Introduction

In the dynamic world of cruise operations, turnaround management emerges as a critical strategy for addressing operational inefficiencies and financial challenges. With the industry's unique complexities—ranging from intricate logistics to the paramount importance of customer satisfaction—leaders must adopt a multifaceted approach to navigate these turbulent waters.

This article delves into essential strategies and practical steps for effective turnaround management, highlighting the importance of:

- Real-time analytics

- Stakeholder engagement

- Robust change management practices

By harnessing these insights, organizations can not only overcome immediate challenges but also position themselves for sustainable growth and enhanced operational efficiency in an increasingly competitive market.

Understanding Turnaround Management in Cruise Operations

Turnaround management Newcastle in cruise operations necessitates a targeted strategy aimed at mitigating operational inefficiencies and addressing financial distress. The distinct characteristics of cruise operations—marked by their intricate logistics, emphasis on customer satisfaction, and stringent regulatory requirements—pose unique challenges. Key considerations include:

- Streamlined Decision-Making: Our approach supports a shortened decision-making cycle throughout the recovery process, allowing your team to take decisive action to preserve the business. This efficiency is critical in an industry where timely responses can significantly impact operational success. We emphasize the 'Decide & Execute' process, ensuring that decisions are not only made quickly but also strategically aligned with overall business goals.

- Operational Complexity: The multifaceted nature of cruise operations demands flawless coordination across departments such as scheduling, ground handling, and guest services. A deep understanding of these interdependencies is essential for effective management of transformations.

- Customer Experience: Elevating customer satisfaction is pivotal for driving revenue growth. Implementing robust feedback mechanisms and enhancing service quality can significantly influence the success of recovery initiatives. As the global cruise market has experienced unprecedented growth, increasing from 16.3 million sourced cruise passengers in 2008 to 30 million in 2019, prioritizing customer experience is more crucial than ever. According to CLIA, this growth indicates a strong demand for cruise experiences, which turnaround plans must utilize.

- Real-Time Analytics: We continually monitor the success of our plans through our client dashboard, which provides real-time business analytics to diagnose your business health. This ongoing assessment allows for immediate updates and adjustments to plans, ensuring sustained performance improvements.

- Regulatory Compliance: Navigating the complexities of regulatory compliance is critical in cruise operations. Adhering to maritime laws and safety standards not only mitigates the risk of costly penalties but also protects the company’s reputation in a competitive market.

A comprehensive monetary evaluation is vital for identifying cash flow challenges and potential cost-saving opportunities. For example, Norwegian's ROIC of 9.8% illustrates the financial performance metrics that can direct recovery plans. This analysis establishes the basis for developing a recovery strategy tailored to the specific operational needs of the cruise line.

- Case Study Insights: The case study titled 'Regional Demand for Cruises' highlights the significant increase in sourced cruise passengers, illustrating both the growth potential and the challenges faced by the industry. By understanding these dynamics, stakeholders can effectively navigate the challenges of management within the cruise industry, positioning themselves for impactful interventions and successful outcomes.

- Building Relationships: Operationalizing lessons learned also involves building strong relationships with stakeholders. This relationship-building is essential for fostering collaboration and ensuring the successful execution of improvement strategies.

- Testing Hypotheses: Finally, a critical aspect of our approach includes testing hypotheses to refine strategies and ensure they are effective. By continuously assessing the results of our choices, we can adjust and enhance our recovery efforts.

Practical Steps for Effective Turnaround Management in Newcastle

To master turnaround management in Newcastle, consider the following essential steps:

- Conduct a Comprehensive Economic Review: Begin by assessing the current economic health of your organization. This involves a thorough analysis of cash flow, liabilities, and revenue streams to identify areas where costs can be reduced without sacrificing service quality. Given that the median response time for current issues is approximately 35 days, timely financial evaluations are crucial to ensure that decisions are made swiftly to capitalize on potential recovery opportunities.

- Engage Stakeholders: Actively involve key stakeholders—employees, suppliers, and customers—in the recovery process. Their insights can reveal operational inefficiencies and suggest potential improvements. As highlighted by management specialists, effective stakeholder engagement is crucial for successful transformations, especially considering the uncertain economic environment.

