Introduction

Commercial due diligence consulting is an essential process that goes beyond financial audits, providing a comprehensive investigation into various aspects of a company. From examining financial health and legal risks to evaluating tax compliance and IT infrastructure, due diligence uncovers hidden issues that can impact investment viability. It's a crucial tool for CFOs and financial decision-makers in identifying growth opportunities and making informed investment decisions.

In this article, we will explore the components of the commercial due diligence process, the importance of market assessment and customer analysis, the evaluation of products or services, financial analysis, legal and regulatory review, the benefits of leveraging external expertise, successful case studies, and best practices for conducting commercial due diligence. By understanding these key aspects, businesses can navigate complex transactions and investments with confidence and precision.

The Importance of Making Informed Investment Decisions

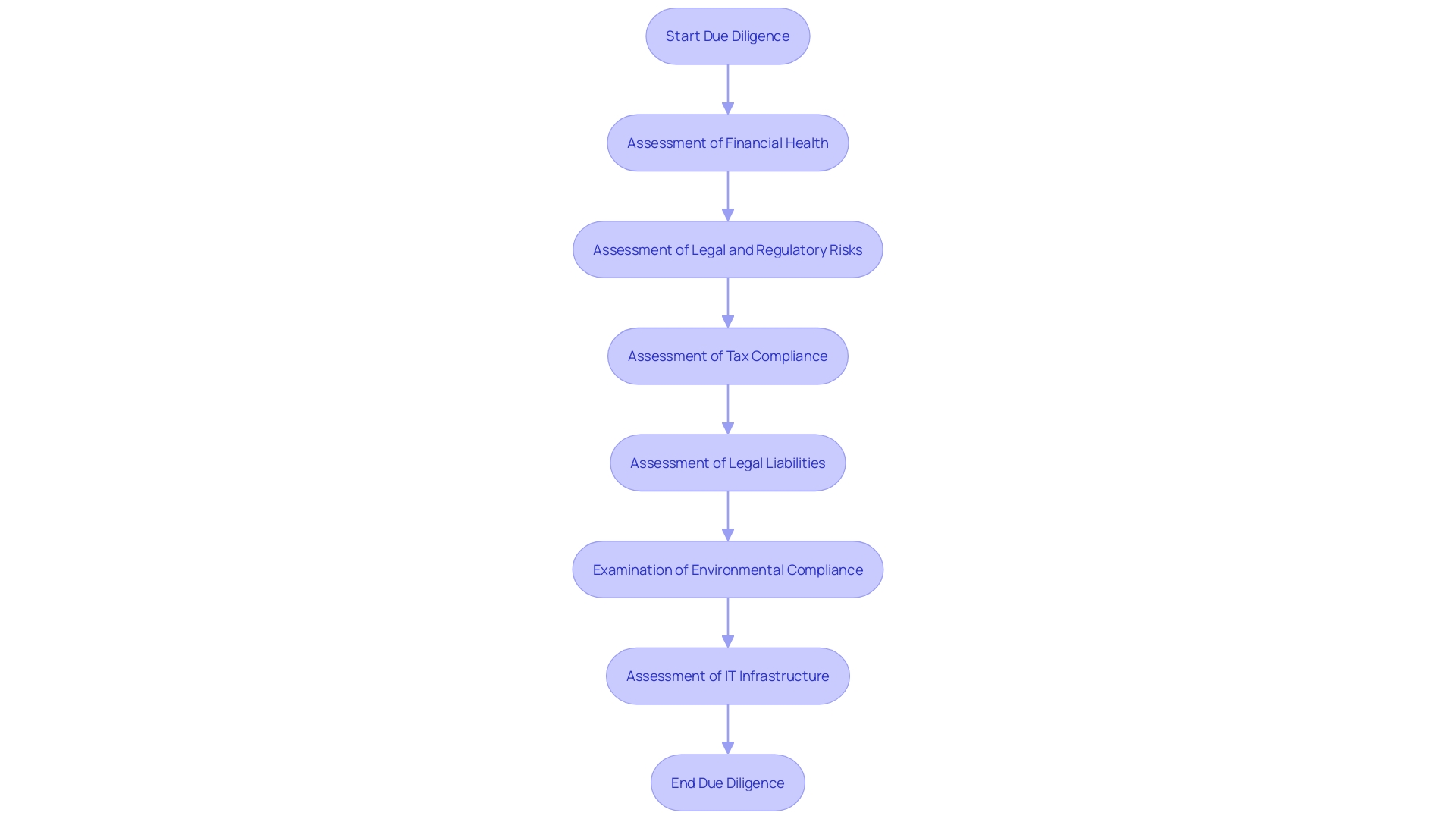

Commercial due diligence consulting is a multifaceted process that goes beyond mere financial audits, serving as an investigative tool that delves into various aspects of a company. This exploration encompasses a rigorous examination of financial health, including scrutinizing financial statements, assets, liabilities, cash flows, and future financial projections. Moreover, it involves a thorough assessment of legal and regulatory risks, which is particularly critical for industries subject to stringent regulations.

Diligence efforts also extend to ensuring that a company's tax affairs are in order, reviewing tax returns, past audits, and related agreements to confirm compliance with tax laws.

Legal liabilities are another pivotal area, where due diligence professionals evaluate existing partnerships, licensing agreements, and other contractual commitments to identify potential risks. This comprehensive approach to due diligence is designed to uncover any hidden issues that could impact the viability of an investment, from environmental compliance to the state of the company's IT infrastructure.

In the realm of commercial real estate, for instance, the office sector is experiencing a transformational phase. Adrian Rahimi, the chief investment officer for Tricera Capital, likens it to the disruption in the retail sector a decade ago. Despite the challenges, there is a resurgence on the horizon, with investment decisions in this sector increasingly being predicated on the availability of capital.

