Introduction

Small businesses often face the challenge of balancing debt management with operational continuity. In times of financial turbulence, debt restructuring can provide a practical solution. By consolidating multiple loans and debts into a single loan, businesses can simplify repayment processes and potentially reduce interest rates.

This article explores the need for debt restructuring, the assessment of a business's financial health, streamlining operations for efficiency, key strategies for financial restructuring, optimizing cash flow, negotiating with creditors, crafting an effective restructuring plan, leveraging professional debt relief services, maintaining open communication with creditors, legal and ethical considerations, and achieving long-term sustainability and growth. With a confident and action-oriented tone, this article offers practical advice and solutions to help small businesses navigate the complexities of debt restructuring and emerge more resilient.

Understanding the Need for Debt Restructuring

Smaller enterprises dealing with financial instability often encounter the challenging duty of maintaining financial obligations while ensuring uninterrupted operations. A practical solution to this predicament is the for companies. This approach involves combining multiple loans, lines of credit, and other financial obligations into a single loan, which can streamline the repayment process and potentially lower interest rates.

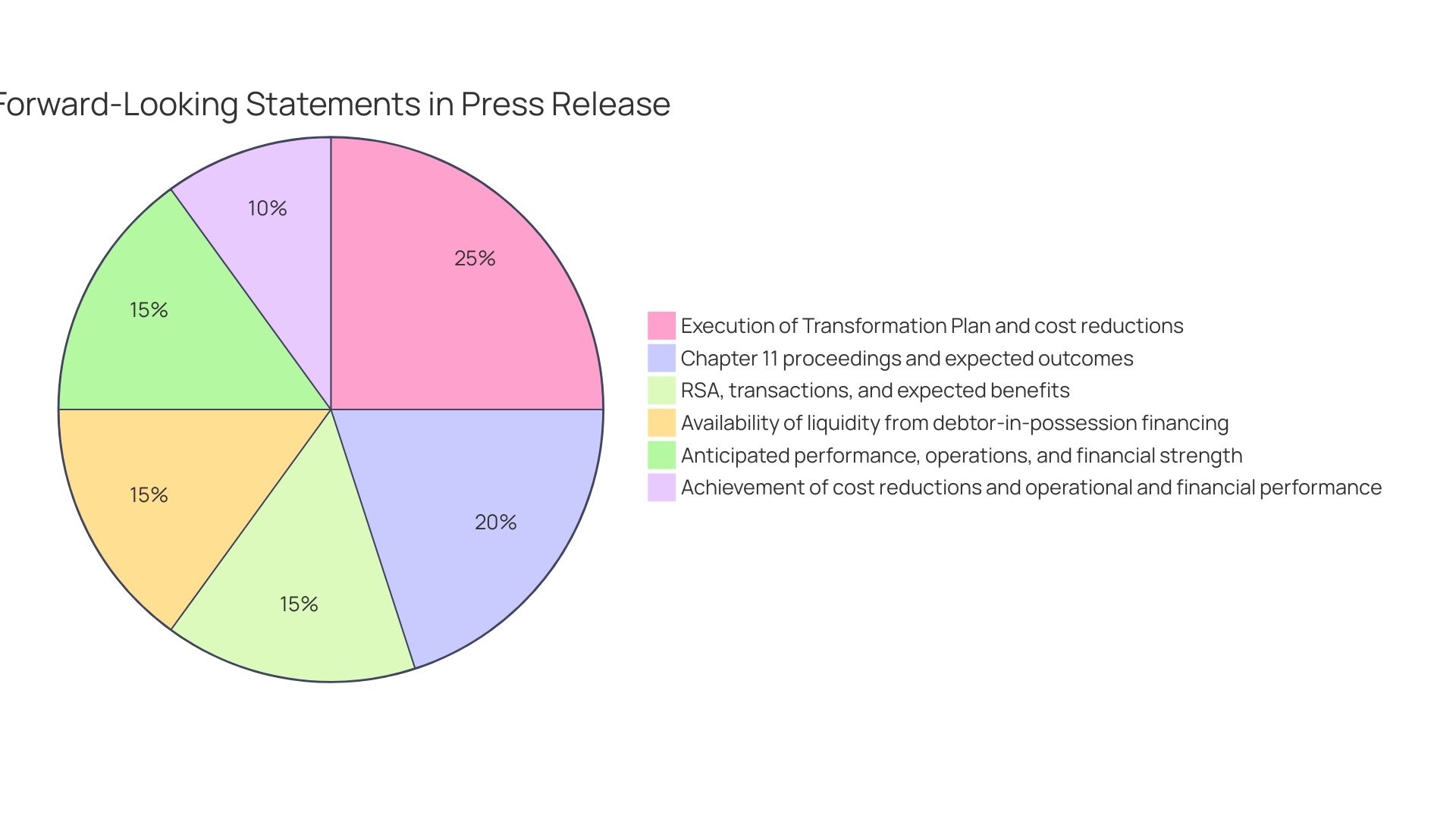

The urgency for such measures is underscored by a significant uptick in Chapter 11 filings, which surged by 29% in September 2023 compared to the previous year. While Chapter 11 bankruptcy allows an entity to reorganize and renegotiate its debts, consolidation offers an alternative that can avert the complexities and stigma associated with bankruptcy proceedings.

