Introduction

In an era where financial agility and strategic foresight are paramount, finance transformation emerges as a critical initiative for organizations aiming to enhance operational efficiency and remain competitive. This strategic overhaul encompasses significant changes in processes, technology, and organizational structure, aligning financial practices with overarching business objectives. Case studies from industry leaders like TBC Bank and Lincoln Financial Group highlight the transformative power of integrating advanced technologies and agile principles.

By fostering comprehensive collaboration across finance, IT, and risk management, organizations can navigate the dynamic financial landscape, meet regulatory demands, and leverage data-driven insights to drive strategic initiatives. This article delves into the key drivers, benefits, and implementation strategies of finance transformation, providing actionable insights for CFOs and finance leaders committed to steering their organizations towards sustained success.

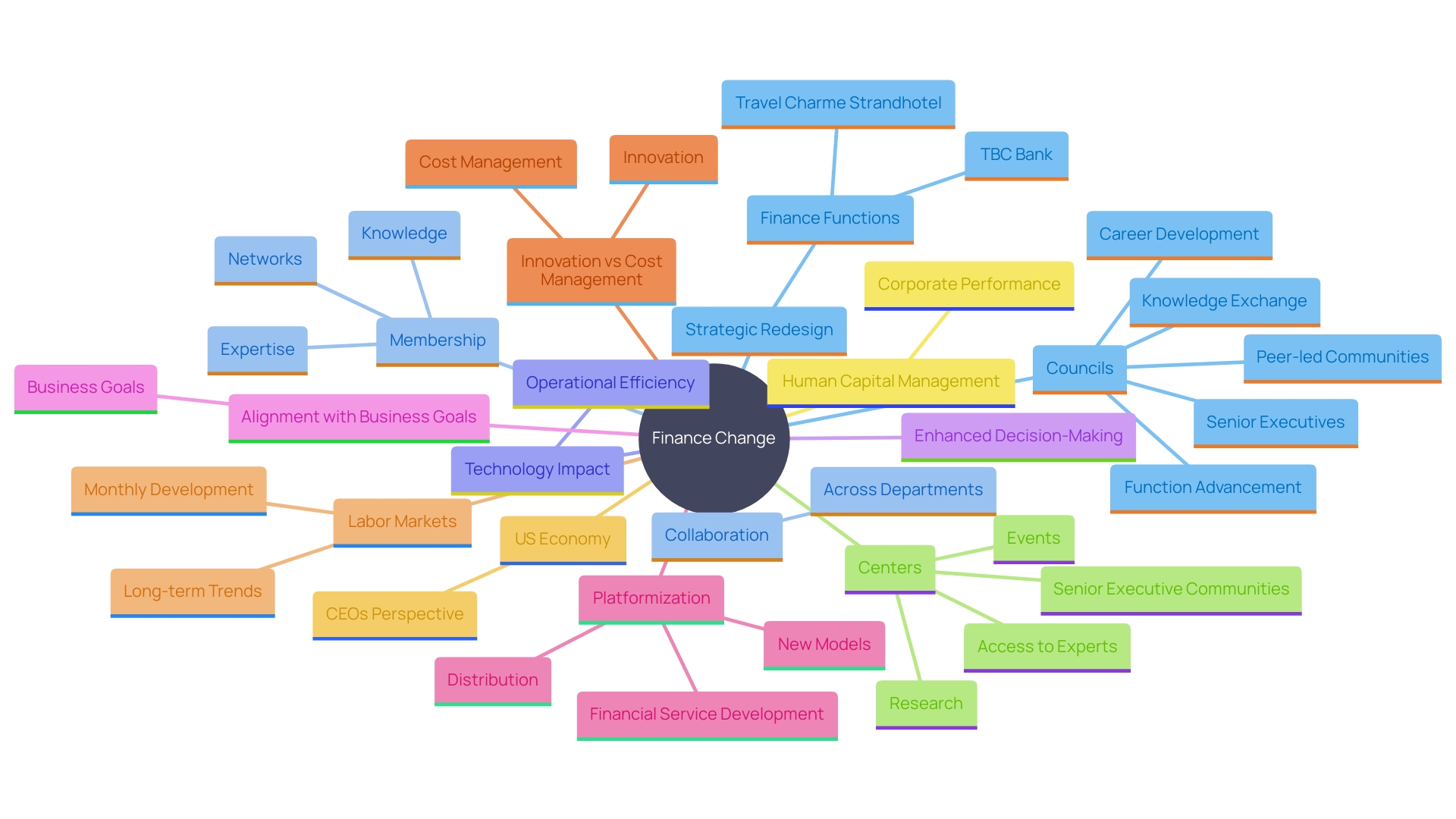

Understanding Finance Transformation

Finance change encompasses a strategic redesign of a company's finance function to boost operational efficiency, enhance decision-making, and align financial practices with overall business goals. This change typically includes significant alterations in processes, technology, and organizational structure.

One notable example is TBC Bank, which redefined its strategy to execution cascade, resulting in increased transparency and better alignment of resource allocations. This transformation not only made the entity more effective and value-oriented but also reduced the time to market for new products by about 40%.

Furthermore, comprehensive collaboration across various organizational functions, such as finance, IT, and risk management, is essential in this process. Such collaboration ensures that all departments are aligned with the overall strategic goals. For instance, the Travel Charme Strandhotel in Germany leveraged technology to streamline operations, leading to improved efficiency and guest satisfaction.

In today's dynamic economic environment, adopting agile principles and focusing on resilience and foresight is critical. This method assists entities in maneuvering through the difficulties presented by the changing economic environment and ESG megatrends. Efficient finance change enables finance teams to handle monetary data and deliver valuable insights that propel strategic initiatives, ultimately improving the organization's worth and competitive advantage.

