Introduction

Efficient management of accounts payable is crucial for the financial optimization of any organization. Large businesses often struggle with processing a high volume of invoices and payments, leading to inefficiencies, mistakes, and inflated costs.

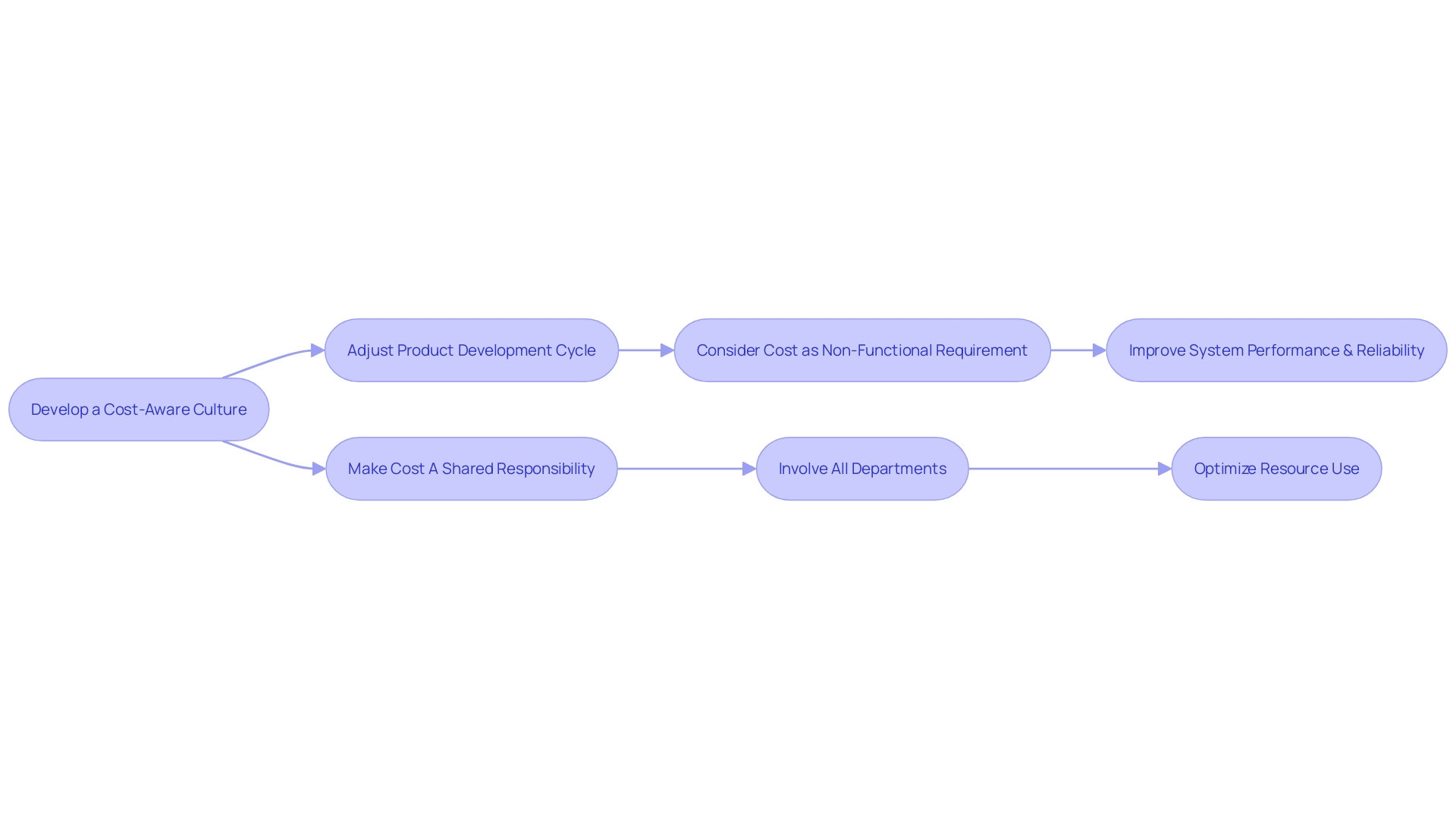

In this article, we explore a strategic approach to cost management that involves creating a cost-aware culture and restructuring product development cycles. We also discuss the benefits of outsourcing the accounts payable process, including improved cost control, visibility into financial operations, and enhanced overall financial performance. By adopting these strategies, businesses can achieve streamlined operations, cost efficiency, and align their current financial health with future objectives.

