Overview

The article explores how CFOs can effectively navigate the complexities of stakeholder management by implementing structured strategies and leveraging technology to enhance engagement and communication. It underscores that successful stakeholder management necessitates the identification of key parties, a deep understanding of their interests, and the utilization of real-time analytics to cultivate trust and collaboration. These elements ultimately contribute to improved financial outcomes and organizational success.

Moreover, by adopting these strategies, CFOs can foster a more collaborative environment that aligns stakeholder interests with organizational goals. This approach not only enhances communication but also strengthens relationships, paving the way for sustainable success in the financial landscape. Consequently, the article emphasizes the importance of proactive engagement and the strategic use of technology in achieving these objectives.

Introduction

In a rapidly evolving financial landscape, the role of CFOs is becoming increasingly complex, particularly in the realm of stakeholder management. As organizations navigate the intricate web of interests from investors, employees, customers, and regulatory bodies, the ability to effectively identify, analyze, and engage these stakeholders is paramount. By fostering relationships built on mutual trust and transparency, CFOs can align financial strategies with stakeholder expectations, paving the way for sustainable growth and resilience in times of crisis.

Moreover, the emergence of technology-driven solutions and real-time analytics further empowers CFOs to tackle the challenges of competing priorities, communication breakdowns, and changing expectations, ensuring they remain agile and responsive. As the landscape continues to shift, mastering stakeholder management will not only enhance organizational stability but will also drive financial success in 2025 and beyond.

Understanding Stakeholder Management: A CFO's Perspective

Stakeholder oversight is a vital process for financial leaders, encompassing the identification, analysis, and engagement of individuals or groups with vested interests in an organization's financial decisions. This includes a diverse array of parties such as investors, employees, customers, and regulatory bodies. As we approach 2025, the landscape of managing these involved parties is evolving, with a notable emphasis on building stable relationships grounded in mutual trust and a clear understanding of each party's position.

Effective management of involved parties enables financial leaders to align financial strategies with their expectations, fostering an environment of trust and collaboration. This alignment is particularly vital during financial crises, where the ability to communicate transparently can significantly influence outcomes. Our team supports a shortened decision-making cycle throughout the turnaround process, allowing CFOs to take decisive action to preserve their business.

For instance, research indicates that enhancing trust with interested parties can lead to a 10% improvement in employee retention within the tech sector, underscoring the tangible benefits of strong relationships and their impact on organizational stability.

Moreover, the importance of engagement is reflected in the growing emphasis on measuring engagement ROI, which quantifies the value derived from involvement by analyzing the costs and benefits associated with engagement efforts. As the Asia-Pacific area undergoes swift expansion in software for managing stakeholders—propelled by heightened digitalization and governmental initiatives—CFOs must adjust to these changes in market dynamics to stay competitive. Our client dashboard offers immediate business analytics to consistently assess business health, allowing financial leaders to track performance and modify approaches efficiently.

In 2025, financial leaders face distinct stakeholder management challenges, including the necessity for swift replies to inquiries. Notably, 39% of social media users express a desire for immediate engagement, highlighting the necessity for fast, effective strategies that cater to the diverse needs of those involved. This urgency emphasizes the importance of utilizing technology-enabled consulting services to overcome stakeholder management challenges, allowing financial executives to quickly identify underlying issues and initiate transformational change.

By applying lessons from the turnaround process, financial leaders can cultivate strong, enduring connections that foster sustainable growth.

Ultimately, mastering the art of engaging with involved parties is not solely about tackling immediate issues; it is about establishing a foundation for sustainable growth and long-term success in an increasingly intricate financial environment.

Identifying Key Challenges in Stakeholder Management

Chief Financial Officers encounter a myriad of stakeholder management challenges that can significantly impact their effectiveness and the overall success of their organizations.

- Competing Priorities are at the forefront of these challenges, as stakeholders often possess conflicting interests, complicating financial leaders' efforts to balance their demands. For instance, while investors may prioritize short-term financial returns, employees might focus on job security and workplace wellness. In 2025, a notable 28% of finance departments are leveraging AI in forecasting to better align these competing priorities, underscoring the necessity for innovative solutions that bridge these gaps. Transform Your Small/Medium Business offers technology-enabled turnaround consulting that assists CFOs in navigating these complexities by providing real-time analytics and insights through our client dashboard.

