Introduction

Mastering cash flow forecasting is crucial for businesses aiming to navigate financial ebbs and flows with precision. By dissecting future cash receipts and disbursements, businesses can craft strategies to maintain liquidity, the lifeblood of any enterprise. In the realm of small businesses, cash flow forecasting emerges as a beacon of foresight, aligning day-to-day operations with financial sustainability.

Recent events have highlighted the importance of maintaining liquidity to cover essential expenses without succumbing to debt. Cash flow forecasting is not just about crunching numbers; it's about understanding the nuances of cash movements during promotions or seasonal changes, ensuring the business stays afloat and thrives. In this article, we will explore the key components of a cash flow forecast model, the process of setting it up, data collection and assumptions, calculating cash flows from different activities, analyzing and interpreting cash flow forecasts, common pitfalls to avoid, the role of automation in enhancing accuracy, and best practices for refining and updating cash flow models.

By understanding and implementing these practices, CFOs can enhance financial foresight and guide their organizations towards value maximization.

Understanding the Importance of Cash Flow Forecasting

Acquiring expertise in revenue projection is not only a strategic benefit but a requirement for enterprises aiming to navigate the financial fluctuations with accuracy. Imagine the power of forecasting that allows organizations to foresee and prepare for potential financial shortages or to capitalize on growth opportunities. By analyzing upcoming monetary inflows and outflows, enterprises can develop tactics to sustain liquidity, the essential element of any organization.

In the realm of small enterprises, where operations are often lean, cash flow forecasting emerges as a beacon of foresight. Take, for example, an eCommerce store with minimal startup costs and a worldwide customer base, or a consulting firm with the luxury of setting its own rates and enjoying recurring revenue. These models exemplify businesses with low overheads, directly translating into higher profitability. Such cases highlight the importance of forecasting; it's the tool that aligns day-to-day operations with sustainability.

Recent news indicates a new economic paradigm where having a strong emergency fund is no longer a luxury but an imperative. The pandemic's strain taught us the importance of maintaining liquidity to cover essential expenses, such as housing and groceries, without succumbing to debt. Likewise, for merchants, predicting monetary movement is not only about analyzing figures; it's about comprehending the intricacies of money transfers during marketing campaigns or shifts in seasons, guaranteeing the enterprise remains solvent and prospers.

Delving into the heart of forecasting for money movement, we discover the statement of cash—a financial foundation that captures the movement of funds across operational, investment, and financing domains. It's a clear lens through which companies can evaluate their cash-generating abilities, track accounts receivable collections, and manage payments for goods, services, and labor. A positive operating cash flow is a testament to a company's efficiency in generating sufficient cash from its core business without the need for external funding.

However, the realm of monetary analytics is changing, with a growing focus on data-driven decision-making. As noted in a 2022 S&P Global survey, a substantial percentage of respondents rely heavily on data for their decisions. This transition to analytics tools, however, highlights challenges such as data security and the requirement for skilled professionals capable of interpreting intricate data into actionable insights.

To summarize, the projection of incoming and outgoing funds plays a crucial role in managing finances, a mechanism that not only anticipates the economic future but also directs enterprises towards maximizing value, regardless of their stage of development.

