Introduction

When a company finds itself in financial distress or facing operational challenges, a comprehensive turnaround strategy becomes crucial. Recognizing the signs that a company requires a turnaround is the first step in this vital process. Conditions such as declining sales, mounting debts, and strained cash flows are indicators of underlying problems that demand immediate attention.

Successful turnarounds, like that of Guthrie Clinic, have shown that a holistic approach encompassing financial restructuring, community engagement, and operational enhancements can lead to a resurgence in performance. In this article, we will explore the key steps and strategies involved in a business turnaround, examine real-world case studies of successful turnarounds, discuss strategies for maximizing cash flow and reducing costs, delve into operational improvements and restructuring, examine how to measure success and adjust the turnaround plan, and highlight the long-term benefits of turnaround consulting. By understanding these crucial aspects, CFOs can navigate the challenging terrain of a business turnaround with confidence and achieve stability and growth.

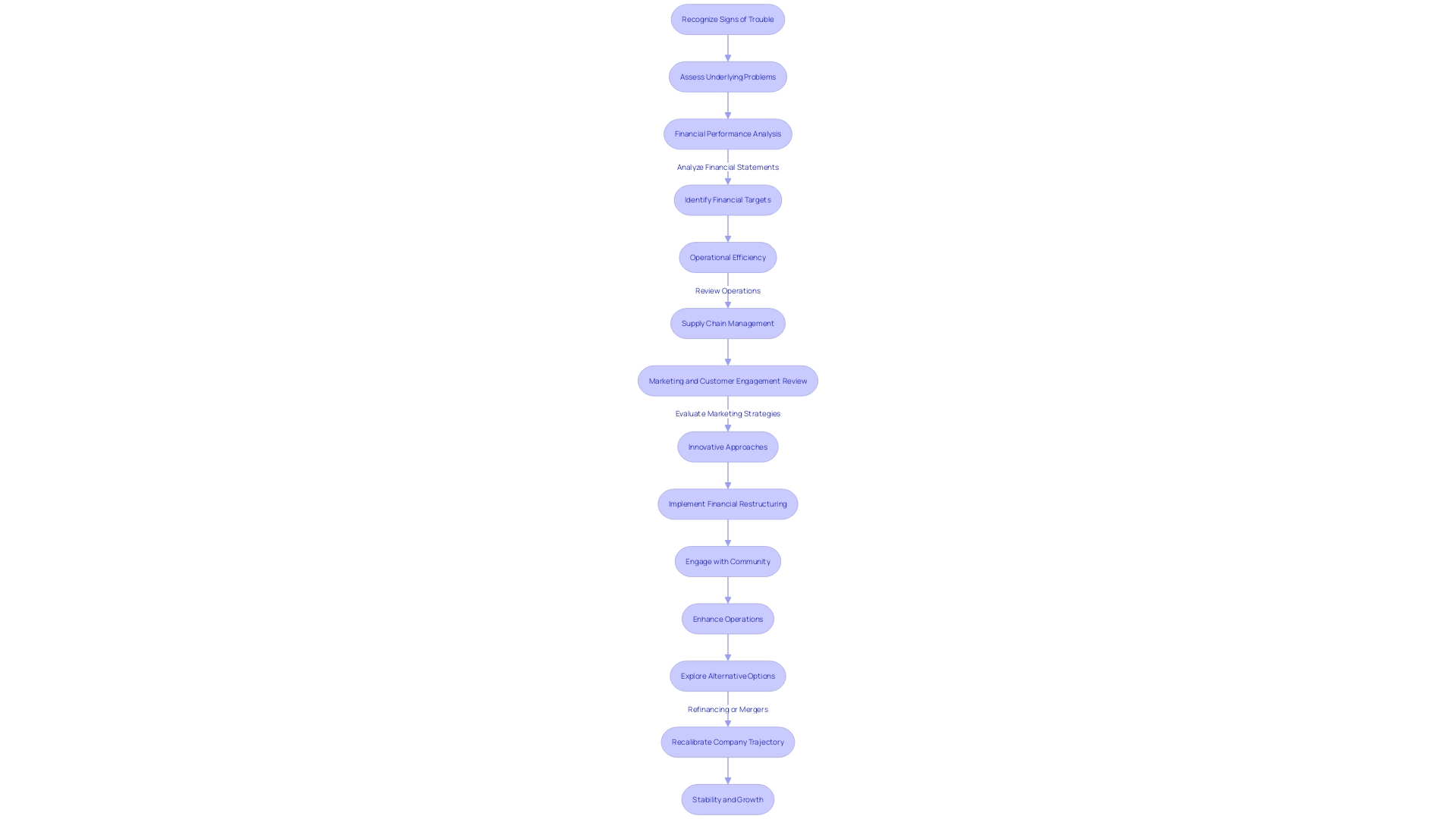

Identifying the Need for a Business Turnaround

When a company encounters financial difficulty or operational challenges, a thorough turnaround strategy becomes crucial. Recognizing the signs that a company requires a turnaround is the first step in this vital process. Conditions such as persistent decline in sales, mounting debts, and strained cash flows signal underlying problems that demand immediate attention.

Companies like Guthrie Clinic have demonstrated that a holistic strategy, embracing not just financial restructuring but also community engagement and operational enhancements, can lead to a resurgence in performance. Similarly, a prominent hotel leveraged its prime location, revamped its restaurant strategy, and saw an immediate uplift in sales.

Declining performance is not just a corporate issue; it reflects broader economic trends too. For instance, during recessions, marked by consecutive quarters of negative growth, even resilient sectors like food and beverage can be affected. Yet, businesses that understand their market and adapt their strategies can thrive.

As James Mohs from the University of New Haven implies, it's essential to exhaust all options before considering bankruptcy. This could mean exploring refinancing, stock issuance, or even mergers.

The importance of timing cannot be overstated. Waiting too long to act can result in missed opportunities for recovery. A decisive action plan, informed by insights from both internal assessments and external market conditions, is key to navigating through tough times.

In 2023 alone, the number of company insolvencies reached a peak not seen since 1993, underscoring the critical nature of proactive financial management. In the end, a business turnaround is not just about financial restructuring; it's about a comprehensive recalibration of the company's trajectory towards stability and growth.

