Introduction

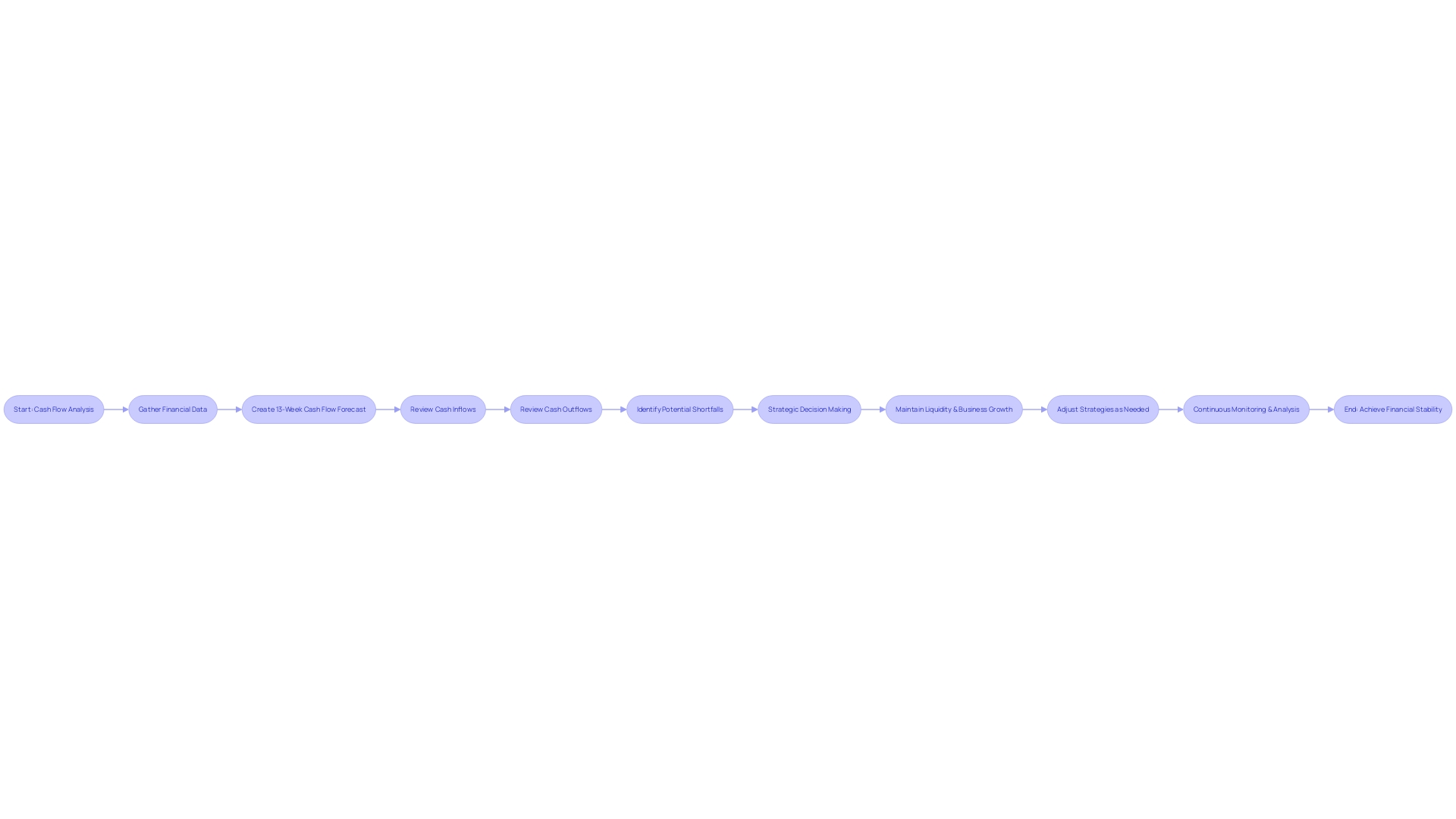

The 13-Week Cash Flow Model is more than just a forecasting tool—it's a fundamental instrument for small businesses to navigate the uncertainties of cash management. By providing a microscopic view of your business's cash activities in the short term, this model delivers actionable insights into cash inflows and outflows every week. This article explores the benefits of using the 13-Week Cash Flow Model, as well as step-by-step guidance on how to create an effective cash flow forecast.

By leveraging this model, businesses can not only prevent the dire consequences of cash depletion but also position themselves to make timely, strategic decisions, fueling their growth and sustainability in the competitive marketplace. So, let's dive in and discover how to master the art of cash flow management using this powerful tool.

What is the 13-Week Cash Flow Model?

The 13-Week Cash Flow Model is not merely a forecasting tool; it's a fundamental instrument for small businesses to navigate the uncertainties of cash management. This model offers a microscopic view of your business's cash activities in the short term, delivering actionable insights into cash inflows and outflows every week for over three months. By applying this forecasting method, entrepreneurs running businesses such as eCommerce stores or consulting services, known for their low overheads and potential for high cash flow, can stay ahead of the financial curve.

Those predictable payments from clients become powerful data points in the model, providing a clear pathway to maintaining liquidity and steering clear of cash shortages that could otherwise cripple a booming venture. Leveraging this model, businesses not only prevent the dire consequences of cash depletion but also position themselves to make timely, strategic decisions, fuelling their growth and sustainability in the competitive marketplace.

