Introduction

In the intricate landscape of corporate finance, the role of a controller within a Limited Liability Company (LLC) is pivotal. Beyond merely overseeing accounting functions, controllers are the architects of financial statements that form the backbone of a company's fiscal narrative.

Their expertise ensures the integrity of financial reporting, which is the lifeblood of strategic decision-making and compliance adherence. With a keen eye on the company's financial health, a controller's acumen in generating accurate financial reports is not just a function—it's a strategic cornerstone that shapes the organization's journey.

For those poised to advance in their financial careers, the mastery of such skills is critical. The journey from controller to CFO demands an in-depth understanding of financial intricacies, encompassing a broader spectrum of competencies.

This transition involves a shift from fundamental financial skills to a comprehensive grasp of strategic financial planning, sophisticated risk management, and incisive financial analysis. A solid educational foundation, often signified by a bachelor's degree in finance or a related field, is complemented by advanced qualifications such as a Chartered Financial Analyst (CFA) certification, which can be a significant lever in propelling one's career trajectory. Moreover, the role of a financial analyst in a small business setting cannot be understated. They are the sentinels who safeguard financial health and identify growth opportunities, analyzing data to shape business strategies and forecast financial trends. In this way, financial controllers and analysts alike are instrumental in the financial stewardship that steers a company towards success.

Key Skills and Qualifications for a Financial Controller

In the intricate landscape of corporate finance, the role of a controller within a Limited Liability Company (LLC) is pivotal. Beyond merely overseeing accounting functions, controllers are the architects of financial statements that form the backbone of a company's fiscal narrative.

Their expertise ensures the integrity of financial reporting, which is the lifeblood of strategic decision-making and compliance adherence. With a keen eye on the company's financial health, a controller's acumen in generating accurate financial reports is not just a function—it's a strategic cornerstone that shapes the organization's journey.

For those poised to advance in their financial careers, the mastery of such skills is critical. The journey from controller to CFO demands an in-depth understanding of financial intricacies, encompassing a broader spectrum of competencies.

This transition involves a shift from fundamental financial skills to a comprehensive grasp of strategic financial planning, sophisticated risk management, and incisive financial analysis. A solid educational foundation, often signified by a bachelor's degree in finance or a related field, is complemented by advanced qualifications such as a Chartered Financial Analyst (CFA) certification, which can be a significant lever in propelling one's career trajectory. Moreover, the role of a financial analyst in a small business setting cannot be understated. They are the sentinels who safeguard financial health and identify growth opportunities, analyzing data to shape business strategies and forecast financial trends. In this way, financial controllers and analysts alike are instrumental in the financial stewardship that steers a company towards success.

