Overview

Conducting a financial risk assessment for legal professionals involves identifying potential financial threats, analyzing their impacts, and developing mitigation strategies to ensure a law firm's economic stability. The article outlines a step-by-step guide that emphasizes the importance of continuous monitoring, stakeholder engagement, and the integration of technology to adapt to evolving financial challenges in the legal sector.

Introduction

In the legal sector, navigating the complexities of financial risk is not merely a task—it's a strategic imperative. As law firms grapple with a landscape marked by fluctuating client demands, evolving regulations, and the ever-looming threat of client non-payment, a comprehensive financial risk assessment emerges as a beacon of stability.

With over 200 funded arbitrations tracked in 2023, the urgency for legal professionals to understand and mitigate these risks has never been more pronounced. By embracing a proactive approach to risk management, law firms can harness insights that not only safeguard their financial health but also position them for growth amid uncertainty.

This article delves into the essential components of financial risk assessment, offering a step-by-step guide and innovative strategies to cultivate a resilient financial framework, ultimately empowering CFOs and legal practitioners to thrive in a dynamic market.

Understanding Financial Risk Assessment in the Legal Sector

Evaluating potential threats in the legal sector is an essential procedure that involves a financial risk assessment for legal professionals to identify, analyze, and manage challenges that can considerably influence a law firm's economic stability. With over 200 funded arbitrations tracked in 2023, legal professionals are increasingly aware of the economic landscape's volatility. They encounter unique challenges, such as:

- Fluctuating client demand

- Adherence to evolving regulations

- The possibility of client non-payment

Understanding these factors equips legal practitioners to perform a financial risk assessment for legal professionals, allowing them to navigate financial uncertainties more effectively. This financial risk assessment for legal professionals must include:

- Internal threats like operational inefficiencies, which can drain resources

- External challenges such as market competition and economic downturns

Significantly, the convergence of legal finance and insurance products, such as judgment preservation insurance, can change exposure profiles for high-stakes commercial disputes.

This trend reflects a growing appetite from heads of litigation and CFOs to explore the complementary use of these financial tools. Moreover, the information shows a hopeful sector that may be underinsured, highlighting the significance of thorough coverage for various challenges, including:

- Employment disputes

- Data breaches

For instance, legal practices that have increased their software investments by an average of 20% annually since 2013 are reaping the benefits, achieving above-average productivity and significantly higher profit margins.

This connection between strategic investment and economic performance underscores the importance of a comprehensive evaluation strategy. By cultivating a thorough comprehension of these challenges, CFOs can devise effective strategies, including financial risk assessment for legal professionals, to protect their firms' economic well-being, ensuring resilience in a constantly evolving market environment.

Step-by-Step Guide to Conducting a Financial Risk Assessment

-

Identify Financial Threats: Begin by conducting a financial risk assessment for legal professionals to create a comprehensive inventory of possible financial challenges specific to your legal practice. Key challenges to consider include delays in client payments, unforeseen operational costs, and shifts in regulatory compliance. Engage your team in brainstorming sessions to guarantee a thorough recognition of threats that could affect your practice.

-

Analyze Threats: Evaluate the probability and possible effects of each recognized threat. Utilize a matrix to classify threats into high, medium, and low categories. This categorization enables you to prioritize your response strategies effectively and allocate resources where they are most needed.

-

Develop Mitigation Strategies: For each high-priority threat, create targeted strategies aimed at mitigation. This may involve diversifying your client portfolio to minimize dependence on a handful of clients or instituting stricter payment terms to enhance cash flow. Adaptability is crucial; as Cate Giordano aptly put it,

Stop waiting around and get into the game.

Given that 36% of attorneys plan to adjust their management strategies this year, it is clear that proactive measures are essential. -

Establish Monitoring Procedures: Implement continuous monitoring systems to keep track of identified challenges and assess the efficacy of your mitigation efforts. Consistently examine and modify your assessment to consider changes within your firm or the wider legal environment, especially since 51% of lawyers anticipate heightened government supervision of AI. Furthermore, be mindful that 44% of attorneys mention potential policy and litigation changes as considerable concerns, which should be included in your ongoing evaluations.

