Overview

The article provides a comprehensive step-by-step guide for conducting a financial institution risk assessment, emphasizing the importance of understanding key concepts such as risk appetite, risk tolerance, and the risk management framework. It supports this by detailing a systematic approach that includes preparation, data gathering, risk assessment, and ongoing monitoring, illustrating how these steps enable organizations to effectively identify, analyze, and mitigate financial risks in a dynamic economic environment.

Introduction

In an increasingly complex financial landscape, the ability to effectively manage risk has become a cornerstone of success for financial institutions. With a myriad of potential threats—from credit and market risks to operational and liquidity challenges—organizations must adopt a comprehensive approach to risk management. This involves not only understanding fundamental concepts such as risk appetite and tolerance but also implementing systematic processes for:

- Identifying risks

- Analyzing risks

- Mitigating risks

As financial institutions grapple with outdated technology and evolving regulatory requirements, leveraging innovative strategies and advanced technologies is essential for safeguarding assets and enhancing decision-making. By exploring the intricacies of financial risk management, institutions can position themselves to thrive amidst uncertainty and secure a competitive advantage in a rapidly changing environment.

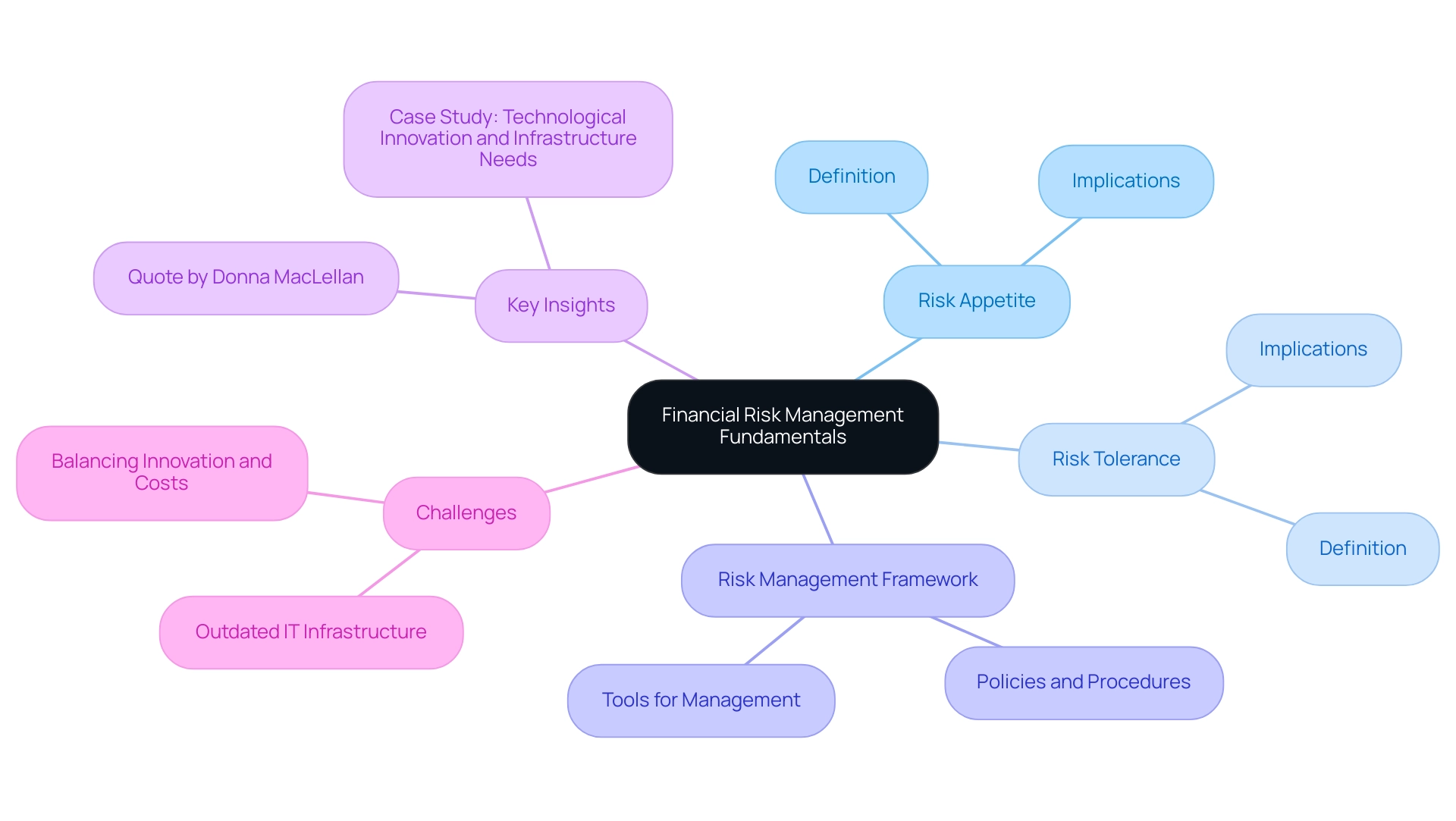

Understanding Financial Risk Management Fundamentals

Financial threat oversight includes a systematic method for recognizing, evaluating, and prioritizing dangers, succeeded by coordinated actions to reduce, observe, and regulate the probability of negative occurrences. Understanding the following key concepts is essential for financial institutions aiming to establish robust risk management strategies:

- Risk Appetite: This refers to the amount of risk an organization is prepared to accept in the pursuit of its objectives, reflecting its overall approach to risk-taking.

- Risk Tolerance: Conversely, this concept signifies the specific level of uncertainty that an organization can withstand without compromising its operational integrity.

- Risk Management Framework: This structured approach incorporates policies, procedures, and tools designed to effectively manage uncertainties and ensure compliance with regulatory requirements.

The importance of these ideas in the context of financial institution risk assessment cannot be exaggerated, as they offer the basis for creating effective hazard control frameworks. As mentioned by Donna MacLellan, Lead Risk and Resilience Analyst at Continuity:

From identifying potential threats to implementing suitable management measures, our goal is to ensure clients can recover and thrive in the face of challenges.

