Overview

This article delves into the critical process of hiring a professional services interim CFO, underscoring the significance of this role during transitional phases within organizations. It presents a comprehensive step-by-step guide for the hiring process, emphasizing the necessity for:

- Clear definitions of responsibilities

- Robust candidate evaluation criteria

- Identification of potential challenges to circumvent

This guidance is bolstered by compelling statistics and case studies that illustrate the increasing demand and strategic value of interim CFOs in effectively navigating financial complexities.

Introduction

In the fast-evolving landscape of corporate finance, the role of an interim CFO has emerged as a pivotal solution for organizations navigating periods of transition and uncertainty. These temporary financial executives step in during critical moments—whether due to the sudden departure of a permanent CFO, financial crises, or significant organizational changes like mergers and acquisitions. With their wealth of expertise, interim CFOs not only stabilize financial operations but also implement strategic adjustments that position companies for future growth. As the demand for interim leadership surges, understanding the unique responsibilities, benefits, and challenges associated with hiring an interim CFO becomes essential for businesses aiming to thrive in today's competitive environment.

Understanding the Role of an Interim CFO

A temporary CFO serves as a short-term executive, stepping in to manage a company's fiscal operations during critical transitional periods. Unlike a permanent CFO, who typically engages in long-term strategic planning, the temporary CFO prioritizes immediate economic stability and operational efficiency. This role is particularly vital during crises, such as the departure of a permanent CFO or significant organizational changes like mergers and acquisitions.

The responsibilities of a temporary CFO encompass:

- Conducting thorough financial assessments to identify opportunities for cash preservation and liability reduction

- Implementing necessary adjustments

- Preparing the organization for the eventual onboarding of a permanent CFO

The demand for temporary CFOs has surged, with an impressive 53% of temporary roles now filled by C-suite executives, reflecting a staggering 220% year-over-year increase in requests for temporary CEOs. This trend underscores the essential nature of securing temporary leadership to ensure organizational stability and drive success in a challenging labor market. As organizations navigate the complexities of mergers and acquisitions in 2025, the temporary CFO's role becomes increasingly crucial, providing the oversight required to facilitate seamless transitions and apply lessons learned from past challenges.

In addition to their immediate fiscal management duties, interim CFOs bring a wealth of expertise and leadership skills, enabling them to adapt swiftly to new environments. Their ability to implement strategic financial changes not only stabilizes the entity but also positions it for future growth. As Bill Klein, President of Consero Global, aptly notes, "Interim CFOs are essential in helping organizations focus on strategic priorities during times of transition."

This highlights the strategic significance of temporary CFOs in managing transitions and ensuring efficient decision-making processes.

Furthermore, the case study titled "Overcoming a Leadership Deficit" illustrates the impact of the labor shortage on the need for temporary CFOs, emphasizing that the lack of skilled labor has led to a substantial rise in demand for leadership positions across various sectors. As the landscape of financial management evolves, the contributions of temporary CFOs will remain indispensable in guiding companies through transitions and crises. With predictions for 2025 indicating a greater focus on FP&A reporting and an anticipated increase in M&A activity, the role of temporary CFOs will be more relevant than ever, particularly in leveraging real-time analytics to monitor business performance and drive effective turnaround strategies.

Transform Your Small/Medium Business provides extensive professional services for interim CFOs, including the Rapid-30 process, to ensure effective decision-making and ongoing oversight of business performance.

Key Responsibilities of an Interim CFO

The primary duties of a professional services interim CFO encompass various crucial functions necessary for managing economic challenges and ensuring organizational stability. These responsibilities include:

- Conducting a comprehensive review of the company's economic health, with a focus on cash flow analysis, budgeting, and forecasting. This thorough monetary evaluation is essential for recognizing opportunities to conserve cash and decrease liabilities, ensuring the entity is on a solid economic footing.

- Strategic Planning: Developing short-term monetary strategies is vital for stabilizing the organization and positioning it for future growth. This involves crafting actionable plans that align with the company's goals and market conditions, particularly in the dynamic landscape of 2025.