Key Components of a Cash Flow Forecast Model

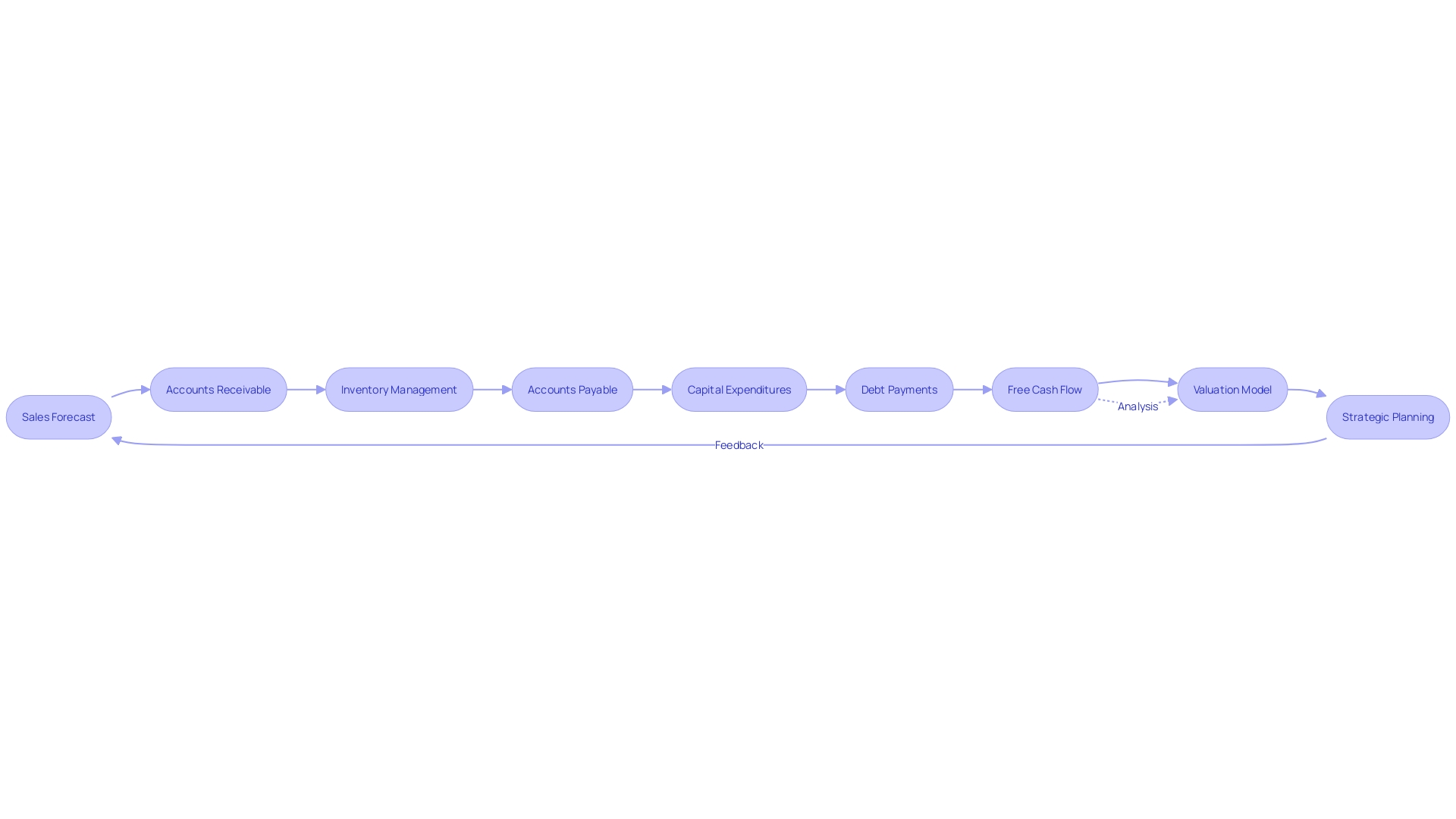

To guarantee the financial well-being and strategic planning of an organization, it's crucial to build a strong forecast model for monetary movement. The model is a comprehensive tool comprising critical elements that facilitate accurate future flow predictions. The elements include sales forecasts, which are the bedrock of the model, reflecting potential revenue based on current market trends and historical data. Accounts receivable and payable are also integral, tracking the money due to and from the company, thus impacting liquidity.

Inventory management cannot be disregarded as it ties up capital and affects reserves. Capital expenditures, which involve investments in assets like equipment and property, require careful consideration due to their long-term impact. Finally, debt payments must be considered, as they represent obligations that can have a significant impact on the movement of funds.

An example is Citizens Financial Group, Inc., which oversees a varied collection of economic products and illustrates the significance of a customized income strategy to fulfill customer requirements. Additionally, the importance of a adaptable revenue projection is echoed in recent news where money managers emphasize the requirement for emergency funds, supporting the uncertainty of monetary demands.

Dr. Sharon H. Porter highlights the significance of understanding all statements for efficient management of funds. In addition, the Blue Chip Economic Indicators emphasize the combined forecasts of prominent economists, highlighting the importance of consensus and expert opinion in predictions. Considering these observations, it's clear that a carefully designed financial inflow projection model is not just an analytical practice but an essential element of financial management.