- Implement Interim Management Solutions: If the situation requires, consider appointing experienced interim managers who specialize in recovery processes. Their expertise can streamline decision-making and ensure the efficient execution of strategies. As Stefan Piotrowski, Partner at Paladin, states, "Despite recent optimism in equity markets, the economic environment remains uncertain for most clients and counterparties," highlighting the sustained demand for skilled turnaround professionals who can navigate these challenges.

- Optimize Ground Handling and Tours: Focus on enhancing ground handling processes and tour offerings. This can involve training staff, streamlining logistics, and leveraging technology to elevate customer experiences and operational efficiency. Such improvements not only boost service delivery but also contribute to financial recovery.

- Monitor Progress with Real-Time Analytics: Establish key performance indicators (KPIs) to track the effectiveness of implemented strategies. Utilize a client dashboard to provide real-time business analytics, allowing for continuous monitoring and timely adjustments to your approaches. Given that the average response time for resolving current issues is 56 days, timely interventions are crucial. For example, in the 2017/18 period, fast track submissions achieved a 91.8% on-time processing rate, showcasing the effectiveness of real-time analytics in efficiency.

- Test Hypotheses: Throughout the recovery process, it is essential to test various hypotheses regarding potential strategies and operational changes. This approach allows for data-driven decision-making and helps in identifying the most effective paths to recovery.

By following these steps, businesses in Newcastle can skillfully navigate the complexities of turnaround management, which enhances operational efficiency, realizes cost savings, and promotes revenue growth amidst challenging market conditions.

