Introduction

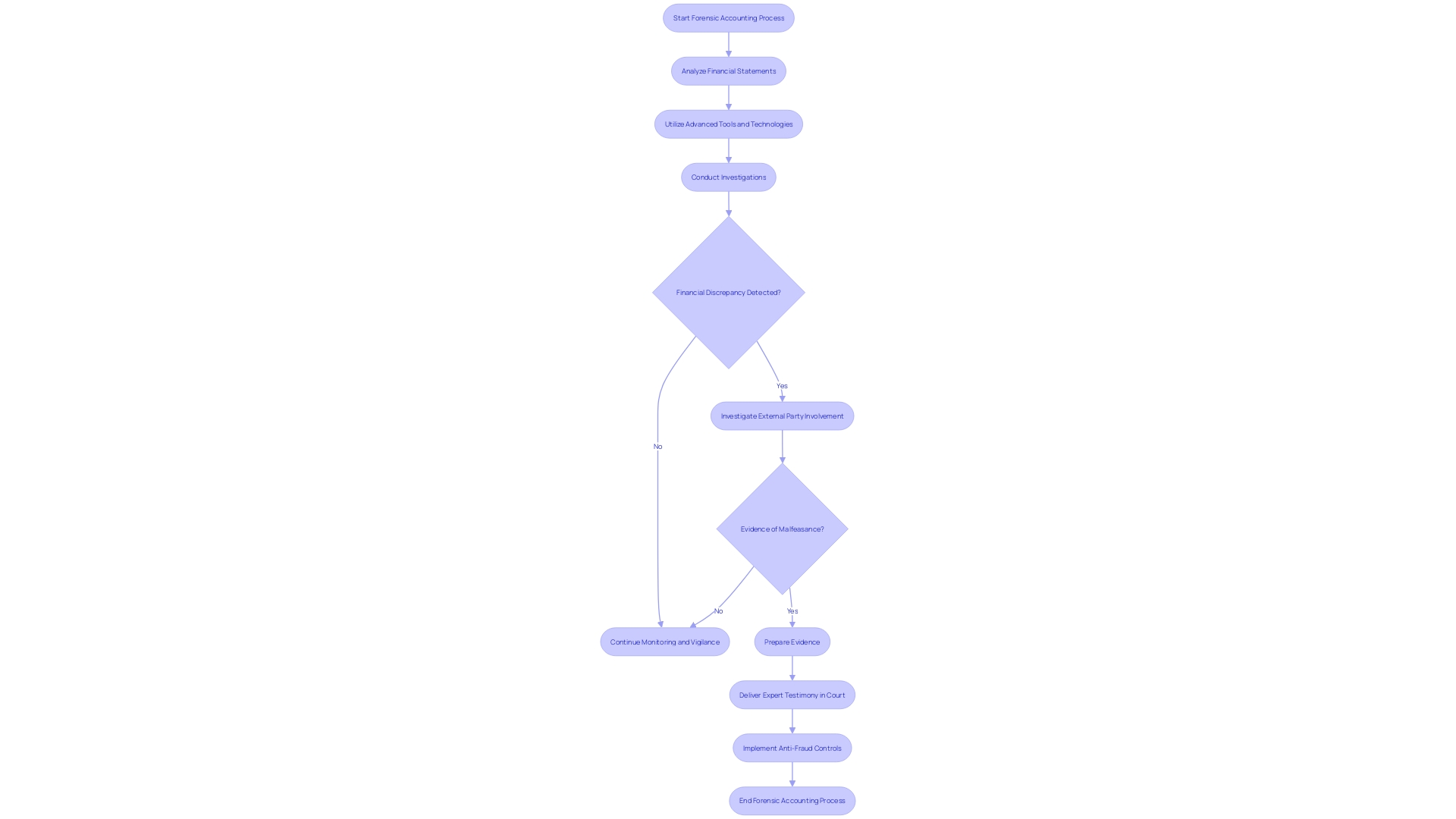

Forensic accounting is a critical field that combines accounting, auditing, and investigative skills to uncover financial fraud and provide insights during legal disputes. With the increasing complexity of financial fraud schemes, forensic accountants play a vital role in analyzing financial statements and identifying irregularities that may indicate fraudulent activities. The use of advanced technologies like machine learning and artificial intelligence has made forensic accountants equipped to handle large volumes of data and interpret their findings effectively.

Real-world cases and the contributions of industry experts underscore the dynamic nature of forensic accounting and its importance in combating financial misconduct. By unraveling the stories hidden within financial numbers, forensic accountants provide essential evidence for legal proceedings and deliver expert testimony in court. Despite the challenges, the rewards of forensic accounting are tangible, as reports and resources highlight the critical role of anti-fraud controls in safeguarding financial interests and upholding the integrity of financial systems globally.

Understanding the need for a forensic accountant is crucial, as their expertise in dissecting financial records and their ability to collaborate across various business functions make them indispensable in legal scenarios. In today's business environment, where financial transparency and accuracy are paramount, organizations must carefully assess their need for forensic accounting expertise to tackle financial challenges and maintain their standing in a vigilant marketplace.

Understanding Forensic Accounting

Forensic accounting combines the knowledge of accounting, auditing, and investigative skills to analyze intricate details, uncover fraud, and offer crucial insights during legal disputes. It explores statements regarding finances to detect any irregularities that could indicate fraudulent activities. By utilizing double-entry accounting's detailed transaction tracking, akin to how fingerprints are employed in criminal investigations, accountants with expertise in investigating can identify discrepancies and anomalies in accounting.

The requirement for forensic accounting is emphasized by the growing shrewdness of statement fraud schemes. Fraudsters, with their intimate knowledge of a company's processes and controls, craft schemes buried within legitimate monetary activities, often undetectable by conventional analysis. The immense volume and intricacy of today's financial information require advanced tools and technologies. With advancements in machine learning and artificial intelligence, financial investigators are equipped to sift through vast datasets, making technology skills indispensable for interpreting the findings and crafting legal strategies.