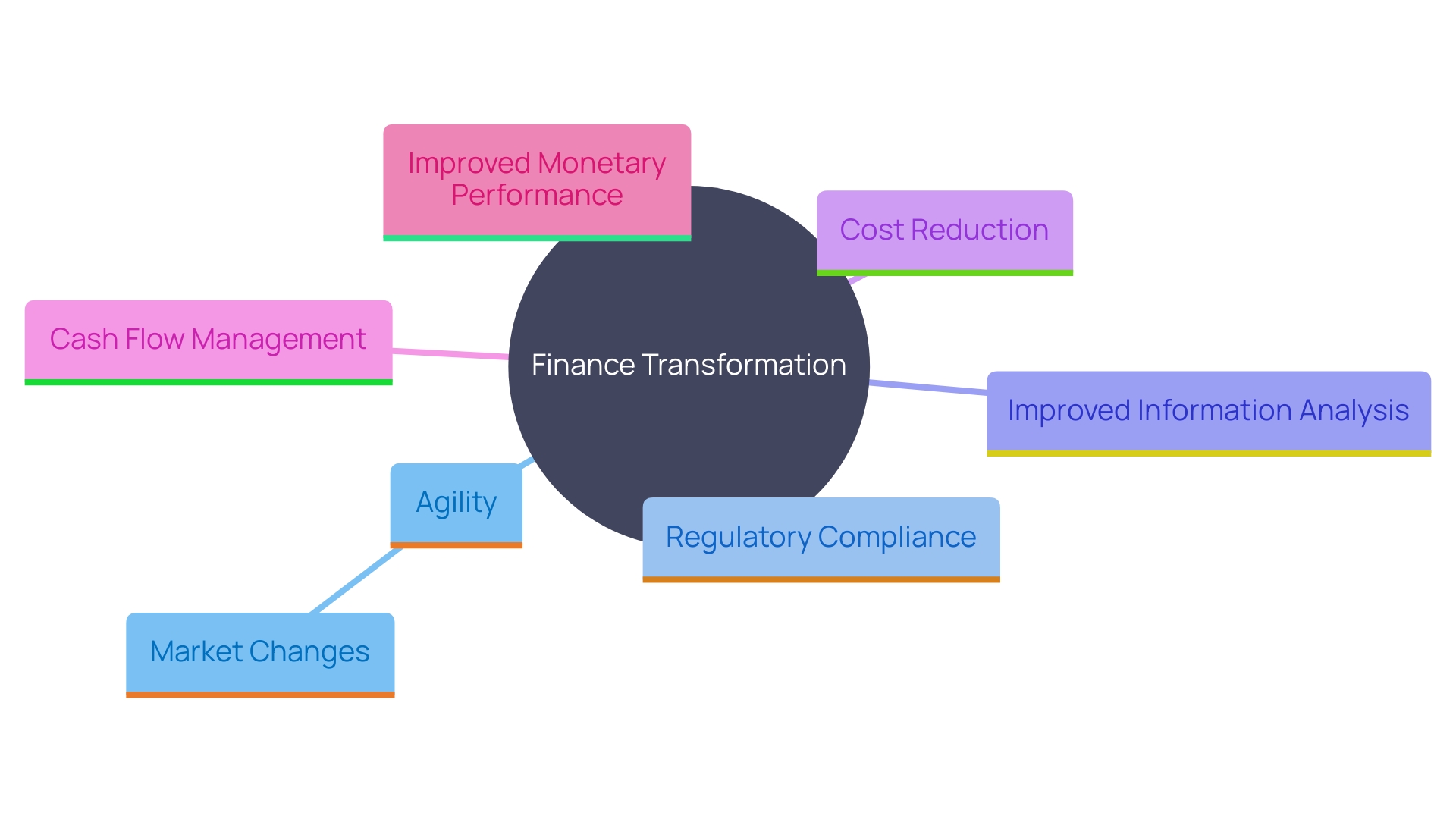

Key Drivers for Financial Transformation

Finance transformation is influenced by several essential elements, each crucial in determining the future of organizational monetary operations. Agility in responding to market changes stands out as a crucial element. As the economic landscape becomes increasingly dynamic, the ability to quickly adapt to new conditions is essential. For instance, Lincoln Financial Group's migration from legacy systems to a cloud-based infrastructure was motivated by the need for modernization and flexibility, allowing them to manage costs more effectively and scale operations efficiently.

Another significant driver is regulatory compliance. With the increasing intricacy and amount of regulations, especially those related to personal information and privacy, entities must ensure they comply with these strict requirements to evade penalties and uphold their reputation. The advancements in technology, such as predictive analytics, are instrumental in this regard, helping organizations interpret monetary information and anticipate future outcomes, thereby improving decision-making and compliance.

Improved information analysis abilities are also increasingly in demand. The ability to leverage advanced analytics tools can provide deeper insights into financial performance, enabling better strategic decisions. This was evident in Lincoln Financial's approach, where transitioning to a cloud environment facilitated more effective data management and analysis.

'Cost reduction remains a fundamental objective for many enterprises.'. By modernizing their technological infrastructure, companies can significantly lower operating expenses. Lincoln Financial, for example, aimed to cut down on the high costs associated with specialized software licensing and fixed-cost legacy systems.

Improving cash flow management is another vital factor. Efficient cash flow techniques guarantee that entities preserve liquidity while enhancing their economic operations. This is particularly relevant in scenarios where traditional investment strategies are evolving, and comprehensive collaboration across various organizational functions is necessary.

Ultimately, the pursuit of improved monetary performance motivates these change initiatives. The integration of advanced technologies, such as AI and cloud computing, not only streamlines operations but also opens up new avenues for growth and efficiency. By comprehending and tackling these factors, companies can synchronize their change initiatives with their wider business objectives, guaranteeing ongoing success in a swiftly evolving economic landscape.

