Introduction

In the intricate world of finance, understanding and managing risk is not just a necessity—it's a strategic imperative. As organizations navigate an increasingly volatile landscape, CFOs must equip themselves with the knowledge of various financial risks that can impact their bottom line. From market fluctuations to credit defaults, the spectrum of risks is broad and complex.

This article delves into the definitions and types of financial risk, offering a comprehensive guide to conducting effective risk assessments. It also outlines robust management strategies that can help organizations safeguard their financial health while leveraging advanced tools for risk analysis. By embracing these insights, CFOs can not only enhance their risk management frameworks but also position their organizations for sustainable growth in an unpredictable environment.

Understanding Financial Risk: Definitions and Types

Financial uncertainty encompasses the potential for monetary loss associated with investments or business operations, making a company financial risk assessment crucial for organizations to grasp its various dimensions for effective management. Here are the primary categories of financial uncertainty that every CFO should be familiar with:

- Market Threat: This threat pertains to potential losses stemming from fluctuations in market prices, such as changes in equity values or interest rates. In recent evaluations, market uncertainty has demonstrated varying effects across sectors, necessitating tailored strategies.

- Credit Risk: This involves the likelihood that a borrower will default on their obligations, affecting cash flow and financial stability. A robust credit evaluation framework is essential for maintaining liquidity and operational efficiency.

- Operational Risk: This category arises from failures in internal processes, systems, or external events that disrupt operations. Comprehending this threat is essential, particularly in a swiftly evolving business atmosphere.

- Liquidity Concern: The possibility of an entity being unable to fulfill its monetary obligations as they arise is a critical issue that can endanger a company's operations.

- Reputational Threat: Adverse public perception can result in considerable losses, affecting both existing relationships and the capacity to establish new collaborations.

By thoroughly comprehending these definitions and categories of economic threats, organizations are better prepared to navigate the intricacies of company financial risk assessment and develop strong oversight strategies. Recent data shows a significant enhancement in the management of third-party challenges, with average scores rising from 5.25 in 2023 to 5.92 in 2024, indicating a growing confidence in handling these relationships. Moreover, industry perspectives from specialists such as Michael Thor, Managing Director at Protiviti, highlight the significance of a proactive strategy toward these challenges, declaring, 'Effective oversight is crucial for long-term economic planning and sustainability.'

Furthermore, the Risk Review document was last revised on May 22, 2024, emphasizing the ongoing advancements in monetary management.

Step-by-Step Guide to Conducting a Financial Risk Assessment

Carrying out a comprehensive company financial risk assessment is essential for protecting your organization’s economic well-being. Follow these structured steps to effectively identify and manage monetary uncertainties:

- Identify Monetary Threats: Gather a diverse team to discuss possible monetary threats. Consider both internal factors, such as operational inefficiencies, and external influences like economic shifts, regulatory changes, and industry trends.

- Assess the impact of each identified threat on your organization’s company financial risk assessment and overall financial stability. Utilize a quantifiable scale to gauge the severity of each threat, allowing for clearer prioritization.

- Analyze the Likelihood: Determine the probability of each threat occurring by leveraging historical data, industry benchmarks, or expert judgment. This step is essential, as 92% of leaders in this area are closely monitoring cyber developments, underscoring the need for accurate company financial risk assessment methodologies.

- Prioritize Threats: Create a matrix that classifies threats based on their evaluated impact and probability. Concentrate on high-impact, high-likelihood threats first, as these present the greatest danger to your organization. As Michael Thor, Managing Director in the Internal Audit practice of Protiviti, emphasizes, understanding the challenges of company financial risk assessment is vital for effective management.

- Develop a company financial risk assessment: Formulate tailored strategies for mitigating, transferring, or accepting each identified threat. Assign specific responsibilities to team members for implementation, ensuring accountability and clarity in your approach.

- Monitor and Review: Establish a regular review process to continuously oversee threats through real-time analytics provided by your client dashboard. This continual alertness is essential, as 35% of compliance executives recognize regulatory challenges as their main worry, emphasizing the need for flexible mitigation practices. Organizations are increasingly prioritizing compliance and regulatory oversight, as shown in a recent case study. Moreover, it is crucial to revise and modify your strategies according to insights derived from these analytics, ensuring that your management approach stays pertinent and efficient.

