Overview

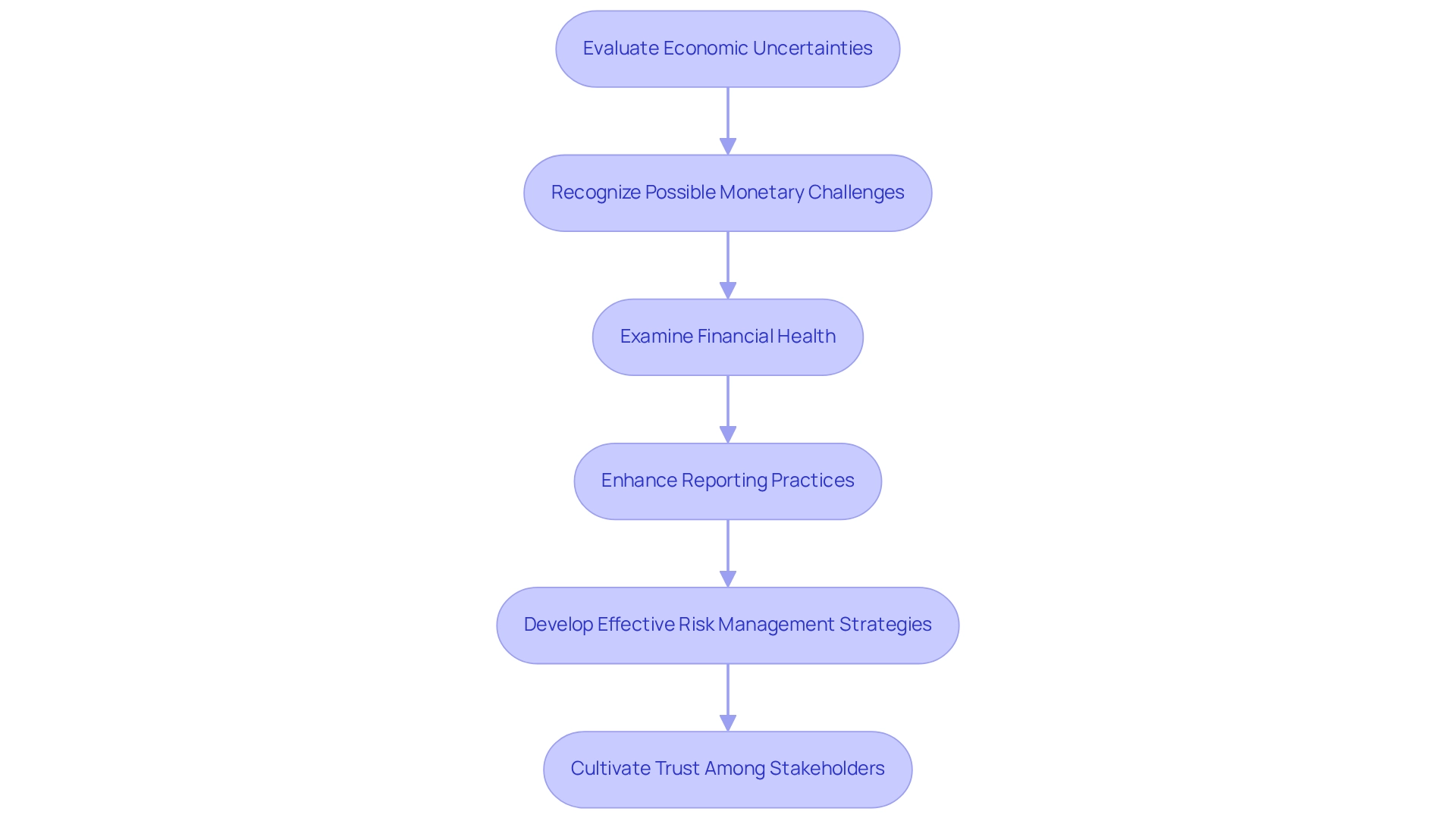

This article delves into the essential strategies nonprofits can employ to master financial risk assessment through a structured, step-by-step approach. By identifying and mitigating economic uncertainties, organizations can significantly enhance their resilience.

Recognizing potential threats is paramount; assessing their impact allows nonprofits to prioritize risks effectively. Furthermore, developing robust mitigation strategies not only fortifies the organization’s economic standing but also cultivates trust among stakeholders.

Ultimately, embracing these practices positions nonprofits to navigate financial challenges with confidence and authority.