In a landscape where outdated IT infrastructure presents ongoing challenges—ranked among the top risks for financial institution risk assessment in both 2024 and 2034—organizations must navigate the complexities of contemporary economic environments.

Recent statistics indicate that a significant percentage of organizations struggle with legacy systems, which hampers their ability to adopt new technologies and remain competitive.

The case study titled 'Technological Innovation and Infrastructure Needs' illustrates these challenges, showcasing how financial organizations face pressures to modernize technology while cutting costs. This situation creates a strategic challenge: balancing investment in innovation against rising operational expenses. By continuously evaluating appetite and tolerance, organizations can better position themselves to leverage economic assets and advanced technologies, ultimately enhancing their competitive edge.

Exploring Different Types of Financial Risks

Financial institutions navigate a complex environment of uncertainties that can significantly impact their financial institution risk assessment and operations. The primary categories of danger include:

- Credit Risk: This refers to the potential loss stemming from a borrower's inability to fulfill loan obligations. Recent reports indicate an alarming trend, as credit unions faced a dramatic rise in loan delinquencies across various segments in 2023. For instance, non-current loans reached $13.37 billion, marking the highest delinquency level since 2016. Significantly, delinquency rates for residential real estate and vehicle loans almost doubled during this period, emphasizing the need for strong credit management practices.

- Market Exposure: This includes the chance of monetary losses due to changes in market prices. Recent statistics indicate that banks are increasingly vulnerable to market fluctuations, highlighting the necessity for thorough market uncertainty evaluations to protect against unforeseen changes in the economic environment.

- Operational Hazard: These challenges emerge from failures in internal procedures, human mistakes, or system breakdowns. A major challenge for monetary organizations is the rise of third-party fraud, including identity theft and account takeovers, which increasingly evade conventional fraud detection systems. As monetary organizations adjust to mixed work settings, overseeing operational challenges is more crucial than ever. The importance of handling workforce expectations has significantly decreased in recent evaluations, which can worsen operational weaknesses.

- Liquidity Concern: This refers to the possibility that an organization will be unable to meet its short-term monetary obligations. With loan loss reserves slightly rising throughout the sector in 2023—commercial banks increasing reserves from 1.61% to 1.70% of gross loans and credit unions from 1.13% to 1.26%—the significance of efficient liquidity management cannot be emphasized enough.

