Introduction

Crafting an exit strategy is not merely about planning for the end but about positioning your business for optimal success upon transition. In this article, we will explore the key elements of business exit planning, the importance of having an exit strategy, and how to evaluate the value of your business. We will also discuss the process of preparing your business for sale, succession planning, and considering financial and tax implications.

Additionally, we will delve into the significance of assembling a professional team, effective stakeholder communication, timing and implementation, and creating a comprehensive exit plan. Lastly, we will highlight common mistakes to avoid in exit planning. Whether you're a CFO or a business owner, this article will provide practical advice and solutions to help you navigate the complexities of business exit planning.

Defining Business Exit Planning

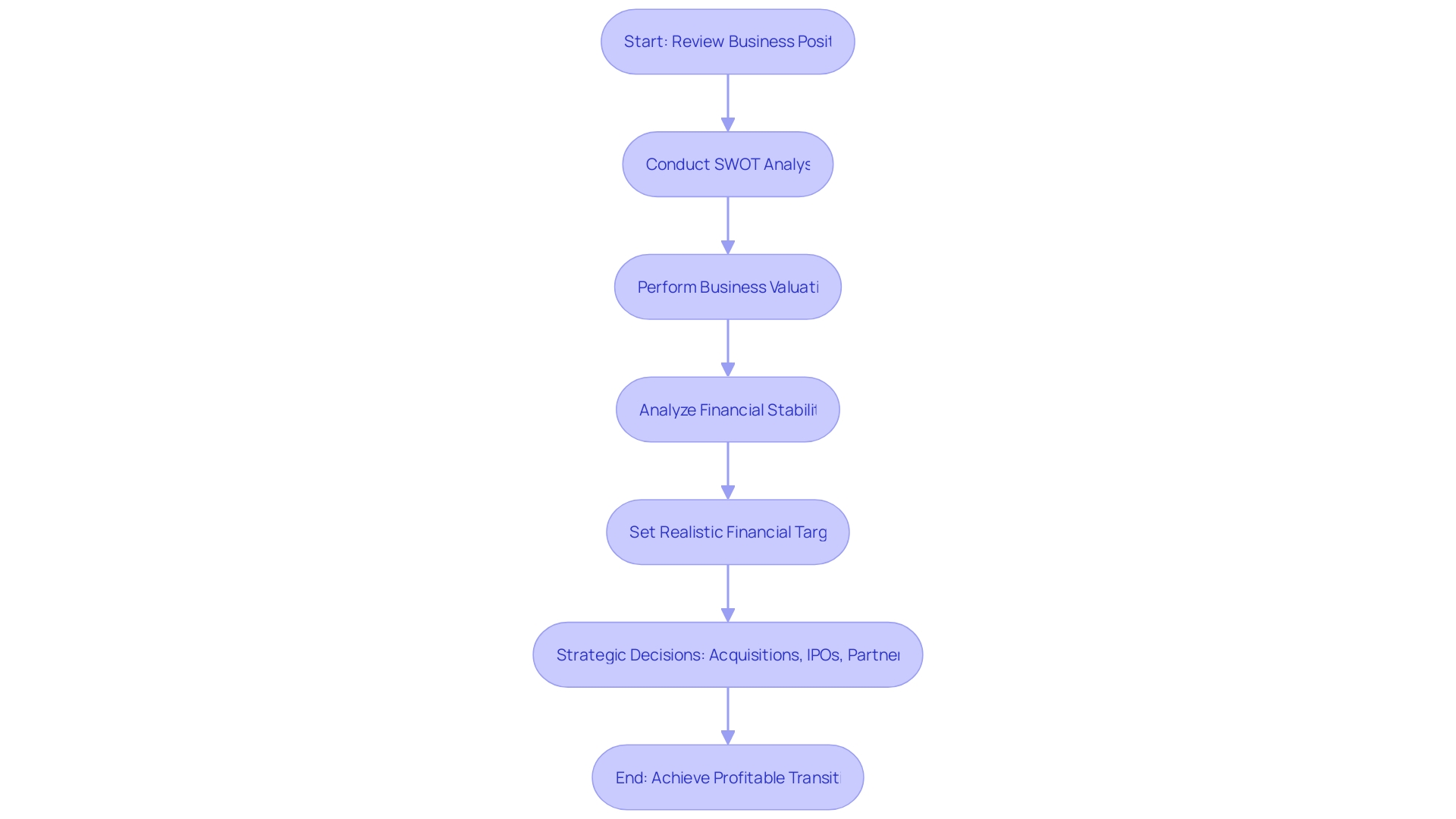

Crafting an exit strategy is not merely about planning for the end but about positioning your business for optimal success upon transition. To begin, a comprehensive review of your company's financial health, potential for growth, and market standing is indispensable.

Conducting a SWOT analysis will shed light on strengths to leverage and weaknesses to address, thus enhancing your bargaining power during negotiations. Moreover, understanding the true worth of your business through a meticulous valuation of assets, revenue, and financial records is crucial.

This not only provides a benchmark against market standards but also informs potential buyers of the intrinsic value of your enterprise. Financial stability is the cornerstone of a lucrative exit.

