Introduction

Financial planning and analysis are essential components of effective decision-making for CFOs. To ensure accurate projections and sound financial strategies, CFOs must master the art of pro forma balance sheet analysis. This process involves understanding the nuances of financial statements, gathering historical data, projecting future financial performance, adjusting for non-recurring items, and finalizing the pro forma balance sheet.

However, pitfalls and challenges in spreadsheet analysis, stakeholder influence, and evolving regulatory standards must be navigated carefully. In this article, we will explore the best practices of pro forma balance sheet analysis and how it can empower CFOs to make informed and successful financial decisions.

Step 1: Understanding Pro Forma Financial Statements

Pro forma financial statements are projected metrics that allow analysts and investors to gauge a company's future fiscal health by reviewing its expected financial activities. This forward-looking tool is vital for balance sheet analysis as it paints a scenario of the company's potential to generate positive cash flows, meet obligations, and sustain dividend payments, especially in the light of observed inconsistencies in the reporting of cash flow statements. Deloitte's recent examination of auditing practices underscores the urgency in treating the cash flow statement with the same diligence as other financial documents to maintain investor confidence.

Moreover, instances like SAP's legal settlement over bribery remind CFOs of the crucial need for transparency and regulatory compliance in financial reporting.

Reflecting on historical cases, such as the one involving Wells Fargo, illuminates the threat of strategic misrepresentations aimed at attracting favorable market perception while hiding internal deficiencies. These unethical practices not only distort market competition but also introduce systemic risks, highlighting the importance of rigorous financial scrutiny, which includes the adept use of pro forma statements.

To ensure a robust financial framework, it's necessary to engage with the basic accounting equation (Assets = Equity + Liabilities) and appreciate its implications on balance sheet stability. Such an equation implies that fluctuations in asset value are reciprocated on the liabilities side, and vice versa. A deep understanding of this relationship is further essential to interpret the intricate tapestry of financial reporting, where cash flow statements, income statements, and balance sheets converge to narrate a company's economic saga.

Step 2: Gathering Historical Financial Data

Accurate financial data collection and analysis are crucial for making educated decisions in the financial market. Stocks, after transitioning from private to public status through an IPO, grant investors a chance to participate as shareholders. Bonds, reflecting debt securities, offer a different investment route as a form of lending to corporations or governments.

To edge past the competition, businesses utilize web scraping to gather comprehensive financial statements and bond market strategies, while drawing insights from key economic indicators like GDP growth rates and unemployment figures.

Understanding the components of a time series—level, noise, trend, and seasonality—enhances the clarity and utility of data, which can be plagued by common pitfalls such as bid/ask bounce, where recorded prices oscillate between bid and ask prices.

Advancements in data analytics have revolutionized risk management and customer knowledge, leading to more nuanced investment strategies and operational advancements. The pivotal task is transforming raw data into strategic financial insights.

Therefore, machinating an efficient approach to collecting and handling data is of paramount importance. It ensures we're not led astray by inaccuracies or application errors that can happen due to bid/ask bounce or other data misinterpretations. Financial professionals leverage historical data and real-time analysis to identify and mitigate potential risks, ensuring that financial statements remain comparable and actionable, aligning with the latest advancements and maintaining a global standard of transparency.

