Overview

This article serves as a comprehensive step-by-step guide for CFOs aiming to implement Non-GAAP accounting effectively. It underscores the critical importance of:

- Identifying key metrics

- Establishing robust internal controls

- Ensuring regulatory compliance

- Maintaining transparency with stakeholders

These elements are essential for enhancing financial reporting and decision-making, while also mitigating risks associated with alternative accounting practices.

Introduction

Non-GAAP accounting has emerged as a pivotal tool for CFOs seeking to present a more nuanced view of their company’s financial health. By deviating from traditional GAAP standards, this approach enables organizations to highlight their core operational performance, thereby enhancing transparency and decision-making for stakeholders.

However, the flexibility of non-GAAP metrics introduces challenges, particularly concerning regulatory compliance and the risk of misrepresentation.

How can CFOs effectively implement non-GAAP accounting while navigating these complexities and ensuring trust among investors and analysts?

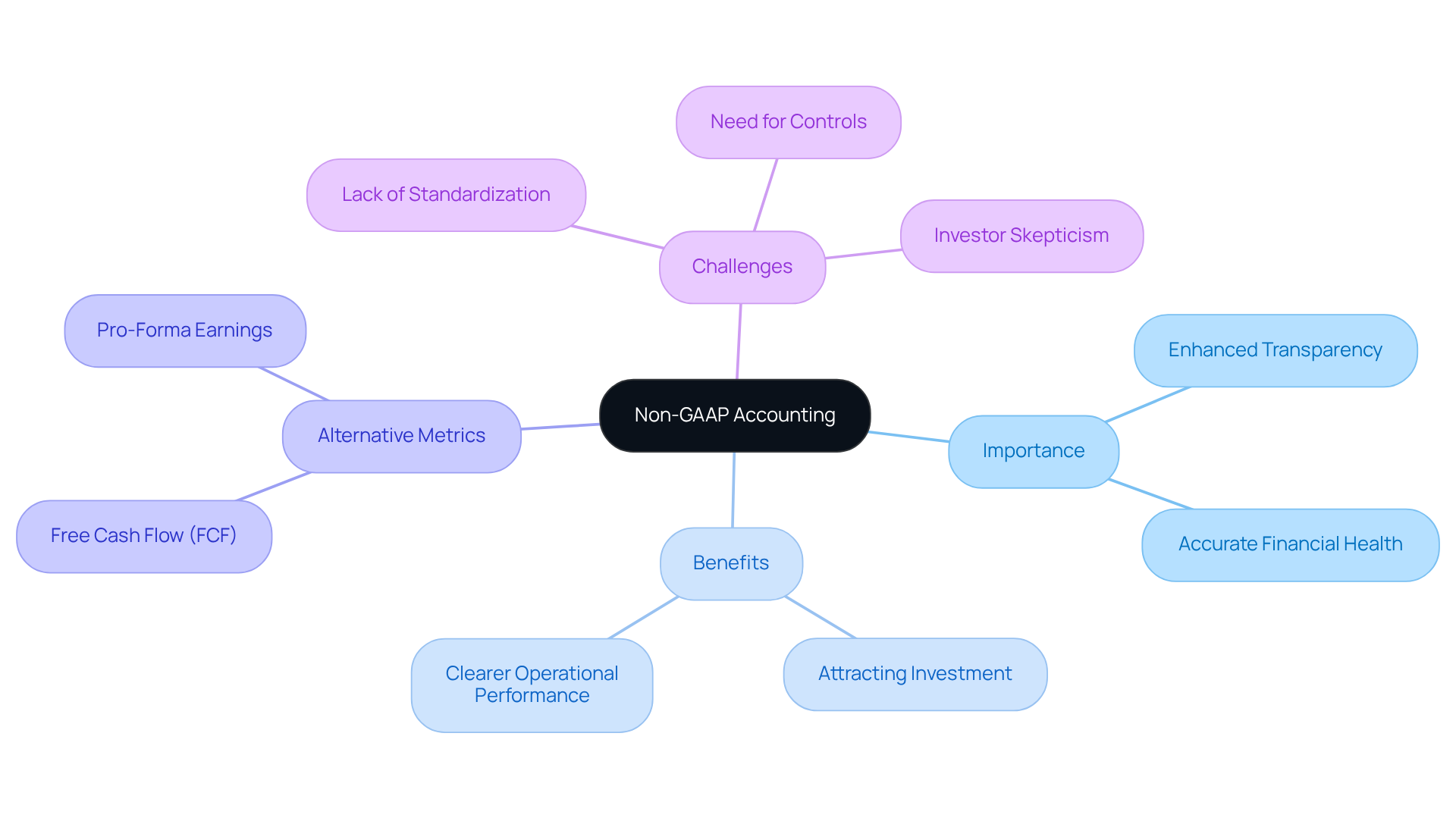

Define Non-GAAP Accounting and Its Importance

Non GAAP accounting represents a distinct set of financial reporting standards that empower firms to present their financial performance in ways that diverge from conventional accounting standards. Such practices often exclude irregular or non-cash expenses—those tied to acquisitions, restructuring, or one-time adjustments—thereby providing a clearer view of a firm's core operational performance. This approach is particularly crucial for CFOs, as it allows them to deliver a more accurate portrayal of financial health to stakeholders, investors, and analysts, ultimately enhancing transparency and facilitating informed decision-making.

The significance of non GAAP accounting standards lies in their capacity to reveal insights that GAAP metrics may obscure. By concentrating on metrics that reflect ongoing operations, CFOs can more adeptly evaluate the organization's performance and make strategic decisions that foster growth and sustainability. For instance, the adoption of Free Cash Flow (FCF) as an alternative metric has gained traction, allowing businesses to highlight cash availability for distribution among stakeholders, which is vital for assessing financial health and operational efficiency.

Moreover, alternative financial metrics can attract investment by presenting a more favorable view of a firm's profitability and cash flow. Indeed, the utilization of alternative performance indicators has surged, with 97% of S&P 500 firms employing them by 2018, signifying an increasing recognition of their importance in financial disclosures. However, it is imperative for CFOs to approach these measures with caution, as the lack of standardization in non GAAP accounting can lead to challenges in comparing outcomes across organizations. Consequently, establishing robust controls and procedures is essential to ensure the integrity and consistency of alternative financial reporting.

