Overview

Stakeholder management training activities are crucial for CFOs, as they enable the identification, analysis, and engagement of key individuals or groups that significantly influence organizational performance, ultimately affecting financial outcomes. Effective stakeholder management not only leads to improved project completion rates but also fosters trust and transparency. Consequently, this alignment allows CFOs to synchronize their financial objectives with stakeholder interests, enhancing overall business success.

Moreover, consider the implications of neglecting this critical aspect. Without proper training, CFOs may struggle to engage effectively with stakeholders, resulting in missed opportunities and potential financial setbacks. Therefore, investing in stakeholder management training is not merely beneficial but essential for achieving long-term financial stability and growth.

In conclusion, CFOs must recognize the value of stakeholder management training as a strategic investment. By prioritizing this training, they can ensure that their financial goals are met while simultaneously building stronger relationships with stakeholders. Take action today to enhance your stakeholder engagement strategies and secure a prosperous future for your organization.

Introduction

In the dynamic realm of corporate finance, stakeholder management has become a critical focus for CFOs striving for organizational success. Stakeholders—including investors, employees, and clients—exert considerable influence over financial outcomes. Therefore, understanding and engaging these groups effectively is not just advantageous; it is imperative. Research indicates that companies excelling in stakeholder engagement are significantly more likely to complete projects on time and within budget, highlighting the essential nature of this practice.

However, challenges such as conflicting interests and communication breakdowns present formidable obstacles. Thus, CFOs must navigate these complexities with strategic acumen. As the financial landscape increasingly shifts towards a data-driven paradigm, leveraging technology and fostering transparent communication will be vital in cultivating trust and ensuring sustainable growth.

This article explores the multifaceted strategies CFOs can implement to enhance stakeholder management, ultimately paving the way for improved business performance and resilience in an ever-evolving environment.

Understanding Stakeholder Management: A CFO's Perspective

[Stakeholder management training activities](https://blog.smbdistress.com/10-effective-strategies-to-improve-cash-flow-management) represent a crucial process that encompasses the identification, analysis, and engagement of individuals or groups with a vested interest in an organization’s performance. For CFOs, grasping this concept is vital, as stakeholders—including investors, employees, and clients—directly impact financial outcomes. Research reveals that companies excelling in engagement with these parties are 40% more likely to complete projects on time and within budget, underscoring the significance of this practice.

Moreover, it is noteworthy that half of cease operations within a mere three years, highlighting the risks associated with inadequate participant coordination. Effective stakeholder management training activities foster trust and transparency, essential components for informed financial decision-making. As the financial landscape evolves in 2025, financial executives must strategically align their financial objectives with the interests of involved parties by implementing stakeholder management training activities. This alignment facilitates sustainable long-term success while adeptly managing immediate pressures.

This process entails identifying underlying business challenges and formulating actionable plans to mitigate weaknesses, which is critical for enhancing overall performance. Metrics such as communication quality, task completion rates, and participant satisfaction become pivotal for assessing the return on investment (ROI) in engagement efforts. Furthermore, the increasing recognition of the need for streamlined decision-making and real-time analytics allows for continuous monitoring of business performance and relationship-building.

As highlighted in a recent PwC survey, 28% of finance departments are leveraging artificial intelligence in forecasting, reflecting a growing trend that underscores the necessity for financial leaders to adapt their management strategies to incorporate technological advancements for improved financial results. Additionally, a pragmatic approach to data, including hypothesis testing to measure investment returns, is essential for optimizing financial strategies. The case study titled 'Skills in Demand for Project Managers' illustrates the critical skills that project managers must cultivate, such as effective communication and strong leadership abilities, to motivate teams and adapt to evolving project requirements, ultimately leading to greater project success.

Identifying and Analyzing Key Stakeholders

Recognizing essential participants is a vital duty for chief financial officers, enhanced through stakeholder management training activities that involve acknowledging individuals or groups influencing or influenced by organizational decisions. To effectively categorize interested parties, financial officers should utilize mapping tools as part of stakeholder management training activities, assisting in distinguishing these individuals based on their levels of influence and interest. This analytical method allows financial executives to understand the needs and expectations of interested parties, thereby facilitating the implementation of targeted engagement strategies.