Also, think about employing contemporary tools like Secureframe's GRC solution, which enables entities to oversee hazards continuously, monitor challenges in a single platform, and designate owners with notification reminders. By systematically adhering to these steps and utilizing efficient decision-making methods, including a reduced decision-making cycle, your entity will be better equipped to conduct a company financial risk assessment effectively, sustaining a strong economic stance in an increasingly intricate environment.

Developing Effective Financial Risk Management Strategies

To navigate the complexities of financial uncertainties effectively, CFOs should implement the following robust strategies, keeping in mind the importance of thorough financial assessments for cash preservation and liability reduction:

- Diversification: By spreading investments across a variety of asset classes and sectors, organizations can significantly reduce exposure to individual threats. Recent statistics indicate that diversified portfolios tend to outperform non-diversified ones, particularly in volatile markets where 2024 has shown an increased emphasis on diversification effectiveness. Furthermore, with merely 23% of C-Suites consisting of women, promoting diversity in decision-making can result in more thorough evaluations.

- Insurance: Utilizing insurance products is crucial for transferring specific uncertainties, such as liability and property damage, to external parties. Current data highlights that insurance utilization in risk management is on the rise, reinforcing its critical role in safeguarding organizational assets and supporting cash preservation efforts.

- Hedging: Utilizing instruments, such as options and futures, enables companies to hedge against market volatility, ensuring that profits remain protected amid economic fluctuations. Recent trends suggest that companies are increasingly utilizing these techniques to stabilize their economic status. Moreover, liquid alternative strategies are poised to gain from market fluctuations and an elevated interest rate environment, rendering them a significant consideration for CFOs centered on mitigation.

- Cash Flow Management: Robust cash flow forecasting is vital for maintaining liquidity and preventing cash shortages during economic downturns. Effective cash handling strategies can assist entities in conserving cash, enduring financial challenges, and ensuring operational stability.

- Regular Training: Ongoing training for staff on hazard awareness and control practices promotes a culture of proactive hazard oversight within the entity. This commitment to education can enhance overall employee engagement, as organizations that prioritize inclusivity and education see a significant boost in engagement—millennials are 83% more likely to be engaged at work in inclusive environments, as noted by Deloitte. The case study titled 'Benefits of Equal Access to Education' illustrates how promoting diversity and inclusion can lead to better organizational outcomes, reinforcing the importance of this strategy in uncovering value and reducing costs.

- Engagement with Stakeholders: Maintaining open communication with stakeholders ensures alignment on priority areas and strategies. This engagement is essential for establishing trust and promoting collaborative decision-making processes.

By adopting these strategies and considering a comprehensive company financial risk assessment service, CFOs can enhance their evaluations, focusing on cash preservation and efficiency. This proactive strategy for managing uncertainties will improve their entities' ability to handle economic challenges, ultimately resulting in improved performance and resilience. For optimal results, we encourage CFOs to engage with our company financial risk assessment service to identify opportunities for cash preservation and liability reduction.