Consolidation can offer multiple benefits, such as streamlined management of finances and the chance to obtain lower interest rates, thus decreasing the overall burden. Nevertheless, it's important to evaluate whether this method aligns with your company's distinct economic circumstance and long-term goals.

Given the recent increase in , it is crucial, now more than ever, to explore all accessible paths for financial relief. Grants from various sources, such as government entities and corporations, can offer additional support tailored to specific industries and initiatives. For example, beauty industry entrepreneurs can receive grants of up to $100,000 to assist in starting or growing their enterprises.

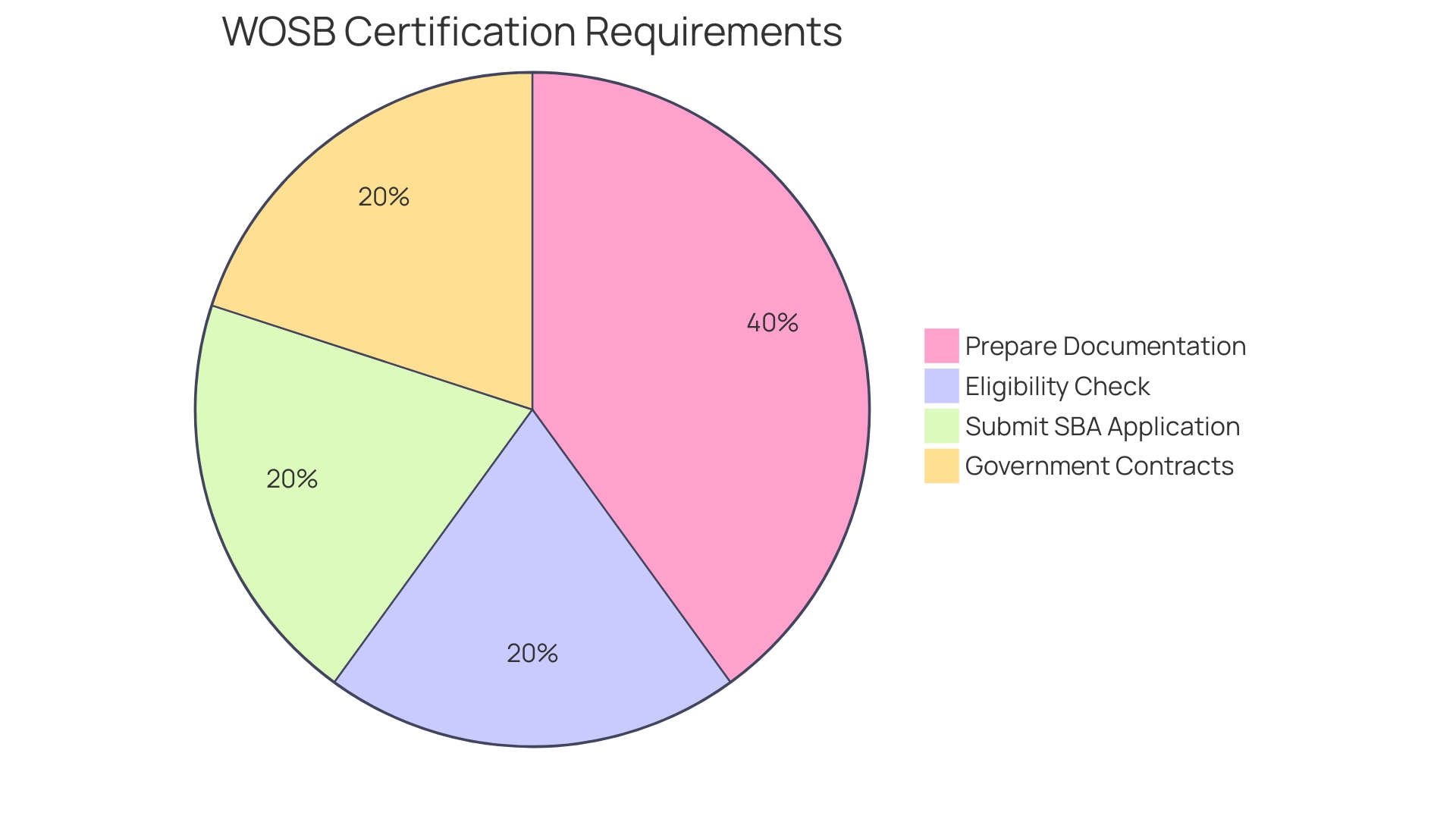

Additionally, women-run small enterprises (WOSBs) can utilize federal contracting opportunities, with the government striving to grant a minimum of 5% of contracting dollars to WOSBs. Certification and training provided by the Small Business Administration (SBA) can improve their likelihood of securing federal contracts, thereby promoting growth and job creation.

When considering consolidation of liabilities, it's recommended to to assess its viability and potential influence on your company's fiscal well-being. In doing so, you can make an informed decision that supports your company's recovery and growth trajectory.

Assessing Your Business Health

Undertaking a journey of necessitates a thorough assessment of your business's monetary health. To start, a comprehensive performance analysis is crucial. Analyze your income statement, balance sheet, and cash flow statement to assess revenue growth, profit margins, cost management, and investment returns. These metrics provide a transparent view of your financial standing and aid in informed decision-making for future and resource allocations.

Next, assess your and supply chain management. Reflect on how well your enterprise has managed potential disruptions to your operations and supply chain processes. This review is crucial to comprehending the resilience and agility of your .