Step 3: Projecting Future Financial Performance

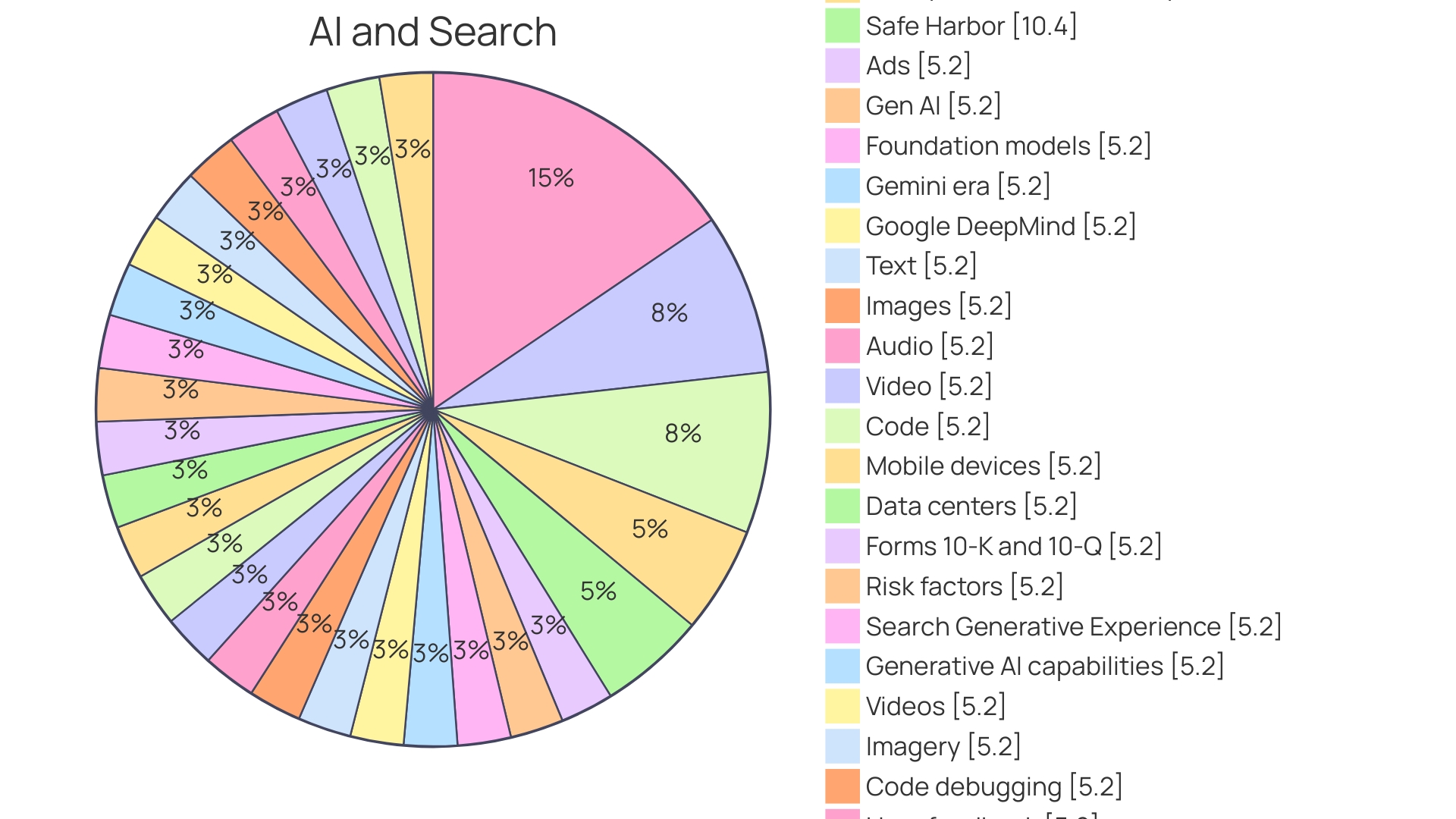

When constructing a framework to project the financial performance of companies, it is essential for CFOs to apply meticulous techniques that offer insight into future solvency and profitability. For instance, in examining Alphabet’s trajectory, a financial analyst would note that although 57% of its revenues are derived from Google Search, its market dominance is solid with a 91.62% share. This sort of focused analysis is pivotal, yet one must remember that historical data, while informative, does not guarantee future performance.

Accurate forecasting necessitates the intersection of technical and fundamental analysis. Technical analysis, often used in stock market predictions, extrapolates from past trends, while fundamental analysis incorporates broader economic indicators. Fu and Bai’s research exemplifies innovation in this realm by leveraging social media metrics, macroeconomic data, and search engine patterns to predict market volatility.