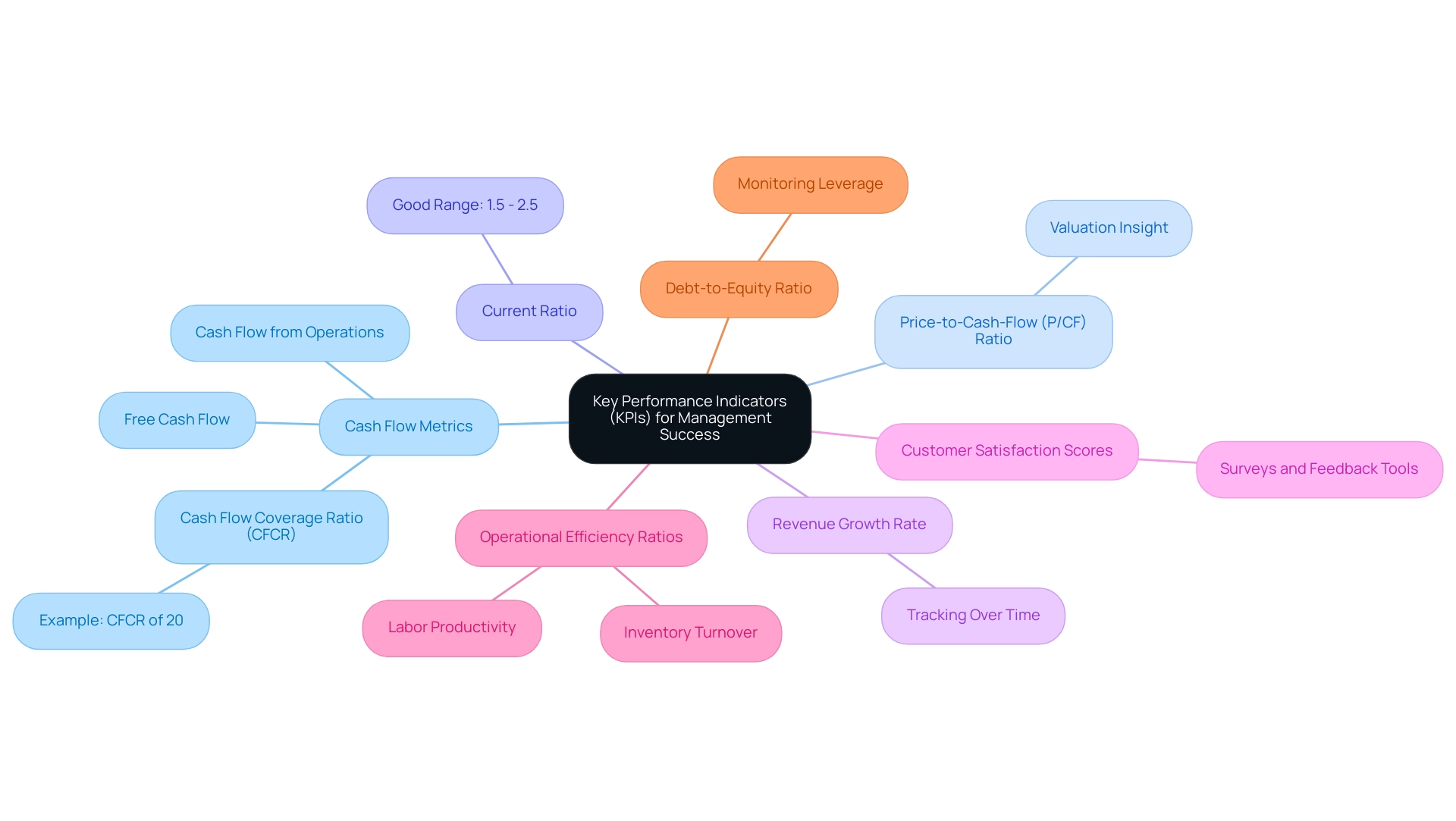

Identifying Key Performance Indicators (KPIs)

To effectively assess the success of your management initiatives, it is essential to implement the following key performance indicators (KPIs):

- Cash Flow Metrics: Diligently monitor both cash inflows and outflows to maintain liquidity. Crucial metrics include cash flow from operations and free cash flow, which illuminate the company’s capacity to generate cash. For instance, a company with a Cash Flow Coverage Ratio (CFCR) of 20%—indicating that its cash flow from operations of $15,000 can cover $75,000 in total debt—demonstrates the potential timeline for debt repayment under current conditions.

- Price-to-Cash-Flow (P/CF) Ratio: This ratio is essential for assessing a company's valuation based on its cash flow. A lower P/CF ratio may suggest that the company is undervalued, which can be a critical insight for CFOs during recovery evaluations.

- Current Ratio: Regularly assess the current ratio to understand the company's ability to pay off short-term liabilities. A ratio between 1.5 and 2.5 is typically regarded as good, offering a benchmark for financial health during recovery efforts.

- Revenue Growth Rate: Consistently track the revenue growth rate over time to evaluate the effectiveness of your implemented strategies. A positive growth trajectory signals successful turnaround efforts and strategic alignment.

- Customer Satisfaction Scores: Implement surveys and feedback tools to gauge customer satisfaction levels. Elevated satisfaction scores typically correlate with enhanced customer loyalty and increased repeat business, essential for sustainable growth.

- Operational Efficiency Ratios: Examine ratios such as inventory turnover and labor productivity to pinpoint areas for operational improvement. Optimizing these ratios can lead to significant cost savings and efficiency gains.

- Debt-to-Equity Ratio: Regularly monitor this crucial economic metric to assess the company's leverage and associated risk. A decreasing debt-to-equity ratio frequently signifies improved financial stability, reassuring stakeholders of the company's viability.

By systematically reviewing these KPIs, CFOs can make informed decisions and modify approaches as needed. Our team supports a streamlined decision-making cycle throughout the turnaround management Newcastle process, enabling your team to take decisive action based on real-time analytics provided through our client dashboard. This dashboard not only tracks the success of our plans but also allows for continuous updates and modifications to approaches, fostering strong, lasting relationships and enhancing overall business performance.

Moreover, mastering the cash conversion cycle through techniques like optimizing receivables and payables oversight will further improve the evaluation process, offering valuable insights into the financial landscape.

Implementing Change Management Strategies

To effectively execute recovery plans, it is essential to adopt robust change management practices that leverage real-time analytics and streamlined decision-making. Here are key strategies to consider:

-

Communicate Clearly and Frequently: Effective communication is pivotal; it ensures that all stakeholders grasp the reasons for changes and their anticipated impacts.

Research indicates that organizations with clear communication throughout the change process experience a 70% higher success rate. Regular updates foster transparency and mitigate resistance, helping to align everyone with the organization’s vision while supporting a shortened decision-making cycle.

