Introduction

Grasping the concept of Cost of Goods Sold (COGS) is crucial for businesses looking to enhance profitability. This financial measure encapsulates direct costs tied to the production or procurement of goods sold by a company, such as raw materials and labor wages. Understanding COGS not only offers insights into profitability but also highlights areas for cost optimization.

This article explores practical strategies for reducing COGS, including negotiating with suppliers, improving production efficiency, and implementing cost-saving technologies. It emphasizes the importance of supply chain efficiency and the re-evaluation of pricing strategies. By implementing these strategies, businesses can enhance their financial health and maintain a competitive edge in the market.

Understanding Cost of Goods Sold (COGS)

Understanding the idea of the is crucial for businesses looking to improve their profitability. This vital financial measure encompasses the direct expenses linked to the production or acquisition of goods sold by an organization. It encompasses expenses such as the price of raw materials and labor wages, which are inextricably linked to the creation or acquisition of products. A more profound comprehension of the not only provides insights into profitability but also highlights potential areas for .

As noted in the instance of Monday.com, a firm's ability to handle the cost of goods sold can have a substantial impact on its ability to generate unrestricted cash flow, especially as growth slows down. This is a testament to the importance of efficient growth and its subsequent effect on cash reserves, investment opportunities, and overall shareholder value. The software industry, for example, values gross margins greatly, which partly include the costs of goods sold. The intricate relationship between gross margins and long-term profitability can lead to intense scrutiny and sometimes misinterpretation, especially when it comes to the nuances of income statement classifications such as customer success.

This emphasis on profit margins and cost of goods sold is not only an operational issue but also a strategic one, as it contributes to the broader objective of maximizing value for organizations. The pursuit of growth, often at the expense of immediate profitability, has been a hallmark of many modern firms, particularly in the realms of technology and renewable energy. However, this approach is not without its detractors, who contend that an excessive emphasis on scaling can overshadow the crucial requirement to establish sustainable models. In the end, the manner in which a company handles its cost of goods sold and other can greatly influence its approach to decision-making, investment plans, and returns for shareholders.

Why Reducing COGS Matters

Reducing is crucial for any enterprise looking to enhance profit margins and stay competitive. ' leads to more efficient operations and the , paving the way for sustainable growth.'.

For instance, consider the approach of using a "Prix fixe" strategy, which has been applied successfully outside the culinary world in technology and service firms. By offering a curated selection of goods or services at a fixed price, businesses can enhance efficiency and client satisfaction.

Taking inspiration from Pacific Steel & Recycling, companies can also explore restructuring traditional expense frameworks. Pacific Steel, a midsize firm, nearly halved its per-person health spending by analyzing insurance claims data and opting for reference-based pricing, demonstrating the significant impact of analysis and strategic changes.

