Overview

Effective turnaround management in Tamworth requires a structured approach that includes assessing the current situation, engaging stakeholders, and implementing strategic planning and execution. The article outlines a step-by-step guide emphasizing the importance of financial assessments, stakeholder collaboration, and continuous monitoring to ensure sustainable improvements and long-term growth, thereby addressing the need for revitalization in struggling businesses.

Introduction

In the realm of business, the ability to navigate through challenges and emerge stronger is crucial for long-term success. Turnaround management serves as a vital strategy for organizations facing financial distress, offering a structured approach to revitalizing operations and restoring profitability.

By focusing on key principles such as:

- Thorough assessments

- Stakeholder engagement

- Strategic planning

companies can not only address immediate issues but also lay the groundwork for sustainable growth.

This article delves into the essential steps of implementing effective turnaround management, highlighting actionable strategies that CFOs can employ to steer their organizations back on course. From identifying financial distress signals to fostering a culture of continuous improvement, these insights empower leaders to make informed decisions that drive recovery and resilience in a competitive landscape.

Understanding Turnaround Management: Key Principles and Strategies

Turnaround management Tamworth is a critical approach designed to revitalize struggling businesses through a series of strategic initiatives. The key principles guiding this approach are as follows:

-

Assessment of Current Situation: A comprehensive analysis of financial health, operational efficiency, and market positioning is essential to pinpoint critical issues.

This diagnostic approach enables organizations to understand their unique challenges and opportunities.

-

Stakeholder Engagement: Active participation of key stakeholders—including employees, creditors, and suppliers—yields valuable insights and encourages collaboration throughout the recovery process. As emphasized by Chris Wigley,

In need of a retail transformation? How to know and what to do, engaging stakeholders is crucial for gathering diverse perspectives and fostering commitment. -

Strategic Planning: Develop a clear, actionable plan that outlines specific goals, timelines, and resources. This strategic framework should be adaptable to accommodate the dynamic nature of the recovery environment, ensuring that the organization can pivot as needed.

It is also important to consider procurement for maintenance, which typically involves long-term contracts for essential services and equipment, requiring flexibility to accommodate changes.

-

Execution and Monitoring: Implement the recovery plan with agility, allowing for real-time adjustments based on performance metrics and feedback. Our team advocates for a reduced decision-making cycle during the recovery process, allowing swift action to protect your enterprise.

Ongoing monitoring is essential, supported by our client dashboard, which offers real-time analytics to continuously assess your organization's health and enhance the cash conversion cycle. For instance, on average, 90,000 passengers are left stranded due to weather every day, emphasizing the need for companies to be responsive and flexible in their recovery strategies.

-

Sustainability: Focus on long-term viability by embedding new practices into the company culture and fostering a mindset of continuous improvement.

This ongoing commitment is vital for ensuring that the changes implemented during the recovery process lead to sustained success.

By thoroughly understanding and applying these principles, businesses can establish a strong foundation for effective recovery management, simultaneously addressing immediate challenges and positioning themselves for long-term growth. A pertinent case study is the strengthening of Asian markets following the financial crisis of 2009, where Asian manufacturing firms gained market share and are now positioned to recover and expand more swiftly than their Western counterparts, illustrating the effectiveness of strategic management for recovery.

Step-by-Step Guide to Implementing Turnaround Management in Tamworth

To effectively implement turnaround management in Tamworth, follow this structured approach:

- Conduct a Comprehensive Financial Assessment: Begin with a thorough analysis of financial statements to pinpoint cash flow challenges, outstanding debts, and areas ripe for cost reductions. This comprehensive assessment provides a clear understanding of the financial landscape, which is critical for informed decision-making and maximizing return on invested capital.

- Engage with Stakeholders Collaboratively: Effective communication with employees, suppliers, and creditors is essential. Gather their insights and foster support for the turnaround initiative, as their buy-in is pivotal for successful implementation. This collaborative effort helps identify underlying organizational issues more effectively.