Regular evaluations of participant dynamics are crucial, enabling financial executives to proactively tackle issues and seize opportunities for stakeholder management training activities. A systematic approach to recognizing fundamental business challenges and formulating strategies to address weaknesses is essential for effective stakeholder management training activities with interested parties. In a landscape where 58% of financial executives are dedicating more time to technology investment and implementation, stakeholder management training activities have never been more crucial for driving organizational success.

Significantly, with merely 2% of global finance and technology leaders executing cyber resilience measures, financial executives must prioritize cybersecurity in their management strategies. Moreover, as FP&A transforms into , stakeholder management training activities become essential for improving participant involvement through cross-departmental collaboration. Continuous business performance monitoring through real-time analytics not only aids in operationalizing turnaround lessons but also strengthens relationship-building efforts.

Testing hypotheses is essential to deliver maximum return on invested capital, ensuring that strategies are both effective and efficient. Considering labor trends indicating that millennial and Gen Z employees prioritize financial stability, financial leaders should tailor their engagement strategies to address these concerns. As noted by Glenn Hopper, a leading authority in AI and former fractional CFO, 'You can’t do it in a vacuum.' This sentiment underscores the importance for financial leaders to actively participate in stakeholder management training activities, interacting with interested parties in a meaningful way and fostering a cooperative atmosphere that enhances overall business performance.

Effective Training Activities for Stakeholder Management

To enhance management capabilities, financial leaders must engage in diverse stakeholder management training activities. Role-playing scenarios serve as a dynamic tool, allowing financial executives to simulate real-world interactions with involved parties, thereby honing their communication and negotiation skills. Moreover, participant mapping workshops effectively visualize relationships and influence, enabling CFOs to strategize more proficiently.

Given that 91% of professionals in related to project management, implementing effective stakeholder management training activities for involved parties is essential in overcoming these obstacles. Incorporating case studies that illustrate successful participant engagement provides valuable insights into best practices. For instance, the case study titled 'Organisational Relevance and Change Alignment' emphasizes the importance of aligning training initiatives with employees' daily tasks. Additionally, feedback sessions foster continuous improvement and strategic refinement.

As Jayne Ruff, Occupational Psychologist & Managing Director at ChangingPoint, asserts, "To find out more about how ChangingPoint can help you align minds to transform your business, get in touch." These interactive techniques not only promote critical thinking but also equip financial leaders with practical skills essential for managing complex relationships, ultimately contributing to their organizations' success.

Best Practices for Engaging Stakeholders

To effectively manage relationships with interested parties, CFOs must prioritize stakeholder management training activities as a foundational practice. Actively seeking feedback and demonstrating empathy towards the concerns of involved parties significantly enhances trust and strengthens relationships through these training initiatives. Regular updates, tailored to the specific needs and expectations of stakeholders, are essential; this personalized communication approach has been shown to result in a 10% improvement in employee retention, particularly within the tech sector.

Moreover, adopting a data-driven approach allows CFOs to test hypotheses and make swift decisions based on real-time analytics, ensuring that interested parties are consistently informed of business health and performance metrics. It is crucial to avoid monitoring or punitive actions against employees, as these can erode trust and engagement. Embracing transparency fosters trust, leading to improved employee satisfaction and retention, as teams gain a clear understanding of their roles within the organization.

Furthermore, stakeholder management training activities that align participant involvement with overarching organizational goals not only meet expectations but also facilitate collaborative decision-making that benefits all parties involved. As Sara Armbruster, a notable CEO, aptly stated, 'If you are going to advocate and implement a high degree of transparency, you need to have systems in place to address any issues that arise.' This sentiment underscores the necessity of establishing robust frameworks that empower participants while upholding transparency, ensuring mutual benefits are recognized and cultivated.