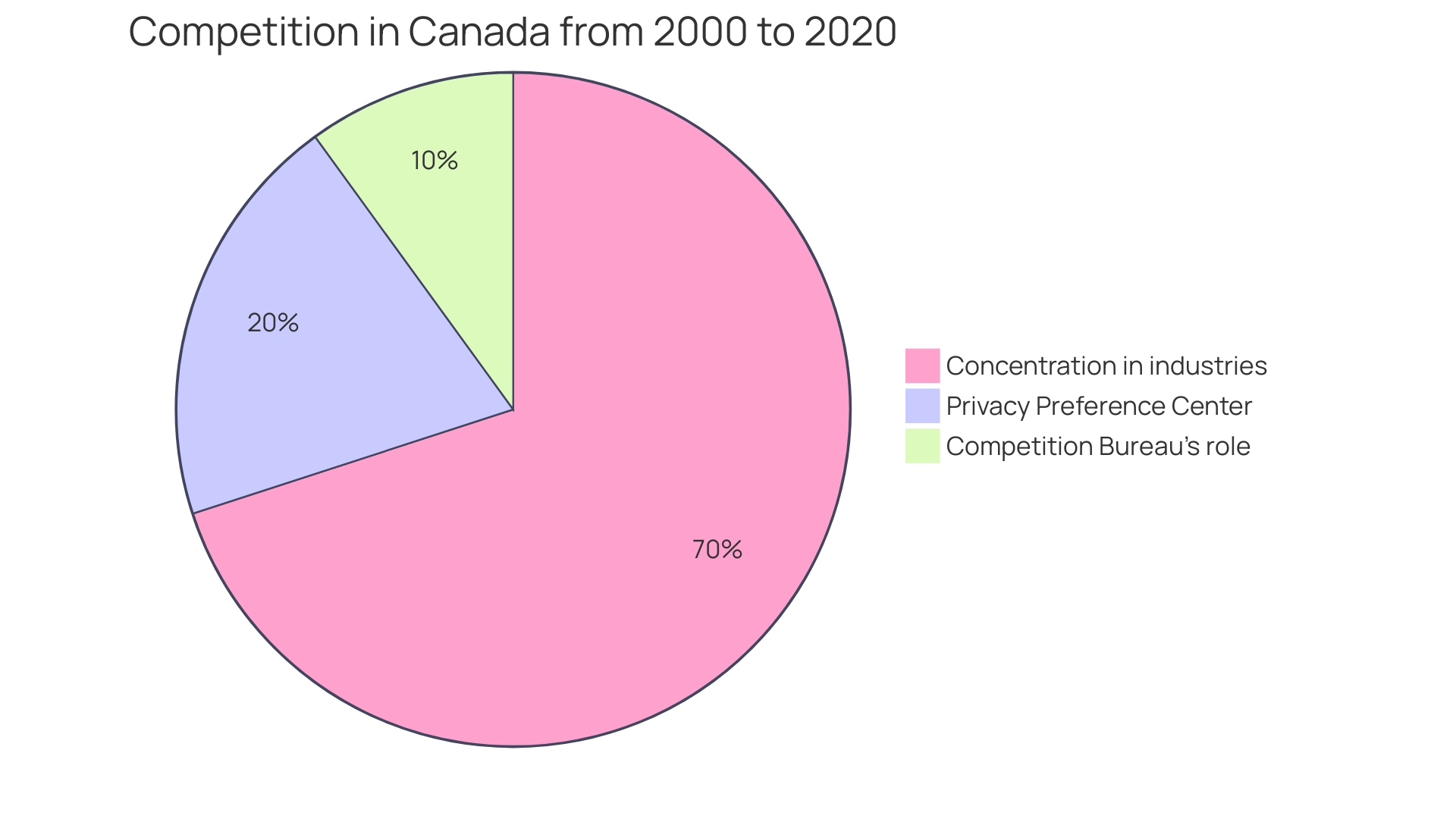

Moreover, as expenses increase due to factors like inflation, as observed with Canada Post's changes in postage rates, companies must stay watchful in their measures to control expenses. Canada Post's efforts to minimize rates for customers while grappling with inflation and decreased mail volume underscores the importance of managing financial pressures proactively.

In the software industry, gross margins are pivotal to long-term profitability. It's important to recognize the diversity within gross margin components to avoid misleading benchmarking and valuations. Specifically, customer success roles, often debated in their classification on the income statement, can influence gross margins considerably.

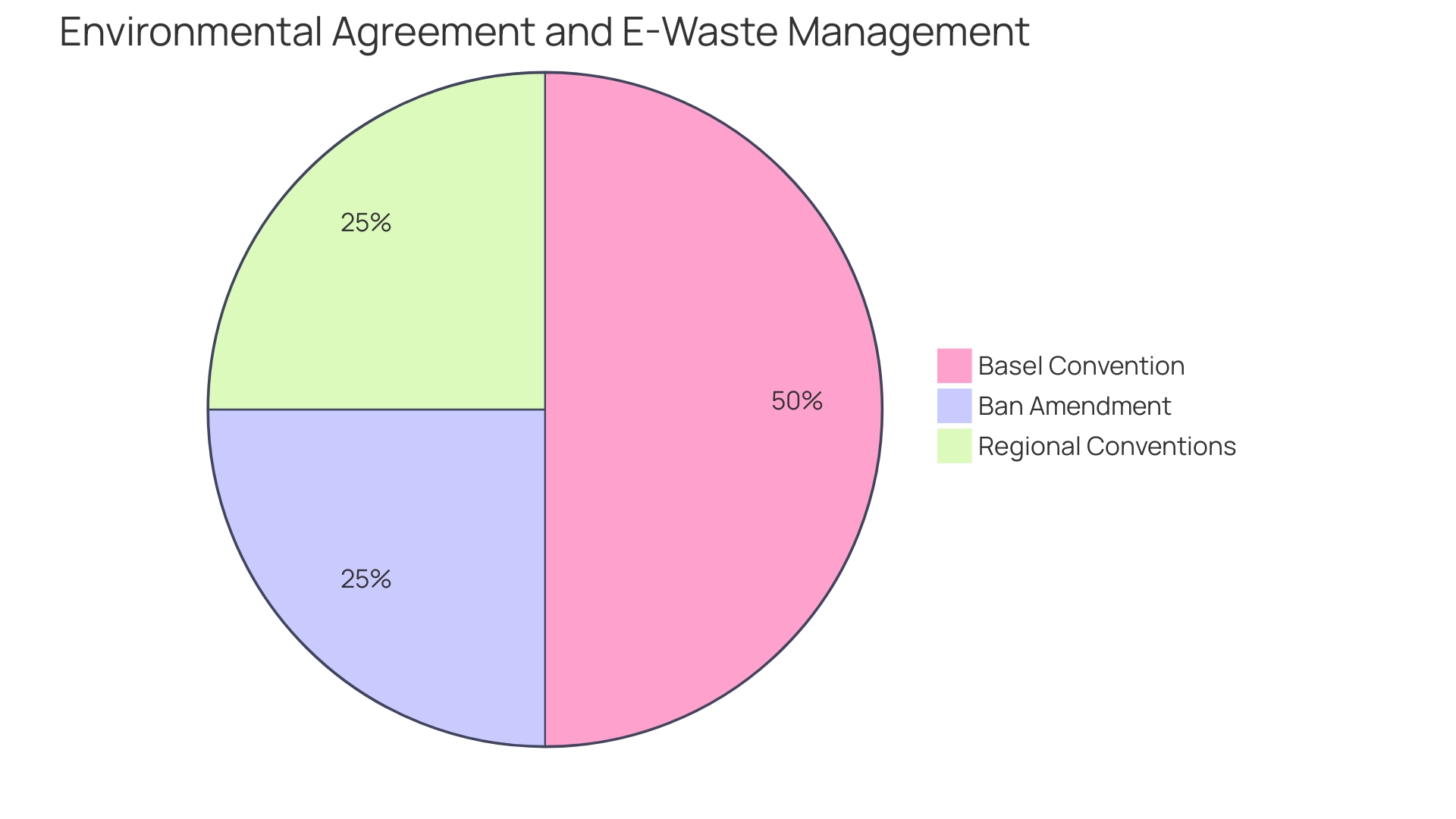

Lastly, enterprises must not underestimate the importance of . While challenging due to the indirect control over these emissions, making educated estimates and prioritizing efforts can lead to substantial improvements, as highlighted by experts advocating for urgent decarbonization to meet the Paris Agreement goals.