- The professional services interim CFO plays a critical role in identifying underlying business issues and planning solutions, which is essential for effective crisis management and turnaround strategies.

- Operational Oversight: Managing daily monetary operations is a core responsibility, including ensuring compliance with regulations, maintaining accurate financial reporting, and implementing best practices to enhance operational efficiency.

- In fact, nearly 25% of project resources in the industrial goods and services sector are allocated to temporary leadership efforts, underscoring the importance of effective oversight during transitional periods. Moreover, the global finance and accounting outsourcing market, valued at $60 billion, highlights the growing trend of organizations seeking professional services interim CFOs to improve efficiency and reduce costs.

- Team Leadership: A temporary CFO must guide the finance team efficiently, encouraging cooperation and ensuring that all monetary functions operate smoothly. Establishing trust within the team is crucial, as emphasized by industry expert Scott Hoover, who observes that 'a temporary CFO can be perceived as a threat, so it’s vital to invest significant time in gaining people's trust so they will follow your guidance.' Earning the team's trust is essential for successful leadership and for operationalizing turnaround lessons.

- Stakeholder Communication: Acting as a liaison between the finance department and other stakeholders, including the board of directors and investors, is a key responsibility. The acting CFO must keep these parties informed about the financial status and strategic initiatives, facilitating transparency and confidence in the entity's direction.

- Transition Planning: Preparing the entity for the transition to a permanent CFO with the help of professional services interim CFO is critical. This involves documenting processes and identifying potential candidates to ensure a seamless handover. As the temporary CFO's tenure concludes, a thorough assessment of the finance team and the documentation of key processes are essential for a smooth transition.

- Case studies, such as those on outsourced accounting services, illustrate that companies are progressively adopting these solutions to enhance efficiency and concentrate on core operations, highlighting the temporary CFO's role in facilitating such transitions.

- In 2025, the average length of temporary CFO engagements is anticipated to mirror the rising complexity of leadership roles, with organizations increasingly depending on these professionals to navigate them through crises and operational challenges. This complexity requires a strategic approach to fiscal leadership, further underscoring the significance of the temporary CFO's role in navigating these turbulent times.

