Introduction

In the dynamic world of finance, streamlining financial processes is not just a necessity—it’s a competitive advantage. Efficient billing operations reduce administrative tasks, empowering finance teams to pivot towards strategic initiatives. Leveraging automation, particularly in accounts payable and receivable, significantly enhances accuracy, operational efficiency, and cash flow management.

Embracing automated invoicing systems is crucial for minimizing human error and delays, thereby ensuring financial stability.

Success stories, like that of Swan utilizing Forest Admin, highlight the pivotal role of advanced solutions in overcoming scalability and security challenges. Regularly refining payment terms with clients, integrating financial software for real-time insights, and adopting Business Intelligence tools are essential steps towards optimizing financial processes. These strategies are not just about improving efficiency—they are about equipping businesses with the agility to navigate today’s complex economic landscape.

Streamlining Financial Processes

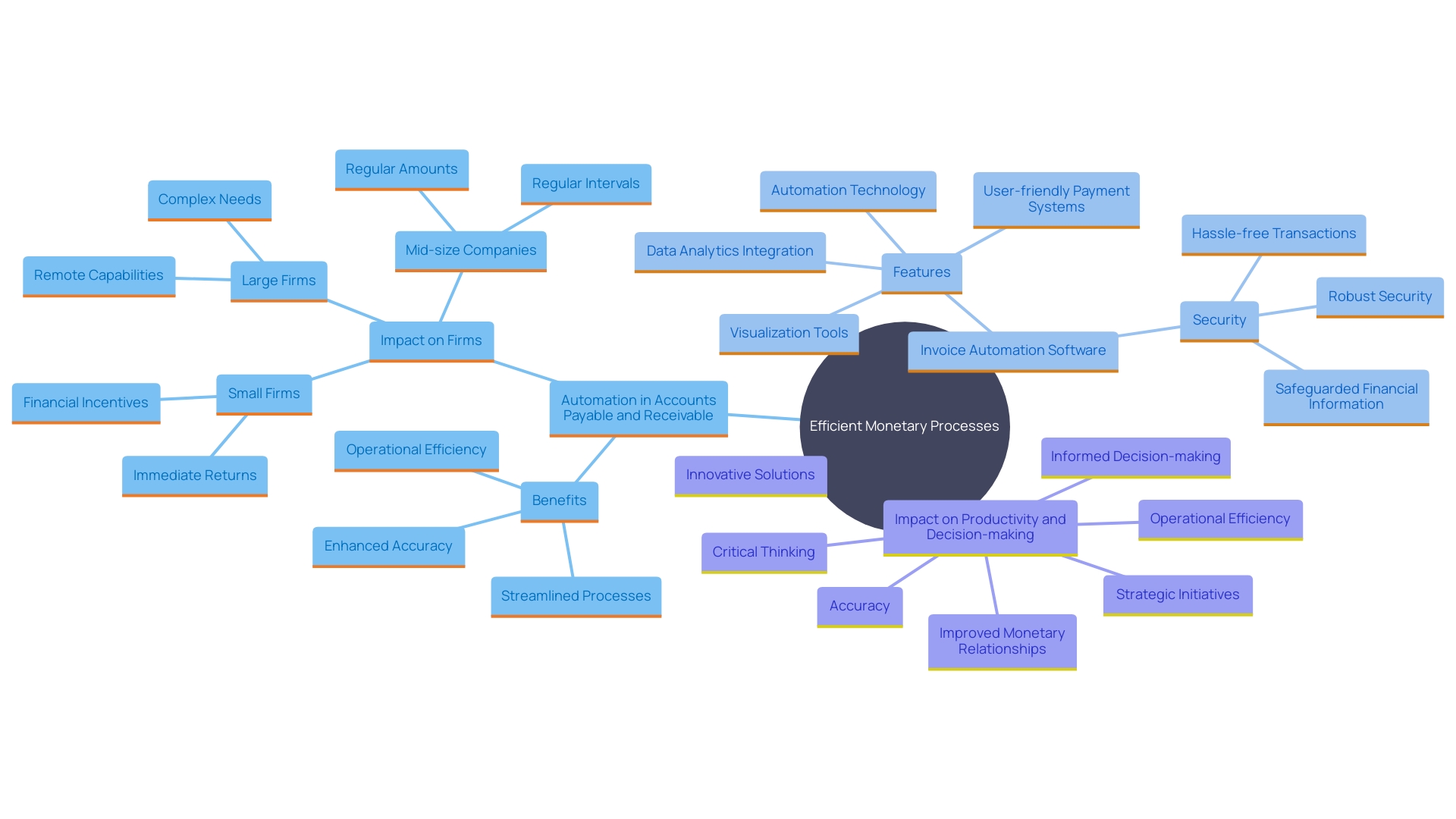

Efficient monetary processes are essential for boosting productivity and ensuring precise reporting. Streamlining billing operations can significantly cut down administrative tasks, allowing finance teams to focus on strategic initiatives. According to a recent study by PYMNTS Intelligence and American Express, automation in accounts payable and receivable processes enhances accuracy, operational efficiency, and cash flow management. Introducing automated invoicing systems can decrease human mistakes and lessen delays, which is essential for preserving economic stability.

Companies like Swan have successfully leveraged solutions such as Forest Admin to overcome scalability and security challenges while increasing user satisfaction. As Julien Mettoudi noted, the support and flexibility provided by these solutions are instrumental in managing growth and complexity.

Consistently assessing and improving payment conditions with clients guarantees transparency and shared understanding, enhancing better monetary relationships. Incorporating monetary software enables centralized data management, providing real-time insights and improving collaboration across departments. This integration aligns with the trend of increasing adoption of Business Intelligence (BI) tools in the BFSI sector, which improves decision-making and risk management.

Seamless integration, user-friendly interfaces, customizable workflows, and real-time reporting are must-have features for any invoice automation software. The capability to obtain and assess monetary information in real-time is essential for reacting to operational interruptions, as emphasized by a survey commissioned by BlackLine, Inc., where 40% of CFOs expressed worries about the precision of their monetary data. Embracing these technologies not only improves efficiency but also provides the agility needed to navigate today's dynamic economic landscape.