The Turnaround Process: Key Steps and Strategies

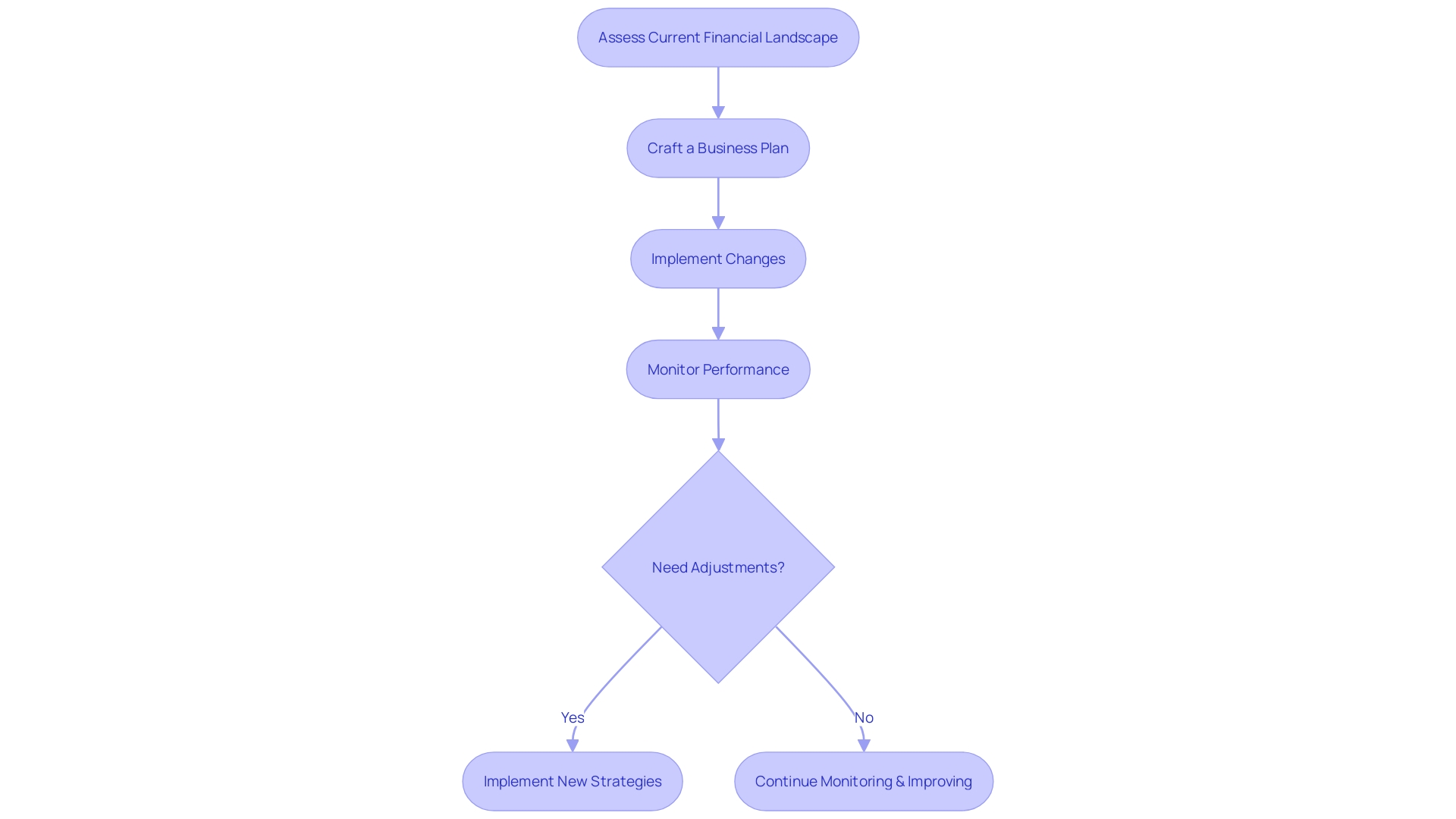

A successful business turnaround hinges on a meticulously charted course of action. At the heart of this process lies the critical assessment of the current financial landscape, a pivotal step that sets the stage for subsequent strategies. Informed by the best of expert advice, this diagnostic phase demands a thorough understanding of the organization's financial health and readiness for change.

Building on this financial insight, crafting a business plan becomes the next linchpin in the turnaround journey. A robust plan, grounded in market analysis and clear business objectives, is essential to chart a path to recovery. This strategic blueprint should detail actionable steps to address operational inefficiencies, market misalignments, and areas ripe for innovation.

The execution of the turnaround plan is where theory meets practice. Here, the emphasis shifts to implementing the prescribed changes with precision and agility. It's a phase characterized by dynamic process transformation, where a 'business as usual' approach gives way to an innovative, continuous improvement mindset.

As echoed by industry leaders, transformative change isn't a one-off project but a relentless pursuit of excellence.

To ensure the effectiveness of these transformations, rigorous monitoring is indispensable. This goes beyond mere oversight; it involves a deep dive into performance metrics, an unwavering commitment to the strategic vision, and an openness to adjust tactics in response to new insights and market shifts. As change is implemented, the organization's pulse must be continually felt, leveraging feedback from teams and customers to fine-tune the approach.

In summary, navigating a successful business restructuring is a multi-stage endeavor that requires a blend of financial acumen, strategic planning, adaptive execution, and vigilant monitoring. It's a journey that demands a clear-eyed assessment of the current state, a roadmap for revival, and the operational flexibility to thrive amid change.

Case Study: Successful Turnaround Examples

Discovering how companies have revitalized their fortunes through restructuring is not just educational—it's often a source of motivation. For instance, Store Enso, a prominent paper manufacturer, faced a declining demand for paper as digital media surged. They pivoted by transforming into a renewable materials company, cutting down their workforce by a third and appointing a new CEO during the late 2000s.

Their strategic shift toward producing sustainable products like alternative drinkware and eco-friendly building materials was a response to increasing demand in renewable resources. Such bold moves showcase how understanding market trends and making decisive changes are vital for a successful turnaround.

In another instance, a well-positioned hotel in the heart of the city struggled to boost its food and beverage sales. The strategy to revitalize the establishment involved tapping into the hotel's prime location to attract diners and understanding the market's needs. This approach underscores the importance of leveraging location and market knowledge as key factors in business restructuring.