Benefits of Using a 13-Week Cash Flow Model

A 13-week cash flow model is not merely a financial tool, but it's a vital strategic planner that offers business leaders like you a crystal-clear glimpse into the future of your company's finances. The model operates on a week-by-week basis, providing detailed insights into the upcoming cash requirements and business operations. It allows you to see potential shortfalls and surpluses in your cash flow, giving you the power to make proactive measures to manage your liquidity effectively.

Citizens Financial Group Inc.'s usage of a smart plan and careful allocation of funds epitomizes how accurate cash flow forecasting and proactive cash management strategies can underpin the stability and progress of large financial institutions. Their comprehensive financial strategies not only ensure operational success but also enable the careful planning of investments and the measured execution of corporate financial obligations.

Echoing the sentiments of Dr. Sharon H. Porter, mastering the ebb and flow of your company's cash is key to averting the dire consequences of cash shortages. The critical takeaway? Know your numbers through a method as effective as the 13-week cash flow model.

It enables not just a thorough analysis of business performance but also lays the groundwork for informed decision-making in spending, investments, and financing to fuel your business's long-term sustainability and growth.

Step 1: Create a Spreadsheet with a 13-Week Time Horizon

To adeptly sculpt a 13-Week Cash Flow Model, envision crafting a spreadsheet to be your map - a detailed plan to navigate the complexities of cash flow. Envision this model as diagnostic technology for your business's fiscal health, with designated compartments for cash inflows and outflows, akin to an intricate dashboard that dissects and displays every financial vein and artery. With precision, you forecast and scrutinize each cash transaction, thus allowing you to master the art of managing liquidity with the finesse of a virtuoso.

As you delve into this model, each week unfolds, revealing incoming revenue streams and outgoing expenditures. Imagine it as laying out a chessboard, where every move is strategic and every piece integral. The model's ability to adapt is its greatest strength, as noted in financial circles, where the most proficient models are not static but evolve with your business, embracing change and new data with each iteration.

This dynamic approach to cash flow monitoring echoes the mantra within the thriving eCommerce realms and consulting services, where agility meets foresight.

The case of the hotel company's initial underwhelming foray into advertising underscores the importance of laying a solid groundwork before further campaign implementation. Their evolution from absence to strategic, tool-embedded precision in online advertising is analogous to the meticulous planning required in the 13-Week Cash Flow Model. The lesson is vivid: foundational clarity begets success.