When to Consider Hiring an Interim CFO

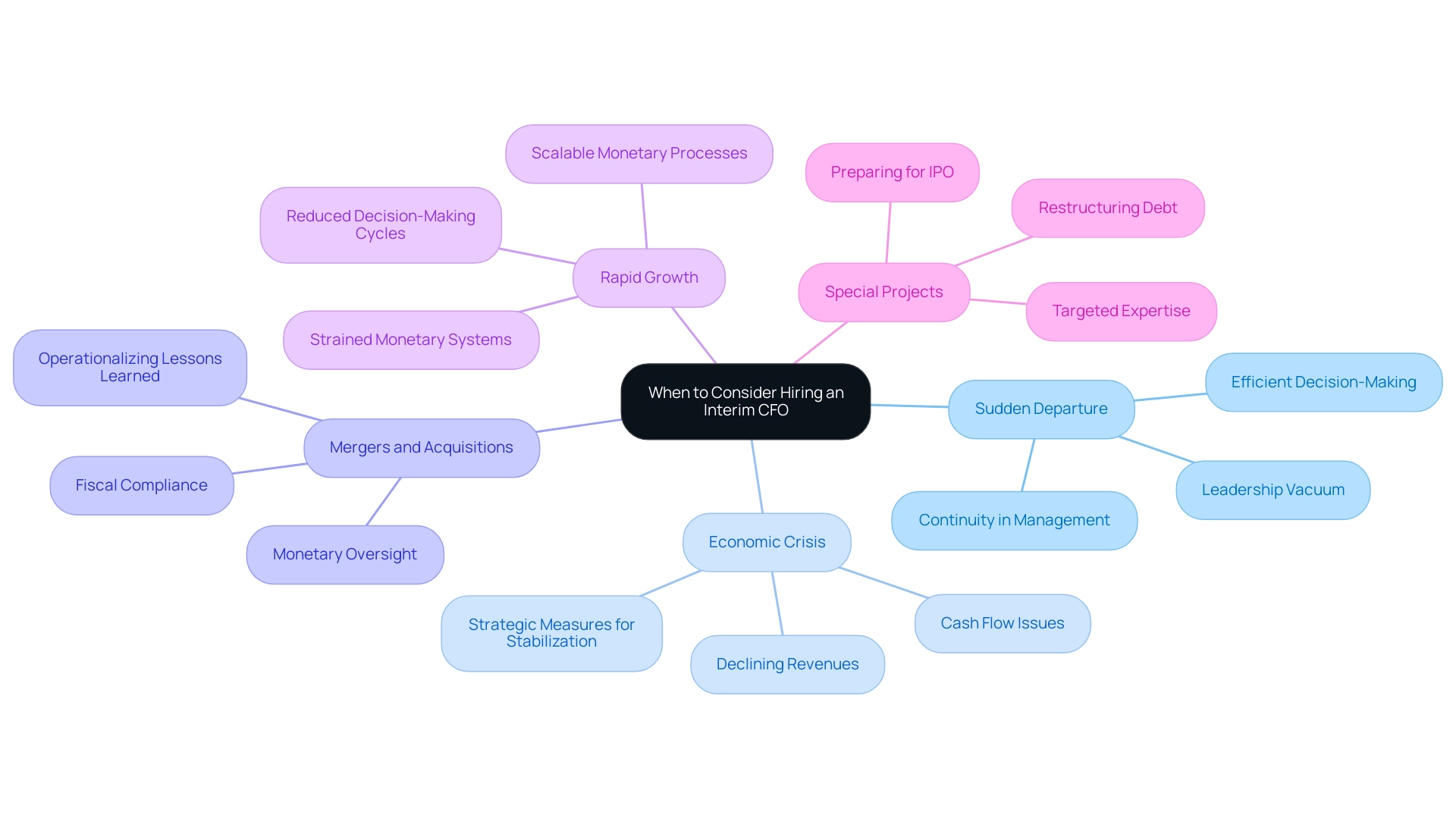

Consider hiring a temporary CFO in the following situations:

- Sudden Departure: The unexpected exit of a permanent CFO can create a leadership vacuum. A professional services interim CFO can quickly step in to ensure continuity in management and uphold stability during the transition, facilitating an efficient decision-making process that is vital during such times.

- Economic Crisis: Companies grappling with monetary challenges, such as declining revenues or cash flow issues, can greatly benefit from the immediate support of a professional services interim CFO. Their expertise allows for the implementation of strategic measures to stabilize the organization and guide it back to profitability, utilizing real-time analytics through the client dashboard to monitor performance and adjust strategies as needed.

- Mergers and Acquisitions: Significant corporate transitions, such as mergers or acquisitions, often require specialized monetary oversight. A professional services interim CFO can assist with the complexities of monetary integration and reporting, ensuring that all fiscal aspects are aligned and compliant during these critical changes, while also operationalizing lessons learned from previous experiences to enhance efficiency.

- Rapid Growth: Organizations experiencing rapid growth may find their existing monetary systems strained. A professional services interim CFO can assist in creating and executing scalable monetary processes that facilitate ongoing growth while preserving operational efficiency, ensuring that decision-making cycles are reduced to quickly adjust to shifting conditions.

- Special Projects: Specific financial initiatives, such as preparing for an IPO or restructuring debt, may necessitate specialized knowledge. A professional services interim CFO can provide the targeted expertise required to effectively navigate these complex projects, continuously monitoring business performance through real-time analytics via the client dashboard to ensure successful outcomes.

The demand for professional services interim CFOs has surged, with a reported 116% year-over-year growth in the need for these temporary leadership roles across various sectors, particularly in private equity and technology. As Adam Zaki noted, this trend underscores the increasing recognition of the value that professional services interim CFOs bring during pivotal moments in a company's lifecycle. Furthermore, case studies reveal that 44% of projects led by CEOs and presidents focused on temporary leadership roles, highlighting the critical nature of financial oversight during significant organizational changes, such as acquisitions, which often require professional services interim CFO.

