Introduction

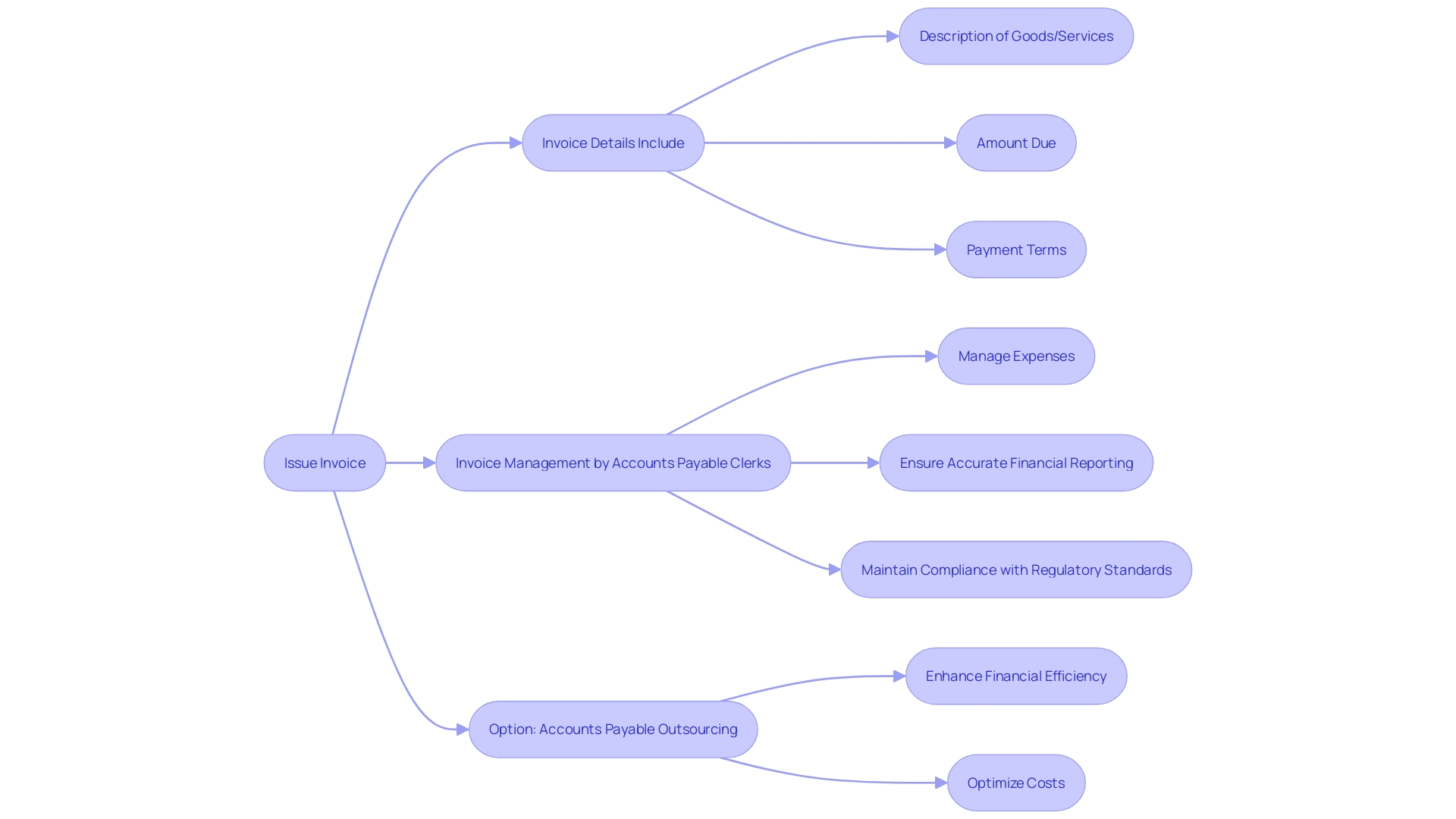

The pivot of any business transaction often hinges on the efficacy of invoice management—a systematic approach encapsulating the issuance of structured demands for payment. These detailed invoices form the backbone of accounts payable, outlining the description of delivered goods or services, the amount due, and specific payment terms. Particularly in smaller enterprises, the accounts payable clerk plays a pivotal role in financial stewardship, where their expertise contributes significantly to managing expenses and ensuring accurate financial reporting.