Optimizing Financial Performance

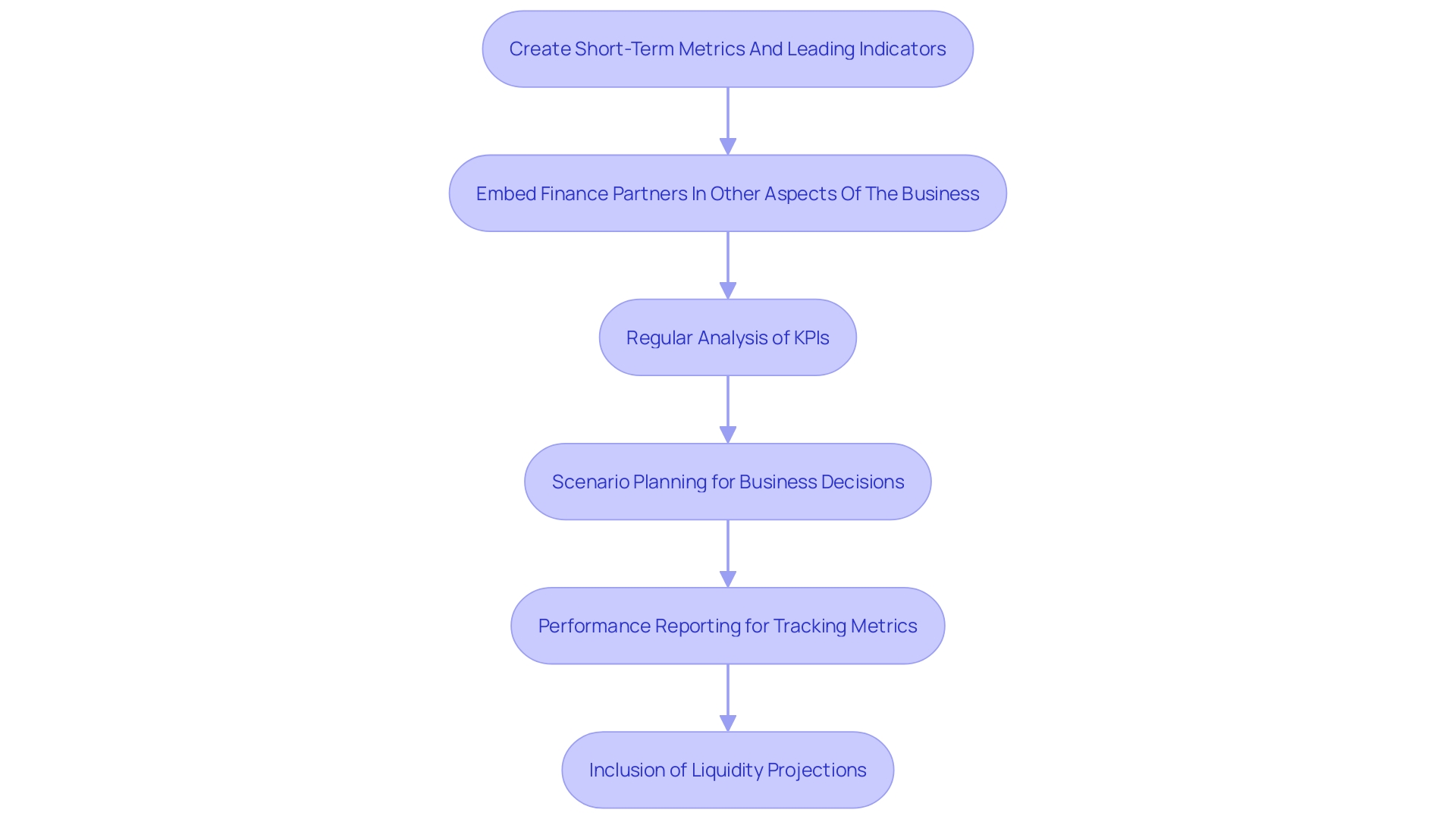

To enhance monetary performance, organizations must embrace a proactive strategy to fiscal management. Implementing key performance indicators (KPIs) that align with overall organizational objectives is essential. Concentrate on metrics like revenue growth, profit margins, and return on investment to ensure thorough economic insight. Regular analysis of these KPIs helps identify trends, assess performance, and pinpoint areas requiring improvement.

Engage in scenario planning to evaluate the potential impact of various business decisions. This approach ensures that strategic choices are well-informed and conducive to growth. For instance, providing monthly Budget vs. Actual Reports allows for collaboration with department heads to address variances and adjust strategies proactively. This method is particularly useful in mitigating external factors like market conditions or competitor actions, which might influence economic outcomes.

Performance reporting is critical in this process. Consistent performance reporting bridges the gap among different departments, tracking revenue and expense targets while offering valuable insights. This not only assists in maintaining the entire organization on track but is also essential for conveying specific economic metrics to stakeholders, including executives and board members.

Including liquidity projection reports can better foresee the entity's future monetary solvency. These forecasts are instrumental in managing cash flow, working capital, and capital expenditure, supporting both operational needs and growth initiatives.

Industry trends and market conditions must also be monitored closely. Remaining informed allows enterprises to adjust to new monetary practices, ensuring adherence to regulatory mandates and enhancing fiscal operations. 'Collaboration with external auditors, tax advisors, and monetary institutions can provide additional insights and support.'.

According to experts, integrating AI techniques to understand causal relationships between operational drivers and strategic outcomes can enhance KPI reliability. This approach has been shown to redefine performance metrics and provide deeper insights, allowing businesses to make more informed decisions and maintain a competitive edge.

Key Financial Management Tips

Effective financial management hinges on implementing best practices that ensure both sustainability and growth. A robust budgeting process should integrate top-down and bottom-up approaches to capture comprehensive input and foster ownership across the organization. Emphasize financial management by predicting upcoming monetary requirements and creating plans to mitigate possible threats.