To summarize, by drawing lessons from various industries and staying updated on financial data, organizations can adopt effective strategies to reduce operational expenses and the , which is vital for financial health and a competitive edge.

Identifying Components of COGS

Enhancing profitability without compromising on quality is a aiming to optimize the . The makeup of COGS typically includes , direct labor, and other . A more detailed examination of these components enables the identification of particular expense influencers, which can subsequently be focused on for enhancement and . For instance, when it comes to raw materials, organizations have the option to bargain for large-scale procurement contracts or investigate substitute suppliers to achieve savings. Concerning direct labor, companies may invest in training to or implement automation to decrease labor-intensive tasks. By concentrating on the direct expenses that have the greatest impact on the cost of goods sold, companies can devise precise strategies that not only reduce expenditures but also uphold product standards and customer satisfaction.

Strategies to Reduce COGS

To improve the financial health of an enterprise, it's crucial to implement strategies that reduce the . One method is the , which entails determining the production expense of a product, then adding a markup to establish a selling price. This strategy is straightforward and can yield predictable profits but lacks market flexibility and may overlook competitor pricing.

Another tactic is , which sets a product's price based on the perceived value to customers. While this strategy can potentially lead to higher profits, it requires a deep understanding of customer needs and market trends.

To effectively handle these strategies, companies should utilize technology for precise expense tracking, which assists in determining suitable markups and comprehending . Direct expenses are expenditures directly linked to the development of products or services, such as materials and labor, and are crucial for calculating COGS. Through the observation of these expenses, organizations can make well-informed choices to enhance pricing and minimize overheads.

Furthermore, businesses can learn from case studies in various sectors. For example, the viewpoints of stakeholders, such as those from hospital departments or maintenance services, were extremely valuable in a project that aimed to decrease emissions and expenses by changing anesthesia practices. This initiative not only cut expenses but also .

Finally, it is crucial to stay updated on that affect operational expenses, such as the impact of inflation on Canada Post's delivery services. Understanding these external pressures allows for improved and expense management. By integrating these strategies and insights, businesses can effectively reduce COGS and bolster their financial performance.

Optimize Inventory Management

Optimizing inventory management is not just about avoiding excess stock and its associated expenses; it's about smart, strategic operations. Take Europris, for example. Norway's leading discount goods chain didn't just automate; they transformed their supply chain, consolidating six warehouses into one high-efficiency hub. This isn't just about cutting costs; it's about setting the stage for scalable growth and agility in an ever-changing market.

Similarly, the automotive industry's pivot to electric vehicles represents more than a shift in technology; it's a reimagining of inventory management. With enormous , companies are rethinking their net working capital, with inventory being a pivotal focus. It's about seizing the moment: and to minimize SKUs, all towards .

Furthermore, AI is revolutionizing inventory management far beyond the confines of any one industry, offering a glimpse into a future where technology enhances decision-making. Yet, it's not just about replacing humans; it's about augmenting our capabilities, optimizing replenishment processes, and that align with corporate responsibility goals. With the right systems in place, businesses can not only reduce their CO2 footprint but also ensure they're meeting demand without overextending resources.

The bottom line is clear: is at the heart of . It's a delicate balance of anticipating demand, managing production expenses, and leveraging technology to maintain not just profitability but also a competitive edge in a dynamic market landscape.

Negotiate Better with Suppliers

Mastering the art of negotiation with suppliers is critical for reducing the (COGS). An astute strategy for supplier negotiation can unlock advantageous terms such as competitive pricing, discounts, and rebates, which directly reduce the expenses of raw materials and inputs. Additionally, developing and exploring other sourcing options can result in substantial .

The creation of a 'should value' model is crucial, breaking down a product into its basic elements and accurately assessing the expenditures linked to materials, labor, overhead, and profit margins. Using industry data, such as average expense structures and wage information, offers insights into potential overquoting by suppliers. This ever-changing landscape of expenses and prices highlights procurement's shift from a simple transactional function to a strategic entity capable of generating value and innovation.

