Introduction

In a landscape where financial uncertainties loom larger than ever, the ability to navigate risk is paramount for organizational success. Financial risk management serves as an essential framework for identifying, assessing, and mitigating potential threats that could disrupt business stability.

With a staggering 75% of executives anticipating significant shifts in their approach to crisis management, the urgency to adopt robust risk management strategies has never been more critical.

This article delves into the key concepts of financial risk management, providing CFOs with actionable insights and a structured roadmap to enhance their organizations' resilience against emerging challenges.

From conducting thorough risk assessments to engaging stakeholders and developing comprehensive action plans, every step is designed to empower decision-makers to safeguard their financial health and drive sustained growth in an increasingly volatile environment.

Understanding Financial Risk Management: Key Concepts and Definitions

A financial risk management assessment is a crucial process that involves identifying, evaluating, and prioritizing financial vulnerabilities, followed by strategic efforts to mitigate, monitor, and control the effects of unfavorable events. Our team supports a shortened decision-making cycle throughout the turnaround process, empowering your company to take decisive action to preserve business stability. This 'Decide & Execute' framework allows for immediate responses to emerging challenges.

As per a recent study by AICPA and NC State University, nearly three-fourths (75%) of executives think there will be substantial changes in their entity's approach to business continuity planning and crisis response, emphasizing the need for strong safety frameworks. Furthermore, the inability to utilize rigorous data analytics for market intelligence has been identified as a new challenge for 2034, underscoring the need for CFOs to stay ahead of emerging threats through continuous performance monitoring. The key concepts in financial threat management include:

- Threat Identification: This involves recognizing potential financial dangers that could jeopardize the organization’s stability.

- Threat Assessment: A comprehensive analysis of the probability and possible effects of recognized threats, employing both qualitative and quantitative techniques to guide decision-making.

- Risk Treatment: Implementing strategies to mitigate threats effectively, which may encompass avoidance, reduction, transfer, or acceptance of challenges depending on the context.

- Monitoring and Review: A continuous process to monitor threat factors and evaluate the effectiveness of control strategies, ensuring flexibility in a changing threat environment. Our client dashboard offers real-time business analytics to consistently assess your business health, enabling timely adjustments and informed decision-making as part of our 'Update & Adjust' strategy.

Given the concerning trend of rising cyberattacks—52% of cybersecurity professionals reported an increase in attacks compared to the previous year—CFOs must prioritize these concepts to protect their enterprises. This trend highlights the growing challenge environment encountered by entities and the need for a thorough comprehension of financial risk management assessment to manage uncertainties and promote informed decision-making.

Step-by-Step Process for Conducting a Financial Risk Assessment

Carrying out a thorough financial risk management assessment of potential challenges is crucial for any organization seeking to manage the intricacies of today’s business landscape. Here’s a structured approach:

-

Define the Scope: Clearly outline the areas of assessment, focusing on critical components such as monetary statements, cash flow, and operational processes.

This step establishes the groundwork for an effective financial risk management assessment of potential issues.

-

Identify Threats: Collaborate with key stakeholders and analyze historical data to uncover potential financial challenges. In the financial risk management assessment, it is important to consider common threats like market fluctuations, credit uncertainties, and liquidity challenges.

Notably, 52% of cybersecurity professionals have reported an increase in cyber attacks, highlighting the need for vigilance in identifying such risks.

-

Analyze Hazards: Evaluate the likelihood and potential impact of each identified threat. Utilizing matrices or specialized software can facilitate a quantitative analysis as part of a financial risk management assessment, allowing for a more nuanced understanding of each threat's implications.

-

Prioritize Threats: Rank the identified threats based on their severity and likelihood. This prioritization helps concentrate resources on the most critical areas, ensuring that high-impact challenges are managed first in the financial risk management assessment. Secureframe's finding that 35% of executives prioritize compliance and regulatory concerns underscores the importance of this step.

-

Develop Treatment Plans: For each prioritized threat, create detailed strategies for mitigation or management. This includes establishing contingency plans and allocating resources effectively to address potential challenges, thus supporting a streamlined decision-making cycle that enables decisive action. The importance of a shortened decision-making cycle is critical in turnaround processes for financial risk management assessment, allowing organizations to respond swiftly to emerging risks.

-

Implement Strategies: Execute the treatment plans, ensuring that all stakeholders are informed and engaged throughout the process. Transparent communication is crucial for cultivating a culture of awareness and establishing connections that are essential for effective turnaround oversight. Additionally, operationalizing lessons learned from past turnarounds can enhance the effectiveness of current strategies.