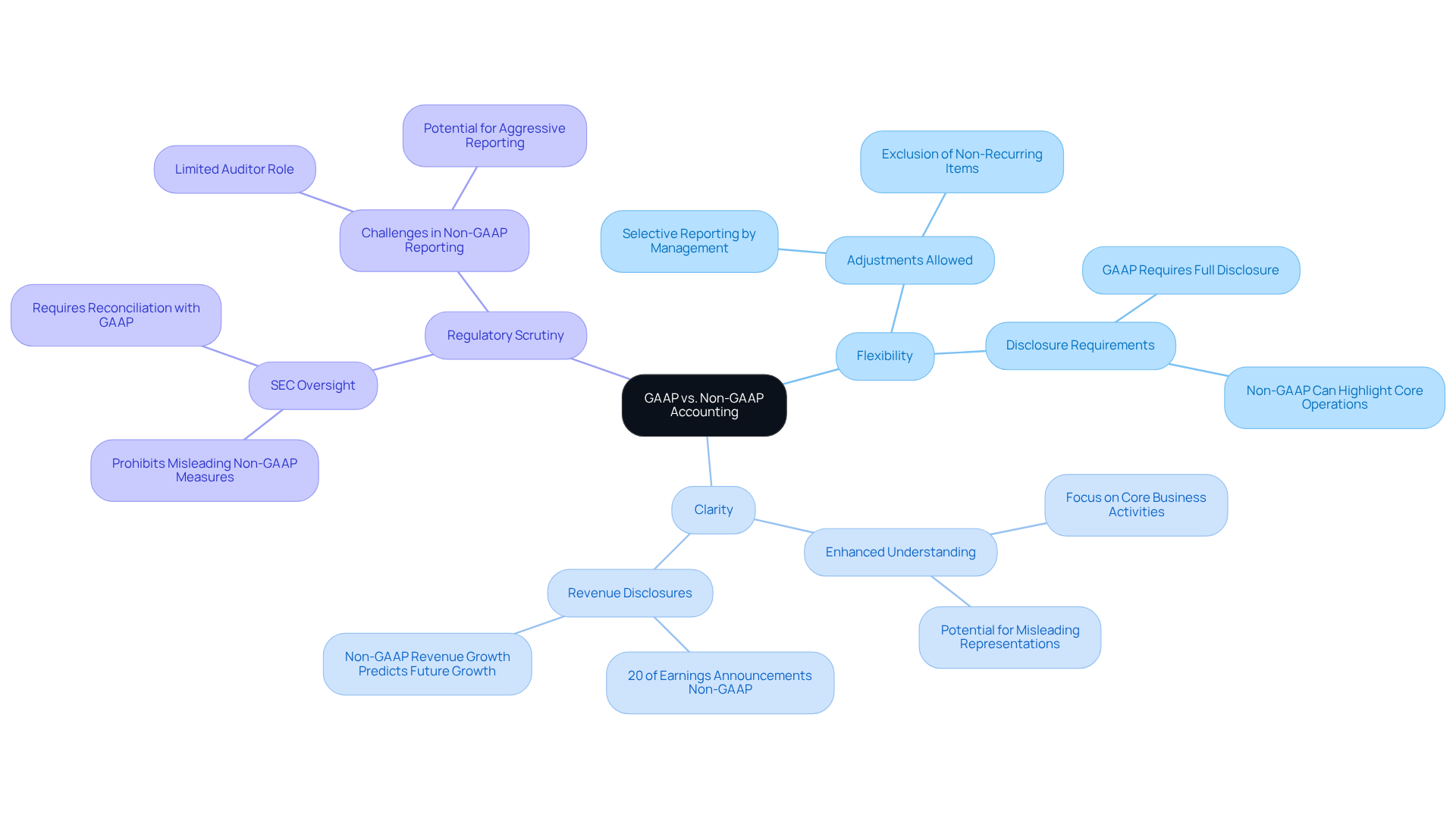

Differentiate Between GAAP and Non-GAAP Accounting

GAAP, or Generally Accepted Accounting Principles, serves as a standardized framework that organizations must adhere to when preparing financial statements. This framework ensures consistency and comparability across organizations, which is essential for investors and regulators. Conversely, alternative accounting provides firms with the flexibility to modify financial metrics, enabling them to showcase a more precise representation of their operational performance.

Key differences include:

- Flexibility: Non-GAAP allows for adjustments that can exclude non-recurring items, providing a clearer view of ongoing operations. In contrast, GAAP requires the disclosure of all expenses, which can sometimes obscure the underlying performance of a business. Management can selectively choose figures to fulfill their reporting goals, a crucial element of alternative accounting reporting.

- Clarity: While alternative financial measures can enhance clarity by emphasizing core business activities, they may also obscure certain financial realities if not disclosed properly. Approximately 20% of earnings announcements feature a revenue disclosure that is not based on Generally Accepted Accounting Principles, primarily intended to showcase revenue growth.

- Regulatory Scrutiny: GAAP is under strict regulatory supervision, ensuring that organizations uphold high standards of accuracy and transparency. Alternative financial metrics, however, are less regulated, which can result in potential misuse if companies do not adhere to best practices in disclosure. The SEC supervises the use of non-GAAP accounting disclosures to prevent misleading practices, emphasizing the importance of clear labeling and reconciliation with GAAP results. The SEC forbids deceptive non-GAAP metrics, including inconsistent earnings documentation between periods.

Understanding these distinctions is vital for CFOs as they navigate the intricacies of financial statements. By examining both GAAP and alternative metrics, CFOs can provide stakeholders with a comprehensive perspective of their company's financial well-being, ultimately assisting in improved decision-making and strategic planning. Furthermore, research indicates that alternative revenue growth forecasts future revenue growth more accurately than GAAP revenue growth, underscoring the practical advantages of this type of reporting.

