Introduction

In the high-stakes world of mergers and acquisitions, understanding net working capital (NWC) is not just a financial necessity; it’s a strategic imperative. NWC, defined as the difference between current assets and current liabilities, serves as a critical indicator of a company's short-term liquidity and operational health. For CFOs navigating the complexities of M&A, mastering NWC calculations can illuminate potential risks and opportunities, guiding purchase price adjustments and ensuring that the acquiring entity does not inherit unforeseen liabilities.

This article delves into practical steps for managing NWC effectively, from conducting thorough due diligence to engaging financial advisors, ultimately equipping finance leaders with the tools needed to optimize cash flow and drive business performance in a competitive landscape.

Understanding Net Working Capital in Mergers and Acquisitions

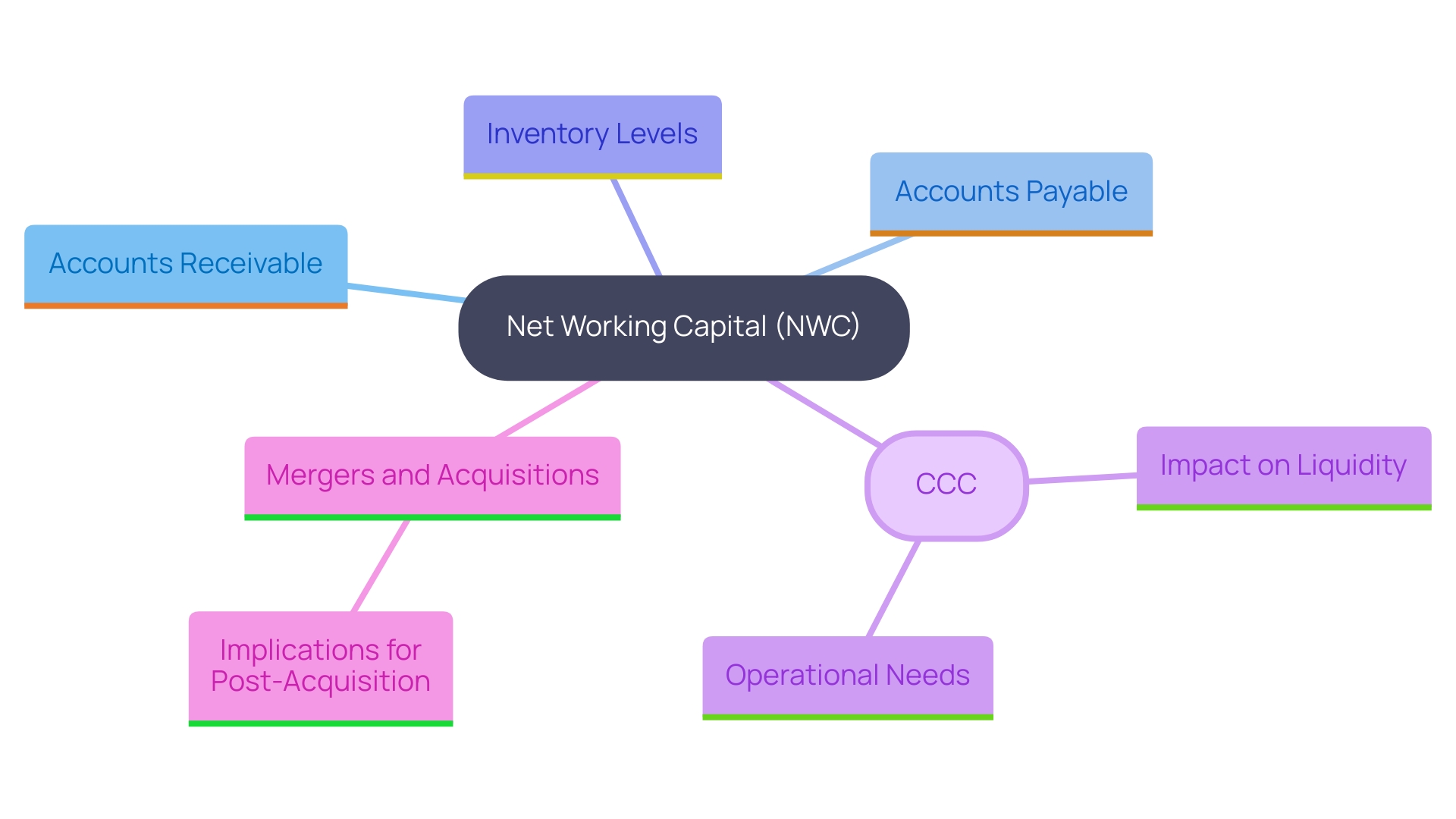

Net Working Capital (NWC) is defined as the difference between a company's current assets and current liabilities. In the context of mergers and acquisitions, NWC is crucial because it represents the short-term liquidity position of the acquired company. Understanding NWC helps assess whether the target company has enough capital to support its operational needs post-acquisition and is essential for optimizing the Cash Conversion Cycle (CCC).