Real-world cases, like the intricate cryptocurrency dealings of De Grandpré Chait law firm, highlight the necessity for strong investigative tools such as Chainalysis, which streamlines the investigative process with high-quality data and user-friendly interfaces. Similarly, the academic and experiential contributions of Dr. Weber, a seasoned investigator in the field of finance and a professor, emphasize the dynamic nature of the discipline and its role in addressing monetary misconduct in various settings.

When accountants carefully examine statements—the income statement, balance sheet, and cash flow statement—they decipher the narratives numbers reveal, building profiles crucial for comprehending the wider scope of investigations. Their expert analyses lead to the development of evidence, preparation for legal proceedings, and ultimately, the delivery of expert testimony in court.

Despite the daunting challenges, the rewards of forensic accounting are tangible. Reports like the Annual Report on the Protection of the EU's Financial Interests and the Report to the Nations on occupational fraud provide a wealth of insights into fraud detection methods and the critical role of anti-fraud controls. These resources emphasize the continuous watchfulness required to protect economic interests and maintain the honesty of monetary systems globally.

Identifying the Need for a Forensic Accountant

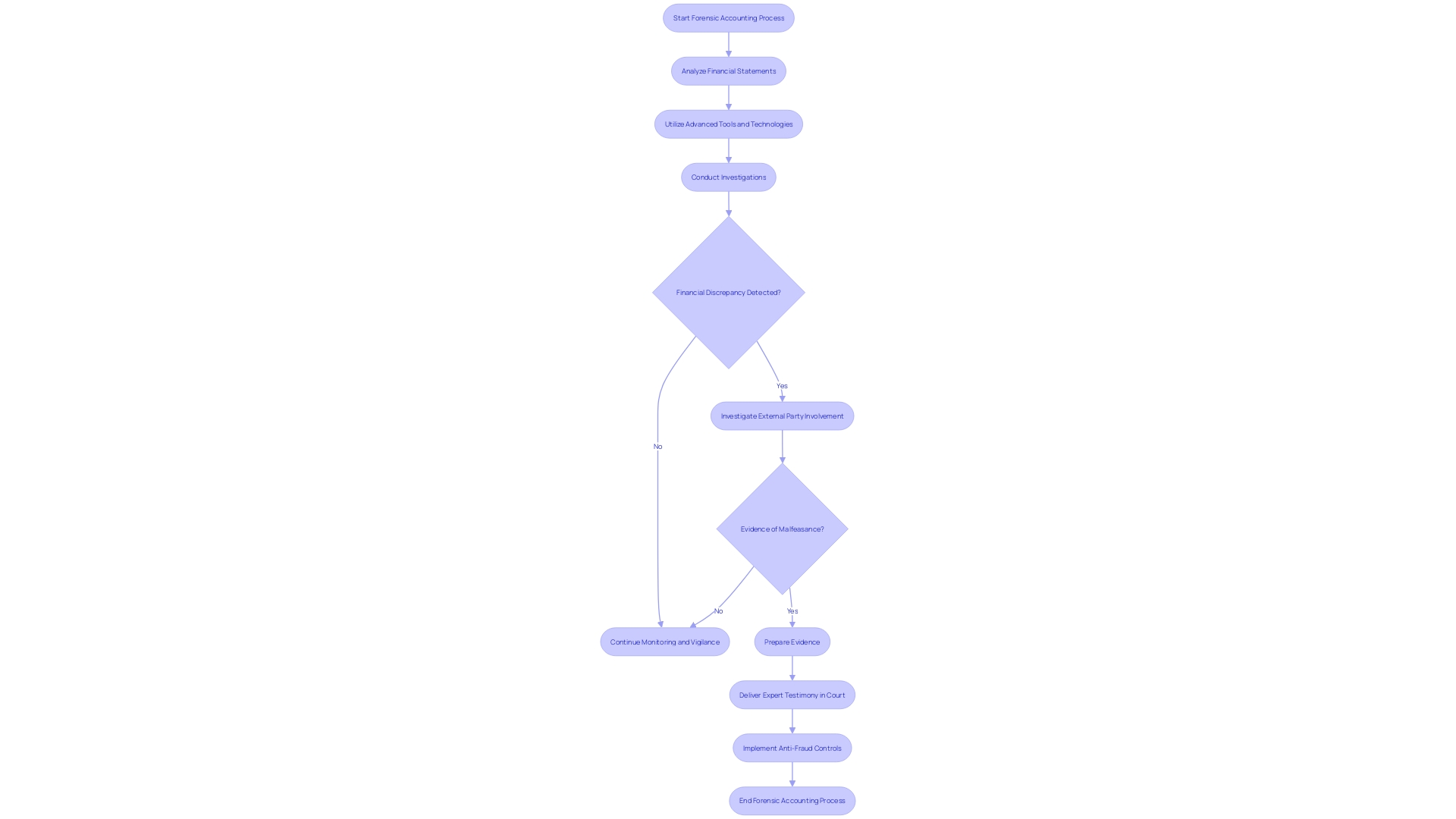

Forensic accountants are the sleuths in the realm of fiscal matters, offering services essential when irregularities or disputes surface. They specialize in analyzing records to uncover fraud, embezzlement, and other discrepancies. Their sharp eye for detail and expertise in deciphering intricate economic data make them a linchpin in legal scenarios, working towards justice and safeguarding the fiscal integrity of businesses. As the representation of watchfulness in money investigations, experts in the field are often called in situations where there's a money inconsistency or suspicion of misconduct involving external parties, such as advisors or employees.