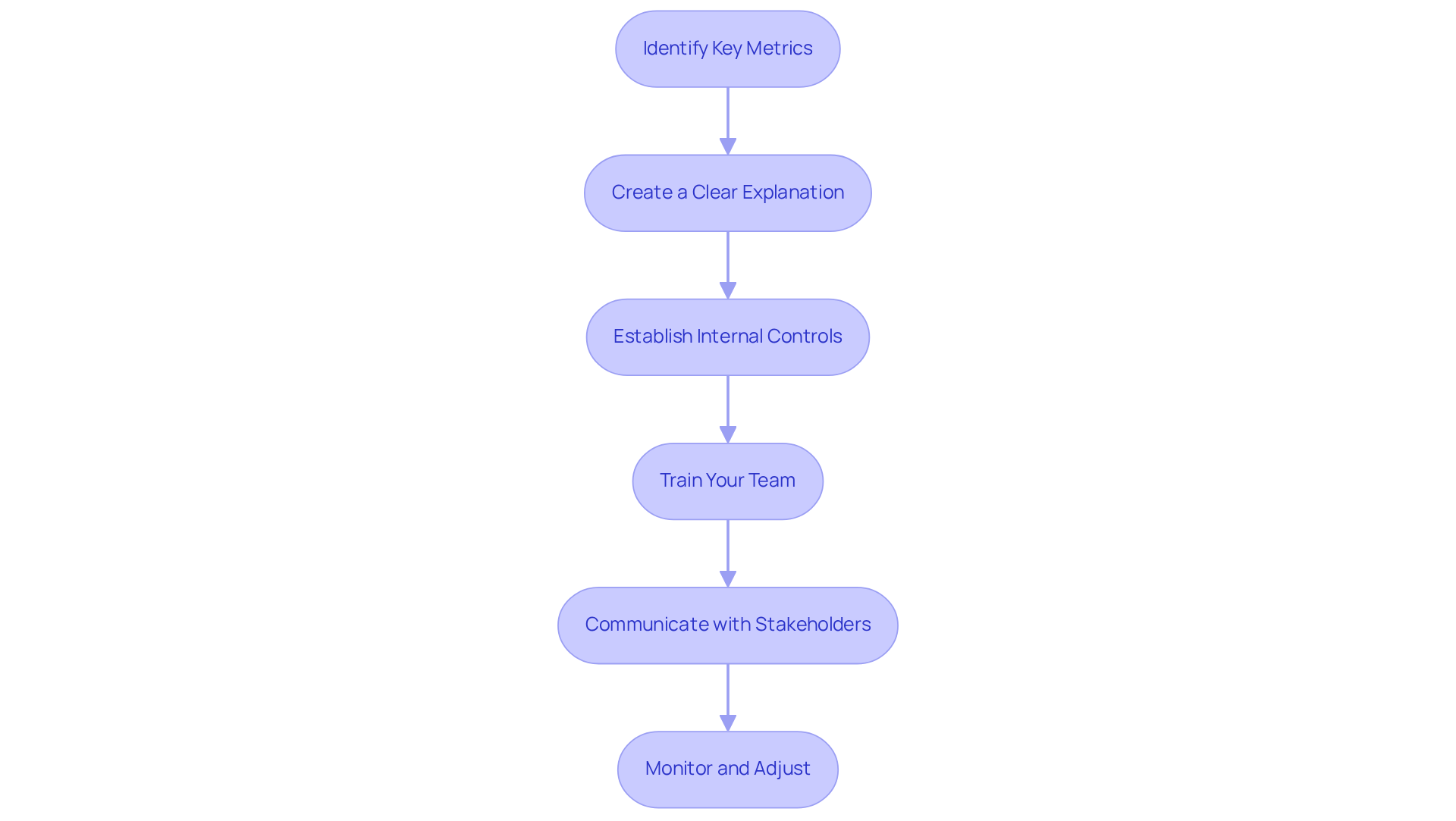

Implement Non-GAAP Accounting: Step-by-Step Process

To implement Non-GAAP accounting effectively, CFOs must adhere to these essential steps:

-

Identify Key Metrics: Determine which alternative accounting indicators will provide the most relevant insights into your company's performance. Common metrics such as EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) and adjusted earnings can significantly enhance understanding of operational efficiency.

-

Create a Clear Explanation: Clearly outline each alternative financial metric you intend to utilize, including the reasoning for modifications. This clarity guarantees consistency and openness in documentation, which is vital for sustaining stakeholder trust.

-

Establish Internal Controls: Implement robust internal controls to ensure that alternative accounting metrics are calculated consistently and precisely. Documenting the methodology for adjustments is crucial to uphold the integrity of financial reporting.

-

Train Your Team: Inform your finance team about the importance of alternative accounting metrics and their proper use. Training should encompass both technical elements and the strategic consequences of utilizing alternative accounting methods, fostering a culture of informed decision-making.

-

Communicate with Stakeholders: Clearly articulate the rationale for using alternative financial measures to stakeholders, including investors and analysts. Transparency is key to maintaining trust and credibility, especially as nearly all public companies report both GAAP and non GAAP accounting earnings.