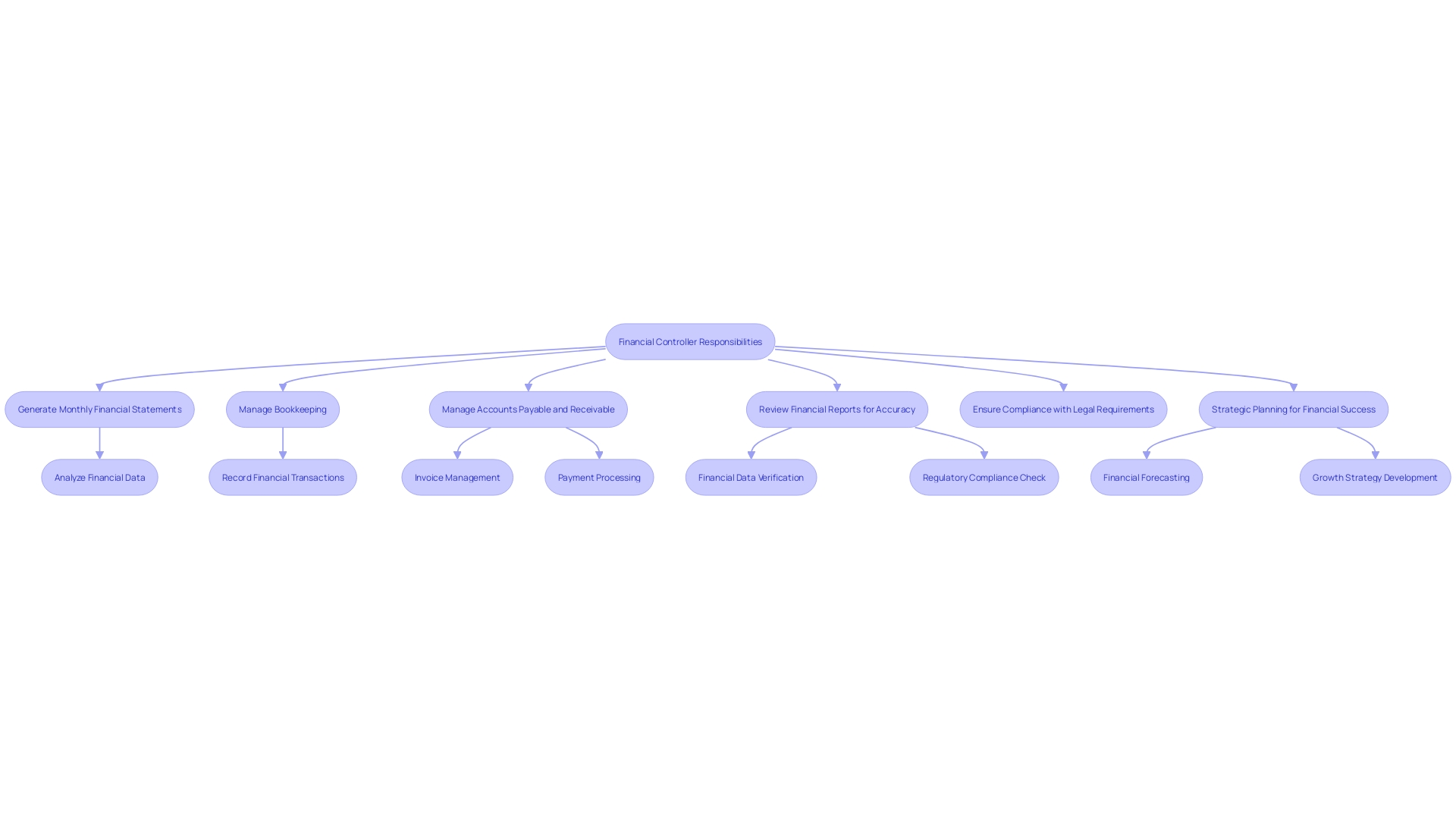

Financial Controller Checklist: Essential Tasks and Duties

For financial controllers in small businesses or Llcs, the scope of responsibilities is comprehensive, encompassing a broad spectrum of financial activities. A controller is the financial sentinel, ensuring that every transaction is accounted for and that the company's financial narrative is both accurate and compliant with legal standards.

On a daily basis, a controller's tasks include the generation of monthly financial statements, which are the bedrock of sound financial reporting and strategic planning. These reports not only reflect the company's fiscal health but also guide future business decisions.

Bookkeeping, while often seen as mere data entry, is in fact a critical function that feeds into the controller's work. A bookkeeper meticulously records all financial transactions, manages both accounts payable and receivable, and is responsible for the preparation of financial reports that the controller will review for accuracy and compliance.

This role is the foundation upon which a controller builds a robust financial strategy. Qualifications for these roles are significant; most small businesses seek bookkeepers with at least a bachelor's degree in accounting or finance. This educational background ensures that they have the necessary skills to manage the intricate details of financial transactions and reporting. For those considering a career in bookkeeping or controlling, or for small businesses looking to hire, recognizing the depth and importance of these roles is crucial for the financial success and growth of the company.

Financial Planning and Analysis: A Critical Component of Financial Control

A financial analyst is pivotal in steering a company's fiscal wellness and strategic foresight. This role requires a nuanced grasp of financial data and market trends to equip decision-makers with insights that address financial challenges and unlock investment potential. At the heart of this role lies the meticulous analysis of financial statements and economic indicators to gauge profitability, liquidity, and solvency.