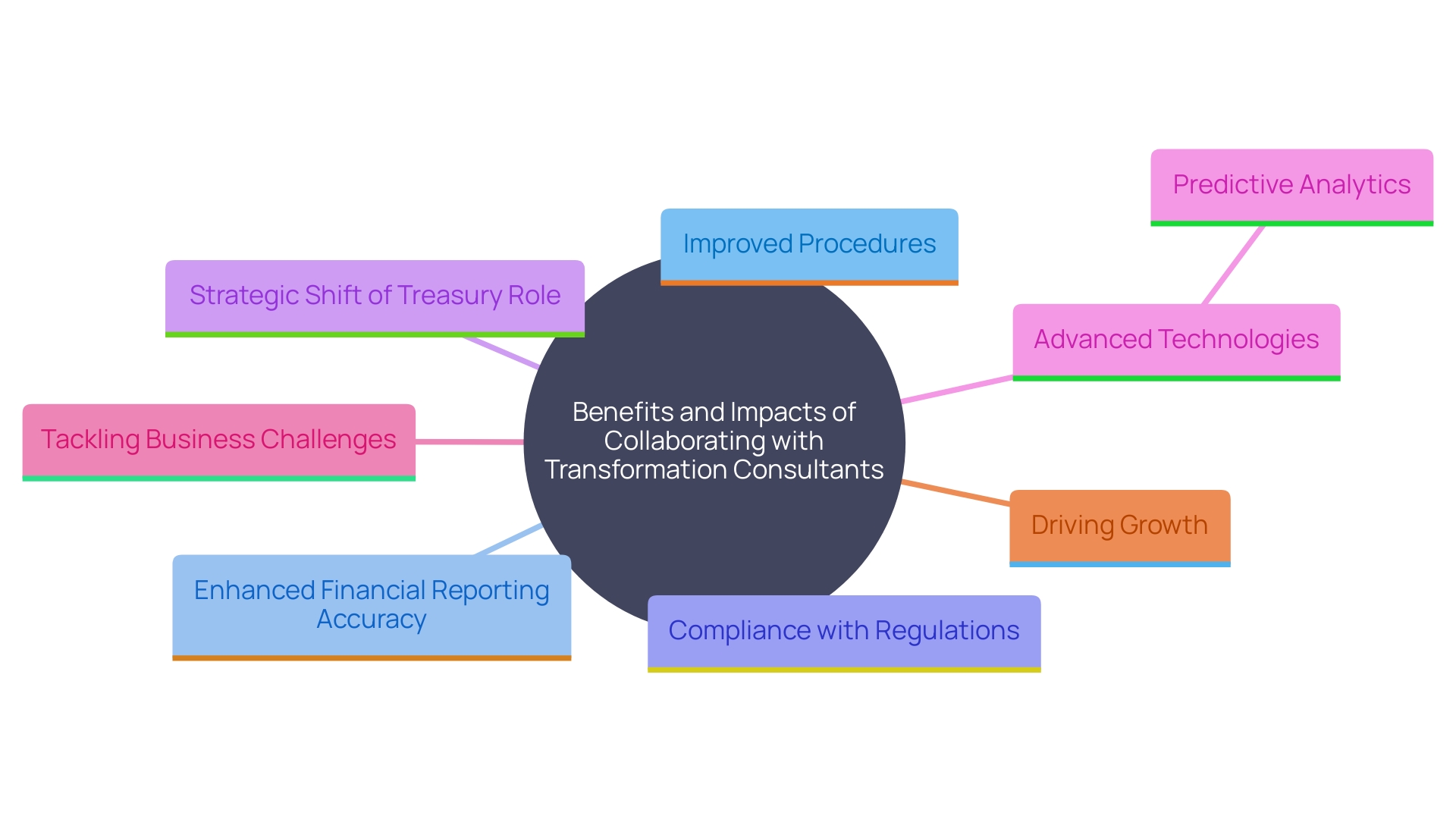

Benefits of Financial Transformation Consulting

Collaborating with transformation consultants provides a variety of benefits, from accessing industry best practices to receiving expert guidance on implementing substantial changes. Advisors enable entities to improve their procedures, increase the precision of monetary reporting, and guarantee adherence to changing regulations. This expert collaboration fosters comprehensive collaboration across various organizational functions, including finance, information technology, and risk management.

Utilizing advanced technologies like predictive analytics, consultants analyze data to predict future results, tackling complex business challenges and enhancing overall performance. In an era of increasingly complex and unreliable economic conditions, predictive analytics plays a crucial role in helping decision-makers respond effectively, thereby driving industry growth.

By adopting these methodologies, entities can transform their treasury role from a mere service provider to a strategic advisor. 'This change not only enhances cash flow forecasting but also boosts the organization's competitive stance in the market, resulting in more informed decision-making and strong economic stability.'.