Understanding these different categories of economic uncertainties allows organizations to effectively customize their financial institution risk assessment and strategies. As noted by Sara Seguin, Principal Advisor of Fraud & Identity Risk,

Banks are in an arms race to catch up to fraudsters' use of gen AI — but should they fight fire with fire?

This viewpoint highlights the pressing necessity for monetary organizations to stay alert and flexible in a continuously changing threat landscape.

Step-by-Step Process for Conducting a Financial Risk Assessment

Conducting a comprehensive financial risk assessment involves a systematic approach, which can be broken down into several critical steps:

- Preparation: Begin by defining the scope of the assessment clearly and gathering all relevant documentation, ensuring alignment with organizational objectives. This sets the stage for a streamlined decision-making process that is crucial during turnaround situations, allowing for a shortened decision-making cycle that facilitates quicker responses.

- Data Gathering: Employ both quantitative and qualitative approaches to collect information pertaining to economic performance and exposure. Recent methodologies highlight the significance of varied data sources to obtain a comprehensive perspective on threats. By integrating real-time analytics into this phase, organizations can continuously monitor their business health and make informed decisions quickly.

- Risk Assessment: Examine the gathered data to pinpoint possible threats and assess their potential influence on the institution's financial well-being. This step is vital, particularly since 61% of leaders in the industry recognize attracting and retaining talent as a top concern in 2034. Furthermore, the anticipated inability to utilize data analytics for market intelligence in 2034 highlights the urgency of this analysis. Implementing real-time analytics can enhance this analysis, allowing for quicker adjustments based on current data. Taking decisive action based on these insights is essential to preserve your business.

- Reporting: Document your findings in a comprehensive report that presents key challenges and recommended actions to stakeholders. Creating a strong reporting framework is crucial to keep leadership updated on any alterations in threat status. Continuous monitoring through a client dashboard enables organizations to adjust strategies in real-time, fostering relationship-building and operationalizing lessons learned from past turnarounds.

By adhering to these procedures, organizations can guarantee a comprehensive and efficient financial institution risk assessment. Furthermore, as emphasized by the PwC Pulse Survey, '33% of leaders in threat management intend to boost their expenditures on management initiatives, showcasing a proactive strategy to tackle emerging challenges.' This highlights the importance for monetary entities to remain alert in their evaluation processes, especially considering the rising cybersecurity dangers—demonstrated by the case study revealing that 52% of surveyed cybersecurity experts have encountered a rise in cyber attacks compared to the prior year.

Such real-world examples reinforce the importance of a robust evaluation framework, connecting the need for decisive action with the insights gained from analytics.