Setting Up a Cash Flow Forecast Model

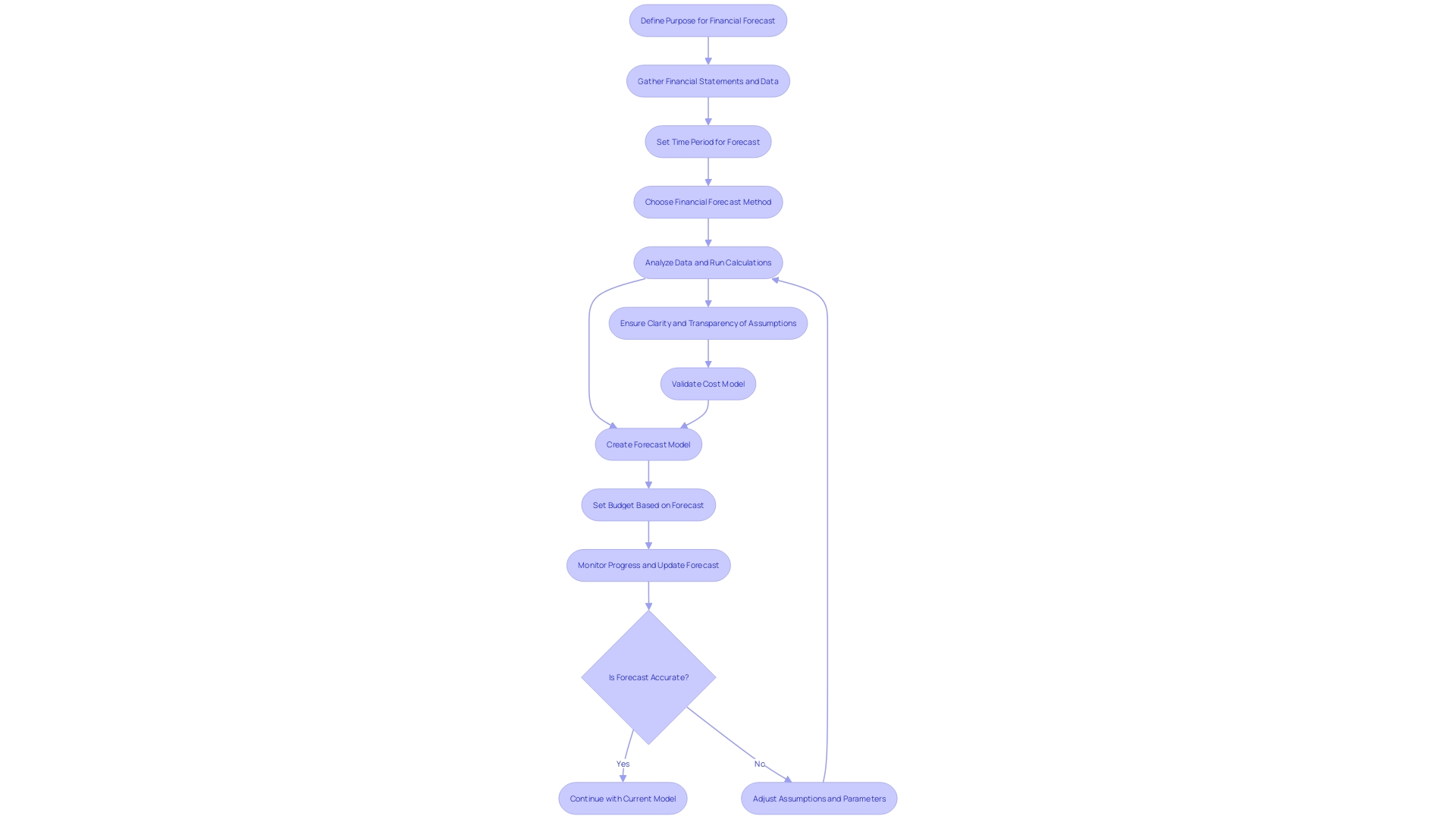

When creating a forecast model for financial movement, the path to achievement involves careful planning and accurate execution. Begin by forecasting revenue with precision, drawing on historical data, market trends, and growth assumptions. This process entails a thorough examination of sales volume, pricing strategies, and overall market conditions. Revenue can be projected through several methods, such as applying a simple percentage growth rate, a bottom-up approach by multiplying the number of units sold with the average price per unit, or a top-down approach by considering the company's market share and market size.

Next, transition to estimating expenses and margins, which includes outlining the cost of goods sold, operating expenses, and other expenditures. This process is essential for creating a structure that not only predicts the movement of funds but also facilitates strategic decision-making. This is especially important in the current landscape where businesses, including healthcare organizations, are navigating through challenges brought on by factors like the COVID-19 pandemic, inflation, and staffing shortages.

Incorporating this approach into a six-step structured methodology will enable the development of a robust 'three-statement projection model' that can estimate cash flow, cash balances, and debt over the years. It’s not only about achieving accuracy but also about capturing the larger picture, focusing on value and impact to create tangible monetary benefits.

As highlighted by industry leaders, the distinction between budgeting and forecasting must be understood. While forecasting predicts future business performance based on historical trends, budgeting sets targets. Both play a crucial role in money management, and their forecasts are essential in establishing and monitoring budgets. The process starts with identifying the purpose of the forecast, gathering all necessary monetary data, establishing a forecasting period, and choosing a technique to carry out the predictions.

Embracing such strategic foresight is more important than ever for CFOs, as the role evolves amid high inflation, technological disruptions, and shifting societal expectations towards business practices. Companies such as Intuit Inc. are showcasing these changes by reallocating resources to invest in areas like artificial intelligence, highlighting the significance of planning and growth-focused strategies.

