Introduction

Pro forma financial statements and budgets are powerful tools that can shape the future of a business. Pro forma statements provide a visionary outlook of a company's potential earnings, expenses, and net income, helping to map out financial success. On the other hand, budgets offer a detailed framework for resource allocation and cash flow management, ensuring that every dollar is spent strategically.

Crafting a pro forma statement involves aspirational planning and proactive decision-making, while budgets provide transparency and accountability. These financial instruments guide decision-making at every level and are essential for monitoring financial health and efficiency. Whether navigating volatile markets or ensuring compliance, pro forma statements and budgets are fundamental in shaping a company's financial narrative and driving resources towards impactful areas.

In this article, we will explore the types of pro forma financial statements, the process of creating them, and the benefits they bring to businesses. We will also delve into the importance of strategic goal-setting, analyzing historical data, and making data-driven decisions. Additionally, we will discuss best practices for accurate forecasting and common applications of pro forma budgeting.

Join us on this journey to understand the power of pro forma statements and budgets in guiding financial success.

Understanding Pro Forma Statements vs. Budgets

Pro forma are tools that can significantly impact the trajectory of a business's growth. Pro forma statements offer a visionary financial landscape, presenting estimations of a company's potential earnings, expenses, and net income. These projections are informed by assumptions about future market conditions and company performance, helping to map out what financial success could look like.

Conversely, budgets are tactical tools that provide a detailed framework for how a business intends to allocate its resources within a set timeframe, typically over the course of a fiscal year. Budgets are designed with precision to manage cash flow meticulously, ensuring that every dollar is accounted for and spent in alignment with the company’s .

When crafting a pro forma statement, one anticipates the . This forward-looking approach is akin to aspirational planning, where the focus is on potential growth and strategic investment. For instance, YNAB’s zero-based budgeting philosophy, which assigns a job to every dollar, emphasizes intentional spending to achieve financial goals—an approach resonating with the proactive planning embedded in pro forma statements.

In contrast, an expense budget reflects a granular breakdown of costs, including labor, materials, marketing, and other operational expenses. It's not just about what the project costs, but why it costs that much, providing transparency and accountability. A complete budget considers all aspects of the business, from everyday operations to long-term investments, and is crucial for monitoring .

A poignant illustration of the strategic use of budgets comes from the world of digital currencies, where investments carry high risks. Here, comprehensive budgeting and pro forma analysis are indispensable for navigating the volatile landscape, as underscored by NetWorth’s suite of financial insights and strategies.

Ultimately, these financial instruments serve to guide decision-making, from day-to-day operations to overarching investment strategies. They are not just about tracking numbers but are fundamental in shaping a company's financial narrative and ensuring that resources are channeled towards the most impactful areas.

Types of Pro Forma Financial Statements

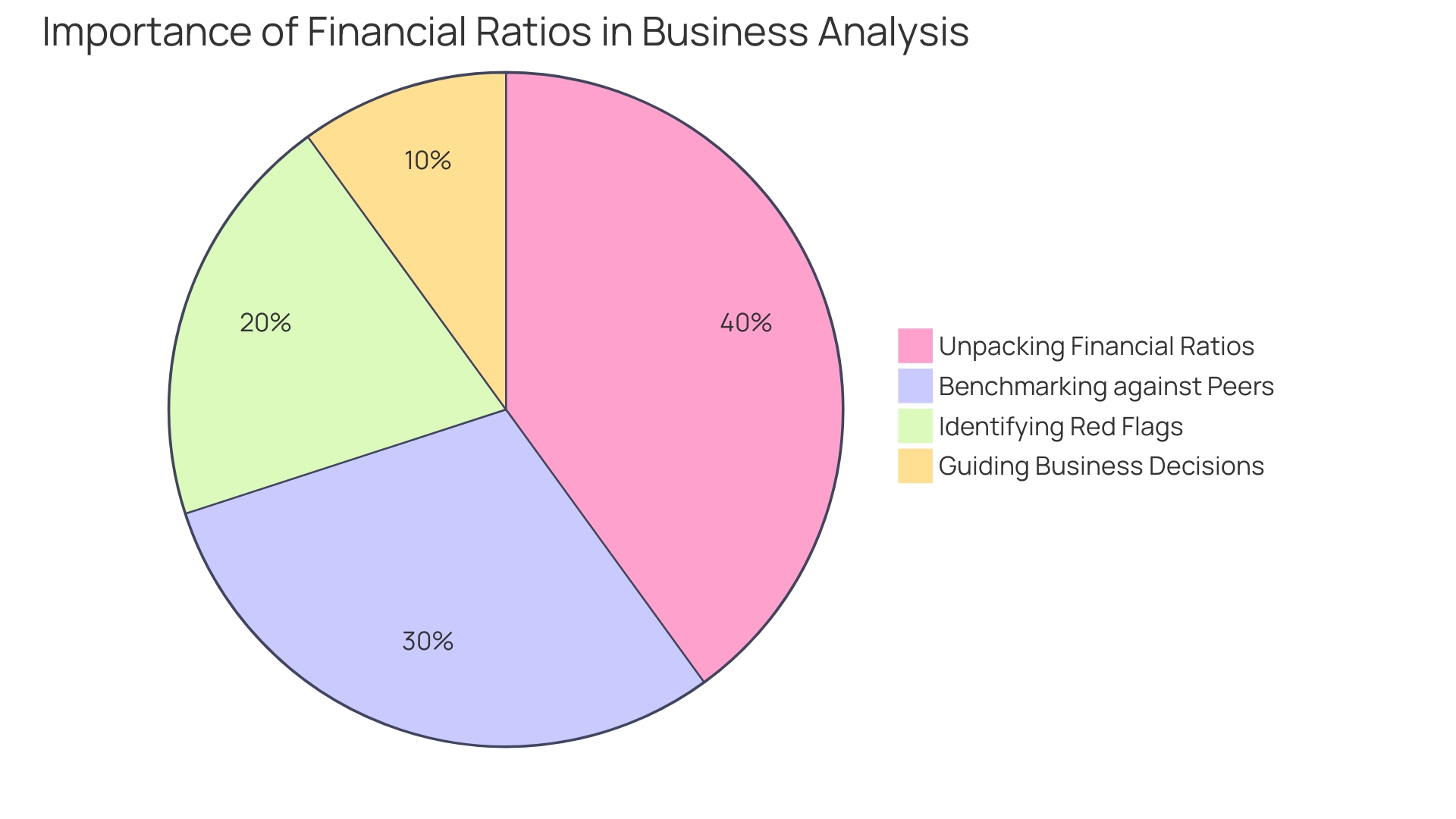

Comprehensive are essential tools for businesses to project their financial health. A allows companies to forecast revenue, expenses, and net income for a future period, revealing the potential profitability and operational efficiency. Meanwhile, the pro forma balance sheet provides a snapshot of assets, liabilities, and shareholders' equity, offering a clear picture of a company's financial standing at a specific point in time.

Lastly, the is indispensable for assessing cash inflows and outflows, helping businesses evaluate their liquidity and cash management strategies. These statements, when utilized effectively, can signal and offer transparency that can attract investors and facilitate responsible corporate governance. As evidenced by companies like AG and Wells Fargo, strong financial reporting can lead to recognition and trust in the marketplace.

