Overview

To conduct a financial reporting risk assessment effectively, organizations must adhere to a structured process that encompasses:

- Identifying objectives

- Assessing threats

- Developing mitigation strategies

This systematic approach is not merely a recommendation; it is essential for enhancing reporting accuracy, ensuring compliance, and ultimately safeguarding economic stability within a complex business environment. By prioritizing this methodical framework, organizations can significantly bolster their financial reporting integrity and resilience.

Introduction

In the intricate world of finance, the accuracy and reliability of financial reporting serve as foundational pillars of organizational integrity. As businesses navigate an increasingly complex regulatory landscape, the significance of financial reporting risk assessments cannot be overstated. These assessments not only pinpoint potential pitfalls that could jeopardize financial statements but also establish a strategic framework for mitigating risks and ensuring compliance.

With a substantial shift anticipated in 2025, where a majority of executives foresee changes in business continuity planning, companies must adapt by embracing robust risk management strategies.

This article delves into the various dimensions of financial reporting risk assessment, exploring the types of risks organizations face, the methodologies for effective risk evaluation, and the best practices that can fortify financial integrity in an ever-evolving environment.

Understanding Financial Reporting Risk Assessment

The process of financial reporting risk assessment is vital as it entails recognizing and analyzing potential hazards that may result in inaccuracies in monetary statements. This evaluation is essential for guaranteeing that financial reports are not only trustworthy but also adhere to regulatory standards. Key factors in this assessment include:

- The integrity of monetary data

- The effectiveness of internal controls

- The potential for fraudulent activities

In 2025, the landscape of fiscal reporting is evolving, with 75% of executives anticipating significant changes in their companies' approaches to business continuity planning. This shift highlights the importance of a robust financial reporting risk assessment, as organizations must adapt to new challenges while maintaining their economic integrity. Moreover, a recent survey suggests that only 33% of leaders in management plan to increase their overall spending in the next year, while 57% intend to maintain their current budgets.

This trend emphasizes a focus on cost-effective investments, particularly in automation, to navigate an uncertain future and reduce reporting uncertainties.

The significance of a financial reporting risk assessment in evaluating reporting uncertainties cannot be overstated. It serves as a foundation for effective financial reporting risk assessment, enabling organizations to implement strategies that mitigate identified threats. A comprehensive monetary review can help identify opportunities to preserve cash and reduce liabilities, which is crucial for enhancing efficiency and uncovering value.

For instance, assigning owners of potential issues and establishing notification reminders can ensure regular reviews and accountability, fostering a proactive approach to managing uncertainties. These practical suggestions are essential for CFOs aiming to enhance their entities' resilience. Successful instances of financial reporting risk assessment demonstrate their effectiveness in strengthening institutional resilience.

Organizations that have prioritized financial reporting risk assessment have reported enhanced accuracy in their statements and greater compliance with regulatory requirements. As 35% of executives cite compliance and regulatory concerns as their primary issue, it is crucial to address these matters through a financial reporting risk assessment to sustain economic stability and protect reputations.

In summary, a comprehensive financial reporting risk assessment is vital for entities striving to succeed in today’s intricate economic landscape. By recognizing and addressing potential threats, companies can not only safeguard their economic stability but also prepare for sustainable development while efficiently managing cash and obligations. Transform Your Small/Medium Business offers a Financial Assessment service that can help organizations achieve these goals.

Types of Financial Risks in Reporting

Organizations face various monetary uncertainties in reporting, each with unique consequences for their operations and economic well-being:

- Market Uncertainty: This encompasses the potential for losses due to fluctuations in market prices. As we approach 2025, market uncertainty continues to be a pressing concern, with recent statistics revealing increasing volatility that necessitates robust management frameworks. Systemic danger, which refers to losses stemming from the failure of an entire economic system or market, further complicates this landscape, underscoring the need for thorough evaluation strategies. Leveraging real-time analytics can significantly enhance the ability to monitor market conditions and make informed decisions swiftly. Transform Your Small/ Medium Business provides customized solutions to effectively manage these challenges.

