Overview

Mastering the bankruptcy process management is crucial for CFOs. This expertise equips them to navigate the complexities of financial distress effectively, enabling informed decisions that can significantly impact a company's recovery. This article outlines the various types of bankruptcy, the necessary steps in the process, and alternative strategies to avoid bankruptcy. It emphasizes the importance of thorough financial assessments and proactive management to enhance long-term financial health. By understanding these elements, CFOs can better position their companies for recovery and sustainability.

Introduction

In a world where financial uncertainties loom large, understanding the intricacies of bankruptcy can be a lifeline for struggling businesses. Bankruptcy serves not only as a means to eliminate or restructure debts but also as a strategic tool for organizations to regain stability and foster long-term growth.

With various types of bankruptcy—such as Chapter 7, Chapter 11, and Chapter 13—each offering distinct pathways to recovery, it becomes crucial for CFOs and business leaders to navigate these options with informed decision-making.

Moreover, as financial landscapes continue to evolve, exploring alternatives to bankruptcy, conducting thorough financial assessments, and following a structured process can empower organizations to turn challenges into opportunities.

This article delves into the essential aspects of bankruptcy, equipping readers with the knowledge to make sound financial choices in turbulent times.

Understand the Basics of Bankruptcy

Bankruptcy serves as a critical legal mechanism for individuals and companies seeking to eliminate or reorganize financial obligations when faced with insurmountable monetary responsibilities. The primary categories of insolvency include:

- Chapter 7: This type involves the liquidation of assets to settle debts, making it suitable for individuals and businesses with limited income. Approximately 60% of companies that file for bankruptcy opt for Chapter 7, underscoring its prevalence among those struggling to maintain operations. This statistic illustrates the significant challenges many enterprises face in sustaining viability.

- Chapter 11: Primarily designed for businesses, Chapter 11 facilitates reorganization, allowing companies to develop a repayment plan while continuing operations. This type is vital for organizations aiming to preserve their value and maintain stakeholder relationships during periods of economic distress. A thorough understanding of bankruptcy process management in Chapter 11 is essential for CFOs, as it equips them to navigate the complexities of restructuring while minimizing disruption. By implementing streamlined decision-making processes and leveraging real-time analytics, such as those provided by a client dashboard, CFOs can significantly enhance the effectiveness of this strategy. This approach enables them to make informed choices swiftly and monitor performance continuously, ultimately maximizing return on invested capital.

- Chapter 13: Accessible to individuals with a regular income, Chapter 13 allows for the creation of a repayment plan to pay back all or part of debts over time. This option is often favored by individuals seeking to protect their assets while managing their financial obligations, highlighting the importance of bankruptcy process management for CFOs in identifying the most effective approach for their organization. Each type carries distinct implications for operations, stakeholder relationships, and long-term financial health, making informed decision-making vital in navigating these challenging circumstances. By testing hypotheses and applying lessons learned from past experiences, CFOs can refine their strategies for financial recovery. As Bill 'No Pay' Fay aptly notes, seeking expert financial guidance is essential for managing funds and avoiding insolvency, particularly in today's complex economic landscape. Furthermore, the case study on repeat insolvency filers highlights the persistent financial challenges many face, emphasizing the need for effective long-term financial solutions.

