Introduction

Financial instability can be a harbinger of significant strategic pivots required for an organization's longevity. To ensure survival, companies must quickly adapt to new financial realities.

In this article, we explore various aspects of understanding and managing financial distress. We'll delve into early warning signs, case studies, assessing business operations, cash flow management plans, negotiating with creditors, implementing cost reduction measures, investing in innovation, and the benefits of effective turnaround strategies. By providing practical advice and solutions, this article aims to equip CFOs with the tools they need to navigate financial challenges and secure long-term success.

Understanding Financial Distress

Financial instability isn't simply a storm to weather; it's often a harbinger of significant strategic pivots required to ensure an organization's longevity. As seen in recent economic shifts, companies that quickly adapt to new financial realities stand a better chance of survival.

This agility was epitomized by the impressive resilience of Kongo Gumi, a Japanese company that has weathered over a millennium of change, from civil wars to the transition to democracy, maintaining operations through adaptability and strategic foresight. In conjunction with understanding the historical endurance of such companies, it's vital for any organization facing financial troubles to recognize early warning signs and implement immediate recovery strategies.

The furniture industry, for example, has faced such predicaments, with The Mitchell Gold Co. unexpectedly needing to cease operations due to an unforeseen inability to secure critical financing. This serves as a cautionary tale for the importance of maintaining liquidity and securing reliable financing channels.

Moreover, the current environment demands that startups, particularly in FinTech, move with increased velocity and strategic precision. The abrupt transition from the fundraising frenzy of prior years to a more reserved capital market structure in 2022 starkly highlights this need. Founders are now acknowledging that perpetual venture funding is unsustainable and are being compelled to innovate and pivot strategies accordingly, embarking on more financially prudent pathways. Embedding financial stability monitoring within operations, as underscored by Adrian, Covitz, and Liang's research, is also crucial for facilitating early interventions and sustaining financial health, proving essential for modern businesses aiming to achieve enduring success in an ever-fluctuating financial landscape.

Case Study: Managing Financial Distress

When XYZ Company faced financial turbulence, underscored by a sharp sales downturn and escalating debts, the management team spearheaded a strategic restructuring effort. This methodical approach not only stabilized the firm but also paved the way for sustainable growth.

With the insight from legal and financial consultants, the team crafted a plan responsive to XYZ's unique challenges. This proactive remediation included engaging with stakeholders through easily accessible FAQs and a dedicated restructuring hotline, ensuring transparency and addressing concerns promptly.

It's important to acknowledge that, as with any forecast, the plan rested on estimations and assumptions subject to change. This underpins the essence of restructuring—accommodating for unexpected market dynamics and evolving realities to emerge more resilient. This case demonstrates that a dynamic response, adapted to real-time feedback and data-driven strategy, is key to navigating complex financial restructuring.