Data Collection and Assumptions for Cash Flow Forecasting

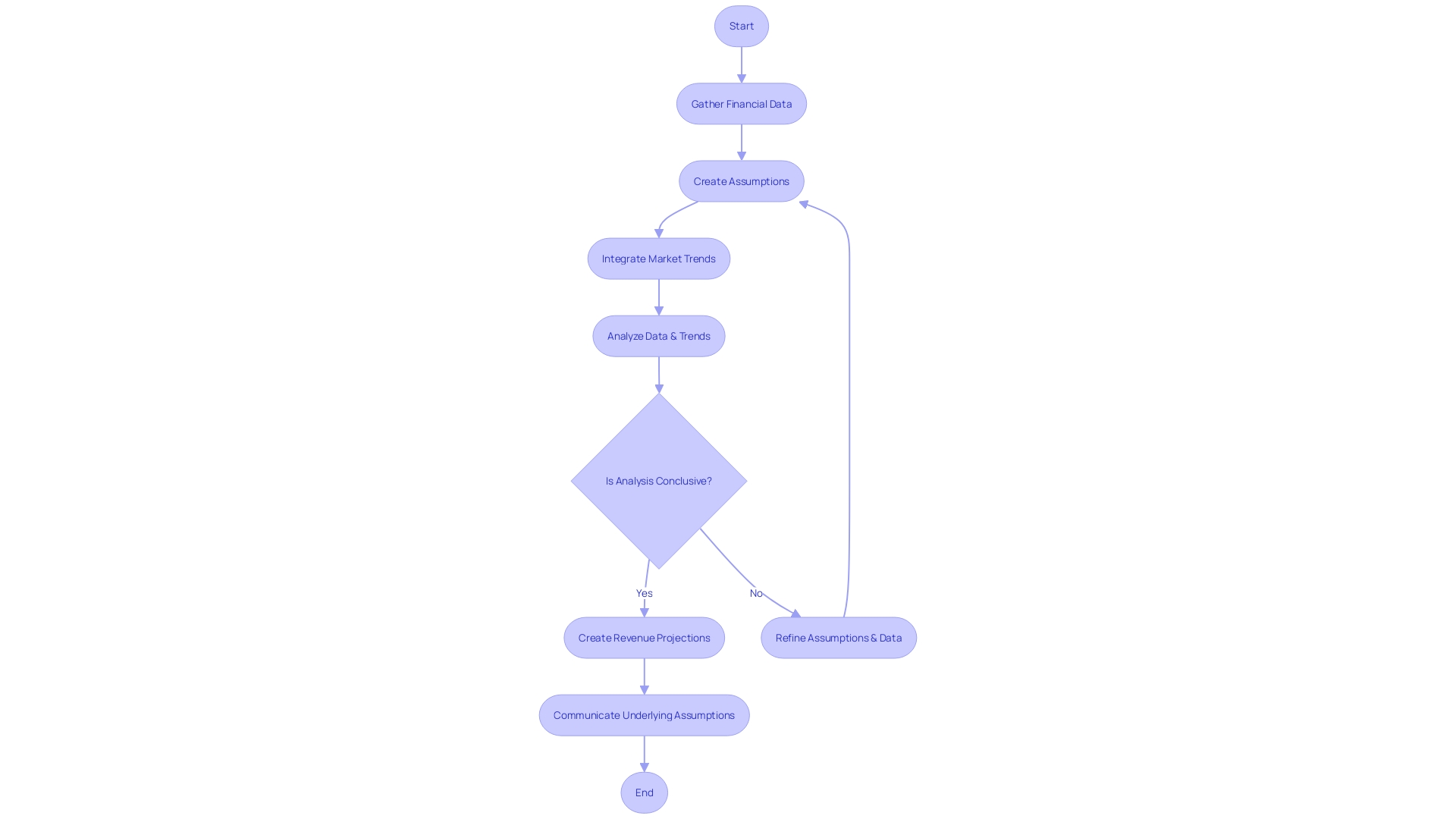

To produce dependable revenue projections, thorough gathering of financial data and the creation of practical assumptions are crucial. This includes a thorough compilation of sales figures, accounts receivable and payable, inventory levels, and analysis of historical financial statements to establish a strong basis for forecasting. Crucial to this process is the integration of market trends, past performance data, and sector-specific insights to inform assumptions and guide strategic planning.

The process mirrors the approach used by successful companies like DoorDash, which base their growth models on detailed data analytics, such as user preferences and market dynamics, to make informed decisions and drive expansion. Similarly, transparent communication of underlying assumptions is essential to the clarity and credibility of the model, as it enables stakeholders to understand the rationale behind projections and assess their validity.

A solid monetary inflow structure additionally demonstrates the qualities of organizations with robust financial streams, which usually have minimal operating expenses and a continual revenue, adding to the durability and profitability of the enterprise. This aligns with insights from corporate finance that suggest businesses should aim for value maximization, even if it means accepting lower profits or enduring losses in the short term to secure long-term growth and market leadership.