With the financial landscape requiring strict compliance and robust relationships with vendors, the meticulous processing of invoices by these clerks ensures that regulatory standards are met unfailingly. In this article, we will explore the benefits of accounts payable outsourcing and how it can enhance financial efficiency and accuracy while optimizing costs.

What is Accounts Payable Outsourcing?

The pivot of any business transaction often hinges on the efficacy of invoice management—a systematic approach encapsulating the issuance of structured demands for payment. These detailed invoices form the backbone of accounts payable, outlining the description of delivered goods or services, the amount due, and specific payment terms. Particularly in smaller enterprises, the accounts payable clerk plays a pivotal role in financial stewardship, where their expertise contributes significantly to managing expenses and ensuring accurate financial reporting.

A core specialism of these clerks entails the dexterous handling of invoice processing and payment, ensuring every transaction is accounted for with impeccable precision. With the financial landscape requiring strict compliance and robust relationships with vendors, the meticulous processing of invoices by these clerks ensures that regulatory standards are met unfailingly. Qualifications for thriving as an accounts payable clerk demand a nuanced understanding of financial transactions, and their position is critical in solidifying a firm's economic wellbeing.

In light of this integral role and the complexities involved, businesses are increasingly entrusting this function to specialized agencies through accounts payable outsourcing—transferring not just the tethered duties but also a segment of corporate well-being into the hands of experts equipped with the processes and tools to enhance financial efficiency and accuracy, all while optimizing costs.