- Credit Concern: This arises when a borrower defaults on repayment obligations, potentially leading to losses for lenders. Efficient credit evaluation is crucial, as highlighted by numerous monetary statements that stress the importance of assessing a borrower's creditworthiness to mitigate possible defaults. Continuous monitoring through analytics can yield insights into borrower behavior, facilitating timely adjustments to credit strategies. Our company specializes in implementing advanced credit risk management methodologies to support businesses in this area.

- Operational Risk: This type of risk is linked to failures in internal processes, human error, or system malfunctions. Organizations must implement stringent controls and monitoring systems to minimize operational disruptions, which can significantly impact reporting accuracy. A case study on technological innovation and infrastructure needs illustrates how financial institutions confront challenges related to outdated IT systems, critical for maintaining competitiveness in a rapidly evolving market. By utilizing real-time business analytics, companies can diagnose operational health and respond proactively to emerging issues. Transform Your Small/ Medium Business offers extensive operational hazard management services to enhance resilience.

- Compliance Threat: Organizations face the risk of incurring legal penalties or regulatory sanctions due to non-compliance with applicable laws and regulations. With the evolving regulatory landscape, maintaining compliance has become increasingly complex, making it imperative for businesses to remain informed and proactive. As Rob Gutierrez, Senior Cybersecurity and Compliance Manager, noted, nearly three-fourths (75%) of executives believe significant changes are forthcoming in their organization’s approach to business continuity planning and crisis management. Real-time analytics can play a pivotal role in ensuring compliance by providing ongoing insights into regulatory requirements and organizational adherence. Transform Your Small/ Medium Business provides solutions to simplify compliance procedures and mitigate uncertainties.

Recognizing these monetary uncertainties is essential for conducting a financial reporting risk assessment to develop effective management strategies. As economic experts emphasize, a comprehensive approach to evaluating uncertainties, such as financial reporting risk assessment, not only safeguards assets but also enhances decision-making processes, ultimately contributing to sustainable development. Furthermore, monetary threat analytics support enterprises in evaluation and management, regulatory adherence, stress testing, portfolio optimization, credit threat evaluation, operational control, market analysis, and strategic decision-making, thereby operationalizing lessons learned during turnaround efforts.

Step-by-Step Process for Conducting a Risk Assessment

To effectively conduct a reporting risk assessment, follow these structured steps:

- Identify Objectives: Clearly define the financial reporting objectives that require safeguarding. This foundational step ensures that all subsequent actions align with the organization's goals.

- Identify Threats: Compile a comprehensive list of potential threats that could adversely affect these objectives. This includes both internal and external elements, such as compliance and regulatory challenges, which 35% of executives in charge cite as their primary concern.

- Assess Hazards: Evaluate the likelihood and potential impact of each identified threat. This evaluation must consider current economic conditions, as 58% of leaders in 2024 emphasize these as a notable concern.

- Prioritize Threats: Rank the identified dangers based on their potential impact on the financial reporting risk assessment. This prioritization is essential for directing resources toward the most significant threats, ensuring that the organization can effectively allocate its management efforts.

- Develop Mitigation Strategies: Formulate actionable plans to address the highest-priority threats. This may involve establishing a workplace culture that promotes open communication, enabling staff to voice concerns and contribute to management strategies. As Andy Hooke emphasizes, nurturing such a culture is essential for effective management of uncertainties.

- Monitor and Review: Establish a routine for regularly assessing the evaluation process. This continuous assessment should adjust to reflect alterations in the business landscape, ensuring that the entity remains robust against developing challenges.

The significance of thorough threat management cannot be overstated. Organizations face various uncertainties, and effective management of challenges can significantly enhance their chances of success by proactively addressing potential threats. By adhering to this methodical approach, entities can bolster their reporting integrity and significantly increase their likelihood of success in managing uncertainties.