Additionally, legal and financial news, such as SAP's settlement of bribery charges, underscores the importance of compliance and transparency in financial operations. The compelling nature of these documents lies in their ability to distill complex financial data into accessible insights, governed by standards that ensure accuracy and consistency.

Creating a Pro Forma Income Statement

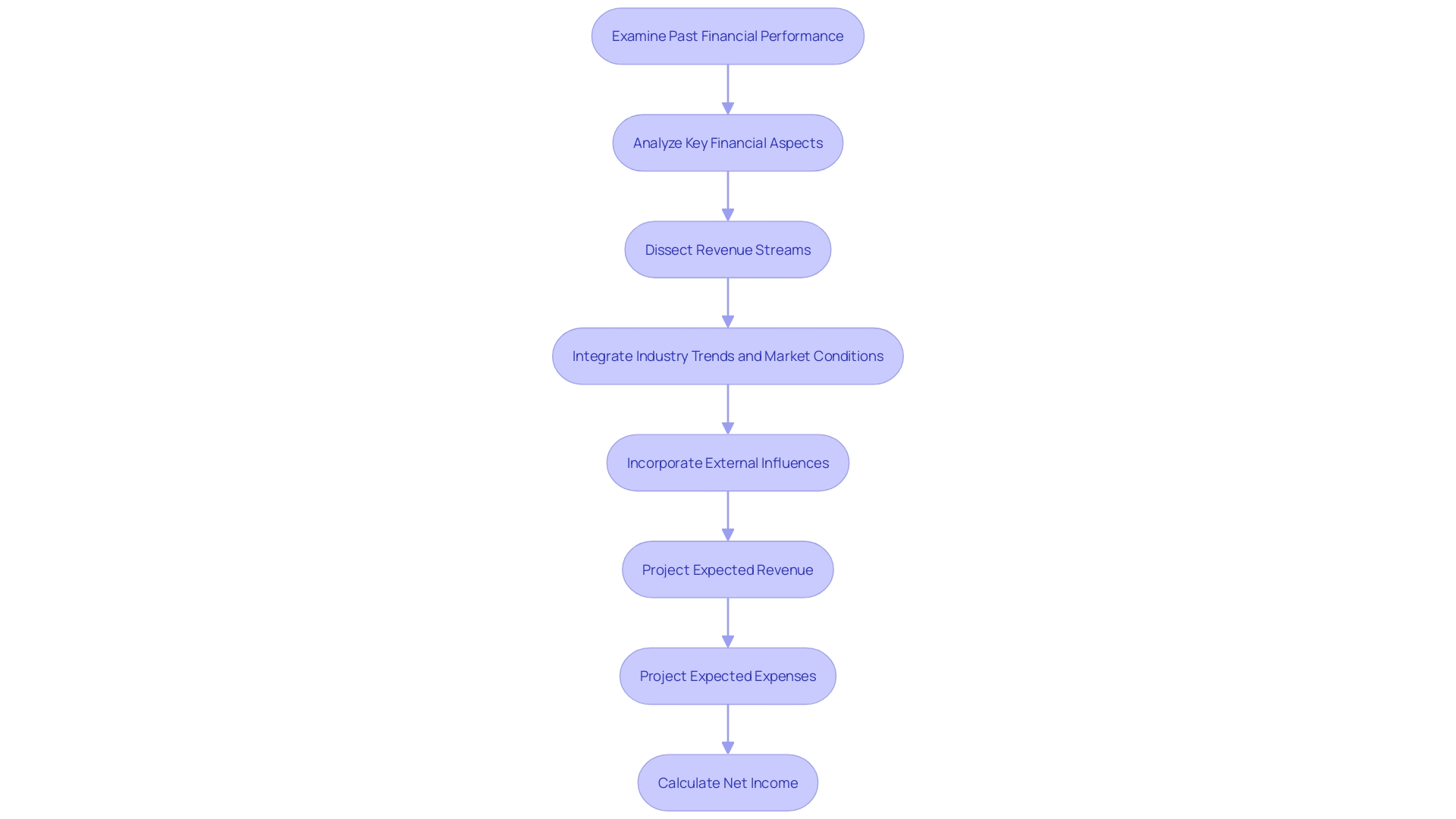

Crafting an insightful pro forma income statement requires careful consideration of both internal financial history and external economic factors. Begin by thoroughly examining past , leveraging at least three years of data to discern trends, seasonal patterns, and anomalies. Key financial aspects to analyze include revenue, operating costs, profit margins, losses, liabilities, investments, and fixed costs.

This historical data not only informs your forecast but also lays the groundwork for realistic projections.

Next, dissect your , categorizing them into distinct segments such as product sales, services, or subscriptions. This granular approach to your income sources allows for a nuanced understanding of each stream's contribution and its potential growth or decline. As you project future performance, integrate knowledge of your business's revenue intricacies with industry trends and market conditions.

For instance, consider the predicted inflation rates for the coming year—economists' surveys, like the Survey of Professional Forecasters and The Wall Street Journal, estimate a CPI of 2.5% and PCE of 2.4% for 2024. This macroeconomic insight should be factored into your revenue and expense calculations.

When , scrutinize each category for possible or anticipate necessary increases. Incorporate external influences such as evolving safety regulations or market disruptions, akin to the wildfire risks that utilities in California must manage, into your expense projections. For example, the stringent safety standards that investor-owned electrical companies must adhere to due to wildfire risks underscore the importance of considering regulatory impacts on operational costs.

Lastly, synthesize this information to project the expected revenue and expenses and calculate the resultant net income. The final pro forma statement should reflect a comprehensive understanding of both your business's financial trajectory and the broader economic landscape, ensuring that your financial planning is both informed and strategic.