Considering the growing complexity of statement fraud schemes, forensic accountants' roles have become more crucial. Fraudsters, leveraging intimate knowledge of a company's operations and controls, craft intricate schemes that blend seamlessly into regular reporting, making detection without specialized expertise challenging. The sheer volume and intricacy of economic data in modern business add to the complexity, requiring advanced analytical tools beyond traditional methods.

With a wide range of expertise, professionals in the field often work together with different departments, like marketing and operations, to offer a comprehensive viewpoint on monetary affairs. This interplay is fundamental, for instance, in calculating and interpreting the return on investment, which guides marketing strategies, or in performing cost analysis and forecasting for operations.

The high stakes of fiscal transparency and accuracy in today's business environment emphasize the importance of forensic accountants. The swiftly changing landscape of regulation and crime necessitates professionals who are not only well-versed in current laws and practices but also proactive in staying informed through industry publications, professional organizations, and educational events.

The craft of monetary forensics is not only about the numbers; it's about navigating through the network of economic interactions to preserve the integrity and trust that underpin the business world. Given this, organizations must carefully evaluate their requirement for forensic accounting knowledge, ensuring they are prepared to address economic challenges directly and uphold their position in a constantly vigilant marketplace.

Key Qualifications and Skills

Forensic accountants are the money detectives of the corporate world, delving into complex records to uncover fraud, embezzlement, and monetary inconsistencies. Important credentials to look for in these experts include not only their educational background, but also certifications like Certified Fraud Examiner (CFE) and specialized experience in legal and monetary investigations. Their role extends beyond crunching numbers; it involves a keen eye for detail and a firm grasp of monetary data interpretation, making them indispensable in legal disputes and protecting a company's assets.

The wide range of an accounting education, which includes areas like marketing and operations, equips investigators with a comprehensive understanding of business functions. This interdisciplinary approach is critical, as it allows them to navigate various aspects of a business, from calculating marketing ROI to conducting cost analyses and monetary forecasting. With the dynamic landscape of accounting standards and regulations, staying informed is a non-negotiable attribute. The best candidates are those who actively engage with industry developments through professional memberships, conferences, and continuous learning.

The influence of financial investigators can be observed in both the academic and professional domains. Consider Dr. Weber, for instance, who has made significant contributions to the discipline by educating students in fraud investigation and obtaining grants to combat monetary crimes. As the economic environment changes, the involvement of investigative auditors becomes increasingly important, with oversight organizations such as the FRC updating examination structures to guarantee comprehensive evaluations of monetary inaccuracies.

When evaluating potential hires, it is crucial to consider their technical proficiency, but also their ability to stay abreast of industry changes and their commitment to ethical practices. Finding an accounting professional with the appropriate combination of abilities, knowledge, and commitment to ongoing education will be a valuable asset to any organization.

Experience and Industry Expertise

Forensic accounting is an intricate field, stretching across a multitude of industries, each with its distinct challenges and regulations. This discipline is indispensable when dissecting intricate records to uncover fraud, embezzlement, or other fiscal discrepancies. In the maze of today's corporate monetary environment, where statement fraud schemes are progressively sophisticated and well-concealed within regular reporting processes, the role of an investigative accountant becomes even more crucial. They are the finance world's detectives, with a sharp eye for detail and a capacity to decipher intricate economic information, thus becoming a cornerstone in legal cases to ensure justice and safeguard companies' fiscal interests.

Consider the expertise brought in by Dr. Kassem, who influences the establishment of standards for professionals dealing with fraud, or the initiatives by CSAFE, which integrates statistical concepts into applications related to investigation and develops accessible tools and databases for the community involved in forensic work. Such expertise is crucial, as modern businesses generate comprehensive data, often including complex transactions that can overwhelm traditional analysis methods. The employment of an investigative bookkeeper with industry-specific proficiency can be a game-changer, offering a profound comprehension of distinct monetary practices and the capacity to navigate through the intricacies of monetary transactions.

In the quest for such professionals, online reviews and interviews are instrumental. Reviews on platforms like Yelp, Google, and Angie’s List can shed light on a professional's reputation, while interviews allow for a direct assessment of their experience, credentials, and fit for your organization. The advantages of employing a forensic expert with the appropriate experience are numerous, including a notable influence on economic results, as research indicates that specialists with specialized knowledge can hinder or expose deception that may otherwise remain unnoticed, resulting in improved fiscal well-being for the institution.

Litigation Support Experience

Forensic professionals play a pivotal role in legal proceedings, where their expertise in analyzing monetary complexities is crucial. Their tasks are multifaceted, including the meticulous gathering and analysis of monetary evidence, the creation of comprehensive reports, and ultimately, providing expert testimony in courtrooms. Engaging an expert in monetary examination with experience in legal assistance is not merely advantageous; it is often necessary in uncovering monetary inconsistencies and presenting discoveries in a legal framework.

The detailed comprehension of protection regulations, like those arising from the EU's strict privacy rights, becomes especially important when investigators handle personal information during investigations. They must navigate these regulations while uncovering the truth behind monetary misdeeds, ensuring that personal information is processed with utmost integrity and in compliance with legal standards. The capacity to handle and analyze extensive quantities of data, considered the fresh energy of the worldwide economy, is evidence of the critical function of the legal disputes' investigator in cases where monetary openness is doubted.

Recent news has highlighted the significant work of financial investigators in high-profile cases. Significantly, a disagreement over the charges imposed by an accounting firm for untangling the intricate monetary matters of a prominent individual highlights the extent and importance of their investigative work. These instances highlight the significance of transparency in money matters and the role of an expert in achieving it.

Additionally, the legal field's increasing acknowledgment of specialization, reflected in accounting for legal purposes, enables professionals to refine their abilities, stay updated on evolving economic and legal landscapes, and offer clients unmatched expertise. As Dr. Weber's work with his students in combating monetary abuse shows, there is an urgent requirement for investigators who not only comprehend the numbers but can also make connections across different sectors and scenarios. Their work embodies the intersection of accounting, law, and investigative expertise, proving indispensable in today's data-driven world.