- Develop a Strategic Turnaround Plan: Formulate a detailed plan that outlines specific actions to rectify identified issues, incorporating real-time analytics to monitor progress. It should include timelines, assigned responsibilities, and measurable outcomes to facilitate tracking of progress, ensuring that each step is aimed at delivering maximum return on invested capital.

- Implement Targeted Cost-Cutting Measures: Identify non-essential expenses and streamline operations to conserve cash. This could involve renegotiating contracts, reducing inventory levels, or optimizing staffing to enhance efficiency.

- Enhance Revenue Streams: Explore new revenue opportunities by diversifying product offerings or penetrating new markets. Adjust marketing approaches to connect with Tamworth's local audience, ensuring relevance and engagement.

- Monitor Progress and Make Adjustments: Regularly evaluate financial and operational performance against the established plan. Utilize a client dashboard for real-time analytics, allowing for agile adjustments based on the effectiveness of executed plans. This includes a commitment to testing hypotheses to ensure that approaches are effective.

- Foster a Culture of Continuous Improvement: Cultivate an environment that encourages ongoing feedback and innovation within the organization. This culture will help ensure that implemented changes are sustainable and can prevent future crises while operationalizing lessons learned to build strong, lasting relationships.

By following these steps, companies in Tamworth can implement effective turnaround management plans, positioning themselves for revitalization and expansion. Notably, the total industries value added in 2022/23 was $3,318.0 million, highlighting the economic potential within the region. Furthermore, as reported by the Tamworth Regional Council, the Health Care and Social Assistance sector was the most productive industry, generating $521 million in the same year.

This underscores the significance of focusing on sectors that drive local economic growth. Furthermore, the case study titled "Income Estimates for Small Areas" offers important insights into how financial evaluations can guide recovery plans, improving practical application.

Identifying Financial Distress Signals

To effectively recognize financial distress signals and implement timely recovery plans, organizations must vigilantly monitor several critical indicators:

- Declining Sales: A persistent decrease in sales revenue may signal a loss of market share or customer dissatisfaction, both of which can jeopardize long-term sustainability. The information industry, for instance, faces a staggering 70.9% failure rate after ten years, underscoring the dire consequences of neglecting sales trends. This statistic highlights the importance of adapting to market conditions, particularly in light of declining profit margins that may arise from intense competition, rising costs, or inadequate pricing strategies.

- Increased Debt Levels: An escalating debt-to-equity ratio is a warning sign of over-reliance on borrowing. Excessive debt can lead to unsustainable financial practices, ultimately threatening a company's viability.

- Cash Flow Problems: Challenges in fulfilling short-term obligations or a pattern of consistently negative cash flow are clear indicators of financial strain. Monitoring cash flow is essential for maintaining operational stability and avoiding insolvency. Leveraging real-time analytics helps CFOs track cash flow trends and make informed decisions promptly.

- Inventory Issues: Surplus inventory or frequent stockouts often reflect poor demand forecasting or operational inefficiencies. Such issues can erode profit margins and hinder a company's ability to respond to market changes effectively. Streamlined decision-making processes can enhance inventory management strategies, ensuring alignment with market demands.

- Employee Turnover: High turnover rates can indicate internal challenges, which may adversely affect employee morale and productivity. An engaged workforce is critical for navigating periods of financial difficulty. Establishing strong connections through performance monitoring can cultivate a supportive atmosphere to retain talent.

By proactively tracking these distress signals and utilizing real-time analytics, organizations can implement timely measures to mitigate risks. For example, the California business failure rate case study illustrates how external economic conditions significantly impact sustainability, with California boasting the lowest business failure rate within the first year at 18.5%. As Schulz wisely noted,

You can shift the odds in your favor a bit by enlisting some help from time to time.