-

Monitor and Review: Lastly, create a system for ongoing threat observation and routinely assess the effectiveness of mitigation strategies. Considering that 75% of executives expect substantial changes in their company's approach to business continuity planning, a proactive monitoring system is essential for adjusting to emerging challenges. Employing real-time business analytics through a client dashboard can offer insights into business health, enabling prompt updates and modifications to strategies.

By following these steps, CFOs can perform a comprehensive financial risk management assessment that not only uncovers potential issues but also creates a strong framework for ongoing management and mitigation approaches. This approach equips organizations to tackle both present and future challenges, especially considering the long-term outlook suggesting ongoing worry over digital disruption and regulatory scrutiny.

Tools and Techniques for Financial Risk Assessment

To effectively conduct a financial risk assessment, several advanced tools and techniques can significantly enhance your approach:

- Risk Assessment Software: Utilizing platforms such as RAIDLOG.com, which offers regular-priced paid plans starting at $99/year with a 30-day free trial, can streamline the identification and analysis of risks. These tools offer a structured methodology for risk management, essential for integrating with existing monetary software and compliance databases, thereby facilitating cross-department collaboration.

- SWOT Analysis: Conducting a SWOT (Strengths, Weaknesses, Opportunities, Threats) analysis enables entities to identify internal and external factors affecting economic stability. This strategic tool is vital for recognizing potential vulnerabilities and areas for growth.

- Scenario Analysis: This method is essential in assessing how different scenarios might affect the entity's economic well-being. By preparing for potential challenges through scenario modeling, CFOs can make informed decisions that bolster resilience against market fluctuations.

- Economic Ratios: Leveraging key economic ratios, such as liquidity and profitability ratios, offers invaluable insights into the organization's current economic standing. This quantitative analysis aids in recognizing areas of concern and opportunities for improvement, enhancing the overall accuracy of evaluations.

Integrating these tools not only enhances the financial risk management assessment process but also aligns with specialist views on effective threat handling strategies. As mentioned by leaders in corporate risk assessment, "Its capacity to link different departments within a company under a unified approach makes it distinctive." Furthermore, the case study of Data demonstrates how automation in security compliance can align entities with regulations and standards through continuous monitoring, exemplifying the significance of incorporating advanced tools in assessments of monetary vulnerabilities.

By adopting these methodologies, organizations can enhance their economic well-being and ensure strong management practices.

Engaging Stakeholders in the Risk Assessment Process

Successful involvement of stakeholders in the monetary evaluation process is crucial for achievement. Consider these proven strategies:

-

Identify Key Stakeholders: It is crucial to pinpoint the individuals who should participate in the assessment.

This encompasses department leaders, financial analysts, and external consultants who can offer varied viewpoints on threat factors.

-

Facilitate Open Communication: Cultivating an atmosphere where stakeholders feel at ease sharing their insights and concerns about possible threats is vital.

Communication quality, task completion rate, stakeholder satisfaction, and alignment with goals are key metrics in assessing engagement ROI, which can significantly impact decision-making.

-

Conduct Workshops: Organizing workshops or meetings is an effective way to discuss challenges collaboratively.

Involving various departments guarantees a comprehensive understanding of the organization’s threat landscape, fostering a culture of shared learning.

-

Share Findings: Openness is essential in handling uncertainties.

After conducting the assessment, disseminate the results to all stakeholders to promote collective ownership of the strategies developed.

This openness helps align with organizational goals and enhances stakeholder satisfaction.

-

Establish a Feedback Loop: Encourage continuous feedback from stakeholders to refine the assessment process.

This continuous conversation enables entities to adjust to changing circumstances and uphold efficient management practices.

-

Learn from Case Studies: For instance, a case study on vendor relationships and breaches reveals that 98.3% of entities maintain relationships with third parties that have experienced a breach in the last two years.

This emphasizes the significance of handling third-party threats as a component of stakeholder engagement strategies.

By actively engaging stakeholders in these processes, entities can substantially improve the depth and precision of their financial risk management assessment.

As noted by AICPA and NC State University, nearly 75% of executives anticipate notable shifts in their organizations' approaches to business continuity and crisis management, underscoring the imperative of robust stakeholder engagement.

Furthermore, with 35% of compliance executives identifying regulatory challenges as their top concern, it is crucial to integrate stakeholder feedback into compliance strategies to address these issues effectively.