The importance of accuracy in data collection is underscored by industry statistics, which reveal that approximately 80% of a data scientist's work involves preparing data, highlighting the critical impact of data quality on time-to-market for new products and services. Moreover, a data team's effectiveness is measured by their ability to ensure consistent uptime and stringent security, reflecting the broader organizational goals of scalability and objective fulfillment.

Ultimately, a strong revenue stream blueprint is not just a conceptual framework but a useful instrument that, when utilized effectively, can greatly improve a company's fiscal foresight and operational effectiveness.

Calculating Cash Flows from Operating, Investing, and Financing Activities

To become proficient in modeling and forecasting of monetary movement, one must understand the intricacies of categorizing the movement of funds. Cash movements are divided into operating, investing, and financing activities, with each playing a distinct role in a company's financial landscape. Evaluating monetary streams requires modifications to total earnings, considering non-monetary expenditures like depreciation and amortization, and tracking alterations in operational capital. One must also consider capital expenditures, which reflect a firm's investment in long-term assets, and financing activities, which encompass transactions relating to debt and equity.

For example, Monday.com demonstrates efficiency in expansion, having rapidly achieved positive free cash flow. Their approach highlights the importance of careful management of monetary movement, especially when growth slows down. By optimizing the movement of funds, a company ensures a more resilient financial position, capable of reinvesting in growth, extending its financial runway, and maximizing shareholder value. This approach emphasizes that not all revenue is the same; instead, the capacity to generate unrestricted funds is crucial.

Similarly, the detailed analysis of a hotel's profit and loss (P&L) statements reveals the critical relationship between income and expenses. This understanding enables hoteliers to strategize effectively by delving beyond top-line figures to uncover valuable bottom-line insights.

Recent updates emphasize the crucial importance of reporting on financial liquidity for investors. Top-notch reporting, encompassing strong stream statements, is essential for investors to assess a company's future net streams, monetary responsibilities, and the possibility for returns. It's also crucial for comprehending the requirement for external funding and the influence of different transactions on a company's fiscal position. Auditors are reminded to give appropriate attention to the statements related to the movement of funds, ensuring that these documents receive the same level of scrutiny as other financial statements.

The operating cash flow section, specifically, is intended to evaluate a company's ability to generate funds through its core business operations. This includes money collected from receivables, payments to suppliers, labor costs, taxes, and interest payments. Positive operating funds indicate the company's proficiency in generating sufficient money internally, whereas a negative stream may require additional sources of funding.

Basically, a skilled CFO must navigate these money movement sections to guarantee the organization's economic health. By utilizing statements related to the movement of funds, one can obtain a comprehensive outlook on a company's economic well-being and make informed choices that promote sustainable expansion and profitability.

