Introduction

In a landscape marked by financial uncertainty and operational challenges, restructuring consulting emerges as a critical lifeline for organizations striving to regain stability and foster growth. As businesses face mounting pressures from high interest rates and evolving regulations, the expertise of restructuring consultants becomes indispensable.

These professionals not only conduct in-depth financial assessments but also devise tailored strategies that address unique operational weaknesses. With a keen focus on enhancing liquidity and minimizing risk, the role of restructuring consultants is evolving, creating a demand for skilled individuals ready to navigate complex financial terrains.

This article delves into the nuances of restructuring consulting, exploring essential skills, exit opportunities, and strategic networking approaches that can empower professionals to thrive in this dynamic field.

Understanding Restructuring Consulting: An Overview

Restructuring consulting exit opportunities play a crucial role in assisting organizations dealing with financial distress or operational inefficiencies, particularly given the high interest rates and regulatory pressures anticipated to challenge healthcare providers in 2024. Experts in this field conduct thorough financial assessments to identify opportunities for cash preservation and liability reduction, which can lead to improved liquidity and reduced financial risk. This process also includes bankruptcy case management, ensuring that businesses have a comprehensive strategy for navigating financial challenges.

By pinpointing operational weaknesses and proposing actionable strategies aimed at stabilization and growth, we tailor our approach to the unique challenges faced by small to medium businesses and create restructuring consulting exit opportunities. As Aarti Dhapte highlights,

Financial Restructuring is expected to have the largest share of the Global Capital Restructuring Service Market in 2023, underscoring the demand for these services amid a complex economic landscape.

Moreover, our client engagement process begins with a comprehensive business review to align key stakeholders, allowing for collaborative planning that tests hypotheses, facilitates quick decision-making, and leverages real-time analytics.

This strategic approach is essential for effectively navigating the complexities of financial turnaround, ensuring long-term survival and operational efficiency in a dynamic market.

Key Skills and Qualifications for Restructuring Consultants

Successful restructuring experts are distinguished by a robust foundation in financial analysis, strategic planning, and project management. In 2024, the demand for key skills such as problem-solving, analytical thinking, and effective communication continues to rise, particularly in the context of business turnaround strategies. An MBA or relevant certifications in finance or management can significantly enhance a consultant's credibility, positioning them as credible candidates in competitive markets.

For instance, professionals like James, who moved from a Loan Restructuring Team at a regional bank to investment banking, demonstrate that practical experience in financial positions is highly valued, especially when paired with relevant skill sets. Brian notes that elite boutiques and local firms play a significant role in the banking side, emphasizing the importance of aligning with reputable organizations. Furthermore, successful advisors implement a comprehensive business review to engage clients, which includes specific processes for identifying underlying business issues.

They utilize real-time analytics to monitor performance and swiftly adjust strategies based on the insights gathered. Additionally, they are committed to operationalizing the lessons learned through the turnaround process, ensuring that these insights are integrated into future strategies. Statistics indicate that applicants frequently experience 12 or more interviews, with 10 concentrated on evaluating their backgrounds in retail, highlighting the competitive aspect of the job market for reorganization specialists.

Grasping these qualifications and the operational strategies used in reorganization enables individuals to strategically customize their personal and professional development efforts. By concentrating on vital skills and adopting a practical method for evaluating hypotheses and making decisions, aspiring professionals can effectively position themselves for profitable exit opportunities, ensuring they meet the changing requirements of the industry.

Exploring Exit Opportunities in Restructuring Consulting

Restructuring consultants benefit from various restructuring consulting exit opportunities, including roles in corporate finance, business development, and operational management. Many professionals find themselves well-prepared to step into executive positions such as Chief Financial Officer (CFO) or Chief Operating Officer (COO) within organizations that are actively seeking restructuring consulting exit opportunities while implementing effective reorganization strategies. Given the high interest rates and regulatory pressures facing healthcare providers in 2024, the need for executives with experience in organizational changes will be essential in managing these challenges.

For instance, healthcare companies are advised to act quickly in their strategic planning to maintain options for addressing potential problems, as highlighted in a recent case study on strategic adaptability. Companies that stress test their assumptions and prepare for downside scenarios will be better positioned to navigate complex distressed situations. By utilizing real-time business analytics and operationalizing lessons learned, organizations can streamline their decision-making processes and enhance performance monitoring.

This includes a shortened decision-making cycle, allowing teams to act decisively. Furthermore, some advisors choose to leverage their expertise by launching their own firms or focusing on specialized markets, such as retail or hospitality. As Brian from M&I observes, elite boutiques are playing a crucial part in the banking sector, which further highlights the significance of consultants for reorganization in the current landscape.

Understanding these pathways, along with a commitment to developing strong lasting relationships, is crucial for individuals aiming to align their skills and experiences with their long-term career aspirations, ensuring they remain competitive in an evolving landscape.

