offer a range of strategies to help entities regain stability and promote growth. Key services include financial assessment, operational streamlining, interim management, tailored solutions, long-term planning, and real-time analytics and continuous monitoring.

Why is financial assessment important in the turnaround process?

Financial assessment is crucial as it involves a comprehensive evaluation of a company's financial health, identifying areas for improvement such as cash flow management and reduction of liabilities. This step is vital because 82% of small businesses fail due to cash flow issues, and effective financial reviews can lead to significant cost savings and improved capital management.

How does operational streamlining benefit businesses in distress?

Operational streamlining enhances efficiency and minimizes costs, which stabilizes businesses facing financial difficulties. By reducing expenditures and improving responsiveness to market changes, organizations can better navigate challenges.

What role does interim management play in restructuring?

Interim management provides experienced professionals for hands-on executive leadership during transitional periods, ensuring continuity and stability. This approach is particularly important for quickly addressing critical business issues.

Why is a tailored approach important in consulting services?

A tailored approach is essential because every entity faces unique challenges that require customized strategies. This is particularly relevant in rapidly changing sectors like retail and hospitality, where specific insights can lead to effective solutions.

What does long-term planning entail in the context of restructuring?

Long-term planning involves developing actionable strategies that lay the groundwork for sustainable growth. This includes focusing on innovation, digital transformation, and strategic initiatives such as mergers and acquisitions.

How do real-time analytics and continuous monitoring contribute to success?

Real-time analytics and continuous monitoring allow organizations to track their progress and make informed decisions, which is vital for ongoing success and the implementation of lessons learned throughout the recovery process.

What criteria should CFOs consider when choosing a turnaround and restructuring consulting firm?

CFOs should evaluate industry expertise, proven track record, tailored approach, financial acumen, interim management capabilities, and communication and collaboration when selecting a consulting firm.

Why is industry expertise important in a consulting firm?

Industry expertise is important because firms that specialize in a specific sector can offer customized insights and solutions that address the unique challenges faced by organizations within that industry.

How can a consulting firm's proven track record influence decision-making?

A proven track record, demonstrated through previous engagements and successful outcomes, indicates the firm's capability to deliver impactful results, which can build confidence in their ability to handle a client's transformation needs.