Businesses with robust financial underpinnings and promising expansion prospects often command higher market values. Analyzing cash flow, debts, and recurring costs is integral to setting forth realistic financial targets for the transition. As quoted by a seasoned business development leader in healthcare, successful exits are marked by strategic decisions such as acquisitions, IPOs, and partnerships that culminate operations or ownership changes profitably. Remember, the most seamless transitions occur when entrepreneurs are prepared and willingly choose to sell at the opportune moment, aligning with Teddy Roosevelt's wisdom that joy is found not in comparison but in the journey of meticulous preparation and staying relevant post-sale.

The Importance of Having an Exit Strategy

To effectively steer a company through the complexities of restructuring or sale, a comprehensive understanding of its financial health and market standing is imperative. Perform a meticulous SWOT analysis to pinpoint improvement areas and existing vulnerabilities.

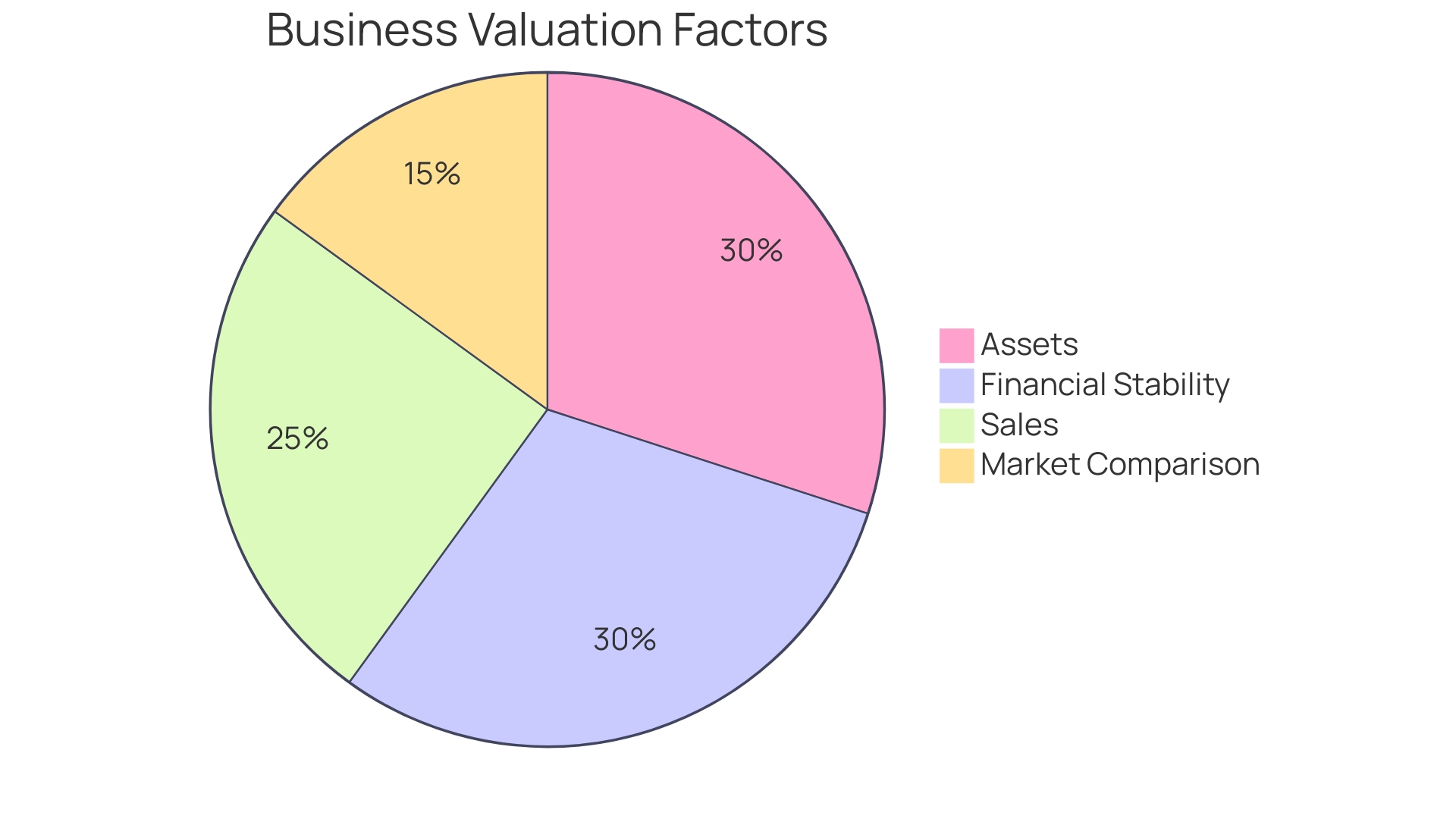

This strategic assessment is crucial for negotiations and smooth transitions. A thorough business valuation is also essential, not just based on assets and sales but by comparing your company's worth to similar entities in the marketplace.

Financial stability is paramount; firms with robust financial foundations and expansion potential often command higher prices. Analyze cash flow, debts, and regular expenses to set realistic financial goals for your company's future.

Remember, articulating the logic and benefits of your business is a form of salesmanship that is vital in convincing potential buyers, investors, and partners. As Mark Cuban suggests, sales skills are indispensable, not just for landing customers or investments, but for effective communication across all business activities. Small businesses are economic powerhouses, providing 70% of global employment. With over 33.2 million small businesses in the US alone, your exit strategy not only shapes your future but also impacts the broader economic landscape. Prepare diligently for a successful transition that aligns with your aspirations and the ongoing vitality of the business sector.