Identifying the Warning Signs

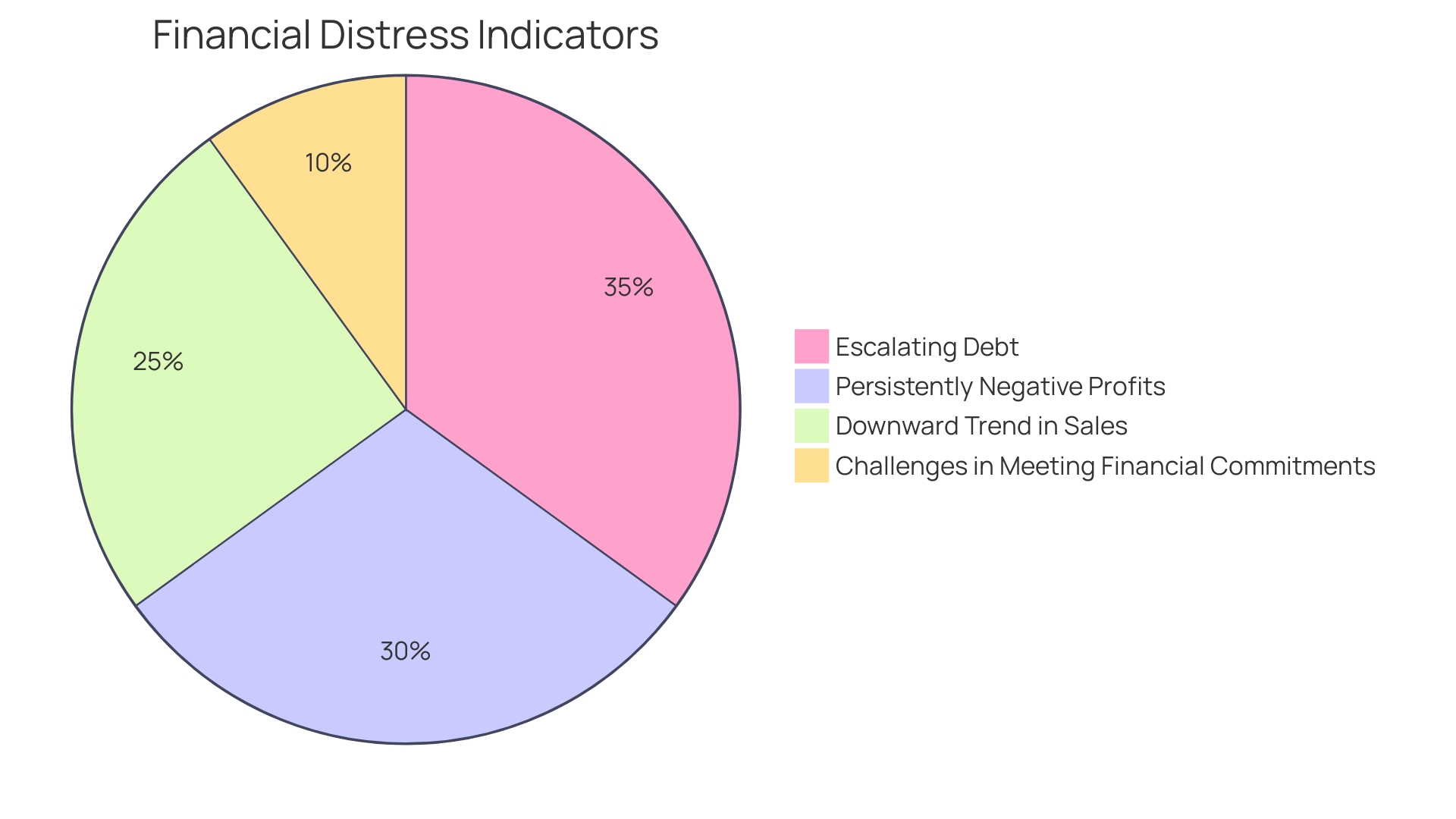

Detecting the early indicators of financial distress is a critical step in safeguarding the financial health of a company. Indicators such as persistently negative profits, a downward trend in sales, escalating debt, and challenges in meeting financial commitments provide a clarion call for immediate intervention.

Moreover, a decline in creditworthiness echoes the urgency for action. Proactive vigilance over these financial health barometers enables businesses to initiate remedial measures and chart a path to financial recovery.

In doing so, companies can engage with financial professionals who offer a fresh perspective on their finances, potentially averting a looming crisis and paving the way for early retirement planning or other long-term financial objectives. It's important to remember that these observations are based on current market conditions and are subject to change; they should not be taken as guarantees of future performance. Always contemplate the advice of a tax or legal expert to tailor financial decisions to one's specific investment goals and horizon.

Assessing the Business Operations

Conducting a thorough annual review is paramount for orchestrating a substantial business turnaround. This process delves beyond mere financial assessment; it queries the company's market position and competitiveness, scrutinizes operational efficiency, and gauges employee and customer feedback. An honest examination of whether the year’s strategic objectives were achieved provides essential insights.

Specific attention must be paid to operational and supply chain efficiency, understanding the effects of any disruptions and the company’s effectiveness in managing them. Financial performance scrutiny is integral, too. This entails a meticulous analysis of financial statements, addressing the question, 'Did we hit our financial targets?'

and evaluating revenue growth, profit margins, cost control, and investment yields. Furthermore, reflect on marketing endeavors: 'How successful were our strategies in engaging our target demographic and fulfilling our objectives?' The synthesis of these findings will facilitate precise strategic planning, charting a course essential for thriving in the forthcoming fiscal period.