Investigative Skills and Techniques

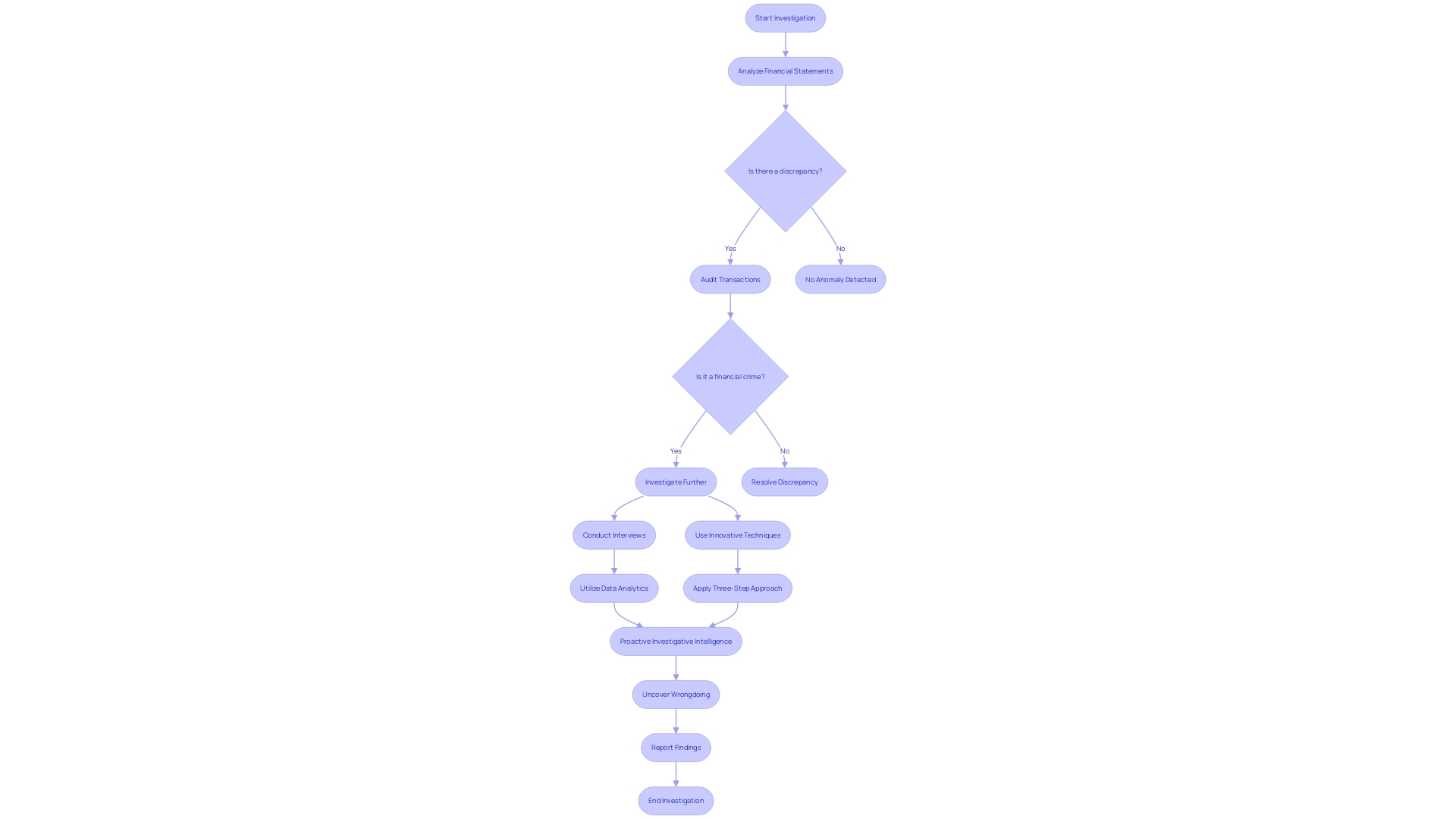

The collection of a investigative accountant includes sophisticated methods that convert economic information into convincing proof of deception or wrongdoing. From analysis and auditing to the nuanced art of interviewing, these tools are crucial in identifying and dissecting financial anomalies. An impressive example of accounting in action involved an AWS account breach where an unauthorized support case signaled malicious intent. The investigation uncovered a month-long attack, dissected into three phases using the MITER ATT&CK framework. In another instance, an innocuous application named PDF AI: Add-On, once granted permissions, became a vehicle for exploitation, accessing sensitive data and evading detection.

Well-known investigator and educator Dr. Weber utilizes his knowledge to guide students in examining high-tech crimes. His approach echoes the principles of watchdog journalism, holding entities accountable and safeguarding the public from financial misconduct. This echoes the wider mission of investigative accountants: to serve as guardians against economic wrongdoing.

In the digital realm, innovative techniques like the space bar trick on LinkedIn empower investigators to find whistleblowers and former employees, bypassing algorithms to hone in on potential sources. These methods, coupled with a three-step approach anchored in generating hypotheses and validating information, enhance the effectiveness of investigations.

Amidst increasing instances of wrongful convictions, Dr. Jon Gould emphasizes the role of flawed scientific analysis as a contributing factor. Similarly, the IRS's Criminal Investigation unit exemplifies the power of data analytics in financial probes, utilizing Bank Secrecy Act data in the vast majority of the cases. This strategic use of information not only solves crimes after they occur but also helps prevent them, epitomizing the proactive nature of investigative intelligence.