By acknowledging the signs that suggest the necessity for a professional services interim CFO, businesses can prepare themselves for recovery and sustainable growth. It is essential to clearly define the role responsibilities and engagement duration when hiring a professional services interim CFO to ensure alignment with the organization's needs.

What to Look for in an Interim CFO Candidate

When assessing candidates for an interim CFO role, it is essential to consider the following criteria:

- Relevant Experience: Seek candidates with a demonstrated history in industries similar to your own, particularly those with experience in turnaround or crisis management situations. The demand for professional services interim CFO leadership has surged, with a 220% increase in interim CEO roles and a 78% rise in overall C-suite demand, highlighting the importance of relevant experience in navigating challenging environments.

- Financial Acumen: Candidates must exhibit robust financial skills, encompassing budgeting, forecasting, and financial reporting. This expertise is vital for making informed decisions that can stabilize and grow the entity during transitional periods. A pragmatic approach to data, including testing hypotheses, can deliver maximum return on invested capital in both the short and long term.

- Leadership Skills: The ability to lead and inspire a finance team is paramount, especially in times of uncertainty. Successful professional services interim CFOs often possess strong leadership capabilities that enable them to foster collaboration and drive performance, supporting a shortened decision-making cycle throughout the turnaround process.

- Adaptability: Look for candidates who can swiftly adjust to new challenges and environments. The evolving landscape of business necessitates leaders who can pivot strategies effectively in response to changing circumstances, continually updating and adjusting plans based on real-time business analytics provided through the client dashboard.

- Communication Skills: Strong interpersonal abilities are crucial for engaging with stakeholders and team members. Effective communication fosters transparency and trust, which are essential during periods of transformation, particularly when operationalizing lessons learned through the turnaround process.

- Strategic Vision: An ideal candidate should possess the foresight to craft and execute short-term strategies that align with the entity’s long-term objectives. This strategic alignment is critical for ensuring that immediate actions contribute to sustainable growth, supported by continuous monitoring of business performance through the client dashboard.

In 2025, the average experience of professional services interim CFOs in crisis management is increasingly becoming a focal point for organizations seeking to navigate financial challenges. Statistics indicate that successful temporary CFO candidates often hold advanced qualifications, further underscoring the importance of thorough evaluation during the hiring process. Notably, CFO job ads have seen a 238% surge in mentions of AI, reflecting current trends in hiring practices.

Furthermore, a case study titled 'Overcoming a Leadership Deficit' reveals that 53% of all temporary roles, particularly for positions like professional services interim CFO, are for C-suite positions, indicating a significant shift in leadership dynamics. Moreover, Adam Zaki reported a 116% year-over-year growth in demand for temporary leadership support roles, emphasizing the necessity for organizations to adapt their evaluation processes to secure the right talent capable of steering them through turbulent times.