Rahimi's insights suggest that for those in wealth creation, opportunities in office and retail investments will arise as market conditions evolve.

The due diligence process is also crucial in unique investment situations such as Akiya purchases. A case study from Chiba Prefecture, Japan, illustrates the importance of understanding the full scope of a project, including costs and implications. In this instance, a client seeking a property away from Tokyo engaged in due diligence to identify suitable Akiya properties, underscoring the personalized nature of the process and its role in facilitating informed investment decisions.

Effective due diligence thus becomes a cornerstone for identifying growth opportunities and profitability, ensuring that businesses are well-equipped to navigate the complexities of investment landscapes and make decisions that align with their strategic objectives.

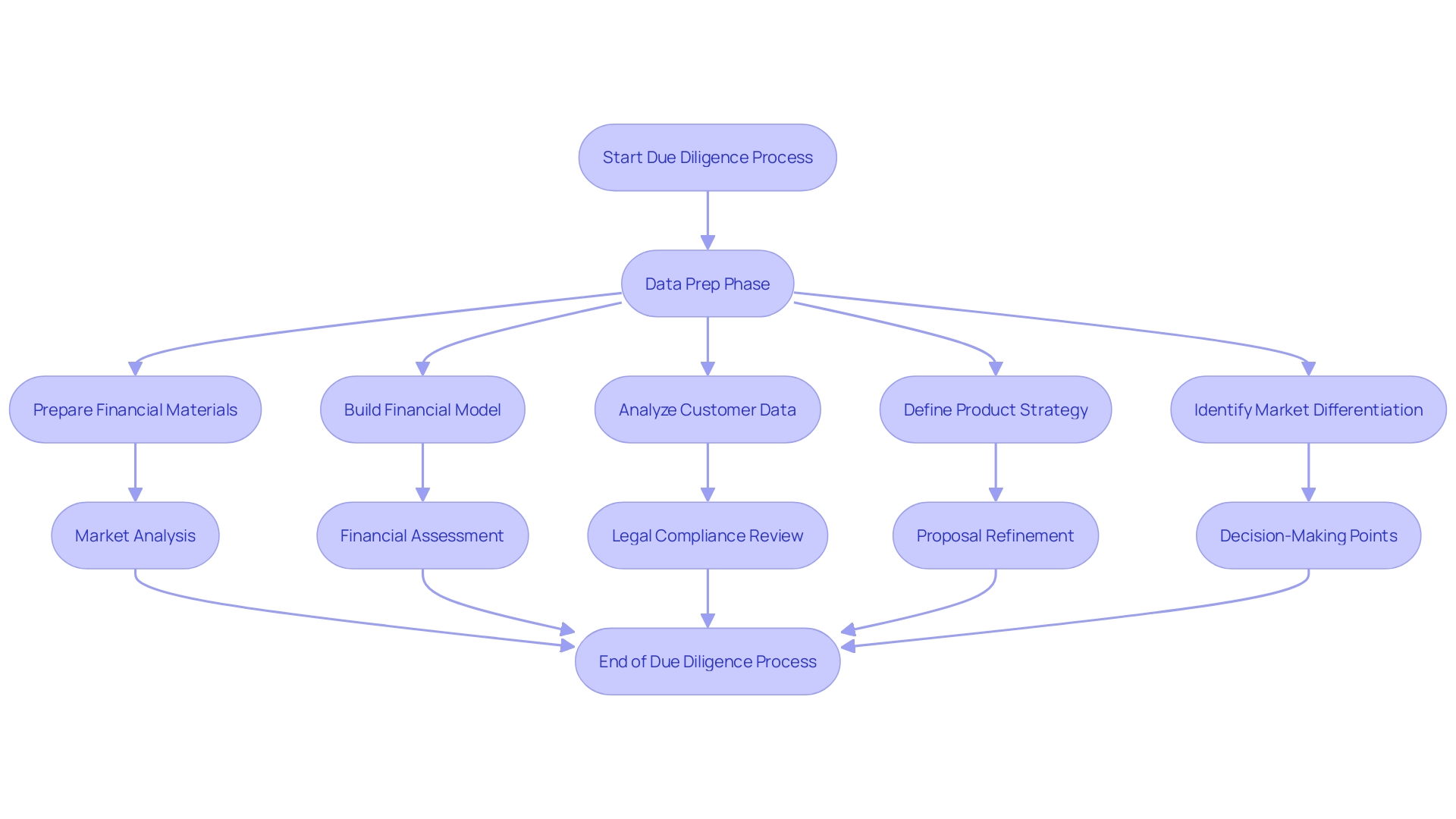

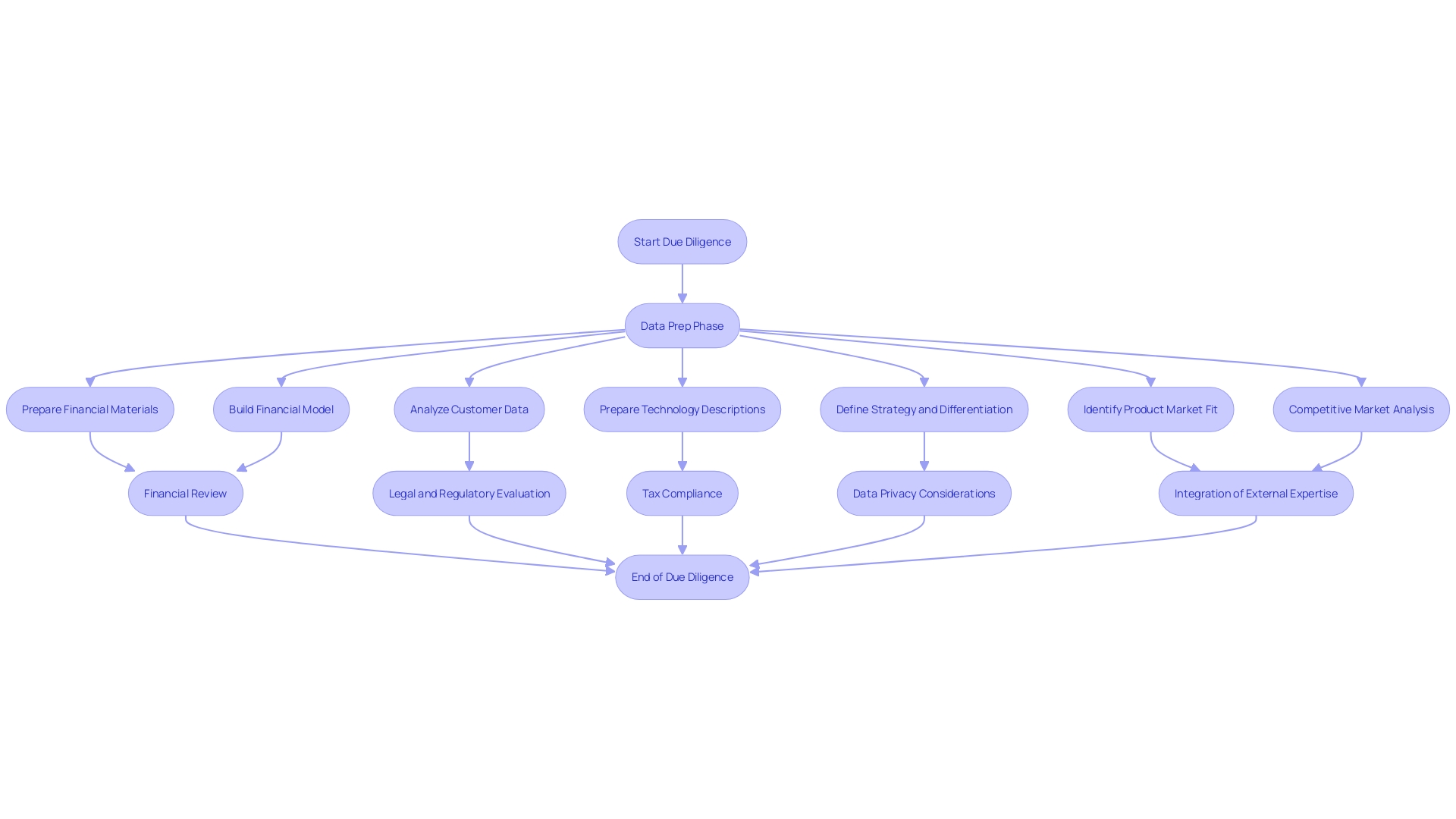

Components of the Commercial Due Diligence Process

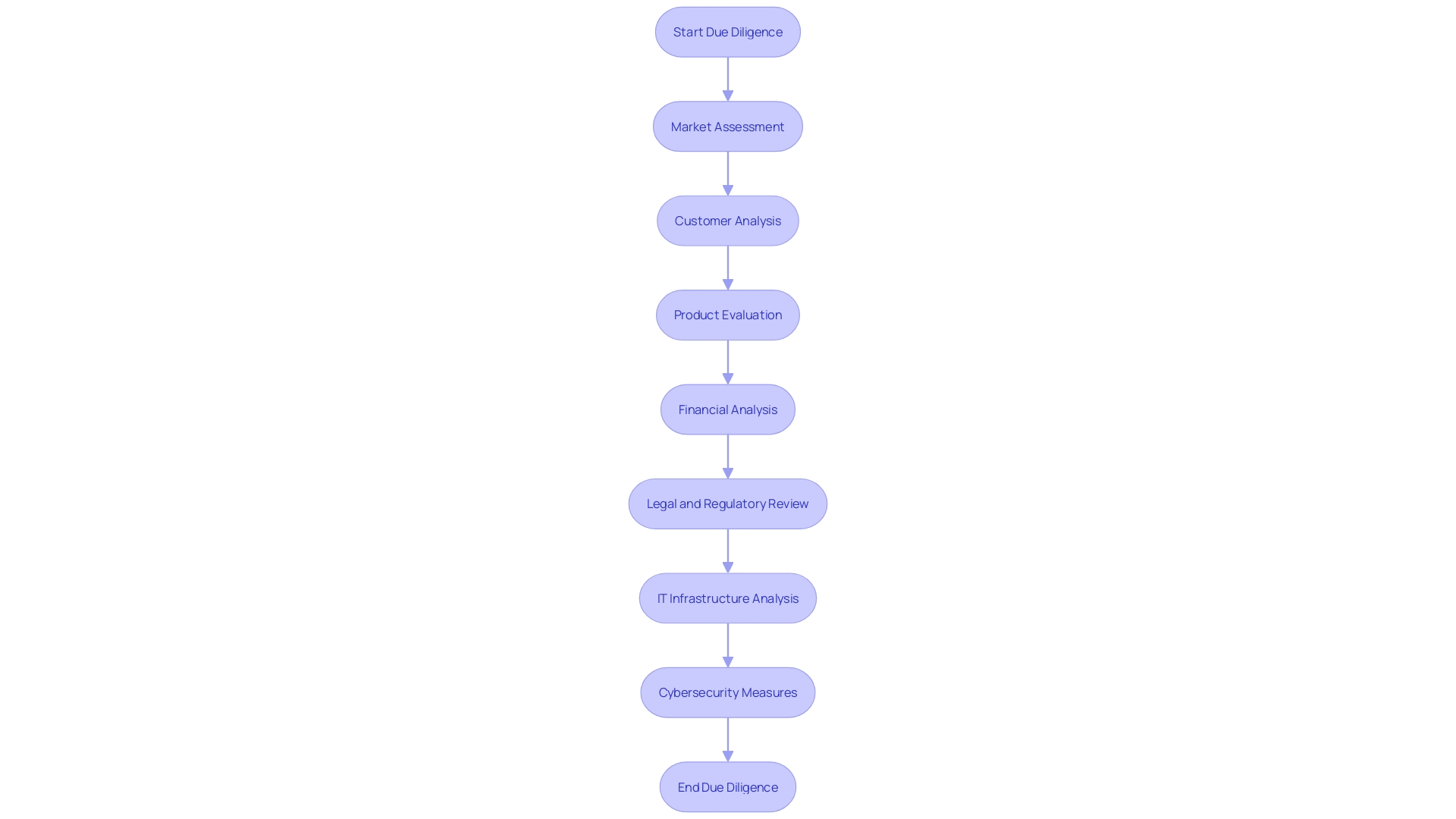

Conducting commercial due diligence is a multidimensional process that delves deep into the target company's ecosystem. This thorough investigation includes a market assessment to gauge the company's competitive landscape and customer analysis to understand the client base's dynamics. It also involves scrutinizing the product or service offerings to evaluate their standing and potential in the market, coupled with a meticulous financial analysis that examines financial statements, assets, liabilities, cash flows, and future projections.

A complete legal and regulatory review is also indispensable, particularly for entities operating within sectors that are subject to intense regulatory scrutiny. This review encompasses an examination of compliance with tax laws, including tax returns, past audits, and existing agreements, as well as an evaluation of legal liabilities, such as existing partnerships, licensing agreements, and intellectual property concerns, including patents and trademarks.

Furthermore, due diligence extends to analyzing a company's IT infrastructure and cybersecurity measures, ensuring that technological assets are robust and risks are mitigated. As stated by industry experts, "Due diligence is an investigation into the many different parts of a company. From adhering to environmental regulations to evaluating a company's entire IT infrastructure, good due diligence will uncover any risks that need to be addressed."