- Communication Breakdowns represent another critical challenge; effective communication is essential in managing stakeholder interests. Misunderstandings can lead to mistrust and disengagement. By implementing technology-driven communication platforms, organizations can enhance transparency and foster stronger relationships among involved parties, effectively addressing communication breakdowns. Our commitment to transparency and collaboration ensures that all parties are kept informed and engaged throughout the turnaround process. Limited resources can further exacerbate stakeholder management challenges, hindering the ability to engage with all parties effectively. Financial executives must strategically allocate resources to ensure that key groups receive the attention they require, which may necessitate prioritizing certain initiatives over others. Balancing cost management with strategic investments is vital to achieving significant cost reductions while addressing the needs of stakeholders. Our approach emphasizes operationalizing lessons learned to maximize resource efficiency and effectiveness, tailored specifically for small to medium businesses.

- Changing Expectations highlight the dynamic nature of stakeholder needs, which are not static but evolve over time. Financial leaders must remain flexible and responsive to these changes, adjusting their strategies to meet new requirements. The increasing emphasis on sustainability has prompted many organizations to explore ESG tax incentives and credits. Industry specialists assert that technology can aid financial leaders in capitalizing on these opportunities, facilitating the integration of sustainability initiatives into their stakeholder engagement approaches. Our services are customized to meet the distinct requirements of small to medium enterprises, ensuring that financial leaders can effectively respond to these evolving expectations.

Recognizing stakeholder management challenges is the first step toward developing effective management strategies. By understanding the dynamics at play, financial executives can implement tailored approaches that not only address immediate concerns but also position their organizations for long-term success. A case study involving Woliba illustrates this point: by integrating wellness, engagement, and analytics, financial leaders can tackle key challenges effectively, fostering a healthier workforce and aligning wellness initiatives with sustainability objectives. This holistic approach ultimately drives retention and supports sustainable growth while also addressing communication breakdowns and resource constraints through innovative solutions.