Vanguard’s Capital Markets Model underscores the dynamic relationship between systematic risk and asset class returns, employing Monte Carlo simulations to produce forecasts. Similarly, Schwab’s digital tools enable strategic screening based on a comprehensive suite of criteria. Both methods espouse a reliance on meticulous data analysis over sole historical trends, thereby providing a robust basis for financial decision-making and planning.

Step 4: Adjusting for Non-Recurring Items

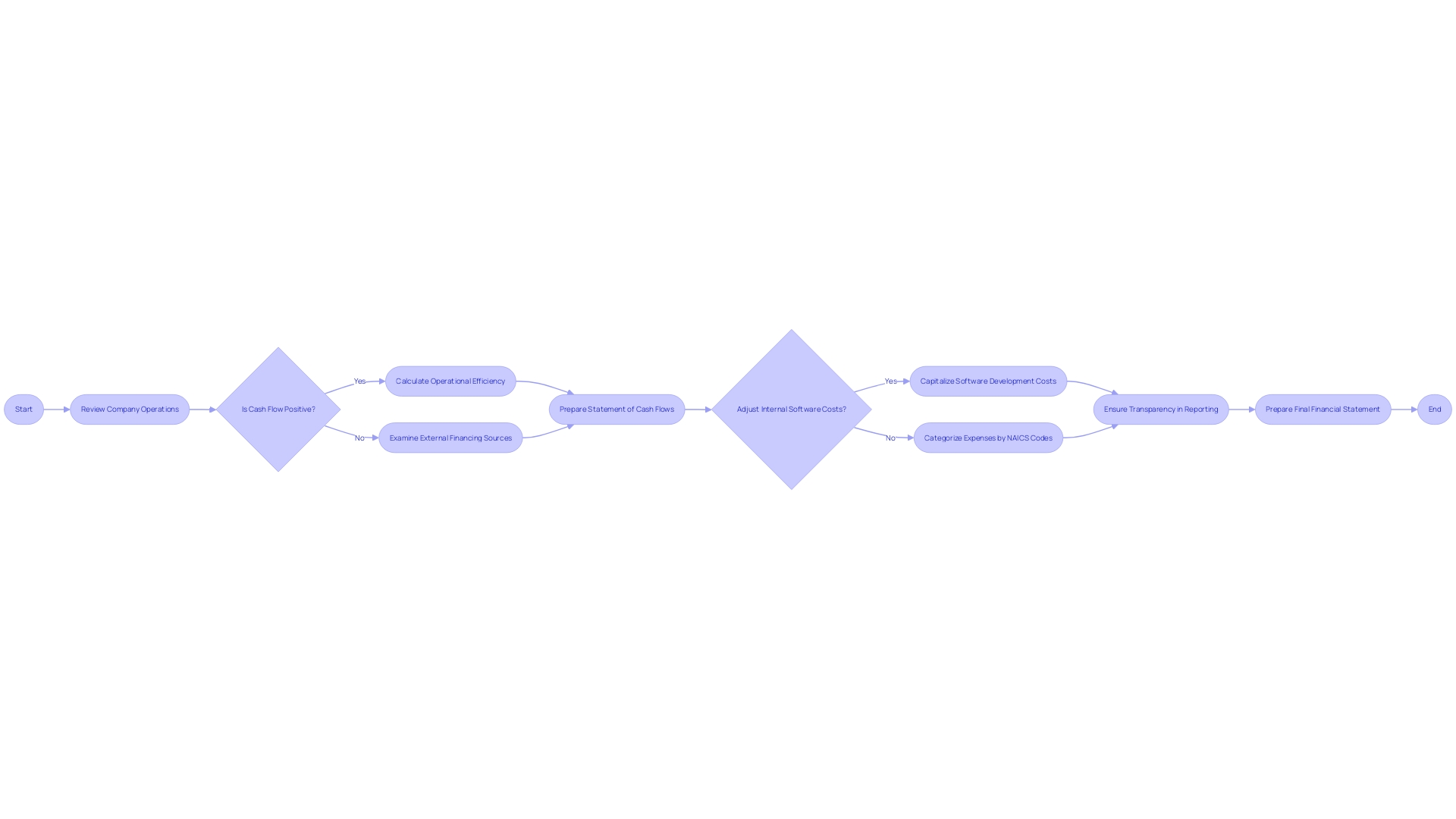

The essence of a well-constructed balance sheet is to accurately reflect a company's financial position. Specific items, such as internal software development costs, should be scrutinized for their eligibility to be capitalized as intangible assets. These are costs that must generate future economic benefits to warrant capitalization, and failing to apply this principle correctly can distort financial realities.

Precise categorization is also essential for the integrity of financial reporting, as evidenced by the use of North American Industry Classification System (NAICS) codes, which ensure comparable capital equipment and labor costs among similar establishments.

Recent developments from the Financial Accounting Standards Board underscore the importance of transparency in expense reporting, particularly in relation to software costs. Their proposal aims at updating long-standing rules by introducing a mandatory line item in cash-flow statements, covering cash spending on software, enhancing clarity for stakeholders regarding capitalization versus expensing of software-related costs. This approach echoes the growing complexity of software investments and its impact on businesses across sectors.

An accurate balance sheet provides a reliable snapshot of assets, liabilities, and shareholder equity, serving as a vital tool for business owners, investors, and lenders assessing creditworthiness and company performance. With the inclusion of every transaction since inception, it is the financial statement that encapsulates the consequences of all economic activities, necessitating the proper distinction of any non-recurring items that could potentially skew an otherwise accurate representation of a company's financial health. Regular amendments to data series by authoritative bodies such as the Board of Governors of the Federal Reserve System further illustrate the dynamic nature of financial reporting and the constant need for vigilance to prevent distortions.

Step 5: Finalizing the Pro Forma Balance Sheet

Constructing a pro forma balance sheet involves weaving together the intricate threads of predicted financial outcomes to present a forward-looking picture of a company's financial footing. This projection often encompasses the detailed tally of assets and the balanced ledger of liabilities and shareholders' equity, at a future point in time. For example, consider Producers Title, LLC that, post-acquisition, leveraged cutting-edge software from Qualia to revolutionize an outmoded home closing process.

Implementing such technology has surely required detailed capital allocation and its effect has to be anticipated in their pro forma balance sheets going forward.