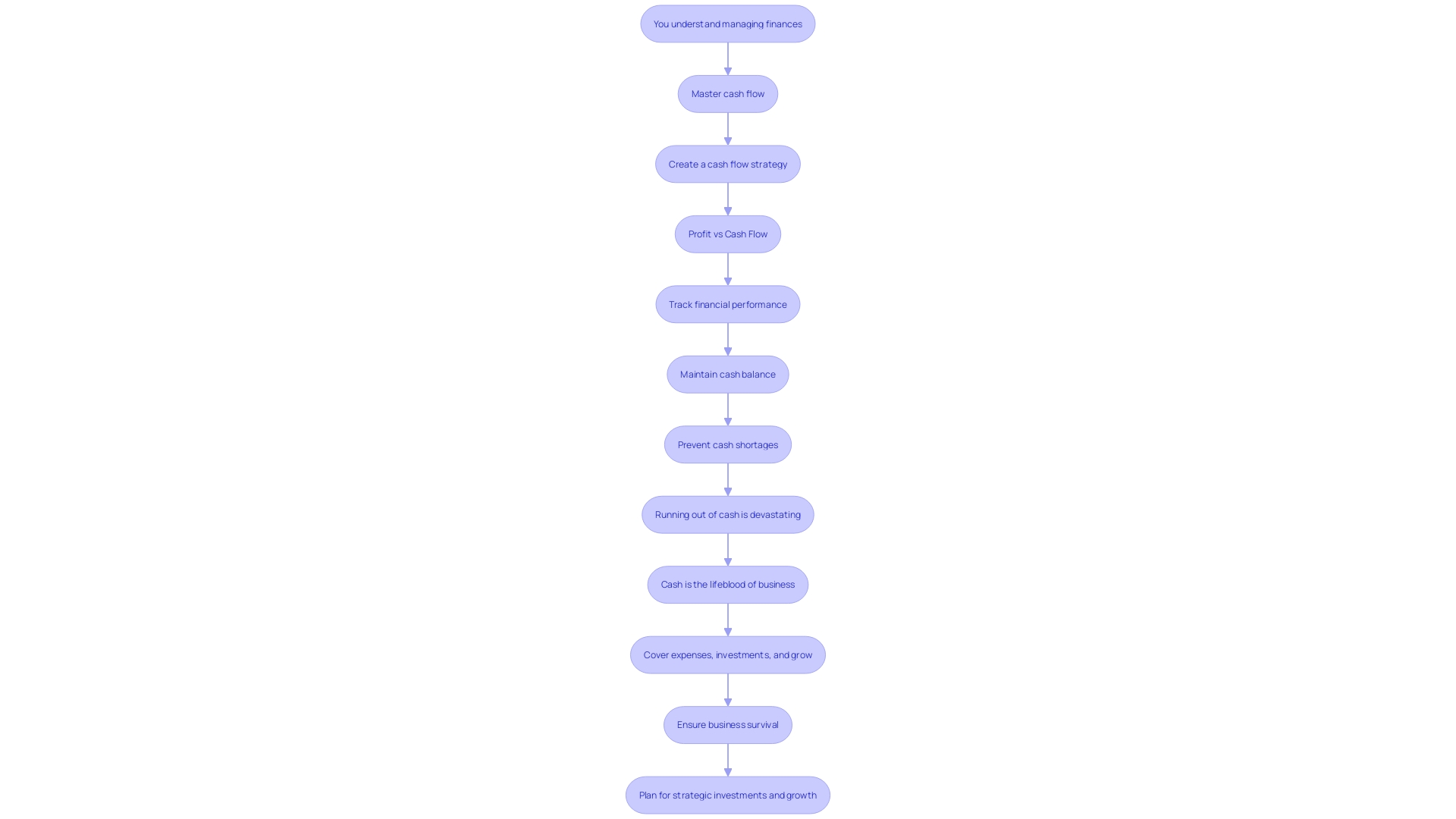

Remember, cash flow and profit, while intertwined, measure distinct aspects of business vitality. Your awareness of this dichotomy should guide your strategy, reinforced by the wisdom that 'cash shortages can be the death of any business.' Thus, injecting this knowledge into your cash flow model will not only cultivate a stable financial ecosystem for your business but also safeguard against the unforeseen perils of insolvency.

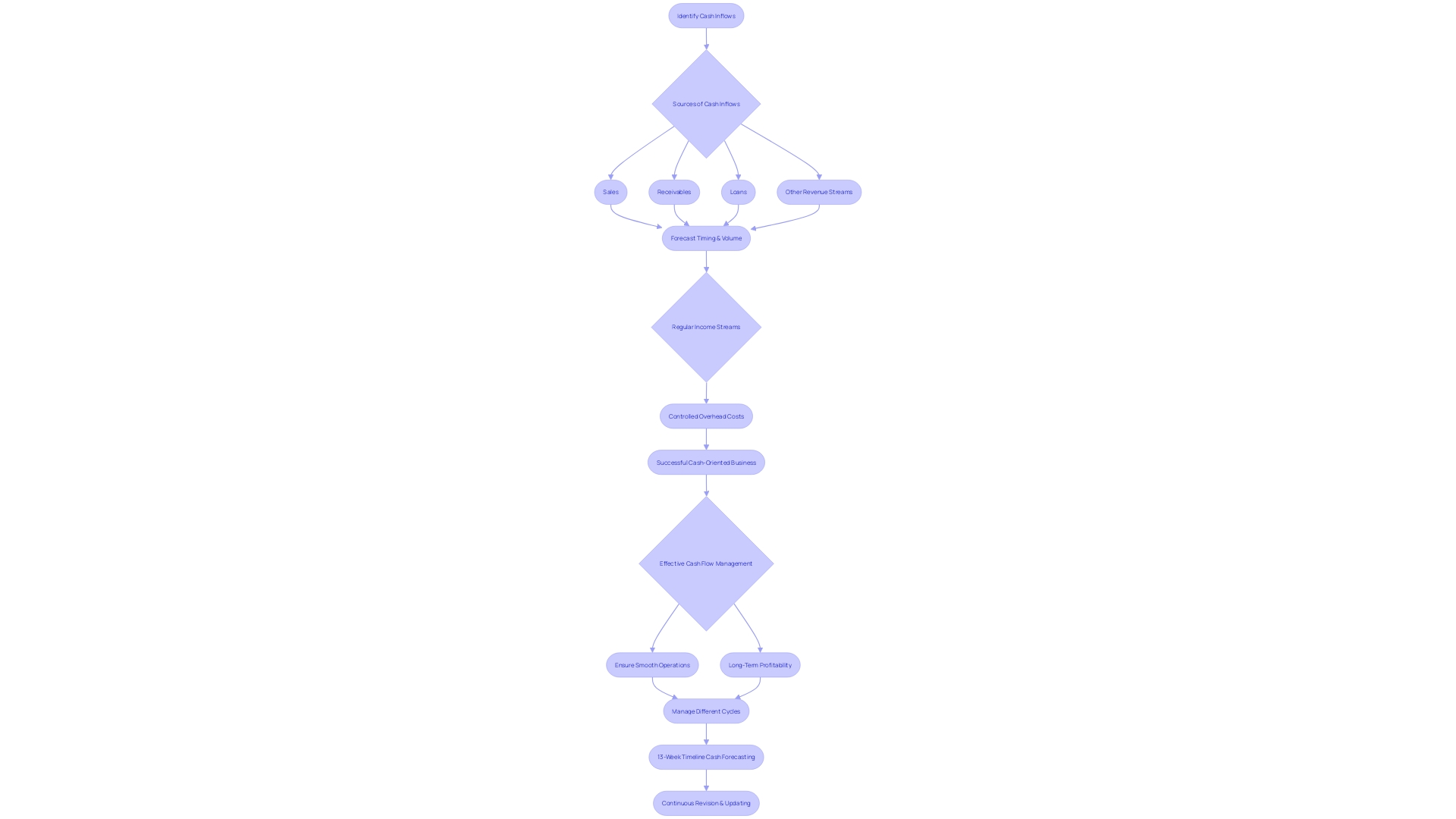

Step 2: Define Cash Inflows

When it comes to forecasting the financial health of a business, pinpointing all possible cash inflow sources is paramount. This encompasses not just the earnings from sales but also encompasses cash collection from receivables, the influx of funds from loans, and other potential streams of revenue. Precision in forecasting both the timing and volume of these cash inflows over the course of a 13-week timeline is imperative for a robust cash flow management plan.