The Importance of Stakeholder Analysis for Financial Success

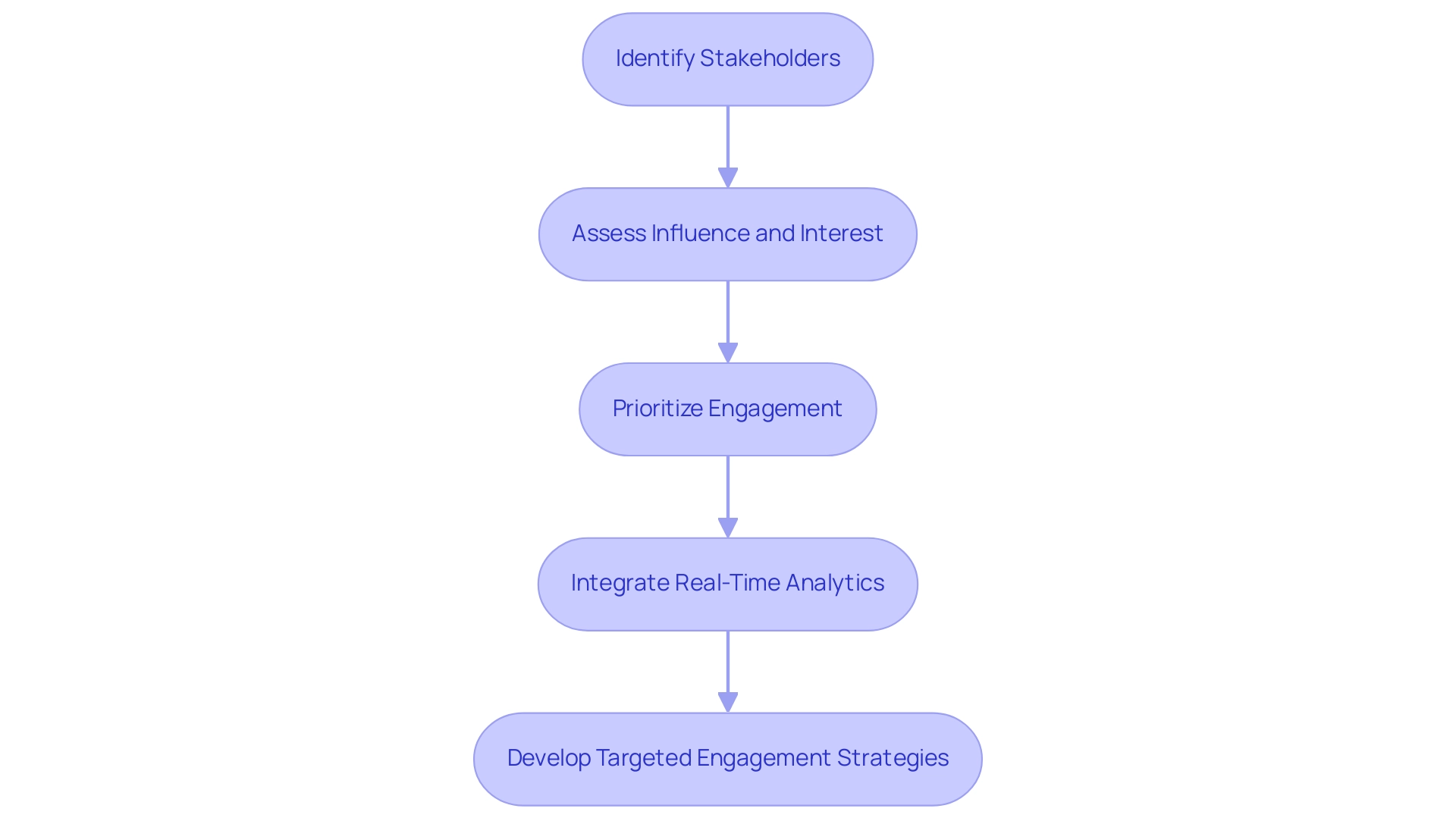

Interest group analysis serves as a crucial framework for chief financial officers, enabling them to systematically identify and evaluate the interests and impacts of various parties. This process is vital for informed decision-making and financial success in 2025. The steps involved include:

- Identifying Stakeholders: Compile a comprehensive list of all individuals and groups affected by financial decisions, including investors, employees, customers, and suppliers.

- Assessing Influence and Interest: Analyze the level of influence each participant wields and their vested interest in financial outcomes. This evaluation is critical, as it allows financial leaders to understand which parties can significantly impact the organization’s financial trajectory, aiding in addressing stakeholder management challenges.

- Prioritizing Engagement: Focus efforts on high-influence, high-interest parties. Engaging these key players effectively ensures that their needs and concerns are addressed, which is essential for overcoming stakeholder management challenges, fostering stronger relationships, and enhancing overall satisfaction.

Integrating real-time analytics into interest group analysis empowers financial leaders to continuously monitor business performance and adjust strategies accordingly. By utilizing tools such as the client dashboard provided by Transform Your Small/Medium Business, CFOs can assess the health of their relationships and operationalize lessons learned from prior engagements. This approach not only leads to improved financial outcomes but also aids in overcoming stakeholder management challenges by enhancing the satisfaction of interested parties.

For instance, organizations that develop targeted engagement strategies for different participant groups can boost contributions and improve results, as illustrated in the case study titled 'Critical Participant Segments: Tailoring Engagement Approaches.' This study underscores the necessity of crafting customized approaches to enhance effectiveness and improve overall outcomes.

In a landscape where 39% of social media users expect prompt responses, the urgency for swift and effective engagement strategies has never been more critical. By supporting a shortened decision-making cycle and ensuring consistent assessment methods alongside open communication, financial leaders can navigate the complexities of financial management and drive sustainable growth in 2025. Furthermore, testing hypotheses to achieve maximum return on invested capital is essential, ensuring that decisions are data-driven and aligned with organizational objectives.