Navigating the Transition: Steps to Pursue Exit Opportunities

To successfully navigate the transition from restructuring consulting exit opportunities to new roles, start by thoroughly assessing your career goals and pinpointing positions that complement your existing skills. It's important to recognize that while 80% of people over the age of 45 consider a change in careers, only 6% actually pursue it, highlighting the challenges faced during such transitions. In today’s competitive job market, updating your resume and LinkedIn profile is essential; ensure they accurately reflect your consulting experience while emphasizing transferable skills.

Given that 80% of workers recognize the importance of a traditional work setting for career advancement, it's crucial to position yourself effectively. This aligns with the Deloitte finding that leaders and managers significantly impact the culture of flexibility, which is increasingly valued in organizations. Seeking mentorship from industry experts can provide invaluable guidance and insights during this transition.

Furthermore, consider pursuing additional education or certifications that can bolster your qualifications for your target roles. With 71% of workers stating that work interferes with their personal lives, understanding the importance of a balanced lifestyle can enhance your appeal to potential employers. Networking is vital—actively participate in industry events and connect with professionals in your field to uncover job openings.

Remember, 35% of the American workforce now consists of independent workers, including consultants, signaling a shift in how careers are structured. The case study of wind turbine service technicians exemplifies the evolution of job markets, as this position is projected to see significant growth, driven by the need to replace retiring workers and those transitioning to new careers. Embrace this change and leverage your connections to facilitate a smooth transition into your next role.