Developing a Cash Flow Management Plan

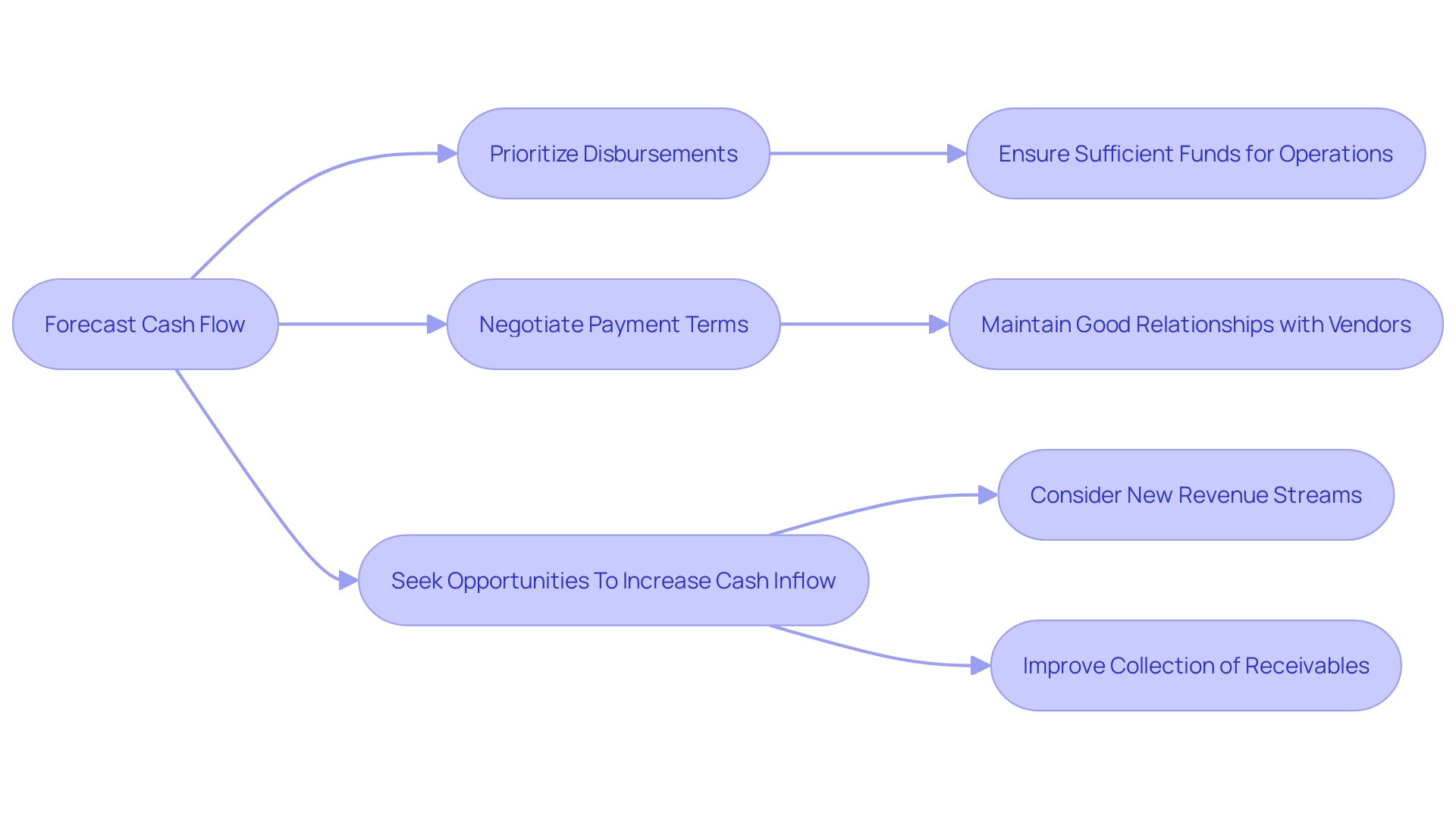

In the complex arena of business finance, cash reigns supreme, providing a lifeline that ensures a company's operational viability. Emphasizing the pivotal role of cash flow management, it's fundamental to distinguish it from profit, as both are critical yet distinct indicators of fiscal health.

While profits may signal success, it is the consistent flow of cash that fuels the day-to-day operations, enabling enterprises to meet their obligations and invest strategically for growth. Accordingly, a strategic cash flow management plan is paramount, which includes meticulous forecasting of incoming and outgoing funds.

A sound plan also encompasses the prioritization of crucial disbursements, astute negotiations of payment terms with vendors, and a proactive quest for avenues to revitalize cash inflow. Remember, a lapse in maintaining a resilient cash reservoir can spell disaster for even a seemingly robust company. As cash flow ebbs and flows reflect the vitality of a business, mastering it is non-negotiable for long-term sustainability and steering clear of the perilous shoals of financial distress.