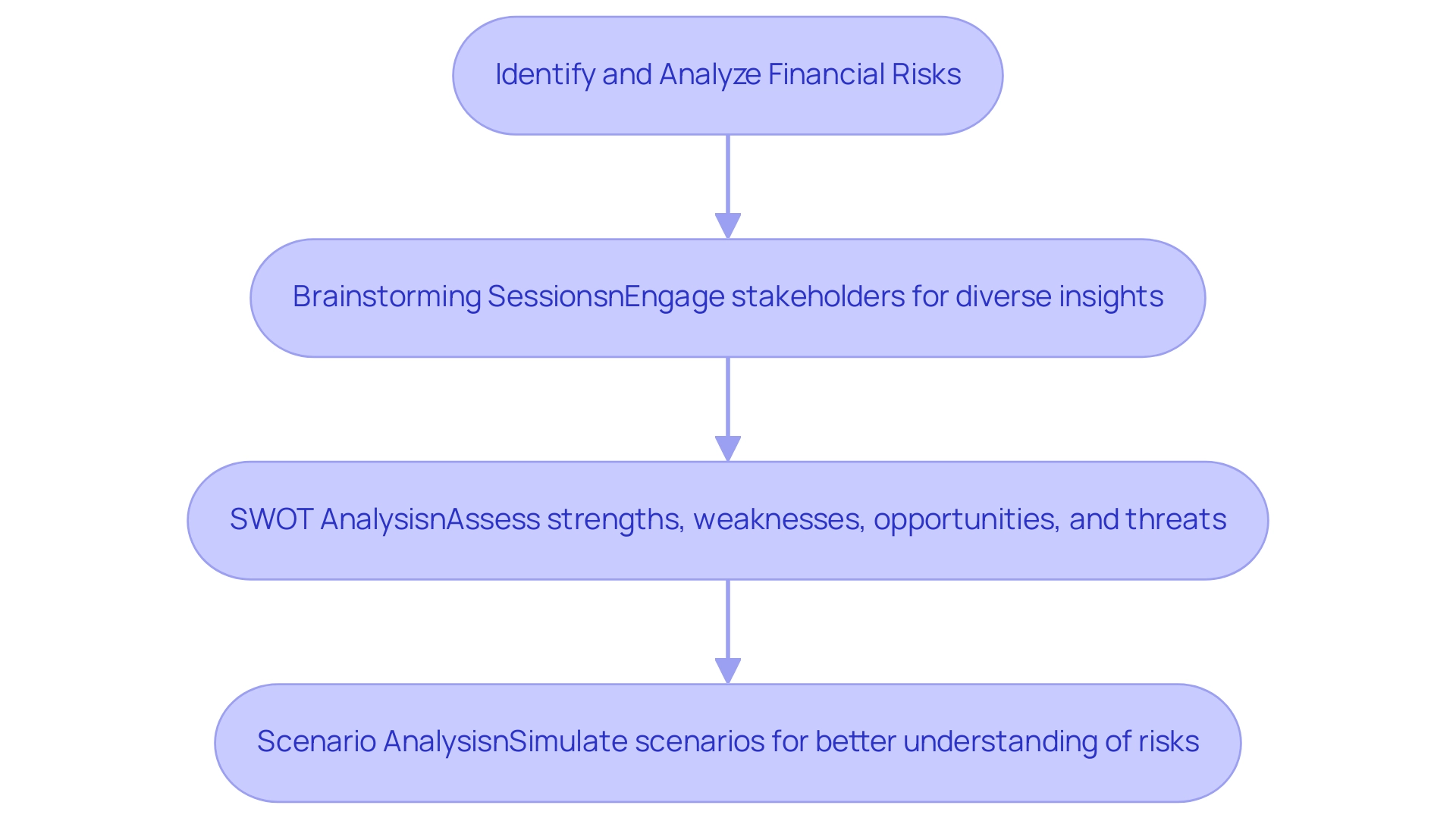

Identifying and Analyzing Financial Risks

To effectively identify and analyze financial uncertainties, financial institutions should adhere to the following guidelines:

- Brainstorming Sessions: Engage key stakeholders in collaborative discussions to draw upon their diverse experiences and insights. Research suggests that brainstorming can greatly improve cognitive flexibility, enabling teams to identify possible challenges more effectively. As noted by experts Ritter and Rietzschel,

When generating ideas in a group, individuals have to take turns in expressing their thoughts, which can lead to more comprehensive hazard identification. In fact, post-hoc paired-samples t-tests revealed that the technique of Random connections yielded a significantly lesser usefulness score within groups compared to individual performance, underscoring the importance of structured brainstorming approaches. Additionally, participants demonstrated significantly higher cognitive flexibility scores using the Evolution technique, which further supports the argument for collaborative brainstorming sessions. This collaborative method is crucial for revealing value and lowering expenses through a comprehensive monetary review. - SWOT Analysis: Conduct a SWOT analysis to systematically assess the organization's strengths, weaknesses, opportunities, and threats in relation to financial institution risk assessment. This technique has proven essential in identifying critical factors that can influence financial institution risk assessment in economic decision-making. Recent case studies, such as The Role of Brainstorming in Successful Risk Management, have demonstrated that organizations utilizing SWOT analysis in 2024 have improved their capability to navigate complex economic landscapes successfully. A comprehensive monetary assessment can help identify opportunities to preserve cash and reduce liabilities, aligning with strategic goals.

- Scenario Analysis: Leverage scenario analysis to assess how various factors could influence economic stability under different conditions. By simulating potential scenarios, organizations can better understand the implications of market changes, regulatory shifts, or economic downturns on their monetary well-being. This proactive method enables the creation of strong strategies to reduce identified threats and facilitates decisive action in business recovery scenarios.

By utilizing these techniques, which are essential to our monetary evaluation services, organizations can develop a thorough financial institution risk assessment that informs strategic decision-making and promotes resilience in a constantly changing economic landscape. A thorough assessment of finances can help identify opportunities to preserve cash and reduce liabilities, ultimately enhancing operations and stabilizing monetary positions.

