Overview

The article focuses on providing a step-by-step guide for implementing cash flow management turnaround services in Texas, emphasizing the importance of effective financial oversight for business sustainability. It supports this by detailing strategies such as financial assessments, cost reduction, and the use of technology, which are essential for improving liquidity and adapting to economic challenges faced by Texas enterprises.

Introduction

In the dynamic business landscape of Texas, where economic conditions are anything but predictable, mastering cash flow management is not just beneficial—it's essential for survival. As small businesses face unprecedented challenges, including a staggering closure rate of 23.2% within a year of opening, the urgency to implement robust cash flow strategies has never been clearer.

With complications arising from seasonal fluctuations, shifting consumer preferences, and fierce competition, organizations must take a proactive stance, ensuring they maintain liquidity and seize growth opportunities. By delving into effective cash flow management practices, businesses can safeguard their financial health and enhance their resilience against economic downturns.

This article outlines actionable strategies, critical performance indicators, and the role of technology in transforming cash flow management into a powerful tool for success.

Understanding the Importance of Cash Flow Management in Texas

In Texas, where economic circumstances can vary greatly among different sectors, utilizing is crucial for mastering and ensuring organizational sustainability. This strategic approach enables companies to maintain liquidity, fulfill operational expenses, and capitalize on growth opportunities. Recent statistics indicate that 23.2% of were shut down by March 2023, highlighting the significant risks associated with establishing strong in a competitive marketplace.

Alarmingly, 37% of small business owners have considered shutting down their operations in the past year due to , highlighting the urgent need for cash flow management turnaround services in Texas. Seasonal fluctuations, shifts in consumer preferences, and heightened competition complicate financial flow dynamics, necessitating a proactive management approach for survival. Businesses must consistently assess cash inflows and outflows, accurately forecast future cash needs, and proactively identify potential shortfalls by utilizing cash flow management turnaround services in Texas.

For instance, understanding that the is $52,158 can enhance . By prioritizing streamlined decision-making and leveraging real-time analytics through our client dashboard, Texas enterprises can significantly improve their while utilizing cash flow management turnaround services in Texas to enhance resilience against economic downturns. Our team advocates for a shortened decision-making cycle during the , enabling your team to take decisive action to safeguard your enterprise.

As emphasized in a 2018 McKinsey report, varied leadership methods not only enhance profits but also improve overall business performance, making it essential for Texas firms to utilize cash flow management turnaround services in Texas that are customized to their specific challenges.

Step-by-Step Strategies for Implementing Cash Flow Management Turnaround Services

- Perform a : Begin by reviewing your existing monetary statements to evaluate your financial well-being. Identify recurring patterns in income and expenses, paying special attention to peak and low periods. This foundational analysis is crucial for creating a strong , as 80% of unsuccessful enterprises are associated with insufficient revenue forecasting and the need for . Additionally, be mindful that an excessively low current ratio may lead to struggles in covering short-term debts, while a high ratio may indicate inefficient asset use.

- Create : Utilize historical data alongside anticipated market changes to craft your . Consider projected sales, expenses, and possible fluctuations due to seasonality or industry trends. Precise forecasts are essential; however, the typical financial projection accuracy in small enterprises frequently lacks adequacy, highlighting the necessity for careful planning and cash flow management turnaround services in Texas. A case study on assisting monetary forecasting and adjustment plans illustrates that effective forecasting, combined with real-time analytics, is vital for financial planning and resilience, enabling businesses to develop contingency plans for potential shortfalls. Testing hypotheses about various scenarios can further refine these projections.

- Implement : Pinpoint areas for cost reduction without compromising quality or service. This may involve renegotiating supplier contracts, minimizing overhead, or optimizing operations. Engaging in these strategies can significantly improve your bottom line while incorporating cash flow management turnaround services in Texas and maintaining operational integrity.

- Enhance Revenue Collection Processes: Streamline your accounts receivable by establishing clear payment terms and diligently following up on overdue invoices. Consider incentivizing quicker payments by offering discounts for early settlements, as effective cash flow management turnaround services in Texas are essential for financial management.

- Optimize Inventory Management: Align your inventory levels with sales forecasts to prevent excess stock that can deplete financial resources. Implement just-in-time inventory practices to ensure that capital is not unnecessarily tied up, enhancing your liquidity.

- Establish a : Create a reserve fund to handle unforeseen expenses or financial downturns. This financial buffer will support cash flow management turnaround services in Texas, helping to absorb shocks and ensuring smoother operations during challenging times.