Negotiating with Creditors

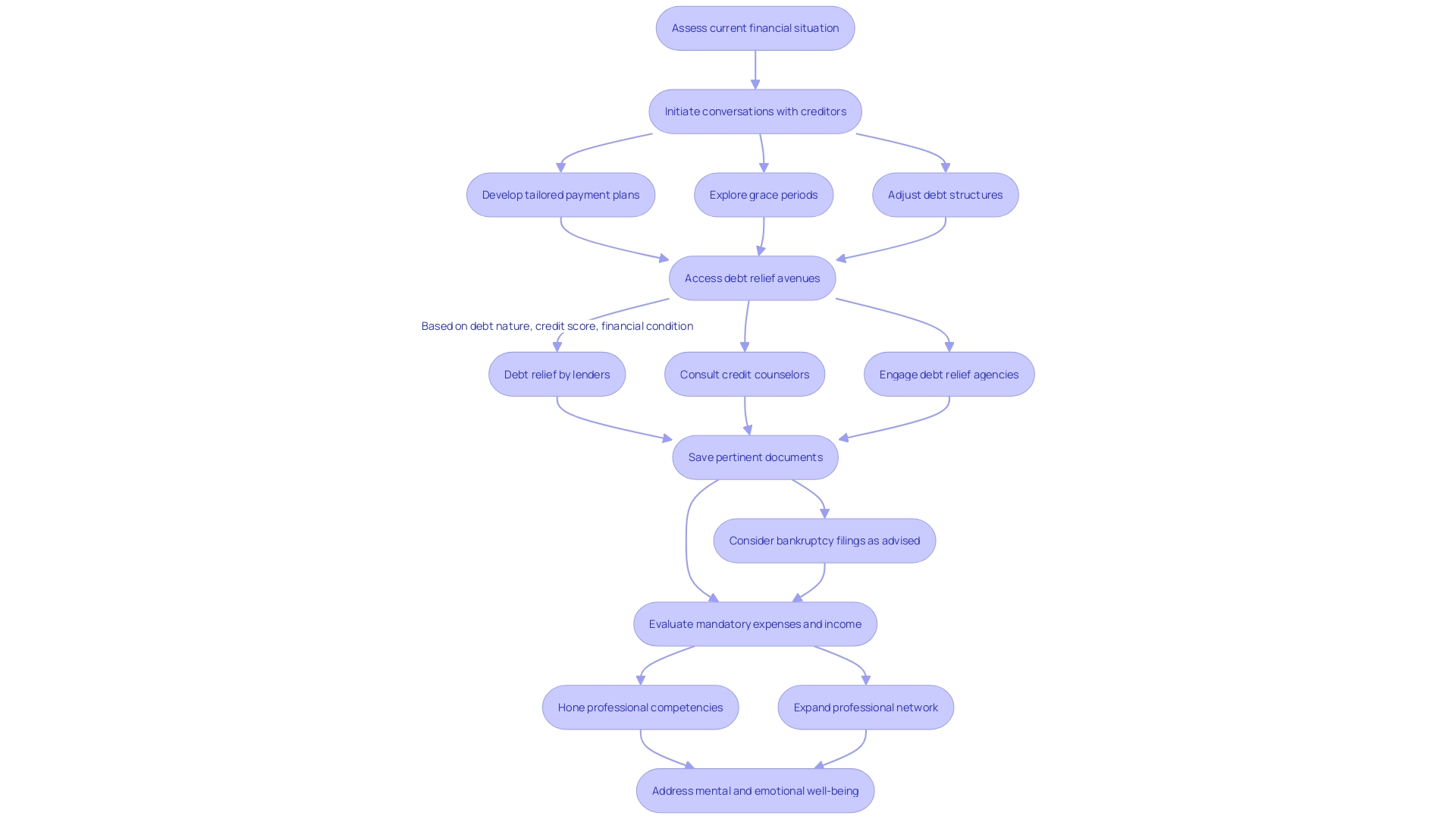

In the vortex of financial instability, it is crucial to take a proactive approach by initiating candid conversations with creditors. The economic landscape, marked by rising inflation and higher interest rates, has led to a surge in debt among Americans, as reported by the Federal Reserve's Q3 2023 data.

To mitigate the stress of escalating credit card and unsecured loan balances, developing tailored payment plans, exploring grace periods, or adjusting debt structures with lenders is paramount. Staying informed on debt relief avenues provided by lenders, credit counselors, or debt relief agencies is a vital step, factoring in one's debt nature, credit score, and financial condition.

