Overview

A business health assessment is a comprehensive evaluation that CFOs conduct to analyze an organization's economic and operational wellbeing, focusing on identifying risks, uncovering cost reduction opportunities, and ensuring regulatory compliance. The article outlines a structured step-by-step process, including financial data analysis, operational efficiency evaluations, and market positioning assessments, which collectively support informed decision-making and promote sustainable growth.

Introduction

In a landscape where financial agility and operational resilience are paramount, business health assessments emerge as indispensable tools for CFOs seeking to navigate complex challenges and drive sustainable growth. These assessments provide a holistic view of an organization's financial and operational performance, enabling leaders to identify risks, streamline processes, and capitalize on opportunities for improvement.

By systematically evaluating financial statements, operational workflows, and market positioning, CFOs can foster a culture of continuous improvement that not only enhances decision-making but also safeguards against potential pitfalls. This article delves into the critical components of effective business health assessments, outlining a step-by-step approach to conducting them, overcoming common challenges, and establishing a framework for ongoing monitoring and enhancement.

As organizations strive for excellence in an ever-evolving market, understanding and implementing these assessments becomes essential for achieving long-term financial stability and operational success.

Understanding Business Health Assessments: Importance and Objectives

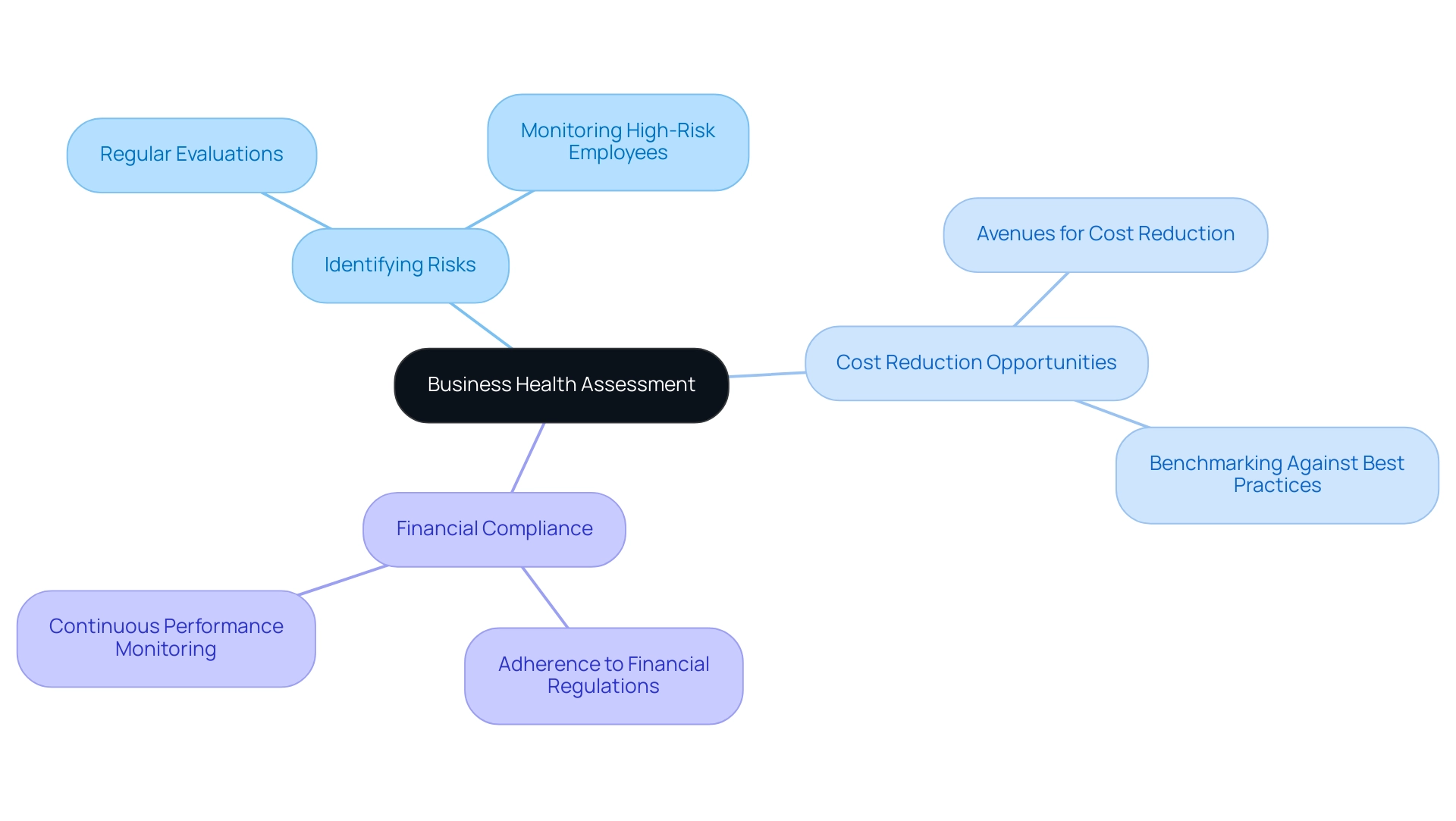

A business health assessment serves as an essential tool for CFOs, carefully crafted to analyze both the economic and operational wellbeing of an organization. This evaluation entails a thorough examination of monetary statements, operational workflows, and market positioning, aiming to deliver a comprehensive view of the organization's performance. The primary objectives include:

- Identifying potential risks

- Uncovering avenues for cost reduction

- Ensuring adherence to financial regulations

Moreover, our strategic approach emphasizes streamlined decision-making through real-time analytics, essential for effective organizational turnaround and performance monitoring. We believe in a pragmatic approach to data, testing every hypothesis to deliver maximum return on invested capital in both the short and long term. Regular evaluations, particularly advantageous for higher-risk employees who may need reviews every six months, allow CFOs to proactively conduct a business health assessment to address emerging issues before they escalate, fostering sustainable growth and enhancing overall business performance.

By integrating continuous performance monitoring into their strategic plan, CFOs can build strong relationships and operationalize lessons learned from past turnarounds. Our collaborative efforts in creating plans to mitigate weaknesses ensure that all stakeholders are aligned and engaged. As emphasized by research on corporate wellness evaluation scores, a consistent strategy to wellness metrics promotes a culture of well-being and relates to decreased healthcare expenses.

