Introduction

Pro Forma financial information is a powerful tool for strategic financial planning, allowing businesses to project their future performance based on hypothetical scenarios. To fully harness its potential, understanding regulations and compliance is crucial.

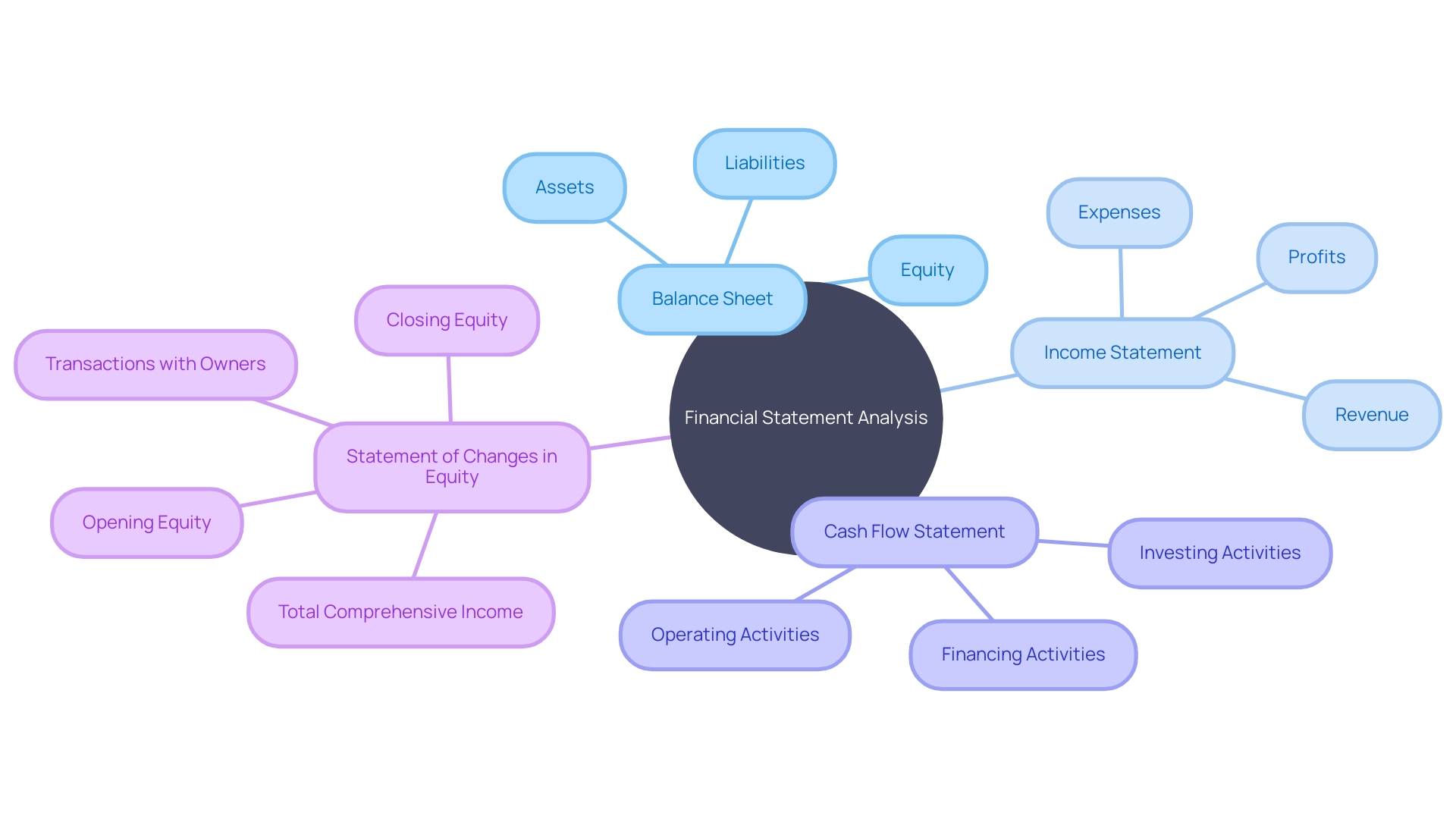

This article will explore the different types of Pro Forma financial statements, the importance of creating a Pro Forma balance sheet, and provide a step-by-step guide on crafting a Pro Forma income statement and cash flow statement. It will also discuss real-world applications of Pro Forma financial statements and provide best practices to follow when preparing them. So, whether you're a CFO or someone interested in financial forecasting, this article will provide practical advice and solutions to help you navigate the world of Pro Forma financial information.

Understanding Pro Forma Financial Information

Pro forma financial information serves as an essential component of strategic financial planning, helping businesses to project their future financial performance based on hypothetical scenarios. This advanced financial forecasting relies on an analysis that incorporates potential cash inflows and outflows. To harness its full potential, understanding regulations and compliance, such as the requirement to report certain financial transactions in the U.S., is crucial.

Specifically, transactions exceeding $10,000 must be reported to the authorities via Form 8300, encompassing cash transactions that extend beyond physical currency to include specific monetary instruments. A cash flow statement, one of the cornerstones of financial reporting, underscores a company's financial robustness, revealing whether operational activities are generating sufficient cash versus dependency on external funding. Delving into this statement sheds light on how effectively a company manages its cash resources, a testament to its operational efficiency and financial well-being.

Paired with the statement of change in equity—also known as the statement of retained earnings—stakeholders can gain insights into choices that affect shareholder equity, including dividends and reinvestments. These financial statements form the basis for pro forma analysis, offering a magnified view of the operational outcomes and strategic decisions that could influence a company's financial trajectory. Such quantitative foresight is grounded in sound financial practices and adherence to reporting standards, ensuring that while businesses plan for the future, they remain rooted in the practicalities of present compliance and fiscal management.