Reputation and References

Selecting the right forensic accountant is a mission-critical decision that hinges on thorough vetting of the candidate's expertise and credibility. Begin by examining their professional history, focusing on concrete achievements and recognitions in the field. Examine cases they've worked on, particularly those related to software or intricate crimes. Their involvement in high-profile cases or those with significant complexity, such as patent infringement or antitrust trials, can be telling of their experience and capability to handle intricate financial puzzles.

In the interview stage, inquire about their continuous learning strategies. Highly skilled forensic financial experts stay updated on changing accounting laws and industry standards through consistent involvement with professional publications, organizations, and industry events. Pose questions that reveal their core competencies, such as their approach to maintaining vigilance in fraud prevention and their proficiency in leveraging technology and data analytics for fraud detection.

Online reviews and client testimonials serve as a barometer of reputation. Nevertheless, due diligence is essential, as online reviews can sometimes be misleading. Assess a spectrum of reviews for consistency and pay attention to any recurring concerns that may suggest systemic issues.

Furthermore, take advantage of the insights offered by recent industry reports, like the Report to the Nations, which highlight the importance of robust internal controls and the profiles of typical fraudsters. These insights can guide your questioning on how the candidate has previously navigated challenges related to fraud concealment and detection.

Finally, consider the accountant's interdisciplinary experience. The integration of accounting with other business functions, like marketing or operations, can be a strong indicator of a candidate's broader business acumen and their capacity to understand the nuanced implications across different areas of your company.

Confidentiality and Ethics

In the intricate domain of oversight, privacy and morals are not only principles but the foundation on which accounting is established. Forensic professionals are the guardians in the shadows, investigating the complex network of monetary transactions, frequently under circumstances that provoke suspicion of foul play or misconduct. Whether it's a pro athlete grappling with a discrepancy, a startup facing a tangled fiscal puzzle, or a law firm navigating the murky waters of cryptocurrency, the investigator's role is pivotal in unearthing the truth and safeguarding the integrity of monetary information.

As these detectives investigate misdeeds ranging from malfeasance to outright fraud, their commitment to confidentiality ensures that sensitive information remains secure, preventing further harm to affected parties. Upholding ethical behavior is equally crucial; it is the beacon that guides their actions, fostering trust and credibility in an environment where the stakes are high and the consequences of ethical lapses can be severe.

To evaluate the commitment of an expert in financial investigation to these principles, one must take into account their compliance with professional codes of behavior and moral standards, which serve as guiding lights in the turbulent waters of financial conflicts. In a world where a single act of impropriety can erode trust, the importance of ethics in finance cannot be overstated—it is the foundation upon which lasting relationships with clients, partners, and the community are built.

The choice of a financial investigator, therefore, is not a choice to be made without careful consideration. Interviews and thorough vetting processes are essential to gain insights into their experience and values. Online reviews, though beneficial, should be approached with a discerning eye, as they may not always reflect the complete picture. Instead, focus on consistent themes and firsthand accounts of their professional conduct.

Ultimately, the selection of a financial investigator is a testament to an organization's dedication to openness and moral management. It is a clear signal to investors, stakeholders, and society that integrity is paramount, and that fiscal stewardship is being managed with the highest degree of vigilance and insight.

Cost and Engagement Terms

Engaging a forensic accountant is a strategic move that calls for a deep dive into the cost structures and negotiation of engagement terms. When pro athletes, represented by their advisors, face discrepancies, disputes, or suspicions of malfeasance with external parties, the intricacy of the investigation can significantly influence the costs involved. For example, a law firm such as Challenge De Grandpré Chait encountered increased complexity when dealing with cryptocurrency-related cases, resulting in the adoption of specialized software like Chainalysis to navigate through murky waters, thus incurring extra expenses.

The expense of employing a financial investigator will always mirror the intricacy of the situation, the level of proficiency needed, and the length of the commitment. A money expert is crucial in analyzing money data and market patterns, playing a similar role to that of a detective who examines money statements and transactions to solve money puzzles. The carefulness of such analysis and the prediction of monetary performance can influence the fees of the investigator.

When negotiating terms, clarity and transparency are key. It's crucial to state and justify the assumptions underlying the engagement, much like the best practices of cost model validation require explicit statement of assumptions for clarity. With the high stakes of monetary investigations, the engagement terms should encapsulate the scope of work clearly, ensuring mutual understanding and agreement.

In the ever-changing realm of finance, where even software estimation presents significant difficulties and the unforeseen can happen, as witnessed with RBC's internal software costs examination, the involvement with a financial investigator should provide for adaptability. The capacity to adjust to new discoveries and changes in scope is a crucial factor in the economic landscape, where protocols are constantly evolving.

In the end, the worth obtained from employing an investigative financial expert goes beyond the monetary commitment, as they reveal significant understandings and solutions in intricate financial circumstances. With cybersecurity professionals commanding impressive salaries for their expertise, it's a testament to the premium placed on specialized knowledge and skills in high-stakes fields, reflecting the potential costs and value of accounting services.