Save all pertinent documents from any debt resolution process, including bankruptcy filings, as advised by debt attorney Leslie Tayne. This documented evidence becomes indispensable, particularly during post-bankruptcy credit pursuits or if disputed by debt collectors. Navigating this treacherous terrain involves a thorough evaluation of mandatory expenses and income, laying the groundwork for future financial stability by honing professional competencies and expanding networks. Moreover, it's essential to acknowledge and address the profound effects these financial trials can impose on your mental and emotional well-being.

Implementing Cost Reduction Measures

Understanding how to navigate financial challenges is key to a company's revival. The first crucial step involves a strategic assessment of the financial landscape, analyzing both expenditures and income streams.

It is imperative not to take a hatchet to costs blindly but rather to prioritize expenditures based on an in-depth understanding of their impact on the company's operations and long-term objectives. To achieve an effective cost-reduction strategy that aligns with the business goals, we've developed a methodology that assesses the practicality, efficiency, and potential impact of various cost-cutting measures.

Each measure is evaluated with a rigorous criterion centered on maintaining operational efficiency, achieving sustainable long-term savings, and ensuring the quality of products or services remains uncompromised. When applied diligently, these cost reduction efforts can significantly improve operational efficiency and, consequently, enhance profitability and cash flow. Sustainable cost management goes beyond mere downsizing or contract renegotiations. It requires a commitment to enhancing operational processes and a strategic approach to resource utilization, ensuring financial health without sacrificing the company's core values or service quality.