With the increasing focus on data-driven decision-making, organizations are leaning more on financial analytics tools to make informed, evidence-based choices. According to a 2022 S&P Global survey, about 69% of respondents indicated that most, if not all, of their decisions are driven by data. However, as financial analytics involves handling sensitive data, security concerns arise, especially with the growing adoption of cloud storage, which accentuates the risks of data breaches and cyberattacks.

The due diligence process is not only about identifying risks but also about understanding the strategic value and growth potential of the business in question. For instance, the recent marketing of Signature Bank's $33 billion Commercial Real Estate loan portfolio, primarily composed of multifamily properties in New York City, underscores the importance of thorough due diligence in high-stakes financial transactions.

In conclusion, a comprehensive due diligence process is pivotal for uncovering risks and opportunities, thereby aiding CFOs and financial decision-makers in navigating complex transactions and investments with confidence and precision.

Market Assessment

Understanding the intricacies of the target market is not merely about recognizing its current size or growth trajectory; it involves a multifaceted analysis that encapsulates competitive forces, customer demographics, and evolving trends. A robust market assessment empowers businesses to pinpoint lucrative opportunities while staying vigilant about potential risks, thus enabling strategic investment decisions that are well-informed.

For instance, consider the example of the California utilities market, where only a handful of companies manage the risk of catastrophic wildfires. Their operational strategies and the public perception of their risk management have significant repercussions on their financial health and require continuous monitoring and adaptation. Such insights are imperative for businesses operating in high-stakes environments where market conditions and risk profiles can shift rapidly.

Market research is pivotal from the inception of a business idea—it's the backbone that supports risk mitigation strategies. By gathering extensive demographic data, companies can gauge the demand for their products or services and estimate the market size, which are crucial steps in validating the business concept. Additionally, understanding the structure of the market, such as the different segments within eCommerce, allows businesses to tailor their strategies to specific niches, enhancing their competitive edge.