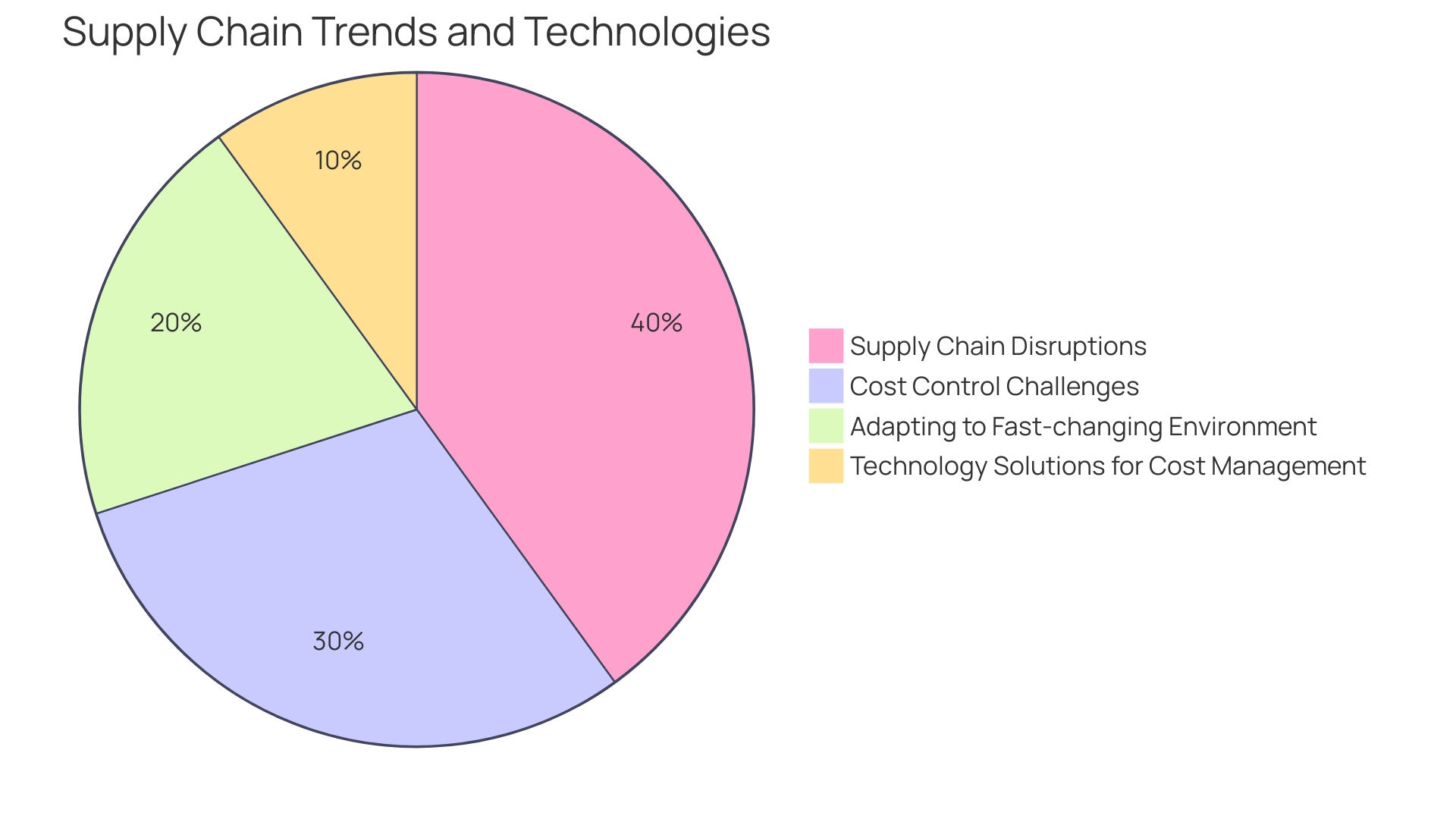

In the interconnected realm of supply chains, awareness of the end-to-end process is paramount. Ignoring the wider network's ebbs and flows can lead to missed opportunities and unforeseen risks, as evidenced by recent global shortages of essential components such as microchips. Effective (SRM) is indispensable and hinges on trust, transparency, and shared risk management. Enhanced SRM can yield tangible benefits such as price reductions and facilitate discussions about expense elimination from the production process.

Forward-thinking organizations, like Ford, underscore the significance of supplier dependence and the risks of raw material shortages. Ford's proactive strategy includes multi-year commitments to suppliers, ensuring access to vital materials for electric vehicle production. Although this introduces potential risks, it also reflects a commitment to innovation and long-term planning.

In the end, negotiation strategies based on data, supported by a thorough comprehension of the supply chain and solid supplier connections, are crucial in reducing and cost of goods sold. This approach not only ensures competitiveness but also prepares organizations to adeptly navigate the complexities of .