Effective Communication Strategies for Engaging Stakeholders

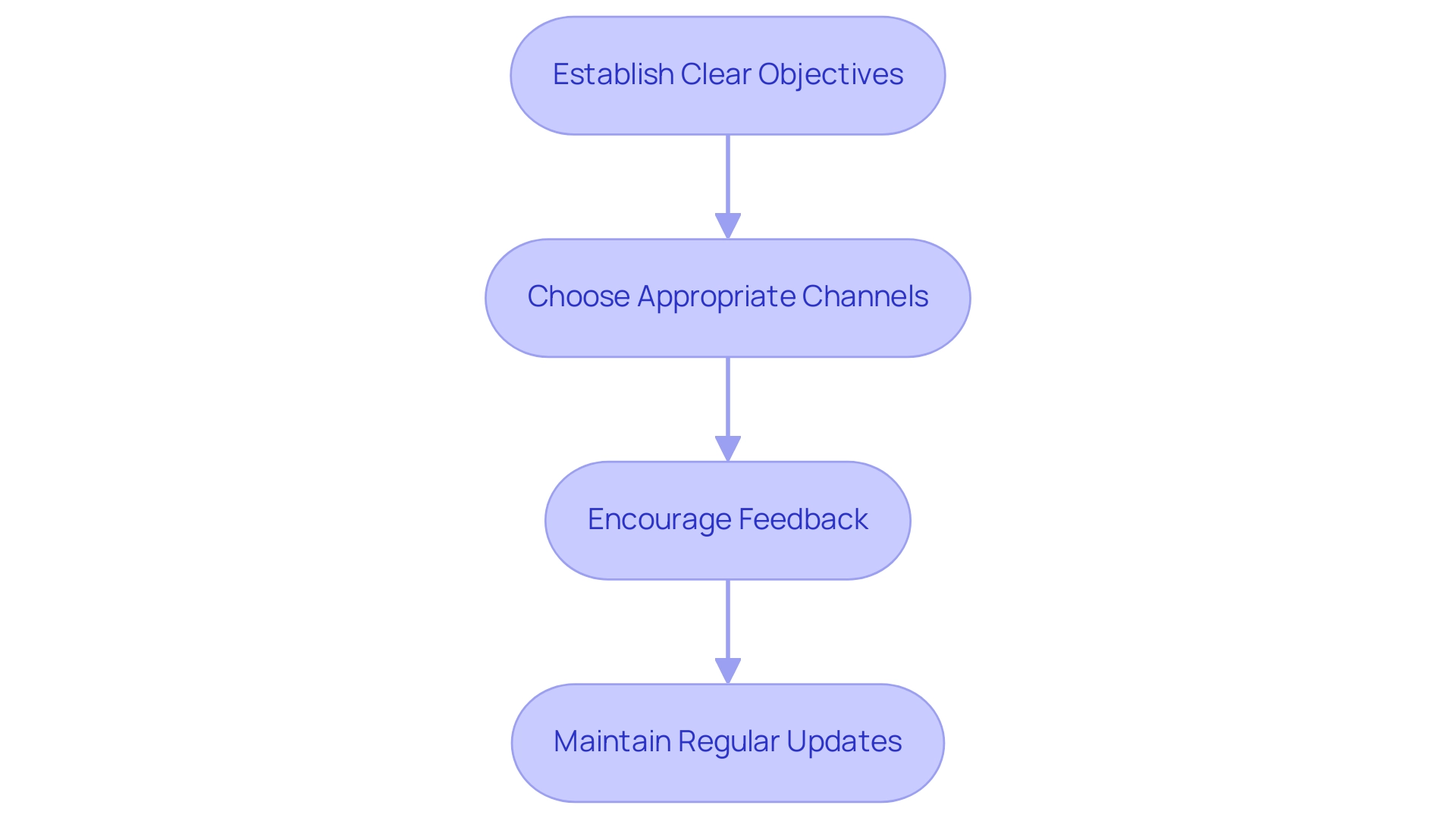

To effectively engage stakeholders, CFOs should implement the following communication strategies:

- Establish Clear Objectives: Clearly define the goals of each communication effort. This guarantees that messages are centered and in harmony with the overall business strategy, ultimately addressing stakeholder management challenges and fostering operational change and long-term benefits for interested parties.

- Choose Appropriate Channels: Select communication channels that connect with involved parties. Whether through emails, meetings, or detailed reports, understanding the preferences of involved parties is crucial for effective engagement. In 2025, leveraging technology and AI can streamline these processes, enhancing data quality and revealing growth opportunities. Additionally, utilizing various communication platforms ensures consistent messaging during a crisis, helping to minimize damage and support recovery efforts.

- Encourage Feedback: Foster an environment where participants feel comfortable providing input and expressing concerns. This two-way communication not only builds trust but also helps in overcoming stakeholder management challenges, allowing for informed decision-making that is essential in navigating complex financial landscapes. By implementing the lessons learned from previous experiences, financial leaders can tackle stakeholder management challenges and improve relationships with interested parties while ensuring that feedback is effectively incorporated into decision-making processes.

- Maintain Regular Updates: Consistently inform stakeholders about financial performance and strategic changes. Regular updates help minimize uncertainty and reinforce transparency, which is vital in addressing stakeholder management challenges and building resilience within the organization. The application of real-time business analytics via client dashboards can continuously assess business health, enabling financial leaders to modify approaches proactively. In fact, a recent study indicates that 28% of finance departments are already utilizing AI in forecasting, showcasing the shift towards more data-driven communication.