Furthermore, turn a critical eye toward marketing and customer engagement. Evaluate the efficacy of your marketing strategies and their success in reaching your target audience, as well as the growth of your customer base. This will help you to understand the impact of your marketing efforts and identify areas for improvement.

It's also important to consider your company's response to market changes, customer preferences, and technological advancements. Reflect on the innovative approaches you’ve implemented and their effectiveness. This introspection will reveal your business's capacity for innovation, which is essential for remaining competitive in today's market.

If the assessment reveals a need for reorganization, remember timing is crucial. Consideration should be given to all available options, such as refinancing, issuing stock, or even exploring mergers or sales. As James Mohs, an associate professor at the University of New Haven, advises, the right time to seek professional help or declare bankruptcy is after all other alternatives have been exhausted.

Take inspiration from Cano Health's experience, which emerged from Chapter 11 with an enhanced capital structure and operations, having taken significant steps to strengthen its performance. Likewise, evaluating the wellbeing of your organization will establish the possibility of financial reorganization and pave the way for a triumphant metamorphosis.

Streamlining Operations for Efficiency

In the pursuit of ensuring a stable economic future, small enterprises frequently encounter the turbulent currents of restructuring obligations. One proven method of steadying the ship is by honing in on . Take the example of Travel Charme Strandhotel Bansin, a family-friendly hotel that managed to streamline their operations through the . This approach not only improved their service delivery but also led to a substantial uptick in guest satisfaction and sales revenue.

Similarly, a city-center hotel identified a unique opportunity by capitalizing on its prime location. By refining their restaurant's focus and understanding the market's pulse, they successfully boosted their food and beverage sales. These case studies underscore the significance of a tactical approach to operational refinement—pinpointing areas that directly contribute to the bottom line.

Streamlining isn't merely about cutting costs; it's about smart consolidation and strategic investment. For example, can simplify money management by merging various debts into a single loan. This move can be a game-changer, allowing for clearer oversight and potentially more favorable terms. Moreover, creating a strong plan that outlines operating expenses and long-term goals is crucial when approaching lenders.

However, it's crucial to recognize the seriousness of the monetary circumstance. As James Mohs, an associate professor at the University of New Haven, remarks, "The right time to declare bankruptcy is after you've exhausted all your other options." This includes considering refinancing, issuing stock, or even a merger. The key is to act promptly and seek professional guidance before the situation becomes untenable. With the proper tactics, small enterprises can navigate through and emerge more durable.

Financial Restructuring: Key Strategies

Navigating monetary restructuring is a crucial challenge for aiming to regain their footing. It requires a strategic approach, beginning with a candid assessment of the current financial situation. , a process where multiple loans are combined into a single loan, can simplify debt management and potentially reduce interest rates.

Pacific Steel's story exemplifies bold restructuring, where they analyzed their insurance claims data and switched to reference-based pricing, leading to substantial savings. Similarly, small enterprises may need to explore unconventional strategies and make difficult decisions, such as renegotiating terms with creditors or revisiting operational expenses.

Inspiration can be drawn from entrepreneurs like Meredith Noble, who transformed her career by leveraging online opportunities to create passive income streams. This kind of innovative thinking can be crucial in redirecting a company's trajectory.

Moreover, , such as grants, can provide a lifeline. With more than 33.2 million small enterprises in the United States, rivalry is intense, but chances like the for beauty industry ventures, the SBA's disaster loans, and federal contracts for women-owned small enterprises can offer crucial support.

In the end, the choice to reorganize financially should be approached with a clear understanding of the options available, from consolidation of liabilities to seeking external funding. Each step forward should be guided by expert advice, considering all the variables that affect a company's unique situation.

Optimizing Cash Flow

Maximizing the movement of funds is an essential strategy, especially when maneuvering through the intricacies of . To effectively handle , organizations need to refine their approach to collections and ensure a consistent influx of funds. An exemplar case is Cano Health, which, after filing for Chapter 11, strategically emerged with a stronger capital structure and streamlined operations, focusing on core markets for sustained patient care quality. The company's successful restructuring was facilitated by converting a sizable portion of its debt into equity and securing new capital to strengthen its plan. This accomplishment highlights the significance of and operational effectiveness in promoting a resilient model.

A practical step in is to rigorously assess and prioritize spending. Rather than hastily slashing costs, a detailed review of both expenses and revenue streams is fundamental. This reevaluation should align with the organization's long-term objectives, ensuring that economic decisions support . Maintaining a positive cash flow is crucial, as it allows companies to avoid and puts them in a position for success. It is a pivotal factor that can significantly influence a company's growth trajectory and profitability. According to the saying, 'Money is the essential element for any enterprise,' and its administration should be a primary concern for any company proprietor.

Negotiating with Creditors

Mastering the art of negotiation is paramount when it comes to . A successful can pave the way for agreements that serve both parties' interests, ultimately lightening the financial burdens that can weigh heavily on a small enterprise. In this endeavor, a well-crafted plan is essential. It should clearly articulate the company's operational expenses, credit profile, and long-term objectives. This plan becomes a critical tool during negotiations, as it demonstrates to creditors the viability and strategic direction of the business.

When considering consolidation, it's important to understand that it involves into a single one, potentially with more favorable terms. This strategy can simplify and may result in a lower overall interest rate or reduced monthly payments. However, it's crucial to evaluate the terms and rates of loans for enterprises, which can differ significantly based on factors like creditworthiness and the lender's policies.