Key Elements of Business Exit Planning

To navigate the complexities of business exit planning effectively, a robust evaluation of your company's financial health is imperative. Begin with a meticulous SWOT analysis to pinpoint your business's strengths, weaknesses, and areas ripe for improvement.

This strategic assessment is vital for enhancing your negotiation leverage in a sale or transition. Further, conducting an in-depth business valuation is essential.

Scrutinize your assets, sales figures, and turnover to ascertain your business's market value, comparing it to similar entities. Consider utilizing a formal valuation service for a comprehensive appraisal.

Financial stability transcends mere asset value; businesses with solid financial underpinnings and growth potential often command higher market prices. Analyze your cash flow, liabilities, and recurring expenses to establish realistic financial targets for your transition. As the experts suggest, selling a business is far from straightforward, entailing rigorous due diligence and mental fortitude. Successful sellers are those who recognize the optimal time to sell, based on a thorough understanding of their business's value and a desire for change. To ensure a smooth transition, maintain accuracy in your financial records, address legal and regulatory concerns promptly, and remain active and relevant post-sale, embracing the new chapter in your life with zeal.

Setting Clear Objectives

Crafting a comprehensive business exit plan demands a meticulous evaluation of the company's financial health, market standing, and growth trajectory. Enlisting a SWOT analysis helps in pinpointing the strengths to capitalize on and weaknesses to address, setting the stage for robust negotiations and a seamless transition.

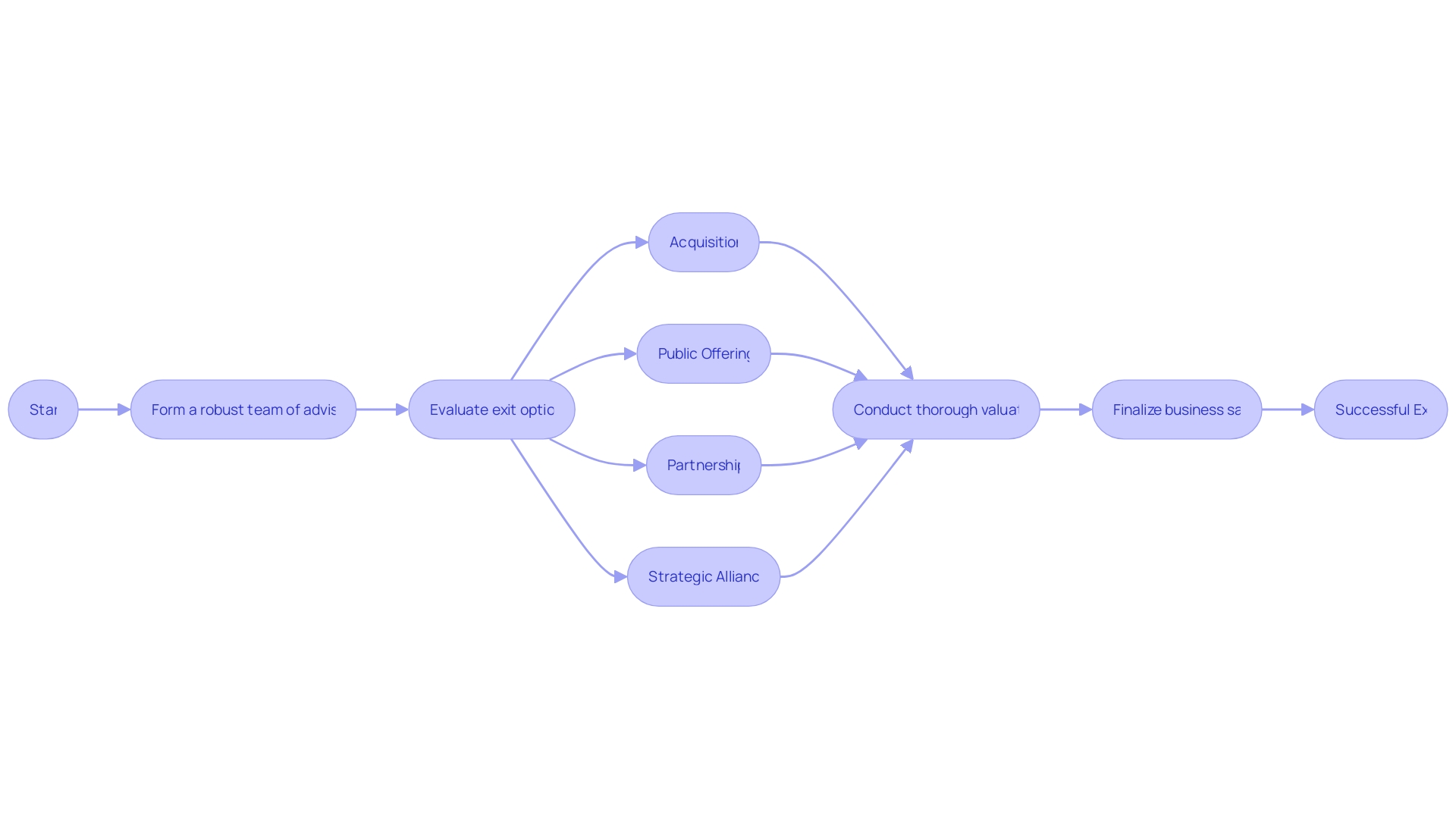

Business valuation is another critical component, requiring a deep dive into assets, sales, and market comparisons to ascertain the company's worth. This groundwork paves the way for various successful exit strategies, such as acquisitions, IPOs, licensing agreements, partnerships, or strategic alliances, each offering distinct advantages and potential financial rewards.