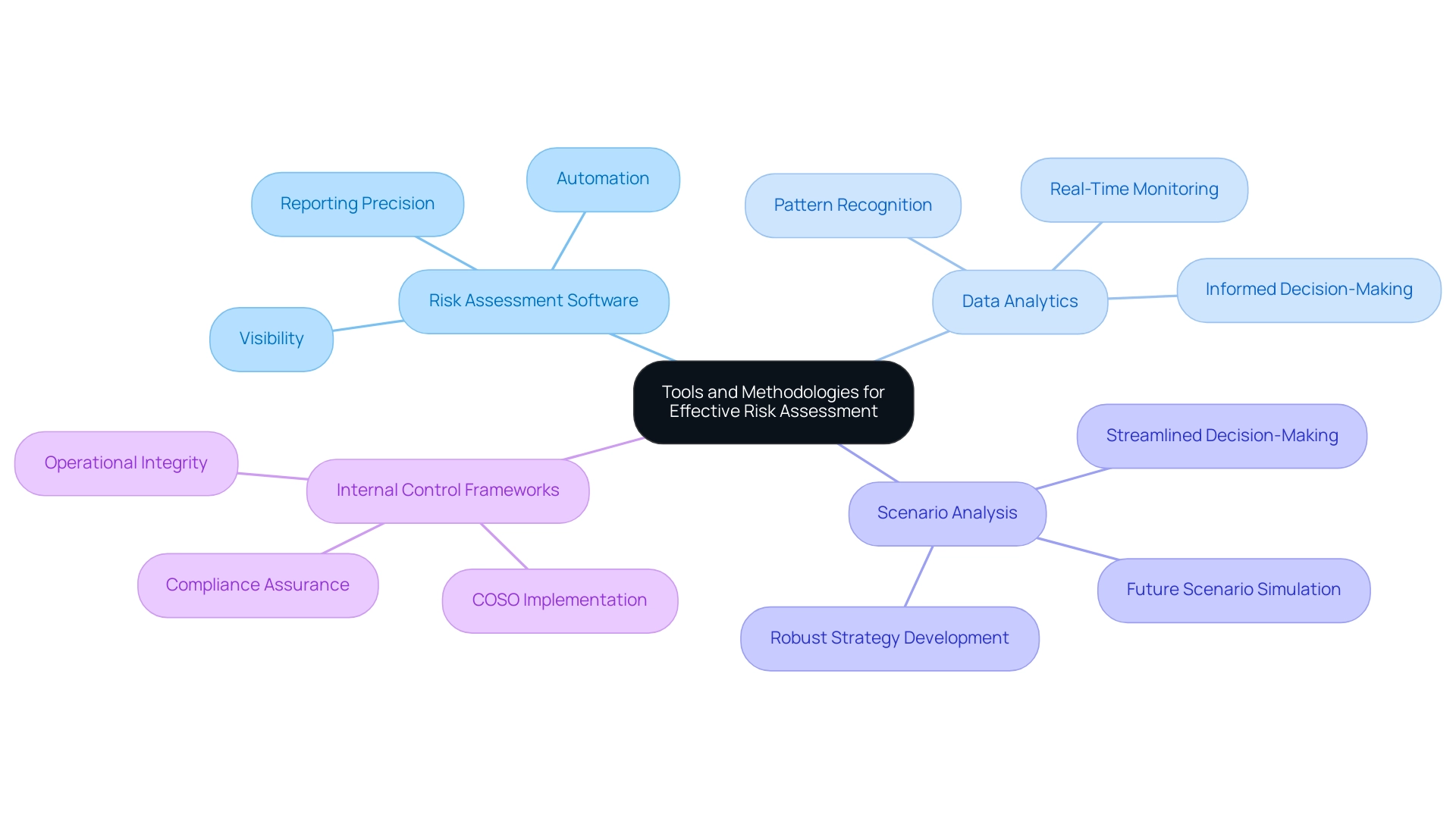

Tools and Methodologies for Effective Risk Assessment

Effective financial risk assessment can be significantly enhanced through a variety of advanced tools and methodologies, including:

- Risk Assessment Software: These tools automate the risk identification and evaluation process, allowing organizations to streamline their assessments and improve visibility into potential risks. In 2025, the adoption of evaluation software is anticipated to increase, with many companies acknowledging its essential role in improving reporting precision. Significantly, 55% of respondents find it difficult to acquire complete information about their third parties, highlighting the need for thorough management solutions.