The financial sector also provides a clear demonstration of the importance of market dynamics. Hedge funds, for example, must navigate through unpredictable variables that dominate market sentiment, requiring a profound understanding of both dull and exciting market trends. Similarly, investors are constantly on the lookout for business ideas that are not only innovative but also address a genuine need, underscoring the value of a deep market understanding.

To encapsulate, a detailed market assessment is a critical step for businesses to navigate complex market landscapes effectively. It serves as a strategic tool that aids in recognizing the nuances of customer needs, competitive differentiation, and industry trends, all of which are essential for making informed investment decisions.

Customer Analysis

Understanding the nuances of customer engagement is pivotal for any business aiming to thrive in today's dynamic market. Delving into the psyche of your customer base to discern their needs, preferences, and purchasing patterns not only aids in identifying key segments for targeted marketing but also in evaluating customer loyalty and the potential for augmenting business operations. For example, businesses may initially concentrate on optimizing sales processes but should subsequently pivot to strategies that increase customer base penetration.

Key to this is recognizing that the customer experience transcends the mere act of purchasing. It is an emotional journey that begins the moment a customer interacts with your product or service across various channels. The quality of this experience can significantly influence customer retention and loyalty.

In a market influenced by socio-cultural, economic, and technological shifts, leveraging these insights to deliver superior customer experiences is essential.

A report titled 'The Emergence of Automation and AI for Customer Service' underscores the transformative power of AI and automation in enhancing customer service. The integration of chatbots, speech recognition, and machine learning not only streamlines customer interactions but also fosters a more efficient and positive experience. As Anne Bakker of Enreach AI points out, the profound impact of AI on business operations is nowhere more evident than in its ability to elevate customer service standards.

Furthermore, the growing trend of cross-border sales among small and micro-businesses, as highlighted in Visa's Global Back to Business Study, indicates a move towards a more global marketplace. The adoption of new technologies, such as digital payment solutions, is facilitating this shift, with a majority of consumers signaling an increased reliance on digital transactions in the coming year.