Jim Collins observed in 'Good to Great' that adhering to a thorough research process is crucial; HealthNEXT analyzed benchmark organizations that have effectively reduced their cost inflation trend over many years, further highlighting the significance of routine evaluations in attaining fiscal stability.

Key Components of a Business Health Assessment

A comprehensive business health assessment is essential for CFOs aiming to enhance their company's economic and operational standing. Key components include:

-

Financial Statements Review: CFOs must meticulously analyze income statements, balance sheets, and cash flow statements to gauge profitability, liquidity, and solvency—critical for informed decision-making and strategic planning.

For instance, a company may target a 20% decrease in debt, emphasizing the crucial role of economic metrics in attaining strategic objectives.

-

Mastering the Cash Conversion Cycle: Effective cash flow analysis is pivotal for maintaining liquidity to meet operational demands. By evaluating cash inflows and outflows, companies can identify trends and enhance their cash management strategies.

Recent advancements, such as multiple linear regression models, provide deeper insights into cash flow dynamics, facilitating more accurate forecasting. Implementing strategies such as optimizing inventory turnover and accelerating receivables can significantly improve cash flow.

-

Operational Efficiency: A thorough examination of processes and workflows is crucial for pinpointing bottlenecks and identifying areas for cost reduction.

Streamlining operations not only improves productivity but also enhances overall efficiency, directly impacting the bottom line and supporting continuous performance monitoring. Strategies such as Lean Management and Six Sigma can be employed to eliminate waste and improve processes.

-

Market Positioning: Assessing competitive positioning and market trends is vital for identifying growth opportunities.

Understanding market value ratios benchmarks the company against competitors, empowering informed strategic choices that align with performance monitoring and business health assessment strategies. Utilizing market analysis tools can help in identifying potential areas for expansion.

-

Compliance and Risk Management: Adhering to monetary regulations is fundamental in safeguarding economic stability.

Identifying potential risks, especially considering the lessons learned from the 2008 economic crisis, is essential. The case study 'Risk Assessment Using Statistical Models' illustrates the importance of enhanced risk assessment practices. This proactive compliance and risk management approach is crucial for maintaining a robust financial position and building strong relationships through operationalizing turnaround lessons.

Additionally, a collaborative approach to identifying and planning solutions can help address weaknesses and leverage strengths effectively.