Furthermore, financial analysts are tasked with forecasting future financial performance, a critical function that shapes a company's strategic direction. Key responsibilities of a financial analyst include:

- Scrutinizing balance sheets, income statements, and cash flow statements. - Identifying market trends and economic conditions to inform business decisions.

- Forecasting financial performance to guide strategic planning. To excel, candidates need a solid educational foundation, technical prowess, and specific personal attributes. They are the architects of a company's financial roadmap, setting goals, and evaluating net worth to provide a clear financial trajectory.

As the BFSI sector grows and embraces Big Data, financial analysts become ever more crucial. Their ability to manage vast amounts of data in real time enhances decision-making, risk management, and customer experience, particularly in North America, where the adoption of Business Intelligence tools and technological advancements lead the way. This strategic role is more than crunching numbers; it's about transforming data into actionable financial strategies.

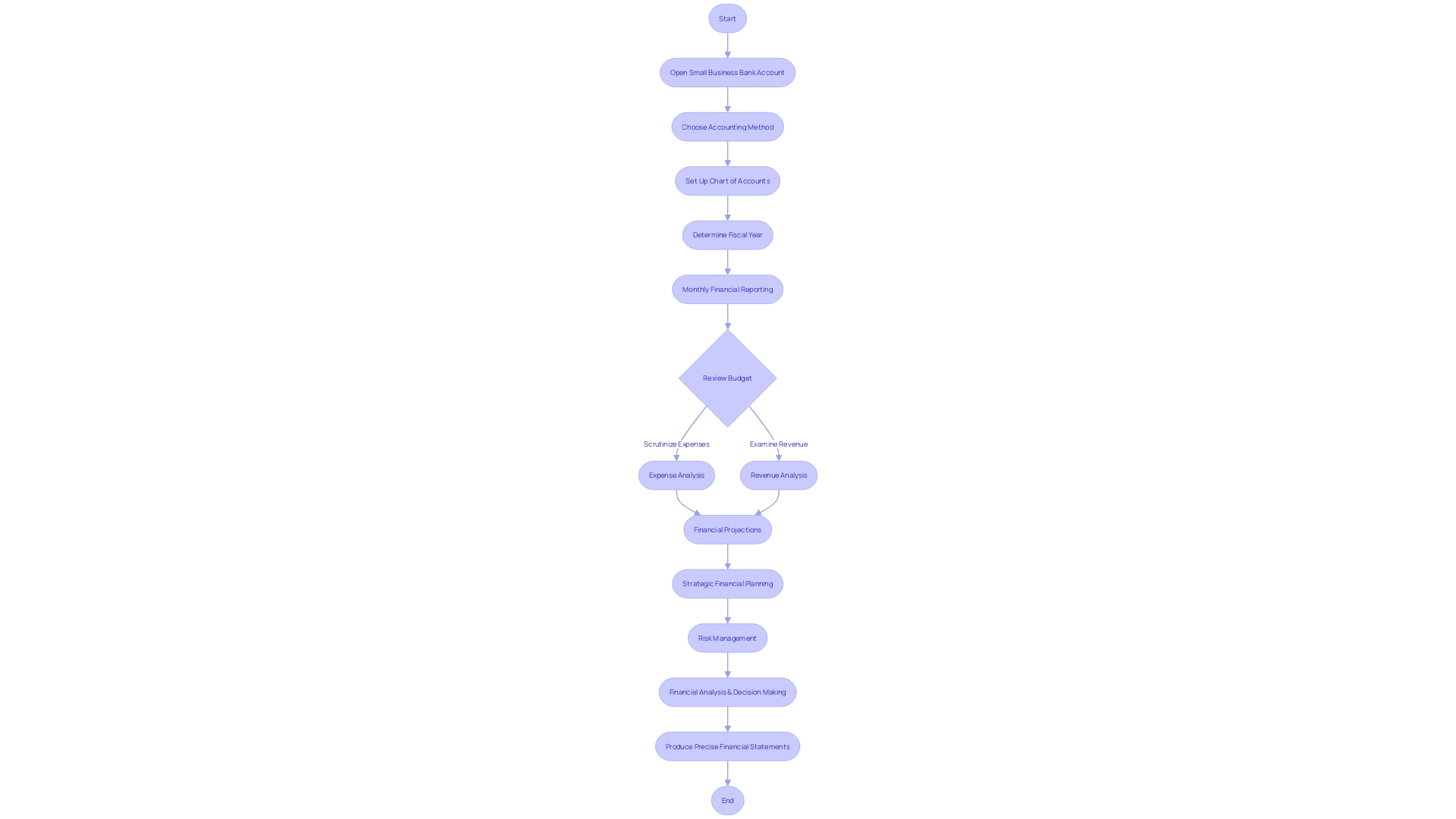

Budgeting and Forecasting: Effective Strategies for Financial Controllers

As a financial controller within an LLC, your expertise in accounting functions is the bedrock of the company's financial health. It's your responsibility to produce precise monthly financial statements, uphold the integrity of financial reporting, and steer the financial direction of the business.

To elevate your role and potentially transition to a CFO position, it's imperative to refine your financial acumen beyond the basics. This entails an in-depth comprehension of financial reporting, strategic planning, risk management, and financial analysis.

Begin by reevaluating every aspect of your company's spending, aligning it with both present and future objectives. Rather than hastily slashing costs, engage in a comprehensive review of the budget, scrutinizing all expenses and revenue sources. This meticulous approach to budgeting and forecasting not only ensures accurate financial projections but also equips you to make strategic decisions that can influence your organization's trajectory.

Financial Reporting and Compliance: Ensuring Accuracy and Transparency

Accuracy and transparency in financial reporting are not just best practices; they are the bedrock of stakeholder trust and regulatory compliance. As gatekeepers of financial integrity, financial controllers are tasked with the meticulous preparation of financial reports that include a balance sheet, income statement, and a cash flow statement, which is a vital component that tracks the liquidity and operational efficiency of the organization.