Investing in Innovation and Market Expansion

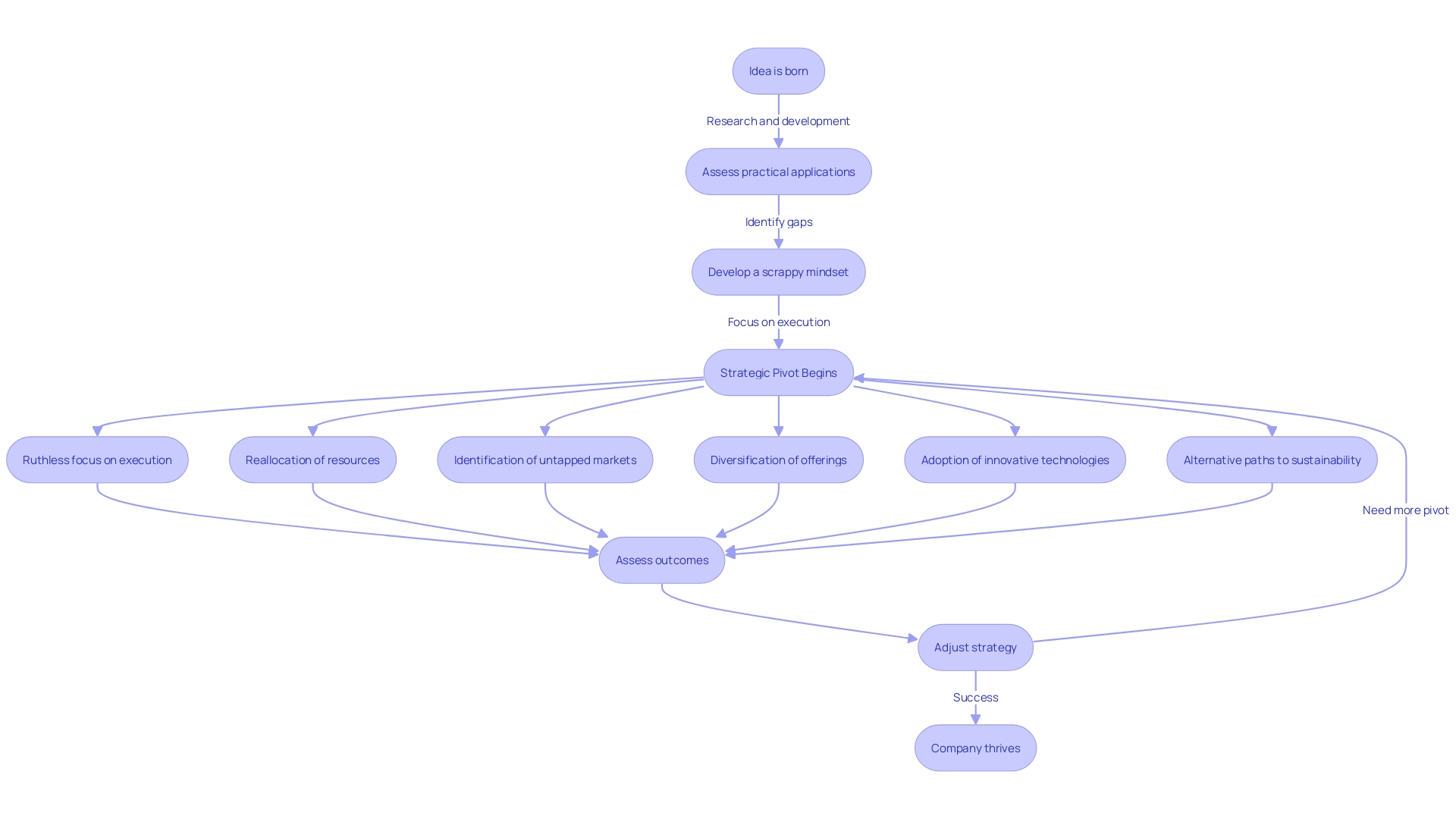

To thrive in financial distress, companies must pivot strategically, reflecting the innovative approaches taken by firms like inDrive. When revenue growth stalls, businesses should reallocate resources to identify untapped markets and diversify their offerings. Take inDrive's expansion saga, which led them from regional success to questioning their global potential.

By 2016, inDrive had pivoted from solely focusing on local metrics to exploring international growth, drilling down into the power of their business model. Even in industries often overlooked for their excitement factor, such as the MRO sector, companies can harness innovative technologies to separate themselves from competitors and realize new opportunities. In the midst of adversity, such as the COVID downturn, embracing a shifted perspective allowed some firms to convert traditional business activities into alternative channels, like shifting from conference-based business development to referral partnerships, and ultimately achieving a record performance year.

This underlines the importance of recognizing the current market situation and strategically investing in technology and other critical areas that can propel the company forward when normalcy returns. Indeed, an insightful quote underscores the urgency of adaptation, noting that in recent times, startups have dramatically felt the impact of market changes, making it evident that a reliance on continuous venture funding is precarious. Companies must therefore accelerate their efforts to devise alternative paths to sustainability, demonstrating agility and foresight in an increasingly unpredictable business landscape.

Benefits of Effective Turnaround Strategies

Crafting strategic turnaround efforts, companies grappling with fiscal pressures can effectively stabilize their operations, reestablish trust amongst stakeholders, and steer towards a healthier financial trajectory, minimizing the peril of failure. Proactive and strategic management is key, much like the adaptive measures taken by Stora Enso.

When the demand for paper dwindled, due to a digitalizing world—a stark tumble from 12% to a mere 4% of the global production—this Finnish company, with centuries of history dating back to 1288, repurposed its vast experience towards becoming a leader in renewable materials. The pivot towards sustainability wasn't just reactive; it mirrored a prescient interpretation of market trends and demanded a bold overhaul.

With its new CEO at the helm, it underwent a significant restructuring, which included letting go of over a third of its workforce to redirect cash flow towards burgeoning sectors like eco-friendly building materials and food packaging solutions. This decisive shift not only served as a lifeline but also positioned Stora Enso at the vanguard of innovation in renewable resources. Companies undergoing financial reconstruction should also consider a meticulous reassessment of all expenses, prioritizing without defaulting to blanket cost reductions. A comprehensive review of the organization’s financial state, standing shoulder to shoulder with future aspirations, will lay a firmer groundwork for a resilient rebound.

Conclusion

In conclusion, navigating financial distress requires CFOs to be agile and adaptive in order to secure the long-term success of their organizations. Early warning signs must be recognized and immediate recovery strategies implemented to maintain liquidity and secure reliable financing channels.

Case studies highlight the importance of dynamic responses and data-driven strategies in managing financial turbulence. Identifying the warning signs of financial distress, such as negative profits, declining sales, and escalating debt, enables proactive interventions and financial recovery.

Thorough annual reviews are crucial for assessing business operations, including market position, operational efficiency, and financial performance, to chart a course for future success. A strategic cash flow management plan, separate from profit, is vital for operational viability.

Negotiating with creditors and staying informed on debt relief avenues are essential steps to mitigate escalating debt. Implementing cost reduction measures requires a strategic evaluation of costs and their impact on the company's operations and long-term objectives.

Investing in innovation and market expansion is crucial for thriving in financial distress. Companies must pivot strategically and reallocate resources to identify untapped markets and diversify their offerings. Effective turnaround strategies stabilize operations, reestablish trust among stakeholders, and position companies for long-term success. In summary, CFOs must be proactive, strategic, and adaptable in managing financial distress. By implementing the practical advice and solutions outlined in this article, they can navigate financial challenges and secure the long-term success of their organizations.