- Data Analytics: Utilizing data analysis allows entities to recognize patterns and irregularities within monetary information, offering deeper understandings of possible threats. The effect of data analytics on reporting accuracy cannot be overstated; it enables more informed decision-making and proactive risk management. As Komron Rahmonbek, SEO Manager, states, "There is no reason not to take action since strong, cost-effective protection is possible even for businesses with modest IT budgets." Furthermore, real-time analytics can facilitate continuous business performance monitoring, enabling organizations to adjust strategies promptly based on current data.

- Scenario Analysis: This methodology involves assessing potential future scenarios to understand their implications on financial reporting risk assessment. By simulating various outcomes, businesses can better prepare for uncertainties and develop robust strategies to reduce potential issues. This approach also supports a streamlined decision-making cycle, allowing teams to take decisive actions during critical turnaround processes.

- Internal Control Frameworks: Implementing frameworks such as COSO strengthens internal controls and aids in reducing vulnerabilities effectively. These frameworks offer a systematic method to managing uncertainties, ensuring that entities uphold compliance and operational integrity.

The incorporation of these tools not only improves the precision and effectiveness of the evaluation process but also facilitates a financial reporting risk assessment, enabling organizations to manage economic uncertainties with increased assurance. Recent surveys indicate that a significant portion of professionals still grapple with low visibility into third-party risks and spend considerable time on low-level administrative tasks, which hinders their ability to focus on high-value risk management activities. By adopting these methodologies, businesses can position themselves for sustainable growth and resilience in an increasingly complex economic landscape, while also fostering relationship-building through continuous performance monitoring.

Ensuring Compliance in Financial Reporting

Ensuring compliance in monetary reporting is a multifaceted process that necessitates a strategic approach:

- Understanding Regulatory Requirements: Familiarizing oneself with the latest laws and regulations, including Generally Accepted Accounting Principles (GAAP) and International Financial Reporting Standards (IFRS), is essential. Staying updated on these standards is crucial, especially as regulatory requirements evolve in 2025. The increasing complexity of ESG regulations has led to 67% of global executives expressing the need for clearer guidance.

- Implementing Internal Controls: Establishing robust internal controls is vital for ensuring reporting accuracy. Effective internal controls not only enhance compliance but also significantly improve reporting precision. Entities that have instituted thorough internal controls report a notable rise in the accuracy of their statements. Furthermore, with the increase in cyberattacks targeting third parties—up from 44% to 49% over the past year—strong internal controls are essential for mitigating these threats. This approach aligns with our focus on economic efficiency and risk reduction, ensuring that your entity preserves cash and uncovers hidden value.

- Conducting Regular Audits: Regular internal and external audits are necessary for assessing compliance and identifying areas for improvement. These evaluations assist entities in revealing potential vulnerabilities in their processes while conducting a financial reporting risk assessment and ensuring adherence to regulatory standards. Recent statistics indicate that entities performing regular audits can save an average of $3.01 million by employing a centralized data governance program, highlighting the economic advantages of proactive compliance measures. As noted by R. Stephens in a 2016 survey, 47% of surveyed internal auditors feel that their internal audit department is 'sufficiently resourced for the demands that are made on it,' underscoring the importance of adequate resources in ensuring compliance. This proactive approach not only reduces challenges but also fosters long-term partnerships by optimizing balance sheets.

- Training Staff: Providing ongoing training for employees on compliance requirements and best practices is essential. Organizations typically cover an average of 12 topical areas over a two to three-year cycle, with the code of conduct, conflict of interest, and cybersecurity being the top three topics. This training equips personnel with essential knowledge while promoting a culture of adherence within the organization, ultimately aiding in the preservation of business value.

By emphasizing these adherence strategies, organizations can effectively mitigate threats associated with reporting, ensuring accuracy and integrity in their disclosures. Furthermore, as the compliance landscape continues to evolve, staying informed and adaptable is more important than ever.