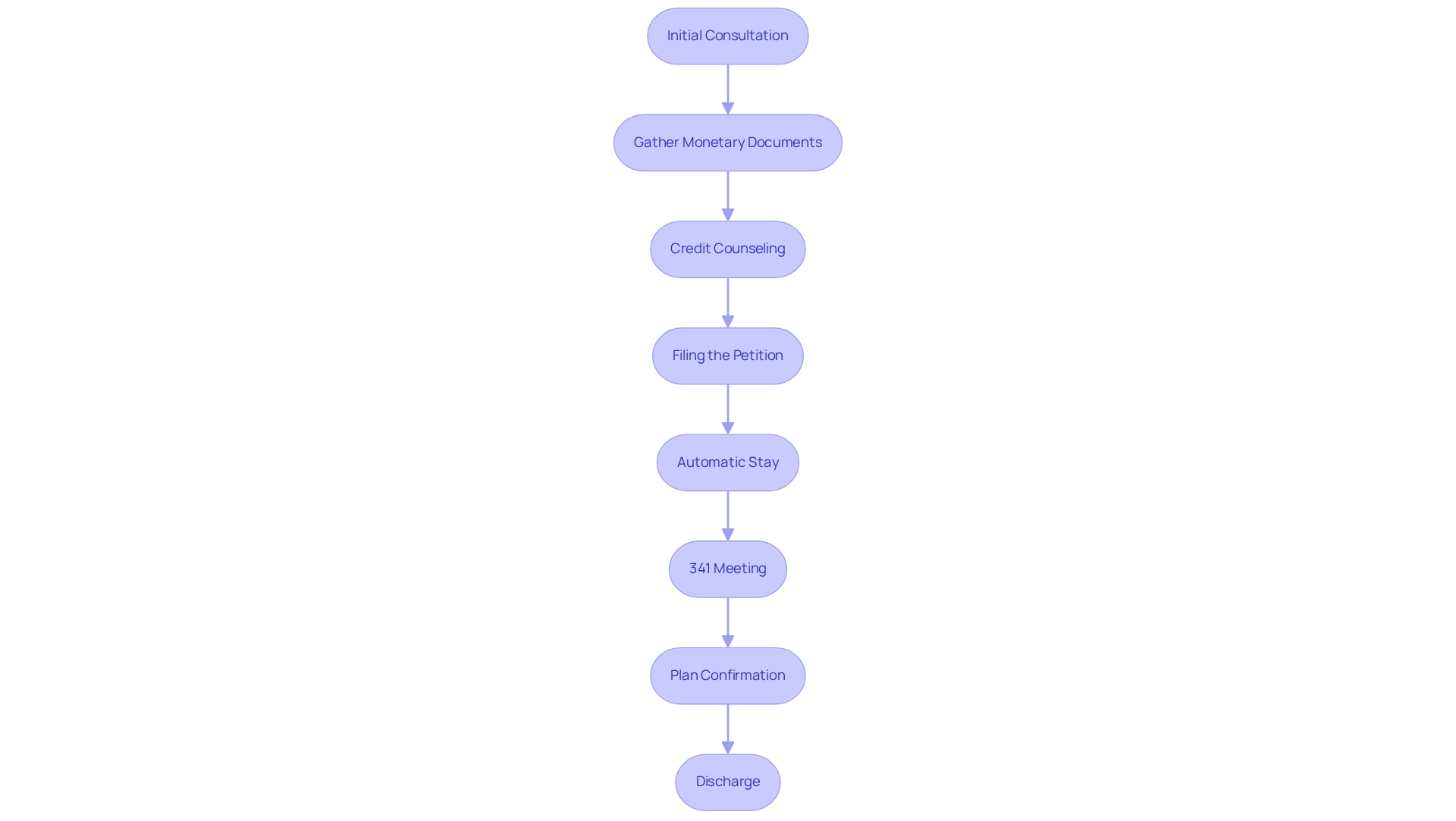

Follow the Step-by-Step Bankruptcy Process

The bankruptcy process involves several critical steps that CFOs must navigate effectively:

- Initial Consultation: Consult with a debt relief lawyer to evaluate your economic condition and investigate possible solutions customized for your business requirements. This initial consultation is crucial for understanding the complexities of your case.

- Gather Monetary Documents: Compile essential monetary records, including income statements, tax returns, and a comprehensive list of liabilities and assets, to provide a clear picture of your economic health.

- Credit Counseling: Complete a credit counseling session from an approved agency, a necessary step before filing for insolvency, which can help identify alternatives to insolvency.

- Filing the Petition: Submit the insolvency petition along with necessary schedules to the court, outlining your monetary situation and the debts you intend to tackle.

- Automatic Stay: Once the petition is filed, an automatic stay is enacted, halting most collection actions against your business, providing immediate relief from creditor pressure.