Tools and Techniques for Financial Risk Analysis

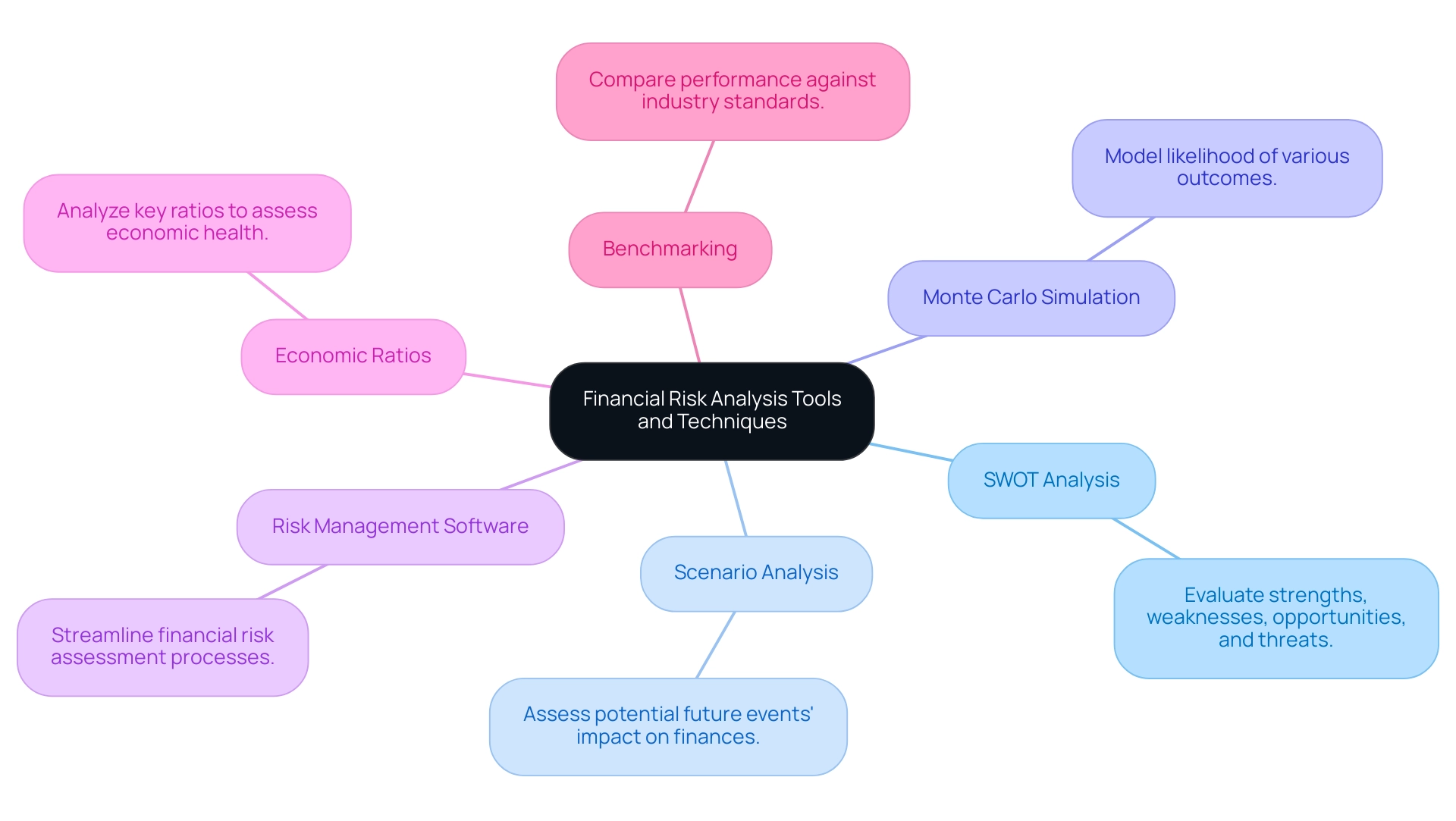

To effectively improve your monetary uncertainty assessment, consider the following tools and techniques:

- SWOT Analysis: This method allows you to comprehensively evaluate your organization’s strengths, weaknesses, opportunities, and threats, thus recognizing possible monetary challenges. The effectiveness of SWOT analysis in risk management is underscored by recent statistics, indicating its pivotal role in strategic planning for 2024.

- Scenario Analysis: Engage in scenario planning to evaluate how various potential future events might affect your monetary position. Expert opinions indicate that scenario analysis is essential for adapting to the volatile economic landscape, enabling more resilient forecasting.

- Monte Carlo Simulation: This sophisticated statistical method assists in modeling the likelihood of various outcomes, offering insights into the range of possible uncertainties and benefits in economic forecasting. Its use has gained traction among analysts seeking to refine their predictive capabilities.

- Risk Management Software: Leverage cutting-edge software solutions such as RiskWatch or LogicManager. These tools not only streamline the company financial risk assessment process but also facilitate comprehensive documentation and monitoring, which are essential in today’s dynamic environment.

- Economic Ratios: Conduct a thorough analysis of key economic ratios, such as debt-to-equity and current ratios, to assess overall economic health. This analysis can help identify areas of concern and guide mitigation strategies.

- Benchmarking: Compare your company’s financial performance against industry standards. Benchmarking is an effective way to identify potential threats and areas for enhancement, ensuring that your organization stays competitive and resilient.

In light of recent reports indicating that 52% of cybersecurity professionals have faced an increase in cyberattacks compared to last year, as highlighted by BusinessWire, it is crucial for CFOs to remain vigilant and proactive in their management strategies. Furthermore, the PwC Pulse Survey reveals that 92% of leaders monitor cyber developments closely, underscoring the importance of staying informed about the evolving threat landscape. Using these tools will enable you to effectively manage the intricacies of economic uncertainty, especially in relation to company financial risk assessment amid rising cyber threats.