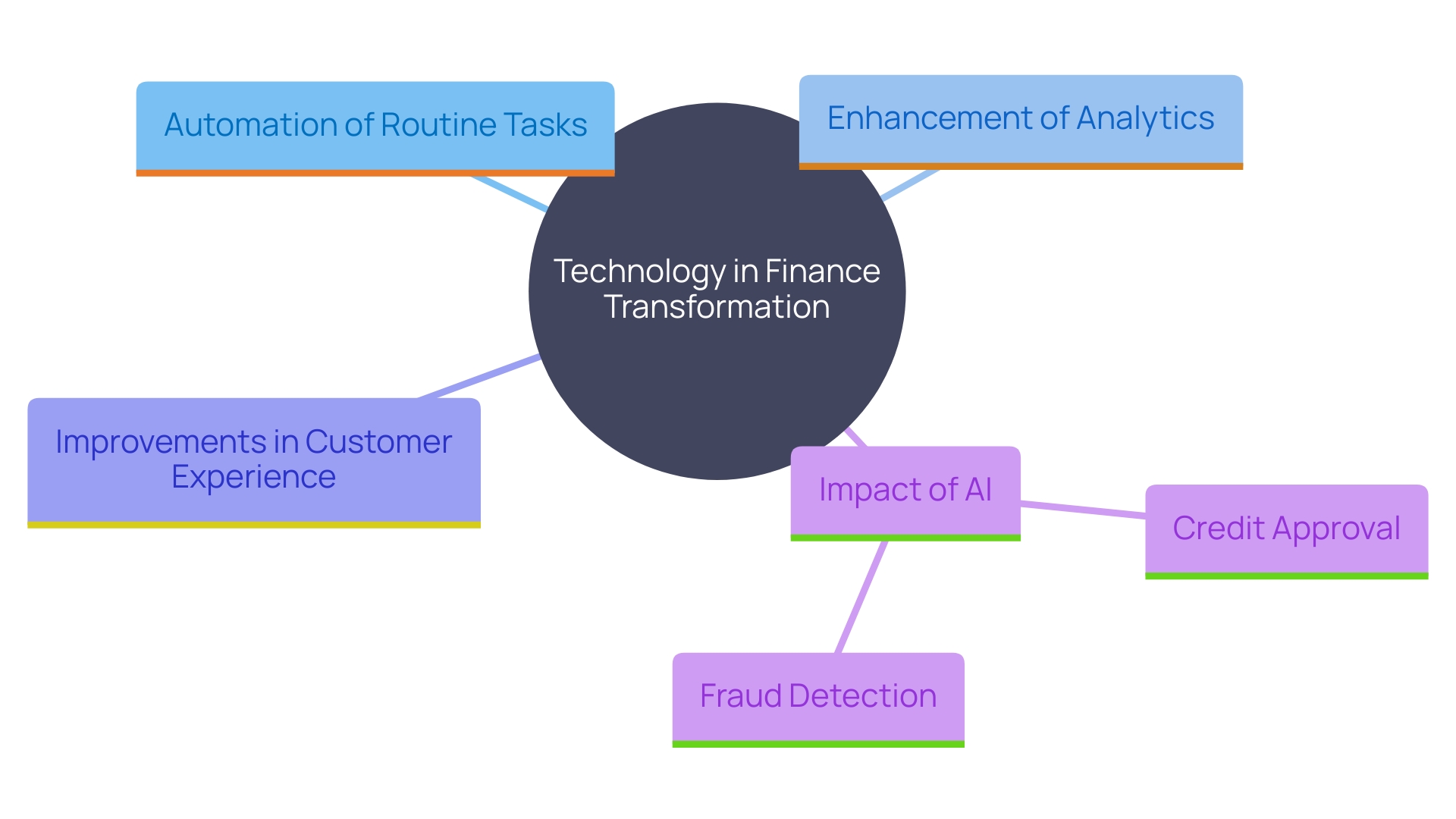

Implementing Technology for Financial Transformation

Technology plays a critical role in finance transformation. Utilizing advanced software and tools can automate routine tasks, enhance analytics capabilities, and improve reporting precision. 'The combination of technologies like artificial intelligence (AI), machine learning, and cloud computing allows finance teams to obtain real-time information, promoting quicker and more precise monetary decision-making.'.