Benefits of Accounts Payable Outsourcing

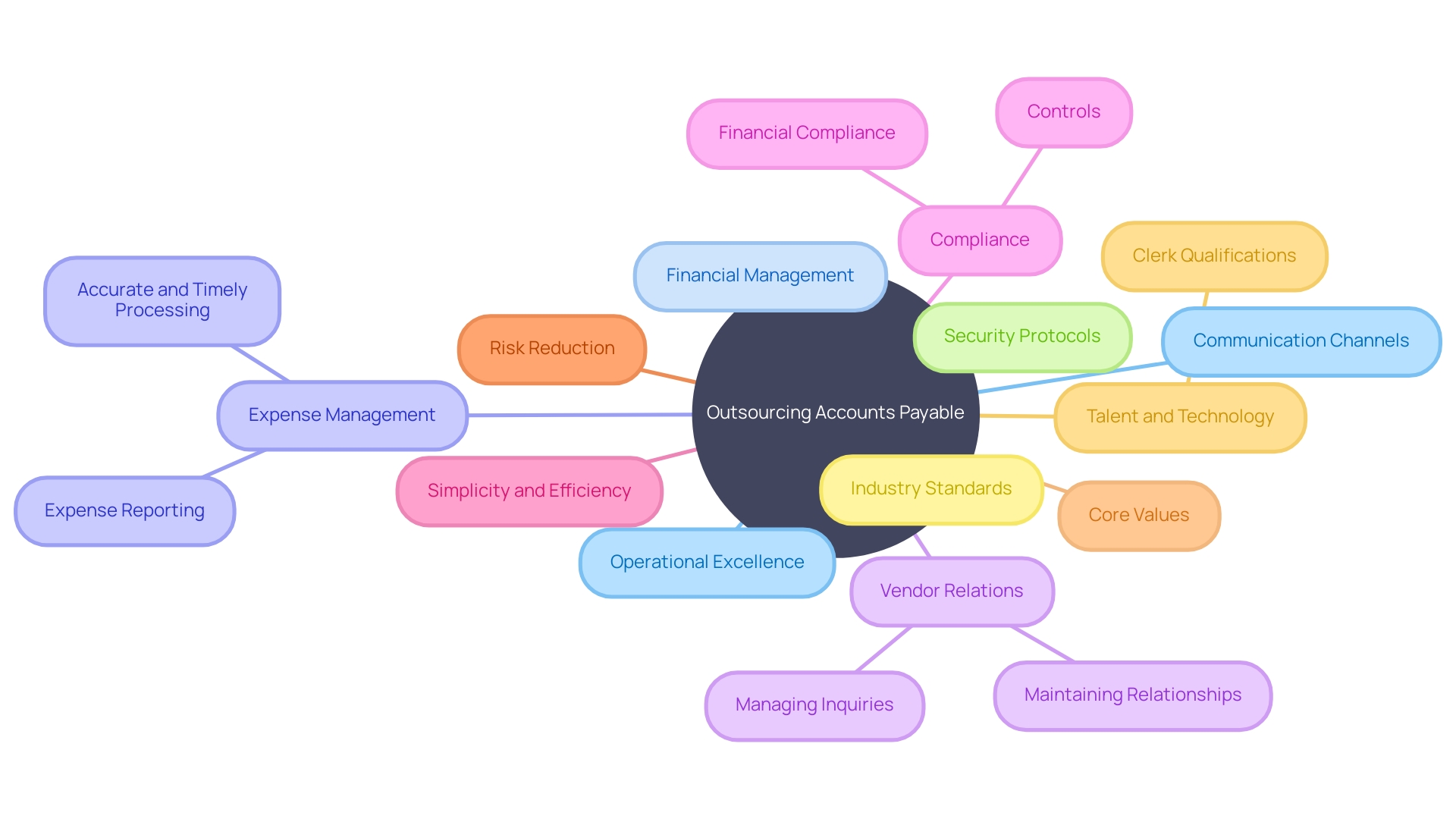

Outsourcing the accounts payable function is a strategic move that can steer a small business toward heightened operational efficiency, especially by tapping into the expertise of specialized agencies. The core of accounts payable work revolves around the meticulous processing and payment of vendor invoices, a task that, when done in-house, can eat up significant time and resources. By ensuring prompt and precise handling of invoice processing, an outsourced accounts payable clerk is crucial for efficient expense management and reporting, allowing the business to maintain a healthier cash flow and compliance with financial regulations.

Effective outsourcing involves a contractual agreement that clearly outlines the scope of work, responsibilities, and payment terms, which provides a firm foundation for an external agency to manage accounts payable processes seamlessly. This delegation brings about a multitude of benefits, including freeing up internal resources, providing scalability during seasonal or growth phases, and reinforcing financial controls by reducing the risk of errors and fraud.

In essence, the qualifications and role of an accounts payable clerk, whether in-house or outsourced, are fundamentally about safeguarding the financial well-being of the business. They play an integral part in managing vendor relationships, navigating inquiries, and ultimately ensuring that the small business stands on solid financial ground with a clear picture of its obligations and resources.

Cost-Effectiveness

Harnessing the strategic advantage of outsourcing, businesses can delegate the intricate tasks of accounts payable to third-party experts. This practice not only brings in efficiency through specialized, proven processes but also enables small businesses to pinpoint financial planning and stringent budget adherence. The rigorous attention to accurate and timely invoice processing by outsourced clerks is vital for maintaining solvent vendor relationships and ensuring adherence to financial compliance, which in turn fortifies overall financial health.

Outsourced accounts payable services stand as a testament to cost effectiveness, negating the capital outlay for advanced software and infrastructural upgrades, and mitigating the necessity for extensive training. Furthermore, these external specialists are exemplary in managing expense reporting and control, crucial for businesses to orchestrate a successful growth trajectory and long-term success.