Identifying these signs enables businesses to implement recovery plans before financial circumstances worsen, establishing a foundation for recuperation and lasting success. Additionally, our team emphasizes a collaborative approach in identifying underlying issues, working closely with stakeholders to create effective solutions. We also adopt a rigorous testing and measuring plan to ensure maximum return on investment, continuously refining our approach based on data-driven insights.

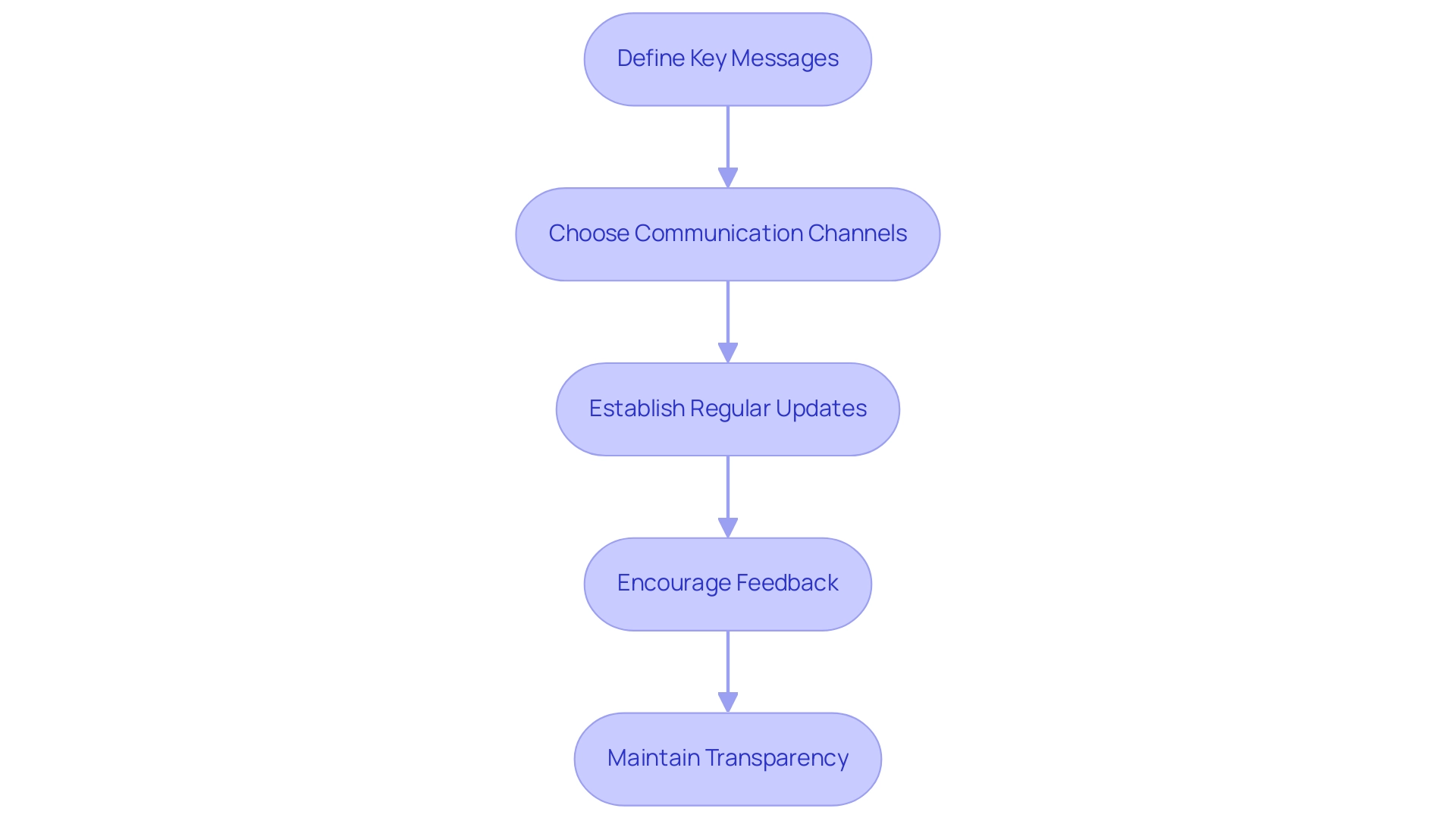

Creating a Communication Strategy

To establish a robust communication strategy during a transformation, CFOs should consider the following actionable steps:

- Define Key Messages: Clearly articulate the rationale behind the turnaround, outlining expected outcomes and specifying the roles of each stakeholder in the undertaking. This clarity is crucial, especially since 45% of employees rate their companies poorly in communicating major changes.

- Choose Communication Channels: Select the most effective channels for disseminating information, such as meetings, emails, and newsletters. Tailoring the mode of communication to the audience enhances understanding and retention of key messages.

- Establish Regular Updates: Schedule consistent updates to inform stakeholders about progress, challenges, and any necessary adjustments to the plan. Integrating real-time analytics from your client dashboard can significantly improve this procedure, enabling swift decision-making and performance monitoring. The client dashboard provides crucial insights that allow for timely adjustments, ensuring that the decision-making cycle remains efficient. Regular communication has been shown to significantly impact employee engagement and productivity, with organizations utilizing people analytics experiencing an 80% increase in recruiting efficiency and a 25% boost in overall productivity. Moreover, 70% of survey participants identified wasted time as a cost of inadequate communication, underscoring the importance of effective information flow.

- Encourage Feedback: Create multiple avenues for stakeholders to provide feedback, ask questions, and voice concerns. This engagement fosters a sense of ownership, which is essential, as employees who feel connected and well-informed at work are 71% more productive than those who do not.

- Maintain Transparency: Uphold honesty about challenges and setbacks during the recovery phase. Transparency not only builds trust but also ensures stakeholders remain engaged and supportive. Research indicates that effective communication can prevent the 68% of employees who waste time due to poor communication from feeling disconnected. By applying these approaches together with a dedication to putting into practice insights gained from the recovery process, organizations can foster cooperation and dedication. This method not only improves the chances of a successful recovery but also nurtures strong, enduring relationships with stakeholders.