-

Provide Training and Support: Tailoring training programs to equip employees with the skills needed for new processes is crucial.

By investing in employee development, organizations not only enhance capability but also foster a sense of ownership in the transition. Support structures during this phase can significantly elevate employee morale and engagement, ensuring lessons learned from the recovery process are operationalized effectively.

-

Encourage Employee Involvement: Actively involving employees in the change process can lead to higher engagement levels.

Seeking their input and feedback transforms change from a top-down mandate into a collaborative effort, thereby increasing commitment to the recovery initiatives. This participatory approach has been shown to drive better outcomes in organizational change efforts, particularly when combined with real-time analytics that monitor progress through tools like our client dashboard.

-

Celebrate Small Wins: Acknowledging and celebrating milestones achieved during the recovery fosters a positive atmosphere.

Recognizing progress not only boosts morale but also reinforces collective effort toward larger goals, establishing a culture of resilience and motivation—essential for maintaining momentum during the turnaround.

-

Establish a Feedback Loop: Implementing mechanisms for ongoing feedback is crucial for sustained improvement.

This iterative method not only aids in tackling challenges in real-time but also fosters an atmosphere of ongoing enhancement, essential for long-term success in recovery. Moreover, testing hypotheses during this process can yield optimal return on invested capital, guaranteeing that approaches are effective and aligned with business goals.

By incorporating these change techniques within your recovery efforts and utilizing real-time business analytics, including our client dashboard, to track success, organizations can effectively navigate challenges and foster a resilient workforce ready for achievement. As noted by Dr. Bob Nelson, whose extensive work on employee engagement underscores the importance of these strategies, organizations must prioritize communication and training to ensure a successful transition.

Leveraging Technology for Turnaround Success

To significantly enhance the effectiveness of recovery strategies, CFOs should consider integrating the following cutting-edge technology solutions:

- Data Analytics Tools: By utilizing data analytics tools, organizations can obtain crucial insights into customer behavior, operational efficiency, and economic performance. This data-driven approach allows for informed strategic decision-making and helps pinpoint areas ripe for improvement. Leveraging such tools can lead to operational efficiency increases of up to 80%. Our consulting services emphasize the importance of continuous monitoring through real-time analytics, ensuring that your business remains agile and responsive.

- Customer Relationship Management (CRM) Systems: Implementing robust CRM systems is essential for streamlining customer interactions and elevating service delivery. Enhanced customer oversight not only increases satisfaction levels but also encourages better retention, establishing a loyal clientele that is vital during recovery phases, reflecting our core principles of transparency and collaboration.

- Management Software: Utilizing management software can revolutionize budgeting, forecasting, and reporting processes. Automation in these areas improves accuracy and provides real-time insight into financial performance, allowing for more agile responses to market changes, which is a fundamental aspect of our recovery strategies.

- Project Management Tools: Monitoring the progress of recovery initiatives is critical. Project coordination tools guarantee that teams stay aligned and responsible for their duties, enabling efficient implementation of recovery strategies and putting into action lessons learned from prior experiences.

- Collaboration Platforms: The implementation of collaboration platforms can significantly enhance communication and teamwork among employees. Enhanced teamwork encourages innovation and strengthens problem-solving skills, which are essential in overcoming challenges.

- Interim Leadership Services: Our interim leadership services offer experienced professionals who can step in during critical periods, ensuring continuity and effective guidance while your organization undergoes transformation.

- Financial Evaluation: Carrying out comprehensive financial evaluations enables companies to pinpoint strengths and weaknesses in their financial activities, facilitating focused approaches for enhancement and stability.

By utilizing these technology solutions and services, companies can foster a more adaptable and responsive organization, ultimately leading to effective turnaround management Newcastle. As the Internet of Things (IoT) continues to expand—with projections of 20.3 billion connected devices generating an astounding 79.4 zettabytes of data by 2025, according to Transforma Insights—the imperative for data-driven strategies has never been clearer. It is also crucial to remain aware of data security risks, as underscored by the statistic that around 700 million LinkedIn users were posted on a dark web forum, emphasizing the importance of robust data management practices.