Creating a Pro Forma Balance Sheet

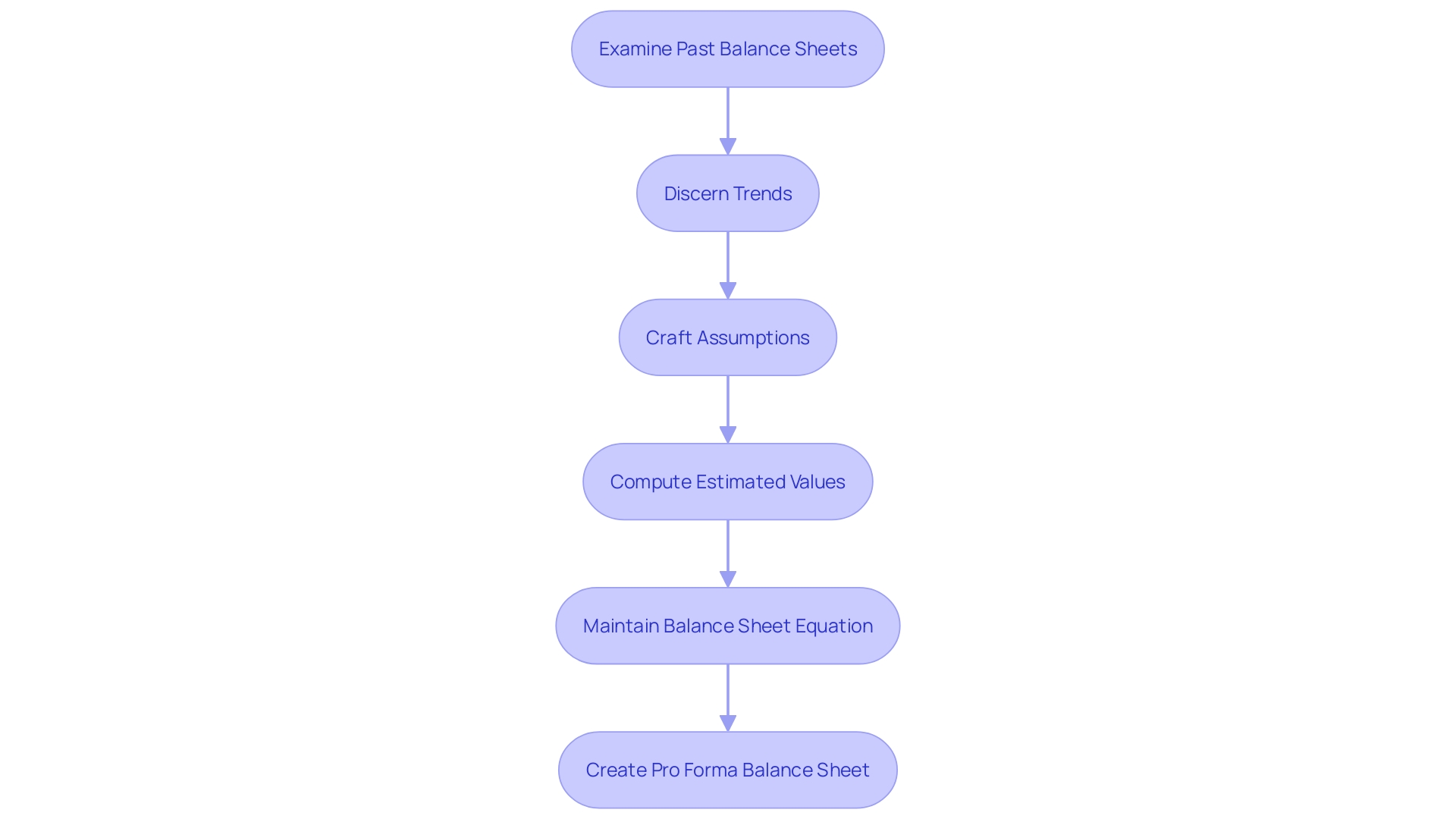

Creating a pro forma balance sheet is an essential exercise to project a company's . Initiate this process by meticulously examining past balance sheets and discerning trends across various asset and liability categories. The next step involves crafting educated assumptions about upcoming changes.

For instance, anticipated revenue growth, debt servicing, or capital expenditures on new assets will impact future financial standings.

To illustrate, let's consider a software startup operating as a single-member LLC. In such a scenario, financial categories are denoted by distinct accounts. Imagine the startup has $2,000 in the bank.

If $1,500 is spent on a laptop, the bank balance reduces, but the transaction is better understood as a conversion of cash into a tangible asset. It's about understanding the ebb and flow of resources, essentially giving 'every dollar a job', as advocated by budgeting systems like YNAB. This approach not only enhances but also promotes intentional spending and aspirational saving.

As you proceed, compute the estimated values of each balance sheet category. It's crucial to maintain the fundamental balance sheet equation: assets must equal the sum of liabilities and shareholders' equity. This equation is the , reflecting the financial equilibrium of a company at any given moment.

Assets, from cash to property, signify potential future benefits, while liabilities encompass debts and obligations.

In recent developments, issues like SAP's $220 million settlement for bribery charges showcase the gravity of accurate financial reporting and compliance. Furthermore, SMEs are being invited to participate in fieldwork by the IASB to better understand proposed financial reporting requirements, highlighting the ongoing evolution of financial standards.

In conclusion, a well-constructed pro forma balance sheet is a financial compass, offering a glimpse into the company's potential fiscal landscape. It guides stakeholders in assessing the company's solvency, risk, and overall , ensuring informed decisions that align with long-term business strategies.

Creating a Pro Forma Cash Flow Statement

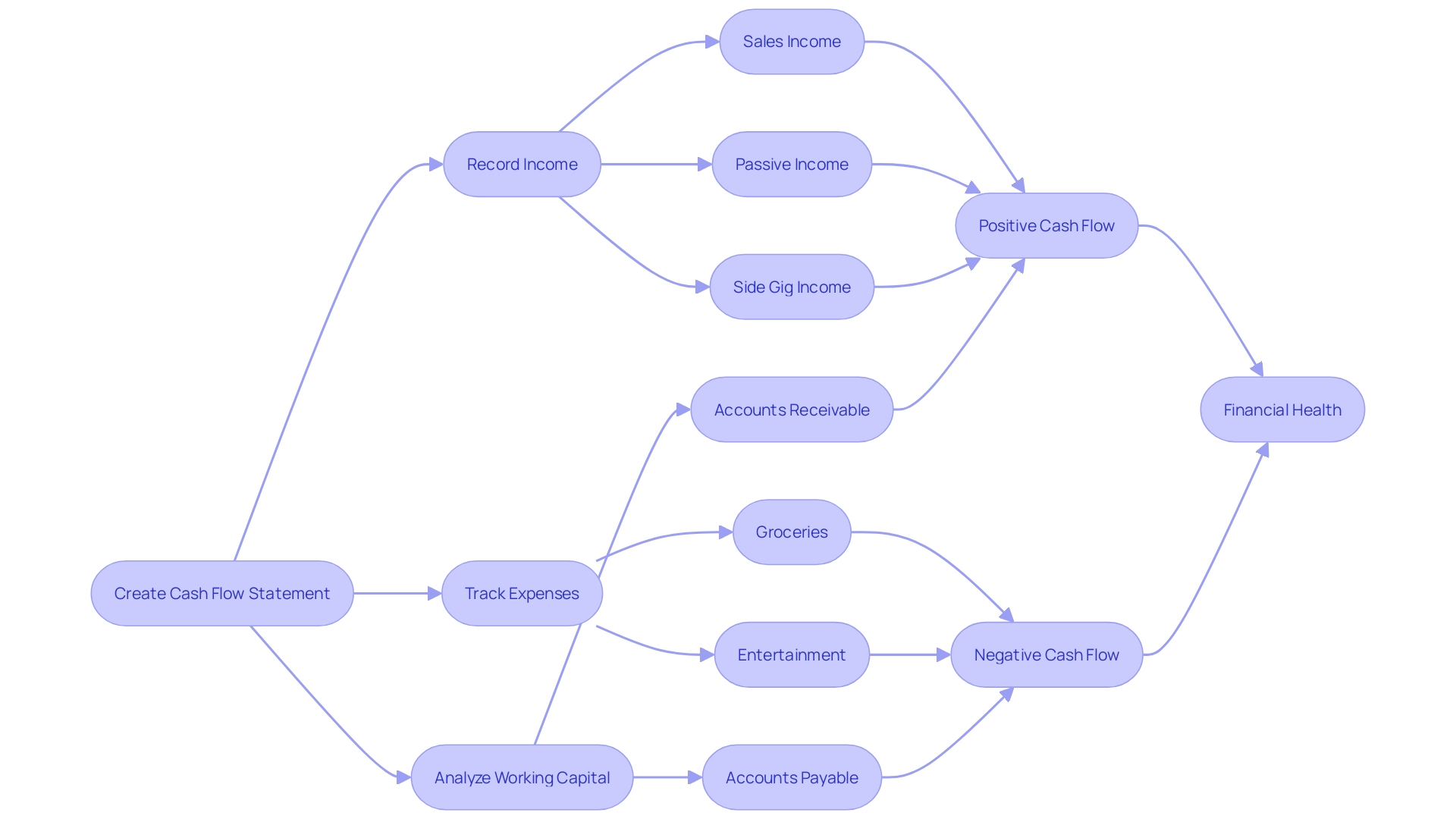

Crafting a pro forma is pivotal for evaluating a company's prospective cash movements within a given timeframe. It requires a meticulous examination of past cash flow patterns to forecast future transactions accurately. Critical to this projection is the consideration of income streams, including sales revenue, coupled with the management of receivables and payables, alongside routine .