As Barbara Larson, CFO, observes, "Chief Financial Officers today are required to provide more than just financial insights." They must offer insights that can propel operational change and direct business approach, ultimately delivering long-term benefits while addressing stakeholder management challenges. By embracing these strategies, financial leaders can develop stronger connections with stakeholders, facilitating smoother financial operations and nurturing a culture of accountability and informed risk-taking. Real-world examples, such as the case study on building resilience in finance, illustrate how promoting transparency and trust can lead to a more engaged group, ultimately supporting recovery efforts during crisis.

Developing a Tailored Stakeholder Management Plan for CFOs

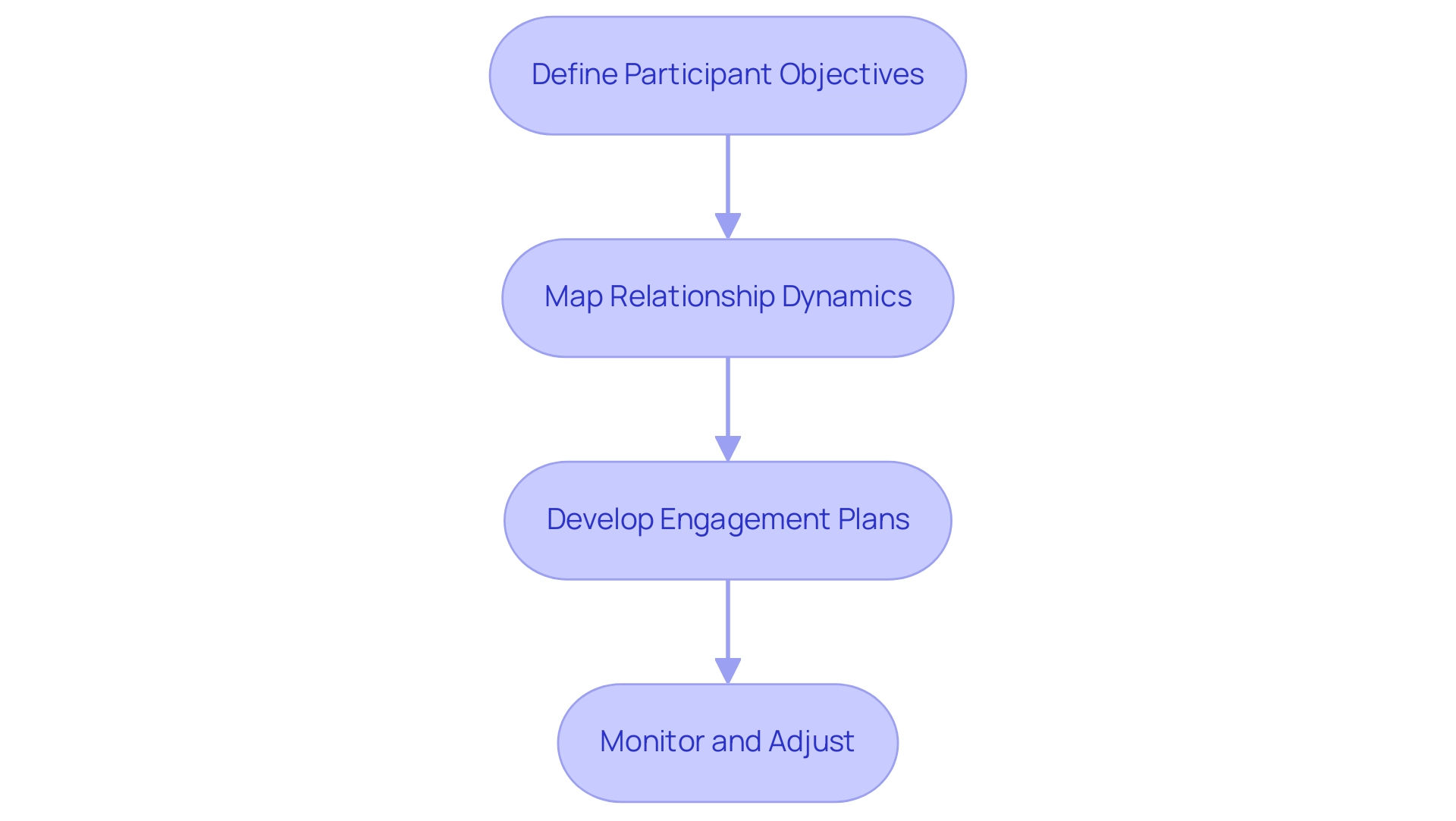

Developing a customized management plan is crucial for CFOs seeking to navigate complex relationships and achieve financial success. This process involves several critical steps:

- Define Participant Objectives: Begin by identifying the specific goals and expectations of each participant group. Comprehending these objectives is essential, as it aligns the interests of involved parties with the organization’s financial goals, ultimately fostering a collaborative environment.