A Step-by-Step Guide to Hiring an Interim CFO

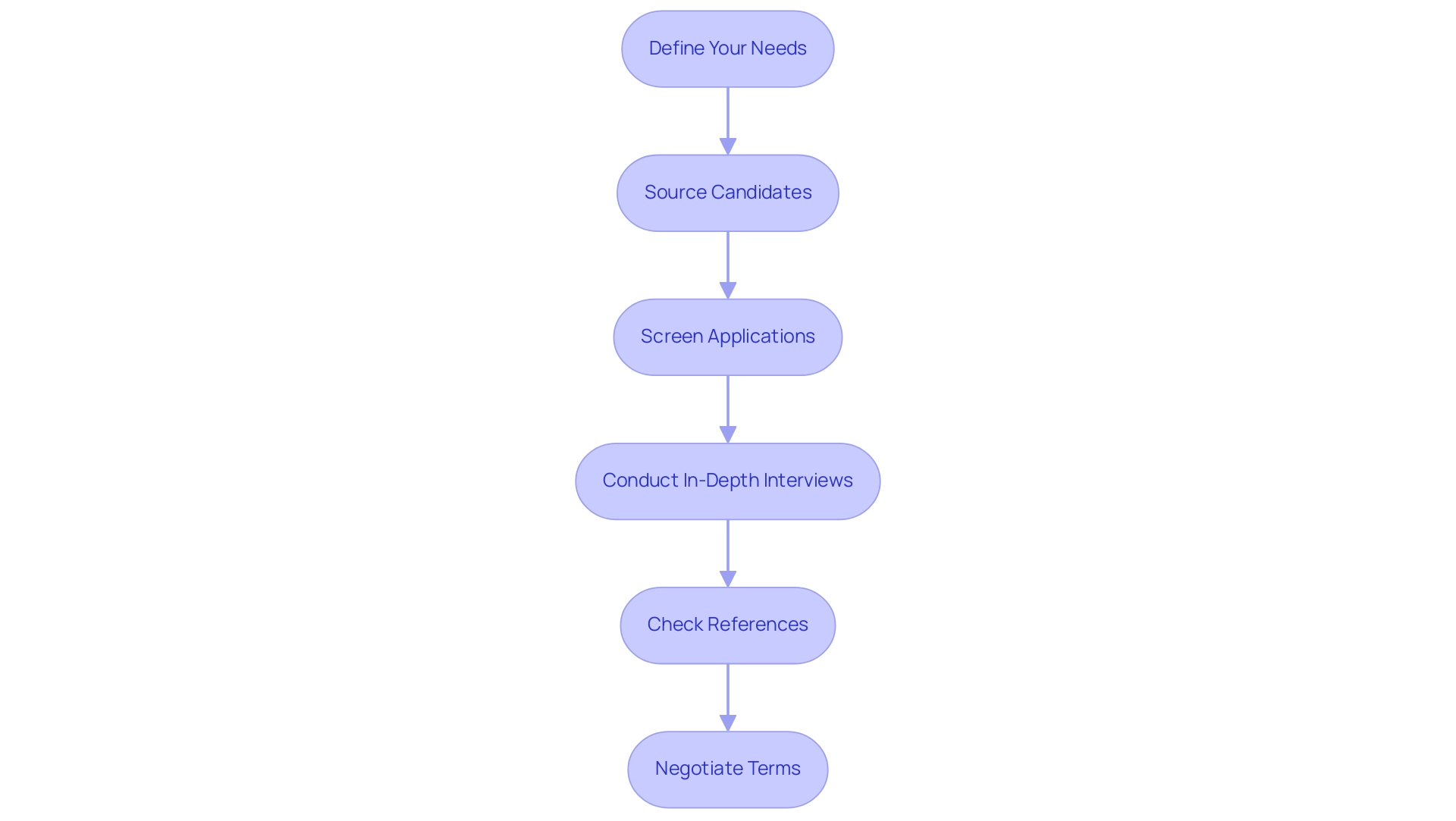

To effectively hire a temporary CFO, follow these comprehensive steps:

- Define Your Needs: Begin by clearly outlining the specific challenges and objectives you want the interim CFO to address. This could involve economic restructuring, cash flow management, or strategic planning, ensuring alignment with your organization's goals. Create a Job Description: Develop a detailed job description that encompasses the responsibilities, required skills, and desired experience. Highlight the importance of strategic financial leadership, particularly in guiding the company through significant transactions such as mergers and acquisitions.

- Source Candidates: Utilize a variety of channels to find potential candidates, including professional networks, recruitment agencies, and online platforms. Engaging with specialized firms can also yield candidates with relevant industry experience.

- Screen Applications: Review resumes meticulously and conduct initial interviews to shortlist candidates who meet your criteria. Look for candidates with a proven track record in temporary roles, as these positions typically last from three months to two years, with most engagements averaging six to eight months. Conduct In-Depth Interviews: Assess candidates' skills, experience, and cultural fit through structured interviews. This is an opportunity to evaluate their ability to leave a comprehensive assessment of the finance team, outlining strengths and weaknesses, and to identify risk areas in the financials, as noted by Ainsworth. Additionally, inquire about their experience with testing hypotheses to deliver maximum return on invested capital and utilizing real-time analytics through the client dashboard to inform decision-making processes.

- Check References: Verify candidates' backgrounds and past performance by contacting references. This step is crucial to ensure that the candidate has successfully navigated similar challenges in previous roles, particularly in operationalizing lessons learned during turnaround situations.