- 341 Meeting: Attend the meeting of creditors, known as the 341 meeting, where you will respond to inquiries regarding your monetary situation and the proposed bankruptcy plan.

- Plan Confirmation: If filing under Chapter 11 or 13, propose a repayment plan to creditors and seek court approval. During this phase, leverage real-time analytics from your client dashboard to monitor the effectiveness of your proposed plan and make necessary adjustments swiftly. Testing hypotheses about your financial strategies can also enhance your approach.

- Discharge: Upon successful completion of the repayment plan or liquidation process, you will receive a discharge of eligible debts, allowing your business to start anew.

Grasping these steps is essential, particularly considering recent trends showing a rise in bankruptcy process management due to increased insolvency filings. Projections suggest that 2025 could see a rise in both liquidation and repayment-plan cases, particularly in spring and early summer when higher rates are typically observed. This highlights the significance of proactive financial management and strategic planning in navigating the bankruptcy process management landscape. As one insolvency attorney noted, "The initial consultation can establish the tone for the entire process, making it crucial for CFOs to approach it with thorough preparation." Furthermore, putting into practice lessons learned during the financial distress process can cultivate stronger relationships and improve decision-making efficiency, ultimately resulting in a more successful recovery.

Conduct Thorough Financial Assessments

A comprehensive economic evaluation is essential for effective bankruptcy process management and recovery planning. Key components include:

- Analyzing Financial Statements: A detailed review of balance sheets, income statements, and cash flow statements is crucial to grasp the company's economic health. This analysis helps identify trends and potential areas for improvement, enabling CFOs to make informed decisions.

- Identifying Liabilities: It is vital to compile a comprehensive list of all debts, distinguishing between secured and unsecured liabilities. This step offers a clear view of total monetary obligations, which is essential for strategic planning and employing expert advice in turnaround strategies.

- Evaluating Cash Flow: Assessing cash inflows and outflows is necessary to determine liquidity and the capacity to meet ongoing obligations. Understanding cash flow dynamics can reveal potential shortfalls and inform necessary adjustments, particularly when operationalizing turnaround lessons.

- Assessing Asset Value: Establishing the fair market value of assets is critical for understanding what can be liquidated or utilized in restructuring efforts. Precise asset assessment can greatly influence recovery strategies, particularly when backed by a valuation report.

- Consulting with Stakeholders: Involving key stakeholders, including creditors and investors, is crucial for collecting insights and encouraging support during the evaluation process. Their viewpoints can offer significant context and promote smoother discussions, improving relationship-building through real-time analytics.

In 2018, there were 13,678 business insolvency filings, emphasizing the importance of strong economic evaluations. While insolvency submissions have risen, they are still beneath pre-pandemic figures, suggesting persistent economic difficulties despite some recovery. As forecasts indicate that weekly submissions could reach 15,000 by late next year, the need for effective monetary strategies is more pressing than ever. Significantly, states such as California, Florida, Texas, and New York are facing considerable financial challenges, which may be pertinent for CFOs working in those areas. By applying best practices in fiscal evaluations, including prompt assessments that usually require several weeks, CFOs can manage the intricacies of insolvency with enhanced assurance and clarity. As we approach 2025, remaining informed on best practices, such as utilizing AI/ML for efficient decision-making and performance monitoring, will be essential for effective resource management during these challenging times.

Explore Alternatives to Bankruptcy

Before opting for bankruptcy, businesses should explore several viable alternatives:

- Debt Restructuring: Engaging in negotiations with creditors can lead to modified debt terms, such as reduced payments or extended repayment periods, significantly easing financial burdens. Statistics indicate that approximately 60% of enterprises that pursue debt restructuring successfully avoid bankruptcy, underscoring its effectiveness. This method enables a pragmatic evaluation of economic hypotheses to maximize returns on invested capital.

- Asset Liquidation: Selling non-essential assets can generate immediate cash flow, assisting in reducing liabilities and stabilizing operations. This strategy can be monitored through real-time analytics via our client dashboard to assess its impact on overall business health.

- Business Downsizing: Streamlining operations by reducing staff or closing unprofitable divisions can lower operational costs and enhance overall efficiency. Quick decision-making in this area is crucial to preserving resources and maintaining operational viability.

