Introduction

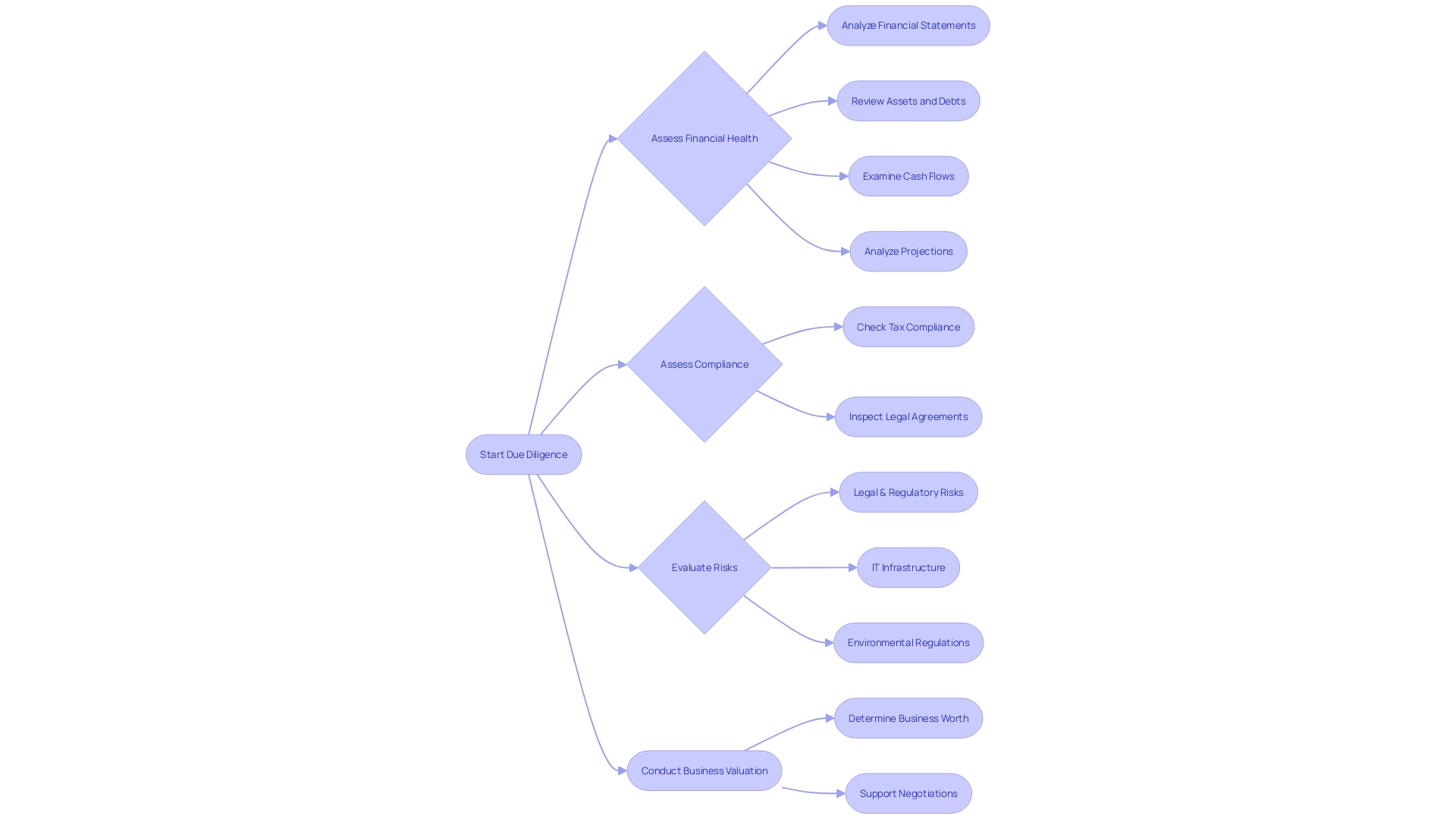

Understanding the full spectrum of due diligence is essential for any significant transaction or investment. It goes beyond just crunching numbers; it involves comprehensive analysis across various sectors of the target company. Financial due diligence should extend beyond balance sheets to include a granular look at all financial statements, cash flows, and financial projections.

This article will cover key components of due diligence services, best practices in conducting due diligence, the importance of financial due diligence, legal due diligence, operational due diligence, human rights due diligence, third-party due diligence, common challenges in due diligence, and case studies of successful due diligence in various industries. Stay tuned to learn everything you need to know about conducting effective due diligence.