-

Engage Stakeholders: Share your findings and strategies with key stakeholders, including partners and fiscal officers. It is crucial that all parties understand the importance of the financial risk assessment for legal professionals and their individual responsibilities in managing these dangers efficiently.

-

Document the Process: Maintain comprehensive records of your financial evaluation procedure, including findings and strategies. This record will serve as a critical resource for future assessments and is vital for demonstrating compliance with regulatory obligations. Interestingly, a case study showed that while 36% of attorneys plan to adjust their management strategies, only 14% intend to implement new or increased-limit insurance policies. This highlights the significance of thorough documentation and proactive strategies in managing uncertainties, emphasizing that effective resource management combines careful planning, adaptability, ethical considerations, and technology.

Implementing a Culture of Risk Awareness

To effectively manage monetary risks, it is paramount to conduct a financial risk assessment for legal professionals and establish a culture of risk awareness within your legal practice. Begin by arranging extensive training sessions that highlight the significance of detailed evaluations in the financial risk assessment for legal professionals, which can uncover opportunities for cash preservation and liability reduction. Conducting a financial risk assessment for legal professionals can help identify opportunities to preserve cash and reduce liabilities.

This clarity on each team member's role in the monetary review process is essential, particularly considering that 35% of compliance executives classify regulatory challenges as their primary concern. Promoting a setting where open dialogue about threats is encouraged can significantly reduce potential issues. Furthermore, with 97% of Secureframe users indicating an enhanced security and compliance stance, the effectiveness of thorough training and extensive evaluations is clear.

Create a safe space where team members feel empowered to report concerns without fear of retribution. Consistently reviewing and improving management policies, while actively engaging your team in the evaluation process, fosters a sense of ownership and responsibility. Additionally, the incorporation of AI and machine learning can significantly improve your management strategy by processing large volumes of unstructured data and adapting to evolving threat patterns.

Such initiatives not only enhance your organization's capacity to proactively tackle monetary challenges but also underscore the significance of thorough financial risk assessment for legal professionals in uncovering value and minimizing expenses. This corresponds with the finding that 92% of security leaders closely monitor cyber developments, emphasizing the need for vigilance in today's dynamic landscape. By embedding awareness of uncertainties into your firm's culture, you position your organization to navigate complexities with agility and confidence, making effective management of challenges not just necessary but compelling, especially considering the constraints that legal practices may face, as shown by the fact that only 33% of leaders in this area intend to increase overall spending in the next 12 months.

To learn more about how our Financial Assessment service can support your organization in achieving these goals, click the button below.

Utilizing Technology for Financial Risk Management

To improve your processes for financial risk assessment for legal professionals, it's essential to utilize advanced technology, especially management software equipped with strong assessment features. Such tools enable a financial risk assessment for legal professionals through detailed analysis of financial data, allowing you to identify trends more effectively. For example, predictive analytics can anticipate possible challenges by examining historical data, thus enabling you to take proactive steps before problems occur.

However, it's noteworthy that only 2% of legal practices are currently using AI for predictive analytics, according to Oxford University, indicating significant room for growth in this area. Moreover, integrating project management tools fosters collaboration among team members throughout the financial risk assessment for legal professionals process, ensuring that insights are shared and acted upon promptly. With 24% of legal practices already utilizing client-facing online portals and an additional 11% planning to implement them, it's clear that technology adoption is on the rise.

This trend is especially relevant for small legal practices, as highlighted in the case study 'Size Matters,' where 85% of small entities allocate $10,000 or less annually for technology spending. By embracing these technological advancements, you can streamline your monetary management efforts, make informed decisions based on real-time data, and ultimately enhance the resilience of your firm against economic uncertainties.