Real-world results may diverge from projections and forecasts, as unpredictable events and various factors can impact a company's . Therefore, during negotiations, it's crucial to maintain a level of flexibility and be prepared for contingencies. As Ami Kassar, an expert in raising capital for small enterprises, advises, maintaining control of oneself is crucial in the negotiation process. You can't control external parties' actions or desires, but maintaining is within your grasp.

The landscape of small enterprise lending is diverse, with a multitude of potential lenders, including online platforms, banks, and credit unions, each offering different types of loans with varied requirements. Understanding these options is vital for selecting the financing that best aligns with your business needs.

Lastly, while the process can be complex, support is available. Frequently Asked Questions (FAQs) and hotlines are resources that provide guidance during the process of reorganization. It is recommended to utilize these tools to stay informed and navigate the complexities of and loan refinancing.

Crafting an Effective Restructuring Plan

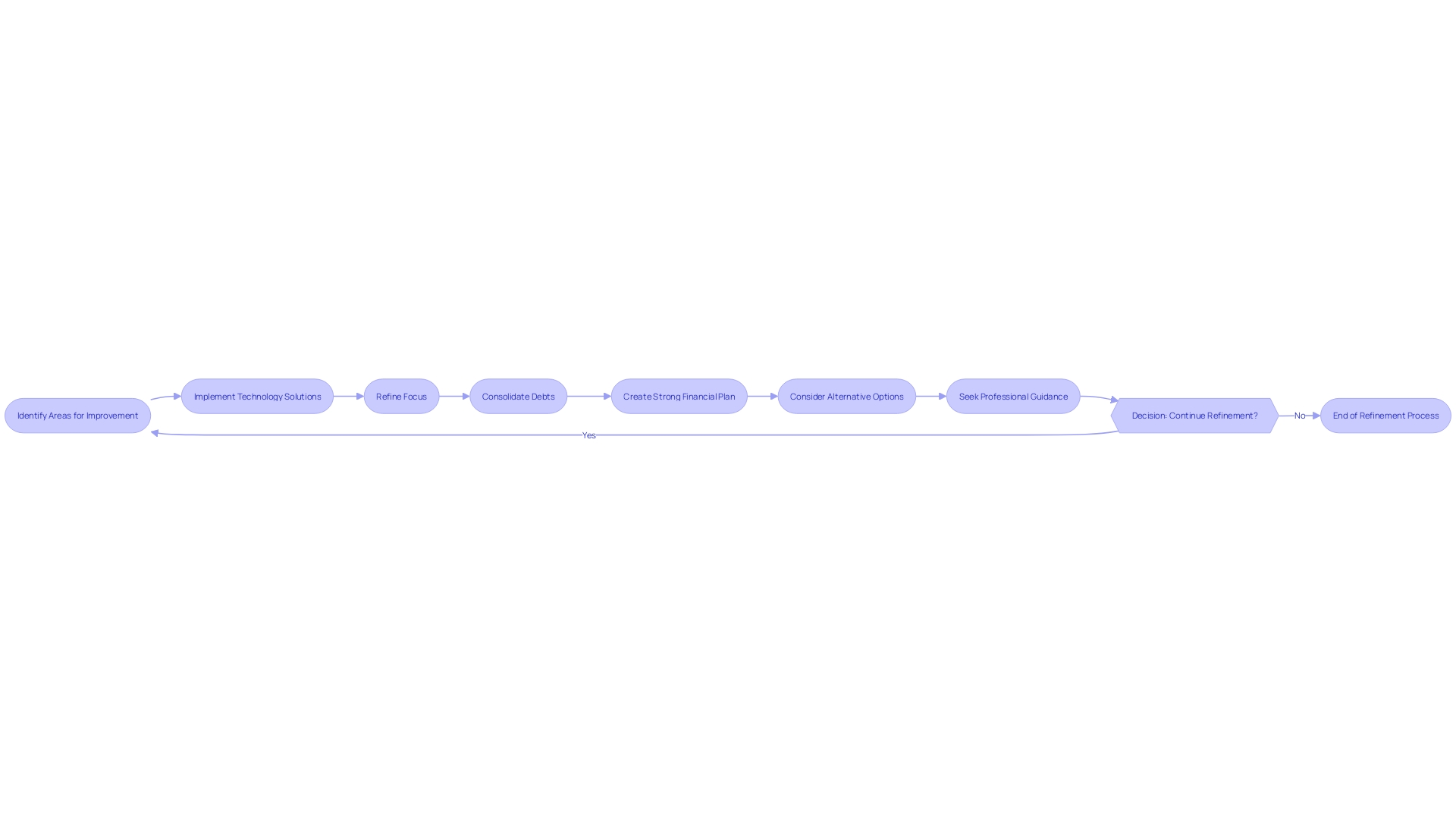

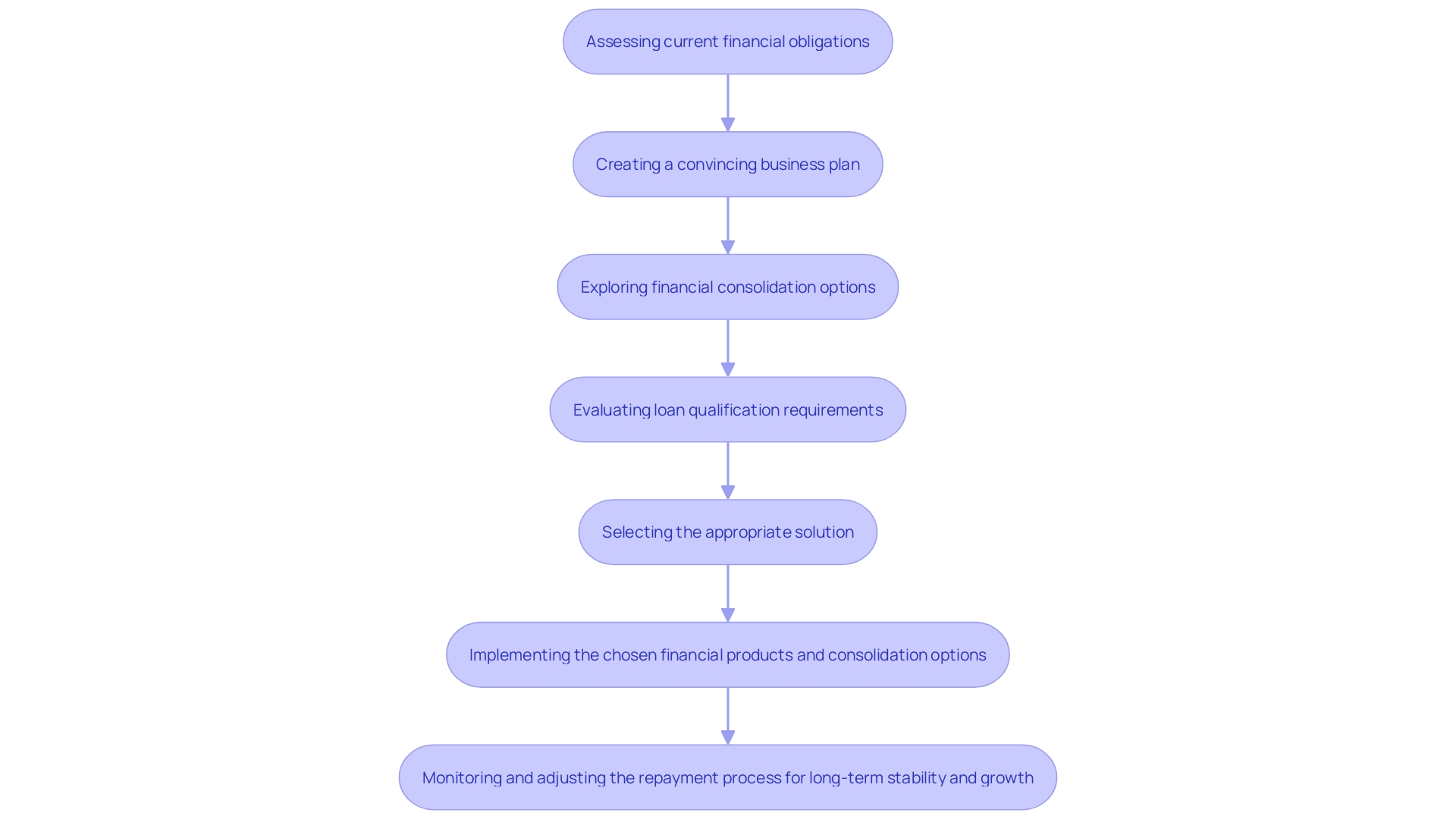

Developing a is not only about establishing objectives; it involves constructing a pathway for economic recuperation and expansion. To establish a successful for your small business, consider the following steps:

- Evaluate the Present : Prior to taking any actions, it's essential to comprehensively comprehend the monetary status of your organization. This includes an in-depth analysis of your operating expenses, credit profile, and long-term objectives. The strategic plan should not only mirror your company's current condition but also integrate market analysis, company structure, product descriptions, and marketing strategies for a comprehensive overview.