AI, in particular, is transforming the services sector by revolutionizing customer experience, credit approval, and fraud detection. It has become integral to the Banking, Financial Services, and Insurance (BFSI) sectors, reshaping how products and services are offered. AI-driven algorithms can analyze market data in real-time, allowing investment managers to react swiftly to changing conditions and optimize portfolios, thus improving client outcomes. This automation not only boosts efficiency but also reduces human error risks.

Additionally, the influence of AI is evident in the rise of generative AI applications like chatbots, which enable customers to interact with banking services using natural language. 'Major monetary institutions such as Bank of America, Wells Fargo, and Citigroup have already launched initiatives harnessing Ai's potential.'. These advancements promise more efficient, innovative, and cost-effective solutions in banking, investment, and insurance, though they also require careful consideration of regulatory and ethical challenges.

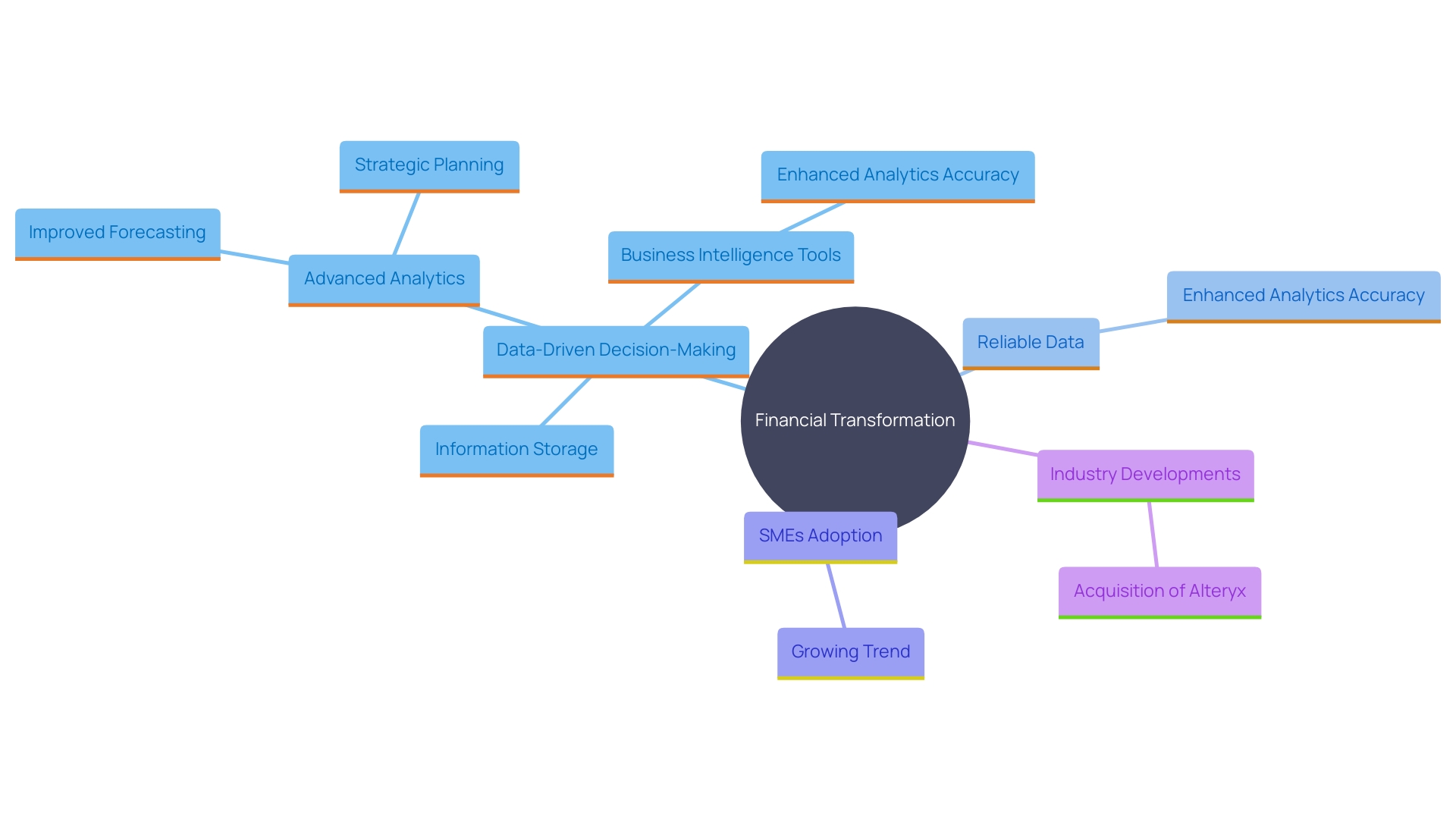

Data-Driven Decision Making and Analytics

A key component of financial transformation is the shift towards data-driven decision-making. By utilizing advanced analytics and business intelligence tools, organizations can achieve a unified perspective of their information, enabling more accurate forecasting and strategic planning. This approach is supported by information storage, which consolidates information from various sources into a central repository, eliminating silos and ensuring quality.

The importance of reliable data cannot be overstated, as it enhances the accuracy of analytics and leads to better business outcomes. For instance, predictive analytics plays a crucial role in navigating complex economic conditions, allowing finance teams to respond more effectively to market changes.

Moreover, the increasing adoption of monetary analytics tools among small and medium-sized enterprises (SMEs) is driving market growth. SMEs are embracing digitalization to stay competitive, while large enterprises leverage data-driven decision-making to maintain their market leadership.

In recent news, the acquisition of Alteryx by Clearlake and Insight Partners underscores the growing focus on data-driven business decisions. Such developments emphasize the industry's dedication to incorporating advanced analytics for strategic monetary management, ultimately fostering growth and operational efficiency.