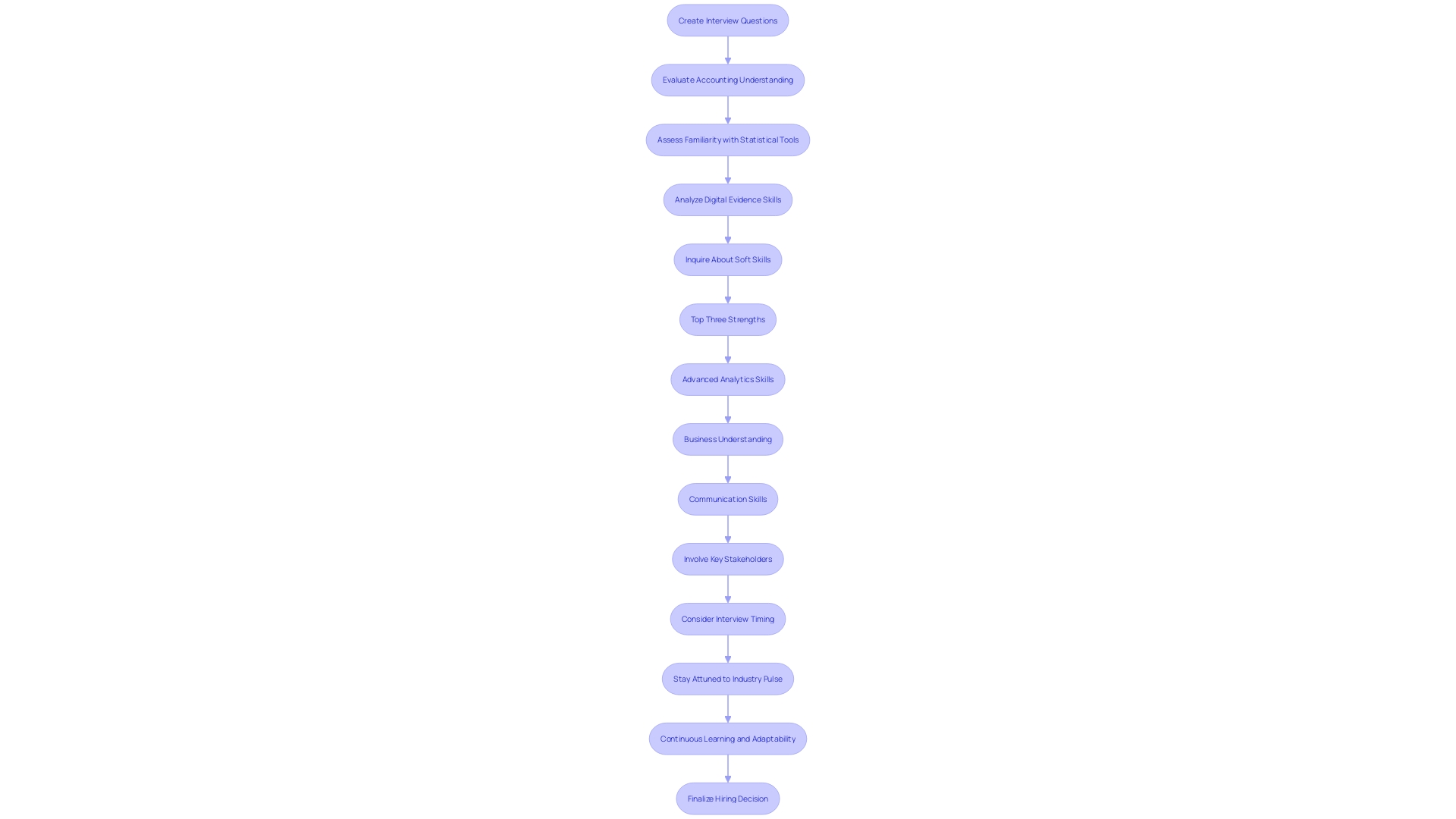

Hiring Process: Interview and Selection

When choosing an accountant specialized in financial investigation, the process goes beyond mere interviews; it requires a keen understanding of the candidate's technical prowess and how they'll mesh with your company's ethos. Start by creating interview questions designed to evaluate their understanding of accounting, such as their familiarity with statistical tools and digital evidence analysis, as demonstrated by the work of centers like CSAFE. This could include asking them to elaborate on their experience with open-source databases or how they stay current with research advancements.

In addition, it's crucial to inquire about their soft skills, requesting them to mention their top three strengths, which should ideally combine advanced analytics with other skills like business understanding and communication. To ensure you’re getting an accurate portrayal of their capabilities, consider structuring the interview with uniform questions and scenarios that reflect the complexities they’ll encounter.

The cultural fit is equally crucial. Insights from firms like De Grandpré Chait, which had to adapt quickly to the intricacies of cryptocurrency cases, underscore the importance of an investigative financial professional who can navigate complex, opaque scenarios with innovative solutions like Chainalysis.

Moreover, involve key stakeholders in the hiring process to gain a comprehensive perspective, and be mindful of the timing of your interviews; data suggests morning candidates may have a higher success rate. Lastly, staying attuned to the industry’s pulse is critical, as the sector is rapidly evolving with technology reshaping roles, making continuous learning and adaptability non-negotiable attributes for an accounting professional.

Retaining a Forensic Accountant: Privilege and Conflicts

Understanding and handling the complexities of accounting engagements necessitates a clear understanding and meticulous handling of privilege and conflicts of interest. Privilege is a legal term referring to a client's right to confidentiality, particularly in the context of legal advice. It ensures sensitive information disclosed during an investigation remains confidential, safeguarded from disclosure in legal proceedings. The importance of preserving this confidentiality cannot be exaggerated, as it supports the trust and integrity of the investigation in money matters.

At the same time, recognizing and resolving potential conflicts of interest is essential to maintain the independence and credibility of their findings. Conflicts of interest can arise in various forms, whether it's a pre-existing relationship with a party involved in the investigation or a financial interest that could bias the outcome. It is essential for financial investigators to reveal any such conflicts from the beginning and, if needed, to excuse themselves from the task to avoid any doubt about their impartiality.

The recent actions of PwC Australia, as reported by their chief executive Kevin Burrowes, demonstrate an industry-wide push towards higher ethical and professional standards. Their dedication to restoring confidence through openness and honesty reflects the fundamental principles that guide professionals in their practice. By dealing with advantage and conflicts of concern directly, accountants can maintain these principles, making sure their work withstands examination and contributes to the legal and monetary resolutions of the matters at hand.