For instance, acquisitions often yield a significant ROI for initial investors, while IPOs enable capital influx through public share offerings. Licensing or partnerships can lead to substantial upfront payments or royalties, and strategic alliances might unlock considerable financial gains. Timing the exit to coincide with a flourishing market can further amplify returns, as buyers may be more inclined to invest with a long-term perspective in a competitive sector brimming with high-value deals.

Evaluating Business Value

Conducting a comprehensive valuation of a business is not only about crunching numbers; it's a strategic move that provides a clear snapshot of a company's worth and market standing. For a software company, this process is particularly nuanced, as it must consider the firm's unique market position, driven by customer loyalty, product distinctiveness, and technological prowess. A well-executed valuation delves into market share, growth patterns, and the longevity of the company's competitive edge, with a focus on innovation as a key value driver.

Firms that demonstrate an ongoing commitment to R&D or strategic acquisitions are often appraised at a higher value. The case of MandM, a UK-based online fashion retailer, underscores the importance of understanding a business's future value potential, which is instrumental in shaping its market strategy and customer engagement. Moreover, referencing the insights on purchasing five SaaS businesses, it's evident that a nuanced approach, which considers both tangible and intangible assets, is crucial.

This approach should reflect in the expected cash flows and the associated risks, with intangibles such as brand reputation and management quality influencing the valuation. As suggested by Canadian business practices, engaging valuation experts or CPAs familiar with local standards is advisable for an informed and compliant assessment. Ultimately, an accurate and comprehensive business valuation is a cornerstone for making enlightened decisions regarding mergers, acquisitions, and other strategic financial endeavors.

Preparing the Business for Sale

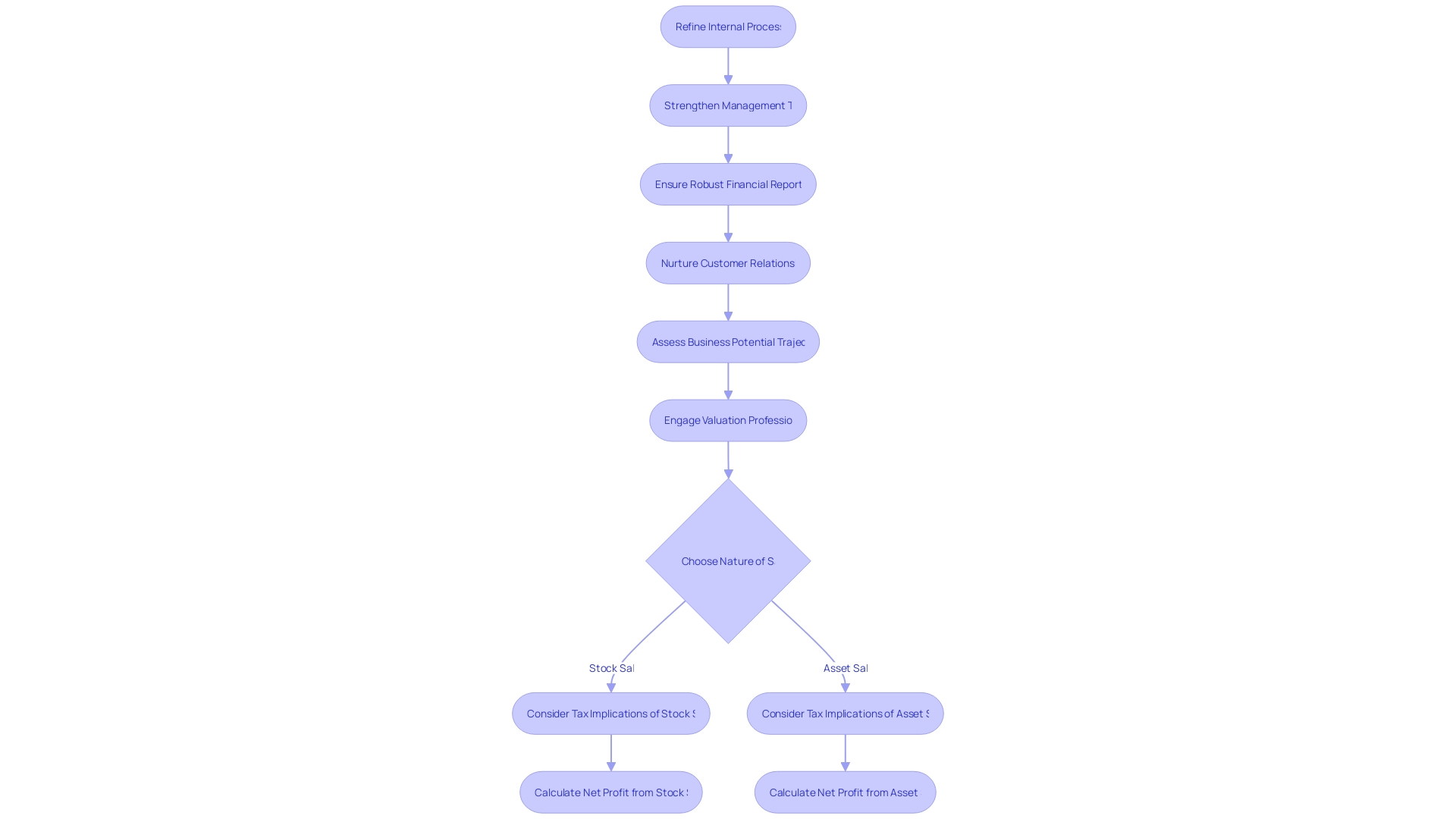

When contemplating the sale of a business, it is paramount to present your enterprise at its best. The perception of value to potential acquirers is heightened by a clear demonstration of operational efficiency and financial clarity.