The Role of Compliance in Financial Risk Assessments

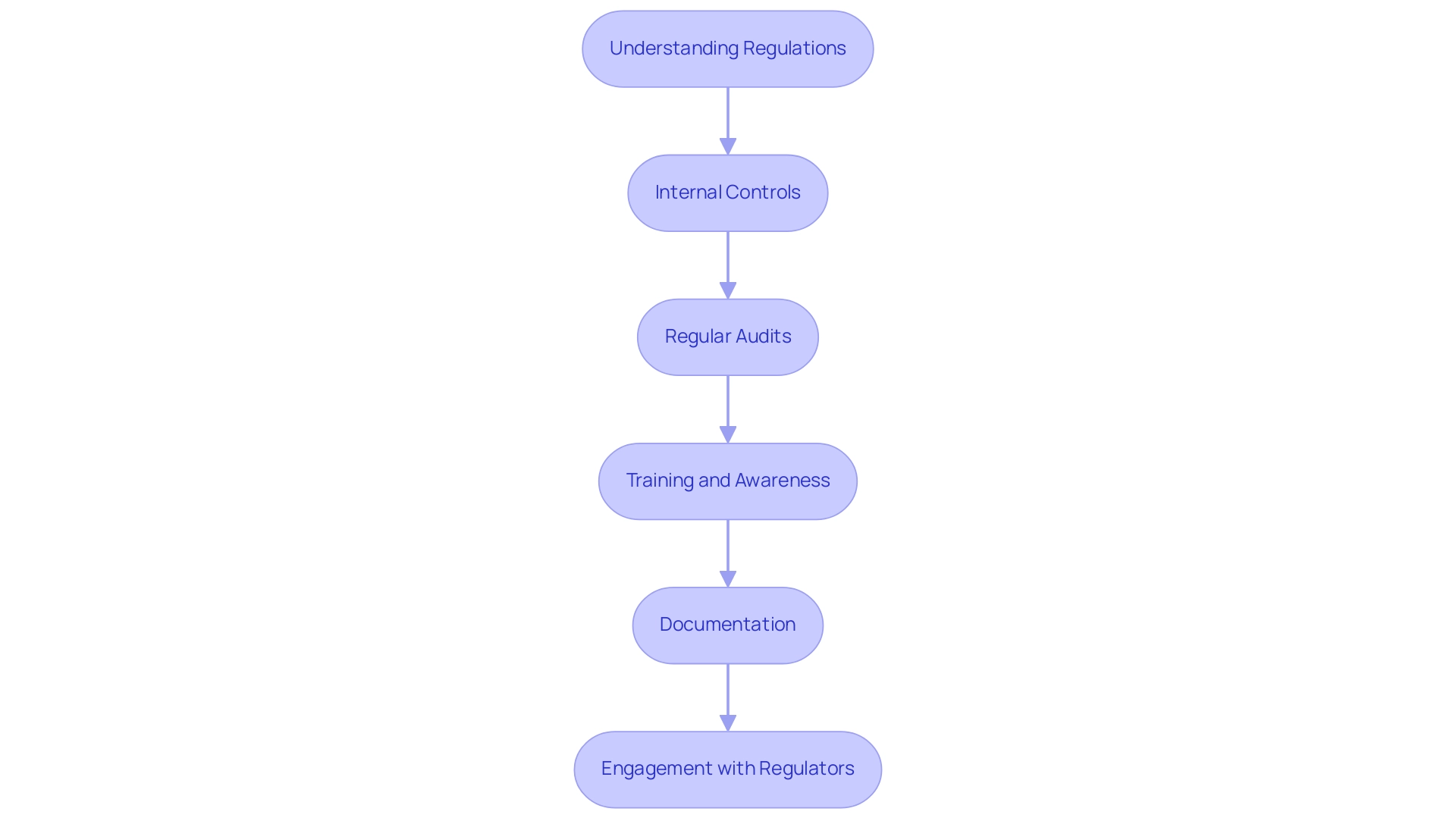

Regulatory compliance is paramount in the realm of risk assessments, particularly as the landscape evolves with digitization and new technologies. Here are essential strategies to ensure effective compliance management:

-

Understanding Regulations: It is crucial to stay abreast of pivotal regulations such as Sarbanes-Oxley, Dodd-Frank, and GDPR that affect your industry.

With 35% of business and tech executives recognizing third-party breaches as a major concern, understanding these regulations is more important than ever. Key economic regulations that CFOs should be aware of include the Basel III framework and the Volcker Rule, which directly impact institutions.

-

Internal Controls: Implementing robust internal controls is vital for meeting compliance with both financial reporting and operational standards.