This statement must also anticipate that could arise from investment maneuvers, funding activities, or shifts in working capital. Such projections are not merely speculative; since 1987, businesses have been mandated to disclose cash flow information, offering transparency into their liquidity through operating, investing, and financing activities. A well-prepared cash flow statement deciphers a firm's capability to sustainably generate cash, providing a lens through which and can be assessed.

It's a that shows whether a company can organically fuel its growth or if it leans on external funding sources. In the dynamic realm of business, where cash is the lifeblood, maintaining a robust cash flow isn't just advisable; it's imperative for survival.

Steps to Creating a Pro Forma Budget

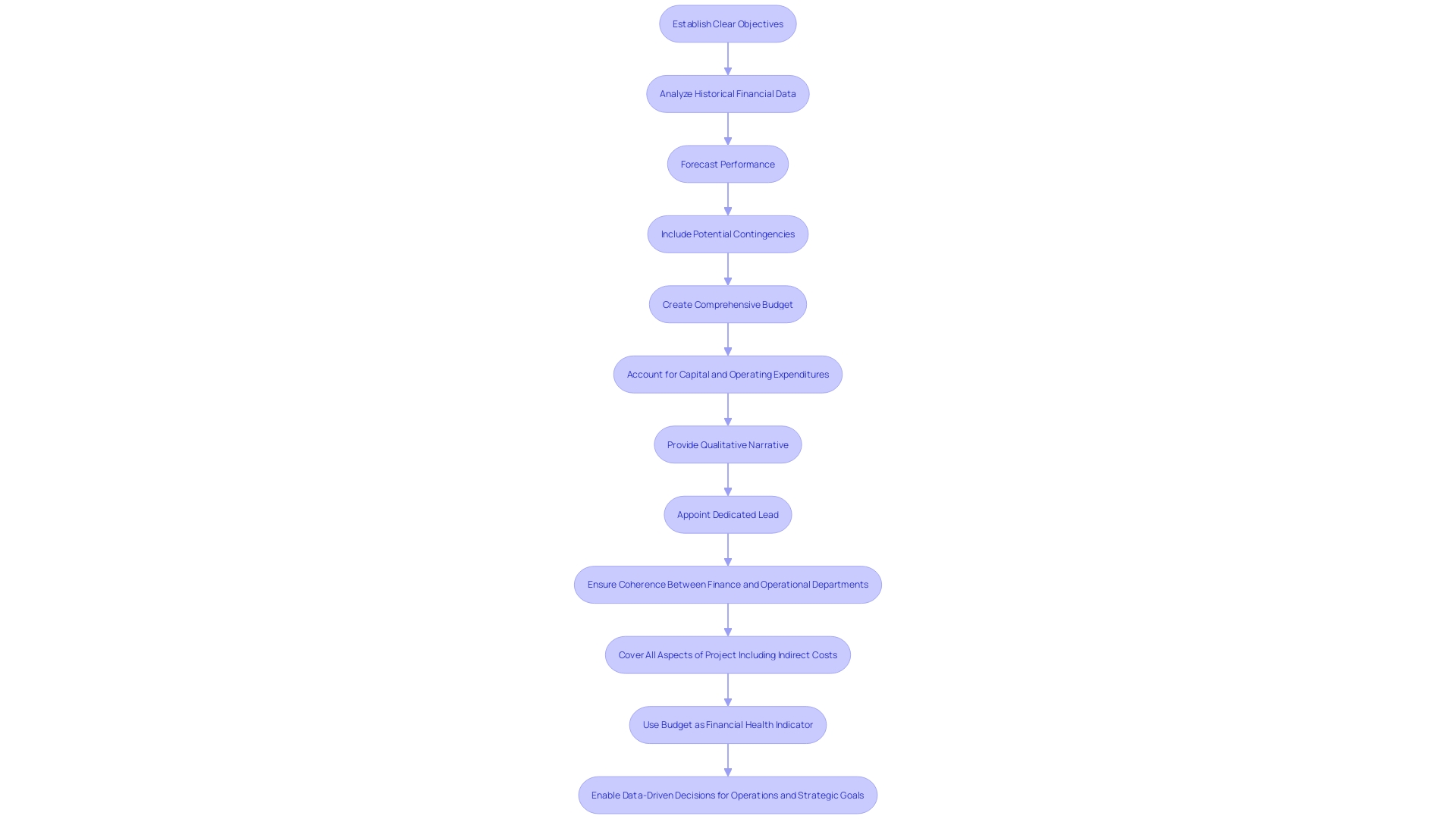

Pro forma budgeting is a strategic tool that guides and aligns it with the business's overarching goals. It begins with establishing clear objectives for the upcoming period, providing a roadmap for . This process requires a comprehensive analysis of historical financial data to identify trends that will inform future projections.

By forecasting performance and including potential contingencies, the budget becomes a reflection of both operational requirements and .

A , for instance, details all anticipated costs, including approved expenses necessary for project completion. It should account for both capital and operating expenditures, offering a nuanced view of financial allocation over time. conveys not just the quantitative cost of a project but also its qualitative narrative, explaining the rationale behind each line item.

For example, a budget may break down the materials, labor, and time required for a sculpture, providing a story in numbers.

To enhance the budget's precision and utility, it's advisable to appoint a dedicated lead to oversee the budgeting process. This ensures a coherent understanding between finance and operational departments, preventing miscommunication and fostering a unified approach. Moreover, an expense budget should be detailed enough to cover all aspects of a project, including indirect costs like publicity and insurance, which are integral to understanding the full financial scope.

In crafting a pro forma budget, it's crucial to incorporate a narrative that explains the financial story, detailing what is required and why. This approach not only satisfies funders' requirements for detail but also equips decision-makers with the insights needed to make informed choices. Ultimately, a well-structured pro forma budget serves as a , enabling data-driven decisions that support the business's short-term operations and long-term strategic goals.