To capitalize on these trends, it's crucial for businesses to conduct thorough market research. Understanding demographic data such as age, wealth, family, and interests, helps in assessing the demand for products or services and the size of the potential market. Addressing these fundamental questions is a cornerstone of strategic planning, enabling businesses to navigate the evolving landscape with confidence and precision.

Product or Service Evaluation

Delving into the core of a business's offerings is more than just scratching the surface of product quality—it's an intricate dance with market dynamics and consumer perceptions. A product's quality isn't merely a checklist of features; it's an ever-evolving standard that hinges on the delicate balance between excellence and cost, as encapsulated by the ISO 9000 standard. It's about aligning with the inherent characteristics that fulfill customer requirements, acknowledging that these needs are not static, but rather a reflection of the market's pulse.

The notion of perceived quality takes us deeper into the consumer's psyche, where the physical and technical traits of a product are weighed by potential users. This subjective judgment, influenced by societal factors, underscores the importance of understanding not only the product itself but also the consumer's interpretation of it.

In the world of venture capital, Emmet King's focus on AI-driven startups demonstrates the relevance of distinctive quality in products that address specific needs, particularly in industries ripe for innovation like FinTech and healthcare. The quest for product/market fit, as highlighted by the insights of Rahul Vohra, further emphasizes the significance of a product resonating deeply with its user base, with the threshold of 40% 'very disappointed' users being a telling metric of a product's indispensability.

To navigate the expansive data landscape, CFOs must employ a multifaceted approach that encompasses quantitative data such as sales metrics, as well as qualitative insights from customer feedback. The aim is to carve out a niche where the business's offerings not only meet but exceed market expectations, leveraging unique qualities that differentiate them from the competition. This requires a deep dive into market size, demand, economic indicators, and location data to ensure that the offerings are crafted to resonate with the target demographic and secure a competitive edge in the marketplace.

Financial Analysis

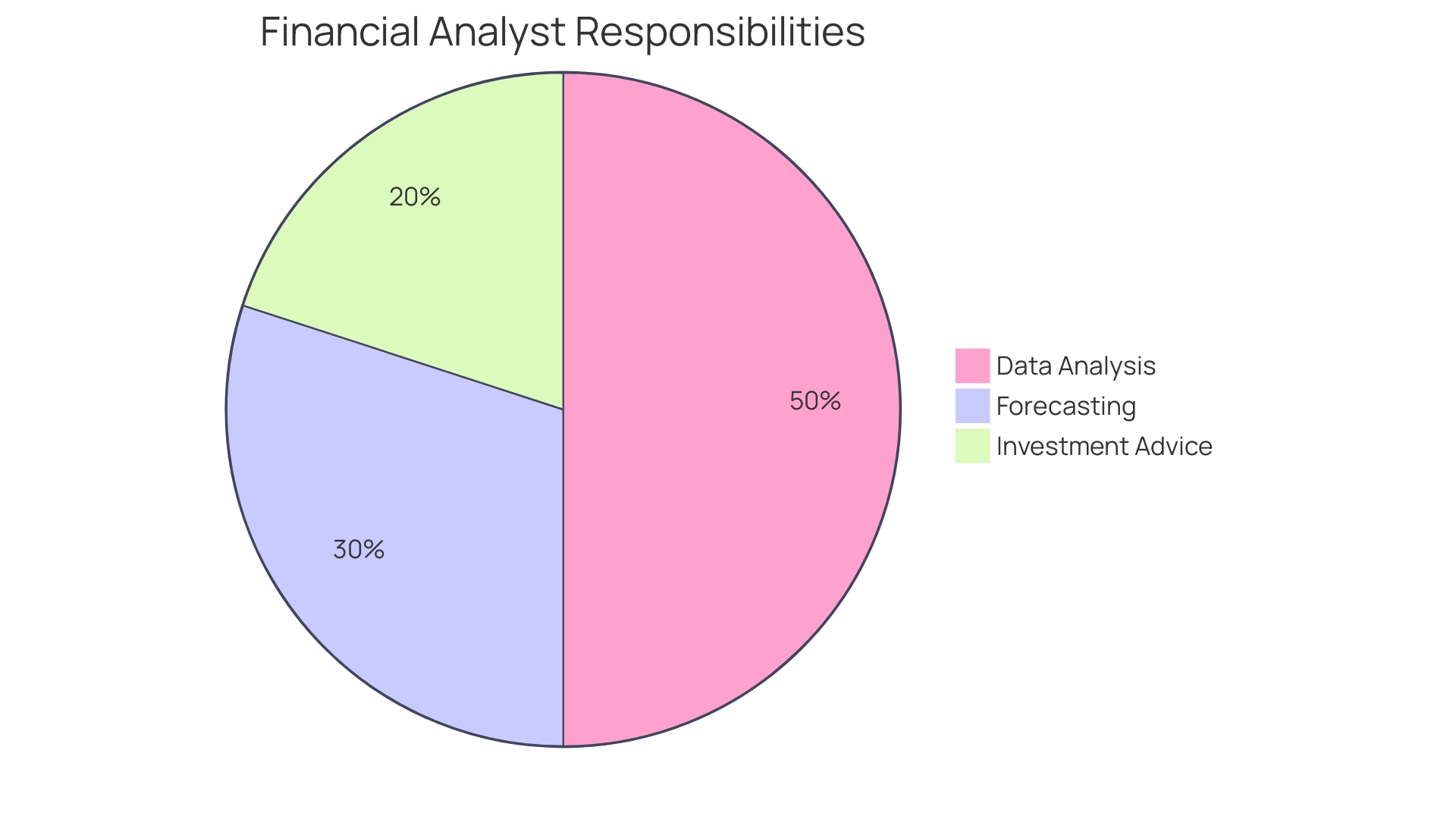

A financial analyst is integral to a company's financial well-being and strategic roadmap. They conduct thorough analysis of financial data and market trends to provide businesses with the insights needed to overcome financial adversity and seize investment opportunities. Tasked with examining financial statements, market indicators, and economic conditions, analysts gain a deep understanding of a business's fiscal status.