Understanding the Importance of Due Diligence

Understanding the full spectrum of due diligence is essential for any significant transaction or investment. It's more than just crunching numbers; it's about in-depth analysis across various sectors of the target company. Financial due diligence should extend beyond balance sheets to include a granular look at all financial statements, cash flows, and financial projections.

As important is an examination of compliance with tax laws and any potential legal liabilities arising from partnerships or licensing agreements.

Assessing the corporate IT infrastructure and ensuring adherence to environmental and other regulations is also key. For those in specialized industries, looking into matters of legal and regulatory risk is particularly crucial. One example highlighted the importance of understanding project structure—an options-based market demanded a careful review to see if the code was original or a modified fork.

Interestingly, one of the more profound oversights during the sale of a business is neglecting its proper valuation. Without a thorough and accurate understanding of a business's true worth, there's a significant risk of undervaluing the business or scaring away potential buyers with inflated numbers. It's recommended to engage a business appraiser or valuation professional.

They offer an objective analysis of the financial health, customer base, and industry trends to ascertain the fair market value and underpin robust negotiations.

Key Components of Due Diligence Services

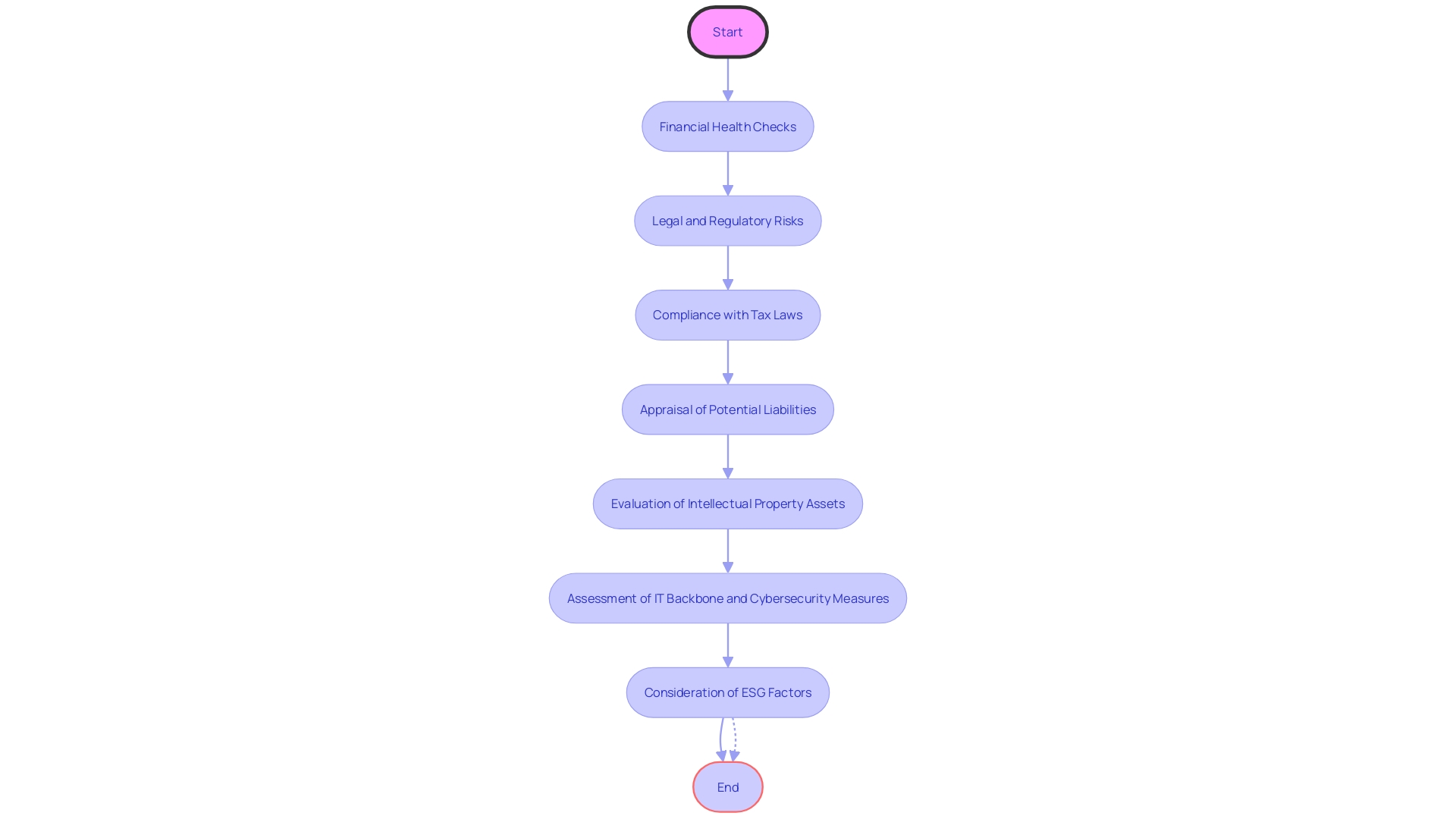

One might like due diligence to the multi-lensed scrutiny a jeweler applies when inspecting a diamond. In the investment landscape, such comprehensive examination is crucial, traversing beyond mere fiscal analyses to encompass multiple facets of the target company. The assessment incorporates vigorous financial health checks, examining the entirety of financial statements, assets, liabilities, cash flow trajectories, and fiscal projections.

Understanding the intricate web of legal and regulatory risks becomes indispensable, particularly as regulations tighten across industries. Equally paramount is the thorough review of compliance with tax laws, scrutinizing every speck from returns to audits and various agreements. Legal due diligence extends to appraising potential liabilities—partnerships, licensing covenants are sifted through with a fine-tooth comb.

Furthermore, any investment venture must rigorously evaluate intellectual property assets such as patents, copyrights, trademarks, and overarching brands. An evaluation of the company's IT backbone and cybersecurity measures is critical, a testament to the modern age's demand for robust digital fortifications. Not to be overlooked is the cornerstone of ESG (Environmental, Social, Governance) factors—human rights—which necessitate a dedicated line of inquiry, recognizing their indivisibility from issues like climate change and their deep-rooted significance in comprehensive investment due diligence.