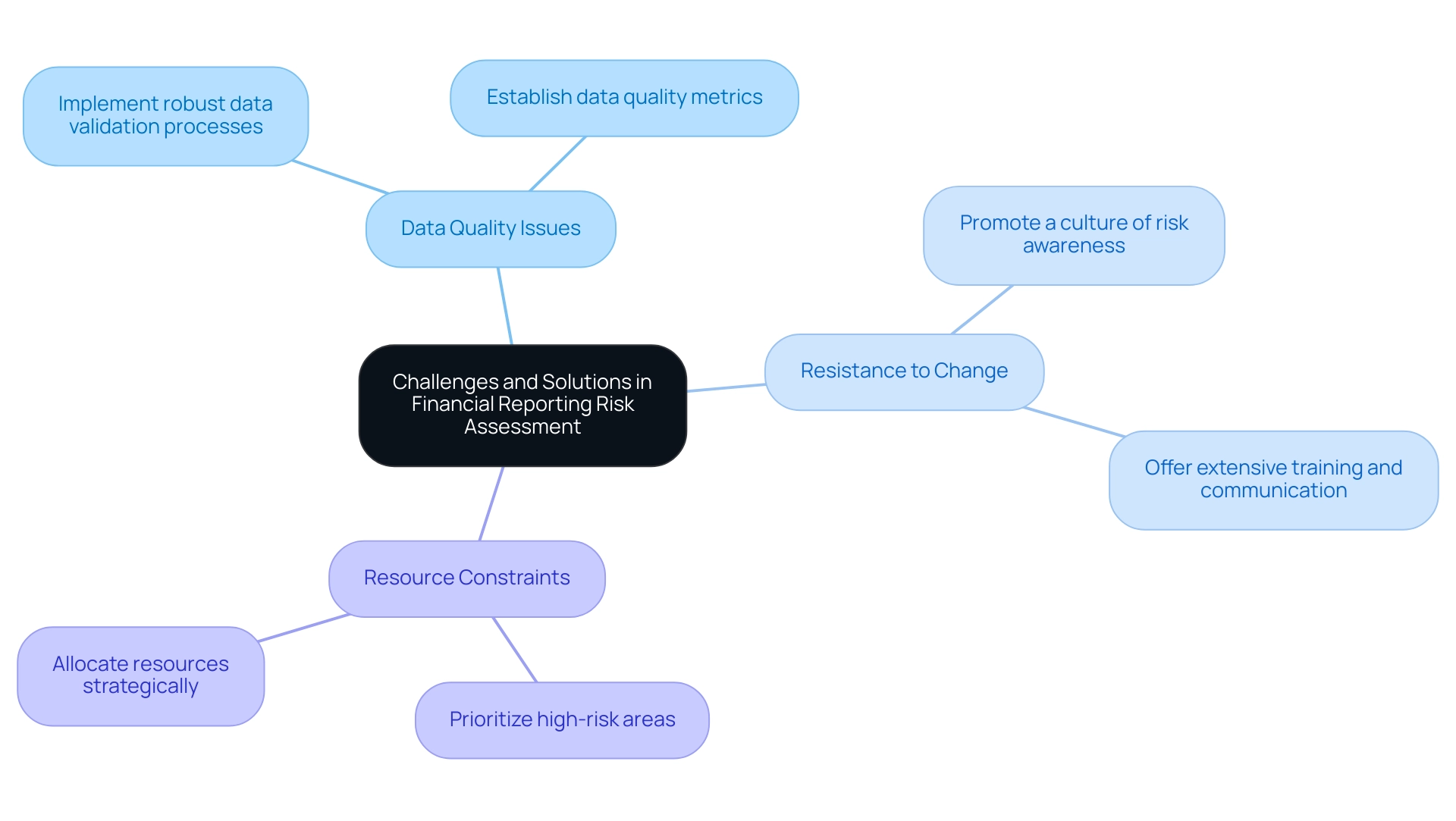

Challenges and Solutions in Risk Assessment

Common challenges in financial reporting risk assessment can significantly affect the precision and trustworthiness of reports. Key issues include:

- Data Quality Issues: Inaccurate or incomplete data can lead to flawed assessments, resulting in misleading monetary reports. Statistics indicate that 40-60% of data quality checks focus on basic problems that are increasingly rare in modern systems. To combat this, entities should implement robust data validation processes that assess data against dimensions such as completeness, accuracy, and consistency. The case study titled 'Dimensions of Data Quality' illustrates how businesses can measure and improve their data quality metrics effectively by establishing these dimensions. Moreover, poor financial data quality can lead to inaccurate financial statements, making a financial reporting risk assessment essential to prevent loss of investor trust, higher operational costs, and non-compliance with industry regulations. As Barr Moses, CEO and co-founder, states, 'As an industry, we need to prioritize data trust to optimize the potential of our data investments.' This emphasizes the essential requirement for entities to concentrate on data quality in their evaluations of potential threats.