The Role of Networking in Securing Exit Opportunities

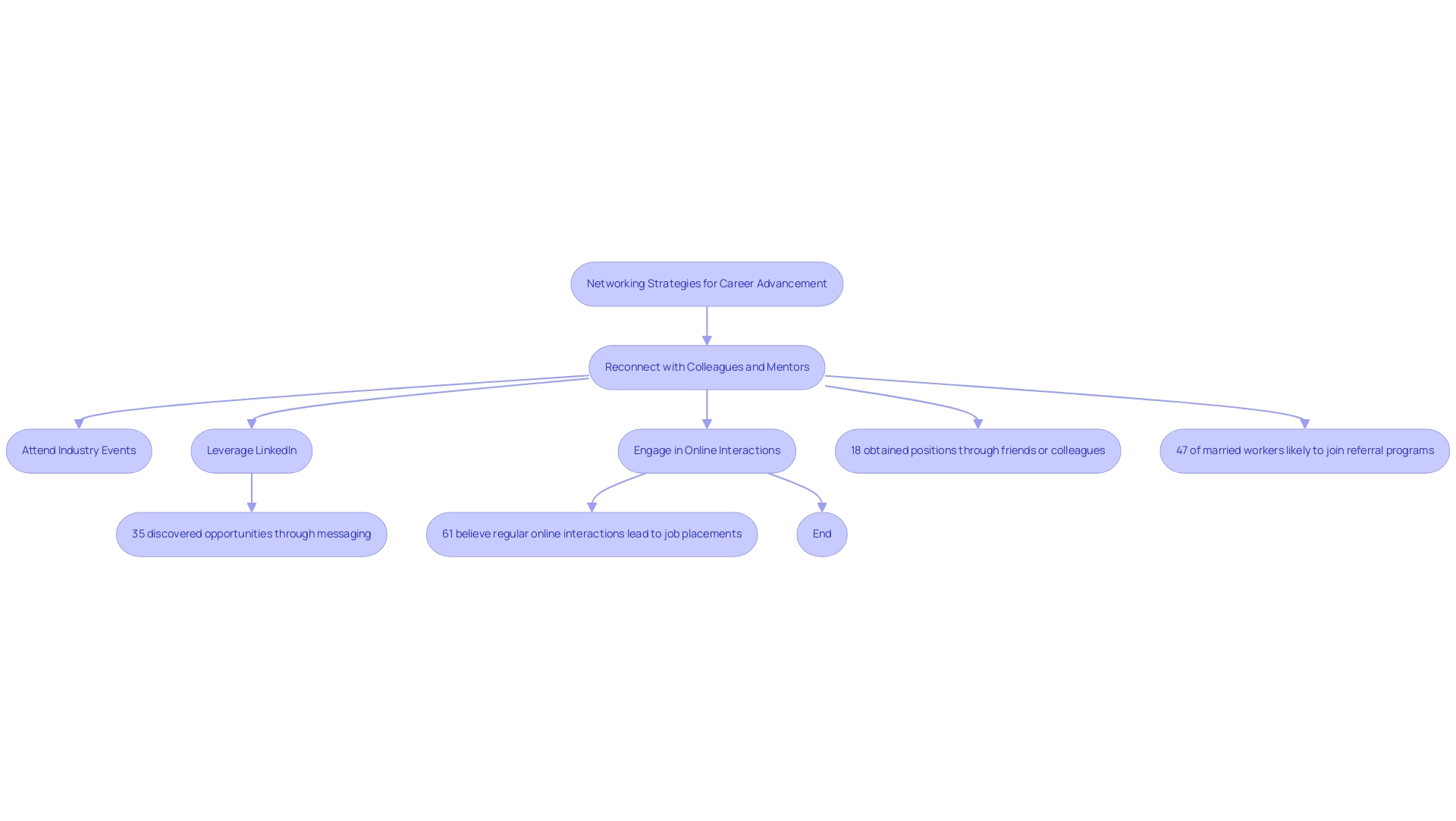

Networking is essential for securing restructuring consulting exit opportunities and advancing your career. Start by reconnecting with former colleagues, industry contacts, and mentors, clearly communicating your career aspirations to expand your reach. Attend industry conferences, workshops, and seminars to build connections with individuals in your Target Field.

Furthermore, leverage social media platforms like LinkedIn, which has been shown to be highly effective for networking. A 2017 study revealed that:

- 35% of LinkedIn users discovered new opportunities through messaging.

- 61% believe that regular online interactions can lead to job placements.

It’s important to note that a study found women had 25% fewer LinkedIn connections than men, highlighting the need for strategic engagement in networking to overcome potential barriers.

Additionally, with 47% of married workers likely to join their company’s referral program, personal connections play a significant role in job searches. This highlights that establishing a strong occupational network can uncover job opportunities that frequently stay unadvertised. With 18% of workers obtaining their current positions through friends or former colleagues, investing time in networking strategies is a crucial tactic for career advancement and securing restructuring consulting exit opportunities in 2024 and beyond.

The case study titled 'Online Networking Success' further illustrates this point; LinkedIn serves as a platform where professionals can engage in casual conversations that lead to job opportunities, showcasing the practical benefits of online networking.

Conclusion

Restructuring consulting stands as a vital resource for organizations navigating financial turmoil and operational inefficiencies, particularly as economic pressures mount. The comprehensive financial assessments and tailored strategies offered by these consultants not only pave the way for enhanced liquidity but also mitigate risks associated with market volatility. The demand for skilled professionals in this field is on the rise, underscoring the importance of mastering essential skills such as:

- Financial analysis

- Strategic planning

- Effective communication

As restructuring consultants explore exit opportunities, the landscape reveals numerous pathways to career advancement, from executive roles in corporate finance to entrepreneurial ventures. The ability to adapt and leverage real-time analytics will be critical for professionals seeking to thrive in this dynamic environment. By fostering strong relationships and staying attuned to industry trends, those in restructuring consulting can align their expertise with the needs of organizations poised for growth.

In this fast-evolving job market, proactive networking and continuous professional development play a pivotal role in securing future roles. By embracing these strategies and focusing on personal and professional growth, restructuring consultants can navigate transitions effectively and position themselves for success in a landscape that demands agility and resilience. The time to act is now—equip yourself with the necessary tools, insights, and connections to not only survive but thrive in the world of restructuring consulting.

Frequently Asked Questions

What role does restructuring consulting play in financial distress situations?

Restructuring consulting assists organizations facing financial distress or operational inefficiencies by conducting thorough financial assessments to identify cash preservation and liability reduction opportunities, which can improve liquidity and reduce financial risk.

What specific services are included in restructuring consulting?

Services include bankruptcy case management and the development of comprehensive strategies for navigating financial challenges, as well as identifying operational weaknesses and proposing actionable strategies for stabilization and growth.

Why is there an increased demand for financial restructuring services in 2023?

Financial restructuring services are in high demand due to the complex economic landscape, including high interest rates and regulatory pressures anticipated to challenge healthcare providers.

How does the client engagement process work in restructuring consulting?

The client engagement process begins with a comprehensive business review to align key stakeholders, facilitating collaborative planning that tests hypotheses, enables quick decision-making, and leverages real-time analytics.

What skills are essential for successful restructuring consultants in 2024?

Essential skills include problem-solving, analytical thinking, effective communication, financial analysis, strategic planning, and project management.

How can educational qualifications impact a restructuring consultant's career?

An MBA or relevant certifications in finance or management can enhance a consultant's credibility and position them as competitive candidates in the job market.

What practical experience is valued in restructuring consulting roles?

Experience in financial positions, such as roles in loan restructuring or investment banking, is highly valued, especially when combined with relevant skill sets.

What is the significance of implementing a comprehensive business review in restructuring consulting?

A comprehensive business review helps engage clients by identifying underlying business issues and allows for the utilization of real-time analytics to monitor performance and adjust strategies accordingly.

How does the job market look for restructuring specialists?

The job market is competitive, with applicants often experiencing 12 or more interviews, particularly focusing on their backgrounds in retail and relevant experience in restructuring.

How can aspiring professionals prepare for exit opportunities in restructuring consulting?

Aspiring professionals can position themselves for profitable exit opportunities by focusing on vital skills, adopting practical methods for hypothesis evaluation, and aligning their personal and professional development efforts with industry requirements.