Introduction

Financial stability is a top priority for CFOs, especially during times of uncertainty. One key tool in their arsenal is the 13-week cash flow forecast. This method of financial planning provides a comprehensive view of a company's cash position in the near term and allows for strategic decision-making to maintain liquidity and navigate through tight capital periods.

In this article, we will explore the crucial role of a 13-week cash flow forecast in ensuring financial resilience and success. We will delve into the key components of this forecast, including in-depth analysis of operating activities and considerations for investing activities. Additionally, we will provide a step-by-step guide on how to create an accurate and effective 13-week cash flow forecast, from collecting accurate financial data to utilizing AI forecasting tools.

Furthermore, we will discuss best practices for CFOs to enhance the accuracy and utility of their cash flow forecasts. By updating and refining projections in real time, leveraging historical data and industry benchmarks, involving key stakeholders, and utilizing advanced forecasting tools, CFOs can navigate financial currents with confidence and support the enduring success of their organizations.

Join us as we dive into the world of 13-week cash flow forecasting and discover how it can be a game-changer for financial stability and long-term growth.

Why a 13-Week Cash Flow Forecast is Crucial for Financial Stability

The practice of a 13-week cash flow forecast is a critical component for companies, particularly during the complex phase of bankruptcy and restructuring. This meticulous approach to financial planning allows for a comprehensive view of the company's cash position in the near term. It is not just about survival but about making strategic decisions that could define the future trajectory of the business.

Committing to this forecasting method enables businesses to pinpoint exact moments of cash shortfalls and equips them to take decisive action, such as adjusting operations or securing financing, to maintain liquidity.

Citizens Financial Group, Inc. serves as an exemplary case where understanding and managing cash flow is paramount, especially when dealing with the financial nuances of both retail and commercial banking. The insights gleaned from Citizens’ survey on small and mid-size businesses emphasize the significant advantages of robust cash flow management systems, which can lead to heightened profitability, improved productivity, and cost reductions. Moreover, the emphasis on digital tools reflects the evolving landscape where companies are increasingly seeking out integrated financial solutions.

In particular, for industries that are cyclical in nature, such as construction or oil and gas, the ability to forecast cash flow with precision is even more crucial due to the fluctuating nature of their revenues. Jack McCullough, president of the CFO Leadership Council, underscores the importance of diligent planning for these industries to weather economic downturns effectively.

Furthermore, a Federal Reserve Bank of New York statement underscores the importance of maintaining a stable and competitive banking system, a goal which is inherently tied to efficient cash flow management. As businesses navigate the intricacies of their financial operations, the implementation of a 13-week cash flow forecast stands out as a vital tool, offering a strategic advantage in achieving long-term financial resilience and success.