Business Challenge

Efficient management of accounts payable is pivotal in the financial optimization of any organization. Large businesses face the enormous task of processing a high volume of invoices and payments, where manual methods can lead to significant inefficiencies, mistakes, and inflated costs.

One effective strategy is to create a cost-aware culture, weaving cost considerations into the very fabric of organizational activities. This approach entails restructuring product development cycles to include cost as an essential, non-functional requirement—an aspect as critical as availability, performance, or reliability.

By doing so, cost control is no longer the sole province of the finance team but a collective responsibility across departments. For instance, a company that reassessed all its expenditures, without hastily jumping into cost reduction, prioritized optimizing their accounts payable through outsourcing. The outcome not only streamlined their costs but also fortified visibility into their financial operations, enhancing overall financial performance. These strategic adjustments ensure a holistic approach to cost management, aligning both current financial health and future objectives.

Solution & Approach

In pursuit of streamlined operations and cost efficiency, the company elected to outsource their accounts payable process, leveraging an external specialist with robust expertise in financial management. They undertook a methodical vendor selection process, placing a high value on attributes such as cost optimization, technological proficiency, and scalability. The chosen vendor distinguished themselves with an impressive background in managing accounts payable and a nuanced grasp of cost accounting methodologies.

This strategic partnership is poised to augment the company's financial analysis and decision-making capabilities, particularly in dissecting and interpreting the discrepancies between projected standard costs and actual expenses—a common practice in cost-intensive industries such as steel production. This move aligns with the insights shared by ex-Fortune 100 auditor Shagun, whose observations highlight the untapped automation potential within financial operations. With a significant 80% of financial tasks poised for automation, this could unlock valuable time for strategic endeavors, ultimately enhancing the overall financial well being of the company.

Results

When a business harnesses the capabilities of accounts payable outsourcing, remarkable transformations unfold within its financial operations. The diligence of an accounts payable clerk, pivotal in managing expenses and financial reporting for small businesses, is mirrored in the outsourced service, which brings a windfall of expertise and sophisticated technology. Akin to the clerk's role, the vendor's precision in invoice processing curtails unnecessary expenditures through heightened accuracy, diminishing the scope for costly manual blunders and reinforcing expense management.

Furthermore, just as a clerk plays a vital part in upholding financial compliance and overseeing vendor relationships, the outsourcing partner provides an elevated vista of the company's financial commitments. Small businesses are not only privy to real-time updates on payments and invoice statuses but also benefit from more profound insights that bolster cash flow management. This, in turn, improves financial reporting, essentially supporting informed strategic decisions, a task for which accounts payable clerks are indispensable.

This collaboration with the outsourcing service liberates the company's internal teams, permitting them to pivot towards more strategic, growth-oriented projects. Such redistribution of efforts echoes the fundamental contribution of an accounts payable clerk to the overall financial well-being of a small business, underscoring the transformation from operational engagements to strategic endeavors. The qualifications of attention to detail, organizational dexterity, and financial acumen required for a successful accounts payable clerk are thus reflected in the benefits realized through outsourcing — a seamless fusion of expertise and strategic financial management.

Conclusion

Efficient management of accounts payable is critical for financial optimization in organizations. Creating a cost-aware culture and outsourcing the accounts payable process are key strategies to achieve streamlined operations and cost efficiency.

By integrating cost considerations and restructuring product development cycles, businesses can make cost control a collective responsibility. Outsourcing accounts payable brings significant benefits.

Partnering with a specialist in financial management enhances decision-making and cost optimization. The outsourced service mirrors the diligence of an accounts payable clerk, improving accuracy and expense management.

Real-time updates and deeper insights enhance cash flow management and financial reporting. By creating a cost-aware culture and outsourcing accounts payable, businesses achieve streamlined operations, cost efficiency, and align current financial health with future objectives. This approach enables organizations to optimize costs, enhance visibility, and improve overall financial performance. These strategies set businesses on the path to success and long-term financial optimization.