Setting Strategic Goals

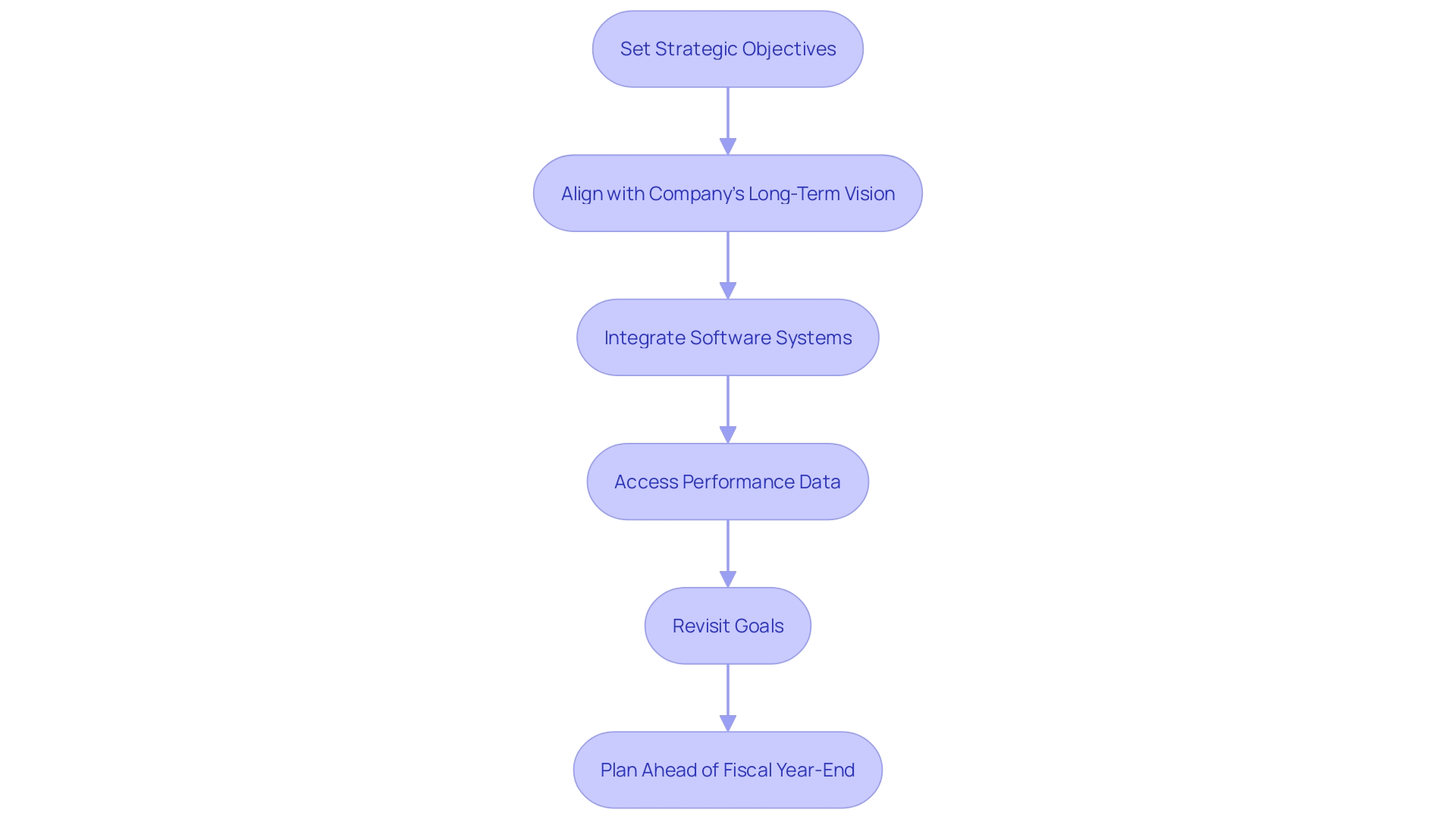

Crafting a is an essential step for forward-thinking organizations, establishing a that is in sync with overarching . It's a meticulous process that starts with setting , which are not just financial targets but, more importantly, a compass for where the business aims to go. These objectives are the bedrock of a budget that is designed to echo and support the company's .

For instance, a clear strategic goal could be enhancing revenue streams, which was a focal point for Strategic Solution Partners (SSP), a leader in the hospitality industry known for their expertise in revenue enhancement and strategic planning. Similarly, when Austin Morgenroth of Somerset Academies of Texas took charge, he emphasized the integration of various software systems to streamline processes, a move that directly supported their educational objectives and operational efficiency.

The importance of setting these goals cannot be overstated. They act as a guide, enabling organizations to allocate with precision and intent. As Michael Grove, Chief Operating Officer of HotStats, puts it, having real-time access to performance data is indispensable for budgeting, as it aids in benchmarking and identifying profit-boosting opportunities.

Moreover, strategic goals should be revisited regularly, and assumptions should be assessed for their validity. This reflection allows organizations to remain on target and agile enough to seize new opportunities, with the long-term vision. Planning well ahead of the fiscal year-end, as early as August, is recommended to avoid a rushed process and to ensure a holistic strategy is in place.

The goal-setting phase is therefore more than just a preliminary step; it's a strategic move that sets the tone for the entire budgeting process, ensuring that every dollar is an investment towards the company's future success.

Analyzing Historical Data

When crafting a pro forma budget, examining historical is more than just a routine step; it's a strategic approach to grasp the . Through the lens of past performance, businesses can decipher patterns and trends that define the very assumptions for future budgeting exercises. This analysis illuminates a company's financial prowess and its vulnerabilities, providing a canvas to pinpoint improvement opportunities.

It forms the bedrock upon which future performance is projected and are penned down.

Understanding that each financial transaction is akin to moving pieces on a complex chessboard, where every move from one account to another reflects a , is crucial. For instance, an expenditure of $1,500 on a laptop is not a mere subtraction from your bank balance; it's an investment into an asset that could potentially fuel future growth. This perspective is central to appreciating the full spectrum of a business's financial activities.