By mastering the CCC, as outlined in our whitepaper 'Mastering the Cash Conversion Cycle: 20 Strategies for Optimal Business Performance,' CFOs can implement strategies that improve liquidity and profitability. Precise NWC calculations are essential for establishing purchase price modifications, guaranteeing that the acquiring firm is not taking on excessive liabilities or inadequate flow of funds.

Key components of NWC include:

- Accounts receivable

- Accounts payable

- Inventory levels

These components should be carefully analyzed during due diligence. For instance, a high accounts receivable turnover can indicate efficient collection practices, while excessive inventory levels may signal potential cash flow issues. This comprehensive approach not only aids in immediate monetary assessments but also contributes to the long-term economic health and performance of the business.

Step-by-Step Guide to Managing NWC Adjustments in M&A

-

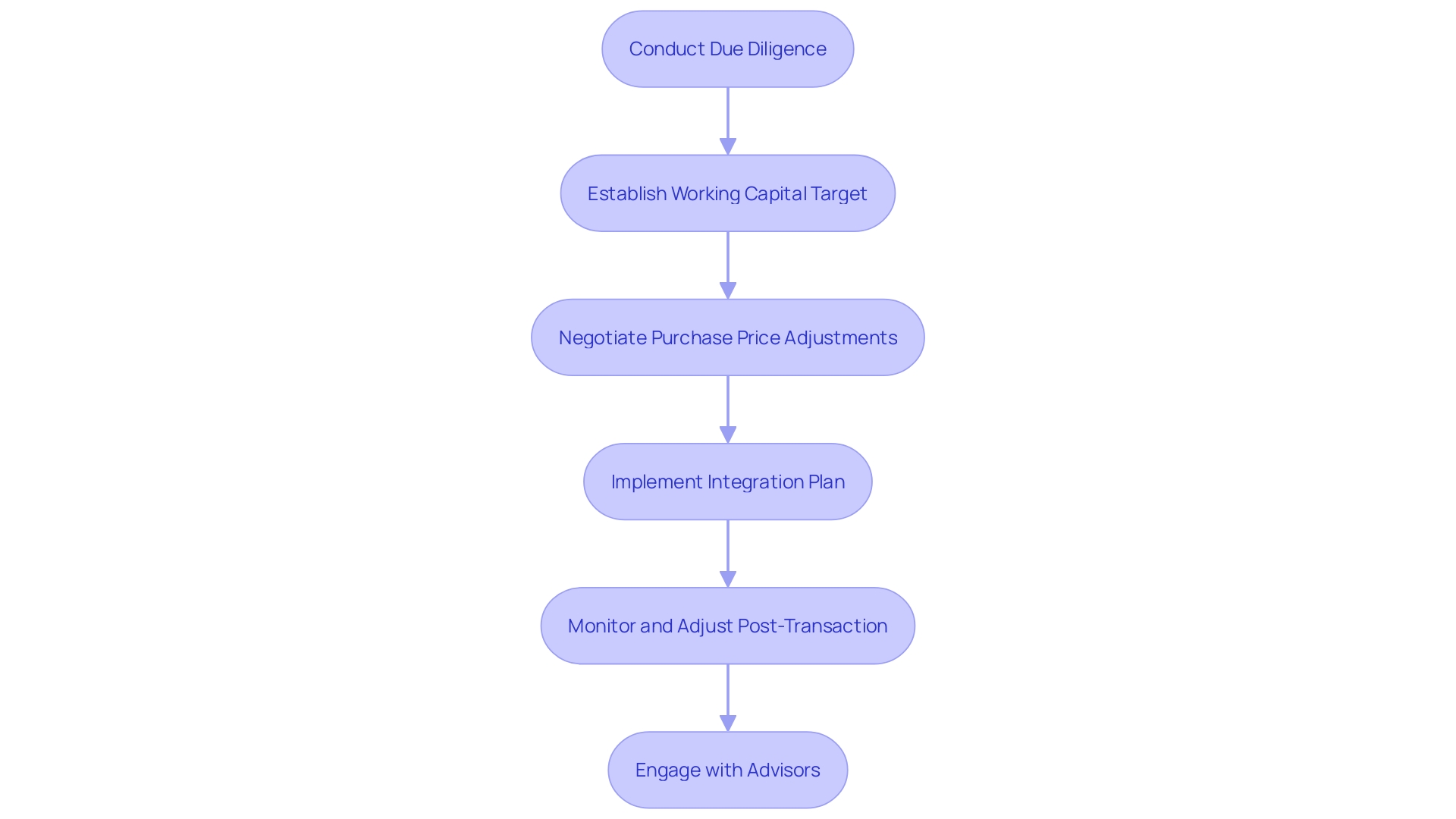

Conduct a Thorough Due Diligence: Begin by analyzing the target company's historical financial statements, focusing on the components of net working capital (NWC). Identify trends in working capital requirements and any seasonal fluctuations that may impact cash flow. Our group advocates for a shortened decision-making cycle during the turnaround process, allowing your team to take decisive action to protect your enterprise.

-

