Overview

To conduct a comprehensive business efficiency evaluation, organizations should systematically assess their current operational practices, evaluate key performance indicators (KPIs), analyze workflow efficiency, and continuously monitor financial health and improvement strategies. The article underscores the importance of utilizing real-time analytics and collaborative planning to identify inefficiencies and optimize resource allocation, which is essential for enhancing financial stability and fostering growth in a competitive economic landscape.

Introduction

In an increasingly competitive landscape, the pursuit of business efficiency has emerged as a cornerstone for achieving financial stability and fostering growth. As organizations navigate the complexities of today's economic challenges, including declining GDP and energy supply risks, the imperative to optimize resource utilization becomes clear.

Chief Financial Officers play a crucial role in this evaluation process, identifying inefficiencies and implementing strategies that enhance cash flow and streamline costs. By harnessing the power of AI and machine learning, businesses can revolutionize their operations, unlocking new levels of productivity and securing a competitive edge.

This article delves into the systematic approach needed to assess and improve operational efficiency, offering insights that can lead to transformative results and substantial financial benefits.

Understanding Business Efficiency: The Key to Financial Stability

Business efficiency evaluation embodies the optimal utilization of resources to achieve desired outcomes while minimizing waste and expenses. For Chief Financial Officers, a business efficiency evaluation is paramount in sustaining financial stability and fostering growth. A meticulous business efficiency evaluation enables organizations to identify inefficiencies, streamline costs, and enhance cash flow—factors crucial in today's fluctuating economic environment.

As the Eurozone grapples with a decline in GDP, which fell by 0.5% in Q3 2023, and persistent risks from energy supply shocks, the significance of efficiency becomes even more pronounced. By leveraging AI and machine learning technologies, organizations can revolutionize operations through real-time analytics and streamlined decision-making, securing a competitive edge and strategically positioning themselves for long-term success. For instance, a global agriculture company released $1.5 billion in cash from its balance sheet by optimizing working capital management, enabling further investments and returns to shareholders.

This showcases the tangible benefits of resource allocation in improving financial outcomes. Furthermore, successful companies are reimagining their approaches to talent management and innovation, focusing on maximizing returns on talent investments and linking innovation to growth strategies. This guide, 'Revolutionizing Operations With AI & Machine Learning - An Operators Guide,' presents a systematic approach to conducting a comprehensive business efficiency evaluation, emphasizing key steps that can catalyze substantial operational improvements.

In the words of economist Joseph Schumpeter,

The fundamental impulse that keeps the capital engine in motion comes from the new consumers’ goods, the new methods of production and transportation, the new markets… [The process] incessantly revolutionizes from within, incessantly destroying the old one, incessantly creating a new one.

Embracing this mindset, along with the strategic application of AI and machine learning, can lead to transformative results in operational practices. To learn more about how to implement these strategies and enhance your efficiency, consider our comprehensive guide available for just $399.

Click the button below to secure your copy now!