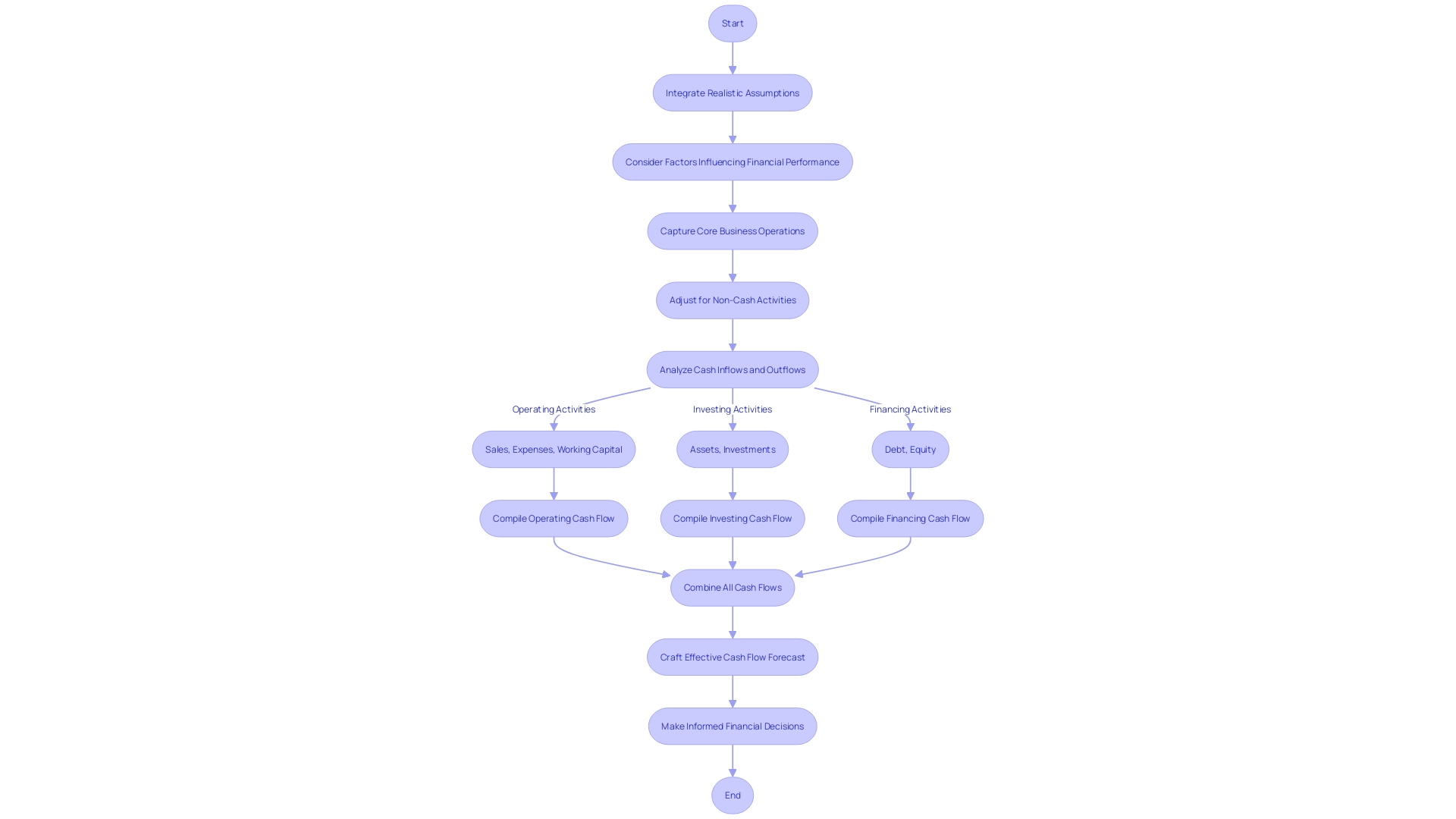

Key Components of a 13-Week Cash Flow Forecast

A robust 13-week cash flow forecast is pivotal for steering a company through uncertain financial waters. Central to this forecasting is an in-depth analysis of operating activities. It involves tracking cash inflows from sales and deducting expenses incurred during business operations.

Additionally, adjustments are made for non-cash transactions, such as depreciation, and fluctuations in working capital accounts, including receivables and payables. This meticulous process is critical in revealing the true financial position and cash-generating ability of the core business functions.

Investing activities are another cornerstone of the cash flow forecast, encompassing the cash implications of fixed asset transactions. This includes purchases and disposals of assets like land, buildings, and equipment, providing insights into the organization's capital expenditure and its impact on cash reserves.

An effective cash flow forecast also anticipates potential risks by considering the possibility of cash shortages. As highlighted by industry leaders, cash flow is the lifeblood of any business, crucial for day-to-day operations and long-term growth. Without a steady flow of cash, even the most promising ventures can falter, underscoring the importance of a well-crafted forecast that accounts for all facets of cash movement within the enterprise.

Through these components, a 13-week cash flow forecast serves as a vital tool for financial planning, enabling businesses to navigate through tight capital periods and maintain liquidity. By mastering the nuances of cash flow management, businesses can forge a path to sustainable profitability and success.