- Map Relationship Dynamics: Visualizing the connections and influence among involved parties is vital. This relationship mapping not only clarifies who holds power and influence but also highlights potential allies and adversaries. By understanding these dynamics, CFOs can strategically involve interested parties to enhance project outcomes.

- Develop Engagement Plans: Customize particular approaches for involving each interest group according to their distinct requirements and degrees of influence. For instance, a recent study revealed that organizations deploying lower voice and value groups on significant projects saw enhanced growth potential. This suggests that inclusive engagement can result in more substantial contributions from involved parties. Furthermore, with a Net Promoter Score of +70 reported by a software firm, it is clear that high satisfaction among interested parties is attainable through efficient approaches. Moreover, acknowledging that 39% of social media users desire prompt replies highlights the importance of swift approaches in engaging with interested parties.

- Monitor and Adjust: Regularly review the effectiveness of the party coordination plan. Continuous monitoring through real-time analytics, facilitated by the client dashboard from Transform Your Small/ Medium Business, allows for timely adjustments, ensuring that strategies remain relevant and effective. In fact, 91% of professionals in project coordination report facing stakeholder management challenges that relate to participant engagement, underscoring the necessity for adaptable processes. Our team supports a shortened decision-making cycle throughout the turnaround process, allowing CFOs to take decisive action to preserve business health.

By following this structured approach, CFOs can effectively manage relationships with interested parties, ultimately supporting their organization’s financial objectives and enhancing overall project success. A case study on Engagement ROI highlights the significance of assessing participant involvement, showing that organizations can enhance their approaches through thorough examination of engagement metrics, resulting in better investment choices and risk oversight.

Leveraging Technology to Enhance Stakeholder Management

In today's dynamic business environment, technology plays a pivotal role in overcoming stakeholder management challenges. CFOs can harness a variety of tools and platforms to optimize their engagement strategies effectively.

- Automate Communication: Implement software solutions that facilitate the scheduling and distribution of regular updates to interested parties, ensuring they remain informed and engaged.

- Analyze Participant Data: Utilize advanced analytics tools to evaluate engagement levels and satisfaction, allowing for data-driven decision-making. This approach is crucial for continuous business performance monitoring, enabling CFOs to make informed adjustments based on real-time insights.

- Facilitate Collaboration: Leverage collaboration platforms that support real-time communication and feedback, fostering a more inclusive environment for participant input. This strategy not only streamlines decision-making but also enhances relationship-building through ongoing dialogue.

- Track Engagement Metrics: Employ data analytics to monitor the effectiveness of engagement approaches, enabling continuous improvement based on measurable outcomes. Real-time business analytics can help diagnose the health and engagement levels of involved parties, which is essential for addressing stakeholder management challenges and ensuring that strategies remain effective.

- Utilize StakeWare Features: Incorporate tools like participant profiling, risk evaluation, and an intuitive dashboard for reporting to enhance participant oversight processes. These features can implement lessons learned during turnaround efforts, ensuring that insights are applied effectively.

Integrating technology into participant oversight not only streamlines processes but also significantly enhances relationships with participants. As highlighted by recent insights, a hybrid approach combining artificial intelligence with empathetic communication is increasingly recognized as the gold standard in overseeing projects, with 60% of project managers advocating for this model. This trend underscores the necessity for financial leaders to adopt innovative tools that not only automate but also customize interactions with involved parties, ultimately driving better engagement and satisfaction.

A practical example is the Jambo consultation oversight software, which emphasizes security in handling consultation data. It allows users to create detailed contact profiles and track interactions comprehensively. While it offers robust tracking and reporting tools, some users have noted the necessity for improved customer support, highlighting the importance of not only possessing the appropriate tools but also ensuring sufficient assistance for effective oversight.