They delve into balance sheets, income statements, and cash flow statements to evaluate profitability, liquidity, and solvency, and to forecast future financial performance.

Cash flow analysis is particularly crucial, as it encompasses all cash inflows and outflows, revealing whether the company is self-sustaining or dependent on external financing. This understanding of cash management speaks volumes about a company's operational efficiency and fiscal health. Furthermore, the analysis of changes in equity, or the statement of retained earnings, offers insights into the financial decisions affecting shareholder value.

Understanding a company's dividend potential is also critical. It reflects the company's capability to turn a profit and distribute dividends to shareholders, a key concern for income-focused investors. Analysts assess a company's current financial performance against historical data and industry standards, including intangible factors like management quality and competitive positioning, to predict future dividends.

Real-world examples underscore the importance of financial analysis. Sirius Technologies, aiming to provide quality financial services to underserved markets, adopted a platform to optimize software development life cycles, driving BFSI sector transformation. The platform facilitated cost reduction and service reach expansion.

Similarly, Your Mates Brewery in Australia realized significant savings by streamlining inventory management and scheduling, demonstrating operational efficiency and sound financial management.

In today's data-driven business landscape, organizations are increasingly relying on financial analytics to guide decision-making. A study by S&P Global in 2022 indicated that 25% of surveyed companies base nearly all decisions on data, while 44% said most are data-driven. This shift towards evidence-based decision-making underscores the diminishing reliance on subjective judgment and the growing importance of financial analysis.

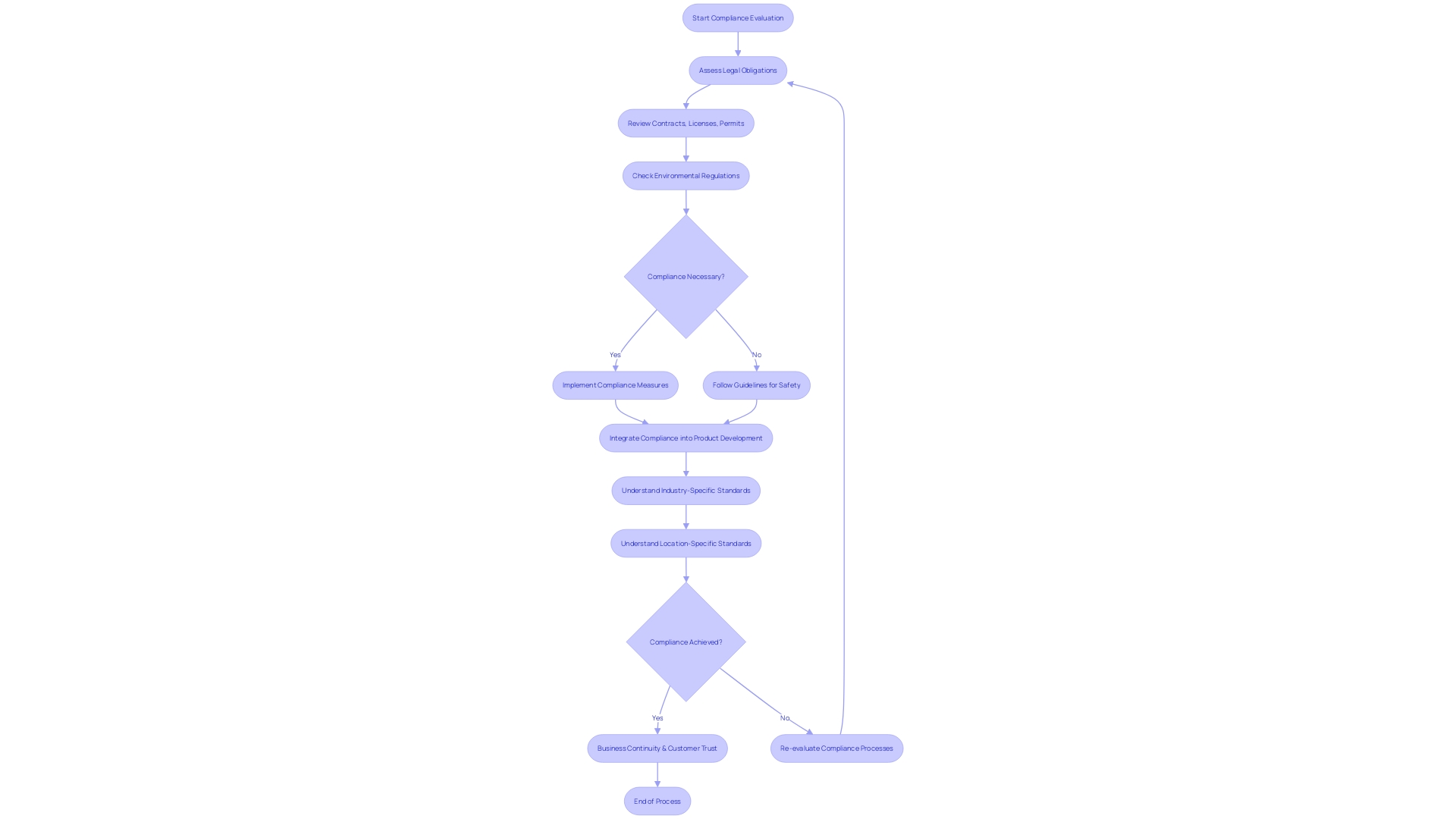

Legal and Regulatory Review

Ensuring that your business adheres to legal and regulatory standards is an essential step in safeguarding its future. A meticulous evaluation of the company’s legal obligations—including contracts, licenses, permits, and environmental regulations—is fundamental to maintain operational integrity and avoid future legal entanglements. For instance, the Environmental Protection Agency (EPA) mandates comprehensive guidelines that influence a wide array of industries, not limited to manufacturing or construction, but extending to seemingly innocuous sectors such as dry cleaning and house painting.