Analyzing and Interpreting Cash Flow Forecasts

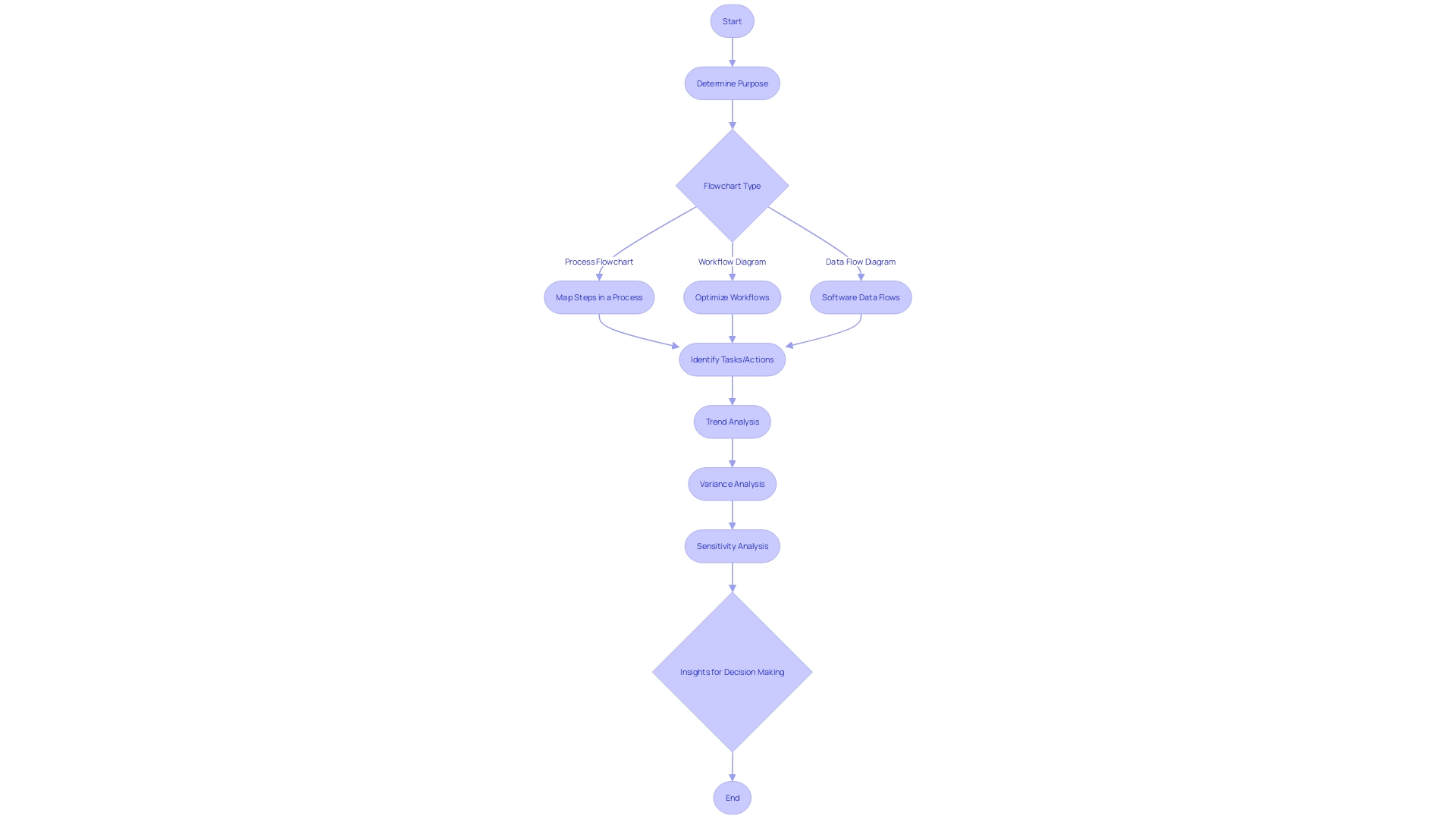

Examining financial projections is not only about analyzing figures; it is a strategic activity that necessitates comprehending both the monetary and operational facets of a company. Methods like trend analysis can reveal the path of inflows and outflows, highlighting areas of growth or concern. Variance analysis, on the other hand, pits actual results against forecasted figures, exposing discrepancies that may signal a need for corrective action.

Moreover, sensitivity analysis provides a glimpse into possible future scenarios, enabling CFOs to examine how variations in market conditions, such as alterations in customer preferences or technological advancements, could affect the movement of funds. By simulating different situations, businesses can create robust strategies that accommodate the dynamic nature of markets.

Armed with these analytical tools, CFOs can interpret the intricacies of cash flow data, transforming raw figures into actionable insights. Such insights could guide decisions on optimizing sales paths, enhancing customer experience, or even adjusting investment allocations to ensure a robust economic position.

In today's fast-paced business environment, where data analytics is transforming industries, it is crucial to stay informed and agile. As fiscal stewards, CFOs must utilize these techniques to guide their organizations towards sustainable growth and resilience, adapting to the ever-evolving economic landscape.

Common Pitfalls to Avoid in Cash Flow Forecasting

Developing accurate financial projections necessitates thorough deliberation of various essential elements to prevent typical errors. One frequent oversight is the failure to meticulously review all financial statements, including the cash flow statement, income statement, and balance sheet. These documents are crucial as they unveil a company's revenue, expenses, profitability, and debt levels. Dr. Sharon H. Porter stresses the significance of being well acquainted with these figures for the ongoing achievement of any organization.

Additionally, it's essential to have a strategic plan for the allocation of funds. This includes making informed decisions about investments that will yield a return and developing a robust system for tracking and measuring accounts payable and receivable monthly.

When it comes to forecasting, distinguishing between forecasting and budgeting is crucial. Forecasting is a predictive tool based on historical and current business performance, while budgeting sets targets for a specific timeframe. A forecast can inform and adjust the budget as needed, but it requires a clear purpose, a defined time period, and a methodical approach to budget forecast methods.

Despite the detailed historical data, understanding revenue streams is paramount. Breaking down revenue into distinct streams, such as product sales, services, or subscriptions, provides a comprehensive perspective on income sources. This, in turn, enables more accurate trend identification and income predictions.

Moreover, financial forecasts are only as reliable as the data and methods used. A report on monetary flow prediction activities outlines the essential elements of money flow analysis and the tools available to track an entity's monetary inflows and outflows. It promotes continuous development of cash forecast reports for various goals, emphasizing the importance of software and intelligence tools, particularly in the public sector.

It's also important to recognize that while growth models can be powerful tools for understanding operations and resource allocation, they are often underutilized. The conversion of equations related to commerce into analytical forms, such as spreadsheets, can result in revelations that are not immediately apparent, emphasizing the effect of modifications in commerce metrics, such as a 10% enhancement in activation rate. However, for complex models like marketplaces, one model may not suffice, and oversimplification can lead to inaccurate outputs, as stated by an industry expert familiar with the challenges of marketplace models.