Establish a Working Capital Target: Based on your due diligence findings, set a working capital target that reflects the normal operating needs of the organization. This target will serve as a benchmark for post-closing adjustments. We continually monitor the success of our plans and teams through our client dashboard, which provides real-time business analytics to assess your business health.

-

Negotiate Purchase Price Adjustments: During negotiations, clearly define how NWC will be calculated and what constitutes acceptable variations from the target. Discuss potential price adjustments based on the final NWC figures at closing, ensuring all parties have a clear understanding of the terms.

-

Implement an Integration Plan: After acquisition, execute an integration plan that aligns the working capital management of both companies. Streamline processes related to accounts receivable and payable to optimize cash flow. Our commitment to operationalizing lessons learned during the turnaround process will help foster strong, lasting relationships.

-

Monitor and Adjust: Following the transaction's closure, continuously monitor NWC against the established targets. Make necessary adjustments to operations and monetary strategies to ensure liquidity is maintained, adapting to any changes in market conditions.

-

Engage with Advisors: Throughout the process, consider involving advisors who specialize in mergers and acquisitions to provide insights and validate your NWC calculations and adjustments. Their expertise can be invaluable in navigating complex transactions, ensuring that your monetary strategies are sound.

Best Practices for Ensuring Accurate NWC Management

To effectively manage net working capital (NWC) and enhance financial performance, consider the following best practices:

-

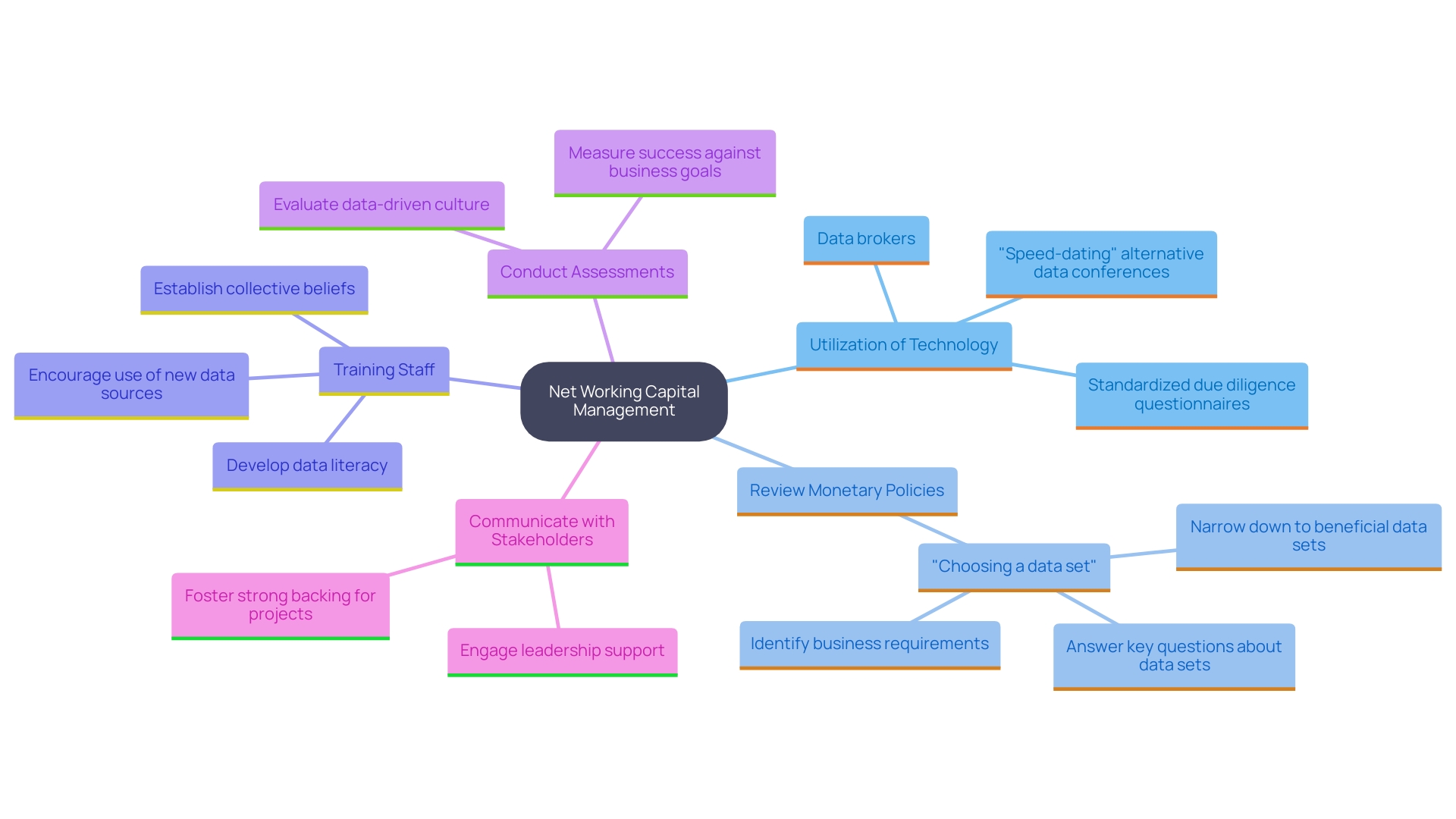

Utilize Technology and Software Tools: Implement management software that allows for real-time tracking of NWC components, enhancing accuracy and efficiency in monitoring flow and working capital needs. For instance, utilizing tools such as QuickBooks or NetSuite can simplify this process, aligning with the significance of performing thorough assessments to preserve cash and reduce liabilities.

-

Regularly Review Monetary Policies: Establish clear monetary policies regarding inventory management, payment terms, and credit policies. Regularly review and adjust these policies to align with the changing business environment. For example, a company may discover that altering payment terms with suppliers can enhance cash flow, thus concentrating on economic efficiency and risk reduction.

-

Train Staff on Economic Literacy: Ensure that key personnel involved in managing NWC are well-trained in economic principles and practices. This training enables proactive management and identification of potential issues before they escalate. Consider implementing workshops or online courses that cover essential monetary concepts to empower your team, contributing to uncovering hidden value in your organization.

-

Conduct Regular NWC Assessments: Schedule regular assessments of NWC, especially after significant operational changes or market fluctuations. This practice ensures that the organization remains aware of its liquidity position and supports a streamlined decision-making process during turnarounds. For example, a quarterly review can help identify trends and areas needing attention.

-

Communicate with Stakeholders: Maintain open lines of communication with stakeholders, including CFOs and operational managers, regarding NWC management strategies and concerns. Collaborative efforts can lead to more informed decisions and strategies. Regular meetings or updates can foster continuous business performance monitoring and relationship-building through operationalizing lessons learned.

By implementing these practices, organizations can enhance their economic health and responsiveness, ultimately leading to better decision-making and improved outcomes.