- Engage in : Schedule consistent assessments of your financial strategies to evaluate their effectiveness and make necessary adjustments. Frequent evaluations encourage a forward-thinking strategy, enabling prompt adjustments that can strengthen financial durability with cash flow management turnaround services in Texas.

By applying these tactics, organizations can greatly improve their , ensuring an efficient decision-making process and ongoing performance assessment. Furthermore, using a client dashboard can offer real-time insights into , enabling improved decision-making. Richard Hamm, a valued specialist in banking education, highlights the significance of strong financial practices, asserting, 'Effective liquidity oversight is essential for navigating the intricacies of today's corporate landscape.

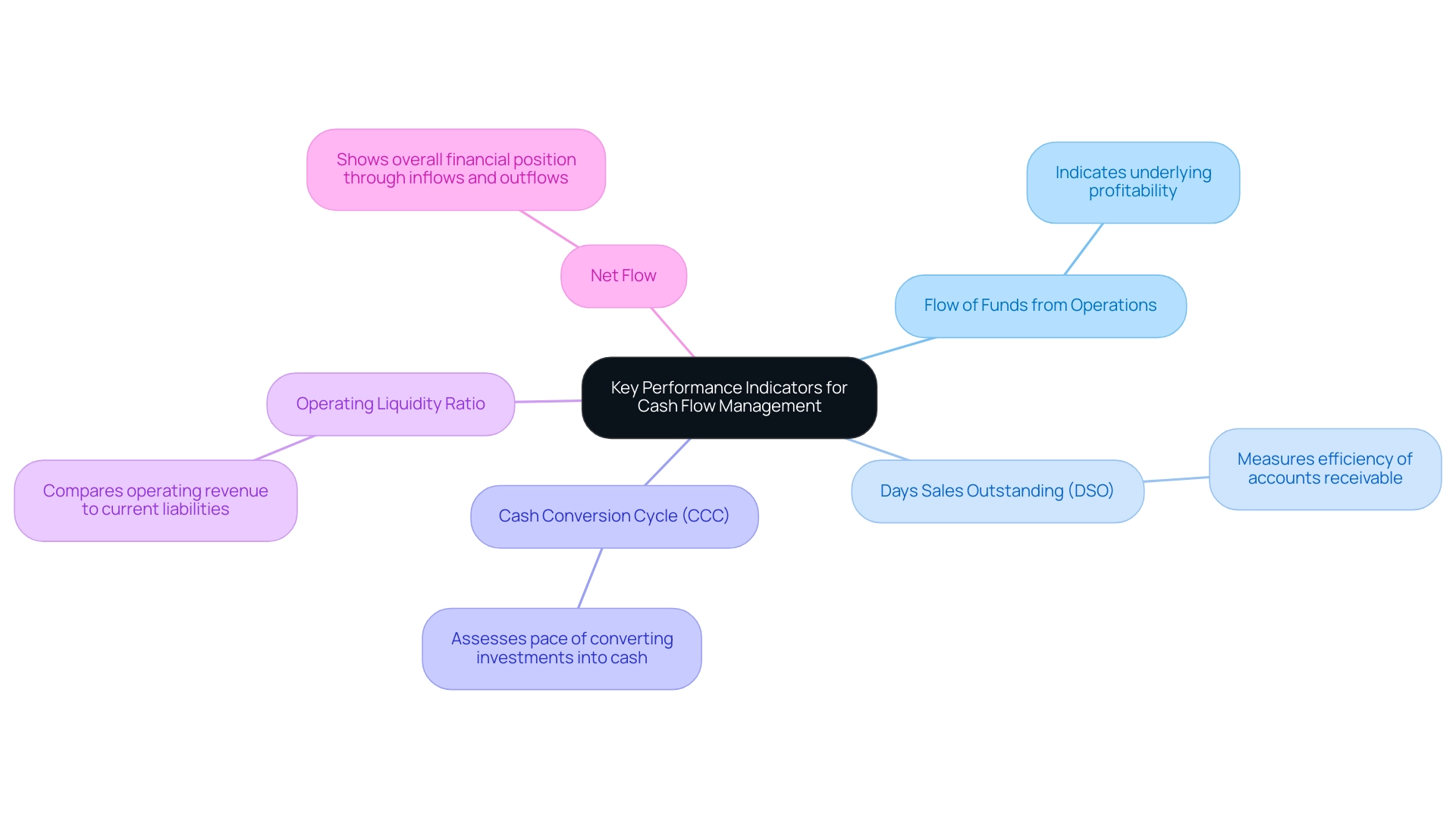

Identifying Key Performance Indicators (KPIs) for Cash Flow Management

Efficient are crucial for enterprises seeking to guarantee profitability and sustainable expansion, especially in turnaround scenarios. Chief Financial Officers should prioritize tracking (KPIs) that offer critical insights into . Here are five essential KPIs to consider:

- Flow of Funds from Operations: This essential metric shows the funds generated from a company’s primary activities, serving as a strong indicator of .