Moreover, recent economic policies have led to a surge in new start-ups, shifting the employment landscape and intensifying competition for labor. This dynamic market environment demands that businesses stay agile and adapt quickly.

Incorporating technology and enhancing user experience also plays a pivotal role in business turnarounds. A case in point is a company that chose Django, Tailwind, and HTMX for its technical stack to provide a seamless customer experience. Coupled with a strategic SEO approach and content roadmap, this led to improved sales and positive reviews within the first week.

These real-world cases, along with insights from industry leaders, highlight the importance of adapting to market shifts, understanding customer needs, and leveraging strategic locations. They also emphasize the significance of being open to learning and ready for change, which are crucial for navigating complex business turnarounds.

Strategies for Maximizing Cash Flow and Reducing Costs

For businesses facing a turnaround, the management of cash flow, coupled with effective cost reduction strategies, is pivotal. To steer your business through a challenging restructuring process, it's essential to focus on enhancing cash flow and curtailing unnecessary expenses. One approach is to leverage your business's unique location or market position, as demonstrated by a hotel that increased Food & Beverage sales by capitalizing on its central city location.

Key performance indicators (KPIs) are vital tools in this endeavor, as management guru Peter Drucker famously said, 'What gets measured gets managed.' By tracking the right metrics, you gain critical insights into your financial health and operational efficiency, which allows for more strategic decision-making.

A robust strategy also emphasizes customer retention, which has been shown to be more cost-effective than customer acquisition and fundamental for sustainable growth. Additionally, maintaining a strong cash flow is essential, as it enables you to avoid financial shortfalls and supports business success. Remember, cash flow is the lifeblood of your business – it dictates your ability to operate effectively and avoid cash shortages that can jeopardize your business's survival.

Further reinforcing this strategy, evidence suggests that businesses with low overhead costs are more likely to enjoy sustainable profitability. Keeping fixed and variable costs to a minimum ensures that more revenue translates into profit. It's also important to differentiate between cash flow and profit, as both are critical but distinct financial measures.

By understanding and managing these effectively, you can drive your business towards efficiency and profitability, even in times of financial restructuring.

Operational Improvements and Restructuring

Achieving operational efficiency is more than just a cost-saving measure; it's a strategic imperative for any business navigating a turnaround. Consider the case of Travel Charme Strandhotel Bansin, where technology played a pivotal role in streamlining operations. The hotel's general manager, Greg Smlatic, leveraged innovative solutions to enhance the guest experience, resulting in a surge of positive reviews and a significant uptick in sales.

Similarly, a major hotel with a centrally located restaurant saw a rise in food and beverage sales by adapting their strategy to better leverage their location, underlining the importance of understanding market dynamics.

Reflecting on these cases, it's evident that operational improvements are not a one-size-fits-all solution. A methodical approach to evaluating operational efficiency, like analyzing income statements, balance sheets, and cash flow statements, can provide a transparent view of a company's financial health. This level of scrutiny allows for a deep dive into revenue growth, profit margins, cost management, and investment returns, informing future financial and resource allocation decisions.

In the broader scope of industry advancements, Berlin Brandenburg Airport's adoption of AI-based software to optimize handling processes exemplifies how embracing technology can lead to heightened service quality and punctuality. This commitment to innovation and efficiency is what sets industry leaders apart.

Businesses must continually assess and respond to market changes, customer preferences, and technological advancements to maintain competitiveness. By recognizing the agility required for innovation and managing any significant disruptions effectively, companies can not only survive but thrive through a restructuring process.

Measuring Success and Adjusting the Turnaround Plan

To effectively navigate a business turnaround, it is imperative to track the right key performance indicators (KPIs) that not only reflect progress but also guide future decisions. This involves a meticulous assessment of financial health, operational efficiency, and market competitiveness.

Crucial financial KPIs include liquidity ratios, which provide insights into the company's ability to meet short-term liabilities, and profitability metrics, such as gross margin and net income, that indicate the organization's capacity to generate profits relative to its revenue and costs.

Operational KPIs, such as inventory turnover and production cycle times, shed light on the efficiency of business processes. These metrics are vital in identifying bottlenecks and streamlining operations to improve overall productivity.