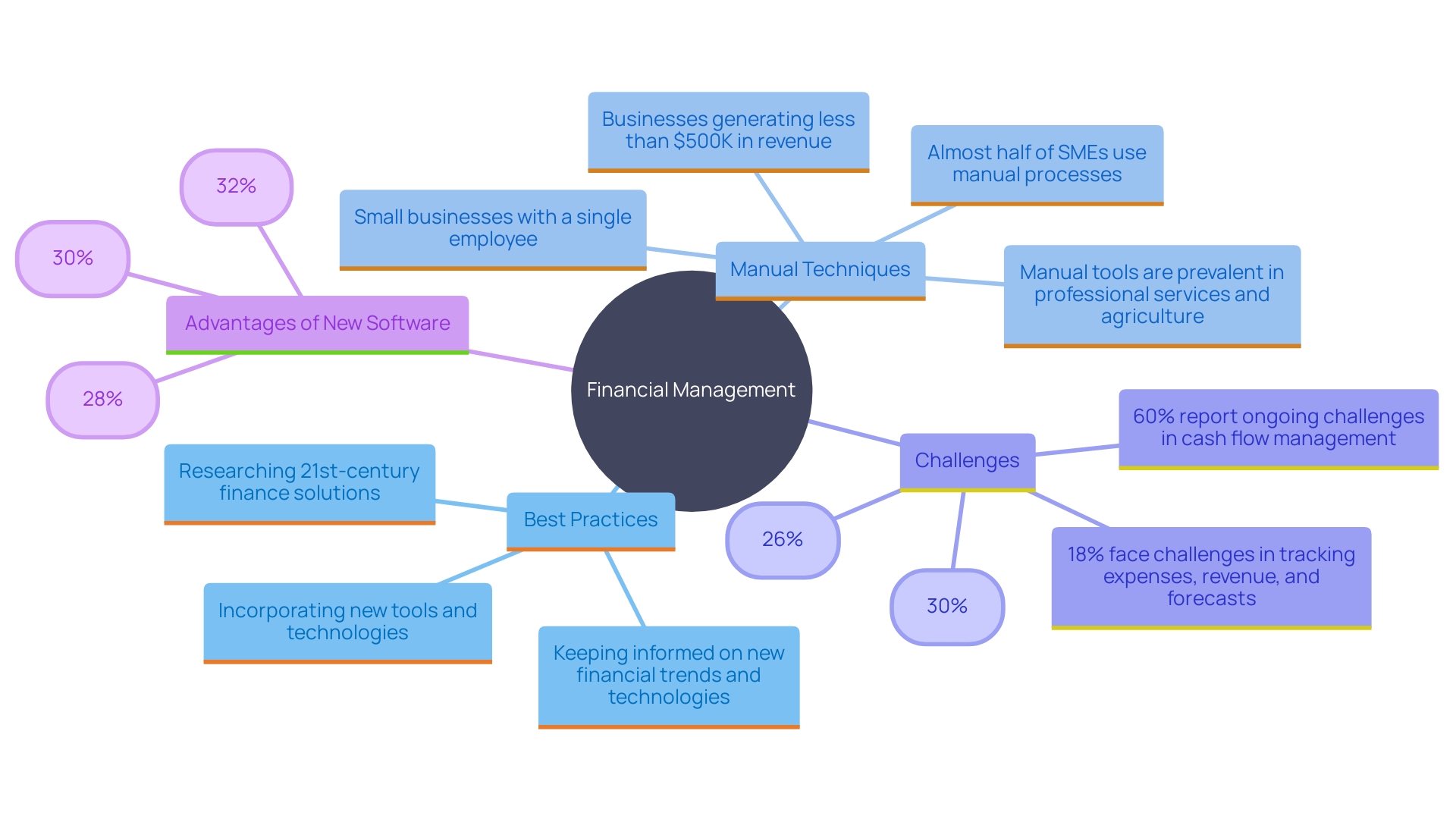

Nearly fifty percent of small and medium enterprises in sectors like farming and professional services persist in depending on manual financial management techniques, such as spreadsheets and paper documentation. This widespread problem adds to the considerable obstacles organizations encounter, with 60% facing challenges in handling finances, and postponed billing and payments impacting 30% of them.