Ultimately, efficient management of financial resources is crucial for the growth and profitability of an enterprise. It’s a balancing act that involves understanding statements, smart planning, and careful forecasting. According to an authority, money is the vital force of any enterprise, and ensuring a positive cash movement is crucial for evading monetary hazards and enhancing achievement.

The Role of Automation in Enhancing Cash Flow Forecast Accuracy

The transformative power of automation in cash flow forecasting is exemplified by the journey of John Dee, a meat processing company that faced the all-too-common challenge of a manual operation system unable to keep pace with growth and complexity. Soeren Schauki, Business Development Manager at Dematic, described their approach which began with a thorough analysis of the company's current and future needs. This led to a customized design that addressed unique challenges such as the unpredictability of meat processing outputs, and the implementation of an automated solution that increased accuracy and efficiency in tracking products from production to dispatch.

Embracing automation, like John Dee, means acknowledging the limitations of manual processes which often result in inefficiencies such as double or triple handling of products, and a lack of real-time data. Actually, based on a recent research, approximately 40% of CFOs question the precision of their monetary information, which highlights the importance of systems that can offer instant insights to assist in prompt decision-making, particularly considering that 78% of leaders are concerned about the start of another worldwide economic crisis.

The role of automation in financial operations is not to be underestimated, with 80% of such operations ripe for automation according to Accenture. Implementing Robotic Process Automation (RPA) can leverage software bots to perform tasks ranging from data entry to transaction processing, enhancing overall productivity. This is additionally reinforced by the discoveries that 42% of small and medium-sized enterprises (SMEs) still depend on manual management of their financial resources, which puts them at a considerable drawback, considering that 60% of enterprises report continuous difficulties with managing their financial resources.

Selecting the right automation tools is crucial and requires a strategic approach that aligns with business goals. As pointed out by Shagun, an ex-auditor and CEO of System, the integration of AI and machine learning in finance automation can be a game-changer, enabling the shift from tactical budgeting and reporting to a strategic, operational, and cross-functional role for CFOs.

In conclusion, adopting automation tools and technologies is not just about keeping up with the times; it is about ensuring that an organization can thrive amid fluctuating market demands and maintaining a competitive edge. Based on the knowledge gained from companies like John Dee and input from industry professionals, the future of predicting and controlling the movement of funds relies on the strategic utilization of automated technology that can adjust to current and upcoming obstacles.