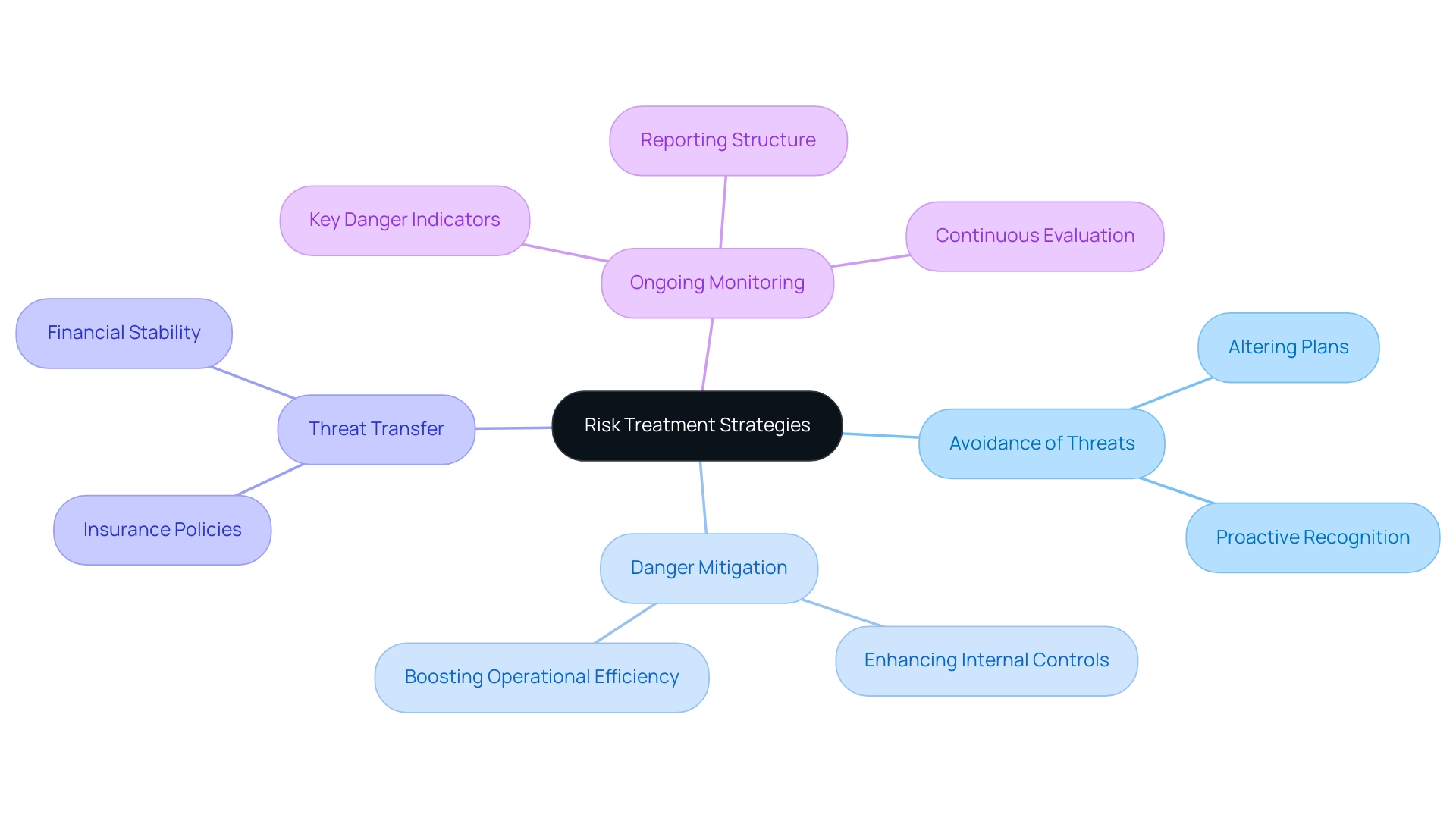

Risk Treatment and Ongoing Monitoring Strategies

Once dangers have been identified and analyzed, monetary entities should implement a series of treatment strategies designed to effectively manage these threats:

- Avoidance of Threats: This strategy involves altering plans or processes to eliminate exposure to potential dangers. By proactively recognizing activities that may pose danger, organizations can significantly decrease their susceptibility through effective financial institution risk assessment.