Investing in new software can vastly improve productivity (32%), data management (30%), and operational efficiencies (28%). Consistently examining monetary policies and procedures is essential to uphold adherence and operational effectiveness, particularly as the commercial landscape changes. 'Automation in monetary processes is crucial, with almost half of the companies recognizing they would invest in liquidity management software to improve their economic operations.'.

Furthermore, the stability in IRS interest rates for Q3 2024 highlights the significance of accurate monetary planning. Governments, for instance, should conduct regular cash flow analysis to predict inflows and outflows, ensuring sufficient liquidity and preventing short-term borrowing. This strategic approach can assist in adapting to changes while maintaining economic health and operational efficiency.

Role of Financial Consultants in Business Performance

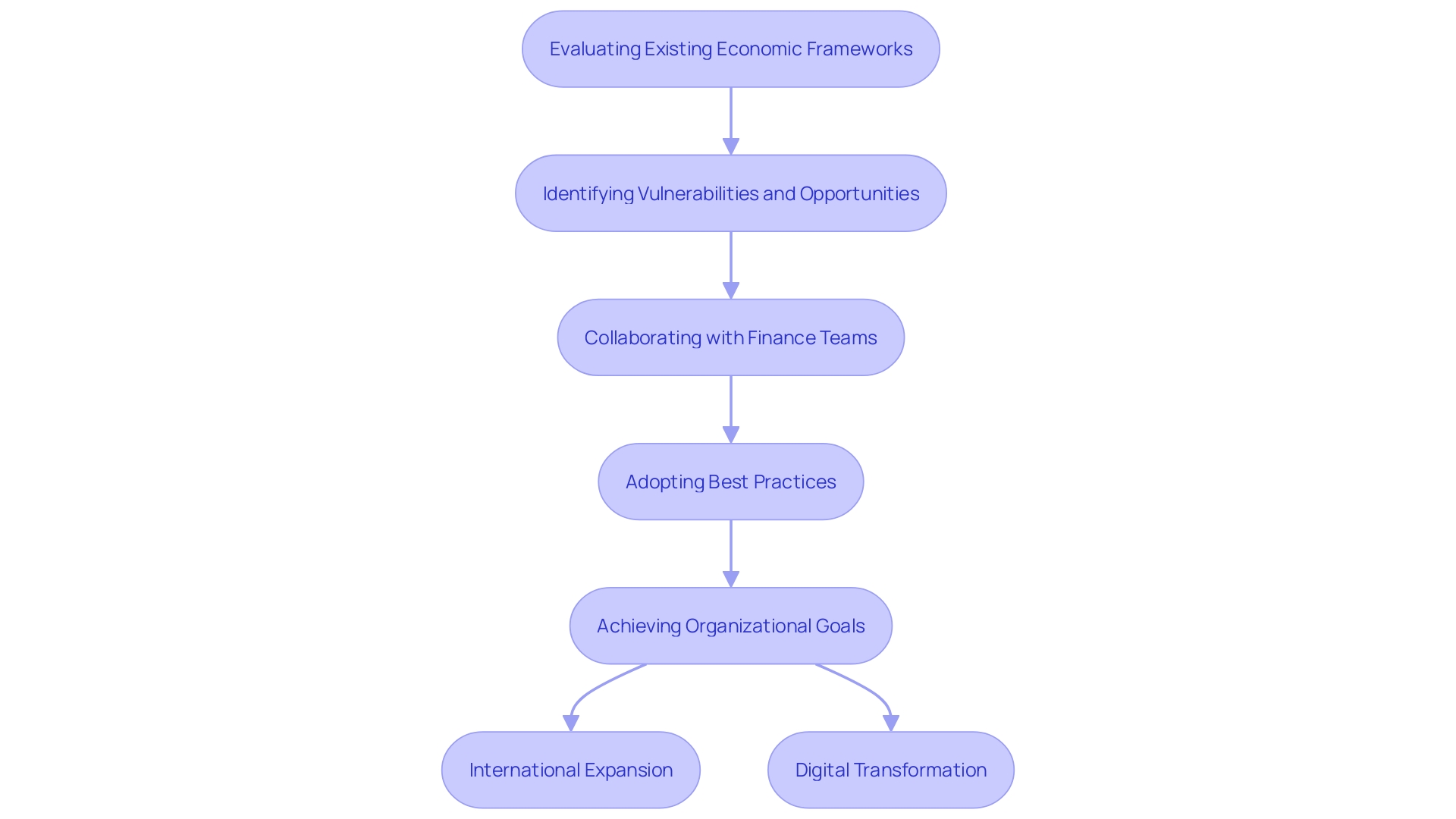

Financial consultants are pivotal in optimizing business performance through expert guidance and bespoke strategies. They meticulously evaluate existing economic frameworks, identifying both vulnerabilities and opportunities for growth. By working closely with finance teams, consultants ensure the seamless adoption of best practices that enhance efficiency and profitability. 'Their expertise in monetary modeling and analysis provides organizations with the insights needed to make informed decisions that align with long-term objectives.'.

For instance, TBC Bank embarked on an agile transformation to achieve international expansion and digital transformation. 'Despite initial complexities, the strategic overhaul facilitated by monetary advisors is gradually driving improvements in speed and customer satisfaction.'. This underscores the critical role consultants play in steering organizations through complex transformations while maintaining focus on growth and stability.