Improve Production Efficiency

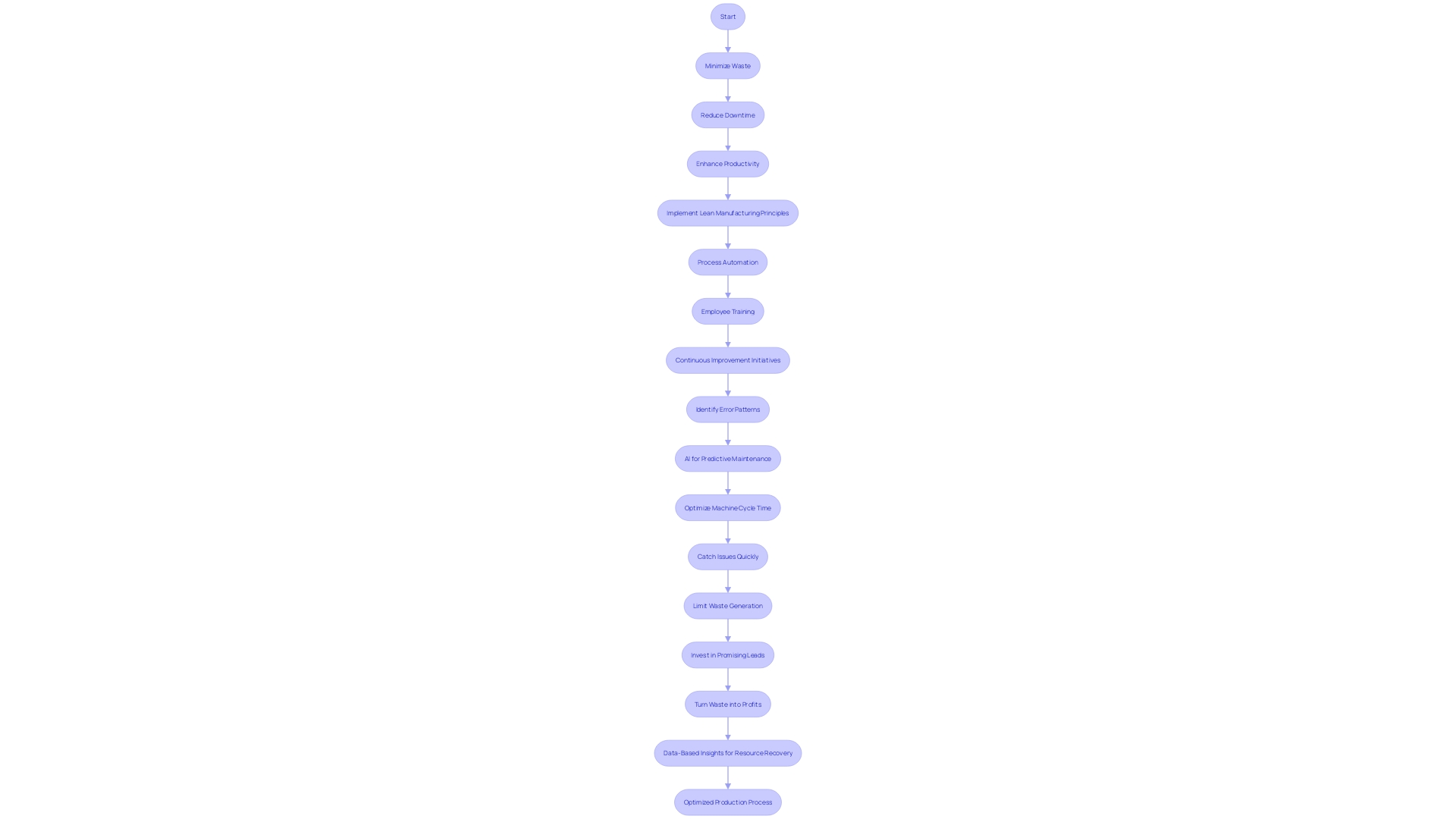

- Optimize production processes by minimizing waste, reducing downtime, and enhancing productivity. Lean manufacturing principles, process automation, and employee training are vital tools for this purpose. Continuous improvement initiatives should be a core part of the strategy to ensure ongoing efficiency gains.

- Case studies from industry leaders such as Smoker Craft and Rivian illustrate the importance of innovation and environmental considerations in the production process. Both organizations have utilized cutting-edge technologies and eco-friendly methods to optimize operations and minimize waste, which are vital for decreasing COGS.

- Embrace digital technologies as a means to improve production chain organization. Research published in Management Science indicates that internet-enabled technology facilitates better coordination within and between companies, affecting production flows and vertical integration decisions.

- Use to measure and manage progress, driving improvements in , , and . Tracking these metrics is crucial for informed decision-making and strategic planning.

Implement that not only decrease environmental impact but also save money. Simple measures like going paperless, printing on both sides, and using black and white printing can significantly reduce waste and energy use in the workplace.

- Focus on as a cost-effective strategy for maximizing profitability and ensuring sustainable growth. It costs less to retain existing customers than to acquire new ones, which highlights the importance of customer satisfaction and loyalty.

- Seek insights from experts in the field. Production managers like Alexander Stone at Hod Assaf Industries Ltd. demonstrate the impact of strategic vision and leadership in modernizing operations and fostering team collaboration.

Reduce Waste and Scrap

Minimizing waste and scrap is a pivotal strategy in the reduction of . Waste audits are an important initial stage; by comprehending the composition and source of waste, organizations can implement targeted strategies to streamline their operations. Actions such as , refining packaging designs, and bolstering quality control can lead to significant cost reductions associated with waste management and product rework, thus bolstering and diminishing direct expenses.

For example, retailers can witness immediate results by adopting simple practices like going paperless to reduce office waste or optimizing print settings, such as printing on both sides of the paper and avoiding color printing when unnecessary. These actions not only cut down on paper usage but also conserve energy. Moreover, companies are encouraged to rethink their , considering environmental, social, and governance (ESG) issues. By establishing definite targets and milestones, similar to what Levi Strauss accomplished with their water usage objectives, companies can make significant progress towards sustainability.

In a wider perspective, as emphasized by research supported by over 120 CEOs and expressed by Ana Botin of Santander, enterprises play a crucial role in reducing energy demand without impeding economic output. Through the implementation of AI in manufacturing and the retrofitting of buildings, organizations can achieve a significant enhancement in energy efficiency, which is an essential measure in meeting worldwide carbon reduction obligations.