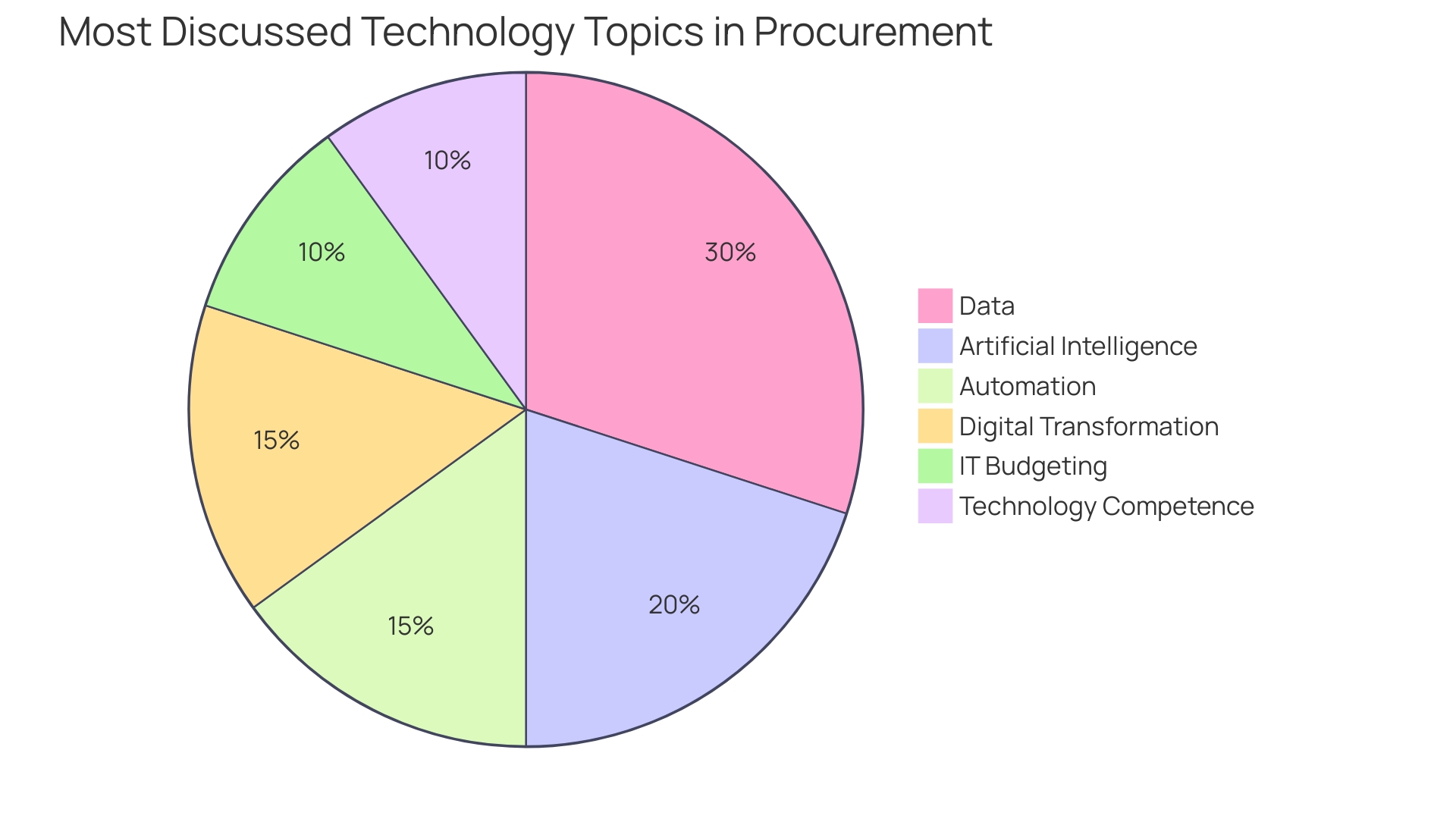

Moreover, the integration of has revolutionized our ability to transform raw financial data into actionable insights. With the aid of , we can now dissect large datasets with a precision that was previously unattainable, offering a competitive edge in strategy formulation. As analytical tools advance and the financial landscape becomes more intricate, the ability to distill complex data into clear, strategic financial planning becomes ever more valuable.

The essence of a cannot be overstated, as it meticulously tracks every cash inflow and outflow, revealing whether a company's lifeblood—its cash—is pulsating from robust operations or dependent on external financing. This critical financial report, alongside others like the statement of change in equity, paints a detailed picture of a company's fiscal health and operational efficiency. It's these insights that allow stakeholders to comprehend the full financial story of a business, from its revenue streams to operational expenditures, and make informed decisions that align with both immediate needs and long-term objectives.

Forecasting Future Performance

is an indispensable tool for envisioning the of a business. This approach extends beyond traditional budgeting by such as market volatility, industry shifts, and the organization's adaptive capacity. By leveraging insights from emerging markets, fringe consumer groups, and innovative , financial leaders can identify weak signals that may indicate a shift in economic trends or the advent of disruptive revenue models.

The integration of technology and data analysis enhances the precision of these forecasts, allowing for more effective in response to both anticipated and unforeseen . The ultimate objective is to craft a that embodies both foresight and flexibility, ensuring that the organization remains resilient and strategically positioned to capitalize on opportunities for growth.

Incorporating Contingencies

Ensuring a includes contingencies is not merely a cautious move; it's a strategic one. Contingencies act as safeguarding buffers, helping businesses face the unpredictable with confidence. For instance, Strategic Solution Partners assisted a hotel company to bolster its bookings by establishing foundational advertising tools and conducting meticulous , which is akin to creating a robust in marketing strategies.

Similarly, the insurance industry provides an enlightening example where a company increased profitability by consciously underpricing new business, challenging conventional targets and embracing the unexpected.

Moreover, recent legislative developments, like the signing of the 2024 state budget by Governor Gavin Newsom, highlight the importance of resilience through substantial reserves and . This mirrors the practice of setting aside funds for unforeseen hurdles. Furthermore, GASB's new Statement 102 mandates disclosures regarding , underscoring the need for transparency about potential fiscal constraints and their impact.

When crafting a , it's not only about tallying expenses but narrating the of a project. This narrative should encompass initial costs, such as publicity and insurance, while also reflecting the project's broader values and priorities as shown in the budget's numbers. A compelling budget narrative, supported by detailed expense categories, paints a clearer picture for stakeholders and funders, aiding in the understanding of both the 'what' and the 'why' behind project costs.

Analyzing and Interpreting a Pro Forma Budget

Delving into is a linchpin for securing a transparent view into an organization's fiscal wellbeing, steering clear of guesswork when making pivotal . Begin by juxtaposing the pro forma figures with actual financial data from preceding periods, spotlighting any substantial discrepancies. Scrutinize the causative factors of these discrepancies and gauge their repercussions on your business's monetary performance.

Pinpoint areas that call for enhancement and carve out tactics to mend any fiscal gaps or inefficiencies revealed. Through meticulous , businesses can unearth avenues for expansion and initiate remedial measures as needed.

A project budget encapsulates all sanctioned expenses to bring a project to fruition. This budget could span several quarters or years and may encompass capital and operational expenditures. It symbolizes the total financial resources allocated for project completion.

Particularly when planning a budget for a project proposal, it's crucial to discern cost categories your organization may standardize, as this aids in crafting a precise and comprehensive project budget.

As per a recent IRS Notice, activities such as planning, designing, building models, coding, and testing of computer software, including enhancements and upgrades, are now officially recognized as software development. This definition serves as a guide for financial planning around technology investments, ensuring alignment with tax regulations and optimizing R&D expenditure.

A , the bedrock of strategic direction, delineates an enterprise's targets, aspirations, and the roadmap to achieve them. It prompts critical inquiry into the organization's trajectory and differentiates between a standard [business plan](https://blog.smbdistress.com/4-key-strategies-for-effective-goal-setting-for-turnarounds) and a strategic plan, the latter being more prevalent in non-profit realms.

The importance of robust business data cannot be overstated. As one expert puts it, "Data is a precious thing and will last longer than the systems themselves." Such data serves as a beacon, illuminating the path forward and substantiating every strategic move with concrete evidence.

This is not just theoretical; companies that harness the power of data analytics to understand customer behavior see a marked superiority in sales growth and gross margins compared to their competitors.

In today's volatile business landscape, the role of a CFO has transcended beyond traditional fiscal stewardship to encompass strategic planning, resource allocation, and performance measurement. They harness key metrics and financial indicators to evaluate and enhance organizational performance, ensuring that every decision is rooted in data-driven insights.

Interpreting Variance

Understanding variances in is crucial for pinpointing why a business's actual may deviate from its projections. When actual figures surpass expectations, this positive variance can reflect superior performance. Conversely, a negative variance may indicate areas of underperformance, necessitating a closer look at the root causes.