Expert Cash Flow Consulting for Financial Stability

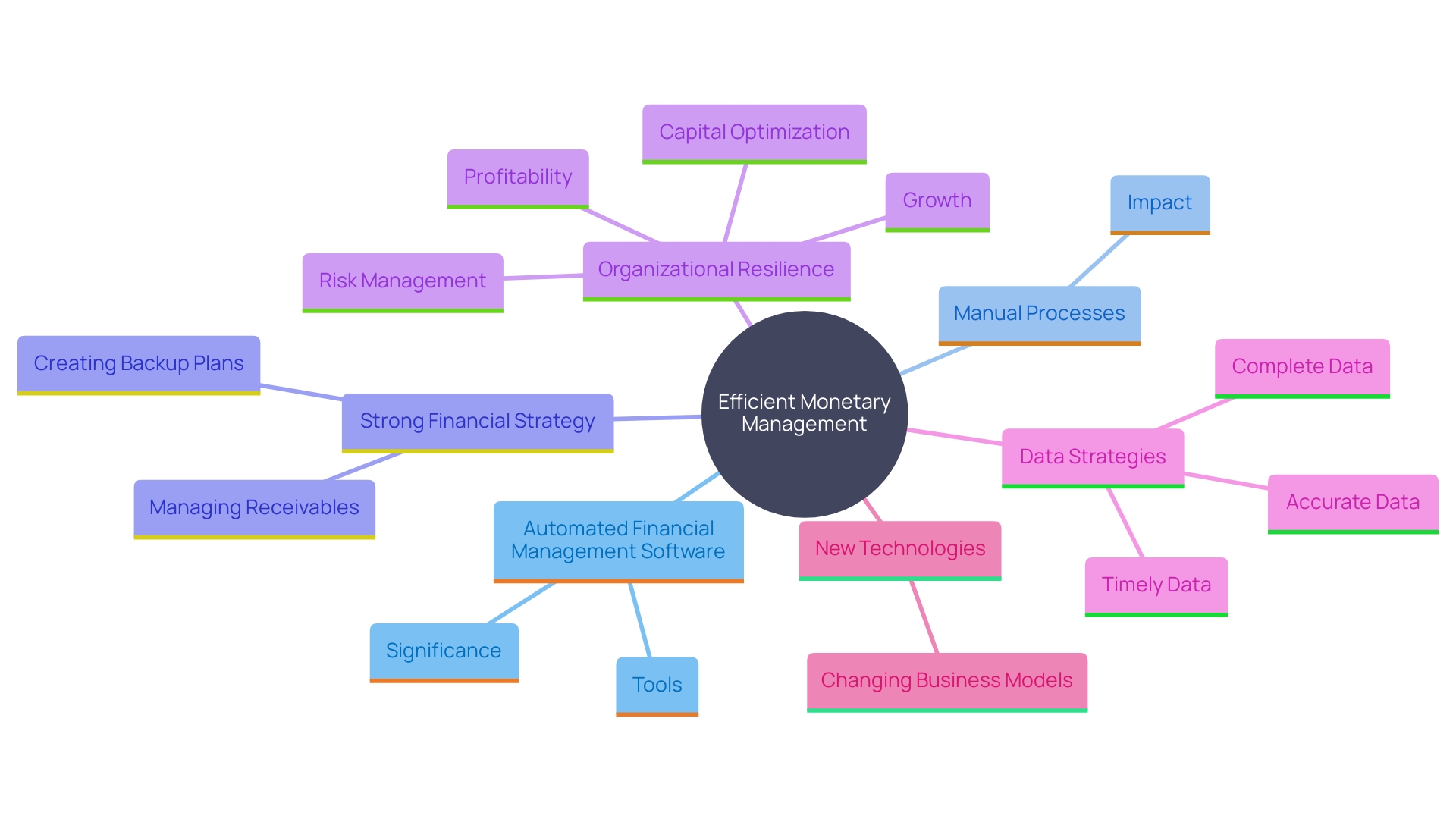

Efficient monetary management is crucial for organizational resilience and expansion. With 60% of companies indicating persistent difficulties in handling their finances, it's evident that a strong plan is necessary to maneuver through monetary intricacies. Performing a thorough monetary movement assessment is the initial action, aiding in recognizing trends and possible deficits. This analysis should integrate modern tools to replace manual processes, which are still used by 42% of SMEs, especially in sectors like agriculture and professional services.

Utilizing automated financial management software can greatly enhance productivity (32%), data handling (30%), and operational efficiencies (28%). Businesses that have adopted these technologies report increased profitability (44%), enhanced productivity (43%), and reduced costs (42%). Supervising receivables, enhancing inventory levels, and negotiating advantageous payment conditions with suppliers are essential elements of a strong financial management strategy.

Furthermore, creating backup strategies for unforeseen monetary disruptions guarantees that companies stay robust in changing market situations. For instance, delayed invoicing and payments, which impact 30% of enterprises, and managing accounts receivable/payable, a frequent challenge for 26%, can be alleviated with effective planning and technological integration. Adopting these strategies not only stabilizes cash flow but also enables organizations to seize growth opportunities and uphold economic well-being.

