Overview

The article provides a comprehensive step-by-step guide on conducting a financial risk assessment process, emphasizing the importance of identifying, analyzing, and prioritizing potential financial hazards to safeguard organizational stability. It supports this by outlining key steps such as data collection, hazard identification, and the development of mitigation strategies, while also highlighting the significance of ongoing monitoring and the use of technology to enhance the assessment's effectiveness.

Introduction

In the complex landscape of financial management, the ability to identify and mitigate risks is paramount for sustaining organizational health. Financial risk assessment serves as a vital framework for understanding vulnerabilities that could threaten an organization's stability. As companies grapple with an array of financial threats—from market fluctuations to regulatory changes—implementing a systematic approach to risk assessment becomes essential.

This article delves into the intricacies of financial risk assessment, exploring key types of risks, step-by-step methodologies for conducting assessments, and the transformative role of technology in enhancing accuracy and efficiency. By prioritizing proactive risk management, organizations can not only safeguard their financial health but also position themselves for sustainable growth in an increasingly unpredictable environment.

Understanding Financial Risk Assessment: An Overview

The financial risk assessment process is an essential procedure that involves the identification, analysis, and prioritization of potential hazards that could negatively affect an organization’s economic well-being. This systematic approach is essential for understanding vulnerabilities and exposures within the financial risk assessment process related to a variety of economic threats. A successful financial risk assessment process allows organizations to evaluate potential dangers, make informed choices, allocate resources effectively, and create strong strategies for mitigation.

The process of financial risk assessment generally includes several key elements:

- Collecting relevant data

- Analyzing monetary statements

- Assessing external factors that can affect the organization's stability

With 35% of compliance leaders indicating adherence and regulatory challenges as their primary worry, as noted by Secureframe, it is clear that thorough evaluations are essential in maneuvering through today’s intricate regulatory environment. Moreover, with 52% of polled cybersecurity experts indicating a rise in attacks compared to the previous year, organizations face escalating monetary challenges that necessitate a thorough financial risk assessment process.

Furthermore, the 2024 trends indicate a proactive shift, with 59% of companies having completed a fraud evaluation in the past year. This case study illustrates a proactive method for recognizing and tackling procurement fraud, emphasizing the significance of monetary analysis in improving organizational stability. Overall, these insights illustrate how organizations can enhance their financial well-being through careful oversight practices.

Identifying Key Types of Financial Risks

Financial uncertainty includes various categories that can significantly influence organizational stability and performance. A comprehensive understanding of these hazards is essential for effective management strategies, particularly in mastering the cash conversion cycle, which is critical for enhancing business performance. Key types include:

- Market Risk: This involves the potential for losses due to fluctuations in market prices or interest rates. As organizations navigate an increasingly volatile economic landscape, the ability to evaluate market uncertainties becomes paramount. Notably, the lack of economic opportunity is recognized as a top 10 concern over the two-year period, highlighting the urgency for CFOs to address market dynamics proactively to optimize cash flow.

- Credit Risk: This concern arises from the possibility that a borrower may default on a loan or fail to fulfill contractual obligations. In 2024, default rates across industries are anticipated to be a crucial focus for monetary institutions as they enhance their credit assessment frameworks, which directly affects the organization’s cash conversion cycle.

- Liquidity Risk: Organizations face the threat of not being able to meet short-term financial obligations if they cannot convert assets into cash promptly. The management of liquidity challenges is crucial, particularly in times of economic uncertainty, as it directly affects cash flow and operational efficiency.

- Operational Hazard: This encompasses threats stemming from internal processes, systems, or external events that can disrupt operations. As digital transformation accelerates, operational challenges associated with technology and process failures are increasingly highlighted. According to Protiviti, "Cyber threats remain a top concern in both 2024 and 2034," emphasizing the need for robust operational management that can streamline processes and support effective cash conversion.

- Regulatory Risk: Changes in laws or regulations can have a profound impact on businesses, leading to potential financial losses. As regulatory scrutiny intensifies, organizations must stay vigilant to adapt to evolving compliance landscapes. Insights from the case study titled "Long-Term Risk Outlook for 2034" reveal that concerns about digital disruption and regulatory scrutiny are persisting, underscoring the importance for CFOs to prioritize these challenges to safeguard against potential cash flow disruptions.

Comprehending these dangers is not merely an academic task; it is essential for creating a proactive and thorough management strategy that can protect organizational well-being in the face of emerging challenges. With the 2034 forecast suggesting a new challenge in data analytics capabilities, CFOs must prioritize these areas to maintain a competitive edge while enhancing their cash conversion cycle. To assist in this endeavor, our guide on "Mastering the Cash Conversion Cycle: 20 Strategies for Optimal Business Performance" is available for $99.00, providing actionable insights tailored for CFOs aiming to optimize their financial strategies.