- : If your business is managing multiple loans, combining them can be a strategic move. This involves combining several loans or lines of credit into a single debt, which may simplify repayments and potentially reduce interest rates. However, it's essential to consider whether consolidation is the best path forward for your specific situation.

- Clearly defined objectives are the cornerstone of any plan for organizational change. These goals should be realistic, taking into account the forecasts and projections for your company's performance. Remember that while forecasts are speculative, they provide a framework for setting achievable targets.

- Define Action Steps: Outline the specific actions required to achieve your goals, such as negotiating with creditors, securing new financing, or streamlining operations. Each step should be actionable and measurable, allowing for regular assessments of your progress.

- : The business environment is dynamic, and your plan for making changes should be adaptable. Regular monitoring allows you to track progress against your goals and make necessary adjustments. Utilize the expertise of legal and financial advisors to ensure that your strategy remains on track and aligns with best practices.

- ': Don't hesitate to seek expert guidance, whether it's for assistance with your plan for reorganization or for addressing specific questions not covered in general FAQs. Experienced consultants can offer the perspective necessary to navigate the intricacies of financial reorganization.

- Stay knowledgeable: As you move forward with your financial reorganization, stay informed about any new advancements or modifications in regulations that could affect your approach. Utilizing resources like FAQs and hotlines can provide valuable information throughout the process.