Looking at examples like ecommerce stores and consulting services can be insightful. Ecommerce platforms benefit from low startup costs and offer access to a wider market, leading to a steady stream of income. Similarly, consultancy services can result in predictable earnings, as consultants often engage with clients on a continuous basis.

Both models highlight the importance of regular income streams and controlled overhead costs, which are the keystones of a successful cash-oriented business.

It is essential to understand that cash flow is the lifeblood of any enterprise, allowing for smooth operations and preventing any potential monetary crunches. A solid grasp of cash flow not only underscores efficient business operations but stands as a substantial predictor of long-term profitability. Effective cash flow management involves an acute awareness of the ebb and flow of monetary resources and a strategy that ensures a balance that can sustain the business through various cycles.

Step 3: Define Cash Outflows

It's essential to map out all cash disbursements to keep the financial gears of your business running smoothly. Expenses, encompassing staff salaries, office space leasing, utility bills, servicing of loans, and any other operational costs, are crucial to track meticulously. Accurately gauging the timing and magnitude of such outflows can be the difference between maintaining a robust financial framework and facing formidable challenges.

Step 4: Develop Assumptions for Inflows and Outflows

Developing robust cash flow projections is pivotal for effective financial management. It involves meticulously crafting assumptions for both cash inflows and outflows. Critical to this process is taking into account the timing of customer payments and expense payments as well as other influences on your cash flow.

An accurate projection leans heavily on historical financial performance, but it should also be adaptable to accommodate industry dynamics. For instance, businesses in cyclical industries, like construction or oil and gas, must diligently plan for economic fluctuations by maintaining sufficient cash reserves. The Federal Reserve Bank emphasizes the importance of financial reporting quality, and given that cash flow statements often lead to restatements, precision here cannot be overstated.

Investors keen on assessing an entity's fiscal health look closely at cash flow statements to gauge future net cash flows, financial obligations, and investment returns potential. Therefore, aligning the extrapolation of cash flows with verifiable data and trend analysis, using formulas like Y(x) = Y(1)+ (x- x(1))/(x(2)-x(1)) * (Y(2) – Y(1)), supports rigorous financial forecasting.