Experienced Professionals

Harnessing the prowess of experienced accounts payable professionals can be a transformational strategy for businesses seeking operational excellence. Outsourcing this critical function to a team like Cantaxpro in Toronto means enlisting a dedicated group of experts who bring not only proficiency but a renowned reputation in financial management. This moves beyond mere data entry—to a holistic approach where every invoice is an opportunity to refine expense management, enhance vendor relations, and fortify the business against compliance issues.

Tailored solutions from Cantaxpro deliver simplicity and efficiency, reflecting the complexity of global payroll and local tax regulations. With their insight, the risk of costly errors is substantially reduced, allowing businesses to hone in on their core values while remaining confidently compliant.

Accurate processing of transactions is a non-negotiable in maintaining the financial health of a business, and with the rise of outsourcing, companies now have access to top-tier talent equipped with the latest software and technology, ensuring financial data not only meets but exceeds industry standards. Embracing a well-selected outsourcing partner, one with stringent security protocols and unambiguous communication channels, is pivotal in navigating the intricacies of accounts payable and beyond.

Transforming Costs from Hourly to Fixed

Incorporating an outsourced accounts payable framework into your business operations can substantially elevate your financial management efficiency. Specifically, this strategy introduces a nuanced fixed cost model, as opposed to the variable nature of in-house salary-related expenses. This shift to paying a third-party provider a predetermined fee for invoice and payment processing liberates businesses from the fluctuations in processing time and associated costs.

Consequently, companies benefit from heightened cost predictability, which is crucial for precise budgeting and financial forecasting, leading to a more stable financial environment. Furthermore, outsourcing offers access to specialized expertise, potentially leading to enhanced accuracy in financial transactions and the meeting of compliance requirements amidst diverse local tax laws and regulations. Businesses can thus mitigate risks of errors while simultaneously curtailing the possibility of incurring penalties, ensuring that financial operations are not only streamlined but also secure and compliant with pertinent regulations.