Step 1: Assessing Current Operational Practices

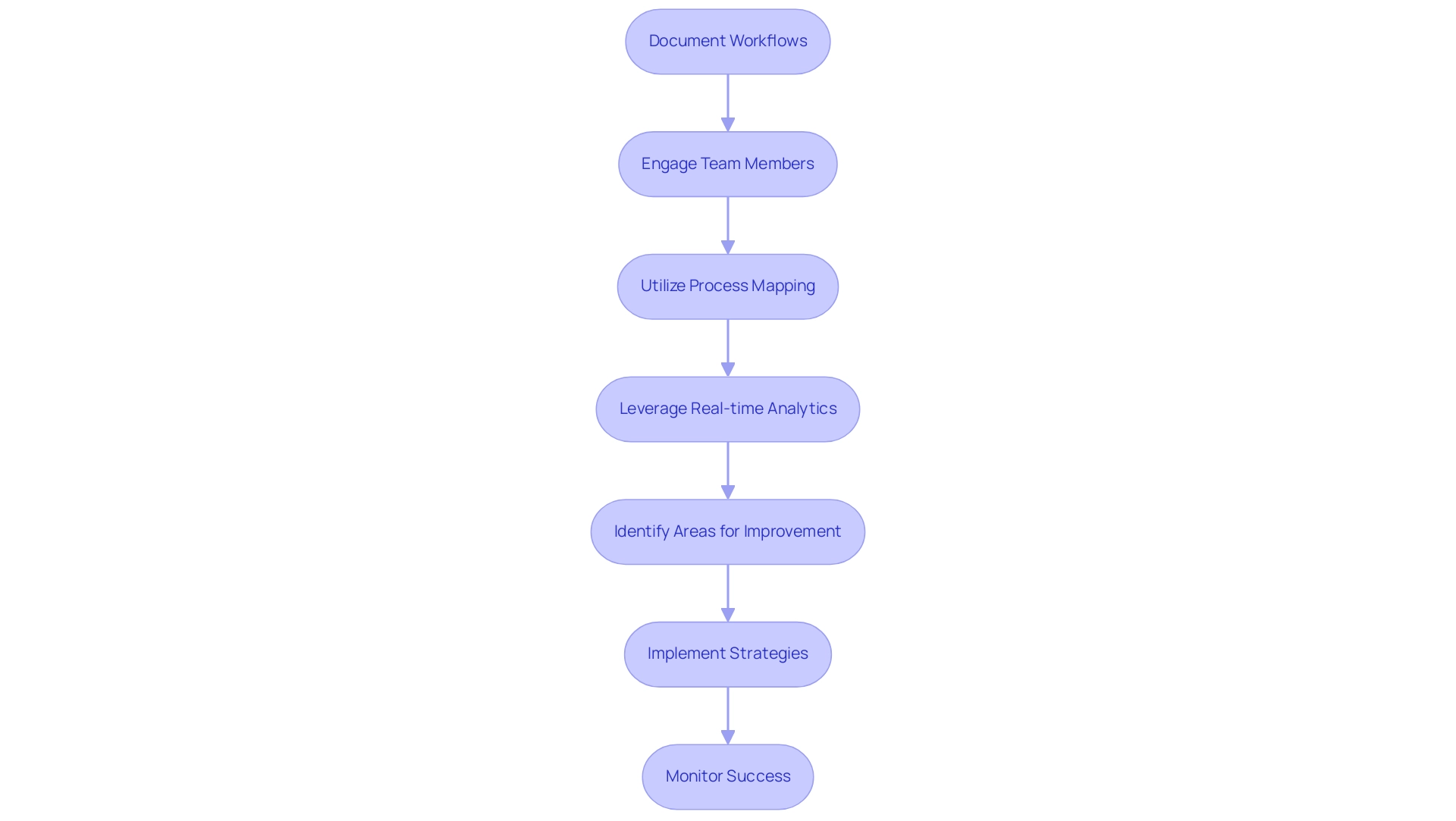

A comprehensive business efficiency evaluation of existing operational practices is crucial for any entity seeking to improve overall efficiency and maintain corporate well-being. This process begins with meticulously documenting workflows, employee roles, and resource allocation, while also engaging team members from various departments to collaboratively identify underlying business issues. Utilizing tools like process mapping not only visualizes workflows but also identifies redundancies and bottlenecks that hinder productivity.

As organizations prepare for 2024, leveraging real-time analytics and customer feedback becomes crucial, revealing critical opportunities for improvement. Significantly, the increase of Battery Electric Commercial Vehicles (BEVs), anticipated to reach between 15% and 34% sales penetration by 2030, illustrates a trend in efficiency that CFOs should contemplate in their strategic planning. Furthermore, as shown by ERB, which forgave over $1 million in testing fees through their fee waiver program in the 2022-23 school year, financial decisions can significantly influence management practices.

By gaining a comprehensive understanding of existing operations and continuously monitoring success through real-time business analytics, companies can perform a business efficiency evaluation to pinpoint specific areas requiring enhancement. This proactive approach aligns with the growing trend towards Asset Performance Management (APM) solutions, recognized for their ability to boost safety and productivity across sectors. Moreover, the use of low-code platforms in supply chain management demonstrates how technology can simplify processes, allowing organizations to adapt swiftly to market changes and improve agility.

Organizations must also implement a systematic approach to test hypotheses related to their operational practices, ensuring maximum return on invested capital in both the short and long term. By determining and implementing strategies based on real-time information, and consistently revising and modifying their methods, companies can uphold a strong health evaluation and monitoring framework.

Step 2: Evaluating Key Performance Indicators (KPIs)

To effectively gauge your organization’s performance and drive strategic improvement, it is crucial to identify and evaluate key performance indicators (KPIs) aligned with your organizational objectives. Common KPIs to consider include:

- Operational costs

- Revenue per employee

- Customer satisfaction scores

- Inventory turnover rates

Notably, the employee net promoter score (eNPS) of 45, calculated from 100 employees, offers valuable insight into employee satisfaction, a relevant KPI for assessing overall organizational health.