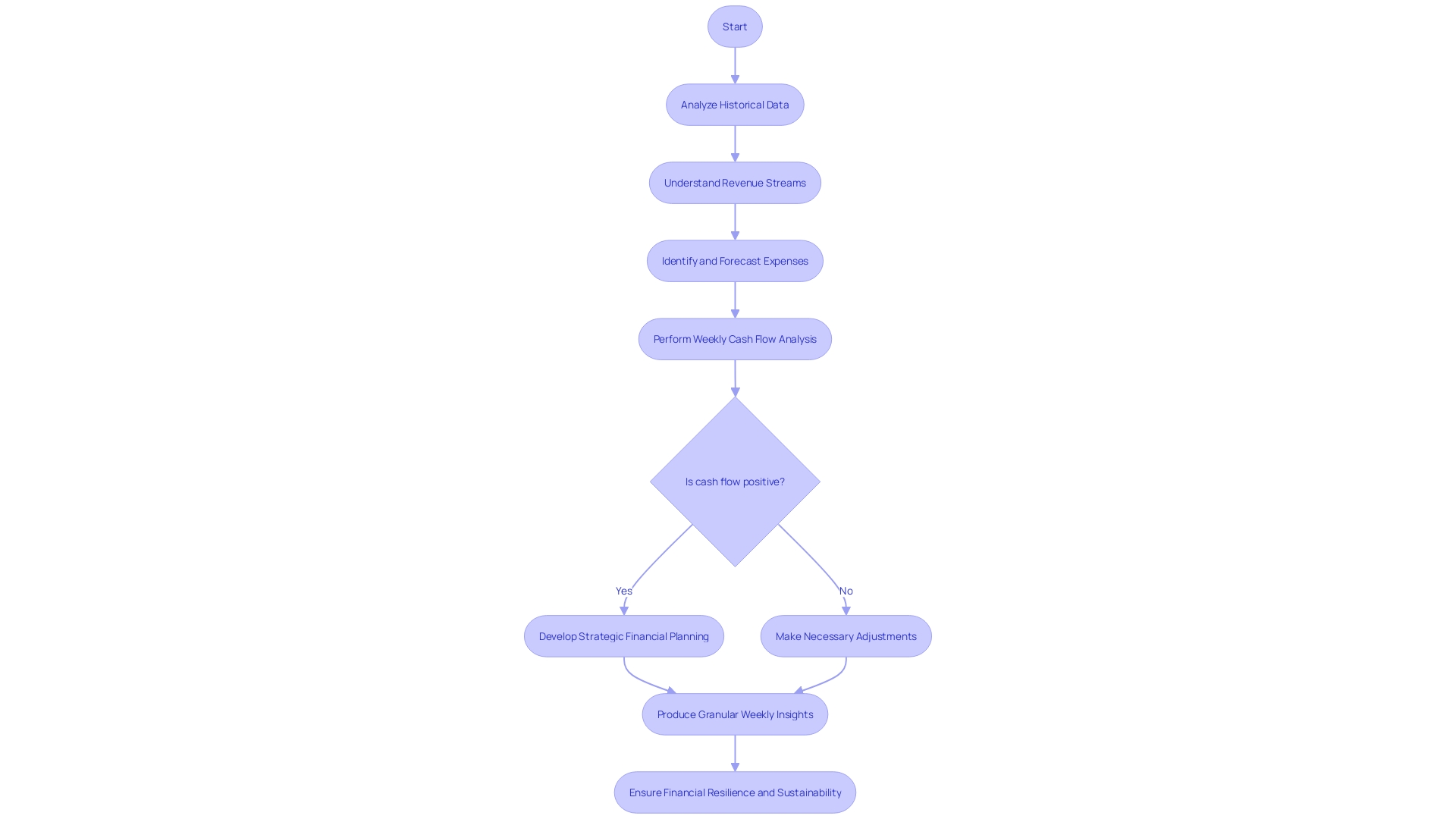

Step 5: Create the Forecast

To ensure the financial resilience and sustainability of your business over time, you must craft a meticulous cash flow forecast. By leveraging historical data and understanding your revenue streams, expenses, and monetary lifeblood, you can pinpoint potentially turbulent waters ahead. By injecting the empirical evidence from past performance such as sales records, financial statements, and anomalies into a 13-week forecast model, you'll transform this strategic approach into a dynamic financial tool, producing granular insights into the weekly cash flow tide of your enterprise.

It's prudent to recall that having an ample cash runway is not just about avoiding insolvency but also securing the strategic agility to maneuver during times of global economic scrutiny or when addressing key financial priorities such as inflationary pressures.

Consider the Giants in industries such as Citizens Financial Group, which manages a vast array of financial dynamics while delivering value to stakeholders, or harness the predictive analytics akin to Saudi Arabia's ME A, foreseeing and preempting crises through rigorous financial planning. Such entities validate the significance of maintaining not just a cash-positive balance sheet, but also illustrating the profound necessity of a watertight, forward-looking cash flow calculus. Make use of this narrative and analytical prowess to turn your cash flow forecast into a navigational chart steering through the fiscal ebbs and flows with the precision and foresight reserved for the seasoned financial mariner.

Step 6: Weekly Review and Adjustments

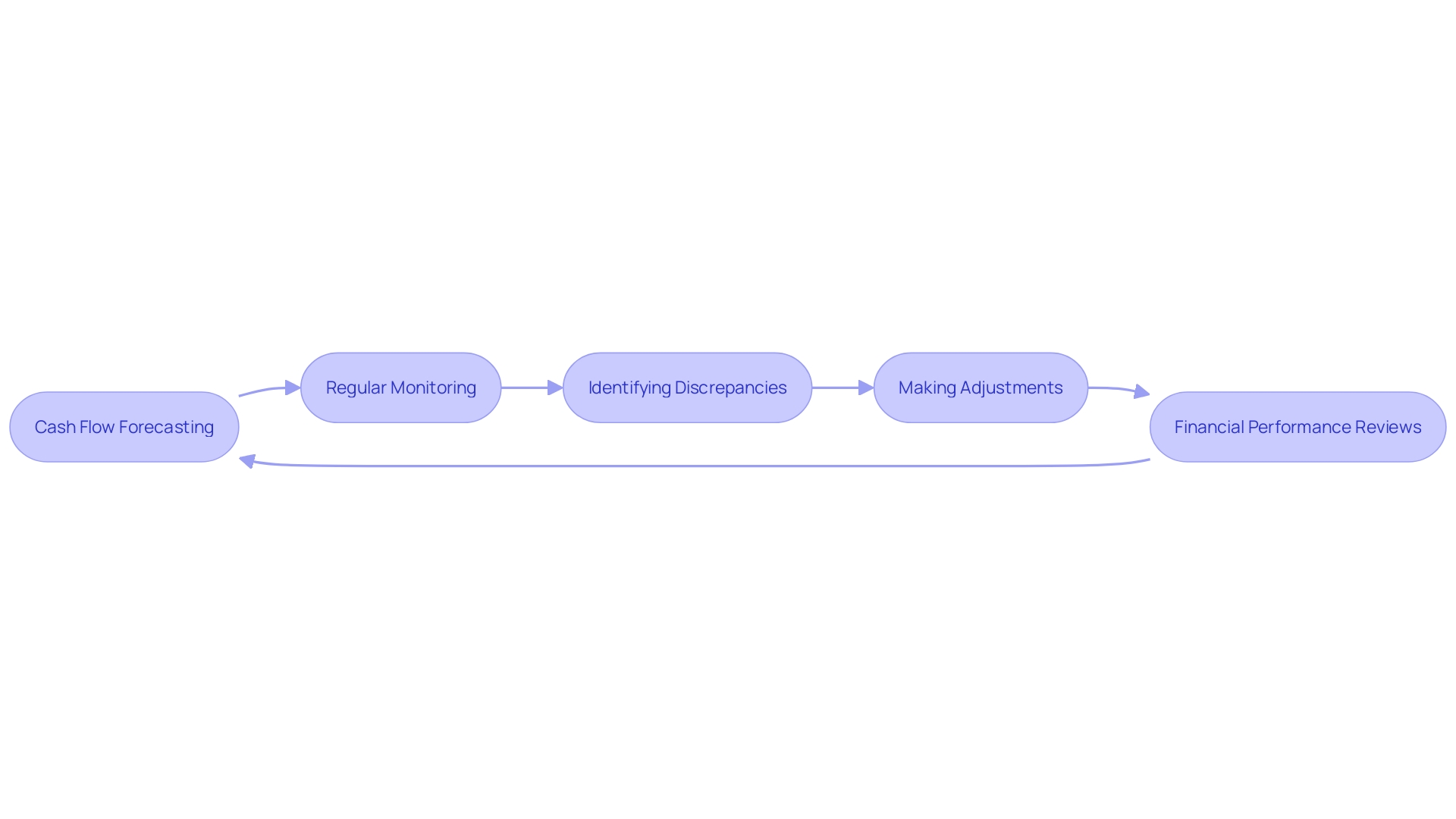

A robust cash flow management plan is pivotal for any business, demanding regular scrutiny and proactive adjustments. Rooted in such an understanding, your cash flow forecast merits a weekly review to reconcile it with the real-world cash flows. Such diligent monitoring against your forecast unlocks insights into discrepancies and triggers the timely tweaks needed to keep your financials on track.