These measures safeguard against potential breaches and enhance organizational resilience, especially in a rapidly changing digital environment.

-

Regular Audits: Conducting systematic compliance audits allows organizations to pinpoint vulnerabilities and identify areas that require bolstering.

Regular assessments help maintain a proactive stance in compliance management, which is increasingly necessary as the regulatory landscape shifts.

-

Training and Awareness: Equipping employees with knowledge about compliance requirements fosters a culture of accountability.

Training sessions highlight the importance of adhering to standards and the consequences of non-compliance, ensuring that all staff understand their role in maintaining compliance.

-

Documentation: Maintaining thorough records of compliance initiatives and evaluations is essential for demonstrating accountability and transparency.

This documentation serves as a vital resource in addressing regulatory inquiries and showcases the organization’s commitment to compliance.

-

Engagement with Regulators: Building and nurturing relationships with regulatory bodies is crucial for staying informed about compliance changes and best practices.

This engagement not only enhances understanding but also fosters a collaborative approach to compliance management, as highlighted by the proactive stance of 61% of corporate risk and compliance professionals prioritizing updates on regulatory changes.

As the 2024 landscape of financial compliance regulations continues to evolve, the integration of compliance into company financial risk assessments is not just advisable; it is essential for maintaining stakeholder trust.

As PwC's survey reveals, 76% of consumers would cease supporting companies that fail to uphold responsible practices, emphasizing the critical nature of compliance in today’s corporate environment.

Conclusion

Understanding and managing financial risk is essential for organizations aiming for sustainable growth in an unpredictable environment. This article has outlined the key types of financial risks, including:

- Market risks

- Credit risks

- Operational risks

- Liquidity risks

- Reputational risks

Providing CFOs with a foundational knowledge to navigate these challenges. Effective risk assessments are crucial, and the structured approach detailed herein empowers organizations to identify, assess, prioritize, and manage risks systematically.

Implementing robust management strategies—such as:

- Diversification

- Insurance

- Financial hedging

- Effective cash flow management

Can significantly enhance an organization’s resilience against financial uncertainties. Additionally, the integration of advanced tools and compliance measures into risk management frameworks ensures that CFOs are well-equipped to address evolving threats, particularly in the face of increasing cyber risks and regulatory demands.

Ultimately, by embracing these insights and strategies, CFOs can strengthen their organizations' financial health and operational stability. The proactive management of financial risks not only safeguards against potential losses but also positions organizations to seize growth opportunities amidst volatility. Now is the time for CFOs to take decisive action, leveraging comprehensive risk assessments and management strategies to secure a prosperous future for their organizations.

Frequently Asked Questions

What is financial uncertainty?

Financial uncertainty refers to the potential for monetary loss associated with investments or business operations, making financial risk assessment crucial for effective management.

What are the primary categories of financial uncertainty that CFOs should know?

The primary categories include: 1. Market Threat: Losses from fluctuations in market prices. 2. Credit Risk: The likelihood of borrower default affecting cash flow. 3. Operational Risk: Failures in internal processes or external events disrupting operations. 4. Liquidity Concern: Inability to fulfill monetary obligations as they arise. 5. Reputational Threat: Losses from adverse public perception affecting relationships.

Why is understanding these categories important for organizations?

Understanding these categories helps organizations navigate financial risks and develop strong oversight strategies to protect their economic well-being.

What recent data indicates about the management of third-party challenges?

Recent data shows an improvement in managing third-party challenges, with average scores rising from 5.25 in 2023 to 5.92 in 2024, indicating increased confidence in handling these relationships.

What steps should organizations follow for a comprehensive financial risk assessment?

Organizations should: 1. Identify Monetary Threats: Discuss potential threats with a diverse team. 2. Assess Impact: Evaluate the severity of each threat. 3. Analyze Likelihood: Determine the probability of each threat using historical data. 4. Prioritize Threats: Classify threats based on impact and likelihood. 5. Develop a Risk Assessment: Create strategies for mitigating or accepting threats. 6. Monitor and Review: Establish a regular review process for ongoing oversight.

What tools can assist in the financial risk assessment process?

Tools like Secureframe's GRC solution can help organizations continuously oversee hazards, monitor challenges on a single platform, and assign responsibilities with notifications.

How can organizations ensure their financial risk management strategies remain effective?

Organizations should regularly revise and modify their strategies based on insights from real-time analytics, ensuring their management approach stays relevant and efficient.