A pro forma budget serves as a roadmap, detailing the , including all necessary payments such as labor, materials, and services—regardless of whether they're paid upfront or deferred. This includes indirect costs like publicity and taxes, underscoring the true cost of a project.

When discrepancies arise between the , it's important to delve into the specifics. For instance, a budget for a sculpture would encompass not only the cost of materials but also who is creating it, where, and the timeframe required. This narrative in numbers helps stakeholders comprehend both the 'what' and the 'why' behind the costs.

Moreover, budgets in complex fields such as public finance or insurance are not just about the numbers but also about effectively communicating them in relation to human experience. For example, an insurance company may strategically write new business at a combined ratio of over 120%, with the understanding that spreading fixed costs over a larger base can offset the losses from individual policies.

In the context of school district budgets, 'equity' can denote the net value of assets after liabilities are deducted or represent a commitment to allocating resources in a manner that promotes equal outcomes across various student demographics.

By analyzing through the lens of detailed project costs, equity considerations, and strategic financial decisions, businesses can gain a multifaceted view of their . This knowledge enables them to , aligning their financial operations with their long-term objectives.

Making Data-driven Decisions

Harnessing the power of data analytics is essential for creating effective . Pro forma budgeting goes beyond mere number crunching; it's about painting a clearer financial picture that guides . Utilizing comprehensive data sets enables businesses to allocate funds wisely, pinpoint areas ripe for enhancement, and seize growth opportunities with precision.

The intricate dance of becomes more choreographed and intentional with robust data at its core, empowering businesses to move towards their strategic goals with confidence.

For instance, zero-based budgeting systems, such as those employed by personal finance apps like YNAB, demonstrate how assigning every dollar a role leads to purposeful spending and, ultimately, and progress. Similarly, the hospitality industry relies on historical data to understand spending patterns and create forecasts that drive . In healthcare, the swift adoption of technology and automation is pushing aside outdated manual reporting, as evidenced by a physician organization streamlining a once labor-intensive reporting process into an efficient operation.

The outcome? Clearer insights and more strategic resource allocation.

The is not without its challenges, though. Data scientists often find themselves bogged down by repetitive tasks, which not only stifles innovation but also incurs unnecessary costs. Yet, when are approached strategically, these hurdles can be overcome, and the true potential of data to transform decision-making can be realized.

As Daniel Kahneman and Amos Tversky's research on biases and heuristics shows, understanding data's nuances—like sample size and confidence intervals—can significantly influence the decisions we make. With data as the guiding light, businesses are better equipped to navigate the complexities of financial planning and emerge more attuned to the nuances of their financial landscape.

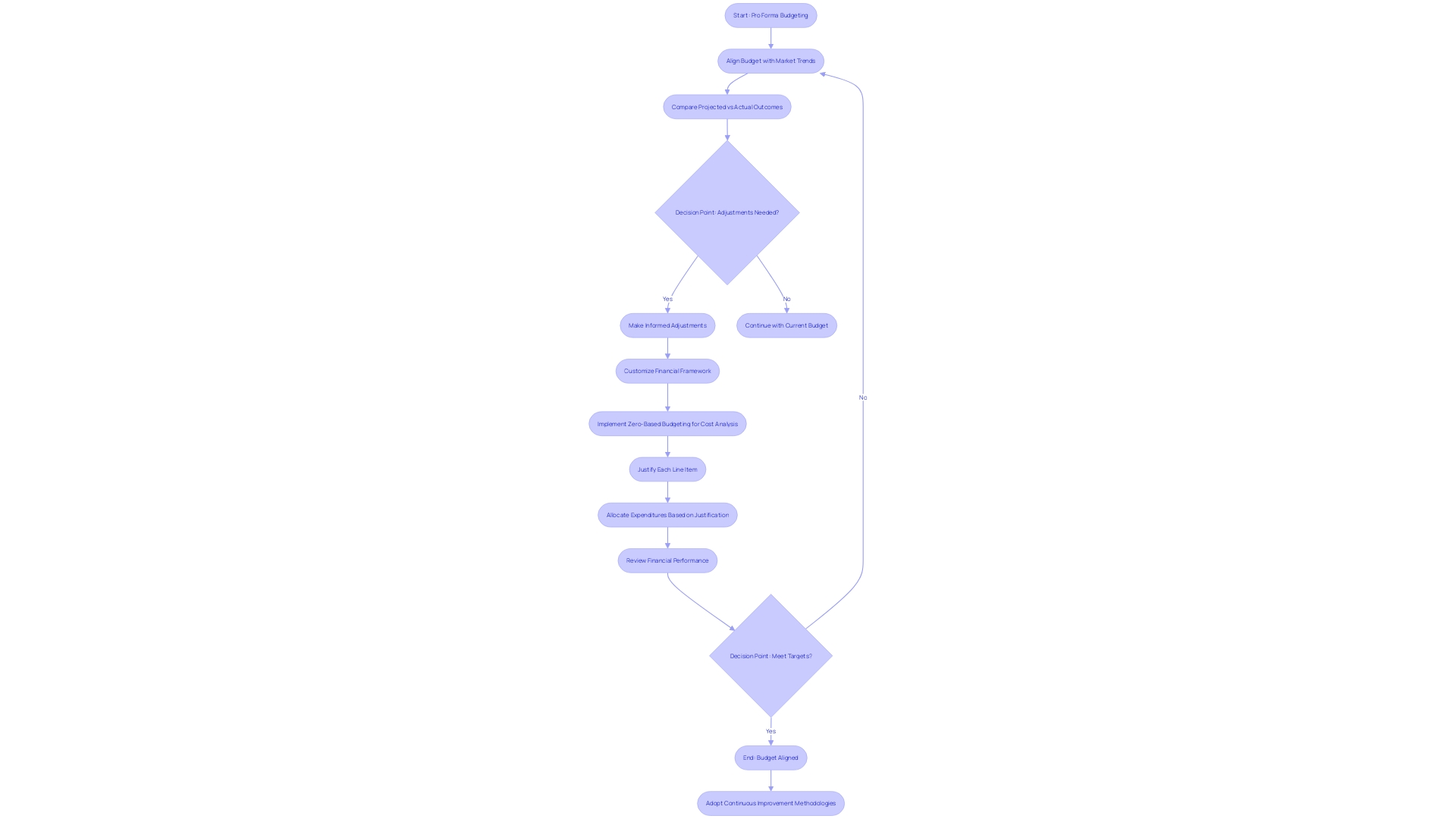

Continuous Improvement and Refinement

To effectively navigate , businesses must embrace the dynamic nature of . This approach is not a set-and-forget strategy; it's a living process that thrives on agility and foresight. Companies must be vigilant in aligning their pro forma budgets with and internal performance metrics.

An active comparison of projected figures against actual outcomes serves as a compass for identifying discrepancies and making informed adjustments. This vigilant refinement is exemplified by forward-thinking organizations, like Somerset Academies of Texas, which consolidated disparate systems to streamline processes and enhance performance visibility. Similarly, Strategic Solution Partners harnesses interim human capital and operational solutions to tailor to each client's specific needs, emphasizing the importance of customizing financial frameworks to the organization's evolving context.

This hands-on approach ensures that the pro forma budget remains a robust tool, steering the business towards fiscal prudence and strategic growth. The wisdom echoed by finance directors and leadership experts underlines the role of finance officers as decision architects, shaping the budget process to enhance and informed decision-making. Embracing methodologies such as zero-based budgeting, as highlighted by industry COO Michael Grove, can revolutionize , challenging traditional norms and fostering a culture of continuous improvement.