Shifting Roles to High-Value Tasks

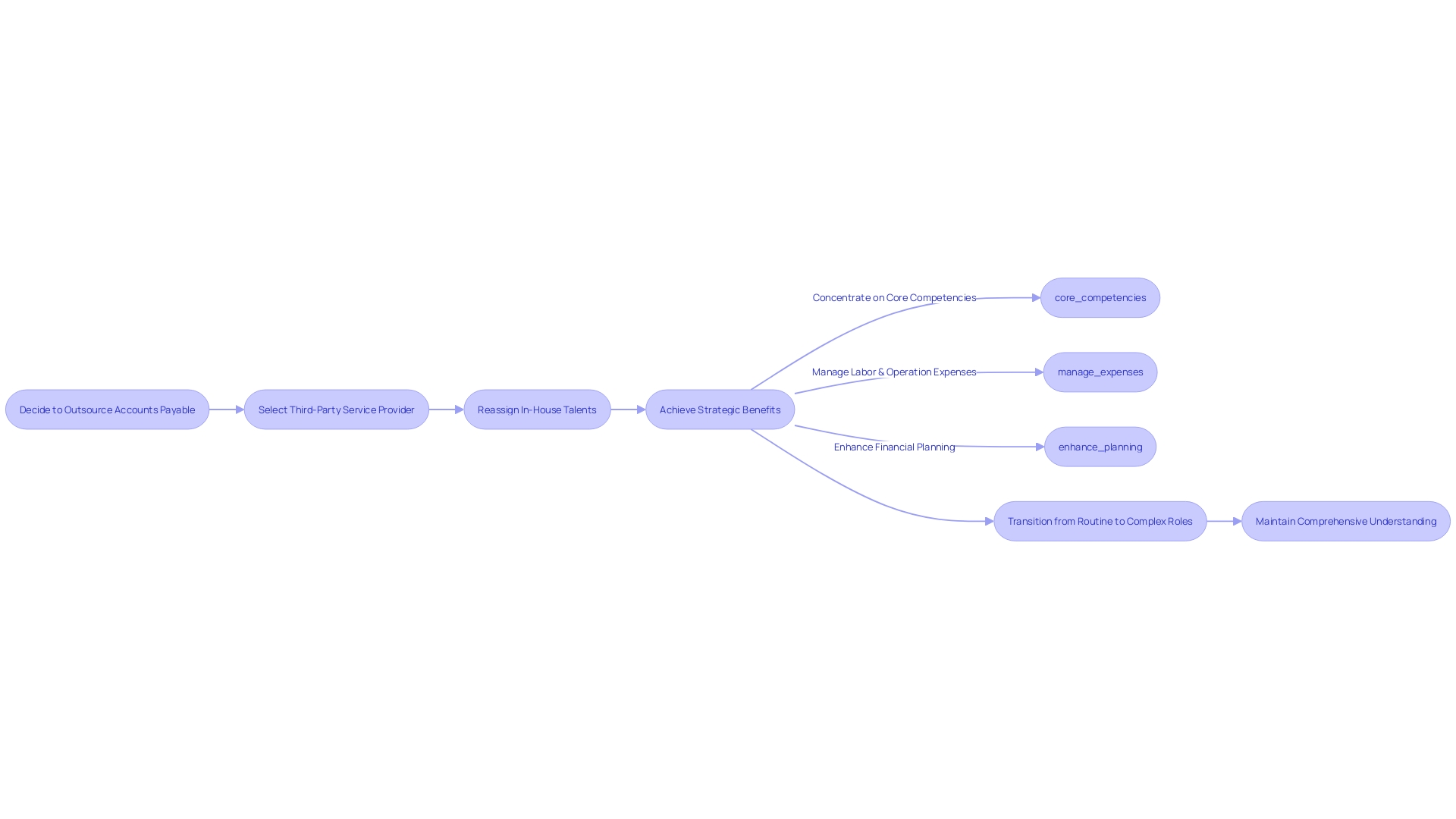

Embracing the practice of outsourcing can revolutionize a company's approach to expense management, especially in the realm of accounts payable. By engaging a third-party service provider, businesses are positioned to reassign their in-house talents to more strategic roles. This reallocation is particularly advantageous when it comes to financial operations, as it allows team members to devote their energies to scrutinizing fiscal data and pinpointing areas where cost-efficiencies can be made.

Outsourcing transcends mere cost-cutting; it is a strategic choice that aligns with a firm's goal to concentrate on core competencies while ensuring operational excellence. As stated by industry experts, "outsourcing is the practice of contracting specific business functions or processes to external service providers." It enables small businesses to maintain a competitive edge by managing labor and operation expenses more effectively, particularly when such tasks are allocated to regions with lower labor costs.

For accounts payable clerks, outsourcing can mean shifting from routine invoice processing to more nuanced roles such as overseeing financial compliance and managing vendor relationships.

Moreover, as companies seek to fortify their financial planning, a comprehensive understanding of accounts payable becomes crucial. It moves beyond simple transaction processing to encompass a vital contribution to the overall financial well-being of a business. Successful navigation in this field demands a blend of precise processing skills and an acute proficiency in managing financial transactions, both of which are integral for small businesses to sustain their competitive advantage and ensure long-term viability.