This encompasses not only refining internal processes and strengthening the core management team but also ensuring robust financial reporting and nurturing key customer relationships. A well-prepared business underscores its worth through these enhancements, which are critical to attracting serious buyers and achieving an optimal sale price.

An astute assessment of the business's potential trajectory over the next decade can inform the decision to sell, as noted by Abhijeet Kaldate of Astra WordPress Theme. Moreover, neglecting an accurate valuation is a pitfall to avoid, as emphasized by experts.

Engaging a valuation professional to scrutinize financial statements, assets, customer base, and market trends is advised to establish a fair market value—a strategic move to prevent undervaluation during negotiations. Choosing the nature of the sale is also a decisive factor, with stock sales and asset sales carrying distinct tax implications and impacting capital gains calculations. This decision is pivotal and should align with the most tax-efficient strategy for the business owner. As we navigate the complexities of selling a business, it is crucial to be informed and prepared for the journey ahead, ensuring that the full value of your business is recognized and realized in the sale.

Succession Planning

As a business owner, the decision to retire is monumental, and the path you choose for exiting your business—whether it's to sell, pass it on, or close up shop—requires meticulous strategizing. Selling your business demands a comprehensive evaluation to avoid underestimating or overvaluing your enterprise.

A professional business valuation is paramount, gauging your business’s worth by examining assets, financial performance, market conditions, and industry trends. This assessment ensures that you receive a fair price for your business.

Communicate your intentions to sell early and clearly to prepare your employees and partners for the impending change and to preserve the trust in the business's future. On the other hand, succession planning is vital for continuity, particularly for family-run businesses where passing the torch to the next generation is preferred.

A well-crafted succession plan addresses the two most common hurdles in business transition: taxes and family discord. By identifying and grooming potential successors, providing them with the necessary training, and ensuring a smooth transition, succession planning safeguards the business's legacy and operational functionality. It also secures financial stability for your family and stakeholders. Remember, a transition is generally smoother for entrepreneurs who actively choose to sell, knowing it’s the right time for them personally, as it aligns with their readiness and business acumen. Navigating these decisions is no small feat and requires a clear, action-oriented approach to safeguard the future of your business.

Considering Financial and Tax Implications

Optimizing financial outcomes in business exit planning is not just about selecting the right exit strategy, but also about the intricate details of the transaction type. A pivotal decision is choosing between a stock sale and an asset sale. In a stock sale, the buyer acquires the company's shares, often utilized by C and S corporations.

An asset sale, on the other hand, involves selling the company's physical assets. Each option has different tax implications, especially regarding capital gains calculations. For instance, long-term capital gains from stock sales may be taxed at a lower rate compared to short-term gains, which are taxed as ordinary income.

Additionally, a thorough analysis of your business's financial health and market positioning is essential. This involves conducting a SWOT analysis to highlight strengths and weaknesses, and a comprehensive business valuation that accounts for not just assets but also sales and turnover. This valuation must include all associated costs, such as depreciation, for an accurate financial picture.

Remember, selling a business is a complex process that requires due diligence, from running numerous what-if scenarios to negotiating deal terms. As Paul Gregory, a Tax Director with extensive experience in mergers and acquisitions taxation, and Cristina Alcontin, an assurance director, advise, it is crucial to engage professional counsel to navigate the tax landscape effectively. Their expertise can ensure that your exit strategy is both tax-efficient and aligned with your financial goals, ultimately leading to a smoother transition and maximizing the value of your business sale.

Assembling a Professional Team

Crafting a strategic exit plan for a business, particularly in the dynamic healthcare sector, necessitates a robust team of advisors. This team typically encompasses financial strategists, legal experts, tax consultants, and business brokers.

Their combined expertise is pivotal in steering through the intricate legal, fiscal, and operational facets of a transition. For instance, in the medical device industry, exits can manifest in various lucrative forms such as acquisitions by larger entities, public offerings on the stock market, or partnerships that yield substantial upfront payments or royalties.

A well-rounded advisory team can evaluate the nuances of each option, ensuring a profitable and positive transition. Moreover, understanding the company's potential trajectory over the next decade is essential when considering an acquisition offer. A thorough valuation, benchmarked against industry standards, is crucial before finalizing any business sale to ensure its true worth is realized. This comprehensive approach to exit planning is crucial for entrepreneurs, whose success is often driven by traits like grit and confidence, to capitalize on their hard work and investment.