By following these actions, you can devise a plan that not only tackles your small enterprise's immediate monetary difficulties but also establishes the foundation for future stability and expansion. Keep in mind that the process may involve significant risks and uncertainties, so it is vital to remain flexible and responsive to changing circumstances.

Managing Debt Restructuring and Unsecured Creditors

Successfully navigating the delicate terrain of is more than a financial maneuver; it's a test of diplomacy and strategy in maintaining cordial relationships with creditors. For a small business, this often involves intricate discussions with both secured and unsecured creditors to renegotiate . Drawing from recent cases, such as that of Van's Aircraft in Oregon, we see that achieving a plan acceptable to a majority of creditors is possible. In this situation, 88 percent of the unsecured creditors, representing 93 percent of funds owed, voted in favor of the plan for reorganization. Similarly, Rhodium Enterprises' innovative approach to âbeing granted the option to take a loan in Bitcoin or USDâunderscores the importance of flexibility and adaptability in monetary negotiations.

Moreover, the example of Sunac China Holdings Ltd. illustrates the resilience required in . After navigating through unstable economic circumstances and securing investor agreement on overhauling $10 billion of offshore debt, Sunac's experience signifies the value of tenacity and . Such instances highlight that, while each case is unique, the overarching principle remains: coupled with a willingness to find common ground is essential. This is echoed in the sentiment that understanding the other party's perspective is critical in negotiations—a viewpoint shared by seasoned deal-makers. As such, should aim to be straightforward and concise in their dealings, similar to 'ripping off the Band-Aid,' to foster trust and expedite resolution. In the end, the achievement of any reorganization approach depends on the capacity to balance between monetary expertise and relational diplomacy.

Developing a Repayment Plan

Devising a is a pivotal element in the restructuring of small enterprise debt. It involves a careful analysis of your company's financial condition and an honest assessment of your repayment capabilities. By examining all financing alternatives, such as , traditional bank loans, and microloans, you can determine the most sustainable path forward. For example, while accounts receivable financing may offer quick cash influx to cover immediate expenses, it's imperative to weigh its costs against other funding sources.

When formulating your repayment strategy, take into account your . It's crucial to refrain from accumulating fresh liabilities that could worsen your financial burden. Instead, concentrate on , where appropriate, to streamline your obligations into a single loan with potentially more favorable terms.

Consider your overall strategy, including your products, services, target customers, and market position. Make sure your projections for money are practical and take into consideration your repayment plan for money owed. It's also wise to consult with a to understand all options available, including the potential for refinancing, stock issuance, or organizational changes.

In the end, your repayment strategy should not only focus on addressing existing obligations but also strengthening your organization against forthcoming economic difficulties. By embracing a thorough and forward-thinking strategy, you can maneuver through the intricacies of and establish your enterprise on a trajectory towards stability.

Leveraging Professional Debt Relief Services

Using assistance with can be a crucial measure for small enterprises seeking to navigate the intricacies of financial restructuring. Financial relief can appear in different forms like loan settlement, consolidation, and management. More specifically, enables an organization to merge numerous loans, regardless of whether they are fixed loans or lines of credit, into a solitary, easier-to-handle loan. This can simplify the repayment process and potentially offer more favorable terms.

It's important for small enterprises to comprehend that collaborating with may result in reduced liabilities or an expedited settlement. However, it's important to be aware that these services can carry substantial fees. Moreover, interacting with a relief company for financial obligations might result in credit harm, so it's crucial to carefully consider these factors.

The increase in , with a 29% rise in Chapter 11 filings from September 2022 to September 2023, emphasizes the necessity for solid monetary approaches. Smaller enterprises should think about options aside from insolvency, like seeking advice from a , or investigating loan consolidation.

When selecting a professional to assist with , it's imperative to consider a range of . Approval for aid typically requires a good credit score, solid revenue, and sometimes a personal guarantee or collateral. Finding the appropriate match for your needs is a crucial step because each lender provides varying loan types, amounts, and repayment terms.

When making these crucial decisions, small enterprises should consult with professionals who can offer a thorough assessment and verification to guarantee that they select the optimal relief plan customized to their specific circumstances.