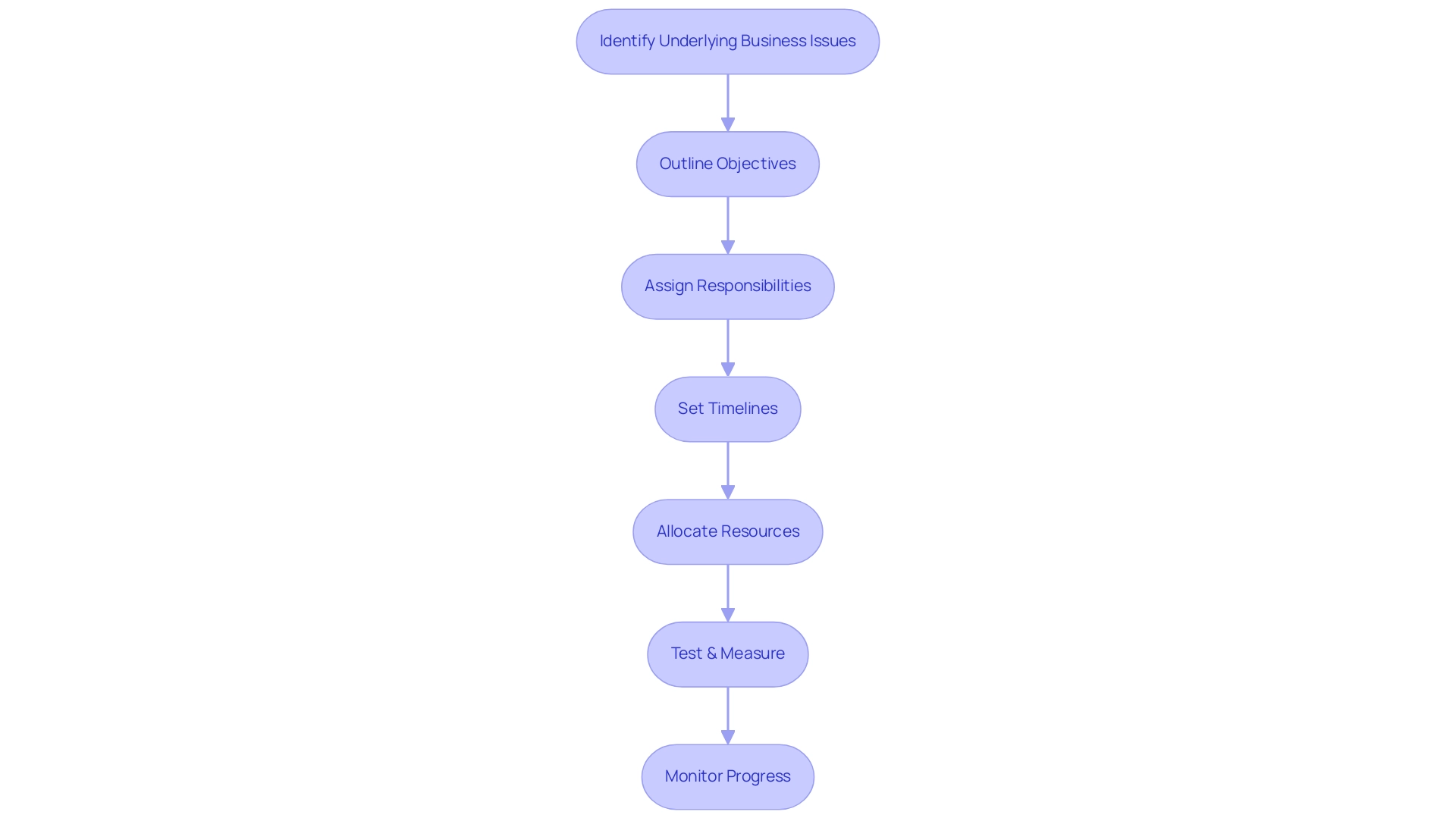

Developing a Risk Management Action Plan

After conducting a financial risk management assessment, the subsequent essential step is the creation of a strong Risk Management Action Plan. This plan acts as a guide for reducing recognized challenges and attaining monetary goals while enabling efficient decision-making and real-time analytics essential for successful business recovery. Here are the essential components to include:

- Identify Underlying Business Issues: Begin by collaboratively identifying the underlying business issues that need to be addressed. This step is essential for creating a focused action plan that targets specific weaknesses.

- Outline Objectives: Define clear, measurable goals for the action plan. This might entail identifying objectives such as reducing specific hazards or improving overall economic stability through ongoing performance assessment.

- Assign Responsibilities: It’s crucial to designate specific team members or departments responsible for implementing each element of the plan. This ensures accountability and clarity in execution, fostering strong relationships among teams.

- Set Timelines: Establish realistic deadlines for each action item. Timelines help maintain momentum and facilitate the tracking of progress, thereby ensuring that the plan stays on course.