Continuous Improvement: Adapting Stakeholder Management Practices

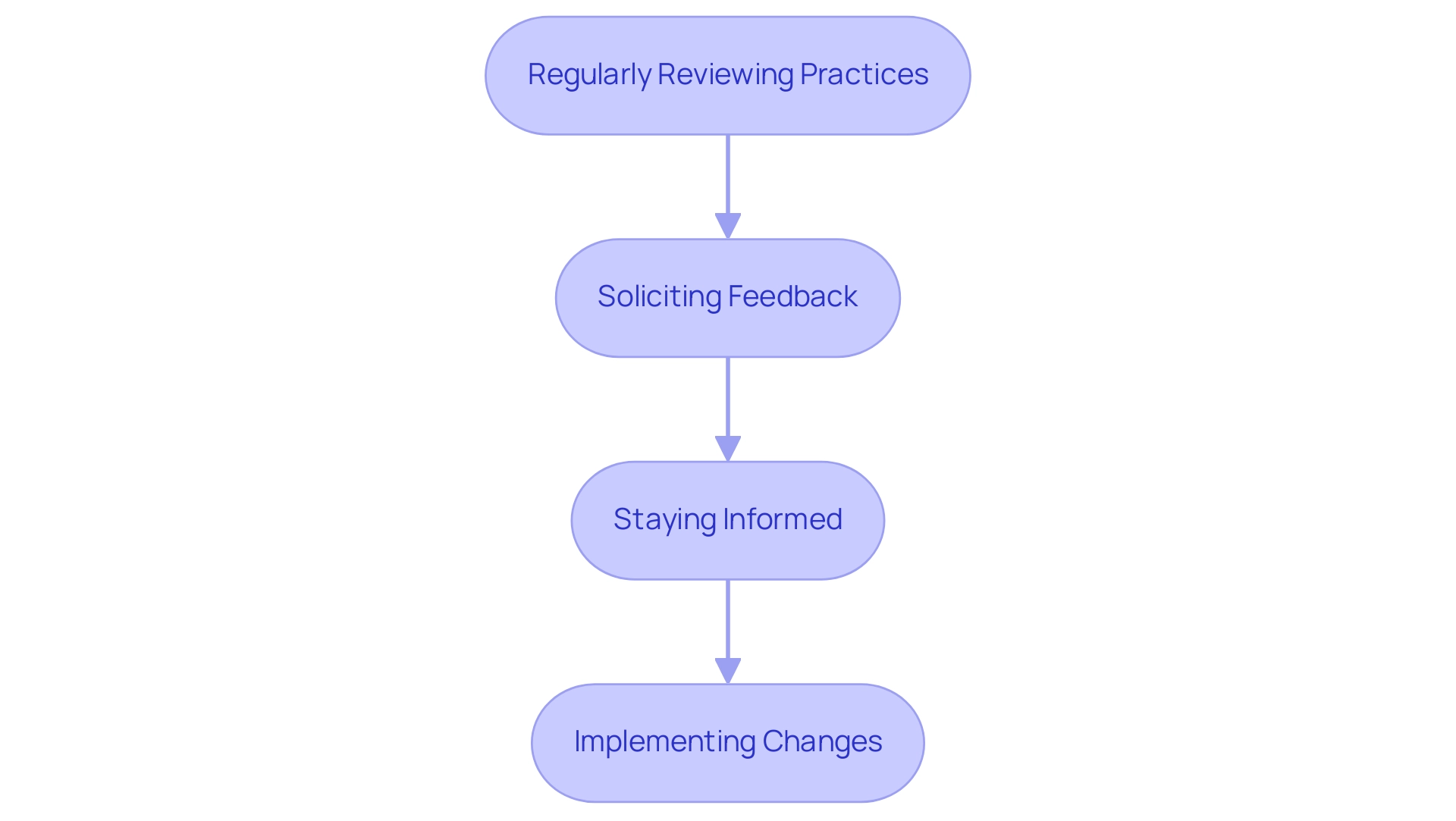

To ensure effective stakeholder management, CFOs at Transform Your Small/ Medium Business must adopt a mindset of continuous improvement by implementing the following strategies:

- Regularly Reviewing Practices: Conduct thorough evaluations of current participant oversight approaches to assess their effectiveness. This ongoing review process is essential; studies indicate that companies aligning their strategies with the expectations of interested parties perform 15% better. Significantly, 50% of a company’s value often comes from just 15-20 key roles, underscoring the importance of effective management of interested parties.

- Soliciting Feedback: Actively gather input from interested parties regarding their experiences and expectations. Feedback is essential; indeed, 39% of social media users express a desire for quick responses, emphasizing the need for agile strategies that meet the needs of all groups involved. By utilizing real-time analytics tools such as dashboards and feedback platforms, CFOs can quickly assess the sentiments of involved parties and adjust their approaches accordingly.