In practice, top-tier financial entities like Citizens Financial Group, Inc. exemplify meticulous financial oversight. With a substantial asset base exceeding $220 billion and a sprawling retail and commercial banking operation, their ability to stay attuned to their cash flows is crucial for day-to-day decisions and long-term strategy. Both Citizens and businesses utilizing on-premise systems, which may preclude frequent updates due to critical infrastructure roles, could benefit from tools like Monte Carlo Simulations—this illustrates cutting-edge approaches to forecasting and scheduling significant financial operations.

While emerging technologies are reshaping financial landscapes, including the booming interest in Web3 and crypto currencies as seen in the upcoming U.S. presidential election policies and Mercari's integration of Bitcoin payments, it's the foundational financial practices that underpin the long-term viability of businesses.

To create a precise cash flow forecast, start by examining your revenue streams and understanding the timing and regularity of your income. This could be influenced by your business's nature, just as payroll scheduling—weekly, bi-weekly, or monthly—rests on operational patterns and legal compliance.

By grounding your forecasts in historical data spanning at least three financial cycles, you capture the essence of your operational health and external market impacts. These past insights provide a lens through which to view your future financial pathways, consider revenue and expenditures, and manage assets and liabilities effectively.

Financial performance reviews further clarify your company's financial health. By closely reviewing income statements, balance sheets, and cash flow statements, CFOs ensure that their financial strategies align with the organization’s performance metrics. This analysis should include scrutinizing revenue growth, cost management, profit margins, and investment returns, essential for steering the company through economic undulations and maintaining a competitive edge.

Lastly, in an AI-driven age, financial leaders must harness technology judiciously. According to recent data, 68% of finance leaders are willing to integrate AI insights into business decisions, underscoring the advances in automated data access and the involvement of diverse teams in financial planning. These technological pivots underscore the importance of maintaining a dynamic and informed approach to cash flow management—essential for effectively navigating today’s fast-paced business terrain.

Step 7: Actionable Insights and Decision Making

The 13-Week Cash Flow Model isn't merely a mechanism for cash flow tracking; it stands as a beacon illuminating the financial pathway of your organization, equipping you with profound insights essential for driving strategic fiscal decisions. Harnessing this model enables you to dissect the intricacies of cash movements, detect spending patterns, and discern actionable trends that influence expenditures, investments, and financing maneuvers. Such analysis positions you to deftly orchestrate your resource allocation, finely negotiate supplier contracts to better terms, and judiciously evaluate funding avenues—all vital to sustaining the lifeline of cash within the enterprise ecosystem, as underscored by experts emphasizing the paramount importance of preventing cash shortages for ongoing business vitality.

Accurately rendered, updated financial models, as advocated in the industry, serve as instruments that adapt fluidly to changing business climates, providing a dynamic canvas to assess financial scenarios in real-time. Embodying the empirical approach of validating financial assumptions through practical experimentation, this model serves as a foundation upon which you can construct a robust, profit-yielding edifice, ensuring that the financial underpinnings of your organization are not only secure but poised for progressive growth.