Considering the advancement of fraud detection methods and the crucial role of anti-fraud controls, as emphasized in the 2024 Report to the Nations, the accounting profession specialized in investigation is rapidly adjusting. The integration of technology and data analytics is becoming increasingly prevalent, enhancing the capability to uncover complex financial schemes. This advancement emphasizes the importance for financial investigators to not only be thorough in their investigative efforts but to also stay alert in upholding ethical principles that promote trust and guarantee the reliability of their work.

Best Practices for Working with a Forensic Accountant

Establishing an effective partnership with an investigative accountant is not simply about hiring expertise; it's about creating a collaborative environment where both parties can work seamlessly towards a common goal. The key to this relationship lies in the clear articulation of expectations, granting unimpeded access to vital information, and fostering a dynamic of continuous communication.

Take the case of De Grandpré Chait law firm for instance, where they faced intricacies with cryptocurrency-related cases. These complexities called for specialized software and an alliance with Chainalysis. This not only provided the necessary tools but also a reliable communication channel that was crucial for problem-solving and process streamlining.

Similarly, Boerse Stuttgart Group's foray into the volatile crypto markets necessitated a dependable association with Chainalysis, which went beyond a mere vendor-client relationship to become a continuous collaboration, instrumental for compliance and informed decision-making.

In the domain of scientific investigation, as emphasized by recent progress, the incorporation of new technology into courtrooms requires thorough scientific reliability and comprehension of measurement uncertainties. This highlights the importance of collaboration with science professionals in the field of investigation and a cautious approach to technology adoption.

Accounting itself is a multifaceted discipline, focusing on the analysis, interpretation, and reporting of financial transactions. It's crucial for forensic financial experts to not just delve into the numbers but to provide strategic advice based on their findings. This is where a transparent and ongoing dialogue between the financial professional and the client becomes invaluable.

Reflecting the sentiment, investigators specializing in athletes' money disputes describe themselves as 'monetary firefighters,' emphasizing the intricate nature of their work and the significance of addressing monetary issues with a collaborative mindset.

While technical expertise is a given, the true worth of an investigative financial expert emerges when they are integrated into the fabric of the organization, similar to how Achilles Research Group approaches art-related crime with innovative research techniques and a collaborative spirit.

By examining these examples, it's clear that a forensic accountant's responsibility is not only to analyze monetary inconsistencies but to collaborate with their clients, offering understanding and direction in maneuvering the complex network of transactions. With this understanding, businesses can overcome challenges, resolve conflicts, and ultimately safeguard their economic integrity.