Best Practices in Conducting Due Diligence

To excel in due diligence services, practitioners must implement a multifaceted strategy that encompasses a robust examination of the target entity's entire ecosystem. Developing a detailed due diligence plan is a bedrock principle for exposing potential risks, with a particular focus on areas beyond mere financials. A rigorous analysis of the company's financial statements, assets, liabilities, cash flows, and financial projections is foundational.

Yet equal attention must be directed towards legal and regulatory compliance, which is essential in heavily-regulated industries. The due diligence process must ensure the company's adherence to tax laws through meticulous review of tax returns, audits, and related agreements.

A multidisciplinary team of experts should be assembled, bringing together cross-functional insights that probe the depths of the company's legal liabilities, including partnerships and licensing agreements, as well as the health and defensibility of intellectual property assets such as patents, copyrights, and trademarks. The evaluation of IT infrastructure and cybersecurity measures is key, as technological integrity is vital in today's digital landscape. Efficiency is improved by employing advanced technology tools, and checklists and templates are indispensable for guaranteeing that nothing is overlooked, thereby ensuring thoroughness and consistency across the due diligence process.

Moreover, confidentiality maintains the integrity of the investigation. It is paramount that due diligence be recognized not merely as a financial audit but as a comprehensive and critical investigation addressing all facets of a business.

Financial Due Diligence: A Comprehensive Guide

Conducting financial due diligence is a multifaceted investigation that delves into a company's various dimensions, far surpassing a routine financial audit. This intensive process scrutinizes every facet of the company's operations, from financial robustness—assessing not only the financial statements but also the intricacies of assets, debts, cash flows, and forward projections—to legal and regulatory compliance. Especially in industries burdened by heavy regulations, evaluating a company's adherence to rules is crucial, necessitating a thorough review of tax returns, audits, and legal contracts such as partnerships and licensing agreements to identify all associated risks and liabilities.

A comprehensive due diligence even entails understanding the originality of the firm's technical documentation or codebase, particularly when analyzing tech-centric businesses or innovative startups. As evidenced in prior research explorations, even without the depth of hundreds of hours of analysis, such assessments can provide valuable insight, pinpointing potential red flags or questions for future in-depth investigation. For entrepreneurs navigating a business sale, neglecting this level of thorough valuation is a perilous oversight that potentially undervalues their enterprise or deters prospective buyers with inflated figures.