In terms of market competitiveness, customer acquisition cost (CAC) and customer lifetime value (CLV) are essential metrics to evaluate marketing strategies and customer relationship management. A balance between sales generation and profit maximization is key to ensuring long-term viability.

Moreover, it's crucial to maintain flexibility in the restructuring plan. As illustrated by Pacific Steel's shift to reference-based pricing for healthcare after analyzing their insurance claims data, being adaptable to unexpected challenges and opportunities can lead to significant cost savings and improved operational performance. Similarly, IBL's diversified innovation portfolio demonstrates the importance of adaptability in sustaining growth during tumultuous times.

By setting SMART quarterly objectives, businesses can maintain focus on immediate goals while aligning efforts with the overarching strategy. This approach also ensures that progress is measurable and manageable, allowing for timely adjustments to the turnaround plan.

Real-world case studies underscore the importance of using data to inform decision-making. For instance, a steel-recycling company's strategic pivot to reference-based pricing was based on a thorough analysis of claims data, which revealed opportunities for cost savings.

In conclusion, the success of a business turnaround hinges on the careful selection and monitoring of relevant KPIs, the agility to adapt to new information, and the strategic use of data to inform decision-making. This holistic approach ensures that every aspect of the turnaround is geared towards achieving a sustainable competitive edge and long-term financial health.

Long-term Benefits of Turnaround Consulting

A turnaround consultant brings a wealth of expertise and an objective perspective that can be pivotal for companies facing financial or operational difficulties. For instance, the Ford Foundation recognized the need for change when their content management system (CMS) became cumbersome after years of use. By engaging with a digital engagement expert, they were able to revitalize their workflow to meet the increasing demand for new content, which enhanced their mission of fostering social change.

Similarly, a hotel company struggling with ineffective Google Ads campaigns sought the assistance of experts to lay a proper foundation for their advertising strategy. The incorporation of fundamental tools like Google Analytics and a meticulous keyword investigation led to a more robust Search/PPC Campaign, ultimately improving their booking rates.

These cases exemplify how consultants can guide companies through complex challenges to achieve long-term benefits. By bringing in a turnaround consultant, organizations can gain a reputation for being well-managed and profitable, which is essential in a period of economic recovery. With the right investments and technological enhancements, advised by a consultant, a company can become more agile, efficient, and better prepared for sustainable growth.

The role of a business consultant extends far beyond mere advice. As per expert commentary, a consultant's primary duties involve an in-depth assessment of a company's practices, interviewing clients, and providing recommendations based on financial modeling, industry trends, and thorough research. The development of business strategies and creation of key documents are also part of their critical role in steering a business towards success.

The importance of such consultancy is underscored by the increasing recognition of mentoring and coaching in the workplace. Statistics highlight the value of experienced professionals providing guidance to less experienced individuals, aiming to improve work performance and achieve career goals. A turnaround consultant, much like a mentor, acts as a role model, employing their profound experience and insights to navigate a company through its challenges towards its full potential.

Conclusion

A successful business turnaround requires a comprehensive approach that encompasses financial restructuring, community engagement, and operational enhancements. Companies like Guthrie Clinic and Stora Enso have demonstrated the effectiveness of this holistic strategy in revitalizing their fortunes.

Timing is key in a business turnaround, as acting promptly can prevent missed opportunities for recovery. Maximizing cash flow and reducing costs are pivotal strategies, with a focus on leveraging unique market positions and customer retention. Tracking key performance indicators (KPIs) provides critical insights for strategic decision-making.

Operational improvements play a vital role, with a focus on streamlining operations through technology and adapting to market changes. Measuring success and adjusting the turnaround plan is essential, with a flexible approach and setting SMART quarterly objectives.

Turnaround consulting offers long-term benefits, providing expertise and an objective perspective. Engaging with consultants can help companies achieve sustainable growth, become more agile and efficient, and gain a reputation for being well-managed and profitable.

In conclusion, a successful business turnaround requires a comprehensive approach that addresses financial restructuring, community engagement, and operational enhancements. Timing, maximizing cash flow, reducing costs, operational improvements, measuring success, and engaging consultants are key elements in navigating the challenging terrain of a business turnaround. By following these strategies, CFOs can achieve stability and growth with confidence.