- Allocate Resources: Identify and allocate the necessary resources—financial, human, and technological—to effectively implement the action plan. According to recent findings, the average cost of post-incident activity can reach $565,363, with the bulk of this expenditure often associated with containment and remediation efforts. This statistic underscores the importance of proactive resource allocation to prevent costly incidents before they occur. As noted by DTEX Systems, "The remaining 90% (averaging $565,363 per incident) was spent on post-incident activity, with the most spent on containment ($179,209 per incident) and remediation ($125,221 per incident)."

- Test & Measure: Adopt a pragmatic approach to data by testing every hypothesis to deliver maximum return on invested capital in both the short and long term. This guarantees that the strategies applied are effective and aligned with monetary objectives.

- Monitor Progress: Regular reviews of the action plan’s progress are essential. By consistently evaluating the efficacy of the applied strategies through real-time analytics, companies can quickly adapt to new challenges or shifts in the economic environment.

The importance of expert insights cannot be overstated in this process. Consulting management specialists can enhance decision-making, but it is crucial to consider potential biases in their input. As highlighted in the case study titled "Expert Judgment," the value of expert advice is significant, yet it is essential to critically evaluate their recommendations to mitigate any biases.

By developing a comprehensive Risk Management Action Plan, organizations not only address the financial risks identified during the financial risk management assessment but also position themselves to achieve long-term financial resilience, ultimately enhancing strategic business improvement.

Conclusion

Navigating the complexities of financial risk management is not just a strategic advantage; it is essential for the survival and growth of organizations in today's unpredictable environment. By understanding key concepts such as:

- Risk identification

- Analysis

- Treatment

- Continuous monitoring

CFOs can create a robust framework to safeguard their organizations against potential threats. The urgency highlighted by the 75% of executives anticipating shifts in crisis management underscores the need for proactive engagement and strategic planning.

Implementing a structured approach to financial risk assessment, including:

- Defining the scope

- Analyzing risks

- Developing action plans

equips organizations to prioritize critical areas and respond swiftly to emerging challenges. The integration of advanced tools and techniques enhances the accuracy and efficiency of risk assessments, allowing for informed decision-making that aligns with organizational goals.

Moreover, engaging stakeholders throughout the risk assessment process fosters collaboration and ensures a comprehensive understanding of potential risks. By sharing findings and establishing feedback loops, organizations can adapt their strategies to the ever-evolving risk landscape. Ultimately, developing a well-defined Risk Management Action Plan not only addresses current vulnerabilities but also positions organizations for long-term resilience and sustained growth.

In an era where financial uncertainties are prevalent, adopting these risk management strategies is imperative. By taking decisive action now, organizations can fortify their financial health and navigate the challenges of the future with confidence and agility.

Frequently Asked Questions

What is a financial risk management assessment?

A financial risk management assessment is a process that involves identifying, evaluating, and prioritizing financial vulnerabilities, followed by strategic efforts to mitigate, monitor, and control the effects of unfavorable events.

Why is a financial risk management assessment important for organizations?

It helps organizations manage the complexities of today's business landscape, enabling them to respond swiftly to emerging risks and protect business stability.

What are the main concepts involved in financial threat management?

The key concepts include Threat Identification, Threat Assessment, Risk Treatment, and Monitoring and Review.

What steps are involved in conducting a financial risk management assessment?

The steps include: 1. Define the Scope 2. Identify Threats 3. Analyze Hazards 4. Prioritize Threats 5. Develop Treatment Plans 6. Implement Strategies 7. Monitor and Review.

How does the 'Decide & Execute' framework work in financial risk management?

The 'Decide & Execute' framework allows for immediate responses to emerging challenges, supporting a shortened decision-making cycle throughout the turnaround process.

What recent trends are impacting financial risk management?

A significant trend is the increase in cyberattacks, with 52% of cybersecurity professionals reporting more attacks compared to the previous year, highlighting the need for enhanced vigilance and a strong safety framework.

How can organizations monitor threats effectively?

Organizations can implement a proactive monitoring system using real-time business analytics, which allows for ongoing observation of threats and evaluation of the effectiveness of mitigation strategies.

What role do executives play in financial risk management assessments?

Executives are crucial in prioritizing compliance and regulatory concerns, as well as ensuring that the organization adapts to substantial changes in business continuity planning and crisis response.

What tools can be used for analyzing hazards in financial risk management?

Matrices or specialized software can facilitate quantitative analysis, providing a nuanced understanding of each threat's implications.

How can organizations ensure effective implementation of strategies in financial risk management?

By executing treatment plans with transparent communication and engaging all stakeholders, organizations can cultivate a culture of awareness and improve the effectiveness of their strategies.