- Staying Informed: Remain updated on industry trends and best practices in managing interests. The collaborative essence of participant engagement initiatives enables teams to adjust and exchange insights across projects, ensuring that approaches remain pertinent and efficient. Continuous business performance monitoring through client dashboards can provide CFOs with the necessary data to make informed decisions, particularly during the turnaround process.

- Implementing Changes: Be prepared to adjust approaches based on participant input and changing conditions. In today’s dynamic business environment, continuous improvement is not just a goal but a necessity, especially in overcoming stakeholder management challenges. A case study titled "Measuring Engagement Effectiveness" emphasizes that assessing engagement is crucial for aligning company strategies with expectations, with studies showing that companies that listen to involved parties perform 15% better in their plans. By simplifying decision-making procedures, financial leaders can take decisive actions that maintain business health and cultivate stronger relationships with partners.

By fostering a culture of continuous improvement and leveraging real-time analytics, CFOs at Transform Your Small/ Medium Business can significantly enhance their stakeholder management capabilities, ultimately driving better financial outcomes and ensuring long-term organizational success.

Conclusion

Mastering stakeholder management is essential for CFOs navigating the complexities of today's financial landscape. The ability to effectively identify, analyze, and engage various stakeholders—including investors, employees, and regulatory bodies—can significantly influence an organization's stability and growth. By fostering relationships grounded in trust and transparency, CFOs can align financial strategies with stakeholder expectations, paving the way for sustainable success.

The challenges faced in stakeholder management, such as competing priorities and communication breakdowns, require innovative solutions and a strategic approach. Utilizing technology-driven tools and real-time analytics can enhance engagement and facilitate informed decision-making. Moreover, developing tailored stakeholder management plans that prioritize clear objectives and continuous feedback will help CFOs adapt to the ever-evolving needs of their stakeholders.

As organizations prepare for the future, the emphasis on stakeholder analysis and effective communication cannot be overstated. By leveraging technology and fostering a culture of continuous improvement, CFOs can not only address immediate concerns but also build robust frameworks for long-term financial success. In a rapidly changing environment, those who master stakeholder management will be well-positioned to thrive in 2025 and beyond.

Frequently Asked Questions

What is stakeholder oversight in financial management?

Stakeholder oversight is the process of identifying, analyzing, and engaging individuals or groups with vested interests in an organization's financial decisions, including investors, employees, customers, and regulatory bodies.

Why is building relationships with stakeholders important for financial leaders?

Building stable relationships grounded in mutual trust and understanding helps financial leaders align their strategies with stakeholder expectations, fostering an environment of trust and collaboration, especially during financial crises.

How does stakeholder engagement impact employee retention?

Research indicates that enhancing trust with stakeholders can lead to a 10% improvement in employee retention, particularly in the tech sector, highlighting the benefits of strong relationships on organizational stability.

What challenges do CFOs face in stakeholder management by 2025?

CFOs will encounter challenges such as competing priorities among stakeholders, communication breakdowns, limited resources, and changing expectations, requiring them to adapt their strategies accordingly.

How can technology assist CFOs in managing stakeholder relationships?

Technology can provide real-time analytics and insights to help CFOs navigate stakeholder complexities, enhance communication, and improve transparency, ultimately fostering stronger relationships.

What role does engagement ROI play in stakeholder management?

Measuring engagement ROI quantifies the value derived from stakeholder involvement by analyzing the costs and benefits associated with engagement efforts, helping organizations understand the impact of their engagement strategies.

What is the significance of quick responses to stakeholder inquiries?

With 39% of social media users seeking immediate engagement, financial leaders must develop fast, effective strategies to meet the diverse needs of stakeholders, emphasizing the importance of timely communication.

How can financial leaders prepare for evolving stakeholder expectations?

Financial leaders must remain flexible and responsive to changing stakeholder needs, adjusting their strategies to incorporate new requirements, such as sustainability initiatives and ESG considerations.

What is a holistic approach to stakeholder management?

A holistic approach integrates wellness, engagement, and analytics to tackle key challenges effectively, fostering a healthier workforce and aligning initiatives with sustainability objectives, ultimately driving retention and supporting growth.

How does understanding stakeholder management challenges benefit financial executives?

Recognizing these challenges allows financial executives to develop tailored management strategies that address immediate concerns while positioning their organizations for long-term success.