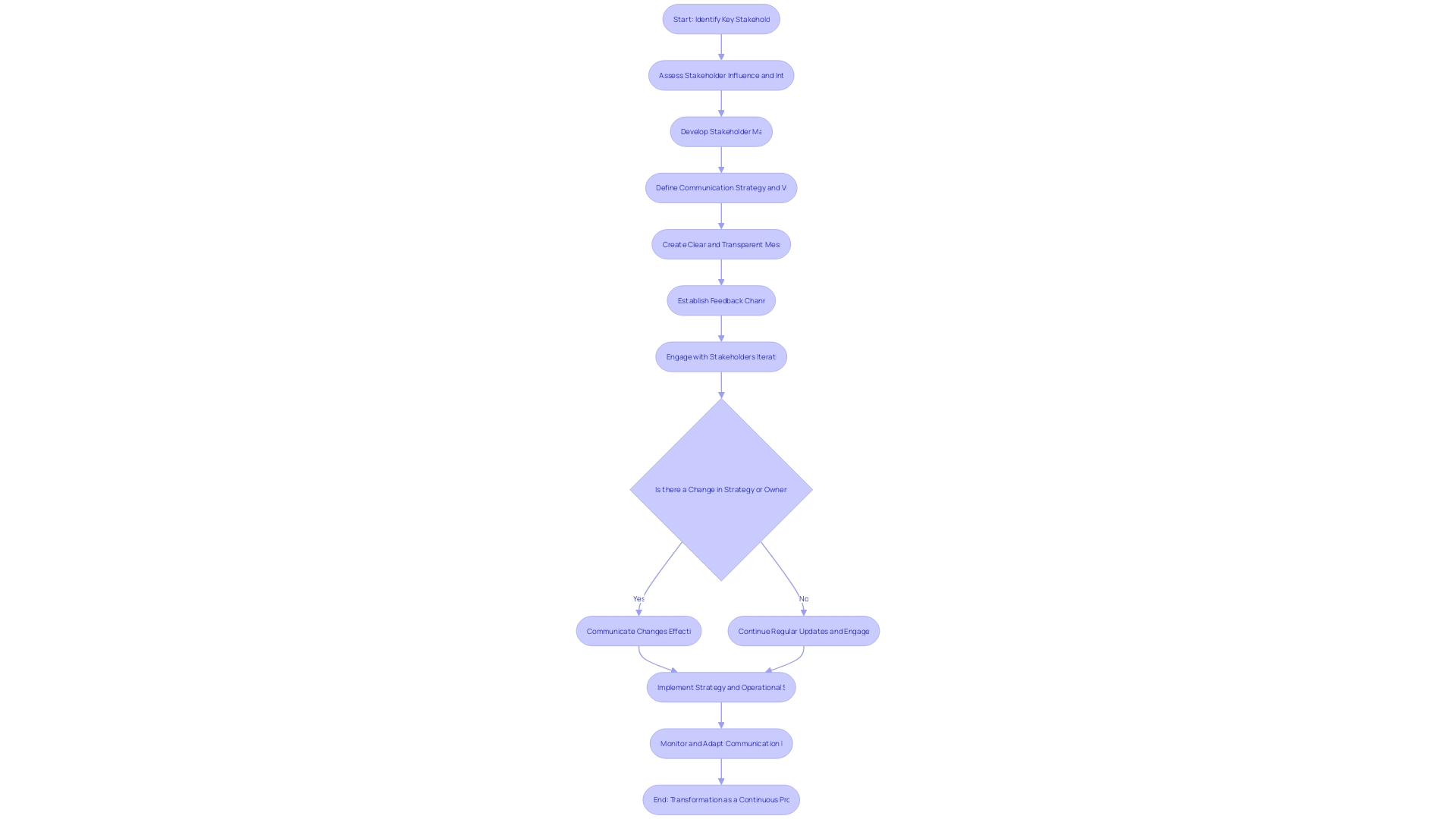

Effective Stakeholder Communication

When a business faces significant changes, such as ownership transitions or operational shifts, effective stakeholder communication becomes pivotal. It's a nuanced art that demands a clear conveyance of strategy and vision to all involved, from employees to investors. Stora Enso's transformative journey from a traditional paper manufacturer to a leader in renewable materials exemplifies the power of strategic communication.

Amidst market shifts and declining paper demand, which saw a drop from 12% to less than 4% in newsprint globally over two decades, they chose innovation over stagnation. This bold move required not only a new CEO and a significant workforce reduction but also a comprehensive communication plan to secure stakeholder buy-in. The success hinged on identifying key stakeholders and understanding their influence and interest levels, as highlighted by communications expert Lis Anderson.

A well-crafted stakeholder communication plan, distinct from a stakeholder management plan, provided the roadmap for engagement, specifying the what, why, and how of communication efforts. It utilized stakeholder maps for strategic outreach and feedback channels for iterative dialogue. This approach mitigated risks and maintained trust through transparent updates on the company's direction, ensuring a smoother transition during turbulent times.

In the realm of mergers and acquisitions—a space where 70% to 80% of endeavors fail, primarily due to cultural integration challenges—such a communication strategy is even more crucial. It's not just about sharing information; it's about fostering a shared culture and vision that propels the company forward. Thus, the art of stakeholder communication lies at the heart of successful business transformations, ensuring that changes are not only understood but embraced by all those who are part of the organization's ecosystem.

Timing and Implementation

The art of business exit planning hinges not only on meticulous preparation but also on impeccable timing. A prime window for selling your business emerges when the market is buoyant and competitive, particularly if your industry is experiencing a surge in transactions.