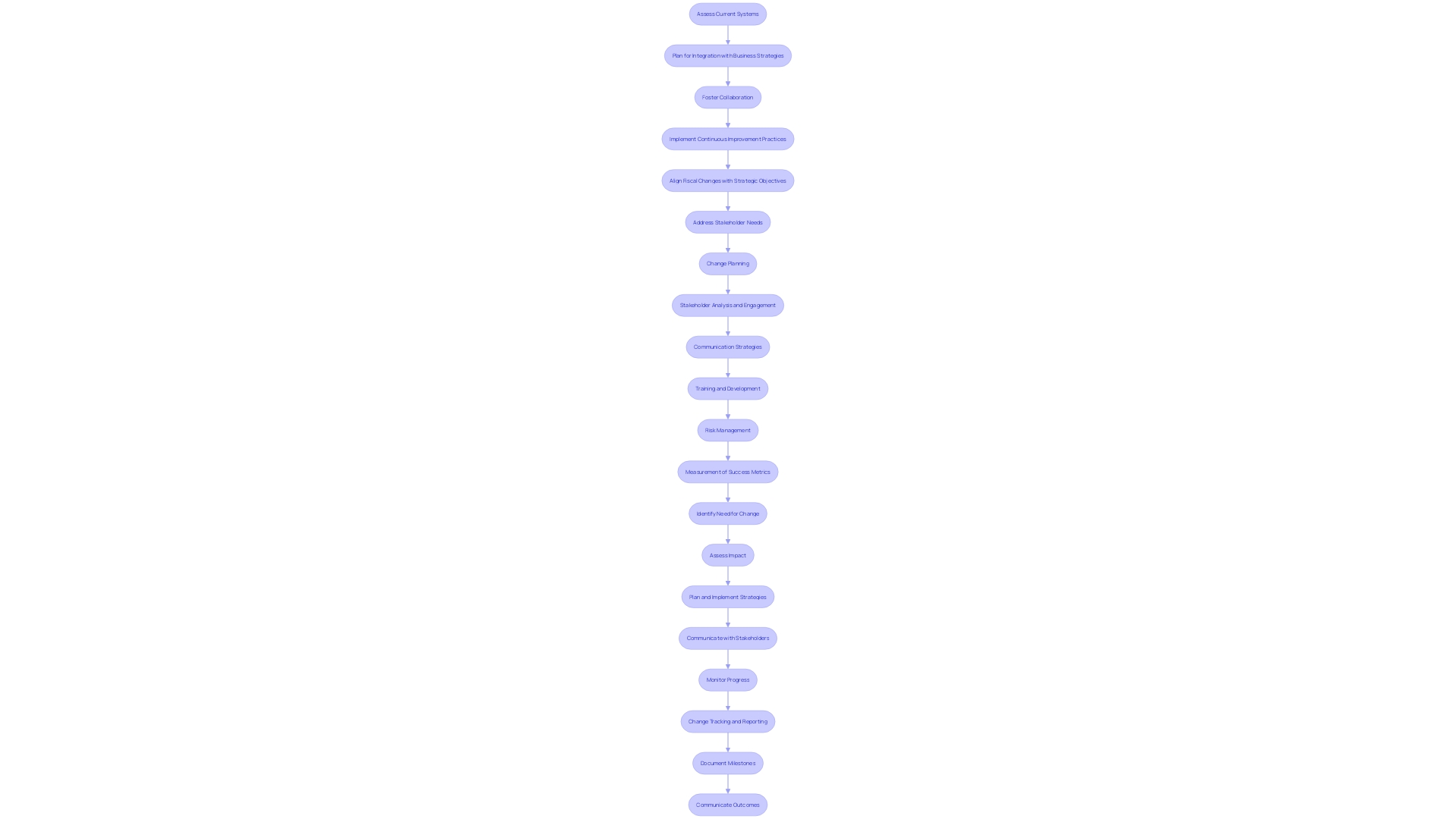

Change Management and Organizational Alignment

Successful monetary change requires strong change management approaches to guarantee all stakeholders are synchronized with new processes and systems. Building a culture of adaptability and continuous improvement is critical. For example, Lincoln Financial Group's transition from legacy platforms to a dynamic cloud-based architecture required addressing the high costs associated with specialized software and moving towards a flexible environment. This modernization, involving 120 complex systems over less than two years, highlights the need for a holistic approach to change.

Organizations must integrate their finance functions with broader business strategies, fostering collaboration across departments. This integration ensures seamless alignment and shared goals. As Rob Klaczak, senior vice president at Lincoln Financial, noted, the change aimed to reduce operating expenses and modernize the infrastructure, demonstrating the importance of aligning fiscal change with strategic business objectives. Furthermore, the shift towards a sustainable future, as emphasized in a report by CISL and A4S, highlights the increasing agreement that companies must align economic objectives with long-term sustainability to fulfill changing regulatory and societal expectations. This alignment necessitates new skillsets, processes, and reporting capabilities within the finance function to support organizational change and sustainability goals.

In sum, successful financial transformation hinges on effective change management, strategic alignment, and fostering a culture of continuous improvement and adaptability.

Conclusion