The rules encompass air pollution, land use, waste management, and water quality, to name a few.

Non-compliance is not an option, as it can result in severe penalties. However, adherence to these regulations does more than just avoid fines—it ensures consumer safety, upholds environmental integrity, and fosters trust among stakeholders and customers. By integrating compliance into the product development lifecycle, businesses demonstrate a commitment to quality, satisfaction, and user safety.

This is especially true in the digital realm, where consumer data protection and privacy laws are stringent.

In today’s highly regulated business environment, understanding the 'what, why, and how' of compliance is paramount. Various compliance standards may apply depending on your industry and location. The ramifications of non-compliance are significant, affecting not just your revenue and reputation, but also the health and safety of employees and the public.

For example, in the event of a traffic incident involving a company vehicle, the business could be held liable for any resultant damages or legal fees, highlighting the importance of proper insurance coverage and adherence to traffic laws.

A proactive approach to compliance, informed by a clear understanding of all applicable regulations, can transform what might seem like bureaucratic hurdles into a robust framework for ethical and sustainable business practices.

The Benefits of Leveraging External Expertise

Tapping into commercial due diligence consulting can greatly enhance a business's ability to navigate complex market landscapes. These consultants are not only a reservoir of industry-specific knowledge and expertise but also serve as a bastion of objectivity during critical assessments. Their role is pivotal in unveiling hidden risks, ensuring a company's compliance with intricate regulations, and presenting action plans grounded on a foundation of industry best practices and benchmarks.

For instance, when De Grandpré Chait, a Canadian law firm specializing in cryptocurrency cases, grappled with the intricacies of transactions outside standard exchanges, they sought the support of Chainalysis. The software's high-quality data and user-friendly interface transformed their approach to complex cases, underscoring the value of specialized external expertise. Similarly, Boerse Stuttgart Group, a stalwart in Germany's financial market, leveraged Chainalysis to navigate the volatile crypto space, gaining invaluable insights for AML compliance and strategic decision-making.

These case studies highlight the multifaceted role of consultants, who can offer a breadth of services from sales strategies and project management to IT and financial management. The reliance on such expertise is crucial, as the due diligence process is not merely a financial audit but an in-depth investigation into legal, tax, and IT infrastructures of a company. With statistics showing that a mere 0.91 percent of startups receive funding from angel investors and an even smaller 0.05 percent from venture capital, the strategic input from consultants is often the linchpin for a company's successful navigation of financial waters.

In essence, consultants bring to the table a wealth of experience and a proven track record of guiding companies through complex regulatory webs and market conditions, often acting as the unseen hand steering businesses toward sustainable growth and compliance.

Case Study: Successful Application of Commercial Due Diligence

Amidst the complex landscape of mergers and acquisitions, a manufacturing company seeking to augment its market share through the acquisition of a competitor embarked on a crucial due diligence journey. Engaging a specialized consulting firm, they delved into the intricacies of market trends, consumer behavior, and the competitive milieu. The firm meticulously scrutinized the target's product mix, financial health, and adherence to legal standards.

Informed by this thorough analysis, they proposed tactical refinements in the acquirer's operational tactics, pricing models, and product lineup. This strategic foresight propelled the manufacturing company not only to consummate the acquisition but also to consolidate its market dominance while harnessing cost efficiencies in operations. The endeavor echoes the sentiment that post-merger integration is the fulcrum upon which the success of M&A pivots, addressing the multifaceted challenges such as disparate corporate cultures, varied employee benefits, and the amalgamation of divergent management systems.

Indeed, the experience of Last Arrow Manufacturing, with over a decade in metal fabrication and a commitment to low-risk, superior-quality services, underscores the importance of expertise and agility in such endeavors. Moreover, the narrative of AirBoss of America Corp. contemplating strategic maneuvers including acquisitions and divestitures, without a predefined timeline, encapsulates the dynamic nature of the industry. The imperative for medical devices to hit the market effectively without excessive initial complexity illuminates the need for a scalable supply chain, a sentiment echoed by industry veterans who emphasize the necessity of experience in navigating the multifarious healthcare landscape, from regulatory intricacies to payer dynamics.

As statistics from past M&A ventures reveal, a staggering 80% of such transactions falter, underscoring the fact that the real test begins once the deal is sealed. This case study serves as a testament to the vitality of swift and strategic action in the face of change, a lesson that resonates with companies across the spectrum seeking to thrive through mergers and acquisitions.

Mitigating Risks and Identifying Opportunities

Commercial due diligence consulting transcends mere investment advice; it's an invaluable tool for businesses to navigate the treacherous waters of market uncertainty. This process involves a meticulous investigation into not only a company's financial health—scrutinizing financial statements, assets, debts, cash flows, and projections—but also a thorough assessment of legal and regulatory risks, which is particularly critical in heavily-regulated industries.

For instance, the Boerse Stuttgart Group, a stalwart in Germany's financial markets, ventured into the unpredictable realm of cryptocurrency. To maintain a highly regulated platform in a notoriously volatile market, they sought the expertise of Chainalysis. The collaboration provided Boerse Stuttgart with comprehensive data enabling precise decision-making, essential for compliance and Anti-Money Laundering (AML) purposes, which allowed them to strategically list tokens and select jurisdictions.