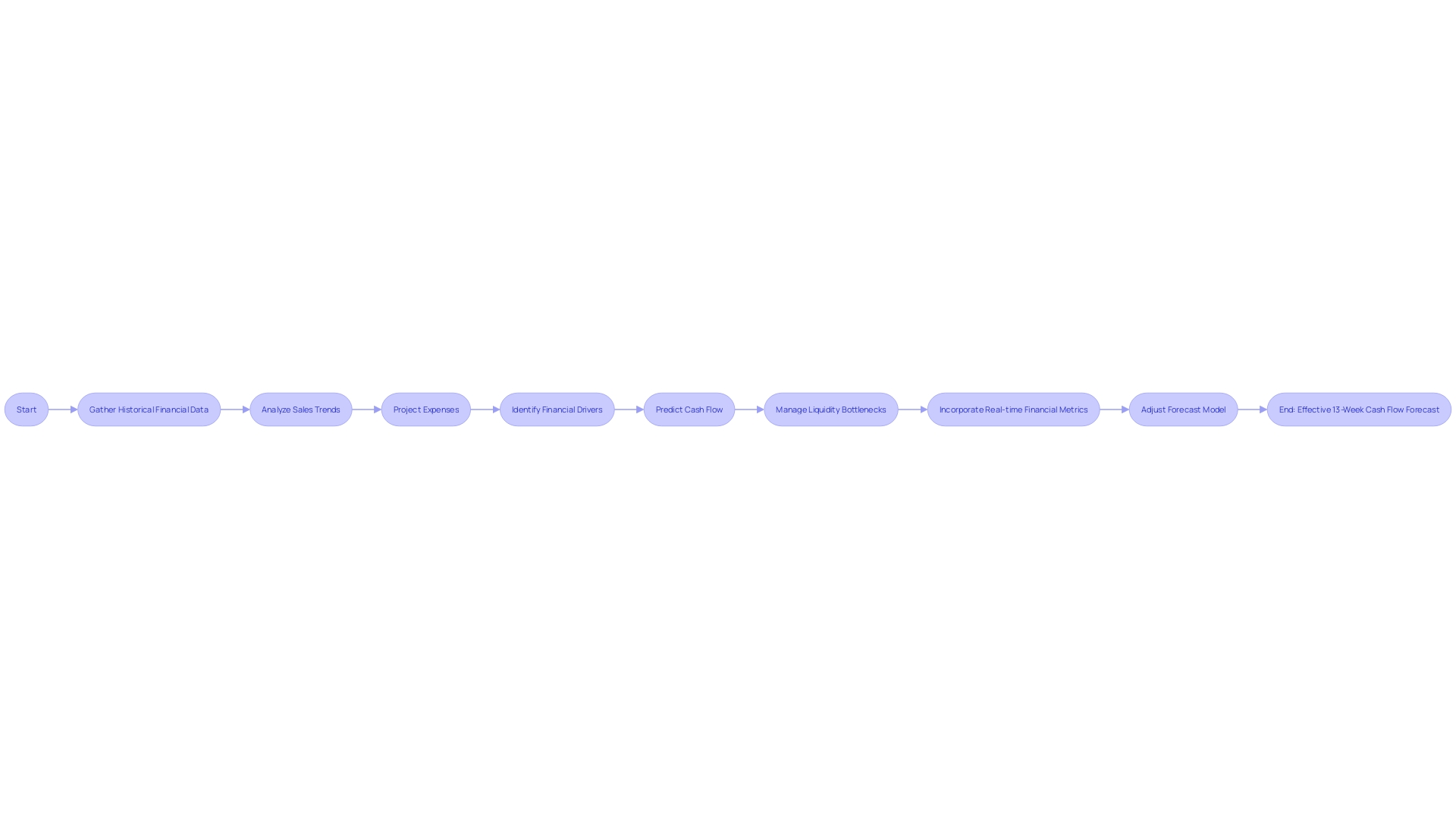

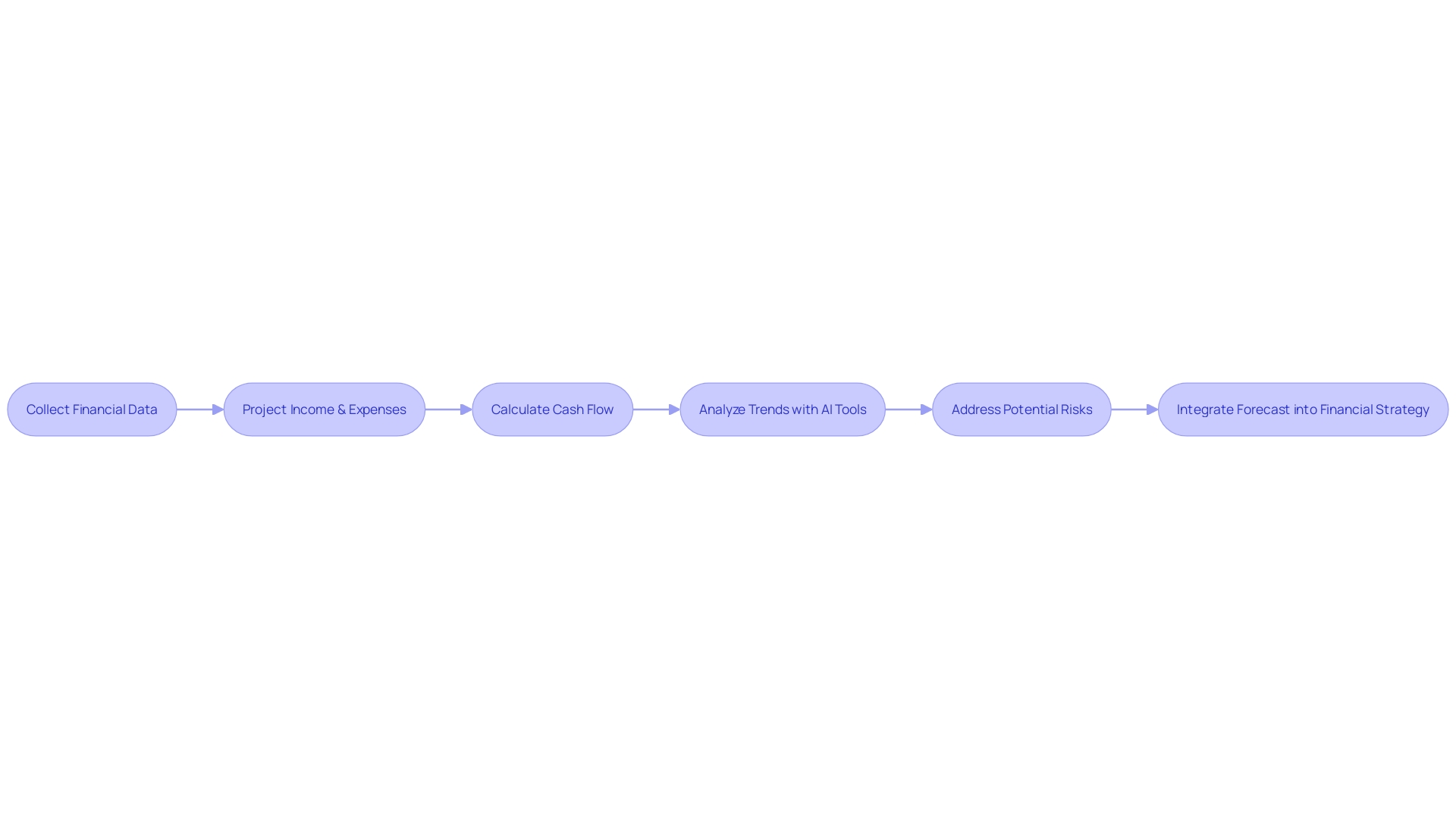

Step-by-Step Guide to Creating a 13-Week Cash Flow Forecast

Designing a 13-week cash flow forecast is a critical task for maintaining financial health and ensuring the operational viability of a business. This indispensable tool assists in projecting cash inflows and outflows, allowing companies to navigate through financial uncertainties with greater precision.