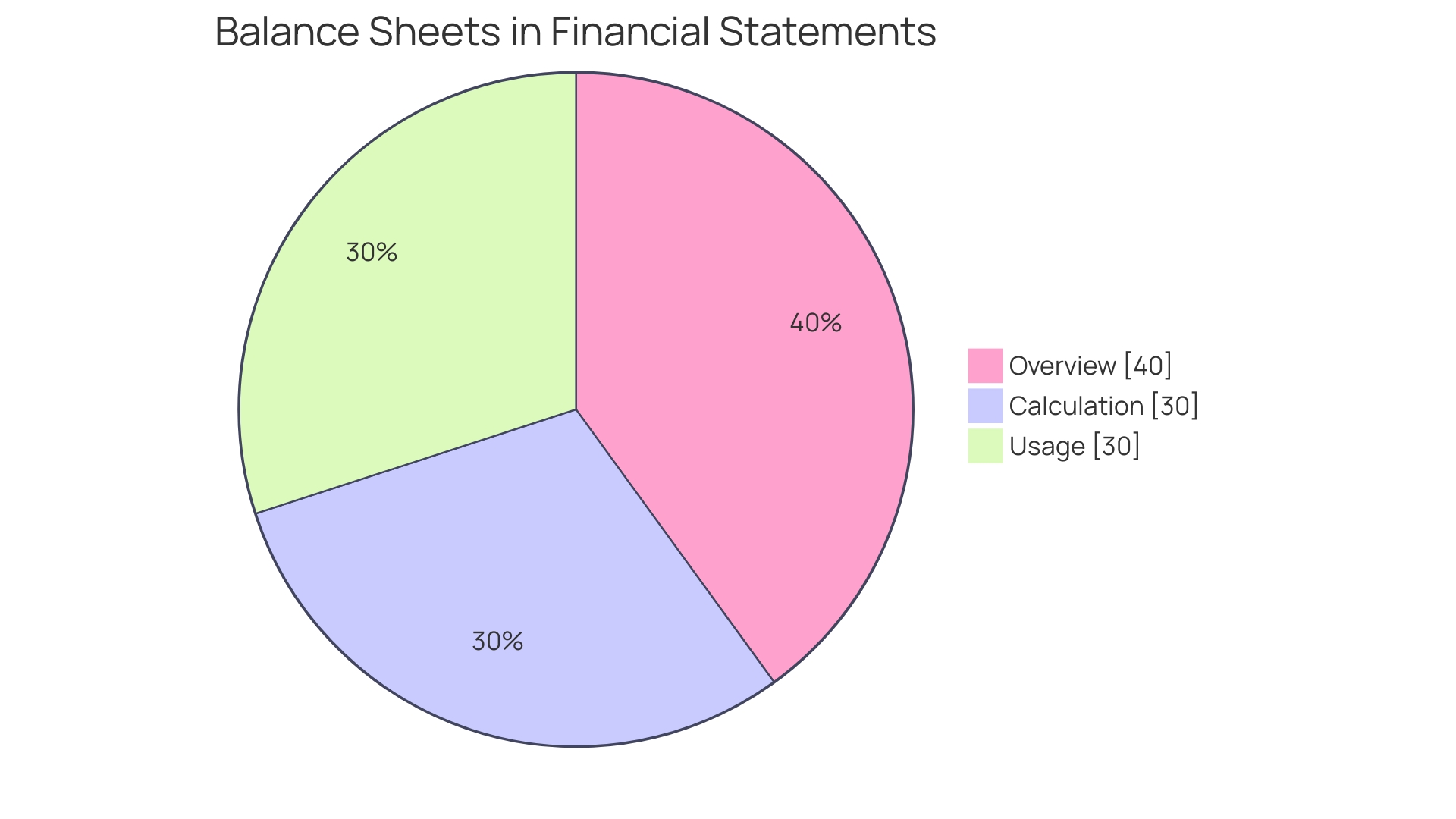

To begin with, the essentials of a balance sheet must be properly understood. It's not just a summary of what a company has and owes, but a dynamic reflection of its financial health at a given moment, factoring in every asset against every liability and equity held by shareholders. Circumspect and prudent, it gives a bird's-eye view of a company’s fiscal robustness.

Given the renewed focus on compliance and transparency in financial practices, as seen in the FASB's recent proposal to refine software cost reporting, the importance of robust and accurate balance sheet projections cannot be overstated.

The Producers Title's case exemplifies proactive financial maneuvering to enhance operational efficiency, safeguard against threats like wire fraud, and ultimately solidify the balance sheet position. Aligning with market trends and regulatory shifts, it's crucial for companies to stay vigilant in cash flow reporting quality, as emphasized in recent SEC rules, ensuring that statements reflect true investor value.

Marrying historical data with expected cash flow trends, capital expenditure, and software innovation costs—such as those arising from the implementation of comprehensive enterprise resource planning systems—these projections are indicative of whether an organization is successfully capitalizing on opportunities and managing risks. Drawing from the stark insight that 3 out of 5 title professionals have countered wire fraud attempts, investments in security systems like Qualia Shield manifest as crucial strategic line items.

The pro forma balance sheet culmination is not merely for compliance; it’s a tool for CFOs to discern the company’s trajectory. As the financial regulators sharpen their focus on the delicate nuances of software investment categorizations, these meticulous projections assume an even greater role in guiding strategic decisions that tie back to the overarching aim of value maximization. It's the unwavering narrative within the numbers that bear testament to a business’s performance and sustainability.