The case study titled 'Creating ' highlights the importance of co-creating transparency initiatives with employees to ensure that the information shared is beneficial and that workers have agency over their data. Additionally, a thorough business assessment at the beginning of participant involvement is vital to align key individuals and comprehend the business context beyond mere figures. Ultimately, fostering a culture of responsible transparency, supported by continuous performance monitoring, operationalizing turnaround lessons, and a commitment to a shortened decision-making cycle, is pivotal for building trust and enhancing overall business outcomes.

Overcoming Challenges in Stakeholder Management

Chief financial officers navigate a complex landscape rife with challenges, including conflicting interests from various stakeholders, communication breakdowns, and constrained resources. As we approach the pivotal shift to electronic invoicing by September 2026, engaging with all involved parties becomes not just important but essential. This urgency is heightened by the administration's preference for Partner Dematerialization Platforms (PDP) over a free national state platform, signifying a substantial transformation in invoicing processes.

To foster an environment where concerns can be shared and addressed openly, financial leaders must prioritize active listening. The Directeur Financier aptly notes that the CFO, acting as the 'Chief Resilience Officer,' must anticipate external constraints such as fluctuations in raw material costs and supply chain disruptions. By instituting organized procedures for regular check-ins and leveraging through our client dashboard, financial leaders can employ to diminish misunderstandings and align the expectations of all parties involved.

Furthermore, the case study titled 'Cyber Resilience in the C-Suite' highlights the growing demand for enhanced cybersecurity measures, underscoring the necessity for financial executives to prioritize resilience in their communication and operations. Proactively addressing potential issues before they escalate not only fortifies positive relationships with stakeholders but also ensures organizational resilience and adaptability. This is facilitated by a commitment to operationalizing lessons learned throughout the turnaround process, adhering to the 'decide and execute' framework.

Leveraging Technology for Enhanced Stakeholder Management

In 2025, CFOs can significantly enhance by leveraging an array of technologies, including management software, data analytics platforms, and communication tools. These digital solutions empower finance leaders to centralize contributor information, streamline the tracking of interactions, and analyze contributor feedback with remarkable efficiency. Moreover, with our pragmatic approach, we emphasize testing hypotheses and utilizing real-time analytics through our client dashboard to continuously monitor business performance and drive successful turnaround strategies.

Automation tools play a critical role, enabling timely communication that ensures involved parties are consistently updated with vital information. Significantly, with 65% of financial leaders indicating growth as one of their top 3 priorities this year, adopting these technological advancements not only promotes greater operational efficiency but also enhances relationships with interested parties, resulting in more informed decision-making processes. Additionally, as CFOs navigate the implications of the Tax Cuts and Jobs Act (TCJA) set to expire at the end of 2025, incorporating these considerations into their engagement strategies becomes essential.

Furthermore, the case study on cyber resilience in the C-Suite emphasizes the growing need for improved cybersecurity measures, highlighting its importance to those involved in today's digital environment. As Jessica McClain, CFO of the Girl Scout Council of the Nation's Capital, insightfully notes, 'I think it’s really important to understand that there is no one way to solve this issue.' This highlights the necessity of adopting a multifaceted approach to interest group engagement, which includes stakeholder management training activities, ultimately driving organizational transformation while operationalizing lessons learned through continuous performance monitoring and employing a 'Test & Measure' strategy to ensure effective decision-making.