Furthermore, the churn rate—a critical KPI measuring customer retention—can significantly influence revenue streams; for instance, if a business loses 20 customers out of 500 in a month, it equates to a churn rate of 4%, underscoring the importance of monitoring customer satisfaction in relation to industry benchmarks.

Analyzing historical data allows for the identification of trends and performance benchmarking against industry standards. For 2024, average KPIs for operational costs and revenue per employee will provide a relevant framework for comparison. Additionally, understanding Interest Coverage—quantifying a company’s ability to meet contractual interest payments on debt—offers further insight into financial health, calculated as EBIT divided by interest expense.

This business efficiency evaluation process is essential to determine if your entity meets its efficiency targets. Should certain KPIs be underperforming, it is vital to investigate underlying causes collaboratively and develop targeted strategies for improvement, echoing our team's approach of identifying issues and planning solutions together.

Aligning KPIs with strategic objectives not only helps maintain focus on financial goals but also promotes sustainable growth. As Nick Perry from SaaS Capital® notes, 'SaaS Capital® pioneered alternative lending to SaaS,' emphasizing the innovative solutions available for companies seeking to improve their results through KPI analysis. By utilizing these insights and the principles of ongoing evaluation, including real-time analytics, CFOs can implement turnaround lessons, promote significant change, and enhance their business efficiency evaluation within their enterprises.

This approach ensures that decision-making is informed by data, allowing for the testing of hypotheses and maximizing returns on investment.

Step 3: Analyzing Workflow and Process Efficiency

A comprehensive business efficiency evaluation of workflows is essential for identifying bottlenecks, redundancies, and resource wastage. As of 2024, nearly 47.9% of firms are automating the tracking and updating of work statuses to bolster task management and ensure deadlines are met. This trend reflects a significant shift towards leveraging technology to enhance process efficiency, essential for streamlined decision-making and real-time analytics that facilitate business turnaround and performance monitoring.

Furthermore, 64% of respondents from enterprise entities are planning to develop and integrate technologies aimed at enhancing employee experience, closely tied to workflow analysis and automation efforts. Employing methodologies such as Lean or Six Sigma allows organizations to systematically evaluate and refine their processes while operationalizing lessons learned from turnaround efforts. Engaging employees in discussions about their workflows can yield valuable insights that may not be immediately obvious, fostering a culture of continuous improvement.

Additionally, with 45% of individuals planning to use AI for responding to messages and emails, automation is becoming a key component of operational strategies. According to the case study titled 'AI's Ability to Handle Complex Tasks in Development Workflow,' developers have mixed opinions on AI's performance, indicating both potential and challenges in its integration. Significantly, 95% of IT professionals indicated heightened productivity after the introduction of process automation, highlighting the strategic improvement opportunities available.

By optimizing workflows through these strategies and rigorously testing hypotheses to measure their impact, organizations can substantially enhance productivity, lower operational costs, and improve overall efficiency, which is essential for effective business efficiency evaluation, ultimately contributing positively to the bottom line. Collaborative planning processes will further ensure that weaknesses are effectively addressed, maximizing returns on investment.

Step 4: Assessing Financial Health and Cost Management

To accurately evaluate your entity’s financial health, begin by meticulously reviewing financial statements, cash flow reports, and budgets. Our approach goes further by identifying underlying issues and collaborating closely with your team to create a comprehensive plan to mitigate weaknesses, enabling your organization to reinvest in key strengths. This foundational analysis will help pinpoint areas for cost reductions without sacrificing quality or service.

Strategies such as:

- Renegotiating supplier contracts

- Minimizing overhead expenses

- Optimizing inventory management

can significantly enhance cash flow. Additionally, we emphasize the importance of testing every hypothesis to deliver maximum return on invested capital, both in the short and long term. By adopting budgeting practices that prioritize flexibility, your organization can respond effectively to fluctuating market conditions.

In a landscape where 20% of small enterprises fail within the first year, proactive business efficiency evaluations are essential for maintaining financial health. Family-owned small enterprises, which represent one in three small establishments in the U.S., can particularly benefit from business efficiency evaluation to ensure their longevity and stability. As Luisa Zhou, a former engineer for the Space Station, emphasized, effective management practices are crucial for navigating challenges.

With 257 entrepreneurs currently addressing similar challenges in 2024, the need for effective financial health evaluations and cost management strategies has never been more critical.

Step 5: Implementing Continuous Monitoring and Improvement

Establishing a strong structure for ongoing evaluation of efficiency and financial results is vital for contemporary organizations. Our team will identify underlying organizational issues and collaboratively create a plan that mitigates weaknesses while allowing the entity to reinvest in key strengths. We employ a 'Test & Measure' approach, rigorously testing every hypothesis to ensure maximum returns on investment.