Step-by-Step Process for Conducting a Business Health Assessment

To effectively conduct a comprehensive business health assessment and improve efficiency, follow this structured approach:

- Gather Monetary Data: Begin by collating all essential monetary documents, including recent statements and budgets. Ensure that the data is accurate and up-to-date to facilitate precise analysis.

- Analyze Financial Statements: Scrutinize the income statements to assess profitability, the balance sheets for solvency, and the cash flow statements to evaluate liquidity. This holistic review provides a snapshot of the business's economic status, which is crucial for a comprehensive business health assessment and informed decision-making.

- Conduct Ratio Analysis: Employ key ratios—such as the current ratio, quick ratio, and debt-to-equity ratio—to measure the organization's economic health. These metrics offer valuable insights into operational efficiency and financial stability, which are essential for conducting a business health assessment and aiding in strategic planning.

- Evaluate Operational Processes: Identify any operational inefficiencies by mapping out key processes and measuring performance metrics. This business health assessment will help highlight areas requiring optimization, ensuring that resources are effectively allocated.

- Assess Market Conditions: Stay informed on industry trends and competitors’ sales strategies. Understanding market positioning can lead to a business health assessment that inspires innovative improvements within your own company, ensuring competitive relevance through strategic insights and real-time analytics.

- Conduct SWOT Analysis: Summarize and share insights from the SWOT analysis regarding the organization to foster agreement or disagreement among stakeholders, ensuring all perspectives are taken into account in the evaluation, which strengthens the decision-making process.

- Compile Findings: Document all insights and actionable recommendations derived from the evaluation, including those from the Operations Audit report, which details the organization's health score and actionable recommendations. This compilation is crucial for presenting the business health assessment to stakeholders, fostering agreement or constructive debate around the findings.

- Implement Recommendations: Refer to case studies, such as the one titled "Recommendations for Improvement," which illustrates how the analysis leads to specific recommendations in areas such as commercial strategy, sales methods, resource management, and marketing. This practical use of the evaluation process directs the company in executing modifications to enhance commercial performance and competitiveness, ensuring ongoing oversight of operational performance.

As highlighted by Professor Colin McCulloch, > A useful introduction for non-specialists in maths/stats <, this approach clarifies complex data analysis, enabling CFOs to utilize insights effectively and implement lessons learned for a successful organizational turnaround. Additionally, our team collaborates closely throughout this process to create a tailored plan that addresses identified issues, while testing hypotheses to deliver maximum return on invested capital.