To start, you must collect accurate financial data, which serves as the foundation for a reliable forecast. This involves identifying all sources of income, including the immediate revenue streams from high cash flow potential activities such as eCommerce sales, where the global market can be tapped with relatively low overhead costs, or consulting services where you can leverage expertise for financial gain.

Next, project your expenses carefully. Operating a lean business with low overhead costs is a hallmark of a high cash flow business, so scrutinize fixed and variable expenses to ensure that they are kept to a minimum. In this phase, consider the cash flow statement's vital role, as underscored by recent observations that it is often subject to less due diligence than other financial statements, despite being crucial for investors and stakeholders to assess financial health.

Calculating cash flow, then, is not merely an arithmetic exercise. It involves the strategic anticipation of cash shortages and surpluses. As noted by industry experts, cash is the lifeblood of any organization, and its effective management is paramount to prevent the devastating consequences of running dry.

With your cash flow calculated, analyze and interpret the data to identify trends and patterns. This is where AI forecasting tools can offer a competitive edge, providing real-time insights and more accurate predictions than traditional forecasting methods. By utilizing AI, you can anticipate customer behavior, market trends, and revenue with enhanced accuracy.

Moreover, address potential risks proactively. Understand that even the most profitable businesses can succumb to cash shortages, which can halt operations. The proactive identification and mitigation of these risks are essential for the survival and growth of any business.

Finally, integrate your cash flow forecast into your broader financial toolkit. This ensures that your cash flow projections are not siloed but are instead a cohesive part of your financial strategy, supporting informed decision-making and long-term financial sustainability.

By meticulously following these steps, you will fortify your business against financial pitfalls and position it to capitalize on opportunities for growth and expansion, as the role of the CFO continues to evolve and expand.