Enlisting the expertise of a valuation professional who can dissect your financials and market trends ensures a justified and substantial valuation for both parties engaged in the transaction.

Legal Due Diligence: Ensuring Compliance and Risk Mitigation

During the scrutiny of a company's legal framework in mergers and acquisitions, due diligence extends beyond mere contractual review. Trademarks, for instance, serve as critical identifiers for goods or services in the commercial sphere. Such intellectual property assets, which could range from distinctive bottle shapes like Coca-Cola's to the Apple logo, must be rigorously evaluated for proper registration and protection.

Contracts anchor the legal fortifications of a business deal. They encapsulate the agreed terms, providing an authoritative basis for enforcement by law if a party fails to comply. It's worth noting that copyright, which secures the rights to original creative works, operates differently than trademarks but is equally vital to ensure exclusive reproduction and dissemination rights.

Both trademarks and copyrights could be registered with corresponding governmental offices, such as the USPTO for trademarks, adding significant legal heft in disputes.

An expert's perspective ascertains that trademarks, their registration status notwithstanding, are pivotal in symbolizing a business's market presence. Moreover, a contract, robust in its drafting, offers the primary legal safeguard. In high-stakes sectors where missteps could lead to extensive harm or loss, evidence of compliance with stringent regulations is indispensable.

Meticulous examination of these legal instruments is quintessential in preempting potential impediments that could pose risks or liability in the transactional process.

Operational Due Diligence: Evaluating Business Processes

Comprehensive due diligence extends beyond simple financial scrutiny; it's an in-depth review of all facets of a potential investment, critical in mitigating unforeseen hazards and ensuring a smooth integration. This thorough vetting process includes analyzing financial stability through statements, assets, liabilities, and future projections. It delves into legal compliance, studying tax returns and existing audits, which is paramount in highly regulated sectors.

Furthermore, the assessment encompasses a review of legal risks and an audit of legal agreements that could imply latent liabilities.

A cornerstone in due diligence is the assessment of intellectual property, safeguarding the value intrinsic to patents and trademarks. Analyzing the company's IT backbone and cybersecurity measures is just as vital to prevent data breaches that could derail a merger or acquisition. These evaluations should be as meticulous as the code reviews conducted by quality assurance engineers to ensure flawless integration, akin to software that passes all tests and delights customers—resulting in a lucrative success.

In the current economic landscape where customer satisfaction has witnessed a significant downturn, impacted by inflation and supply chain challenges, diligence in operational due diligence has never been more essential. KPIs, user profitability, and customer-based risks are scrutinized, ensuring that investments are grounded in sustainable and validated business practices. Failing to execute this due diligence can jeopardize business mergers or acquisitions, leaving companies struggling rather than thriving.

Human Rights Due Diligence: Ethical Considerations

Conducting human rights due diligence is not just about ticking a box; it's integral to the ‘social’ pillar of ESG, where companies must align with both global human rights standards and potentially more stringent regional or national laws. This comprehensive assessment examines a company’s adherence to the rights of workers and marginalized groups, ensuring diverse and inclusive workplaces, and evaluating ethical operations. Recently, the impending Corporate Sustainability Due Diligence Directive, agreed upon on 14 December 2023, magnifies the importance of such evaluations.

Forging ahead to March 2024, this legislation will mandate businesses operating within the EU market to undertake rigorous human rights and environmental due diligence, signaling a transformational shift toward corporate accountability on a global scale.

Through adherence to internationally recognized human rights standards, companies demonstrate their commitment to respecting the indivisible interplay between social, environmental, and governance issues. The United Nations Guiding Principles (UNGPs) on Business and Human Rights establish a global framework for protecting human rights, which investors use to navigate their responsibilities. Proper due diligence bolsters a company's reputation, underpins its social license to operate, and aligns with investors' expectations, all while contributing to the prevention of human rights violations that might be exacerbated by environmental changes, such as climate impacts.

The intersection of environmental consequences and human rights is particularly telling: for instance, climate change is not only an environmental threat but also poses significant challenges to human rights, impacting the livelihoods and well-being of individuals worldwide. As such, the due diligence process is a crucial step in recognizing and mitigating these intertwined risks, promoting sustainable and ethical business conduct.