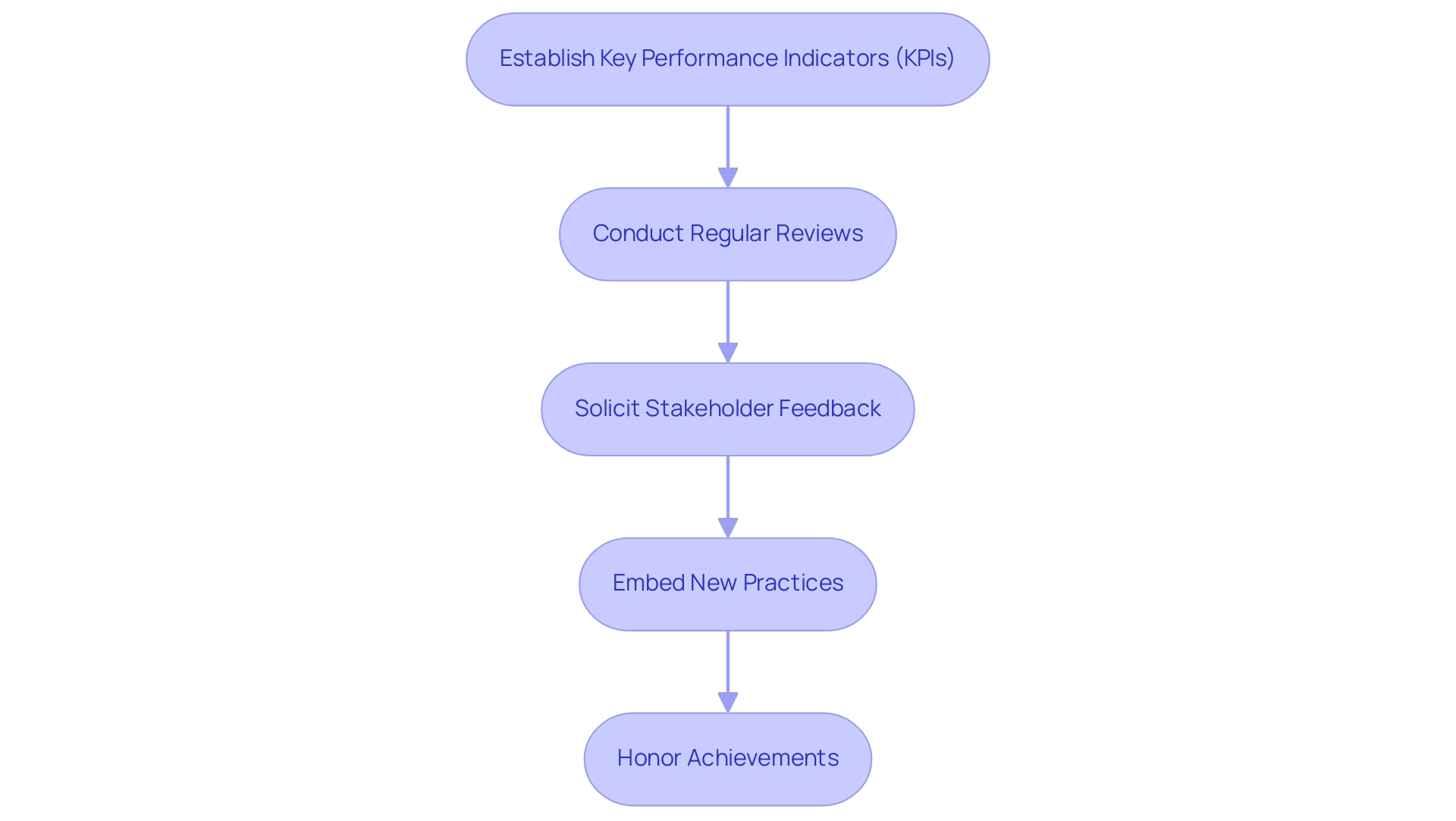

Evaluating and Sustaining Changes Post-Turnaround

To successfully assess and maintain alterations after a business transformation, organizations must adopt a structured method that encompasses the following techniques:

- Establish Key Performance Indicators (KPIs): Clearly define measurable KPIs that align with the specific objectives of the recovery. Tracking financial indicators such as Gross Profit Margin, Operating Expense Ratio, and Cash Conversion Cycle is crucial for ongoing performance assessment. Additionally, project managers should focus on 15 key performance indicators, including timeliness, budget compliance, and quality metrics, to ensure a comprehensive evaluation framework.

- Conduct Regular Reviews: Schedule systematic reviews to gauge progress against established KPIs. This ongoing assessment enables organizations to detect performance gaps and identify areas for continuous improvement. Utilizing real-time analytics via client dashboards enables prompt modifications to approaches based on actual performance data, emphasizing the significance of a shortened decision-making cycle.

- Solicit Stakeholder Feedback: Engage employees and other stakeholders to gather insights on the effectiveness of implemented changes. This feedback is vital for understanding the real impact of the turnaround management Tamworth initiatives and recognizing areas that may require further attention, thus fostering a culture of open communication and adaptability.

- Embed New Practices: To ensure that successful changes are sustainable, integrate them into the company culture and standard operating procedures. This requires a commitment to continuous training and reinforcement of new practices within the workforce. As highlighted in recent studies, aligning operational strategies with data-driven insights can lead to remarkable improvements. For example, testing hypotheses and applying lessons learned can enable data-driven decisions that improve operations and enhance sustainability after a turnaround.

- Honor Achievements: Recognize and celebrate milestones accomplished during the recovery phase. Recognizing accomplishments not only boosts morale but also reinforces a culture of success that motivates employees to remain engaged and committed to ongoing improvements, which is crucial for turnaround management in Tamworth.