Overcoming Challenges in Business Health Assessments

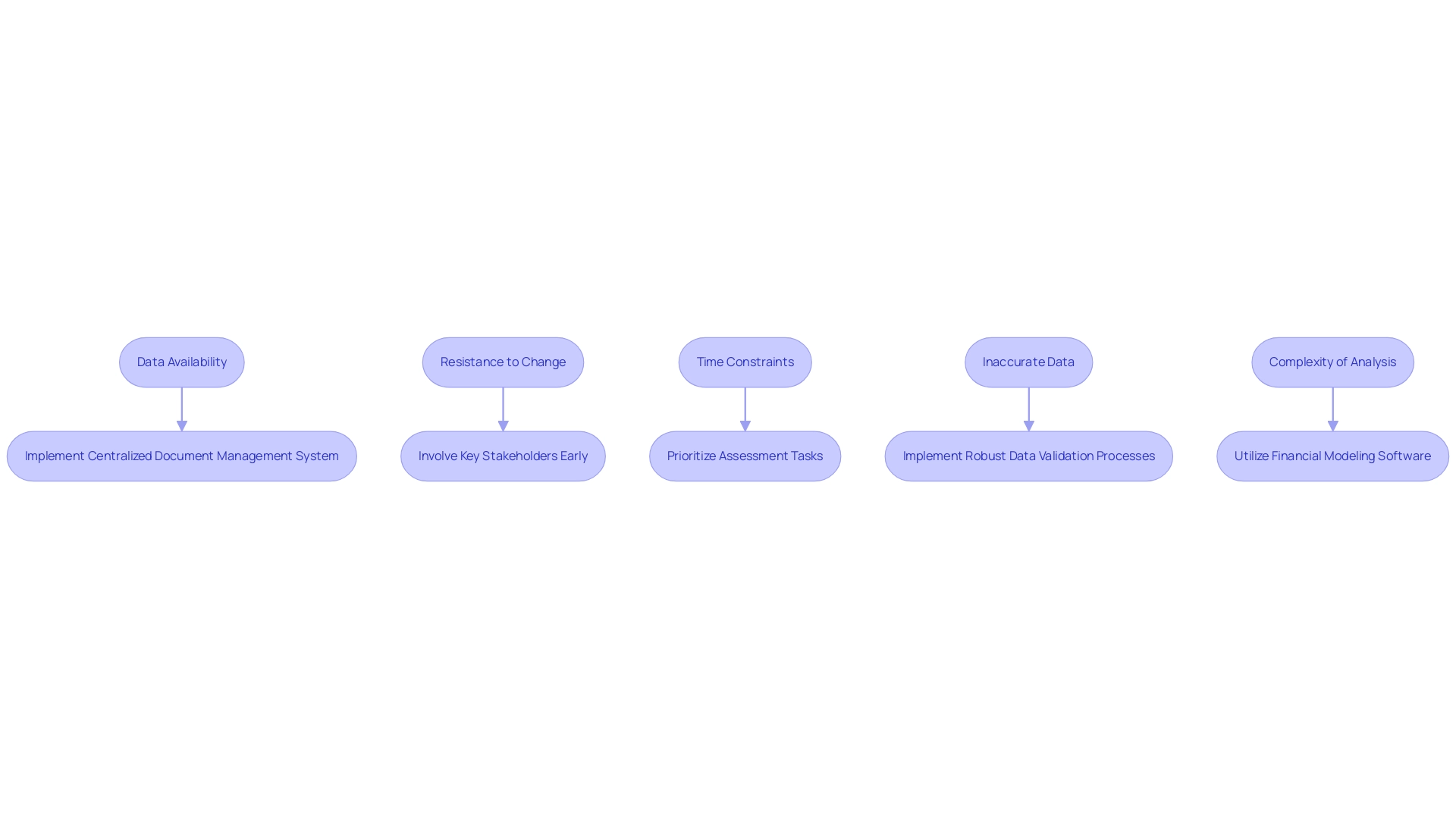

CFOs face a myriad of challenges during a business health assessment, which can significantly impact decision-making and operational efficiency. Addressing these challenges effectively is crucial for conducting a business health assessment to maintain economic health and ensure the long-term success of an organization. Here are the key obstacles and strategies to navigate them:

- Data Availability: Access to all necessary monetary documents is paramount. Implementing a centralized document management system can streamline this process, ensuring that critical information is readily available when needed. A comprehensive financial review can uncover opportunities for cash preservation and liability reduction, particularly as ongoing training trends, such as 60% of the technology workforce in a Latin American bank engaging in upskilling, emphasize the importance of improving data quality.

- Resistance to Change: Involving key stakeholders early in the evaluation process is essential to foster buy-in and minimize pushback. By involving them from the outset, you can address concerns and increase acceptance of new initiatives. The case study titled 'Recommendations for Continuous Data Quality Improvement' highlights the significance of stakeholder involvement in enhancing data quality.

- Time Constraints: As deadlines loom, it’s important to prioritize assessment tasks and allocate resources effectively. This strategic approach helps ensure that critical evaluations are completed on time without sacrificing quality. Our team supports a shortened decision-making cycle throughout the turnaround process, allowing you to take decisive action to preserve your business.

- Inaccurate Data: The integrity of financial information is non-negotiable. Implementing robust data validation processes can significantly enhance the accuracy of your data prior to analysis, reducing the risk of errors that could lead to misguided decisions. Continuous monitoring of performance through real-time analytics provides insights that can help mitigate risks and uncover value, with our client dashboard offering a comprehensive view of your health.

- Complexity of Analysis: Financial modeling software can be a game-changer in simplifying complex analysis. Utilizing such tools not only enhances understanding but also aids in communicating findings effectively across departments. GitLab exemplifies effective remote work practices, emphasizing shared reality and decision velocity, which can also apply to CFOs in enhancing organizational wellness assessments.

As noted by a finance expert, 'And if they’re missing information that is basically a retraining issue.' It’s uh you know sit down say ‘Okay, well, this is why, this is wrong, this is what it needs to be.’ This highlights the importance of continuous training to maintain high data quality. By implementing these approaches, including a business health assessment focused on thorough monetary evaluations centered on cash conservation and effectiveness, CFOs can greatly enhance their enterprise evaluations and propel organizational success.