- Resistance to Change: Staff frequently oppose new evaluation processes, which can impede implementation and obstruct advancement. To overcome this challenge, it is essential to promote a culture of risk awareness within the entity. Offering extensive training and transparent communication regarding the advantages of the new procedures can assist in reducing resistance and fostering acceptance from employees.

- Resource Constraints: Limited resources can hinder detailed evaluations, especially in small to medium-sized enterprises. To address this, entities should prioritize high-risk areas and allocate resources strategically. This focused method guarantees that essential weaknesses are evaluated and handled efficiently as part of a financial reporting risk assessment, even with limited resources.

By proactively tackling these obstacles, entities can greatly improve their monetary reporting vulnerability analysis efforts, resulting in more precise statements and better adherence to industry regulations.

Leveraging Technology for Risk Assessment

Technology is essential to contemporary economic evaluations, enabling organizations to enhance their capabilities and conduct a financial reporting risk assessment that proactively addresses potential risks. Key strategies for leveraging technology include:

- Automated Assessment Tools: Implementing specialized software significantly streamlines the identification and evaluation process, facilitating quicker and more precise assessments. This aligns with the need for a condensed decision-making cycle, empowering teams to take prompt action during critical turnaround processes.

- Data Analytics: Utilizing advanced analytics in financial reporting risk assessment uncovers insights from monetary data, revealing patterns and anomalies that may indicate emerging threats. In 2022, the financial sector faced fraud losses exceeding $8.8 billion, underscoring the importance of robust data analysis in managing uncertainties. Continuous observation through real-time analytics is vital for assessing business health and adjusting strategies as necessary, made feasible by the client dashboard from Transform Your Small/ Medium Business.

- Cloud-Based Solutions: Adopting cloud platforms facilitates immediate data access and fosters collaboration among stakeholders, ensuring all parties are informed and can respond swiftly to potential challenges. This practice incorporates lessons learned from previous evaluations, enhancing relationship-building and communication within teams.

- Artificial Intelligence: The integration of AI technologies is crucial for forecasting and mitigating challenges. By analyzing historical data and trends, AI provides valuable forecasts that assist organizations in navigating uncertainties. Finance sector organizations that have embraced AI-driven solutions are better positioned to enhance their management frameworks and safeguard their assets.

As financial institutions are projected to increase their edge computing investments by 218% by 2026, the strategic importance of these technologies cannot be overstated. In fact, monetary institutions implementing edge computing solutions have reported an average 69% reduction in transaction processing times. By adopting these advancements, entities can significantly improve their financial reporting risk assessment procedures and ultimately achieve greater economic stability.

Moreover, the testing and measuring of these strategies will maximize the return on invested capital in both the short and long term.