By focusing on these evaluation and sustainability strategies, businesses can ensure that their turnaround management Tamworth efforts yield lasting enhancements and foster resilience against future challenges. As Patrick aptly puts it,

Setting goals and relentlessly executing them daily is the key to achieving them

— a guiding principle for CFOs leading change in their organizations, emphasizing the importance of consistent action in the evaluation and sustainability process.

Conclusion

Navigating the complexities of turnaround management is essential for organizations seeking to revitalize their operations and achieve long-term success. By employing a structured approach—rooted in thorough assessments, stakeholder engagement, and strategic planning—businesses can effectively address immediate challenges while laying the foundation for sustainable growth.

The journey begins with a comprehensive evaluation of the current financial landscape, enabling leaders to identify distress signals and engage key stakeholders effectively. This collaborative effort fosters support and provides critical insights that inform the development of actionable turnaround plans. As organizations implement targeted cost-cutting measures and enhance revenue streams, continuous monitoring and adaptation become vital to ensure that strategies remain effective and relevant.

Moreover, establishing a robust communication strategy is paramount. Clear messaging, regular updates, and transparency help maintain stakeholder engagement throughout the process. By fostering a culture of continuous improvement and embedding new practices into the organizational framework, businesses can sustain the momentum gained during the turnaround.

Ultimately, successful turnaround management is not merely about overcoming immediate crises; it is about equipping organizations with the resilience to thrive in a competitive landscape. By committing to ongoing evaluation and celebrating successes, CFOs and leaders can steer their companies toward a prosperous future, ensuring that the lessons learned today pave the way for enduring stability and growth.

Frequently Asked Questions

What is turnaround management in Tamworth?

Turnaround management in Tamworth is a strategic approach aimed at revitalizing struggling businesses through a series of initiatives that focus on assessing financial health, engaging stakeholders, strategic planning, execution, and sustainability.

What are the key principles of turnaround management?

The key principles include: 1. Assessment of Current Situation 2. Stakeholder Engagement 3. Strategic Planning 4. Execution and Monitoring 5. Sustainability

Why is the assessment of the current situation important?

It provides a comprehensive analysis of financial health, operational efficiency, and market positioning, enabling organizations to identify critical issues and understand their unique challenges and opportunities.

How does stakeholder engagement contribute to turnaround management?

Engaging stakeholders, such as employees, creditors, and suppliers, yields valuable insights and fosters collaboration, which is essential for gathering diverse perspectives and ensuring commitment throughout the recovery process.

What should a strategic turnaround plan include?

A strategic turnaround plan should outline specific goals, timelines, resources, and adaptable strategies to accommodate changes in the recovery environment, ensuring effective execution.

What is the role of execution and monitoring in turnaround management?

Execution involves implementing the recovery plan with agility while monitoring performance metrics and feedback in real-time, allowing for necessary adjustments to improve organizational health.

How can businesses ensure sustainability after a turnaround?

By embedding new practices into the company culture and fostering a mindset of continuous improvement, businesses can ensure that the changes implemented during recovery lead to long-term success.

What steps should be taken to implement turnaround management effectively?

Steps include conducting a financial assessment, engaging stakeholders, developing a strategic plan, implementing cost-cutting measures, enhancing revenue streams, monitoring progress, and fostering a culture of continuous improvement.

What is the significance of the economic context in Tamworth for turnaround management?

The economic potential in Tamworth is highlighted by the total industries value added in 2022/23, which was $3,318.0 million, and the productivity of the Health Care and Social Assistance sector, indicating opportunities for revitalization and expansion.

How can financial evaluations guide recovery plans?

Financial evaluations provide critical insights that help identify challenges and opportunities, allowing businesses to develop effective recovery strategies and improve practical applications, as illustrated by the case study on income estimates for small areas.