These practices, coupled with a deep understanding of the organization's unique operational landscape, ensure that are not only preserved but optimized for contemporary challenges and opportunities.

Best Practices for Accurate Forecasting

Creating a robust pro forma budget requires foresight and an understanding of both historical trends and potential future conditions. Here's how to enhance forecast accuracy:

- Blend Data Types: Incorporate both quantitative and qualitative data for a well-rounded view. Quantitative data could include and trends, while qualitative insights might come from on industry movements.

- : Engage with department leaders and senior management to gather diverse insights. Their can provide valuable input that may not be apparent from data alone.

- Market Adaptability: Stay agile by regularly revisiting your projections and adjusting them as market conditions shift. Economists from major firms suggest that forecasts should be dynamic, reflecting the latest economic indicators and consensus.

- : Use actual results as a feedback loop. By comparing projections with real performance, you can calibrate your forecasting model to be more accurate over time.

- Tech Leverage: Utilize for data analysis automation, which can streamline the process and reduce human error.

The importance of an accurate forecast is underscored by the fact that it lays the groundwork for and helps to articulate the story behind the numbers. Remember, an expense budget is more than just figures; it's a narrative about your project's goals and resources.

Common Applications and Benefits of Pro Forma Budgeting

Pro forma budgeting stands as a vital tool for businesses, offering a blueprint for future financial activity and serving several key functions:

- Strategic Alignment: It bridges the gap between financial forecasting and strategic targets, ensuring that financial plans are in sync with the company's vision and goals.

- : By juxtaposing actual financial outcomes with pro forma projections, organizations can gauge their fiscal performance, pinpointing areas ripe for enhancement.

- Guided Decisions: These budgets offer a data-driven foundation for making decisions, ensuring resources are allocated efficiently and effectively.

- : Pro forma budgets act as a communication medium, providing investors and stakeholders with a transparent view of the company's financial well-being and prospective growth trajectory.

- : Including potential contingencies within the budget allows for better anticipation and management of potential financial risks and uncertainties.

In the hospitality sector, for example, the adoption of Zero-Based Budgeting (ZBB) has underscored the importance of meticulous . Unlike traditional budgeting, ZBB starts from a 'zero base,' with every expense needing justification for the current period. This level of scrutiny ensures expenses align with strategic imperatives, fostering enhanced fiscal discipline and potentially leading to considerable cost savings.

Furthermore, a well-crafted business budget is more than a collection of figures; it reflects the aspirations and priorities of a business, with a focus on cash flow management—crucial for covering expenses and fostering growth. Utilizing a can streamline this process, structuring financial data and facilitating strategic decision-making.

In summary, pro forma budgeting is a comprehensive fiscal management instrument that not only supports but also serves as a cornerstone for performance evaluation, informed decision-making, investor relations, and risk management.

Conclusion

Pro forma financial statements and budgets are powerful tools that shape a business's future. Pro forma statements provide a visionary outlook of potential earnings, expenses, and net income, while budgets offer a detailed framework for resource allocation and cash flow management. They provide transparency, accountability, and guide decision-making at every level.

Comprehensive pro forma financial statements are essential for projecting a company's financial health. They distill complex data into accessible insights, attract investors, and ensure responsible corporate governance. Analyzing historical data is crucial for informed forecasting, allowing businesses to identify trends and make accurate projections.

Creating pro forma budgets involves setting strategic goals aligned with the company's objectives. Historical data analysis helps identify improvement opportunities, and leveraging data analytics enhances forecast precision. Pro forma budgets should include contingencies to confidently face unexpected challenges.

Understanding variances in pro forma budgets helps pinpoint areas of underperformance, enabling informed adjustments. Data-driven decision-making is critical for effective budgeting, empowering businesses to allocate funds wisely and seize growth opportunities. Continuous improvement and refinement ensure budgets remain aligned with market trends and internal metrics.

Pro forma budgeting serves multiple functions, including strategic alignment, performance evaluation, guided decisions, stakeholder confidence, and risk mitigation. It bridges the gap between financial forecasting and strategic targets, providing transparency to investors and stakeholders.

In conclusion, pro forma financial statements and budgets shape a business's financial narrative, driving resources towards impactful areas and ensuring financial success. By leveraging these tools, businesses make informed decisions, attract investors, and navigate the dynamic landscape with confidence.

Frequently Asked Questions

What is a pro forma financial statement?

A pro forma financial statement is an estimation of a company's potential earnings, expenses, and net income based on assumptions about future market conditions and company performance. It provides a visionary financial landscape for what financial success could look like.

How does a budget differ from a pro forma statement?

A budget is a detailed framework for how a business intends to allocate its resources within a set timeframe, usually a fiscal year. It is designed to manage cash flow meticulously in alignment with the company's strategic goals, whereas a pro forma statement focuses on potential growth and strategic investment.

What are the types of pro forma financial statements?

There are three types of pro forma financial statements: the income statement, which forecasts revenue, expenses, and net income; the balance sheet, which shows a snapshot of assets, liabilities, and shareholders' equity; and the cash flow statement, which assesses cash inflows and outflows for liquidity and cash management strategies.

How do you create a pro forma income statement?

To create a pro forma income statement, you start by examining past financial performance, analyze revenue streams, factor in industry trends and market conditions, and forecast expenses while considering potential cost-saving opportunities or necessary increases.

What is the purpose of a pro forma balance sheet?

The purpose of a pro forma balance sheet is to project a company's financial health by estimating the values of assets, liabilities, and shareholders' equity, ensuring they balance out, and offering a glimpse into the company's potential fiscal landscape.

Why is a pro forma cash flow statement important?

A pro forma cash flow statement is important because it projects a company's future cash movements, helping to evaluate operational efficiency and financial vigor, and showing whether the company can sustain growth organically or relies on external funding.

What are the steps to creating a pro forma budget?

Creating a pro forma budget involves establishing clear objectives for the upcoming period, analyzing historical financial data, forecasting future performance, incorporating contingencies, and interpreting the budget to inform decision-making.

How do strategic goals relate to pro forma budgets?

Strategic goals are the foundation of pro forma budgets, guiding organizations in allocating financial resources with intent and precision, and ensuring that every dollar is an investment towards the company's future success.

What is the significance of analyzing historical data in budgeting?

Analyzing historical financial data is crucial in budgeting as it helps decipher past performance patterns and trends that define assumptions for future projections, and offers a canvas to identify improvement opportunities.

How can businesses interpret and adjust pro forma budgets?

Businesses interpret pro forma budgets by comparing them with actual financial data from previous periods, identifying discrepancies, and adjusting future projections to align with actual outcomes for continuous improvement.

What are best practices for accurate forecasting in pro forma budgets?

Best practices include blending quantitative and qualitative data, engaging with stakeholders for insights, staying adaptable to market conditions, tracking performance against actual results, and leveraging technology for data analysis.

What are the benefits of pro forma budgeting?

Pro forma budgeting helps align financial forecasting with strategic targets, provides performance metrics, guides decisions with data-driven foundations, improves stakeholder confidence, and mitigates risks through contingency planning.