Third-Party Due Diligence: Guidelines and Best Practices

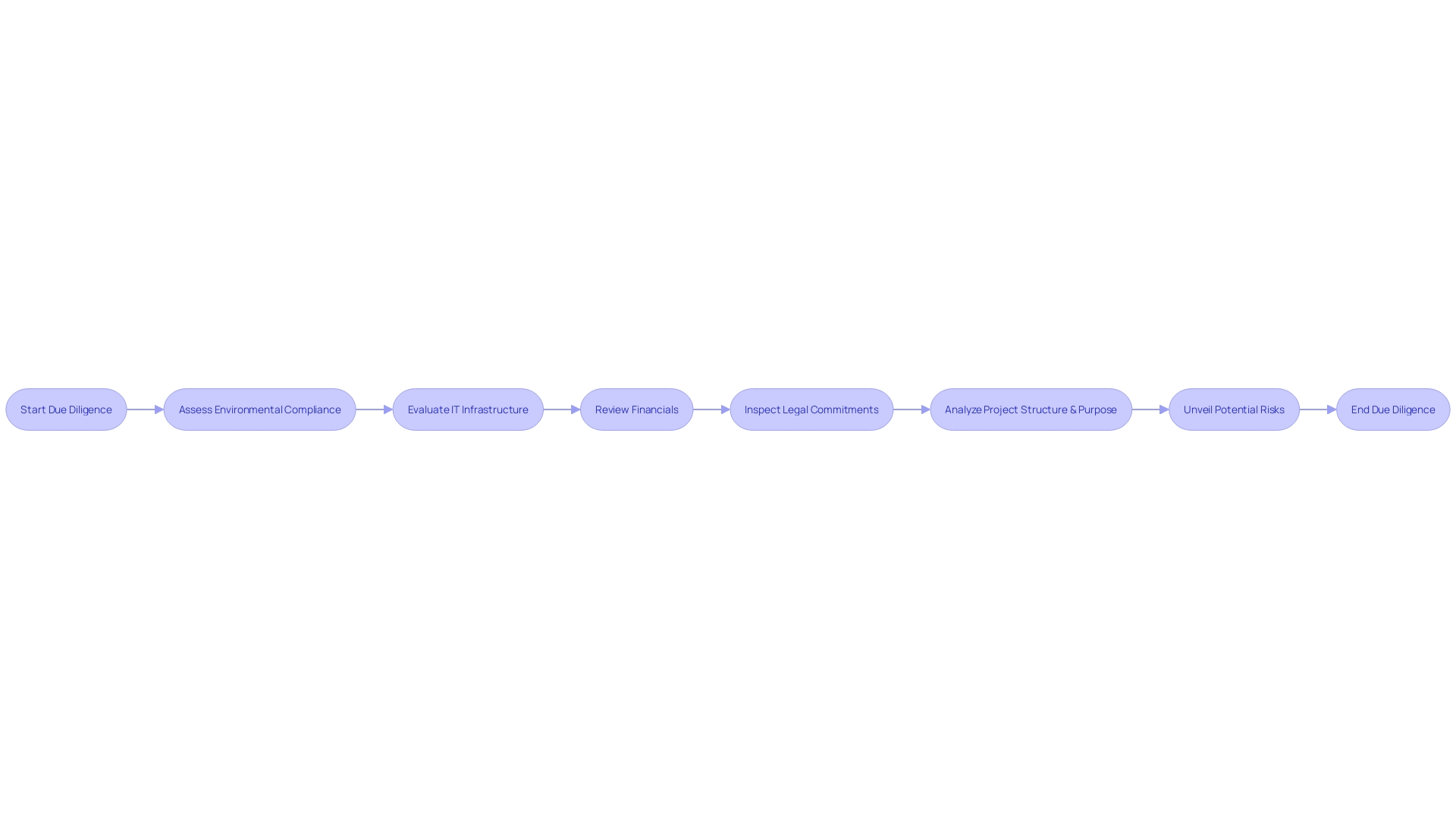

When vetting third-party entities like suppliers or partners, comprehensive due diligence is imperative. It's an investigative necessity that entails delving into environmental compliance, IT systems integrity, and other operational facets, essentially beyond a mere financial audit. A thorough inspection of financial statements, debts, and projections should form the core of your risk management strategy, revealing potential financial vulnerabilities of these third parties.

Similarly, legal and regulatory compliance checks are critical, especially in tightly controlled sectors. Assessing the adherence to tax laws through the examination of tax returns, past audits, and related agreements is also vital to uncover hidden contingencies. Additionally, evaluating legal liabilities connected to existing partnerships and licensing agreements can safeguard against unforeseen entanglements.