In such a climate, historical data from similar companies that fetched premium prices can serve as a benchmark. This is when strategic acceleration of the exit process could significantly enhance the outcome.

To chart a successful course, initiate by examining your business’s financial health, growth trajectory, and market standing. A SWOT analysis can reveal strengths to leverage and weaknesses to address, fortifying your position in negotiations.

Understanding your business's value in comparison to the market is pivotal, so assess your assets, revenue, and sales figures thoroughly. Notably, transitions are smoother for entrepreneurs who proactively choose to sell rather than those compelled by circumstances.

This sentiment echoes the experiences of seasoned business owners, who underscore the necessity of readiness and the alignment of personal and business timing. In the dynamic healthcare sector, where I have three decades of experience, successful exits for medical device startups manifest in various forms: acquisitions, IPOs, lucrative licensing deals, or strategic alliances. These outcomes not only celebrate the perseverance and confidence of the founders but also represent the culmination of their strategic foresight and rigorous preparation. As you approach the sale of your business, remember the wise words of Teddy Roosevelt: “Comparison is the thief of joy.” Focus on the unique journey of your enterprise, ensuring your financial records are pristine and all regulatory hurdles are navigated. Post-sale, embrace the new chapter with zeal, staying engaged and relevant in your next venture.

Creating a Comprehensive Exit Plan

Developing a robust exit strategy is essential for an organized transition, be it a sale or change in ownership. This blueprint starts with a meticulous assessment of your business's financial standing, growth trajectory, and market presence.

A detailed SWOT analysis helps pinpoint your company's strengths and weaknesses, providing leverage or identifying areas for improvement before a potential sale. Understanding your business's value is crucial; examine your assets, revenue, and customer accounts to estimate your market position relative to competitors.

This might involve an informal review or a formal valuation. Moreover, financial solidity is pivotal—companies with stable finances and expansion potential often command higher prices. Scrutinize cash flows, liabilities, and recurring costs to establish achievable financial targets for your exit. An exit plan synthesizes these evaluations into a coherent strategy, detailing the necessary actions, timelines, roles, and backup plans, ensuring a well-orchestrated exit.

Voluntary and Involuntary Exit Strategies

Crafting a robust business exit strategy is crucial, whether you're steering a start-up towards a lucrative acquisition or navigating potential financial turbulence. Take inspiration from Tech Ladies, a community business that blossomed from a small meetup into a multi-million dollar enterprise with 200,000 members before its successful acquisition. The founder, Allison Esposito Medina, transitioned from Google to focus on Tech Ladies, illustrating the power of a well-executed exit plan.

Similarly, in the healthcare sector, successful medical device companies often follow a strategic path to exit, including acquisitions that reward investors and founders, IPOs that infuse fresh capital, and partnerships or licensing deals that yield substantial upfront payments or royalties. Strategic alliances too can pave the way for profitable exits. These diverse exit avenues, underscored by the common traits of grit and perseverance among successful CEOs, demonstrate the importance of a forward-thinking exit strategy that can adapt to both voluntary and involuntary scenarios, ensuring a smooth and profitable transition.

Developing a Well-Rounded Exit Strategy

Crafting an effective exit strategy necessitates a meticulous evaluation of your business's financial well-being, market standing, and growth prospects. Initiating with a comprehensive SWOT analysis to pinpoint your company's strengths and weaknesses is critical for improvement and identifying vulnerabilities that could impact negotiations or transitions.

Understanding the value of your business is equally paramount. Assessing assets, revenue, and sales ledger provides insights into your company's worth and market positioning.

A formal valuation service can provide a more structured assessment. Financial stability is often a more significant determinant of value than hard assets or intellectual property.

Analyzing cash flow, debts, creditors, and expenses is crucial for setting realistic financial targets for your transition. As noted by seasoned entrepreneurs, the mental fortitude required for selling a business involves due diligence and the ability to navigate complex scenarios. Successful exits, whether through acquisition, IPOs, or strategic alliances, hinge on robust financial foundations and the potential for future growth. Entrepreneurs who actively choose to sell often find transitions smoother, acknowledging the right timing for their decision. Remember, the journey toward a successful exit is paved with updated financial records, resolved regulatory issues, and a commitment to remaining relevant post-sale.