- Days Sales Outstanding (DSO): This KPI measures the average duration it takes for a company to collect payments post-sale. A lower DSO indicates a more efficient accounts receivable process, critical for maintaining liquidity.

- Cash Conversion Cycle (CCC): The CCC assesses the pace at which a company converts its investments in inventory and receivables into real monetary returns from sales. Mastering this cycle is crucial for improving financial resources and overall business performance.

- : This ratio compares operating revenue against current liabilities, offering insight into a company’s capacity to meet short-term obligations using funds generated from operations.

- Net Flow: Monitoring the net difference between inflows and outflows over a designated period offers a comprehensive view of a company's overall financial position.

Concentrating on these KPIs allows Texas enterprises to obtain valuable insights into their cash flow management turnaround services in Texas and make informed decisions about their . For instance, the case study titled "Oracle Fusion Cloud Financials Implementation" demonstrates how this platform has empowered CFOs to access comprehensive financial data, leading to improved understanding of financial health and decision-making. Furthermore, streamlined decision-making processes are supported through continuous monitoring via client dashboards, which provide real-time business analytics to assess and adjust strategies effectively.

These dashboards include capabilities such as customizable reports, trend analysis, and alerts for significant changes in financial metrics. As emphasized by JPMorgan Chase, although comparing carbon efficiency metrics can frequently be flawed, grasping liquidity metrics is unquestionably essential for a company's profitability, growth, and sustainability. By strategically assessing these KPIs, CFOs can operationalize turnaround lessons and leverage cash flow management turnaround services in Texas to make data-driven adjustments that bolster both .

Furthermore, our service presents '' at $99.00, equipping CFOs with practical insights and frameworks to improve their financial handling practices.

Leveraging Technology for Effective Cash Flow Management

In the fast-paced digital environment, technology is a game-changer for efficient financial management. Here are actionable ways businesses can harness technological advancements to strengthen their :

-

: Implementing strong accounting software like QuickBooks or Xero automates the invoicing process, monitors expenses effectively, and produces detailed financial reports.

These systems offer real-time insights into financial positions, enabling CFOs to make informed decisions swiftly and collaborate effectively with their teams.

-

: Specialized financial management applications with advanced forecasting features enable enterprises to anticipate future monetary requirements by examining historical data and recognizing patterns. This foresight is essential, especially as 20% of small enterprises fail within the initial year due to financial issues.

Leveraging technology for these insights embodies the core value of innovation in turnaround consulting.

-

: Implementing , including mobile payment platforms and online payment gateways, accelerates payment collection. This not only reduces Days Sales Outstanding (DSO) but also enhances overall liquidity, essential in any successful turnaround strategy that utilizes .

-

: Employing data analytics enables a comprehensive analysis of financial trends and emphasizes areas ready for enhancement. These insights assist companies in optimizing spending and investment strategies, ultimately enhancing cash flow oversight while promoting a culture of transparency and collaboration.

-

: Embracing cloud-based financial management tools facilitates real-time collaboration among stakeholders, ensuring that all team members have access to the latest financial information.

Such transparency is essential in today's dynamic corporate environment and supports streamlined decision-making.

-

: As IT hardware investments are forecast to reach $579.7 billion by 2025, organizations must recognize the importance of adopting modern solutions to remain competitive. This investment emphasizes the need for dependable technology in improving financial resource oversight, as noted by industry leaders such as Jonathan Browning.

-

: The anticipated expansion of the quantum computing market, predicted to hit $12.62 billion by 2032, underscores the importance for organizations to remain updated on emerging technologies. This awareness can result in enhanced liquidity handling strategies that utilize advanced innovations.

By embracing these technological solutions, businesses can not only optimize their financial processes but also set themselves up for better economic results. This proactive method is crucial in maneuvering the changing environment of financial resources, particularly in relation to cash flow management turnaround services in Texas. Furthermore, our tailored consulting services ensure confidentiality and trust, which are critical in fostering a successful consulting relationship.