Introduction

In the intricate landscape of nonprofit organizations, financial risk assessment stands as a cornerstone for sustainability and success. Given their unique reliance on donations and grants, nonprofits often navigate a precarious financial environment, rendering them vulnerable to unforeseen threats. Understanding the nuances of financial risks not only enables these organizations to safeguard their assets but also fosters trust among stakeholders who demand responsible management of resources. As the nonprofit sector continues to evolve, the imperative for a robust financial risk assessment becomes increasingly evident. By adopting systematic approaches to identify, analyze, and mitigate risks, nonprofits can enhance their resilience. This ensures they remain focused on their missions while effectively managing the challenges that lie ahead.

Understand the Importance of Financial Risk Assessment in Nonprofits

Evaluating economic uncertainties is crucial for charitable organizations, as it forms the basis of a financial risk assessment for nonprofits. This enables them to recognize, examine, and reduce possible monetary dangers. Due to their dependence on donations and grants, nonprofits frequently operate with restricted resources, rendering them especially vulnerable to economic instability. A thorough financial risk assessment for nonprofits provides valuable insights into an organization's economic well-being, exposing weaknesses and guiding strategies to safeguard assets. This proactive strategy not only enhances economic resilience but also cultivates trust among stakeholders, including donors and board members, who anticipate responsible resource management.

Furthermore, by comprehending monetary uncertainties, organizations can synchronize their economic strategies with their purpose, guaranteeing enduring viability and influence. In 2025, the significance of financial risk assessment for nonprofits remains crucial, as organizations must balance uncertainty with the need for stability and security. Effective risk management strategies enable organizations to tackle challenges efficiently, ultimately improving their ability to achieve their goals.

For example, in 2005, surged by over 12 percent, roughly six times the rate of growth in real per capita GDP. This demonstrates the economic variations that can influence funding for charitable organizations. Moreover, numerous organizations face challenges with inadequate monetary reporting, which can result in inaccurate revenue evaluations and imprudent expenditures. This complicates the detection of fiscal loopholes. By enhancing reporting practices, organizations can sustain economic health and transparency, allowing them to manage their resources more effectively and evade potential pitfalls.

Recognizing possible monetary challenges is essential for organizations to conduct a financial risk assessment for nonprofits, comprehend vulnerabilities, and prepare themselves properly against dangers.

Conduct a Step-by-Step Financial Risk Assessment

To conduct a financial risk assessment, follow these steps:

- Identify Potential Dangers: Begin by listing your nonprofit may face. Typical challenges encompass cash flow shortages, excessive dependence on a limited number of funding sources, and the possibility of fraud. Nonprofits may be particularly susceptible to fraud due to their smaller size and limited resources, which can lead to inadequate segregation of duties and fewer anti-fraud measures. This underscores the necessity of implementing robust anti-fraud strategies.

- Assess the Impact of Each Threat: Evaluate the potential impact of each identified threat on your organization. Consider elements such as financial loss, reputational harm, and operational interruptions that might arise from these threats.

- Prioritize Threats: Rank the threats based on their likelihood and potential impact. This prioritization allows you to focus on the most pressing challenges that require urgent attention, ensuring that resources are allocated efficiently.

- Develop Mitigation Strategies: For each high-priority risk, devise a plan to mitigate its impact. Strategies may involve diversifying funding sources, implementing stronger internal controls, or enhancing accounting reporting practices to improve transparency and accountability. For instance, organizations like Network Depot have demonstrated how effective management practices can support financial health, enabling clients to concentrate on their core objectives while ensuring their operations remain secure.

- Monitor and Review: Establish a regular evaluation process to assess the effectiveness of your mitigation strategies. Be prepared to modify your plans as needed in response to changing circumstances or the emergence of new challenges.

By following these steps, organizations can create a comprehensive risk assessment framework that not only identifies vulnerabilities but also fosters a culture of proactive risk management, ultimately safeguarding their economic health. As Rev Adam Russell Taylor stated, "Advocacy represents the lifeblood of our democracy. Enhancing advocacy throughout the charitable sector is essential for the continued well-being and safety of our nation." This highlights the vital connection between economic well-being and the capacity of charitable organizations to achieve their goals.

Identify and Mitigate Common Challenges in Financial Risk Assessment

Nonprofits face numerous obstacles when engaging in . Below are prevalent challenges and effective strategies to address them:

- Limited Resources: Operating on tight budgets often restricts nonprofits from dedicating adequate time and funds for thorough evaluations. To alleviate this, organizations can utilize free or affordable evaluation tools available online. Moreover, collaborating with nearby universities or consulting agencies that provide pro bono services can offer valuable assistance without straining monetary resources. Nonprofits are also categorized by size according to total expenses reported on Form 990, which can affect the resources available for risk evaluation. A comprehensive financial risk assessment can help uncover opportunities to conserve cash and minimize obligations, ensuring that organizations maximize their restricted resources.