Step 8: Communication and Weekly Review

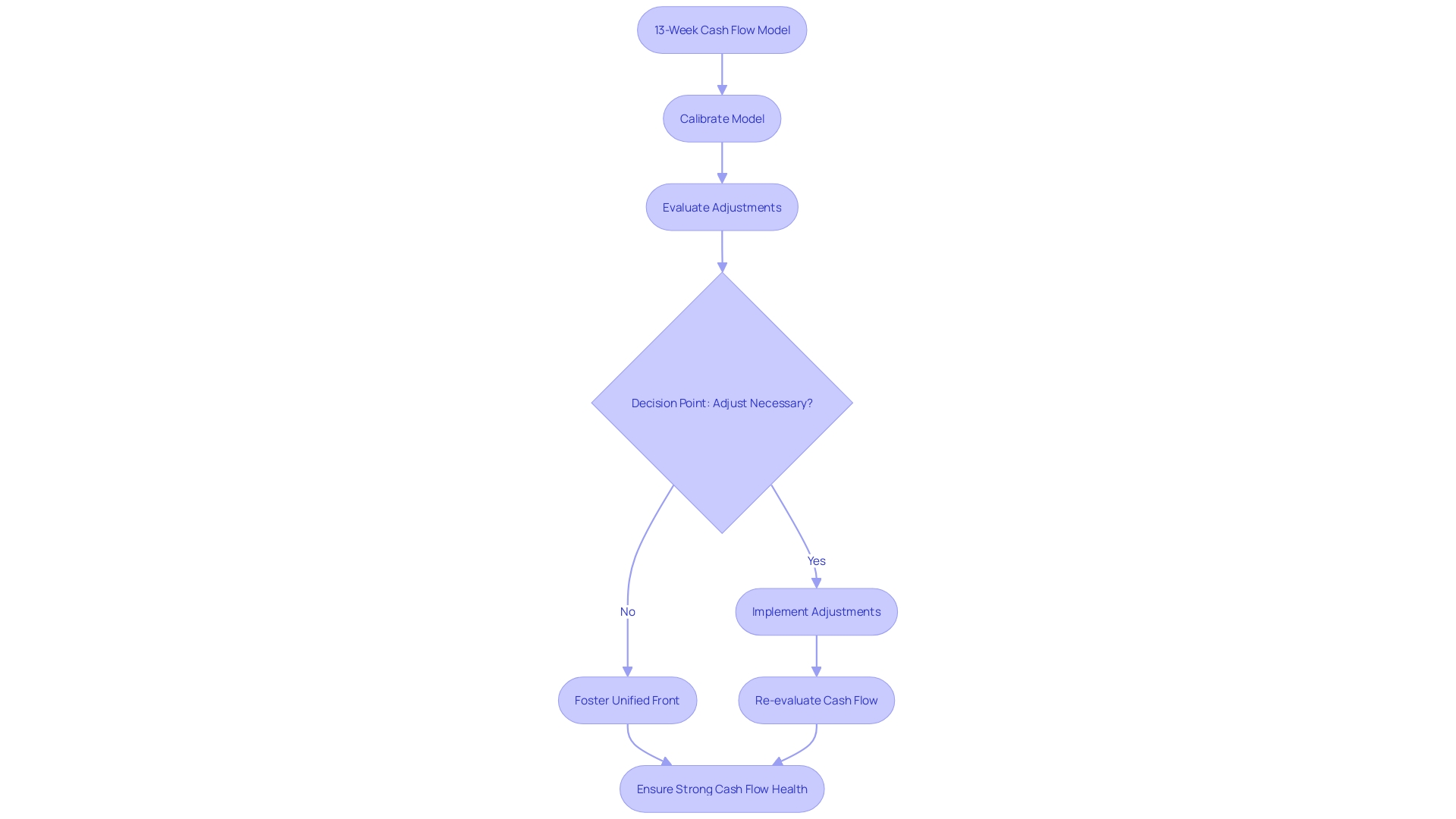

The pivotal 13-Week Cash Flow Model is a dynamic tool vital for businesses seeking to enhance their financial stability. It serves not just as an internal metric but as a beacon, guiding management teams and stakeholders through the complexities of a company's financial wellbeing. The weekly calibration of this model becomes a crucial platform where discussions unravel - adjustments are evaluated, concerns are addressed, and a unified front is forged to secure robust cash flow health.

In the practical realm, transparent communication engenders trust. Stakeholders appreciate an organization that functions as an open book, where each page turns to reveal an unwavering commitment to ethical financial practices. These discussions mirror the interactive experience that Strategic Solution Partners delivers to their clients, balancing expertise in revenue management with agile responses to unique operational hurdles.

Embracing the analogy of a 'prix fixe' menu, this approach to financial management presents options that are strategically curated and priced to improve efficiency, much like a chef's finely tuned offering. It echoes the precision and foresight required in effective cash flow forecasting, akin to the meticulous planning in fine dining establishments.

To sidestep the pitfalls of cash flow mismanagement, leaders must become intimate with the financial narratives told within their statements. A granular assessment of cash flow activity, underscored by the revenue and expenses laid bare in financial documentation, is not an option - it's a cornerstone of strategic foresight. Such scrupulous attention to detail could be the difference between a buoyant enterprise and an alarming shortfall, highlighting the significance of forging strategies that extend beyond the immediate horizon, investing in ventures that promise not just returns, but robust financial health.

Undoubtedly, the cornerstone of financial acumen lies in the knowledge that grand visions can falter without the lifeblood of cash flow stability. Thus, the union of strategic planning, comprehensive evaluation, and unceasing vigilance in cash management becomes the backbone of a successful business trajectory. Weekly meetings to deliberate on the statements of cash flows, then, are less of a routine and more of a strategic incantation - spoken in the language of finance and designed to safeguard the entity's vital financial pulse.

Common Questions and Considerations

Mastering cash flow within your business requires astute management of funds and a deep understanding of your company’s financial health. Employing financial models such as the 13-Week Cash Flow Model offers a platform to anticipate cash requirements and address variables that can influence your budget. Here’s what you should consider to steer through the potentially choppy waters of cash flow management.

The heartbeat of any business is its working capital and liquidity metrics, which are gleaned from financial statements that reflect revenue, expenses, profitability, and debt. Crucial to success, as Dr. Sharon H. Porter points out, is the intimate knowledge of your numbers. It’s the financial trifecta of the income statement, cash flow statement, and balance sheet that will provide the comprehensive overview necessary to weather unexpected economic tremors.