Regularly reviewing key performance indicators (KPIs) and operational practices ensures improvements are not only achieved but also sustained over time. Moreover, we support a shortened decision-making cycle throughout the turnaround process, enabling decisive actions that preserve your business. Recent insights reveal that companies implementing regular feedback mechanisms enjoy a remarkable 40% increase in employee engagement rates, underscoring the importance of fostering a culture of feedback and innovation.

Grace Smith notes that

Perhaps more telling, organizations that employ data-driven strategies demonstrate 23% higher profitability.

This exemplifies the financial advantages of adopting a proactive assessment approach. Our client dashboard provides real-time business analytics, allowing for ongoing monitoring of success and the continual diagnosis of business health.

Additionally, a survey conducted in February 2024 involving Secureframe users found that 50% of respondents reduced costs associated with compliance programs, further demonstrating the financial advantages of continuous monitoring. With the rise of remote work reshaping evaluation review systems—80% of employees now favor ongoing feedback over traditional annual assessments—companies must adapt their strategies accordingly. This trend emphasizes the need for continuous monitoring to ensure performance evaluations remain relevant and effective.

By prioritizing continuous improvement and fostering an environment where employees feel empowered to propose new ideas, organizations can remain agile, competitive, and well-positioned for sustainable growth in 2024 and beyond.

Conclusion

The journey toward enhanced business efficiency is not merely a trend but a critical necessity for organizations aiming to thrive in today's volatile economic landscape. By systematically assessing current operational practices, evaluating key performance indicators, analyzing workflows, and maintaining a keen focus on financial health, businesses can uncover inefficiencies and strategically position themselves for growth. The integration of AI and machine learning further empowers organizations to make data-driven decisions, streamline operations, and ultimately improve their bottom line.

Continuous monitoring and improvement are paramount in ensuring that the gains achieved are sustained over time. As organizations adopt a culture of feedback and innovation, they not only bolster employee engagement but also enhance overall profitability. The insights gleaned from real-time analytics and ongoing assessments enable businesses to adapt swiftly to market changes, ensuring they remain competitive and responsive to consumer demands.

As the economic climate continues to evolve, the commitment to operational efficiency will be the defining factor that separates successful organizations from those that falter. Embracing these strategies is essential for any business looking to secure its future, optimize resource utilization, and unlock new avenues for growth. The time to act is now; the path to transformative results lies in the hands of those willing to invest in their operational capabilities and foster a culture of continuous improvement.

Frequently Asked Questions

What is a business efficiency evaluation?

A business efficiency evaluation involves the optimal utilization of resources to achieve desired outcomes while minimizing waste and expenses. It helps organizations identify inefficiencies, streamline costs, and enhance cash flow.

Why is business efficiency evaluation important for Chief Financial Officers (CFOs)?

For CFOs, a business efficiency evaluation is crucial for sustaining financial stability and fostering growth, especially in a fluctuating economic environment.

How can AI and machine learning technologies assist in business efficiency evaluations?

AI and machine learning can revolutionize operations by providing real-time analytics and streamlining decision-making, helping organizations secure a competitive edge and position themselves for long-term success.

Can you provide an example of the benefits of resource allocation in business efficiency?

A global agriculture company optimized its working capital management, releasing $1.5 billion in cash from its balance sheet, which allowed for further investments and returns to shareholders.

What are some key steps in conducting a comprehensive business efficiency evaluation?

Key steps include documenting workflows, employee roles, and resource allocation, engaging team members from various departments, and utilizing tools like process mapping to identify redundancies and bottlenecks.

What role does real-time analytics and customer feedback play in business efficiency?

Real-time analytics and customer feedback reveal critical opportunities for improvement, allowing organizations to adapt and enhance their operational practices.

How does the trend of Battery Electric Commercial Vehicles (BEVs) relate to business efficiency?

The anticipated increase in BEVs sales penetration illustrates a trend in efficiency that CFOs should consider in their strategic planning.

What is Asset Performance Management (APM) and its significance in business efficiency?

APM solutions boost safety and productivity across sectors and are recognized as a growing trend that can enhance operational efficiency.

How can low-code platforms benefit supply chain management?

Low-code platforms simplify processes, allowing organizations to adapt swiftly to market changes and improve agility in their operations.

What is the importance of continuously monitoring operational practices?

Continuously monitoring operations through real-time business analytics helps companies identify specific areas for enhancement and ensures maximum return on invested capital.