Reviewing and Updating Your Risk Assessment Regularly

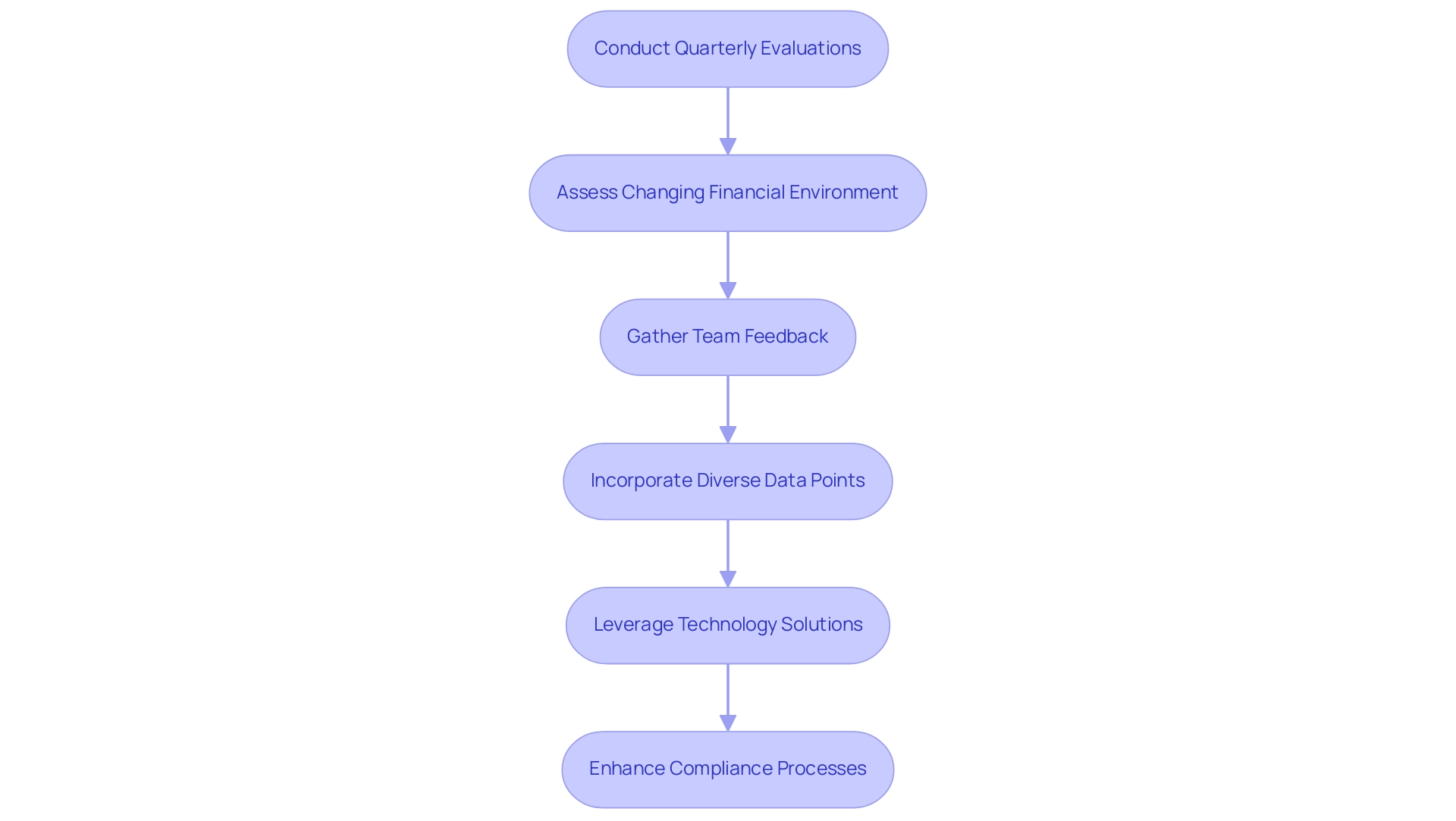

To ensure an efficient financial risk assessment for legal professionals, conducting routine reviews is crucial. It is recommended to arrange quarterly evaluations to perform a financial risk assessment for legal professionals, assess the changing financial environment, and adjust your evaluation as necessary. Companies must reveal the number of Suspicious Activity Reports (SARs) they submitted in the previous year, highlighting the importance of these routine financial risk assessments for legal professionals in maintaining compliance and managing uncertainties effectively.