Measuring Success in Stakeholder Management Initiatives

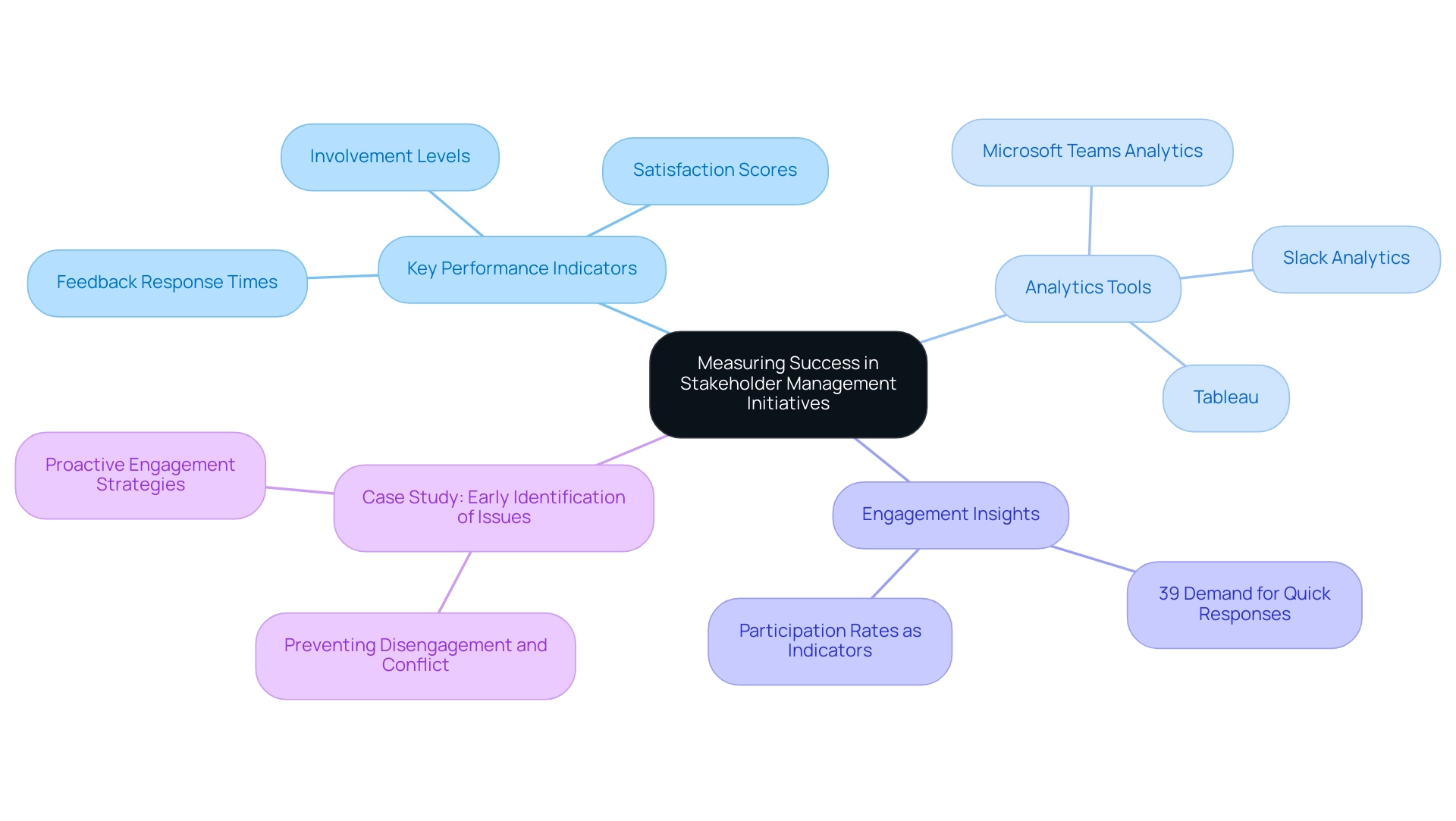

To effectively assess the success of management initiatives involving interested parties, financial executives must implement well-defined key performance indicators (KPIs) such as:

- Satisfaction scores

- Involvement levels

- Feedback response times

while incorporating . With 39% of social media users expressing a desire for prompt responses, the importance of timely feedback cannot be overstated. Regular surveys and performance evaluations provide valuable insights into perceptions and highlight areas ripe for improvement.