- Lack of Knowledge: Many organizations struggle due to a shortage of personnel with the necessary economic expertise for comprehensive evaluations. To address this, organizations should consider training current staff on the principles of financial risk assessment related to risk management. Alternatively, involving outside experts who specialize in organizational fiscal health can provide the knowledge required to navigate complex evaluations efficiently. A thorough economic assessment can reveal worth and lower expenses, making it crucial for organizations to seek informed collaborators.

- Resistance to Change: Opposition from staff and board members to recognize monetary challenges or implement essential adjustments can obstruct progress. To foster a culture of transparency, it is essential to convey the importance of financial risk assessment in achieving the organization's mission. Engaging stakeholders in the evaluation process can also promote buy-in and support a cooperative approach to tackling financial challenges. As Dan Prater from Forvis Mazars states, "Forvis Mazars understands the vital role nonprofits play and is committed to supporting the industry with resources like the 2024 State of the Nonprofit Sector Report to help them move forward with clarity, while staying true to the organizational mission."

- Insufficient Information: Quality data is crucial for precise evaluation. Nonprofits should ensure robust monetary reporting systems are established and regularly review and update records to maintain accuracy and transparency. This diligence not only aids in effective threat evaluation but also improves overall organizational accountability. Clarity in resource management is essential for charitable organizations to foster trust and enhance their reputation. Clear communication regarding funding sources and expenditures can enhance accountability and attract more resources, as illustrated in the case study titled "Transparency in Nonprofit Management."

By proactively addressing these challenges, nonprofits can enhance their financial risk assessments, leading to improved decision-making and enhanced economic stability. A thorough financial review is a key step in this process, helping organizations identify opportunities to preserve cash and reduce liabilities.

Conclusion

Financial risk assessment is not merely a procedural necessity for nonprofits; it is a critical practice that underpins their ability to thrive in an unpredictable financial landscape. By systematically identifying, analyzing, and mitigating risks, nonprofits can safeguard their resources and enhance their operational resilience. Addressing common challenges such as limited resources, lack of expertise, resistance to change, and inadequate data is essential for developing a robust financial risk management strategy.

The proactive approaches outlined in this article empower nonprofits to prioritize their financial health, ultimately allowing them to remain steadfast in their mission-driven goals. Through effective risk assessment, organizations can not only protect their assets but also build trust with stakeholders who expect responsible resource management. As the nonprofit sector continues to evolve, the commitment to understanding and managing financial risks will be instrumental in ensuring sustainability and long-term impact.

In conclusion, the integration of comprehensive financial risk assessment practices is vital for nonprofits aiming to navigate the complexities of their funding environments. By fostering a culture of transparency and accountability, organizations can mitigate potential threats and position themselves for future success. Embracing these strategies will not only enhance financial stability but also empower nonprofits to fulfill their missions with confidence and clarity in an ever-changing landscape.

Frequently Asked Questions

Why is evaluating economic uncertainties important for charitable organizations?

Evaluating economic uncertainties is crucial for charitable organizations as it forms the basis of a financial risk assessment, enabling them to recognize, examine, and reduce potential monetary dangers.

How do economic uncertainties affect nonprofits?

Nonprofits often operate with limited resources due to their dependence on donations and grants, making them especially vulnerable to economic instability.

What benefits does a financial risk assessment provide for nonprofits?

A thorough financial risk assessment provides valuable insights into an organization’s economic well-being, identifies weaknesses, and guides strategies to safeguard assets, enhancing economic resilience and cultivating trust among stakeholders.

How can understanding monetary uncertainties help organizations?

By comprehending monetary uncertainties, organizations can align their economic strategies with their mission, ensuring long-term viability and impact.

What challenges do nonprofits face in financial reporting?

Many organizations struggle with inadequate monetary reporting, which can lead to inaccurate revenue evaluations and imprudent expenditures, complicating the detection of fiscal loopholes.

What can organizations do to improve their economic health?

By enhancing reporting practices, organizations can sustain economic health and transparency, allowing for more effective resource management and avoidance of potential pitfalls.

What is the significance of financial risk assessment for nonprofits in 2025?

The significance remains crucial as organizations must balance uncertainty with the need for stability and security, enabling them to tackle challenges efficiently and improve their ability to achieve their goals.