- Negotiate Terms: Discuss and agree on the terms of engagement, including duration, compensation, and specific deliverables. Be clear about expectations to foster a productive working relationship.

- Onboard the Temporary CFO: Provide the necessary resources and information to help the temporary CFO adjust to the company swiftly. Conduct regular progress reviews with key stakeholders to ensure the transition remains on track and to address any emerging issues. This collaborative approach promotes alignment and timely adjustments during the transition, ultimately leading to successful outcomes. Furthermore, consider utilizing the professional services of an interim CFO from Transform Your Small/Medium Business for tasks such as ERP rollouts and fiscal health assessments to improve the efficiency of the temporary CFO in your company.

Benefits of Engaging an Interim CFO for Your Business

Engaging an interim CFO offers a multitude of advantages that can significantly benefit organizations, especially in today's dynamic business environment.

- Immediate Expertise: Interim CFOs bring specialized skills and extensive experience that can be immediately applied to tackle urgent monetary challenges. Their ability to quickly assess and address issues ensures that businesses can navigate crises effectively. Candidates within the BluWave network are pre-vetted with multiple references before being recommended, guaranteeing access to top-tier talent.

- Cost-Effectiveness: Opting for an interim CFO frequently proves more affordable than hiring a full-time executive, particularly for organizations with short-term monetary needs. This approach allows companies to obtain high-level expertise from a professional services interim CFO without the long-term financial commitment associated with permanent hires.

- Flexibility: Interim CFOs can be engaged for specific projects or defined timeframes, providing businesses with the flexibility to scale their financial leadership according to evolving needs. This adaptability is especially beneficial for small to medium-sized enterprises that may not require a full-time CFO.

- Objective Perspective: A temporary CFO offers an impartial evaluation of the company's economic landscape, identifying areas for improvement free from the influence of internal politics. This fresh perspective can be crucial for implementing effective financial strategies and driving transformational change.

- Focus on Results: Interim CFOs are typically results-driven, emphasizing the achievement of specific outcomes within a set timeframe. Their commitment to delivering measurable results aligns with the overarching goal of helping businesses overcome challenges and achieve sustainable growth. They support a shortened decision-making cycle throughout the turnaround process, empowering teams to take decisive action to preserve business health.

As we look toward 2025, the trend of employing professional services interim CFOs continues to gain traction, as many organizations recognize the strategic advantages they provide. Statistics indicate that businesses utilizing a professional services interim CFO often experience enhanced efficiency and growth potential, particularly when balancing internal staff with outsourced expertise. For instance, a case study on outsourced accounting illustrates how a strategic mix of internal and external resources can optimize financial operations, allowing companies to focus on core business objectives while managing costs effectively.

As Scott Slatton, Managing Director, aptly states, "People aren’t looking for a temporary executive to come in and bark orders. Anybody can do that." This perspective underscores the importance of temporary CFOs in fostering collaboration and achieving success.

Their role in continually monitoring business health through real-time analytics via a client dashboard and operationalizing lessons learned is pivotal in driving success for both companies and nonprofits alike. Transform Your Small/Medium Business is dedicated to leveraging these advantages to maximize return on invested capital.