-

Monitor and Adjust: Regularly assess the effectiveness of your alternative financial disclosures. Be prepared to make adjustments based on stakeholder feedback and evolving business operations or regulatory requirements. Continuous improvement in reporting practices can lead to better insights and decision-making.

By following these steps, CFOs can effectively apply non GAAP accounting methods, providing valuable insights into their organization's financial performance while ensuring adherence to regulatory standards. This approach not only enhances operational visibility but also aligns with the increasing trend of firms employing alternative financial metrics to provide a clearer view of their financial well-being.

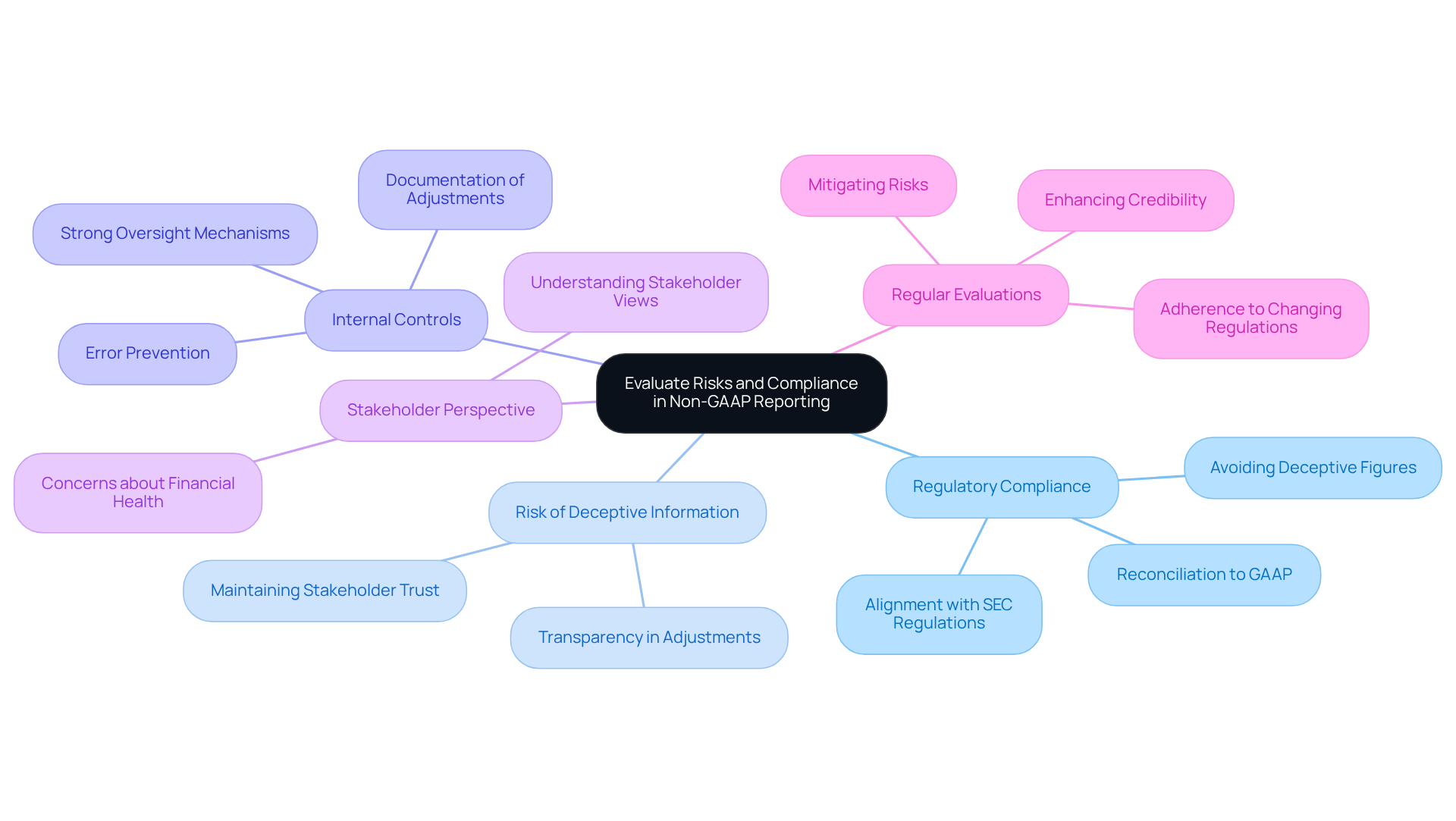

Evaluate Risks and Compliance in Non-GAAP Reporting

When applying alternative accounting principles, CFOs must carefully evaluate associated risks and ensure compliance with relevant regulations. Key considerations include:

-

Regulatory Compliance: Alternative accounting indicators must align with SEC regulations, specifically Regulation G and Item 10(e) of Regulation S-K. This involves offering a reconciliation to the closest GAAP standard and ensuring that alternative figures are not deceptive. As Paul Koziarz emphasizes, "Without compliance, many organizations wouldn’t have security controls in place, and there would be no consistency of standards among the protocols being used."

-

Risk of Deceptive Information: There is a considerable danger that alternative financial metrics can mislead stakeholders. It is crucial to transparently disclose the adjustments made and the rationale behind them to maintain trust and clarity. Bill Harrison notes, "You have to evaluate compliance not as an expense, but as a money saver."

-

Internal Controls: Implementing strong internal controls is crucial for overseeing the computation and presentation of alternative financial metrics. This practice helps prevent errors and ensures that all adjustments are well-justified and documented.

-

Stakeholder Perspective: Grasping stakeholder views of alternative accounting metrics is essential. While these measures can offer valuable insights, they may also raise concerns regarding the company's financial health if not presented with care.

-

Regular Evaluations: Carrying out consistent evaluations of alternative financial practices is essential to guarantee adherence to changing regulations and optimal methods. This proactive approach mitigates risks and enhances the credibility of financial reporting. The case study on "Cost Savings through Compliance" illustrates that investing in compliance can prevent significant financial losses and maintain stakeholder confidence.

By thoroughly evaluating these risks and ensuring compliance, CFOs can effectively leverage non GAAP accounting while protecting their organizations from potential pitfalls.

Conclusion

Implementing non-GAAP accounting serves as a powerful tool for CFOs, enhancing financial transparency and operational clarity. By utilizing alternative metrics, organizations can present a more nuanced view of their financial performance—essential for informed decision-making and fostering stakeholder trust. This approach not only highlights ongoing operational efficiency but also attracts potential investments by offering a favorable perspective on profitability and cash flow.

Throughout this discussion, we have explored key points, including:

- The distinctions between GAAP and non-GAAP accounting

- The step-by-step process for implementation

- The critical importance of compliance and risk evaluation

Emphasizing flexibility and clarity, non-GAAP accounting empowers CFOs to tailor financial reporting to reflect their organizations' unique circumstances more accurately. However, it remains crucial to uphold rigorous internal controls and transparency to mitigate risks associated with misleading information.

Ultimately, the adoption of non-GAAP accounting transcends mere trendiness; it is a strategic imperative for organizations striving to thrive in a competitive landscape. By embracing this approach, CFOs can enhance financial reporting practices, foster stakeholder confidence, and drive sustainable growth. Taking proactive steps in implementing non-GAAP metrics can lead to a clearer understanding of a company's financial health, paving the way for better strategic decisions and a more robust financial future.

Frequently Asked Questions

What is Non-GAAP accounting?

Non-GAAP accounting refers to a set of financial reporting standards that allows companies to present their financial performance in ways that differ from conventional accounting standards, often excluding irregular or non-cash expenses.

Why is Non-GAAP accounting important?

Non-GAAP accounting is important because it provides a clearer view of a firm's core operational performance, enabling CFOs to present a more accurate portrayal of financial health to stakeholders, investors, and analysts.

How does Non-GAAP accounting benefit CFOs?

It allows CFOs to evaluate the organization's performance more effectively and make strategic decisions that promote growth and sustainability by focusing on metrics that reflect ongoing operations.

What is an example of a Non-GAAP metric?

An example of a Non-GAAP metric is Free Cash Flow (FCF), which highlights cash availability for distribution among stakeholders and is vital for assessing financial health and operational efficiency.

How prevalent is the use of Non-GAAP metrics among companies?

By 2018, 97% of S&P 500 firms were utilizing alternative performance indicators, indicating a growing recognition of the importance of Non-GAAP metrics in financial disclosures.

What challenges are associated with Non-GAAP accounting?

The lack of standardization in Non-GAAP accounting can make it difficult to compare outcomes across organizations, which necessitates establishing robust controls and procedures to ensure the integrity and consistency of alternative financial reporting.