Finance transformation is a vital initiative for organizations striving to enhance operational efficiency and stay competitive in an ever-evolving financial landscape. By reimagining financial processes, integrating advanced technologies, and fostering a culture of collaboration, organizations can adapt swiftly to market changes and regulatory demands. The cases of TBC Bank and Lincoln Financial Group exemplify how strategic overhauls can lead to significant improvements in transparency, resource allocation, and overall performance.

Key drivers such as agility, regulatory compliance, and enhanced data analytics capabilities are instrumental in shaping finance transformation efforts. Organizations that modernize their technology infrastructure can not only reduce costs but also improve cash flow management and decision-making processes. The benefits of engaging with financial transformation consultants further amplify these advantages, enabling organizations to refine their practices, enhance reporting accuracy, and leverage predictive analytics for informed strategic choices.

Moreover, the integration of cutting-edge technologies, particularly artificial intelligence and cloud computing, is transforming financial operations by automating tasks and improving data accessibility. This shift towards data-driven decision-making, supported by robust analytics tools, empowers organizations to achieve a unified view of their financial data, leading to better forecasting and strategic planning.

In conclusion, effective finance transformation is not merely a technological upgrade; it requires a comprehensive change management approach that aligns financial functions with broader business strategies. By embracing a culture of adaptability and continuous improvement, organizations can not only navigate current challenges but also position themselves for sustained success in a competitive market. The integration of financial goals with long-term sustainability further underscores the importance of aligning financial practices with organizational objectives, ensuring resilience and growth in the years to come.