Challenges to Avoid When Hiring an Interim CFO

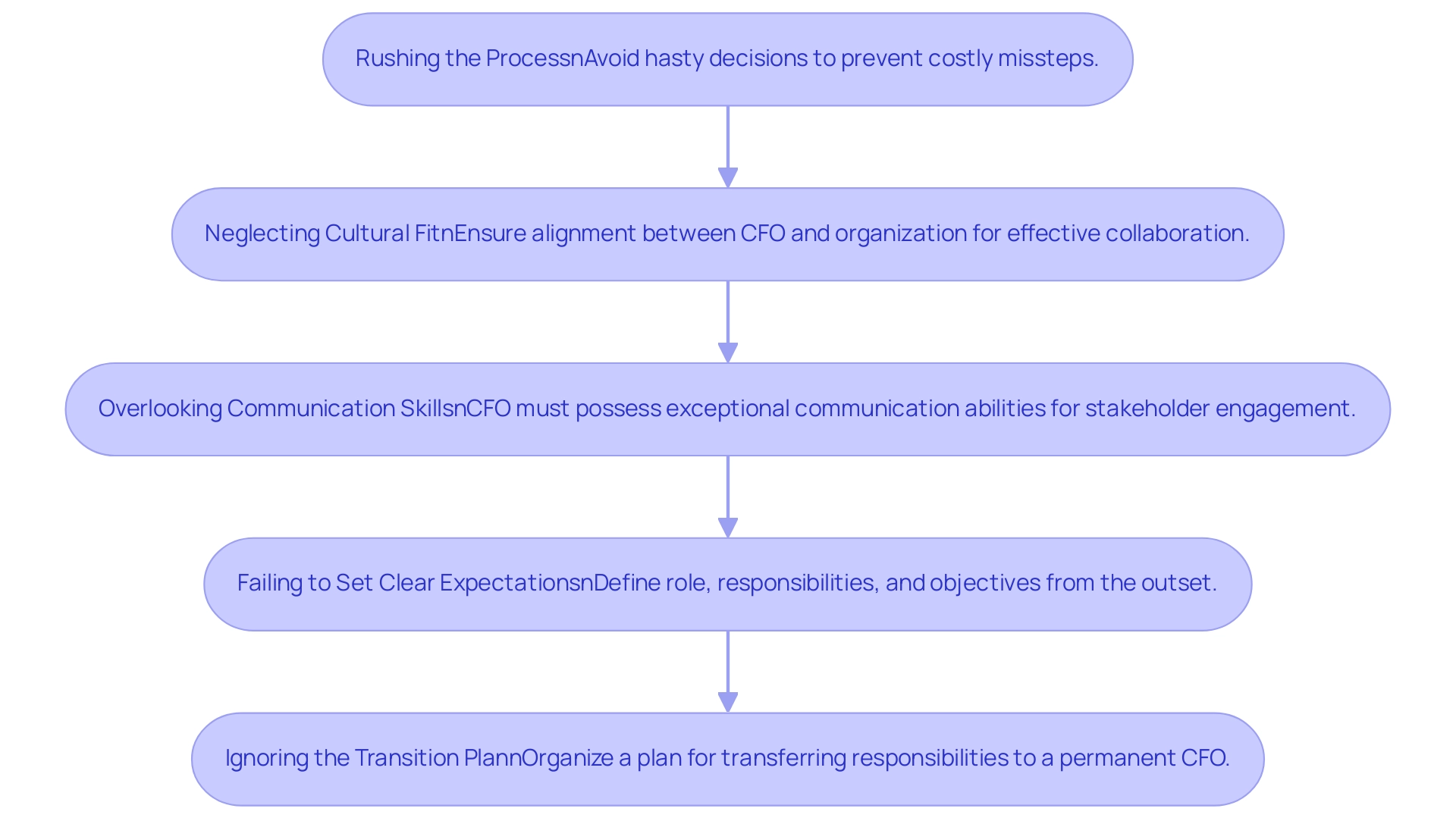

When hiring an interim CFO, organizations must navigate several key challenges to ensure a successful placement:

- Rushing the Process: It is crucial to avoid hasty decisions. Taking the time to thoroughly vet candidates can prevent costly missteps and ensure a strong match for the company. Virtual CFOs typically cost businesses an average of $40,000 to $60,000 annually, making it essential to make informed hiring choices.

- Neglecting Cultural Fit: While technical skills are vital, the cultural alignment between the CFO and the organization is equally important. A strong cultural fit fosters effective collaboration and enhances team dynamics, which is essential for driving financial strategies.

- Overlooking Communication Skills: An interim CFO must possess exceptional communication abilities. This role requires not only leading the finance team but also engaging effectively with stakeholders across the organization. As Christian DeChurch, CFO of Centri Business Consulting, notes, "the data output from the new tech stack will need an analyst mindset, not number crunchers." Clear communication can significantly impact the success of financial initiatives.