This statement is a critical indicator of whether a company is sustaining its operations through earned revenues or dependent on external funding, shedding light on the strategic management of cash resources. Moreover, the statement of changes in equity, or the statement of retained earnings, provides a transparent account of the fluctuations in shareholder equity, offering insights into decisions affecting shareholder value.

Delving into the budget financial report, it is a strategic roadmap projecting income and cash flows, setting financial benchmarks for a future period. It's a dynamic tool that allows for real-time financial assessment and operational adjustments by juxtaposing projected figures with actual financial outcomes. Upholding the principles of international financial reporting standards and generally accepted accounting principles is non-negotiable, ensuring every figure in these reports stands up to scrutiny. Embrace these reports as more than just regulatory obligations; they are a narrative of your company's fiscal health and operational success, crucial for informed decision-making and strategic financial planning.

Risk Management and Internal Controls: Mitigating Financial Risks

Effective risk management is a critical aspect of financial control, encompassing both the identification and mitigation of potential threats that could adversely impact the organization's fiscal health. To navigate these challenges, it is essential to understand the two primary components of risk management: risk assessment and risk mitigation.

Initially, the focus is on pinpointing potential risks that could stem from upcoming financial decisions or changes in the market, global events, or shifts in personal circumstances. Following the identification of such risks, a strategic plan must be formulated to determine the extent of risk acceptance, avoidance, or transfer, and to implement measures to mitigate their impact.

The landscape of financial risks includes a spectrum of types: operational, credit, market, liquidity, legal, and foreign exchange risks. Each type presents unique challenges and requires tailored strategies to manage.

For instance, operational risk pertains to unexpected events in daily operations that may affect the company's financial outcomes. By comprehensively understanding these risks and employing best practices in financial instruments, portfolio management, budgeting, allocation, and asset management, an organization can enhance its financial decision-making capabilities. Diversification is a key tenet of risk management, advocating for an investment portfolio that is spread across different asset classes, sectors, and geographies to balance potential losses with gains. This approach to diversification, where investments are allocated among various asset classes like stocks, bonds, real estate, and commodities, offers a robust defense against the volatility of the financial markets and contributes to the stability and growth of the organization.