- Danger Mitigation: Organizations can implement measures aimed at minimizing the potential impact of threats. For example, enhancing internal controls not only boosts operational efficiency but also reduces exposure to threats, creating a more secure economic environment.

- Threat Transfer: Monetary institutions may opt to transfer specific dangers to third parties, often via insurance policies. This method can ease financial pressures through a thorough financial institution risk assessment in the case of unfavorable results, ensuring stability and continuity.

- Ongoing Monitoring: Establishing key danger indicators (KDIs) is crucial for tracking threat levels over time. Frequent evaluations and revisions to the hazard control strategy are crucial for preserving its efficacy. According to insights from the Global State of Risk Oversight report, effective ongoing monitoring practices are crucial for financial institution risk assessment, enabling organizations to adapt to emerging challenges and reinforcing their management strategies.

Additionally, it is vital to implement a robust reporting structure that keeps management informed of changes in status, allowing for timely decision-making and adjustments to strategies as necessary.

Recent statistics indicate that a significant 61% of leaders view attracting and retaining talent as a top concern by 2034. This statistic highlights the need for continuous evaluation and adaptation of treatment strategies, as the financial institution risk assessment indicates that talent retention directly impacts organizational stability and performance. Furthermore, the 2023 Risk & Compliance Survey Report emphasizes that despite challenges, three out of five corporate compliance professionals express confidence in their ability to handle compliance challenges.

This emphasizes the significance of incorporating these strategies into a thorough financial institution risk assessment framework. Additionally, emerging trends indicate that 43% of professionals under pressure to boost revenue are looking to implement AI and ML technologies to counteract economic crime. This innovative approach not only exemplifies reduction of uncertainties but also enhances ongoing monitoring capabilities, demonstrating how technological advancements can be leveraged within treatment strategies.

By concentrating on efficient threat management approaches, institutions can both protect their operations and improve overall economic performance.