Best Practices for Refining and Updating Cash Flow Models

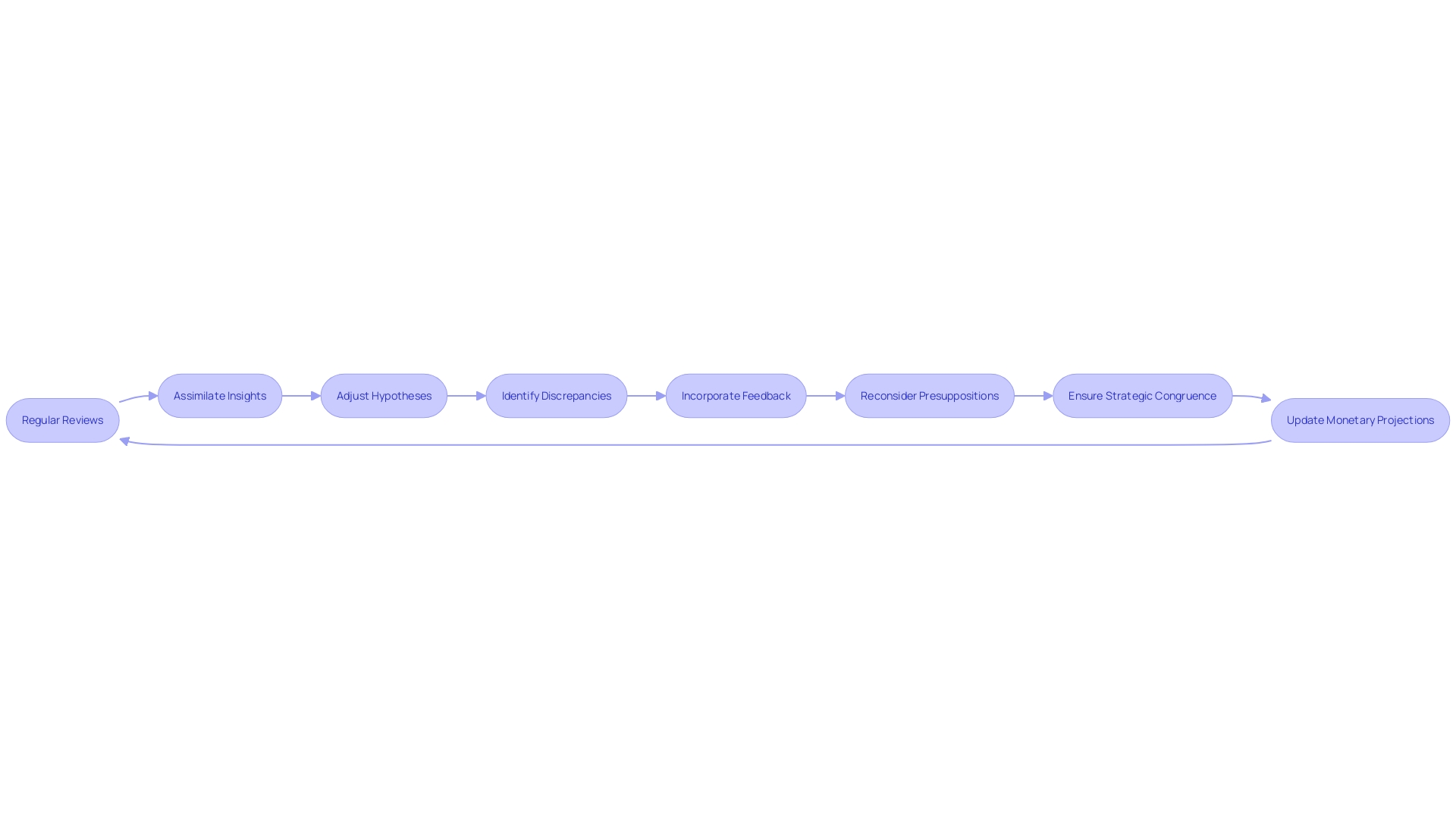

To preserve accuracy in modeling the movement of funds, CFOs must embrace a dynamic approach to updating their monetary projections. This involves a diligent process of regular reviews, assimilating insights from cross-functional leadership, and adjusting hypotheses in response to evolving economic landscapes. By taking this action, CFOs guarantee that their monetary stream models are strong and indicative of the company's financial path.

Periodic reviews are critical, as they enable the identification of discrepancies between projected and actual figures, allowing for timely corrections. These evaluations should cover a comprehensive analysis of monetary records—including the money movement report, income statement, and balance sheet—to understand a complete overview of the company's fiscal health and performance. Dr. Sharon H. Porter emphasizes the importance of being intimately familiar with these numbers for the sustained success of any enterprise.

In addition to internal reviews, incorporating feedback from diverse stakeholders is paramount. This collaborative approach not only enriches the model with varied perspectives but also fosters alignment with the organization's overarching monetary strategy. For example, performance reporting and management play a pivotal role in capturing the essence of past trends and guiding future plans. Regularly providing budget versus actual reports and operational review reports can highlight variances and prompt strategic adjustments.

Furthermore, the presuppositions supporting the monetary movement models must be reconsidered and improved as market conditions change. Clarity and transparency in these assumptions are non-negotiable, as they underlie the model's integrity and facilitate informed decision-making. This is not just a practice for internal clarity but also for ensuring stakeholders can follow the logic and evaluate the model's soundness.

Finally, conformity with the general monetary strategies of the organization ensures that monetary movement patterns back up long-term goals while accommodating short-term operational requirements. This strategic congruence is vital for the models to be actionable and for them to truly aid in steering the organization towards its monetary targets.

In essence, by embracing these best practices, CFOs can wield cash flow modeling as a potent tool for financial foresight and strategic planning, ultimately driving the company towards stability and growth.

Conclusion

In conclusion, mastering cash flow forecasting is crucial for businesses to navigate financial ebbs and flows with precision. It aligns day-to-day operations with financial sustainability, especially for small businesses with low overheads and high profitability. Recent events have highlighted the importance of maintaining liquidity and understanding cash movements during promotions or seasonal changes.

To construct a robust cash flow forecast model, key components such as sales forecasts, accounts receivable and payable, inventory management, capital expenditures, and debt payments must be considered. Data collection and assumptions play a crucial role in generating reliable cash flow forecasts.

Calculating cash flows from operating, investing, and financing activities provides insights into a company's financial health and helps optimize cash flow management. Analyzing and interpreting cash flow forecasts involve techniques such as trend analysis, variance analysis, and sensitivity analysis.

To avoid common pitfalls in cash flow forecasting, CFOs must meticulously review financial statements, have a strategic plan for fund allocation, and understand revenue streams. Automation plays a significant role in enhancing cash flow forecast accuracy, providing real-time insights for quick decision-making.

Best practices for refining and updating cash flow models include regular reviews, assimilation of insights from cross-functional leadership, adjustment of hypotheses, incorporation of stakeholder feedback, and revisiting and refining assumptions. Aligning cash flow models with overall financial strategies ensures their actionability and supports long-term objectives.

By understanding and implementing these practices, CFOs can enhance financial foresight and guide their organizations towards value maximization. Cash flow forecasting is a practical tool that improves a company's financial health and operational efficiency.