We encourage you to engage with our financial evaluation services to unlock your organization's potential.

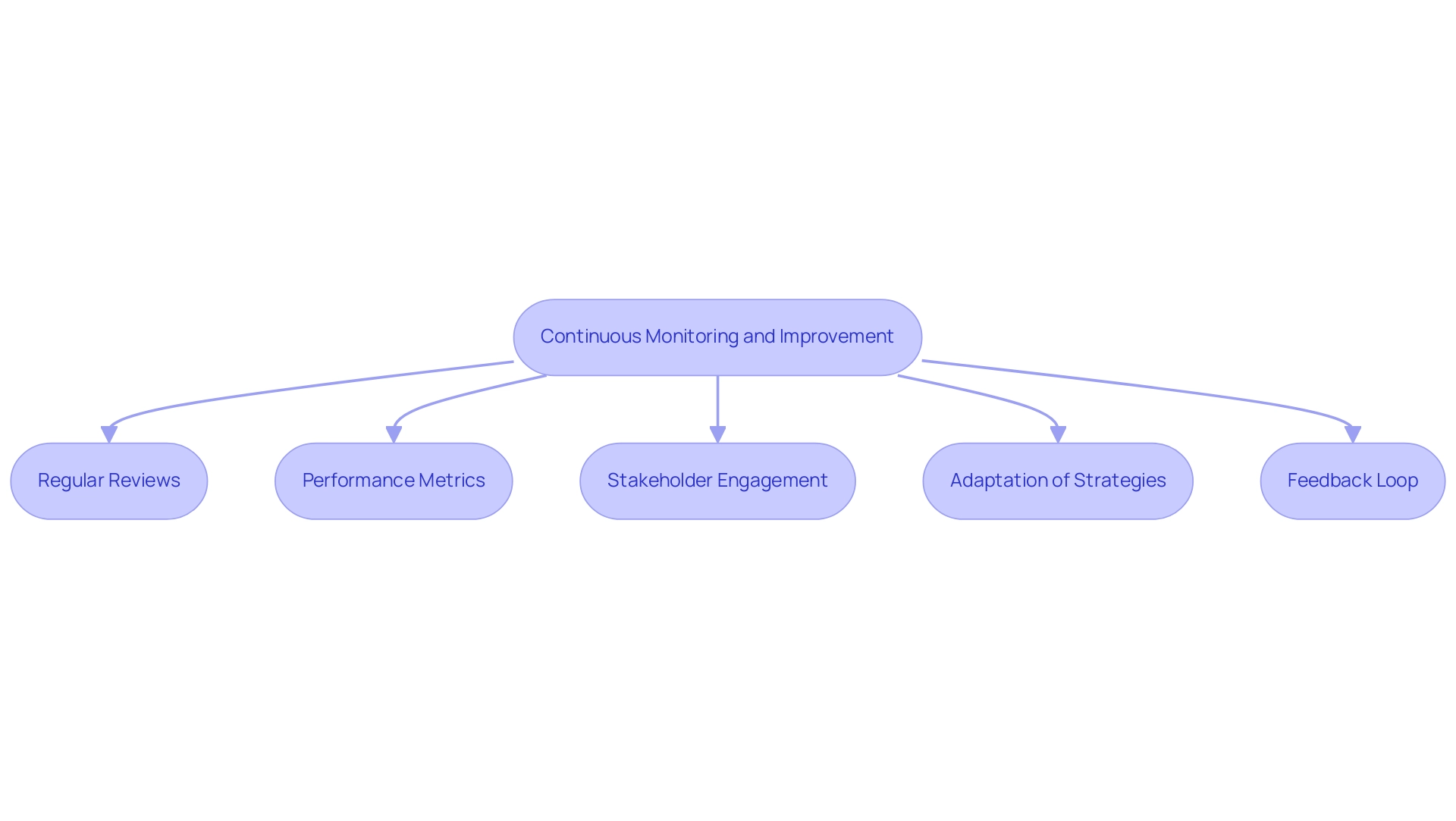

The Importance of Continuous Monitoring and Improvement

Following a business health assessment, establishing a robust system for continuous monitoring and improvement is essential. This approach goes beyond mere compliance; it proactively safeguards against potential risks, including cyber attacks. Continuous monitoring is a key component of a data protection strategy, effectively mitigating risks while providing real-time insights into business performance through our client dashboard.