Consider the latest developments within your firm's operations, shifts in client demographics, and changes in the regulatory environment. Engaging team members for feedback regarding current strategies is crucial; their insights can highlight effectiveness and areas for improvement. Anita Kim-Reinartz, a partner at PwC Germany, emphasizes this necessity:

For many companies, a refresh of their approach to scoring third parties is overdue.

Incorporating a more diverse set of internal and external data points can provide a more holistic portrait of a third-party population, in turn enabling more effective risk management. Additionally, leveraging technology, such as RegTech solutions like AI-powered monitoring and digital ID checks, can streamline compliance processes, making it easier to adapt assessments based on real-time data. By viewing the SRA’s AML Data Collection exercise as an opportunity for internal review rather than just a regulatory requirement, organizations can enhance their reputation with clients, regulators, and industry peers.

By committing to these regular reviews, your financial risk assessment for legal professionals framework will remain dynamic and adept at addressing new challenges, ultimately enhancing your firm's financial stability and compliance posture.

Conclusion

Navigating the complexities of financial risk in the legal sector is a critical endeavor that demands attention and proactive strategies. The comprehensive financial risk assessment process outlined in this article serves as a vital framework for law firms aiming to safeguard their financial health. By identifying unique financial risks, analyzing their potential impacts, and developing targeted mitigation strategies, legal practitioners can enhance their resilience against uncertainties.

Establishing a culture of risk awareness is equally essential, as it empowers teams to engage in open discussions about financial challenges. Regular training and the integration of advanced technologies can further bolster a firm's ability to manage risks effectively. With the right tools and a commitment to ongoing assessments, law firms can not only navigate the current landscape but also position themselves for future growth.

Ultimately, embracing a proactive approach to financial risk assessment is not just about avoiding pitfalls; it is about unlocking opportunities for innovation and efficiency. As the legal sector continues to evolve, those who prioritize comprehensive risk management will be best equipped to thrive in a dynamic market, ensuring their financial stability and fostering long-term success.

Frequently Asked Questions

What is the purpose of evaluating potential threats in the legal sector?

Evaluating potential threats in the legal sector is essential for conducting a financial risk assessment that helps legal professionals identify, analyze, and manage challenges that can significantly impact a law firm's economic stability.

What unique challenges do legal professionals face that can affect their financial stability?

Legal professionals encounter challenges such as fluctuating client demand, adherence to evolving regulations, and the possibility of client non-payment.

What should a financial risk assessment for legal professionals include?

A financial risk assessment should include internal threats like operational inefficiencies and external challenges such as market competition and economic downturns.

How are legal finance and insurance products changing the landscape for law firms?

The convergence of legal finance and insurance products, such as judgment preservation insurance, is changing exposure profiles for high-stakes commercial disputes and reflects a growing interest from litigation heads and CFOs in utilizing these financial tools.

What challenges highlight the importance of thorough insurance coverage for law firms?

Challenges such as employment disputes and data breaches emphasize the importance of comprehensive insurance coverage for law firms.

What has been the trend in software investments among legal practices, and what benefits have been observed?

Legal practices have increased their software investments by an average of 20% annually since 2013, resulting in above-average productivity and significantly higher profit margins.

What are the steps involved in conducting a financial risk assessment for legal professionals?

The steps include identifying financial threats, analyzing threats, developing mitigation strategies, establishing monitoring procedures, engaging stakeholders, and documenting the process.

Why is it important to engage stakeholders in the financial risk assessment process?

Engaging stakeholders, including partners and fiscal officers, ensures that everyone understands the importance of the financial risk assessment and their individual responsibilities in managing these risks effectively.

What role does documentation play in the financial risk assessment process?

Documentation maintains comprehensive records of the financial evaluation process, which serves as a resource for future assessments and demonstrates compliance with regulatory obligations.