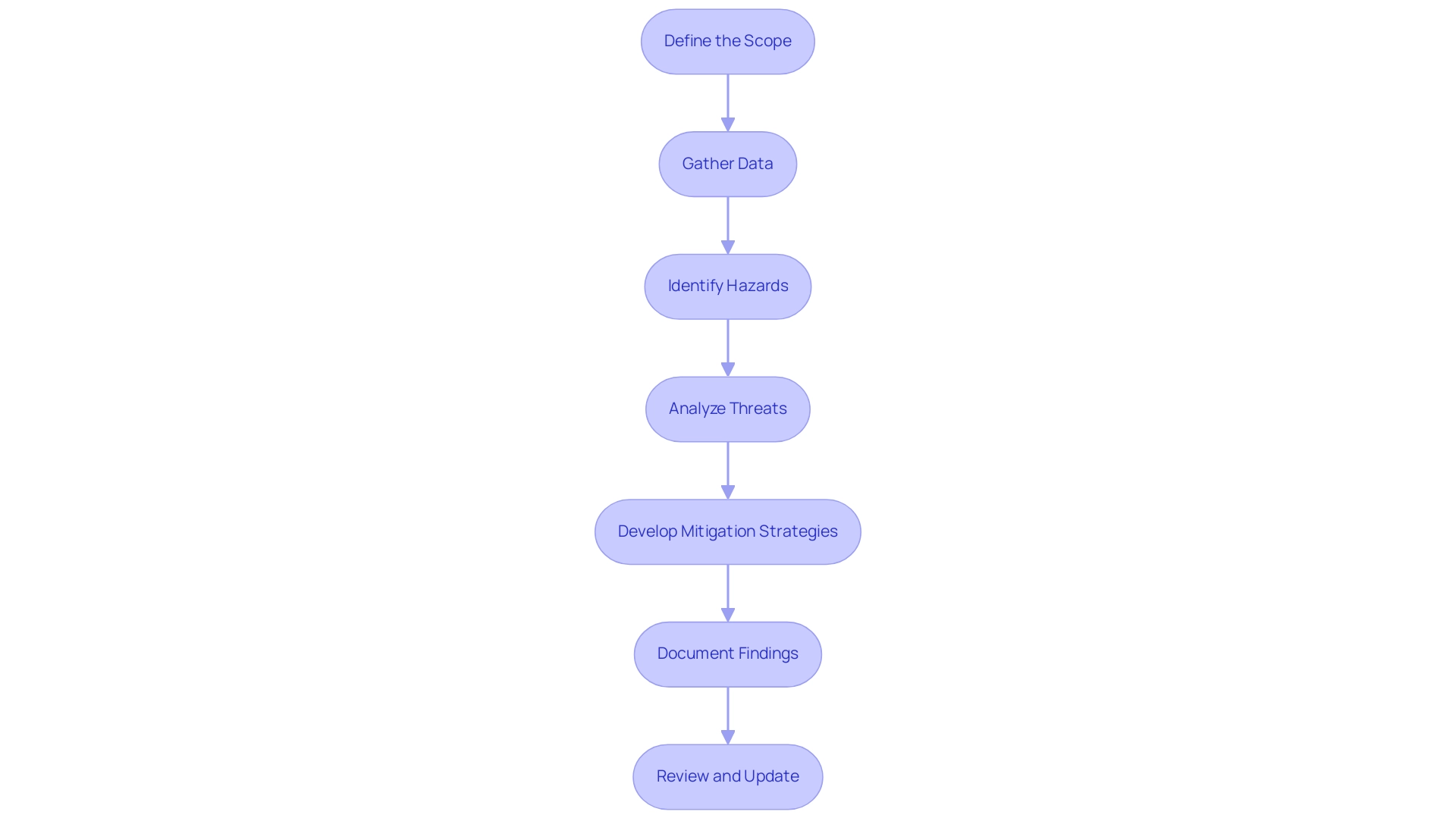

Step-by-Step Guide to Conducting a Financial Risk Assessment

-

Define the Scope: Start by outlining the particular areas within the business that need evaluation, along with the categories of threats that will be analyzed. This foundational step prepares the ground for a focused and effective financial risk assessment process.

-

Gather Data: Collect pertinent economic data, which includes comprehensive statements, detailed cash flow projections, and thorough market analysis. Utilizing advanced tools such as Excel, Python, and Tableau can streamline this process, enhancing accuracy and efficiency in data gathering.