Common Pitfalls in Pro Forma Analysis

Conducting a pro forma balance sheet analysis requires meticulous attention to detail, strategic foresight, and an awareness of potential pitfalls. Common errors in spreadsheet analysis can have significant repercussions, as studies highlight that 90% of spreadsheets with more than 150 rows contain errors. This is particularly concerning when considering that most users, despite the high cognitive load akin to a doctor's diagnosis, jump headfirst into creating complex spreadsheets without sufficient testing or validation.

One must be vigilant regarding the rights and influences of third parties and stakeholders. Frequently overlooked, significant stakeholders such as joint venture partners, employees with purchase options, and founders hold crucial roles that can affect the analysis outcome. Furthermore, in the context of today's digitized environment, spreadsheets can become the dark matter of corporate IT, cloaking unknown hazards related to errors, privacy breaches, trade secrets, and compliance transgressions.

The operating-investing-financing classification system under new standards, such as IFRS 18, necessitates income and expense categorization that offers a clearer picture of a company's financial activities. This reflects an evolving landscape where transparency and refined reporting mechanisms are pivotal for robust financial analysis. Additionally, as regulators work to enhance public company disclosures based on market events and investor demands, CFOs must remain abreast of changes in accounting standards that could affect the interpretation of pro forma financial statements, as elucidated by authoritative voices within the Commission.

With so much at stake, scrupulous review and strategic approaches to valuing equity instruments, understanding computational uncertainties, and evaluating residual interest become essential. The cautionary tales of spreadsheet errors serve as a reminder that effective pro forma balance sheet analysis transcends mere number-crunching—it demands a comprehensive understanding of the bigger financial picture and the interconnectedness of various stakeholders.

Best Practices for Pro Forma Balance Sheet Analysis

- Understanding the Composition of a Balance Sheet

Mastering the intricacies of a balance sheet is a fundamental aspect of small business accounting—especially for construction companies. The composition of the balance sheet, which includes assets, liabilities, and equity, sheds light on the financial wellbeing of a company as of a specific date. This contrasts with expenses that pertain to the income statement and represent the outward cash flows within a fiscal period.

- Assets, Liabilities, and Equity Explained

Assets symbolize the resources a business owns, while liabilities are the debts or financial obligations it needs to address. Equity represents the remaining value of the company's assets after accounting for liabilities.

- Real-world Insight into Balance Sheet Application

Take the case of Jane, who owns a thriving construction business. Her understanding of what comprises a balance sheet versus immediate expenses has shaped the financial stability and growth of her enterprise.

- Importance of Pro Forma Balance Sheet Analysis

A pro forma balance sheet analysis is not just a routine task; it forms the backbone of astute financial planning and management. It serves as a gauge for future financial health, allowing businesses to strategize and project outcomes in intricate details.

- Recent Regulatory Developments

The SEC's final rules concerning definitions of "dealer" underscore the importance of clarity and adherence to financial reporting standards, reflecting how critical accurate balance sheet analysis is in ensuring compliance and informing business decisions.

Conclusion

In conclusion, mastering pro forma balance sheet analysis is crucial for CFOs to make informed financial decisions. Understanding balance sheet composition and gathering accurate historical financial data allow CFOs to gain insights and identify risks. Forecasting future financial performance requires a combination of technical and fundamental analysis.

Adjusting for non-recurring items and finalizing the pro forma balance sheet are important for accurate financial reporting and strategic decision-making. CFOs should be aware of common pitfalls in pro forma analysis, like spreadsheet errors and stakeholder influence. Staying informed about accounting standards is vital for compliance and transparency.

By following best practices and conducting thorough pro forma balance sheet analysis, CFOs can empower themselves to make successful financial decisions. This analysis supports strategic planning, risk management, and compliance for the financial health and sustainability of the company.