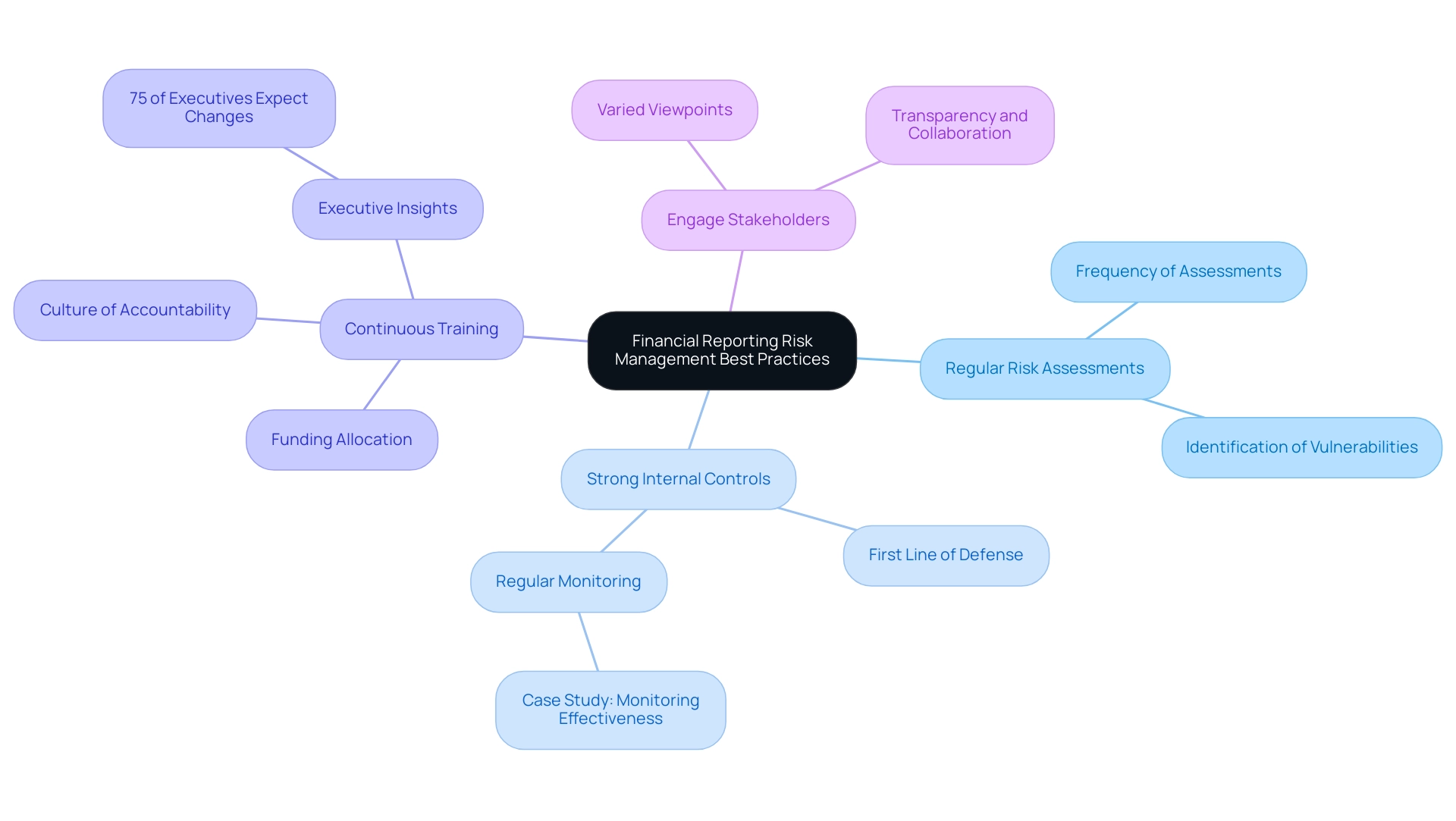

Best Practices for Financial Reporting Risk Management

To effectively manage financial reporting risks, organizations must implement the following best practices:

- Regular Risk Assessments: Conducting risk assessments on a regular basis is crucial for adapting to the ever-evolving business landscape. In 2025, the frequency of these assessments is more important than ever, as organizations that engage in consistent evaluations are better positioned to identify potential vulnerabilities before they escalate into significant issues.

- Strong Internal Controls: Establishing and maintaining robust internal controls is essential for preventing inaccuracies in reporting. These controls serve as the first line of defense against errors and fraud, ensuring that financial data remains reliable and trustworthy. Regular monitoring of these internal controls is necessary to identify weaknesses before they escalate into significant problems, as highlighted in the case study titled "Monitoring Effectiveness."

- Continuous Training: Ongoing training programs for staff on risk management and compliance are vital. Organizations should allocate sufficient funding for these initiatives, as this not only enhances employees' understanding of proper accounting practices but also fosters a culture of accountability and vigilance within the entity. Nearly three-fourths (75%) of executives believe there will be significant changes in their company's approach to business continuity planning and crisis management, according to a quote from AICPA and NC State University, underscoring the need for continuous training.

- Engage Stakeholders: Involving key stakeholders in the threat evaluation process is critical for ensuring comprehensive coverage of potential hazards. Involving stakeholders not only enhances the assessment with varied viewpoints but also strengthens the dedication to transparency and collaboration throughout the entity.

By adhering to these best practices, organizations can significantly enhance the integrity of their financial reporting and bolster their resilience against potential risks.