Utilizing Financial Advisors for NWC Management

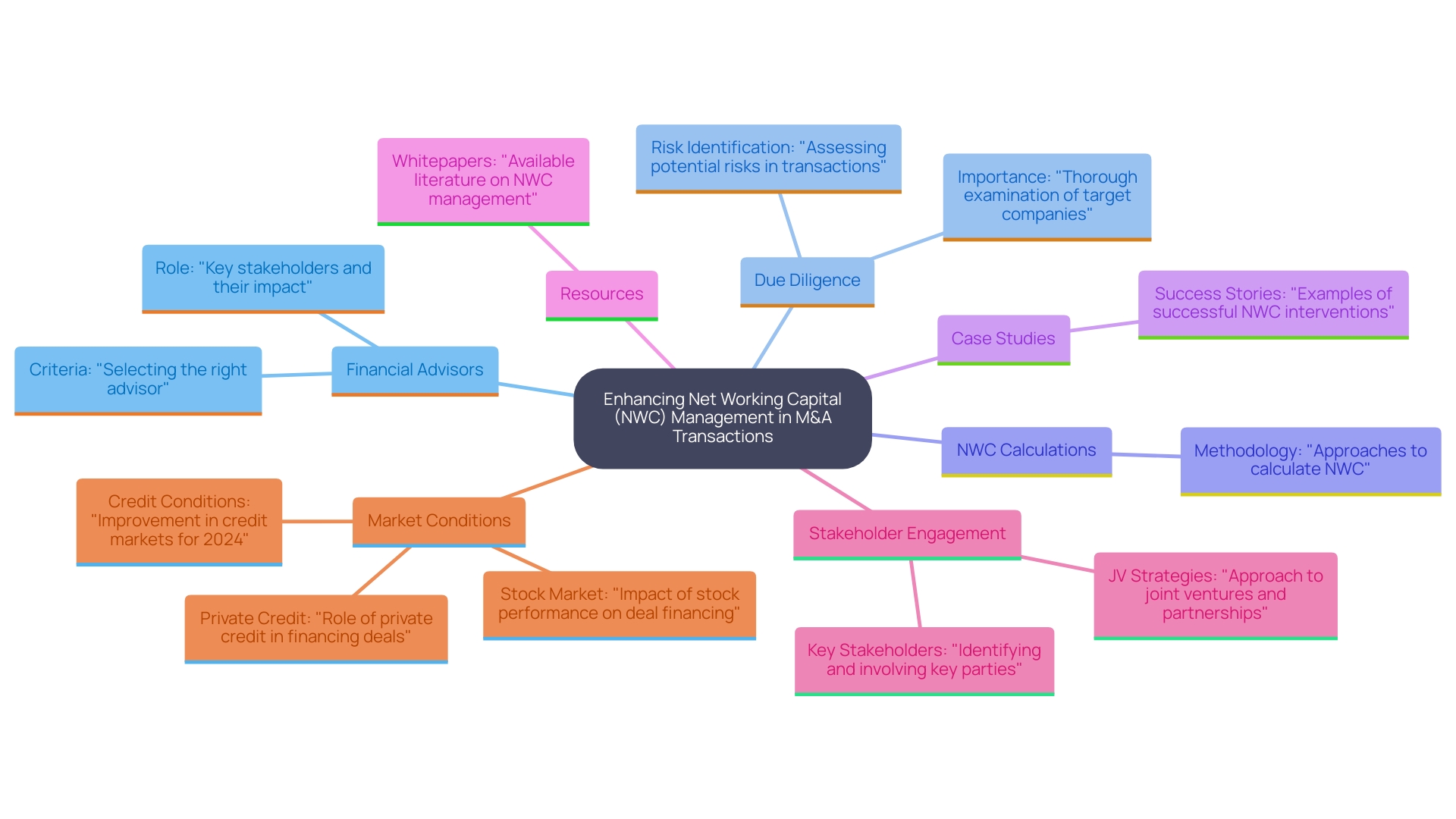

Engaging financial advisors can significantly enhance the management of net working capital (NWC) during M&A transactions. Advisors bring a wealth of experience in conducting thorough due diligence, identifying potential risks, and ensuring accurate NWC calculations.

For instance, a case study involving a mid-sized manufacturing company showed that by leveraging expert advisors, the firm was able to identify $500,000 in hidden liabilities that would have adversely affected its valuation. Advisors can also facilitate negotiations by providing objective insights that help align the interests of both parties.

In this context, leveraging resources such as our 'Mastering the Cash Conversion Cycle: 20 Strategies for Optimal Business Performance' whitepaper can provide CFOs with actionable strategies to optimize cash flow and profitability. This whitepaper, along with our 'Comprehensive Business Valuation Service,' offers detailed insights into business worth, which is invaluable for stakeholders during these complex processes.

When choosing an advisor, seek out experts with a proven track record in M&A and a deep understanding of industry-specific challenges. Their expertise can be instrumental in navigating complex economic landscapes, ultimately leading to smoother transitions and more successful mergers.

To take advantage of these resources, consider downloading our whitepaper and exploring our valuation services to empower your financial strategies.

Conclusion

Understanding and managing net working capital (NWC) is paramount for CFOs involved in mergers and acquisitions. By meticulously analyzing NWC, finance leaders can gain critical insights into a target company's liquidity and operational efficiency, mitigating potential risks and enhancing decision-making. The steps outlined—from conducting thorough due diligence to engaging financial advisors—provide a comprehensive framework for optimizing cash flow and ensuring that the acquiring entity is well-prepared for the transition.

Implementing best practices such as utilizing technology, regularly reviewing financial policies, and fostering financial literacy among staff empowers organizations to maintain a proactive stance on NWC management. These strategies not only safeguard against unforeseen liabilities but also enhance overall financial health and operational performance.

In conclusion, a strategic approach to NWC management can significantly influence the success of M&A transactions. By prioritizing accurate calculations, effective negotiations, and continuous monitoring, CFOs can navigate the complexities of acquisitions with confidence, ultimately driving business performance in a competitive landscape. Embracing these practices will pave the way for informed decision-making and sustainable growth.