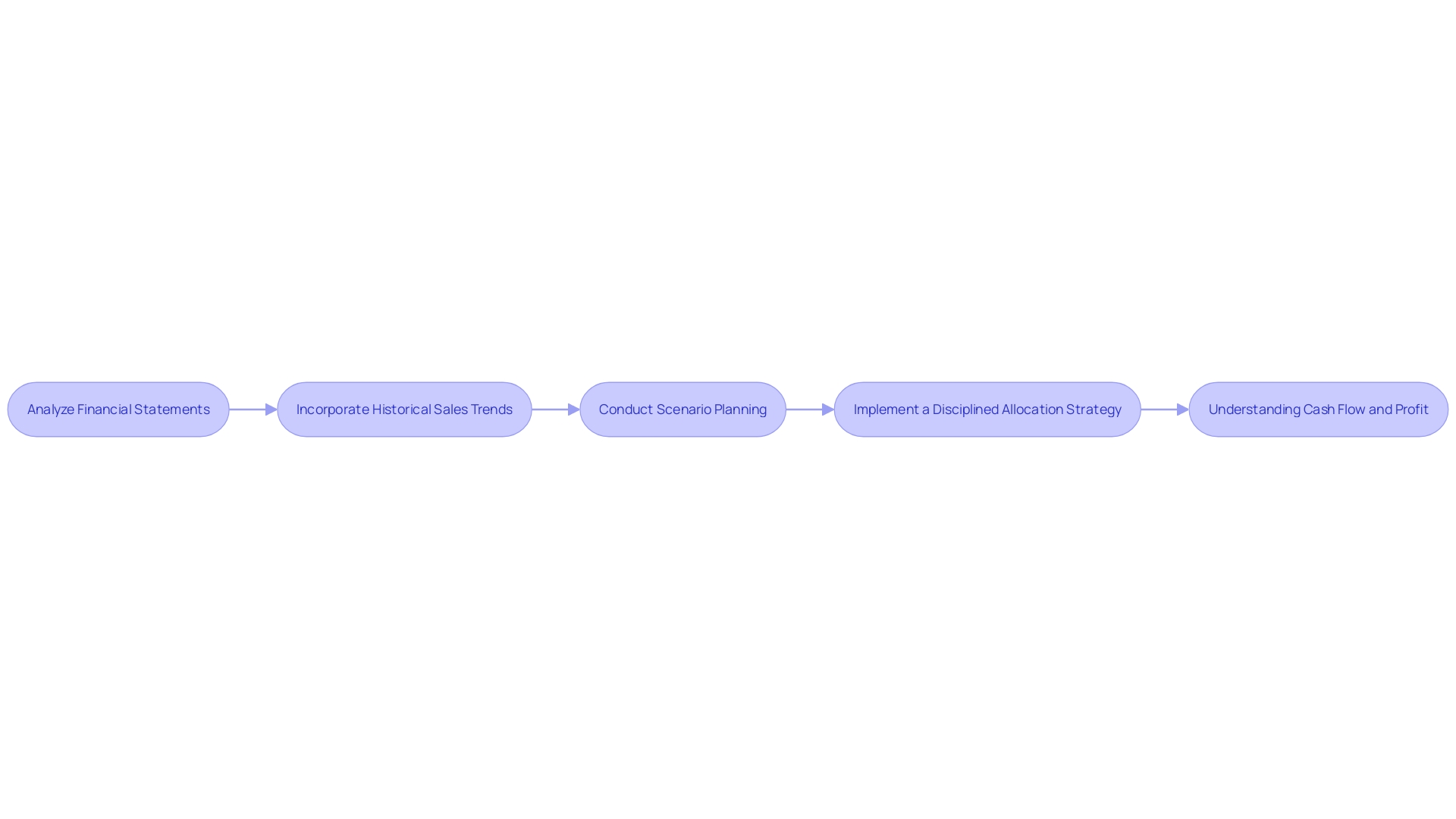

For instance, when addressing seasonal fluctuations, historical sales trends and inventory management become key. By analyzing past performance encapsulated in financial records, you can adjust your forecasts and maintain the necessary cash flow to support operations during slower sales periods.

Another essential element of managing cash flows is scenario planning. Testing your business against a variety of conditions, such as potential outcomes of inflation and changes in interest rates, prepares you to pivot as needed. The recent case of Silicon Valley Bank serves as a stark reminder of the balance sheet risks associated with rising interest rates and the dire need for sustainable sources of funding.

A company like Cisler Sweets illustrates the vital role of a disciplined allocation strategy for funds. Targeting investments with the potential for returns, not forgetting routine tracking of accounts payable and receivable, forms a financial bulwark that ensures stability and positions a business for expansion into new markets.

Understanding the distinctions between cash flow and profit, while ensuring you have a strategic handling of both, is pivotal. As revenue translates into cash, it's this lifeblood that carries your business forward. Without sufficient cash flow, no level of profitability can save a company from collapse.

The continuous movement of cash in and out determines not just solvency but also operational success and growth potential.

Conclusion

In conclusion, the 13-Week Cash Flow Model is a fundamental tool for small businesses to navigate cash management uncertainties. It provides a clear view of cash activities in the short term and enables proactive decision-making. By leveraging this model, businesses can prevent cash depletion, make informed decisions, and ensure growth and sustainability in the competitive marketplace.

The benefits of using a 13-week cash flow model are abundant. It offers insights into future finances, allowing businesses to manage liquidity effectively. Creating a precise cash flow forecast involves defining cash inflows and outflows, developing assumptions, and regularly reviewing and adjusting the forecast.

The 13-Week Cash Flow Model serves as a beacon for driving strategic fiscal decisions. By analyzing spending patterns and actionable trends, businesses can allocate resources and evaluate funding avenues. Transparent communication and weekly reviews ensure financial stability and build trust with stakeholders.

Mastering cash flow management requires astute financial management and understanding of a company's financial health. By employing the 13-Week Cash Flow Model, businesses anticipate cash requirements and address variables that influence budgets. Managing both cash flow and profit strategically is crucial for success.

In summary, the 13-Week Cash Flow Model empowers businesses to navigate cash management uncertainties and make informed decisions. By mastering the art of cash flow management, businesses can ensure growth and sustainability in the competitive marketplace.