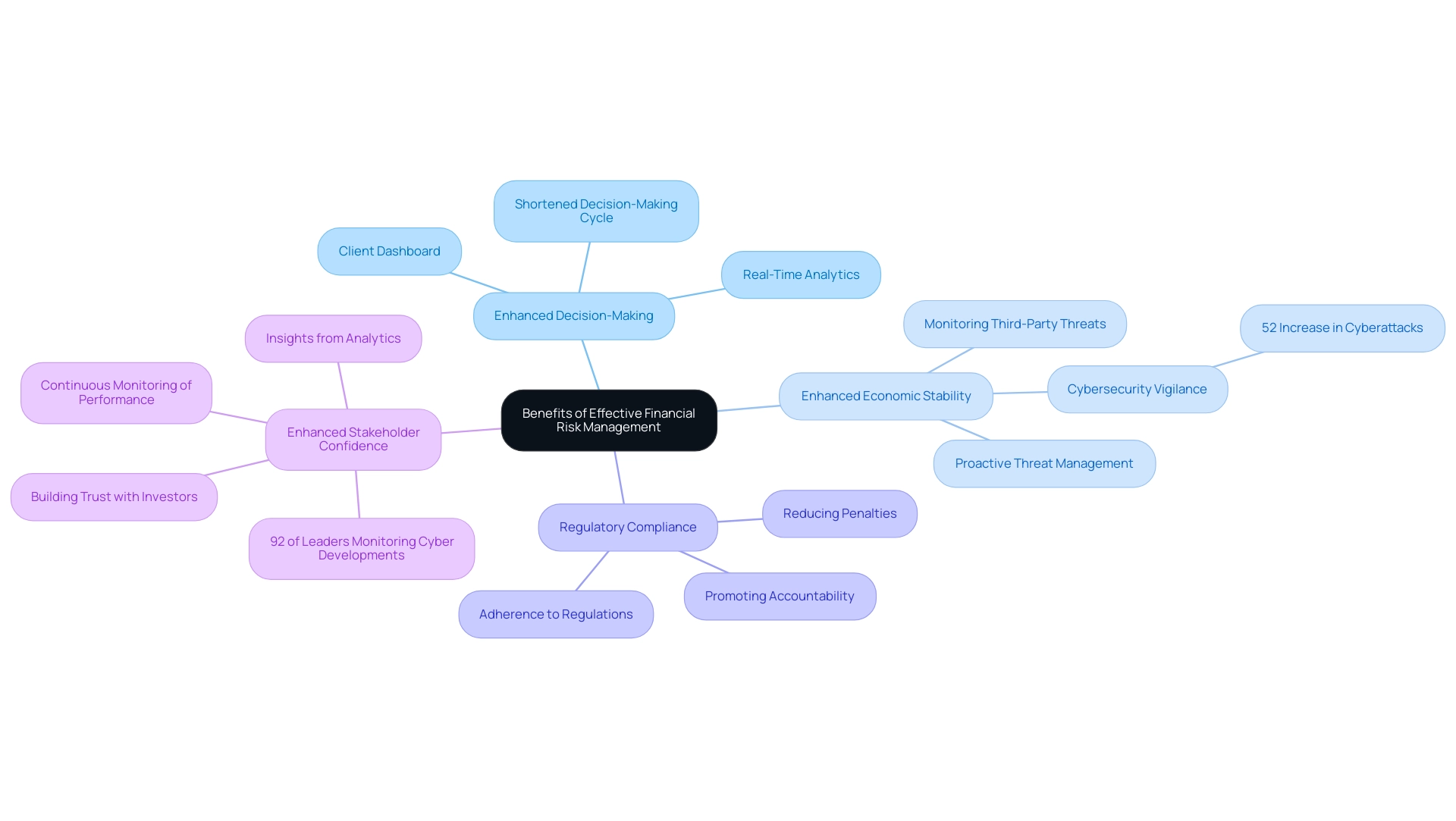

Benefits of Effective Financial Risk Management

Executing a thorough financial institution risk assessment approach produces a multitude of benefits that are essential in today’s dynamic economic environment. These benefits include:

- Enhanced Decision-Making: A well-structured risk management framework empowers organizations to make informed decisions grounded in a thorough understanding of potential risks. Our team supports a shortened decision-making cycle throughout the turnaround process, allowing your organization to take decisive action to preserve business health effectively. The use of our client dashboard enhances this process by providing real-time analytics that inform decision-making.

- Enhanced Economic Stability: Proactive threat management not only reduces dangers but also encourages better economic performance, ultimately resulting in increased stability. This is becoming increasingly essential as third-party threats have surged, now ranking fifth in the 2024 threat landscape, emphasizing the need for diligent monitoring of external entities to ensure they do not adversely affect the organization.

- Regulatory Compliance: Adhering to stringent regulations and standards for financial institution risk assessment is paramount. Efficient hazard oversight within financial institution risk assessment guarantees that organizations stay compliant, reducing the chance of penalties and promoting a culture of accountability.

- Enhanced Stakeholder Confidence: By showing a dedication to effective oversight practices, organizations can greatly boost trust among investors and clients. Continuous monitoring of business performance through real-time analytics, as seen via our client dashboard, facilitates relationship-building and operationalizes lessons learned from turnaround efforts. This confidence is further strengthened by the fact that 92% of leaders in the field, according to a recent PwC Pulse Survey, are closely observing developments in cybersecurity, emphasizing the essential nature of vigilance in oversight. The insights gained from these analytics directly support the 'Update & Adjust' theme, ensuring that organizations remain agile in their strategies.

A case study titled 'Importance of Comprehensive Risk Control' illustrates that organizations encounter various uncertainties, and effective financial institution risk assessment can significantly enhance their chances of success. As the environment of monetary threats keeps changing, especially with 52% of cybersecurity experts noting an increase in cyberattacks over the last year, the importance of a strong management strategy cannot be understated. Organizations that integrate these practices not only safeguard their assets but also position themselves for sustained success.

Leveraging Technology for Enhanced Risk Assessment

The incorporation of technology is essential for improving monetary evaluation processes in today's intricate economic environment. Key components include:

- Data Analytics: Advanced analytics tools enable monetary organizations to process extensive datasets, facilitating improved hazard identification. By utilizing advanced algorithms, organizations can reveal concealed patterns and possible weaknesses that conventional methods may miss.

- Hazard Control Software: The adoption of state-of-the-art hazard control software automates essential processes, enhancing vulnerability evaluation and reporting. This automation not only boosts efficiency but also reduces human mistakes, ensuring more precise assessments for financial institution risk assessment.