A focus on circularity, as suggested by the Environmental Defense Fund (EDF), can also propel businesses towards financial gains from reduced resource consumption and waste disposal costs. With an anticipated 70% increase in waste by 2050, it is clear that is not just a myth but a long-term goal that begins with conscious decision-making today. Strategies should revolve around reducing, reusing, and recycling, creating systems that treat waste materials as valuable resources.

To summarize, through waste auditing, the implementation of efficient , and the adoption of circular economy principles, organizations can greatly decrease their cost of goods sold while making a positive impact on environmental sustainability and operational efficiency.

Implement Cost-Saving Technologies

Harnessing is pivotal for enhancing manufacturing processes and slashing the (COGS). By integrating robotics, artificial intelligence (AI), and data analytics, companies like GrayMatter Robotics are setting new benchmarks. They optimize operations and elevate product quality while trimming down labor expenses. Similarly, energy efficiency is another frontier where innovation plays a crucial role. Implementing Smart Building Automation Systems (BAS) can lead to of 8% to 15%, as per Navigant Research, by optimizing building operations and adapting to real-time conditions.

Moreover, aligning with , which AT&T Business emphasizes as integral to meeting current needs without jeopardizing future generations, businesses can address ESG challenges effectively. This approach not only aids in diminishing utility costs but also aligns with the broader objectives of environmental conservation and sustainability.

These strategies are not just theoretical; they are evident in the operational efficiencies discussed by leading organizations in various sectors, including health care and financial services, as reported by analysts like Michael Wilson. The tech-driven push for productivity is also mirrored in industries like IT, which, as Svitla Systems demonstrates, leverages cloud computing for dynamic workloads and CI/CD pipelines, ensuring resource availability for critical functions.

The business world's preference for such technologies is evident, with a persistent quest for amidst economic uncertainties, as observed in earnings calls from S&P 500 organizations like Pfizer and BlackRock. As these companies seek to safeguard margins, they also recognize the importance of innovative solutions provided by firms like Millennium Recycling, which continues to lead in material recovery through the adoption of .

In brief, the convergence of technology, efficiency, and sustainability is demonstrating to be a powerful influence in decreasing operational expenses and cost of goods sold. These advancements are not only driving immediate financial benefits but are also paving the way for a sustainable, tech-forward future, as underscored by Florent's work in , where innovative solutions are at the forefront of the transition to a low-carbon economy.

Re-evaluate Pricing Strategies

For enterprises aiming to decrease their , a crucial measure is the re-evaluation of . To achieve this, companies should invest in regular pricing analysis and market research to detect opportunities for structuring prices more effectively. Strategies may include revising prices, adopting tiered pricing models, or leveraging , all aimed at and maintaining .

Utilizing a pricing approach such as , where a markup is added to the expenses of production, can be straightforward for startups and smaller businesses with advantages in terms of expenses. It offers simplicity in implementation and can yield predictable profits, but may lack flexibility and ignore competitive dynamics. Companies should consider using technology to determine the actual production expenses, thus establishing precise markups.

Another approach is value-based pricing, which determines prices based on perceived customer value rather than solely on expenses. This approach fosters a price that customers are willing to pay and can better reflect the value delivered.

Expenditures associated with the operation, which include wages, supplies, and insurance, must be meticulously controlled. By incorporating these into the COGS, companies can ascertain a comprehensive perspective of their expenses, crucial for pricing determinations.

In reference to health care, for instance, the concept of reference pricing has emerged as a solution to the issue of price variation across services. By setting a consistent benchmark, like Medicare rates, companies such as Pacific Steel have effectively managed healthcare expenses for their employees.

Similar to the changes suggested by Canada Post for postage rates, companies must carefully evaluate the effect of pricing adjustments. The proposed increases, though modest, are a response to the financial pressures of inflation and reduced mail volume, demonstrating the delicate balance between expense management and revenue generation.

Ultimately, companies need to frequently evaluate and modify their pricing approaches to enhance cost of goods sold, boost profitability, and stay competitive in the market.