Common Applications of Forensic Accounting

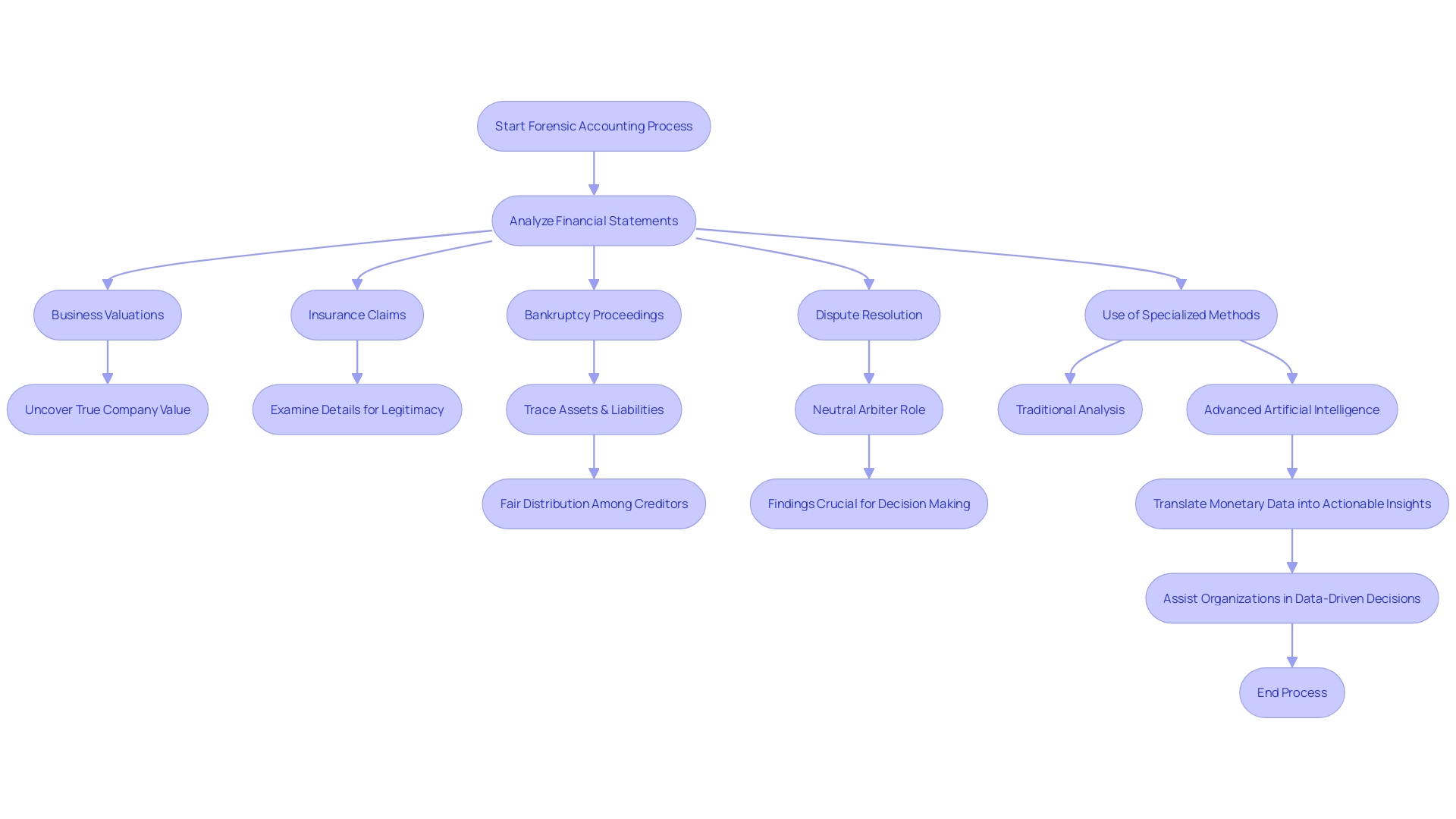

Forensic accounting extends its reach well beyond the realms of fraud detection and criminal investigations, playing a pivotal role in an array of monetary scenarios. Consider the careful work needed in business valuations, where financial experts analyze financial statements to uncover the true value of a company. Their analytical prowess is equally crucial in insurance claims, picking apart the details to ensure claims are legitimate and equitable. Bankruptcy proceedings rely heavily on their skills to trace assets and liabilities, ensuring fair distribution among creditors. In the tense arena of dispute resolution, financial investigators act as neutral arbiters, their findings often crucial in resolving conflicts. In each of these situations, specialized financial investigators utilize specific methods and approaches, utilizing technologies from traditional analysis to advanced artificial intelligence, as emphasized in the Anti-Fraud Technology Benchmarking Report. They are well-versed in the 'language of business'—finance and accounting—recognized for its complexity and nuance, and their expertise is priceless in translating monetary data into actionable insights, assisting organizations in making data-driven decisions. In the midst of a background of well-known accounting controversies and a continuously rising necessity for regulatory compliance, the responsibility of investigators of irregularities becomes even more crucial, guaranteeing honesty within economic ecosystems. This is emphasized by the efforts of professionals like Dr. Weber, who not only contribute to the field through research but also prepare the next generation to tackle misconduct. As organizations increasingly seek to protect their operations against white-collar crime, the demand for skilled financial investigators surges, despite a notable shortage in the market. Their work ensures that businesses can confidently navigate the complexities of the monetary world, secure in the knowledge that their fiscal practices withstand scrutiny and align with legal and ethical standards.

Final Considerations and Next Steps

After hiring an investigative accountant, it's essential to maintain a strong partnership. This collaboration will be the foundation of ensuring a comprehensive and successful investigation. Regular updates on the status of their work and their findings will not only keep you informed but also allow you to make timely decisions. When evaluating the results of the investigation, it's important to incorporate any suggestions into your monetary procedures to strengthen protections against monetary misconduct in the future.

For example, firms like De Grandpré Chait faced challenges with intricate cryptocurrency transactions that demanded specialized tools for clarity and compliance. Similarly, integrating solutions like Chainalysis can be a significant step in enhancing transparency and record-keeping. Additionally, law firms, such as the Canadian subsidiary focusing on cybersecurity, provide a relevant lesson: tailoring security measures to specific operational needs is vital. This approach ensures a proactive defense against potential breaches that could jeopardize sensitive information.

The significance of preparation cannot be exaggerated. As emphasized in the three-phase process described for client engagement, starting with the Data Prep phase is essential. This stage involves gathering all monetary documents, models, and customer data, which is a practice that can be replicated in the aftermath of a forensic accounting initiative. By having all the pertinent monetary information carefully organized and analyzed, you're paving the way for a clear understanding of your business's fiscal health and readiness for any subsequent audits or investigations.

Lastly, it is important to consider the cultural context within which monetary investigations occur. As noted, culture influences communication and social interactions, which can be particularly relevant during interviews and discussions following an investigation. Being mindful of these nuances can enhance rapport and cooperation, which is key to a successful outcome.

In essence, the journey doesn't end with the hiring of a forensic accountant; it's an ongoing path of vigilance, adaptation, and strategic implementation of learned lessons to fortify your financial foundation.

Conclusion

In conclusion, forensic accounting is a critical field that combines accounting, auditing, and investigative skills to uncover financial fraud and provide insights during legal disputes. With advanced technologies like machine learning and artificial intelligence, forensic accountants are equipped to handle large volumes of data and interpret their findings effectively.

Real-world cases and industry experts highlight the dynamic nature of forensic accounting and its importance in combating financial misconduct. By unraveling the stories hidden within financial numbers, forensic accountants provide essential evidence for legal proceedings and deliver expert testimony in court.

Understanding the need for a forensic accountant is crucial in today's business environment, where financial transparency and accuracy are paramount. Organizations must carefully assess their need for forensic accounting expertise to tackle financial challenges and maintain their standing in a vigilant marketplace.

When hiring a forensic accountant, consider their qualifications, skills, and industry expertise. Look for certifications like Certified Fraud Examiner (CFE) and specialized experience in legal and financial investigations.

Forensic accountants play a pivotal role in legal proceedings, providing litigation support and unraveling financial discrepancies. Their advanced investigative skills and techniques, coupled with technology and data analytics, enhance the effectiveness of investigations and contribute to proactive fraud prevention.

Selecting the right forensic accountant requires thorough vetting of their expertise, reputation, and references. Consider their professional history, achievements, and client testimonials.

Establishing an effective partnership with a forensic accountant is crucial. Clear communication, unimpeded access to information, and a collaborative environment are key to a successful financial investigation.

Forensic accounting extends beyond fraud detection, playing a pivotal role in business valuations, insurance claims, bankruptcy proceedings, and dispute resolution. Their expertise translates financial data into actionable insights, helping organizations make data-driven decisions.

After engaging a forensic accountant, maintaining a robust partnership is essential. Regular updates and integrating their recommendations into financial protocols bolster safeguards against financial improprieties.

In essence, by working collaboratively with a forensic accountant, organizations can confidently navigate the complexities of the financial world and safeguard their financial integrity.