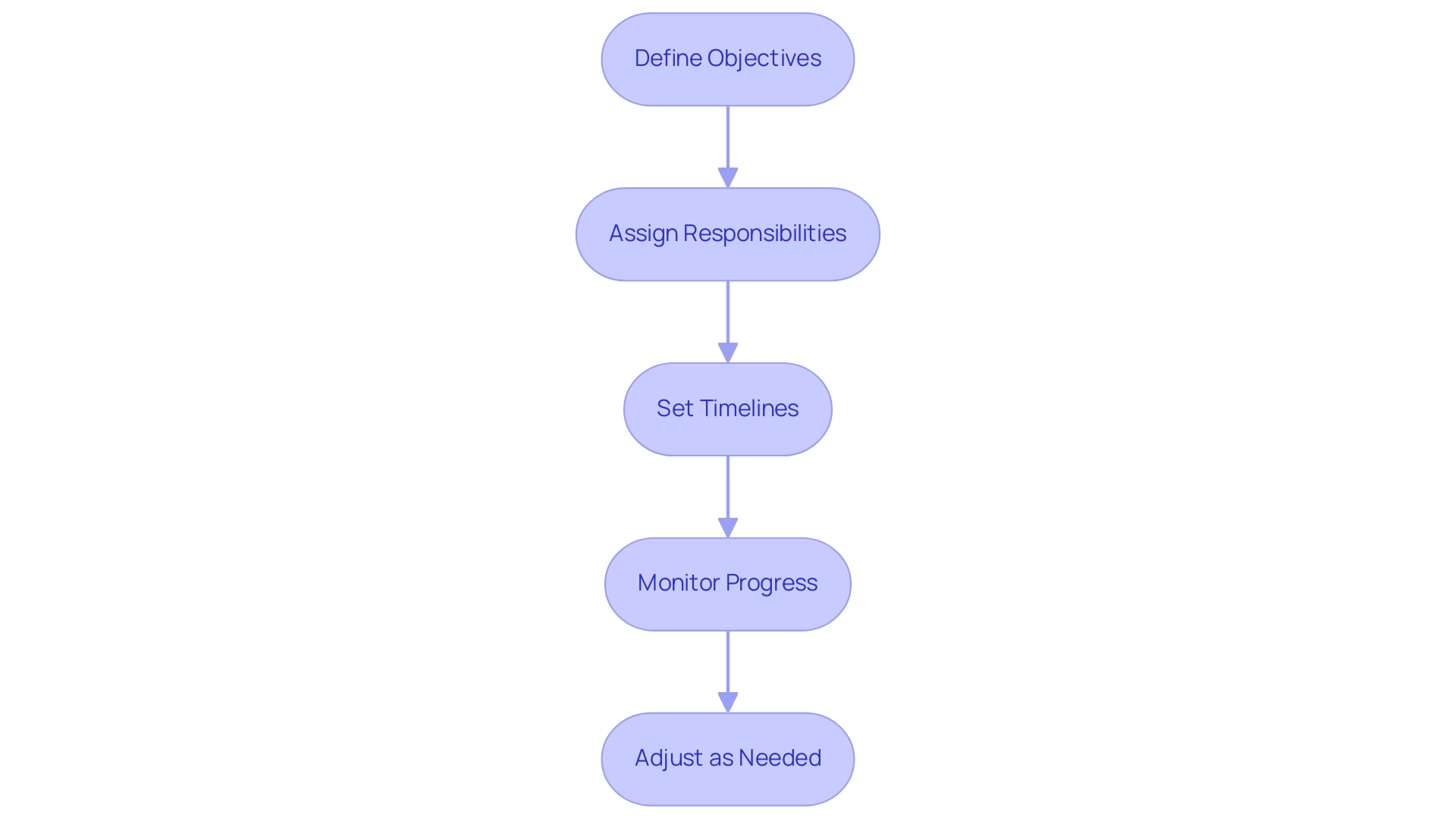

Creating an Action Plan for Cash Flow Management Turnaround

To develop a robust action plan for a cash flow management turnaround, consider the following :

- Define Objectives: Start by articulating specific goals for your . For example, strive to lower Days Sales Outstanding (DSO) by a set percentage or improve efficiently. It is crucial to remember that any beyond what is entitled under the Federal award represent a debt to the Federal Government, highlighting the significance of adherence in financial oversight.

- Assign Responsibilities: Clearly designate team members accountable for executing particular strategies. This ensures that each aspect of the plan is managed by knowledgeable individuals, fostering accountability and streamlined communication within your finance team.