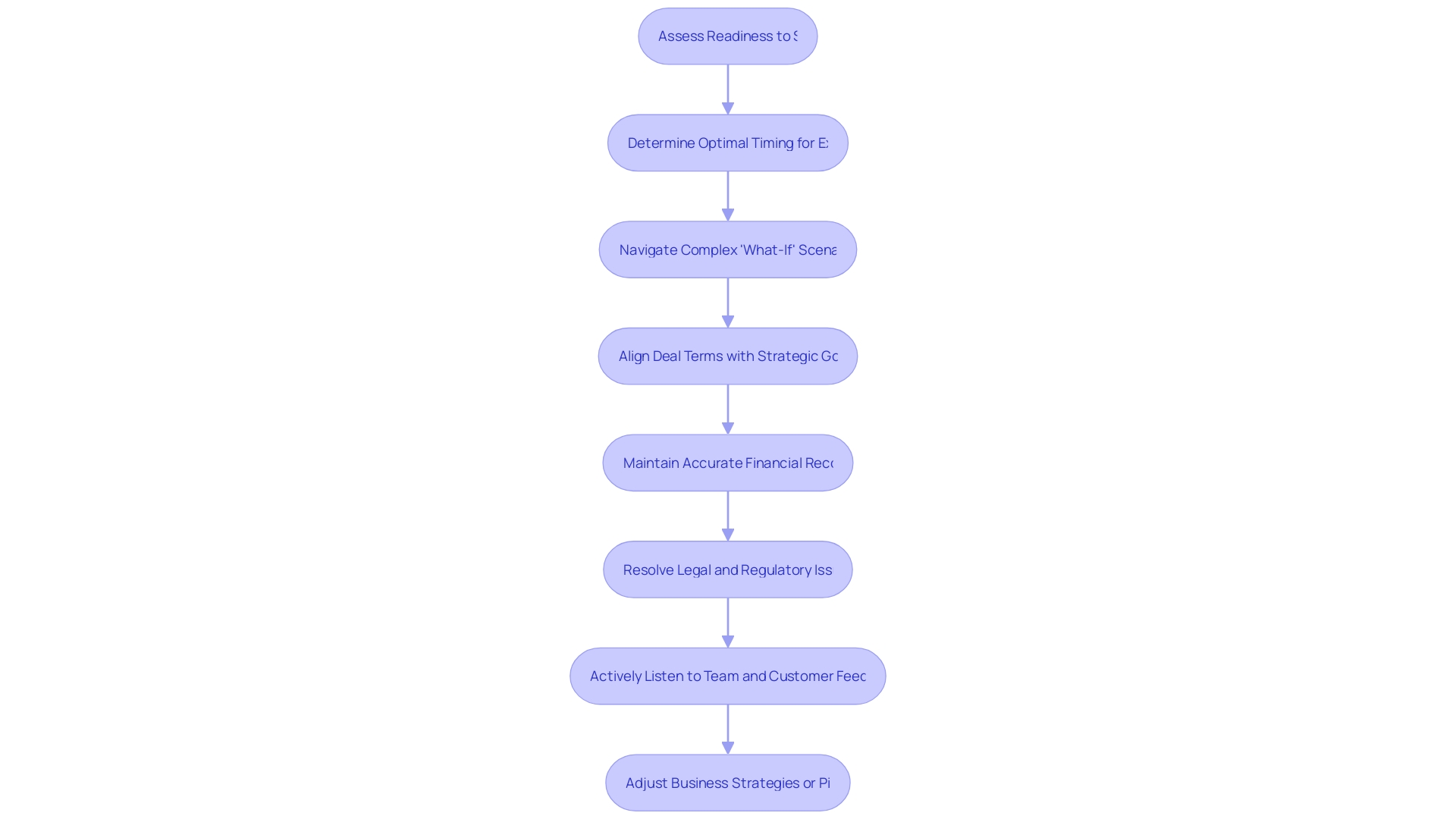

Common Mistakes to Avoid in Exit Planning

Mastering the art of exit planning is crucial for entrepreneurs aiming to sell their business. It's a challenging process that demands mental fortitude and meticulous attention to detail. Entrepreneurs who've thrived post-sale often share common traits, such as a readiness to sell and an understanding of the optimal timing for their exit.

Selling a business isn't just about getting through due diligence; it's about navigating complex what-if scenarios and aligning deal terms with strategic goals. To ensure a successful transition, avoid critical mistakes like the lack of a budget, which can lead to financial missteps, and poor expense tracking, which can cost thousands. Instead, focus on maintaining accurate financial records and resolving legal and regulatory issues.

As Teddy Roosevelt wisely said, "Comparison is the thief of joy." Don't get caught up in how others have sold their businesses; concentrate on your unique journey and stay relevant in your new phase of life. Moreover, an organized process for listening to team and customer feedback can signal when it's time for a change, supporting a strong execution of business adjustments or pivots.

Conclusion

Crafting an effective exit strategy is crucial for positioning your business for success upon transition. It involves evaluating your company's financial health, conducting a SWOT analysis, and understanding its true value through meticulous valuation. Financial stability is paramount, as businesses with robust foundations and growth potential often command higher prices.

Having an exit strategy is essential for navigating the complexities of restructuring or sale. It requires a comprehensive understanding of your business's financial health and market standing. A SWOT analysis helps pinpoint improvement areas, while a thorough business valuation ensures you receive a fair price.

Preparing your business for sale involves refining internal processes, strengthening the management team, and ensuring robust financial reporting. Accurate valuation is crucial to prevent undervaluation during negotiations, and choosing the nature of the sale has significant tax implications. Succession planning is vital for family-run businesses, ensuring continuity by identifying potential successors and providing training for a smooth transition.

Effective stakeholder communication fosters trust and ensures a shared culture and vision. Timing plays a crucial role in exit planning. Selling during a buoyant market can enhance outcomes, but it is important to evaluate your business's financial health and market standing before making decisions.

Creating a comprehensive exit plan involves assessing your company's financial standing through a SWOT analysis, understanding its value through asset evaluation and sales figures, analyzing cash flows and liabilities to establish realistic financial targets, and developing a coherent strategy with clear actions and timelines. In conclusion, crafting an exit strategy requires careful consideration of various factors such as financial health assessment, market positioning evaluation, timing considerations, effective stakeholder communication, succession planning (if applicable), tax implications analysis,and assembling a professional team for guidance. By following these key elements,you can position your business for optimal success upon transition.