- Real-Time Monitoring: Technology allows for ongoing observation of economic dangers, giving organizations the capability to react swiftly to new challenges. This proactive approach is essential in an environment where 63% of accountants report reduced profitability as a significant concern, influenced by rising costs and high interest rates. Moreover, almost all (98%) concur that alternative routes to CPA licensure can equip future accountants as efficiently as or more efficiently than the conventional 150-hour path, emphasizing the changing environment of the accounting field and its importance to monetary assessment.

By adopting these technological innovations, institutions can greatly enhance their management abilities. The emergence of data-driven machine learning systems and rule-based methods within AI, for instance, demonstrates how foundational models are transforming assessment strategies. It is worth noting that 61% of organizations employ some level of security AI and automation, which correlates with lower data breach costs, reinforcing the importance of AI in reducing vulnerabilities.

However, it is crucial to recognize that while generative AI models offer powerful analytical tools, they have cognitive limits that necessitate careful consideration in economic contexts. As technology continues to evolve, its impact on financial institution risk assessment will remain profound, transforming how organizations identify, evaluate, and mitigate risks.

Conclusion

In the face of an increasingly complex financial landscape, effective risk management emerges as a vital component for the success of financial institutions. The article highlights the necessity of understanding fundamental concepts such as risk appetite and tolerance, which serve as the foundation for developing robust risk management frameworks. By systematically identifying, analyzing, and mitigating various types of risks—including credit, market, operational, and liquidity risks—organizations can better navigate the challenges posed by outdated technology and evolving regulatory requirements.

Moreover, the implementation of a structured risk assessment process is crucial for financial institutions striving for resilience. By engaging in collaborative brainstorming sessions, conducting SWOT analyses, and leveraging scenario analysis, organizations can create a comprehensive risk profile that informs strategic decision-making. These proactive measures not only enhance the understanding of potential threats but also facilitate timely and informed actions to safeguard financial health.

The benefits of effective financial risk management extend beyond mere compliance; they enhance decision-making, improve financial stability, and foster stakeholder confidence. As technology plays an increasingly pivotal role in risk assessment—through advanced analytics, risk management software, and real-time monitoring—financial institutions are empowered to respond swiftly to emerging threats and adapt their strategies accordingly.

Ultimately, a commitment to comprehensive risk management strategies is essential for organizations to thrive amidst uncertainty. By prioritizing innovation and leveraging technology, financial institutions can not only protect their assets but also secure a competitive advantage in a rapidly changing environment. The path forward is clear: embracing a proactive approach to financial risk management is not just beneficial; it is imperative for sustained success.

Frequently Asked Questions

What is financial threat oversight?

Financial threat oversight is a systematic method for recognizing, evaluating, and prioritizing risks, followed by coordinated actions to reduce, monitor, and regulate the likelihood of negative occurrences.

What is the difference between risk appetite and risk tolerance?

Risk appetite refers to the amount of risk an organization is willing to accept in pursuit of its objectives, while risk tolerance indicates the specific level of uncertainty that an organization can withstand without compromising its operational integrity.

What is a risk management framework?

A risk management framework is a structured approach that includes policies, procedures, and tools designed to effectively manage uncertainties and ensure compliance with regulatory requirements.

Why are risk appetite and tolerance important for financial institutions?

Understanding risk appetite and tolerance is crucial for financial institutions as they form the basis for creating effective hazard control frameworks, helping organizations to manage potential threats and recover from challenges.

What are the primary categories of danger that financial institutions face?

The primary categories of danger include credit risk, market exposure, operational hazard, and liquidity concern.

What is credit risk?

Credit risk is the potential loss that arises when a borrower fails to meet loan obligations. Recent reports indicate a rise in loan delinquencies among credit unions, emphasizing the need for strong credit management practices.

What does market exposure entail?

Market exposure refers to the risk of monetary losses due to changes in market prices, with banks increasingly vulnerable to market fluctuations.

What are operational hazards?

Operational hazards arise from failures in internal procedures, human mistakes, or system breakdowns, including challenges from third-party fraud such as identity theft and account takeovers.

What is liquidity concern?

Liquidity concern is the risk that an organization will be unable to meet its short-term monetary obligations, making efficient liquidity management critical.

How can understanding different categories of economic uncertainties help financial organizations?

By understanding these categories, organizations can effectively customize their financial institution risk assessment and strategies to better navigate the complexities of the economic environment.