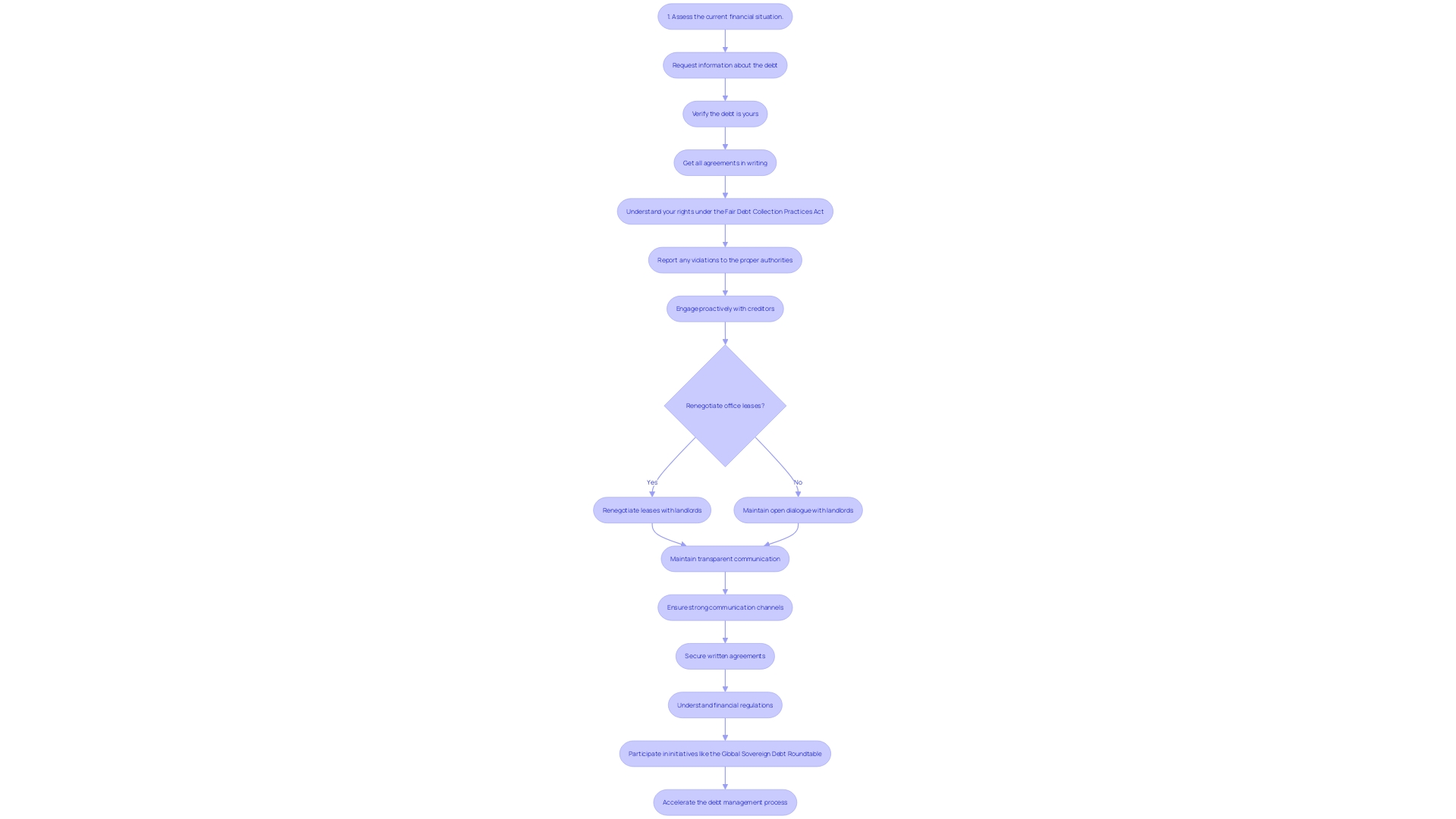

Maintaining Open Communication with Creditors

Effective communication with creditors is a cornerstone of . WeWork's recent experience illustrates the power of proactive engagement with stakeholders. Through close collaboration with creditors and renegotiating hundreds of office leases, WeWork not only emerged from Chapter 11 bankruptcy but also positioned itself for future growth. The company's open dialogue with landlords and creditors was pivotal in crafting a sustainable, profitable path forward, emphasizing the indispensable role of transparent communication in the process of creating a new structure.

In the domain of , the monetary consequences of inadequate communication can be substantial, affecting the bottom line significantly. A lack of clarity can lead to unresolved issues and prolong challenges, as evidenced by instances where organizations suffer due to inadequate communication skills. This emphasizes the need for enterprises to develop throughout the phase of transformation.

Moreover, the importance of written agreements and understanding your rights under cannot be overstated. As highlighted by the Fair Debt Collection Practices Act, protecting oneself from potential scams and ensuring all settlements are documented is critical. This level of carefulness and openness is crucial not just in personal dealings with collectors but also in the wider framework of .

Additionally, the Global Sovereign Debt Roundtable (GSDR) initiative by IMF, World Bank, and G20 showcases how structured dialogue among creditors and debtors can accelerate the process of managing debt. The Roundtable's focus on technical issues such as the comparability of treatment among creditors and information sharing has been instrumental in progressing ongoing cases and setting foundations for future negotiations.

While dealing with the intricacies of organizational changes, the experiences gained from entities such as WeWork and worldwide endeavors like the GSDR provide . Keeping creditors informed and involved is more than a courtesy; it is a strategic approach that can lead to more favorable outcomes and a stronger economic position post-restructuring.

Legal and Ethical Considerations

When a small organization encounters , becomes a vital pathway to regain stability. Legal compliance is paramount, notably adherence to which dictate the terms of reorganization plans. are equally essential, ensuring fairness to all creditors involved. An exemplar case saw Van's Aircraft presenting their plan in court, which received a remarkable 88% approval from unsecured creditors, demonstrating a balance of legal acumen and ethical integrity. The American Association for Debt Resolution champions such ethical practices, mandating that member companies meet rigorous standards.

This framework is vital in today's economic landscape, where , as mirrored in Fiserv's report. However, before considering bankruptcy, Professor James Mohs emphasizes the importance of exploring all alternatives, such as or refinancing, which could offer a lifeline without the rigors of bankruptcy proceedings. Small entrepreneurs must navigate these options with both the legal implications and ethical responsibilities in mind to ensure a .

Long-Term Sustainability and Growth

Restructuring of small enterprises' is not only about immediate relief but also establishing the groundwork for . By utilizing techniques like , companies can streamline their financial obligations, potentially securing more favorable terms. For instance, consolidating multiple loans into a single one often simplifies the repayment process and can lead to reduced interest rates or more manageable payment schedules.