Leadership and Communication: Effective Collaboration with Stakeholders

To ascend to the CFO position, a financial controller must not only possess financial acumen but also master the art of leadership and communication. It's critical to articulate the 'why' behind financial fundamentals, transforming complex data into compelling narratives that resonate with various stakeholders.

For instance, Nets, a digital payment solutions provider, faced the challenge of making technical data accessible. They succeeded by reimagining dense tables and schemes into engaging formats that encouraged user exploration.

As Edita Baranauskaitė from STATICUS emphasizes, individualizing the journey to enhance financial understanding across teams is key. This approach not only fosters better financial guidance but also supports the organization's strategic trajectory. Drawing from various sources, including The CEO Magazine and The Economist, which highlight the significance of clear, high-level communication, financial controllers can present options succinctly to maintain stakeholder interest and confidence. In summary, effective leadership in finance entails clear communication, strategic insight, and the ability to make the complex simple.

Career Path and Professional Development for Financial Controllers

As a financial controller, your expertise in generating monthly financial statements and ensuring accurate financial reports is pivotal for maintaining the financial health of your organization. Controllers are instrumental in shaping the financial strategy and compliance, especially within an LLC where these responsibilities are paramount.

To progress towards a CFO role, it's essential to deepen your financial knowledge beyond the basics. This entails a comprehensive grasp of financial reporting, strategic planning, risk management, and financial analysis.

Edita Baranauskaitė of STATICUS emphasizes the importance of explaining the 'why' behind finance fundamentals. By increasing financial literacy among non-financial teams and translating complex financial data into accessible language, you become not just a controller of numbers, but a strategic partner in your company's growth. Remember, guiding your organization's financial trajectory is a journey that requires individualized approaches and a commitment to continuous learning and leadership.

Best Practices and Industry Trends in Financial Control

In the dynamic landscape of financial control, the role of a financial controller within an LLC is pivotal. Tasked with overseeing accounting functions, controllers are the stewards of monthly financial statements, accurate reporting, and the overall financial vitality of the business.

As the financial terrain has been reshaped by events such as the COVID pandemic, geopolitical conflicts, and the advent of AI, the need for controllers to adapt and lead with innovative strategies has never been more pressing. The 2020s have witnessed a BFSI sector rapidly expanding through digitization, with Big Data technologies at the forefront of transforming decision-making and operational efficiency.

In this era, North America, particularly the U.S., leads in financial analytics, propelled by advanced BI tools and regulatory compliance. However, the challenge remains in dismantling the data silos that plague many organizations—outdated information, duplications, and errors that not only escalate IT costs but also hinder compliance with critical regulations like KYC and AML. A Data Governance Framework is essential for eradicating these silos, ensuring a unified and accurate customer data view. As we prepare for an in-depth discussion in our forthcoming eBook and webinar, it's clear that the financial controller's role is more than just managing numbers; it's about guiding the company through the complexities of today's global economic landscape.

Conclusion

Financial controllers in LLCs play a pivotal role in shaping the organization's financial journey. Their expertise ensures accurate financial reporting, compliance adherence, and strategic decision-making.

To advance in their careers and potentially transition to a CFO position, controllers need a comprehensive understanding of strategic financial planning, risk management, and financial analysis. Controllers generate precise monthly statements and engage in comprehensive budgeting to align expenses with objectives.

Accuracy and transparency in financial reporting are essential for stakeholder trust and compliance. Effective risk management involves identifying potential threats and implementing measures to mitigate their impact.

Leadership and communication skills are critical for collaborating with stakeholders. Continuous learning and professional development are necessary to deepen knowledge and adapt to industry trends. Controllers must navigate challenges like the COVID pandemic and digitization with innovative strategies. In summary, financial controllers' technical expertise, strategic thinking, effective communication, and continuous learning make them valued partners in driving their organization's success in today's complex economic landscape.