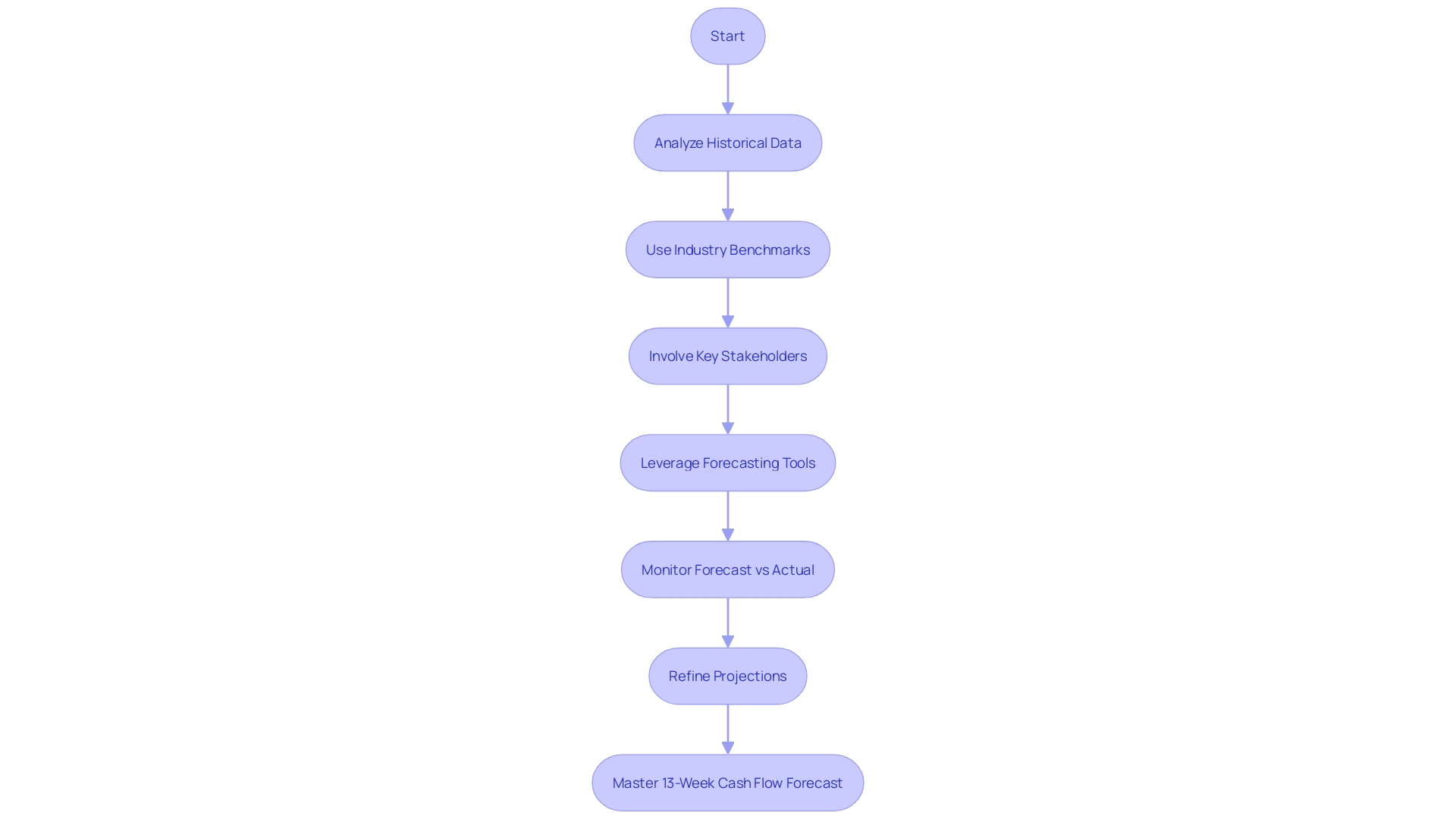

Best Practices for Accurate and Effective Forecasting

For CFOs, mastering the 13-week cash flow forecast is pivotal in steering a business towards financial stability. Implementing best practices can significantly enhance the accuracy and utility of these forecasts. It begins with the diligent updating and refining of projections, ensuring that adjustments are made in real time to reflect the dynamic nature of business operations.

Historical data and industry benchmarks serve as critical reference points, providing a reality check against which future cash flows can be gauged. This data, which encapsulates revenue, operating costs, profit margins, and more, not only reveals seasonal patterns but also long-term growth trajectories. Involving key stakeholders, from department heads to financial analysts, in the forecasting process ensures a multi-faceted perspective, leveraging collective insights to predict future financial scenarios.

Advanced forecasting tools and technology, which can automate and streamline the process, allow for a more sophisticated analysis of the data, leading to more nuanced predictions. Lastly, continuous monitoring of the forecast against actual performance is necessary, providing opportunities to adjust strategies and maintain a competitive and well-functioning financial system. By embracing these practices, CFOs can better navigate financial currents, avoid cash shortages, and support the enduring success of their organizations.

Conclusion

A 13-week cash flow forecast is crucial for financial stability, allowing companies to make strategic decisions and maintain liquidity. By pinpointing cash shortfalls and taking decisive action, businesses can define their future trajectory.

Analyzing operating activities and considering investing activities are key components of a 13-week cash flow forecast. This reveals the true financial position and cash-generating ability of the business, essential for day-to-day operations and long-term growth.

Creating an accurate forecast involves collecting precise financial data, projecting expenses carefully, and utilizing AI forecasting tools for enhanced accuracy. Integrating the forecast into the broader financial strategy supports informed decision-making and long-term sustainability.

To enhance accuracy and utility, CFOs should update and refine projections in real time, utilize historical data and industry benchmarks, involve key stakeholders, and leverage advanced forecasting tools. Continuous monitoring allows for adjustments and a well-functioning financial system.

By following these practices, CFOs can confidently navigate financial currents, avoid cash shortages, and support the success of their organizations. The 13-week cash flow forecast is a game-changer for financial stability and growth, providing practical advice and solutions. It empowers CFOs to ensure the financial resilience and success of their companies.