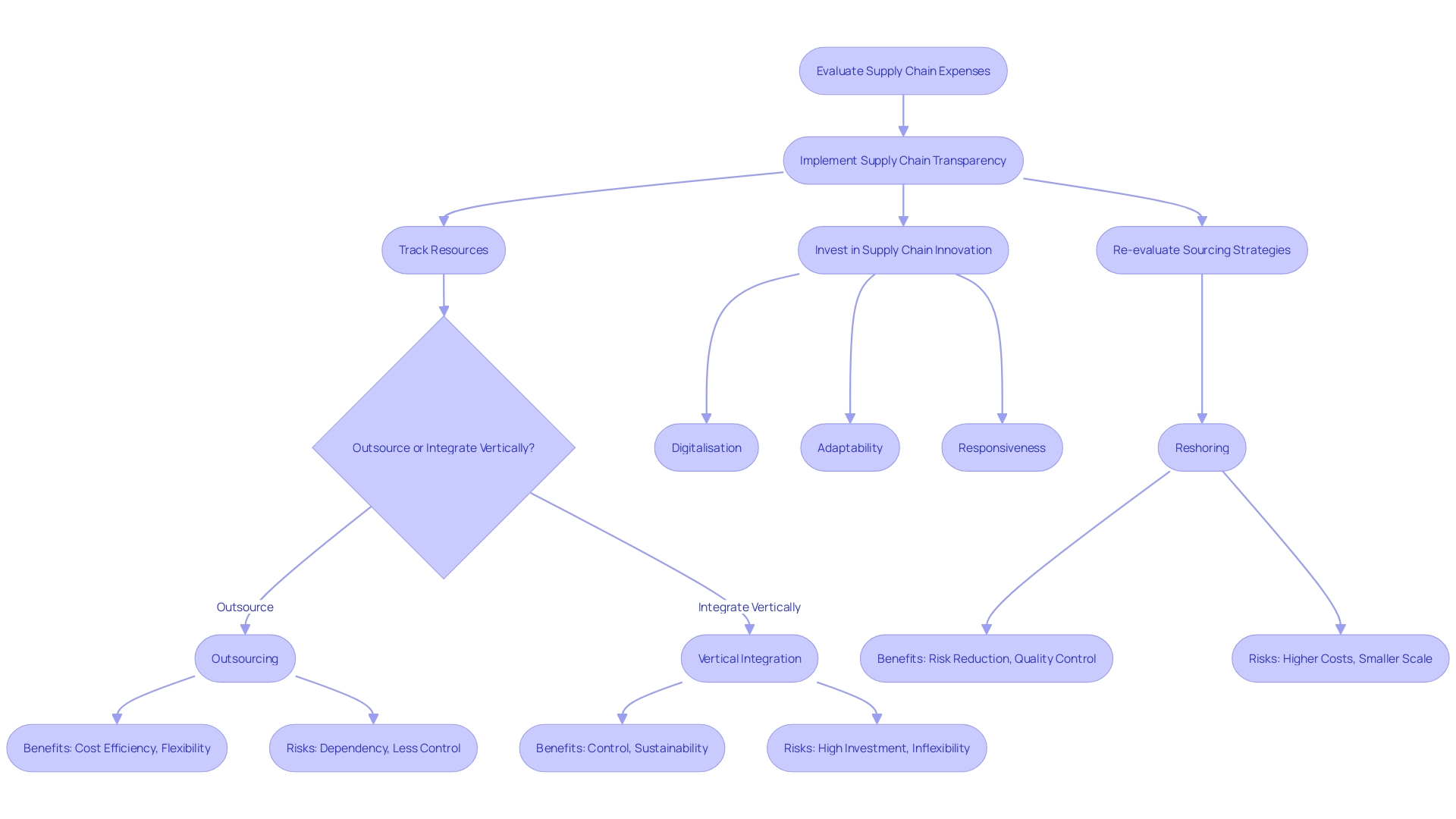

Consider Outsourcing and Vertical Integration

Exploring strategies to minimize the expense of goods sold (COGS) and is a perennial challenge for businesses. One successful strategy is utilizing the idea of , which allows businesses to trace and oversee the movement of materials and products, ensuring effectiveness and possibly lowering expenses. This approach can be executed through either outsourcing or .

Outsourcing involves engaging specialized external suppliers to handle certain production processes or components. By doing this, companies can benefit from the suppliers' economies of scale and expertise, which often results in reduced expenses. Additionally, small businesses can outsource tasks like content creation, bookkeeping, or recruitment to specialized agencies, allowing them to focus on core operations without the burden of managing these processes in-house.

Conversely, vertical integration involves acquiring suppliers or distributors to gain more control over the supply chain. This approach can result in improved efficiency and savings, as it simplifies processes and reduces the requirement for external coordination. A prime example of vertical integration's efficacy is observed in industries that exhibit traits of natural monopolies, such as railways or power grids, where the structures of expenses favor single providers over competitive markets.

Implementing these approaches necessitates thorough evaluation of direct expenses, encompassing resources and workforce exclusively linked to the manufacturing of products. Accurate tracking and accounting of these expenses are essential, as they directly impact COGS, a critical financial metric that mirrors the expenses associated with producing a company's sold goods.

To put the significance of into perspective, take into account Amazon's in-house logistics initiative, which has notably raised its shipping expenses throughout the years. Nevertheless, through enhancing its effectiveness in transporting products, Amazon has succeeded in reducing its shipping expenses as a portion of income, demonstrating the possible advantages of streamlining supply chain operations.

In conclusion, businesses considering outsourcing or vertical integration must weigh the benefits of reduced costs and increased control against the potential risks and investments involved. The decision should align with the organization's broader and operational goals, ensuring sustained growth and competitiveness in the market.

Improve Supply Chain Efficiency

To drive down the (COGS), enhancing is essential. This involves fine-tuning several key components: logistics, transportation, and inventory management. By doing so, companies can achieve shorter lead times, avoid inventory shortages, and reduce . , the integration of cutting-edge , and the adoption of streamlined, lean supply chain methodologies are instrumental for heightened efficiency and cost savings.

Supply chain visibility, as defined by GOCOMET, is the capability to trace and monitor the flow of products, materials, and information through each phase of the supply chain, capitalizing on real-time data to manage the movements, locations, and statuses of goods. This visibility is not just about tracking; it's about optimizing every step from raw material sourcing to the final delivery to consumers.

Real-world success stories like Europris, Norway's leading discount retailer, illustrate the impact of supply chain optimization. By transitioning from six separate warehouses to a single automated logistics hub, Europris has not only consolidated its operations but also positioned itself for future growth and efficiency.