As underscored in a quality of earnings (QoE) analysis, an in-depth review of revenue sources confirms their sustainability and mitigates risks associated with customer concentration. Examining a business's KPIs, user profitability, potential seasonality effects, and customer risks also contributes to a 360-degree view of third-party robustness. This multifaceted assessment approach is foundational to ensuring that third-party collaborations resonate with your organization's standards and expectations.

Common Challenges in Due Diligence and How to Overcome Them

Undertaking due diligence is a comprehensive process that involves more than scrutinizing financial records; it's an investigative journey into the many facets of a company's operations. This includes assessing compliance with environmental and tax laws, evaluating IT infrastructure, and understanding legal liabilities, such as licensing agreements and partnerships. It's a multi-layered approach where each element, from financial health -- examining financial statements, assets, and cash flows -- to legal and regulatory risks -- particularly vital for industries under tight scrutiny -- is meticulously analyzed.

Addressing such a wide spectrum of challenges requires rigorous preparation. The Data Prep phase plays a pivotal role, during which advisors like GrowthPoint collaborate with companies to craft meticulous financial materials, models, and customer data analyses, strategically positioning them ahead of potential investor or acquirer questions. Creating transparent communication channels, employing experts in specialized fields, performing in-depth research, and remaining adaptable are all crucial components to navigate these hurdles.

It's essential not to underestimate the valuation piece; a thorough and precise valuation underpins the entire process. Business owners should resist the temptation to rely on gut feelings or arbitrary figures, as these can lead to under or overvaluations. Bringing in a valuation professional is advised to ensure fair market value assessment, informed by financials, customer base, and industry dynamics.

Case Studies: Successful Due Diligence in Various Industries

To grasp the essence of due diligence, it's crucial to understand that it encompasses far more than financial scrutiny. True due diligence delves deep into every aspect of a business, from ensuring compliance with environmental laws to a meticulous assessment of the IT infrastructure. It’s an exhaustive investigation designed to unveil potential risks.

A detailed inspection includes a thorough review of the financials such as assets, debts, and cash flow projections, alongside an evaluation of any legal or regulatory risks which are particularly significant in highly-regulated sectors. Moreover, a keen assessment ensures that a company's tax affairs are in order, looking closely at tax returns, audits, and related agreements, as well as scrutinizing its legal commitments, including existing partnerships and licensing arrangements.

When we look at the example of an options-based market project, due diligence involves analyzing the project’s structure, understanding the originality of the code, and pinpointing its purpose. In the broader context, such as with California's utilities and their relationship to wildfire risks, only a select few companies may pose a significant threat. However, the potential parallels and differences in such case studies to sectors like AI labs can provide key insights into managing and mitigating risks.

Collecting and examining such comprehensive data sets can be a formidable task, but the right report can streamline this process, serving as a one-click resource that amalgamates both publicly available information and private deals, saving significant time and energy for stakeholders involved.

Conclusion

In conclusion, conducting effective due diligence is crucial for any significant transaction or investment. It goes beyond simply crunching numbers; it involves comprehensive analysis across various sectors of the target company. Financial due diligence should not be limited to balance sheets but should also include a detailed examination of all financial statements, cash flows, and financial projections.

It is equally important to assess compliance with tax laws and potential legal liabilities arising from partnerships or licensing agreements.

Successful due diligence requires a multifaceted approach, encompassing financial, legal, operational, and human rights considerations. A thorough evaluation of the company's financial health, legal compliance, intellectual property assets, IT infrastructure, and cybersecurity measures is essential in mitigating risks and ensuring a smooth integration. Additionally, evaluating the company's adherence to human rights standards is becoming increasingly important, aligning with global and regional laws.

To overcome the challenges of due diligence, meticulous preparation is key. Creating transparent communication channels, employing experts in specialized fields, performing in-depth research, and remaining adaptable are crucial for navigating the complexities of the process. It is also important to prioritize accurate valuation, engaging a valuation professional to ensure a fair market assessment based on financials, customer base, and industry trends.

Ultimately, conducting thorough due diligence is vital for making informed decisions and mitigating risks in any transaction or investment. By following best practices and considering all relevant factors, CFOs can ensure that their due diligence process is comprehensive, strategic, and ultimately leads to successful outcomes.