- Failing to Set Clear Expectations: Defining the temporary CFO's role, responsibilities, and objectives from the outset is critical. Clear expectations help prevent misunderstandings and ensure that both the temporary CFO and the entity are aligned on goals and deliverables.

- Ignoring the Transition Plan: A well-organized transition plan is crucial for transferring responsibilities to a permanent CFO after the temporary period. This strategy should detail key milestones and ensure continuity in budgetary leadership, minimizing disruption to the entity.

By addressing these challenges proactively, organizations can enhance their chances of successfully integrating a professional services interim CFO who not only meets immediate financial needs but also contributes to long-term growth. The benefits of hiring virtual CFOs, as highlighted in the case study "Benefits of Virtual CFO Services," include substantial cost savings and improved decision-making, further supporting the need for a structured hiring process.

Conclusion

The role of an interim CFO has become increasingly vital in today's corporate landscape, particularly as organizations face transitions and uncertainties. From managing sudden departures to guiding financial recoveries during crises, interim CFOs provide immediate expertise and leadership that stabilize operations while positioning companies for future growth. Their responsibilities encompass financial assessments, strategic planning, and operational oversight, all tailored to address the unique challenges each organization encounters.

Hiring an interim CFO can offer numerous benefits, including cost-effectiveness, flexibility, and an objective perspective that fosters transformational change. However, it is crucial for companies to approach this process thoughtfully, avoiding common pitfalls such as rushing the hiring decision or overlooking the importance of cultural fit and communication skills. By clearly defining needs and expectations, organizations can ensure that they select the right candidate who not only meets immediate financial demands but also contributes to long-term success.

As the demand for interim CFOs continues to rise, understanding their unique advantages and challenges becomes essential for businesses navigating a complex financial environment. Engaging an interim CFO is not just a stopgap solution; it is a strategic move that can drive efficiency, enhance decision-making, and ultimately support sustainable growth in an ever-evolving marketplace. Now is the time for organizations to recognize the value of interim financial leadership and leverage it to thrive amidst uncertainty.

Frequently Asked Questions

What is the role of a temporary CFO?

A temporary CFO serves as a short-term executive responsible for managing a company's fiscal operations during critical transitional periods, focusing on immediate economic stability and operational efficiency.

When is a temporary CFO particularly needed?

A temporary CFO is especially vital during crises, such as the departure of a permanent CFO or significant organizational changes like mergers and acquisitions.

What are the main responsibilities of a temporary CFO?

The responsibilities include conducting financial assessments, implementing adjustments, preparing for the onboarding of a permanent CFO, managing daily monetary operations, and ensuring compliance with regulations.

How has the demand for temporary CFOs changed recently?

The demand for temporary CFOs has surged, with a 53% increase in temporary roles filled by C-suite executives and a 220% year-over-year increase in requests for temporary CEOs.

What skills do interim CFOs bring to an organization?

Interim CFOs bring expertise and leadership skills that enable them to adapt quickly, implement strategic financial changes, and stabilize the organization for future growth.

What is the significance of temporary CFOs in the context of financial management?

Temporary CFOs are essential for managing transitions, ensuring efficient decision-making, and guiding organizations through crises, particularly in a challenging labor market.

What does the case study "Overcoming a Leadership Deficit" highlight?

It emphasizes the impact of the labor shortage on the rising demand for temporary CFOs, indicating that the lack of skilled labor has increased the need for leadership positions across various sectors.

What are the anticipated trends for the role of temporary CFOs in 2025?

Predictions indicate a greater focus on financial planning and analysis (FP&A) reporting and an increase in mergers and acquisitions activity, making the role of temporary CFOs more relevant for leveraging real-time analytics and driving effective turnaround strategies.

What are some specific tasks a temporary CFO might undertake?

Specific tasks include cash flow analysis, budgeting, strategic planning, operational oversight, team leadership, stakeholder communication, and transition planning for the eventual onboarding of a permanent CFO.

How do temporary CFOs contribute to team dynamics?

They must guide the finance team, establish trust, and ensure smooth operations, as trust is crucial for effective leadership and implementing turnaround strategies.