-

Identify Hazards: Leverage the collected data to pinpoint potential dangers, categorizing them by type—operational, financial, reputational, and compliance hazards. This categorization assists in comprehending the scope of challenges faced by the organization during the financial risk assessment process. In 2022, more than 422,000 identity theft complaints were reported to the FTC, with fraud losses surpassing $5.8 billion, highlighting the essential need for comprehensive evaluation.

-

Analyze Threats: Evaluate both the likelihood and potential impact of each identified threat. Utilize quantitative methods, such as regression analysis and descriptive statistics, to prioritize these threats based on their possible effect on the organization’s objectives. As noted by Faraj Hasanpour, a Risk Analyst, "One time at work the boss asked me to predict future price of housing based on historical prices. I started using descriptive statistics and regression analysis using Python to predict future price based on square meter, floor, bedroom, and etc." This real-world application of statistical techniques is part of the financial risk assessment process and can reveal significant patterns that inform predictions, providing a data-driven foundation for analysis.

-

Develop Mitigation Strategies: Formulate actionable plans to address the identified hazards. This includes developing contingency plans and considering risk transfer strategies, such as insurance or outsourcing, to mitigate potential negative impacts. Our team supports a shortened decision-making cycle throughout the turnaround process, allowing your team to take decisive action to preserve your business.

-

Document Findings: Ensure that the evaluation process and findings are meticulously recorded. Documentation functions not only as a reference for future evaluations but also supports the financial risk assessment process in meeting compliance and governance requirements. Insights gained from case studies on crisis response illustrate that organizations with robust documentation are better positioned to adapt to challenges. The case study on Crisis Management and Governance emphasizes the need for adaptable governance structures, reinforcing the importance of thorough documentation in navigating crises.

-

Review and Update: Create a schedule for routine evaluations, ensuring that the control framework stays pertinent and efficient amid evolving market circumstances and new challenges. Continuous improvement and performance monitoring are key, as we continually monitor the success of our plans and teams through a client dashboard that provides real-time business analytics, enabling ongoing diagnosis of your business health. The dashboard offers insights into key performance indicators (KPIs) and trends, allowing for timely adjustments to strategies. This 'Update & Adjust' method guarantees that your management framework develops in reaction to new information and market dynamics.

Leveraging Technology for Effective Risk Assessment

Incorporating advanced technology into the financial risk assessment process can significantly improve both precision and efficiency, especially within our Financial Evaluation service. Key tools to consider include:

- Management Software: Solutions such as RiskWatch or Resolver streamline the assessment process through automation, delivering powerful analytics and comprehensive reporting features. This corresponds with the strategic agreement between Riskmethods and Zurich Insurance Group, which aims to provide enhanced management services to commercial customers, as noted by Manideep Patel in March 2019. A comprehensive assessment of resources using such technologies can aid in recognizing opportunities to conserve cash and diminish liabilities efficiently.

- Data Analytics Tools: Employing platforms like Tableau or Microsoft Power BI facilitates detailed analysis of monetary data, allowing organizations to visualize and pinpoint possible threats efficiently. As the cargo shipping market, anticipated to reach $15,328, becomes more intricate, the financial risk assessment process highlights the need for thorough financial evaluations emphasizing cash preservation and efficiency.

- Financial Modeling Tools: Employing Excel or dedicated financial modeling software aids in strong forecasting and scenario analysis, providing CFOs with the insights necessary for strategic decision-making. By adopting these technologies, organizations not only bolster the accuracy of their evaluations but also enhance their ability to proactively address emerging threats. As highlighted in the case study titled 'The Future of Threats: Now and 2034,' cyber threats are expected to remain a top concern, emphasizing the need for agile strategies and data-driven decision-making in navigating evolving challenges. The growing need for management software, especially following the COVID-19 pandemic's effects on the healthcare and pharmaceutical industries, highlights the importance of these tools in today’s swiftly changing economic environment. Continuous business performance monitoring through real-time analytics can further operationalize turnaround lessons and foster relationship-building. Moreover, our team supports a shortened decision-making cycle throughout the turnaround process to allow your team to take decisive action, preserving your business effectively.

The Importance of Ongoing Risk Monitoring and Review

To maintain an effective financial risk assessment process, ongoing monitoring and review are indispensable. Organizations should establish regular intervals for these reviews, ideally on a quarterly or bi-annual basis, to ensure a streamlined decision-making cycle that allows for decisive action. This practice includes several key components:

- Updating Risk Profiles: It is crucial to reassess the likelihood and impact of identified threats by leveraging new data or acknowledging shifts in the business environment. In fact, 77% of corporate compliance professionals acknowledge the significance of remaining knowledgeable about the latest developments in Environmental, Social, and Governance (ESG) criteria. Additionally, only 44% of participants perform evaluations of third-party data handling methods, emphasizing a considerable area for enhancement in oversight practices.