Moreover, by utilizing real-time analytics through interaction tools such as:

- Slack Analytics

- Microsoft Teams Analytics

- Tableau

along with a comprehensive client dashboard, financial executives can continuously monitor business health and participant involvement. This ongoing performance monitoring, coupled with a shortened decision-making cycle, enables them to refine strategies and maintain alignment with organizational objectives. For instance, as emphasized in the case study on early identification of problems, assessing participant involvement is crucial for identifying and addressing issues that could result in project failure.

Furthermore, metrics such as participation rates act as crucial indicators of interest from involved parties, enabling CFOs to proactively tackle signs of disengagement and enhance stakeholder management training activities within the team. As Dražen Vujović noted, 'Understanding the nuances of stakeholder engagement is essential for any CFO looking to drive success.' This proactive, data-driven approach ultimately ensures smoother project execution and improved success rates.

Conclusion

Stakeholder management stands as an indispensable pillar of corporate finance, wielding a profound impact on organizational success. As emphasized throughout this article, CFOs must prioritize the identification, analysis, and engagement of stakeholders to cultivate trust and transparency—elements that are critical for informed decision-making. By implementing robust strategies such as stakeholder mapping, continuous performance monitoring, and the utilization of technology, CFOs can effectively align financial objectives with stakeholder interests, thereby enhancing overall business performance.

The challenges inherent in stakeholder management, including conflicting interests and communication breakdowns, necessitate a proactive approach from CFOs. By emphasizing active listening and transparency, misunderstandings can be mitigated, fostering positive relationships. Furthermore, the integration of real-time analytics and automation tools not only streamlines communication but also ensures that stakeholders remain informed and engaged, ultimately driving organizational resilience.

In conclusion, the evolving landscape of corporate finance compels CFOs to embrace innovative strategies and technologies to enhance stakeholder management. By doing so, they can navigate complexities adeptly, ensure sustainable growth, and contribute to their organizations' long-term success. As stakeholder engagement continues to play a pivotal role in achieving business objectives, the commitment to nurturing meaningful relationships will undoubtedly yield significant benefits for all parties involved.

Frequently Asked Questions

What are stakeholder management training activities?

Stakeholder management training activities involve identifying, analyzing, and engaging individuals or groups who have a vested interest in an organization's performance, which is crucial for financial executives like CFOs.

Why is stakeholder engagement important for CFOs?

Engaging stakeholders such as investors, employees, and clients is vital for CFOs because these parties directly impact financial outcomes. Companies that excel in stakeholder engagement are 40% more likely to complete projects on time and within budget.

What risks are associated with inadequate participant coordination in project management?

Inadequate participant coordination can lead to the failure of Project Management Offices, with half ceasing operations within three years, highlighting the importance of effective stakeholder management.

How do stakeholder management training activities contribute to financial decision-making?

These activities foster trust and transparency, which are essential for informed financial decision-making, and help align financial objectives with the interests of stakeholders for sustainable long-term success.

What metrics are important for assessing the return on investment (ROI) in stakeholder engagement efforts?

Key metrics include communication quality, task completion rates, and participant satisfaction, which are crucial for evaluating the effectiveness of engagement strategies.

How is technology influencing stakeholder management in finance?

A growing trend shows that 28% of finance departments are using artificial intelligence in forecasting, emphasizing the need for financial leaders to adapt their management strategies to incorporate technological advancements.

What skills should project managers cultivate for effective stakeholder management?

Project managers should develop effective communication and strong leadership abilities to motivate teams and adapt to evolving project requirements, leading to greater project success.

What role does cybersecurity play in stakeholder management for financial executives?

Financial executives must prioritize cybersecurity in their management strategies, as only 2% of global finance and technology leaders are currently executing cyber resilience measures.

How can financial leaders enhance participant involvement through stakeholder management training?

By fostering cross-departmental collaboration and continuously monitoring business performance through real-time analytics, financial leaders can improve stakeholder engagement and strengthen relationships.

Why is it important for financial leaders to actively participate in stakeholder management training activities?

Active participation allows financial leaders to interact meaningfully with stakeholders, fostering a cooperative atmosphere that enhances overall business performance and addresses the concerns of employees, particularly younger generations.