Conclusion

Effective turnaround management in cruise operations is not just a reactive measure; it is a strategic imperative that can lead to sustainable growth and operational excellence. By focusing on:

- Streamlined decision-making

- Enhancing customer experience

- Leveraging real-time analytics

organizations can navigate the complexities of the industry and address financial challenges head-on.

The implementation of robust change management practices, including:

- Clear communication

- Stakeholder engagement

is crucial for fostering a culture of collaboration and resilience. These strategies not only empower employees but also ensure that all stakeholders are aligned with the turnaround vision, driving collective success.

As technology continues to evolve, integrating advanced data analytics and financial management tools can provide CFOs with the insights needed to make informed decisions. By continually assessing key performance indicators, organizations can track progress and make necessary adjustments in real-time, fostering an agile and responsive operational environment.

In summary, mastering turnaround management in the cruise industry requires a multifaceted approach that embraces both strategic planning and technological innovation. By prioritizing these elements, organizations can overcome immediate operational hurdles and position themselves for long-term success in an increasingly competitive landscape. The time to act is now—embrace these strategies to propel your organization towards a brighter and more efficient future.

Frequently Asked Questions

What is the focus of turnaround management in cruise operations?

Turnaround management in cruise operations focuses on mitigating operational inefficiencies and addressing financial distress through a targeted strategy that considers the unique characteristics of the industry, such as intricate logistics, customer satisfaction, and regulatory requirements.

Why is streamlined decision-making important in turnaround management?

Streamlined decision-making is crucial because it shortens the decision-making cycle, allowing teams to take decisive actions that preserve the business. Quick and strategic decisions can significantly impact operational success in the cruise industry.

What role does operational complexity play in cruise operations?

Operational complexity requires flawless coordination across various departments, including scheduling, ground handling, and guest services. A deep understanding of these interdependencies is essential for effective management during transformations.

How does customer experience influence recovery in cruise operations?

Elevating customer satisfaction is key to driving revenue growth. Implementing feedback mechanisms and enhancing service quality can significantly affect the success of recovery initiatives, especially given the growth in the global cruise market.

What is the importance of real-time analytics in turnaround management?

Real-time analytics allow for continuous monitoring of recovery plans and immediate updates to strategies, ensuring sustained performance improvements and helping diagnose the health of the business.

Why is regulatory compliance critical in cruise operations?

Navigating regulatory compliance is essential to mitigate risks of penalties and protect the company’s reputation in a competitive market, as adherence to maritime laws and safety standards is mandatory.

What is the significance of conducting a comprehensive economic review?

A comprehensive economic review helps assess the organization's current financial health, identifying cash flow challenges and areas for cost savings, which is vital for making timely decisions that capitalize on recovery opportunities.

How can stakeholder engagement aid in turnaround management?

Engaging stakeholders, including employees, suppliers, and customers, can reveal operational inefficiencies and suggest improvements, making their involvement crucial for successful transformations.

What are interim management solutions, and why are they beneficial?

Interim management solutions involve appointing experienced managers who specialize in recovery processes. Their expertise can streamline decision-making and ensure efficient execution of strategies during challenging times.

What strategies can enhance operational efficiency in cruise operations?

Strategies include optimizing ground handling processes, enhancing tour offerings, training staff, and leveraging technology to improve customer experiences and operational efficiency.

How do key performance indicators (KPIs) contribute to recovery efforts?

KPIs, such as cash flow metrics, revenue growth rates, and customer satisfaction scores, provide insights into the effectiveness of recovery strategies, helping organizations make informed decisions and adjust approaches as necessary.

What are some key strategies in change management during recovery?

Key strategies include clear communication, providing training and support, encouraging employee involvement, celebrating small wins, and establishing a feedback loop to foster ongoing improvement.

How can technology solutions enhance turnaround management?

Technology solutions, such as data analytics tools, CRM systems, and project management tools, can improve operational efficiency, streamline customer interactions, and facilitate real-time monitoring of recovery initiatives.

What is the role of interim leadership services in turnaround management?

Interim leadership services provide experienced professionals to guide organizations through critical periods, ensuring continuity and effective management during transformations.