- Monitoring Key Indicators: Tracking financial and operational metrics is essential as these can indicate emerging threats. Alarmingly, only 14% of procurement and 13% of supplier oversight professionals currently utilize continuous monitoring tools for supplier evaluations, indicating a significant gap in proactive threat mitigation. Employing real-time business analytics via a client dashboard, organizations can consistently assess their health and modify strategies as needed.

- Engaging Stakeholders: Involving key stakeholders, including CFOs and departmental heads, in the review process is essential to gather varied insights and promote a culture of shared accountability in safeguarding. As mentioned by Saravanan, > Several factors weaken trust in overseeing compliance challenges <, which highlights the necessity for collaborative involvement to tackle these issues effectively.

By focusing on these continuous monitoring practices, organizations can stay adaptable and responsive to new obstacles, ultimately strengthening their financial stability and refining their financial risk assessment process. Furthermore, case studies have demonstrated that 54% of professionals in the field advocate for stronger relationships with senior executives to bolster their influence in decision-making. This collaboration is essential for effective management of uncertainties, as it enables better alignment of strategies with organizational goals.

The integration of a shortened decision-making cycle further empowers organizations to act swiftly in response to evolving risks.

Conclusion

Proactive financial risk assessment is not just a best practice; it is a fundamental necessity for organizations aiming to thrive in today’s unpredictable economic landscape. By systematically identifying and analyzing key financial risks—ranging from market fluctuations to regulatory changes—companies can enhance their decision-making processes and safeguard their financial health. The importance of leveraging technology cannot be overstated, as advanced tools facilitate more accurate data analysis and improve risk management efficiency.

Moreover, the implementation of a structured step-by-step risk assessment process empowers organizations to develop robust mitigation strategies tailored to their unique vulnerabilities. Regular monitoring and review of these risks ensure that businesses remain agile, allowing them to quickly adapt to emerging threats and capitalize on new opportunities. Engaging stakeholders in this ongoing dialogue fosters a culture of shared responsibility, enhancing the overall effectiveness of risk management strategies.

In conclusion, prioritizing financial risk assessment is essential for sustaining organizational stability and positioning for long-term growth. By embracing a proactive approach and integrating cutting-edge technology, organizations not only protect their assets but also create a resilient framework capable of navigating the complexities of the financial landscape. Now is the time to take decisive action—invest in comprehensive risk assessment practices to secure a more stable and prosperous future.

Frequently Asked Questions

What is the financial risk assessment process?

The financial risk assessment process is a systematic procedure that involves identifying, analyzing, and prioritizing potential hazards that could negatively impact an organization’s economic well-being. It helps organizations understand vulnerabilities and exposures related to various economic threats.

What are the key elements of the financial risk assessment process?

The key elements include: 1. Collecting relevant data 2. Analyzing monetary statements 3. Assessing external factors that can affect the organization’s stability.

Why is financial risk assessment important for organizations?

It allows organizations to evaluate potential dangers, make informed choices, allocate resources effectively, and create strong strategies for mitigation, which is essential in navigating complex regulatory environments and addressing escalating monetary challenges.

What recent trends indicate the importance of financial risk assessments?

Recent trends show that 35% of compliance leaders are concerned about adherence and regulatory challenges, while 52% of cybersecurity experts report a rise in attacks. Additionally, 59% of companies have completed a fraud evaluation in the past year, highlighting a proactive approach to financial risk management.

What types of financial risks can affect organizational stability?

Key types of financial risks include: 1. Market Risk: Losses due to fluctuations in market prices or interest rates. 2. Credit Risk: The possibility of a borrower defaulting on a loan. 3. Liquidity Risk: The threat of not meeting short-term financial obligations. 4. Operational Hazard: Threats from internal processes or external events disrupting operations. 5. Regulatory Risk: Financial losses due to changes in laws or regulations.

How does understanding financial risks contribute to management strategies?

A comprehensive understanding of financial risks is essential for creating proactive management strategies that protect organizational well-being and enhance business performance, particularly in mastering the cash conversion cycle.

What resources are available for CFOs to improve their financial strategies?

A guide titled 'Mastering the Cash Conversion Cycle: 20 Strategies for Optimal Business Performance' is available for $99.00, providing actionable insights tailored for CFOs aiming to optimize their financial strategies.