Eliminating the Need to Cover Absent Employees

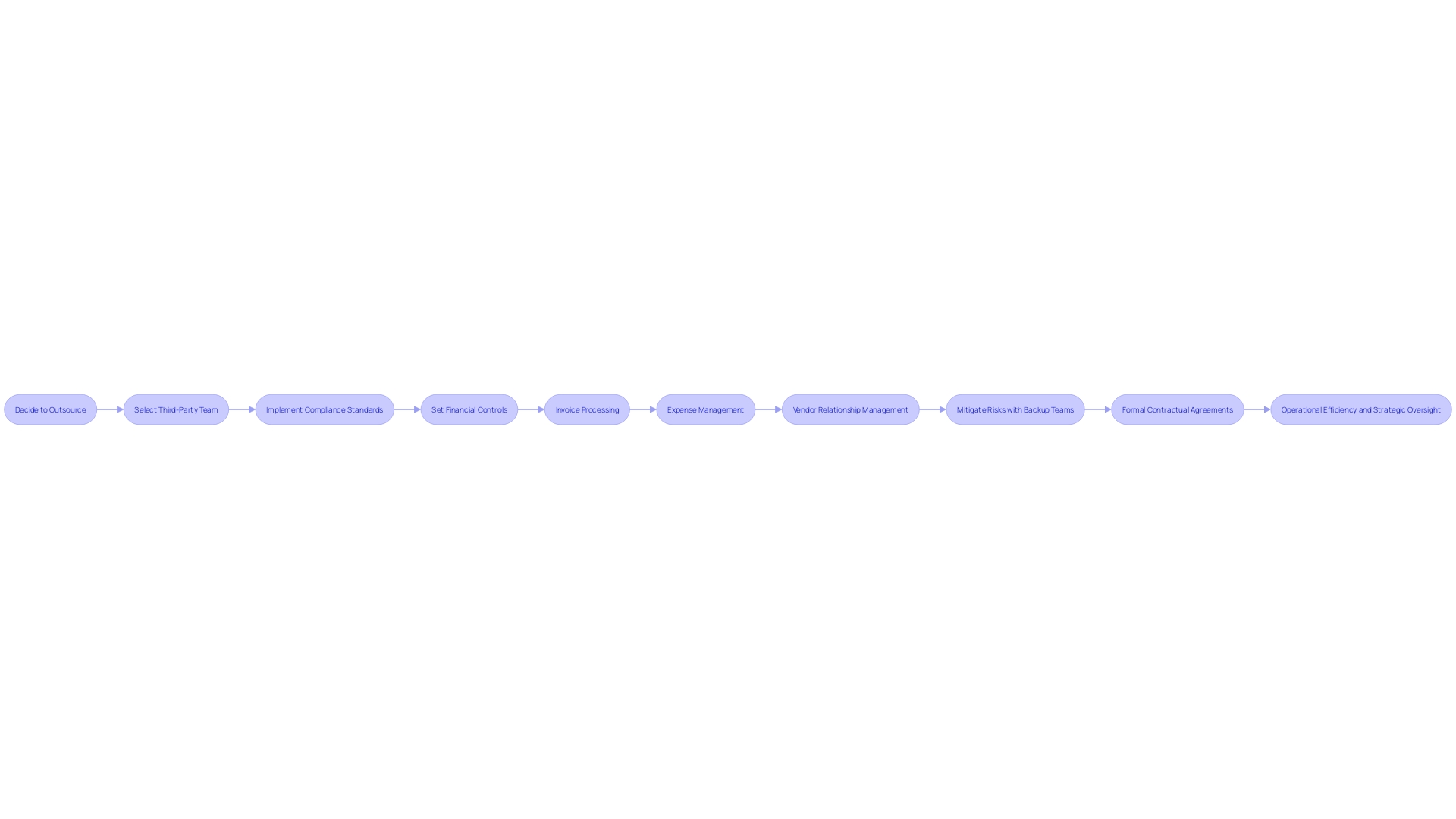

Outsourcing accounts payable transforms an essential financial function into a streamlined operation, armed with a third-party team of experts adept in invoice processing and expense management. By relying on an outsourcing partner, small businesses capitalize on meticulous compliance standards and robust financial controls typically championed by seasoned accounts payable clerks. These specialists not only manage invoices with precision but also nurture vendor relationships – a pillar of solid financial health.

Outsources mitigate risks linked with staff turnover or unplanned absences by deploying backup teams. They deftly shoulder the staffing demands, ensuring seamless operations without the burden of hiring temporary staff or redistributing your internal workforce. These strategic alliances are bolstered by formal contractual agreements, crystallizing the scope of work and payment minutiae for transparency and mutual benefit.