Consider implementing the following strategies:

- Regular Reviews: Conduct periodic evaluations of economic performance and operational processes to swiftly identify emerging issues. This practice is crucial, especially as 73% of executive leaders recognize remote workers as a heightened security risk compared to in-house employees.

- Performance Metrics: Define key performance indicators (KPIs) tailored to measure progress against your economic objectives. Incorporating real-time analytics and predictive modeling into these metrics enables precise evaluations of business health assessment, ensuring your strategies are data-driven.

- Stakeholder Engagement: Maintain open lines of communication with stakeholders about findings and necessary changes. This engagement is vital for ensuring alignment and garnering support for adjustments that enhance operational efficiency.

- Adaptation of Strategies: Be prepared to adjust economic and operational approaches based on insights from ongoing evaluations and changing market conditions. Richard Mueller, Vice President of Audit Services, emphasizes the importance of Continuous Monitoring (CM) and Continuous Auditing (CA), advocating for various automated solutions to meet specific monitoring needs.

- Feedback Loop: Create a strong feedback system that incorporates lessons learned into future evaluations, promoting a culture of ongoing enhancement. For instance, Wells Fargo has successfully integrated continuous monitoring capabilities to assess portfolio risks and ensure compliance post-merger with Wachovia Corporation, significantly enhancing their risk management in a dynamic financial environment.

Additionally, a recent survey of Secureframe users highlights the critical role of continuous monitoring in maintaining security and compliance. By prioritizing these strategies and operationalizing the lessons learned from past assessments, CFOs can ensure that the business health assessment translates into actionable insights, leading to sustained improvements in efficiency and security.

Conclusion

Business health assessments are not just a periodic task; they are essential for fostering a resilient financial future. By systematically evaluating financial statements, operational workflows, and market positioning, CFOs can identify risks and opportunities that drive strategic growth. The structured approach outlined—from gathering financial data to implementing actionable recommendations—ensures that assessments lead to informed decision-making and enhanced operational efficiency.

Challenges such as data availability, resistance to change, and time constraints can impede the effectiveness of these assessments. However, by leveraging technology, engaging stakeholders, and adopting a proactive mindset, CFOs can navigate these obstacles and maintain a clear path toward financial stability. Continuous monitoring and improvement are vital in this journey, allowing organizations to adapt to changing market conditions and safeguard against potential risks.

Ultimately, embracing a culture of regular business health assessments empowers organizations to stay ahead of the curve, ensuring long-term success and operational excellence. The commitment to ongoing evaluation and strategic adjustment positions CFOs as proactive leaders, capable of steering their companies toward sustainable growth in a complex business landscape.

Frequently Asked Questions

What is the purpose of a business health assessment?

A business health assessment is designed to analyze both the economic and operational wellbeing of an organization. Its primary objectives include identifying potential risks, uncovering avenues for cost reduction, and ensuring adherence to financial regulations.

What components are included in a comprehensive business health assessment?

Key components include a review of financial statements, mastering the cash conversion cycle, assessing operational efficiency, evaluating market positioning, and ensuring compliance and risk management.

How do CFOs utilize financial statements in a business health assessment?

CFOs meticulously analyze income statements, balance sheets, and cash flow statements to gauge profitability, liquidity, and solvency, which are critical for informed decision-making and strategic planning.

Why is mastering the cash conversion cycle important?

Effective cash flow analysis is vital for maintaining liquidity to meet operational demands. By evaluating cash inflows and outflows, companies can identify trends and enhance their cash management strategies.

What strategies can improve operational efficiency?

Strategies such as Lean Management and Six Sigma can be employed to streamline operations, eliminate waste, and improve processes, which directly impacts productivity and overall efficiency.

How does market positioning factor into a business health assessment?

Assessing competitive positioning and market trends helps identify growth opportunities. Understanding market value ratios allows companies to benchmark against competitors and make informed strategic choices.

What role does compliance and risk management play in a business health assessment?

Adhering to monetary regulations is fundamental for safeguarding economic stability. Identifying potential risks and implementing proactive compliance strategies are crucial for maintaining a robust financial position.

How can regular evaluations benefit CFOs and their organizations?

Regular evaluations allow CFOs to proactively address emerging issues before they escalate, fostering sustainable growth and enhancing overall business performance. They also help in operationalizing lessons learned from past experiences.