Conclusion

In the evolving landscape of finance, the significance of financial reporting risk assessments stands out more than ever. This process is vital for identifying and evaluating risks that could undermine the accuracy of financial statements, thereby ensuring that organizations adhere to regulatory standards. As businesses gear up for anticipated changes in 2025, the necessity for robust risk management strategies becomes increasingly critical. By acknowledging various types of financial risks—including market, credit, operational, and compliance risks—organizations can construct comprehensive frameworks to protect their financial integrity.

Implementing a structured risk assessment process is essential for organizations aiming to enhance their financial reporting reliability. By identifying objectives, assessing risks, prioritizing them, and formulating effective mitigation strategies, businesses can proactively tackle potential threats. Moreover, leveraging advanced tools and methodologies, such as risk assessment software and data analytics, empowers organizations to navigate the complexities of the financial landscape with greater confidence.

To cultivate a culture of compliance and ensure long-term sustainability, organizations must also prioritize ongoing training and the establishment of strong internal controls. Regular audits and stakeholder engagement further contribute to a comprehensive risk management approach that not only enhances financial reporting accuracy but also fosters organizational resilience.

Ultimately, by integrating these best practices and embracing technological innovations, businesses can significantly enhance their financial reporting processes. In doing so, they not only safeguard their financial health but also position themselves for sustainable growth in an increasingly complex environment. The journey toward effective financial reporting risk management is ongoing; however, with the right strategies in place, organizations can thrive amidst uncertainty.

Frequently Asked Questions

What is the purpose of financial reporting risk assessment?

The purpose of financial reporting risk assessment is to recognize and analyze potential hazards that may lead to inaccuracies in monetary statements, ensuring that financial reports are trustworthy and comply with regulatory standards.

What key factors are considered in a financial reporting risk assessment?

Key factors in a financial reporting risk assessment include the integrity of monetary data, the effectiveness of internal controls, and the potential for fraudulent activities.

How is the landscape of financial reporting expected to change by 2025?

By 2025, 75% of executives anticipate significant changes in their companies' approaches to business continuity planning, highlighting the need for robust financial reporting risk assessments to adapt to new challenges while maintaining economic integrity.

What is the current trend regarding organizational spending on financial reporting?

A recent survey indicates that only 33% of leaders in management plan to increase their overall spending in the next year, while 57% intend to maintain their current budgets, emphasizing a focus on cost-effective investments, particularly in automation.

Why is a comprehensive financial reporting risk assessment important?

A comprehensive financial reporting risk assessment is vital for identifying reporting uncertainties, implementing strategies to mitigate threats, enhancing accuracy in financial statements, and ensuring compliance with regulatory requirements.

What practical suggestions can enhance the effectiveness of financial reporting risk assessments?

Practical suggestions include assigning owners for potential issues, establishing notification reminders for regular reviews, and fostering accountability to proactively manage uncertainties.

How does financial reporting risk assessment contribute to organizational resilience?

Organizations that prioritize financial reporting risk assessments report enhanced accuracy in their statements and greater compliance with regulations, which helps sustain economic stability and protect reputations.

What types of monetary uncertainties do organizations face in reporting?

Organizations face various monetary uncertainties, including market uncertainty, credit concerns, operational risk, and compliance threats, each with unique consequences for their operations and economic well-being.

How can organizations manage market uncertainty?

Organizations can manage market uncertainty by leveraging real-time analytics to monitor market conditions and make informed decisions swiftly, addressing fluctuations in market prices.

What role does credit evaluation play in financial reporting?

Efficient credit evaluation is crucial to mitigate potential losses from borrower defaults, and continuous monitoring through analytics can provide insights into borrower behavior for timely adjustments to credit strategies.

What is operational risk, and how can it be minimized?

Operational risk is linked to failures in internal processes, human error, or system malfunctions. It can be minimized by implementing stringent controls and monitoring systems to reduce operational disruptions and maintain reporting accuracy.

Why is compliance a significant concern for organizations?

Compliance is a significant concern due to the risk of legal penalties or regulatory sanctions from non-compliance with laws and regulations, necessitating proactive measures to stay informed and adhere to evolving requirements.