Moreover, modern supply chain finance solutions are reshaping how businesses manage their finances. By collaborating with financial institutions, businesses can ensure their suppliers are paid promptly, while also enjoying extended payment terms. This bolsters both the supplier's and the buyer's cash flow and working capital, exemplifying a win-win scenario for all parties involved.

The concept of nearshoring is also gaining traction, with heavyweights like HP and Dell shifting operations closer to home to mitigate risks and reduce lead time. This strategic move not only reduces transportation and logistics costs but also enhances a firm's ability to respond swiftly to market demands, ultimately boosting operational efficiency.

Incorporating these strategies requires a mindset shift towards embracing , which, as Nate Morrison suggests, is not solely about technology but about solving real-world problems. With the increasing pressure from investors and corporate buyers for , as reported in the "State of Supply Chain Sustainability", companies must also consider the environmental and social dimensions of their supply chain decisions.

The Logistics Performance Index (LPI) report highlights the slow but positive progress in logistics efficiency in developing countries, spotlighting the necessity for continued efforts to bridge the gap between high and low performers in the global market. By implementing responsive, feasible solutions, companies can enhance their supply chain resilience, which is crucial in today's digitally interconnected and security-conscious world.

Monitor and Adjust COGS Regularly

To succeed in a competitive environment, companies must not only monitor their but also analyze its elements for . A utility company, leveraging a platform like Cribl Stream, exemplifies this proactive stance. By democratizing data accessibility, they have , enabling swift and precise decision-making during critical events such as service restoration amidst extreme weather. Similarly, Chess.com's dedication to chess is mirrored in their commitment to robust IT infrastructure, assuring a seamless experience for their global user base. These cases underscore the importance of and and market dynamics. Companies can thus sustain cost-effectiveness by making in a comprehensive understanding of their operational expenses and the agility to adjust to ever-evolving business landscapes.

Conclusion

In conclusion, reducing COGS is crucial for businesses to enhance profitability and maintain a competitive edge. Practical strategies such as negotiating with suppliers, improving production efficiency, optimizing inventory management, implementing cost-saving technologies, re-evaluating pricing strategies, considering outsourcing or vertical integration, and enhancing supply chain efficiency are key.

Negotiating with suppliers unlocks favorable terms and significant cost reductions. Improving production efficiency minimizes waste and enhances productivity. Optimizing inventory management leads to scalability and improved cash flow.

Implementing cost-saving technologies optimizes operations and reduces expenses. Re-evaluating pricing strategies enhances profit margins. Considering outsourcing or vertical integration minimizes costs.

Enhancing supply chain efficiency ensures smooth operations.

By implementing these strategies, businesses can enhance financial performance and remain competitive in the marketplace.

Frequently Asked Questions

What is the Cost of Goods Sold (COGS)?

COGS refers to the direct expenses associated with the production or acquisition of goods sold by a business. This includes costs such as raw materials, labor wages, and other direct expenses linked to the creation or purchase of products.

Why is understanding COGS important for businesses?

Understanding COGS is crucial for improving profitability. It provides insights into cost optimization and the overall financial health of a business, impacting cash flow, investment opportunities, and shareholder value.

How does COGS affect cash flow?

A firm’s management of COGS can significantly influence its ability to generate unrestricted cash flow, especially during periods of slowed growth. Efficient handling of COGS enhances cash reserves and investment prospects.

What role does COGS play in profitability?

COGS is closely tied to gross margins, which are critical for long-term profitability. Misinterpretations of income statement classifications, such as customer success costs, can lead to skewed assessments of a company's financial standing.

How can businesses optimize their COGS?

Businesses can optimize COGS by analyzing and negotiating with suppliers to secure better terms, implementing cost-effective production processes, utilizing technology for precise expense tracking, and adopting pricing strategies that reflect customer value.

What strategies can companies use to reduce operational expenses?

To reduce operational expenses, companies may apply strategic expenditure reductions, restructure expense frameworks, as demonstrated by Pacific Steel's use of insurance claim analysis, and stay vigilant about external factors like inflation impacting pricing.

How can inventory management impact COGS?

Effective inventory management minimizes excess stock and associated expenses. For example, companies like Europris have streamlined operations by consolidating warehouses, thereby enhancing efficiency and scalability.

What is the significance of waste reduction in managing COGS?

Minimizing waste and scrap is vital for reducing COGS. Implementing waste audits and enhancing recycling efforts can lead to significant cost reductions. Companies are encouraged to adopt circular economy principles to treat waste as a valuable resource.

How do pricing strategies affect COGS?

Regular pricing analysis and market research help companies structure prices effectively. Strategies like cost-plus and value-based pricing can enhance profit margins while keeping the business competitive in the market.

What technological advancements can aid in reducing COGS?

Integrating advanced technologies such as AI, robotics, and data analytics can optimize manufacturing processes, enhance product quality, and lower labor expenses. Emphasizing energy efficiency through smart technologies also contributes to reduced operational costs.

How can businesses manage supplier relationships to reduce COGS?

Mastering supplier negotiation and building strong relationships can lead to better pricing, discounts, and rebates, directly impacting COGS. Companies should also consider the entire supply chain to identify potential cost-saving opportunities.

Why is continuous monitoring of COGS essential?

Regular monitoring of COGS and its components enables businesses to make informed decisions, adapt to market changes, and maintain cost-effectiveness. Proactive analysis allows for quick responses to operational shifts, ensuring sustained profitability.