- Set Timelines: Create realistic timelines for each component of your action plan. Incorporate regular progress reviews that allow for necessary adjustments. This structured timeline not only keeps the team focused but also facilitates timely interventions when issues arise. Streamlined decision-making cycles during these reviews enable your team to take decisive action, preserving organizational health.

- : Implement a systematic approach to track the effectiveness of your action plan against predefined objectives and key performance indicators (KPIs). Utilize financial reports and our client dashboard to obtain insights into the effectiveness of your strategies, ensuring adherence to . from our client dashboard allow for continuous performance monitoring, which is crucial for operationalizing lessons learned during the turnaround process. For example, the case study named 'Collections of Improper Payments' explains that recovery expenses can be classified as direct or indirect costs, emphasizing the importance of comprehending permissible expenses in your financial management efforts.

- Adjust as Needed: Maintain the based on continuous analysis and feedback from your team. Adapting to shifting market conditions is crucial for sustaining financial health. Mandie Tibball Svatek, MD, Chair of STAC, emphasizes the importance of feedback in this process, stating, "I am happy to receive your feedback on the AAP or answer any questions." In Texas, businesses have successfully utilized to manage financial challenges by staying adaptable in their strategies.

By adhering to this comprehensive approach and leveraging real-time analytics through our client dashboard, organizations can effectively implement cash flow management turnaround services in Texas, fostering resilience and long-term financial sustainability.

Conclusion

In the intricate business environment of Texas, effective cash flow management emerges as a vital component for survival and growth. By understanding the importance of cash flow dynamics, businesses can navigate challenges posed by economic fluctuations and competition. The staggering closure rates among small businesses highlight the critical need for proactive measures, including:

- Conducting thorough cash flow analyses

- Creating accurate projections

- Implementing strategic cost reductions

Moreover, identifying and tracking key performance indicators (KPIs) enables organizations to gain valuable insights into their financial health, ensuring that decisions are data-driven. Leveraging technology further enhances cash flow management, with tools that streamline processes and provide real-time analytics. As businesses embrace these advancements, they position themselves to thrive in a landscape where adaptability and informed decision-making are paramount.

By developing a structured action plan that defines objectives, assigns responsibilities, and monitors progress, organizations can establish a solid foundation for financial resilience. The integration of continuous feedback and adjustment ensures that cash flow strategies remain effective, allowing businesses to weather economic storms and seize growth opportunities. Ultimately, prioritizing robust cash flow management is not just a strategy; it is an imperative for long-term success in the ever-evolving Texas business landscape.

Frequently Asked Questions

Why is cash flow management important for businesses in Texas?

Cash flow management is crucial for Texas businesses to maintain liquidity, fulfill operational expenses, and capitalize on growth opportunities, especially given the varying economic circumstances across different sectors.

What recent statistics highlight the risks of poor financial management for small businesses?

Recent statistics show that 23.2% of small enterprises that launched in March 2022 were shut down by March 2023, and 37% of small business owners have considered shutting down due to delayed payment issues.

What challenges do businesses face regarding cash flow?

Businesses face challenges such as seasonal fluctuations, shifts in consumer preferences, and heightened competition, which complicate financial flow dynamics and necessitate proactive cash flow management.

How can businesses assess their cash flow needs?

Businesses must consistently evaluate cash inflows and outflows, accurately forecast future cash needs, and identify potential shortfalls to manage their finances effectively.

What is the average loan size for small enterprises, and why is it significant?

The average small enterprise loan size is $52,158, which is significant as it can enhance financial planning and funding strategies for businesses.

What strategies can businesses implement for effective cash flow management?

Key strategies include performing a financial movement assessment, creating financial projections, implementing cost reduction strategies, enhancing revenue collection processes, optimizing inventory management, establishing a contingency fund, and engaging in regular financial evaluations.

How can businesses improve their revenue collection processes?

Businesses can streamline accounts receivable by establishing clear payment terms, following up on overdue invoices, and potentially offering discounts for early payments.

What role does a client dashboard play in cash flow management?

A client dashboard provides real-time insights into financial handling strategies, enabling improved decision-making and enhancing financial stability.

Why is it important for Texas firms to customize their cash flow management strategies?

Customized cash flow management strategies are essential for addressing specific challenges faced by Texas firms, which can enhance profits and overall business performance.

What is the significance of regular financial evaluations?

Regular financial evaluations help businesses assess the effectiveness of their financial strategies and make necessary adjustments, promoting a forward-thinking approach to strengthen financial durability.