A convincing plan is crucial when seeking to restructure debt. It should detail your operational expenses, credit profile, and long-term aspirations. This plan not only showcases professionalism but also gives lenders a well-rounded view of your company, which can be crucial for loan approval. Including market analysis, company structure, product descriptions, and marketing strategies into your plan enhances its effectiveness.

Real-world success stories, like that of a branded hotel that utilized its prime location to boost food and beverage sales, demonstrate the power of in overcoming financial hurdles. In the same way, small enterprises can embrace a multi-faceted method to financial reorganization, aligning it with broader operational tactics to enhance overall effectiveness.

It's crucial to understand that acquiring a , whether for modifying current financial obligations or driving expansion, usually necessitates a strong credit score and revenue, in addition to a personal guarantee or collateral. Understanding the available and their respective qualification requirements is crucial to selecting the appropriate solution.

In summary, navigating the complexities of small business debt restructuring calls for a systematic approach, beginning with a thorough and culminating in a strategic selection of financial products and consolidation options to foster long-term stability and growth.

Conclusion

Debt restructuring provides practical solutions for small businesses facing financial challenges. By consolidating loans, simplifying repayment processes, and potentially reducing interest rates, businesses can navigate turbulent times.

To succeed in debt restructuring, businesses must assess their financial health, streamline operations, and optimize cash flow. Crafting an effective restructuring plan involves setting achievable goals, seeking professional advice, and maintaining open communication with creditors.

Negotiating with creditors is crucial, and businesses should be mindful of legal and ethical considerations. Leveraging professional debt relief services can offer support, but it's important to weigh the associated fees and credit impact.

The ultimate goal of debt restructuring is long-term sustainability and growth. By incorporating strategies like debt consolidation and aligning restructuring plans with broader operational strategies, businesses can overcome financial obstacles and emerge more resilient.

In summary, debt restructuring provides practical solutions for small businesses. By assessing financial health, streamlining operations, and optimizing cash flow, businesses can navigate challenges successfully. With effective negotiation, professional guidance, and open communication, businesses can achieve long-term sustainability and growth.

Frequently Asked Questions

What is financial obligation consolidation for companies?

Financial obligation consolidation for companies involves combining multiple loans, lines of credit, and other financial obligations into a single loan. This can streamline the repayment process and potentially lower interest rates.

How has the trend for Chapter 11 filings changed recently?

There has been a significant uptick in Chapter 11 filings, with a surge of 29% in September 2023 compared to the previous year.

What are the benefits of consolidating financial obligations for a company?

Consolidation can streamline the management of finances, potentially obtain lower interest rates, decrease the overall financial burden, and avoid the complexities and stigma associated with bankruptcy proceedings.

What additional financial relief options are available for small enterprises?

Small enterprises can seek grants from government entities and corporations, federal contracting opportunities, especially for women-run small enterprises (WOSBs), and certification and training from the Small Business Administration (SBA).

Why is assessing your business's financial health important?

Assessing your business's financial health is crucial for informed decision-making for future financial strategies, understanding operational efficiencies, marketing effectiveness, and the capacity for innovation.

What is the significance of operational refinement for small enterprises?

Operational refinement, such as using technology to improve service delivery or refining a restaurant's focus, can lead to increased sales revenue and contribute to the bottom line.

When should a small enterprise consider declaring bankruptcy?

Declaring bankruptcy should be considered after all other options have been exhausted, such as refinancing, issuing stock, or exploring mergers or sales.

What are key strategies for financial restructuring in small businesses?

Key strategies include debt consolidation, exploring unconventional strategies like renegotiating terms with creditors, seeking external funding sources like grants, and making difficult decisions to cut operational expenses.

How can small enterprises optimize their cash flow during financial reorganization?

Small enterprises can optimize cash flow by managing collections effectively, assessing and prioritizing spending, and ensuring that economic decisions support sustainable growth.

What should be included in an effective restructuring plan for small businesses?

An effective restructuring plan should include evaluating the current financial condition, consolidation of obligations if beneficial, clearly defined objectives, actionable steps, regular progress monitoring, expert advice, and staying informed about new developments.

How can small enterprises successfully manage negotiations with creditors?

Successful negotiations with creditors involve crafting a clear plan that outlines operational expenses and long-term objectives, understanding the terms and rates of loans, maintaining flexibility, and exploring various lending options.

What legal and ethical considerations must be taken into account during debt restructuring?

Small enterprises must comply with bankruptcy laws and adhere to ethical practices that ensure fairness to all creditors, such as those advocated by the American Association for Debt Resolution.

How can small enterprises achieve long-term sustainability and growth after restructuring?

Long-term sustainability and growth can be achieved by consolidating financial obligations to secure favorable terms, strategic planning that aligns with broader operational tactics, and understanding loan options to select appropriate financial products.

Why is maintaining open communication with creditors important during debt restructuring?

Open communication with creditors is essential to negotiate sustainable repayment plans, foster trust, and expedite resolution, leading to more favorable outcomes post-restructuring.

What professional debt relief services are available to small enterprises?

Debt relief services include loan settlement, consolidation, and management. It is important to consider the potential credit impact and fees associated with these services when deciding to work with a financial management firm.