- Seeking Additional Financing: Investigating new financing options or attracting investment can bolster cash flow and support ongoing operations, providing a lifeline during challenging times. Ongoing observation of performance through our client dashboard can assist in making informed decisions.

- Credit Counseling: Partnering with a credit counseling service can aid in creating a personalized financial management plan, offering organized guidance to prevent bankruptcy. It is advisable to acquire a free credit report as a fundamental step in developing a repayment strategy, essential for efficient money management.

In 2025, these strategies are crucial for CFOs aiming to navigate economic distress effectively. Insights from monetary consultants highlight that debt restructuring not only maintains company viability but also improves long-term economic health, enabling organizations to emerge stronger and more resilient. For instance, a case study on forbearance options demonstrates how temporary solutions can provide prompt relief for companies facing payment challenges, showcasing a practical method for handling economic distress without resorting to bankruptcy. Furthermore, as noted by financial expert Sorin Pirău, "Proactive financial management is essential for businesses to navigate through challenging times and emerge successfully.

Conclusion

Navigating the complexities of bankruptcy is essential for businesses facing financial distress. Understanding the different types of bankruptcy—Chapter 7, Chapter 11, and Chapter 13—equips CFOs and business leaders with the knowledge needed to choose the best path forward. Each option presents unique implications for operations and stakeholder relationships, emphasizing the importance of informed decision-making.

The step-by-step bankruptcy process outlined provides a structured approach for businesses to follow. From the initial consultation with a bankruptcy attorney to the final discharge of debts, each phase plays a crucial role in achieving a successful outcome. Proactive financial assessments and thorough documentation can significantly enhance the chances of recovery, enabling organizations to regain stability.

Moreover, before declaring bankruptcy, exploring alternatives such as:

- debt restructuring

- asset liquidation

- credit counseling

can offer viable solutions. These strategies not only help avoid bankruptcy but also promote long-term financial health and operational efficiency. As financial landscapes continue to evolve, the importance of proactive management and strategic planning cannot be overstated.

Ultimately, understanding and effectively navigating the bankruptcy landscape can empower organizations to turn challenges into opportunities, fostering resilience and growth in the face of adversity. With the right knowledge and tools, businesses can emerge from financial turmoil stronger and better prepared for the future.

Frequently Asked Questions

What is the purpose of bankruptcy?

Bankruptcy serves as a legal mechanism for individuals and companies to eliminate or reorganize financial obligations when faced with overwhelming monetary responsibilities.

What are the main types of bankruptcy?

The primary categories of bankruptcy are Chapter 7, Chapter 11, and Chapter 13.

What is Chapter 7 bankruptcy?

Chapter 7 involves the liquidation of assets to settle debts and is suitable for individuals and businesses with limited income. It is the most common type, with approximately 60% of companies that file for bankruptcy opting for this route.

How does Chapter 11 bankruptcy work?

Chapter 11 is designed for businesses and allows them to reorganize while developing a repayment plan. This type enables companies to continue operations and maintain stakeholder relationships during economic distress.

What is the significance of bankruptcy process management in Chapter 11?

Effective bankruptcy process management in Chapter 11 is crucial for CFOs to navigate restructuring complexities. It helps in making informed decisions, minimizing disruptions, and maximizing return on invested capital.

Who can file for Chapter 13 bankruptcy?

Chapter 13 is accessible to individuals with a regular income, allowing them to create a repayment plan to pay back all or part of their debts over time while protecting their assets.

Why is informed decision-making important in bankruptcy situations?

Each type of bankruptcy has distinct implications for operations, stakeholder relationships, and long-term financial health, making informed decision-making vital for effective navigation of these challenging circumstances.

What role does seeking expert financial guidance play in bankruptcy?

Seeking expert financial guidance is essential for managing funds and avoiding insolvency, especially in today's complex economic landscape.

What does the case study on repeat insolvency filers indicate?

The case study highlights the persistent financial challenges many individuals and businesses face, emphasizing the need for effective long-term financial solutions.