As a result, outsourcing accounts payable becomes a conduit for unwavering operational efficiency and strategic expense oversight, both vital to fostering the overall financial well-being of small businesses.

Challenges and Considerations

When considering outsourcing your accounts payable tasks, the role of an accounts payable clerk in expense management and financial compliance becomes critically pertinent. Such clerks ensure that invoicing is both timely and precise, a fundamental component in maintaining the financial health of a small business. Their expertise in managing vendor relationships and addressing inquiries efficiently can significantly impact both internal and external business relations.

With responsibilities encompassing the meticulous processing of financial transactions, an accounts payable clerk contributes vital support to the control and reduction of expenses. Their contributions uphold financial compliance and controls which are essential for the business's ability to navigate through the intricacies of fiscal regulations. Moreover, the qualifications of these clerks, grounded in their ability to perform these tasks faithfully and punctiliously, form the backbone of a successful financial strategy in any growing enterprise.

In light of this, it is clear that the skills of an experienced accounts payable clerk are invaluable for small businesses looking to sustainably scale and flourish.

Comparison with Accounts Payable Automation

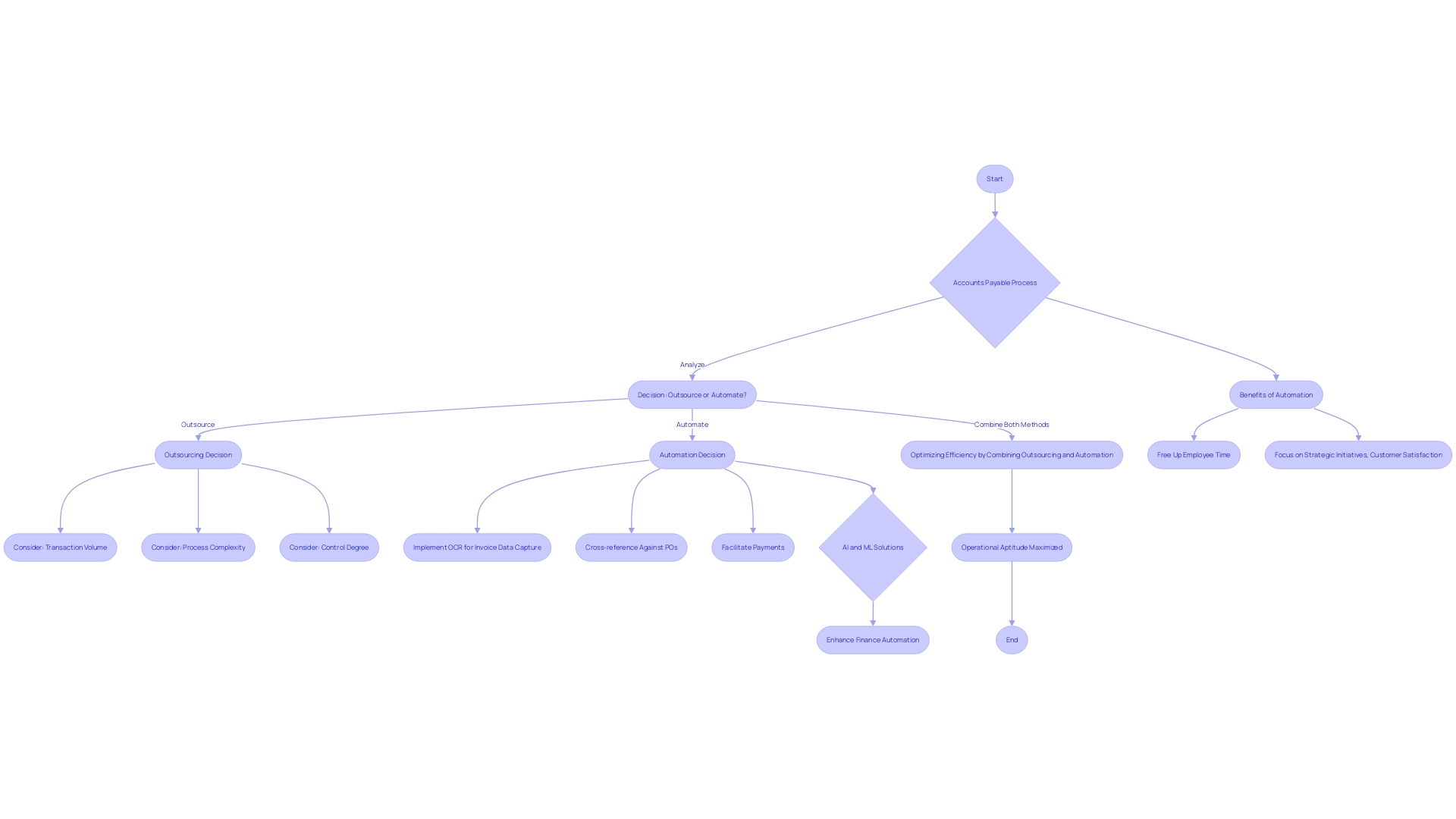

Optimizing the efficiency of the accounts payable process is an ongoing challenge for many organizations. Some may weigh the merits of accounts payable outsourcing against the rapid advancements in automation technology. Outsourcing entails entrusting your entire accounts payable workload to an external company, providing a hands-off approach that some businesses find advantageous.

However, the cutting-edge automation technology that is currently available offers an alternative that can revolutionize the way we handle accounts. Tools equipped with optical character recognition (OCR) can now automatically capture invoice data, cross-reference this against existing purchase orders, and even facilitate payments. Meanwhile, the buzz in financial circles, such as insights from ex-Fortune 100 auditor and System CEO, Shagun, emphasizes that while consumer finance relishes automation, corporate finance departments lag behind.