Similarly, in the dynamic field of telehealth, Lemonaid Health leveraged consulting services to overcome challenges in market penetration and growth. With each service carrying unique customer acquisition costs and lifetime values, their paid media strategy was complex and inefficient. Consulting services helped streamline these processes, enabling Lemonaid Health to focus on expansion and operational enhancement.

Moreover, amidst financial strains exacerbated by the pandemic, inflation, and staffing shortages, healthcare organizations have increasingly turned to consulting firms. These firms offer more than just financial advice; they provide strategies to navigate decreased revenues and increased expenses. The 2020 Financial Improvement Consulting report by KLAS highlights how consulting firms have been instrumental in guiding healthcare organizations through financial adversity.

In conclusion, engaging with commercial due diligence consultants offers businesses the crucial ability to identify both risks and opportunities. Whether it's understanding the implications of regulatory changes, market volatility, or competitive threats, or recognizing chances for growth and operational advancements, consulting services empower businesses to make informed decisions and thrive even in the face of market fluctuations.

Best Practices for Conducting Commercial Due Diligence

Commercial due diligence transcends a mere financial audit; it's an investigative deep dive into a business's multifaceted aspects, including adherence to environmental regulations and an in-depth evaluation of the IT infrastructure. The process demands meticulous research and data-driven analysis, where financial statements, assets, liabilities, cash flows, and projections are scrutinized. Legal and regulatory risks are assessed, a task of particular importance in industries under stringent regulation.

Tax compliance is verified through examination of tax returns, audits, and agreements, while a company's legal liabilities, such as partnerships and licensing agreements, are also carefully evaluated. Intellectual property, including patents, copyrights, trademarks, and brand value, is subject to thorough review to prevent any future legal complications.

A comprehensive approach includes assessing IT infrastructure and cybersecurity risks, crucial in an era where digital presence is inseparable from a company's valuation. Engaging with external experts and stakeholders, and fostering a collaborative environment, is pivotal, as illustrated by interdisciplinary projects that combine expertise from various domains for enhanced outcomes. Regular communication and transparent feedback mechanisms between the consulting firm and the business are imperative to address emerging concerns throughout the due diligence process and to ensure that all findings are fully leveraged.

This extensive process, while daunting, is vital and should not be rushed. Allocating sufficient resources and time is necessary for due diligence to be thorough and effective. As evidenced by recent shifts in commercial real estate investments and the evolving office sector, the ability to identify and act on opportunities depends significantly on the quality of due diligence conducted.

Common Pitfalls to Avoid in Due Diligence

Navigating the complex terrain of commercial due diligence demands a meticulous approach, recognizing that the process transcends mere financial scrutiny. It's an exhaustive investigation that requires an in-depth examination of a company's compliance with environmental regulations, IT infrastructure integrity, and legal liabilities, ensuring that all potential risks are identified and addressed. A comprehensive financial review is only the beginning; it involves a detailed analysis of financial statements, assets, liabilities, cash flows, and projections.

Furthermore, the due diligence process must also encompass an evaluation of legal and regulatory risks, which are particularly crucial for industries subject to stringent regulations. Tax compliance is another critical aspect, requiring a thorough review of tax returns, audits, and agreements.

To sidestep the pitfalls that can compromise the due diligence process, businesses must avoid reliance on partial or inaccurate data. For instance, in the world of cryptocurrency, where regulatory landscapes are well-defined, founders must ensure they are fully compliant with established rulebooks. This adherence to regulation is not just a matter of legal necessity but also a strategic approach for sustainable growth.

Another common oversight is the failure to appreciate the dynamic nature of the market. An example of this is observed in the commercial real estate sector, where office spaces are undergoing a significant transformation, paralleling the disruption experienced by retail a decade ago. Investors like Adrian Rahimi of Tricera Capital in Miami emphasize the importance of adapting to these shifts and recognizing the potential in new opportunities, such as the office and retail sectors.

The integration of external expertise is also paramount. As observed in the case of utility companies in California, where the risk of catastrophic wildfires has surged, understanding the interplay between safety standards, economic trade-offs, and reputational risks requires a nuanced perspective that often benefits from specialized knowledge.

In essence, successful commercial due diligence is a multifaceted endeavor that demands a comprehensive and well-informed approach. It's about ensuring uptime and security in data services, as well as guaranteeing that data privacy is upheld in accordance with regulatory standards. By diligently avoiding common pitfalls and tapping into external expertise, businesses can navigate through the due diligence process effectively, laying the groundwork for informed decision-making and strategic growth.

Conclusion

In conclusion, commercial due diligence consulting is essential for CFOs and financial decision-makers. It goes beyond financial audits, exploring various aspects of a company such as financial health, legal and regulatory risks, tax compliance, and IT infrastructure. By leveraging external expertise, businesses can navigate complex market landscapes with confidence and precision.

Market assessment and customer analysis are crucial components of the due diligence process. Understanding the competitive landscape, customer dynamics, and evolving trends empowers businesses to identify opportunities and risks. Evaluating products or services, conducting financial analysis, and reviewing legal and regulatory compliance are also essential.

Engaging commercial due diligence consultants provides industry-specific knowledge, objectivity, and insights into hidden risks and best practices. Successful case studies demonstrate the value of external expertise in guiding businesses through transactions and investments.

To navigate due diligence successfully, businesses must avoid common pitfalls such as relying on partial or inaccurate data, underestimating market dynamics, and neglecting external expertise. Thorough research, data-driven analysis, collaboration, and sufficient resources and time allocation are best practices for conducting due diligence.

In summary, commercial due diligence consulting enables CFOs and financial decision-makers to identify growth opportunities, mitigate risks, and make informed investment decisions. By conducting a comprehensive investigation into various aspects of a company, businesses can navigate transactions and investments confidently.