Financial Transformation for Scalable Growth

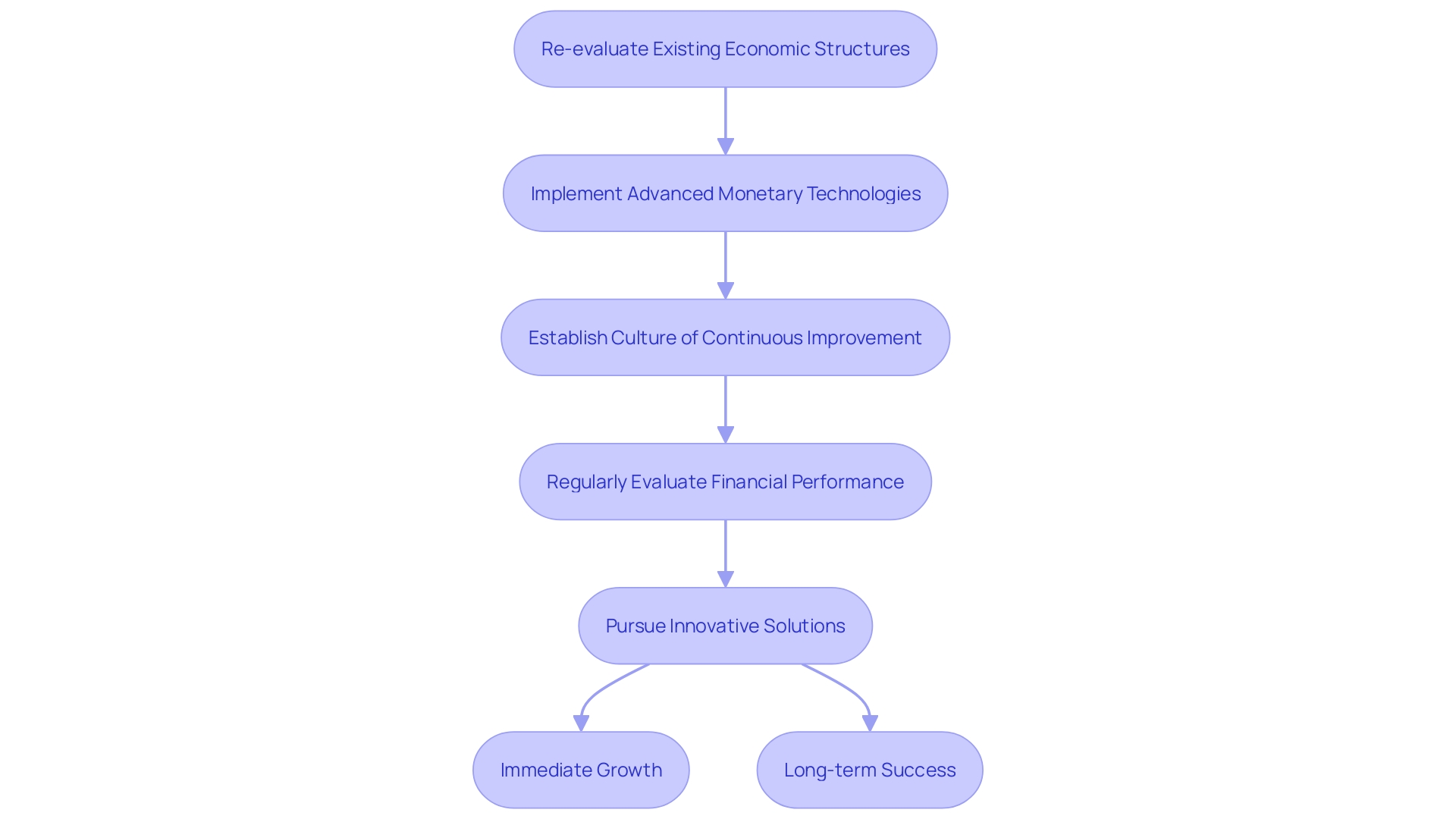

For businesses aiming for scalable growth, economic transformation is essential. This involves re-evaluating existing economic structures and processes to support expansion. Implement advanced monetary technologies that facilitate automation and enhance data analytics capabilities. Establish a culture of continuous improvement by regularly evaluating financial performance and seeking innovative solutions. This proactive approach not only supports immediate growth objectives but also positions the organization for long-term success.

Conclusion

Streamlining financial processes is a critical factor for businesses seeking to enhance productivity and maintain competitive advantage. Implementing automation in accounts payable and receivable not only reduces human error but also optimizes cash flow management. The success stories of companies like Swan, which effectively utilized advanced solutions, highlight the importance of technology in addressing scalability and security challenges.

Optimizing financial performance requires a proactive approach, focusing on key performance indicators that align with overarching business goals. Regular analysis of these metrics, along with scenario planning and performance reporting, equips finance teams to make informed decisions and adjust strategies in response to market conditions. The integration of cash flow forecasting further supports financial liquidity, ensuring that organizations can meet both operational needs and growth initiatives.

Effective financial management practices, such as robust budgeting and cash flow forecasting, are essential for sustainability and growth. Businesses that invest in modern financial software can significantly improve productivity and operational efficiency. Regular reviews of financial policies, along with the adoption of automated solutions, are crucial for maintaining compliance and adapting to an evolving business environment.

The role of financial consultants cannot be overlooked in this landscape. Their expertise in evaluating financial frameworks and guiding organizations through complex transformations is vital for optimizing performance. By integrating best practices and innovative strategies, businesses can navigate financial complexities and position themselves for scalable growth.

Embracing these approaches not only enhances financial stability but also empowers organizations to seize new opportunities in an increasingly competitive market.