Notably, Accenture reports that an astounding 80% of finance operations could be automated, which would significantly liberate staff to engage in strategic initiatives, enhancing customer experiences, and more. Adopting artificial intelligence (AI) and machine learning (ML) solutions can be a game-changer, propelling finance automation from potential to reality. Navigating between outsourcing and employing automation entails a strategic evaluation of one's specific needs—contemplating the transaction volume, process complexity, and the desired degree of control.

Indeed, combining both methods might just result in the pinnacle of operational aptitude for the accounts payable process.

Conclusion

In conclusion, accounts payable outsourcing is a strategic move for small businesses to enhance financial efficiency, accuracy, and cost optimization. By entrusting invoice processing to specialized agencies, businesses can benefit from streamlined processes and expertise, freeing up internal resources and reinforcing financial controls.

Outsourcing accounts payable tasks offers cost-effectiveness by eliminating the need for software and infrastructure investments. It ensures accurate transactions, compliance with regulations, and strengthened vendor relationships.

Shifting from hourly to fixed costs provides cost predictability, precise budgeting, and access to specialized expertise for compliance with local tax laws.

Outsourcing allows businesses to reallocate in-house talents to strategic roles, improving expense management and fiscal data analysis. This focus on core competencies helps businesses maintain a competitive edge.

Eliminating the need to cover absent employees, outsourcing provides seamless operations without hiring temporary staff or redistributing the workforce, ensuring operational efficiency.

Considering the qualifications and role of accounts payable clerks is crucial for managing expenses and ensuring financial compliance, supporting sustainable growth.

While automation technology offers an alternative, combining outsourcing with automation can optimize the accounts payable process based on specific needs and process complexity.

In summary, accounts payable outsourcing revolutionizes financial management for small businesses, offering efficiency, accuracy, and cost optimization. By leveraging specialized expertise, businesses can focus on core competencies while ensuring financial health.