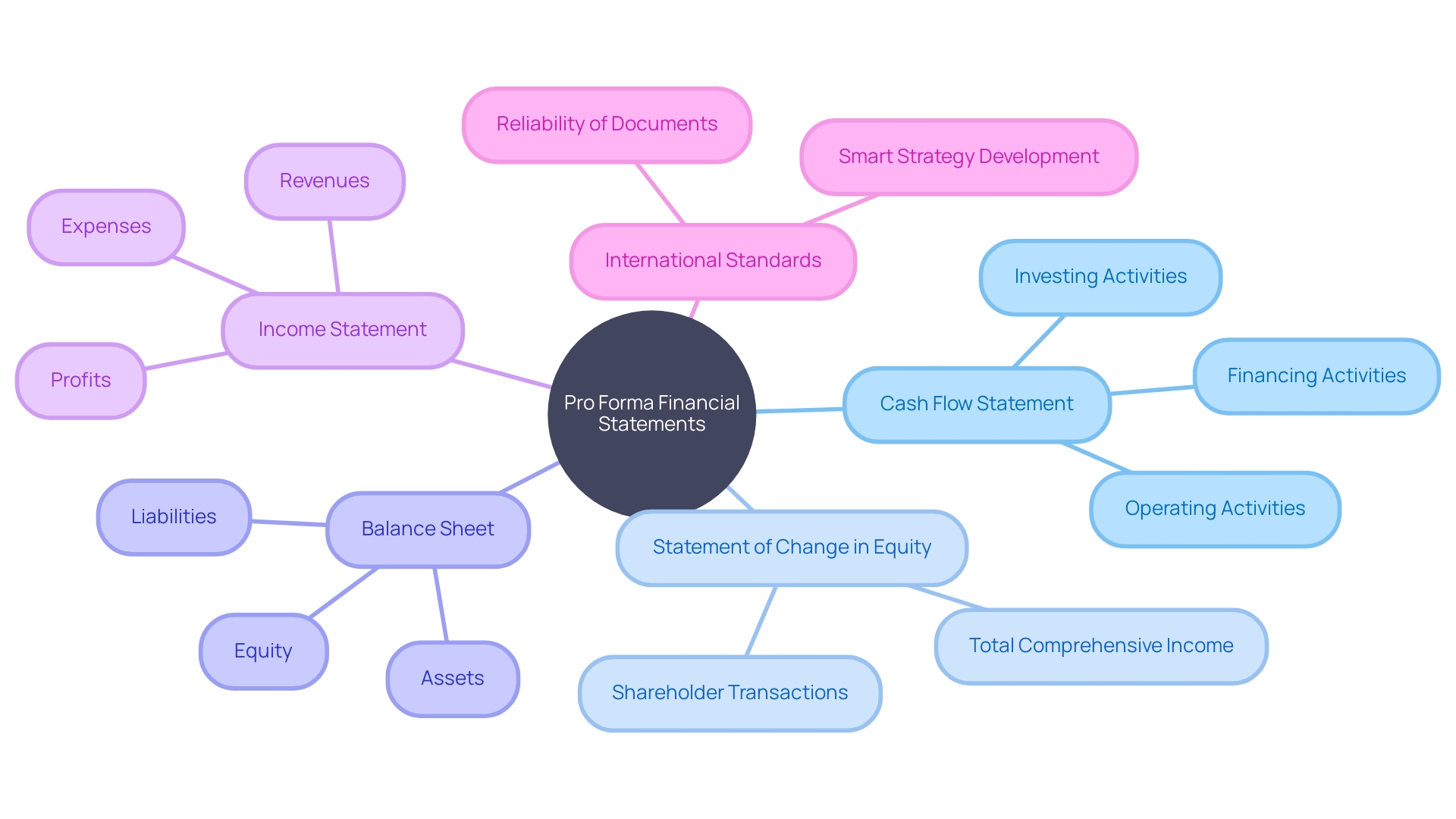

Types of Pro Forma Financial Statements

Pro forma financial statements are pivotal tools for forecasting a company's financial trajectory. Rooted in the principles of double-entry accounting pioneered by Luca Pacioli, they enable an exploration beyond static numbers and infer dynamic impacts across the balance sheet, income statement, and cash flow statement – the three financial statements intricately connected with each other.

By simulating different financial scenarios, pro forma statements offer an insightful peek into a company’s future financial health, potential risks, and opportunities. They are particularly revelatory when evaluating the going concern assumption, ensuring that the company is presumed to continue its operations unless facing imminent liquidation.

Utilizing such foresighted analyses is more than just a compliance adherence to the generally accepted accounting principles (GAAP); it's an internal audit into whether the financial resources at hand suggest robust continuity or 'substantial doubt' – a term auditors use to signal caution regarding a company's ability to meet forthcoming obligations. A pro forma statement dissects a business's responses to market fluctuations, customer preferences, and technological innovation, helping to assess operational agility and strategic foresight. Not only does it reflect on past financial performance, but it also scrutinizes operational efficiency and marketing initiatives, asking fundamental questions about financial goal realization, cost management, and customer engagement success.

Creating a Pro Forma Balance Sheet

Crafting a pro forma balance sheet is an exercise in foresight, allowing businesses to make strategic decisions with a comprehensive outlook on financial standing. By aligning a company's assets, liabilities, and shareholder equity, this forward-looking tool can signal the financial trajectory and aid in critical planning stages.

Particularly for construction businesses, where assets and expenses might blur lines, clarity is found in the balance sheet's structure. Assets are not merely what a company owns but what it can leverage for growth.

Liabilities, while denoting debts, are obligations key to progress. Equity—shareholders' investment—embodies the tangible confidence in a business's future. Whether assessing creditworthiness or mapping out ambitions, the balance sheet transcends simple accounting; it's a blueprint for stability and success. Remember, comprehending what comprises a balance sheet compared to immediate expenses is vital—ensuring accuracy not just in reporting but in strategizing for short, medium, and long-term objectives.

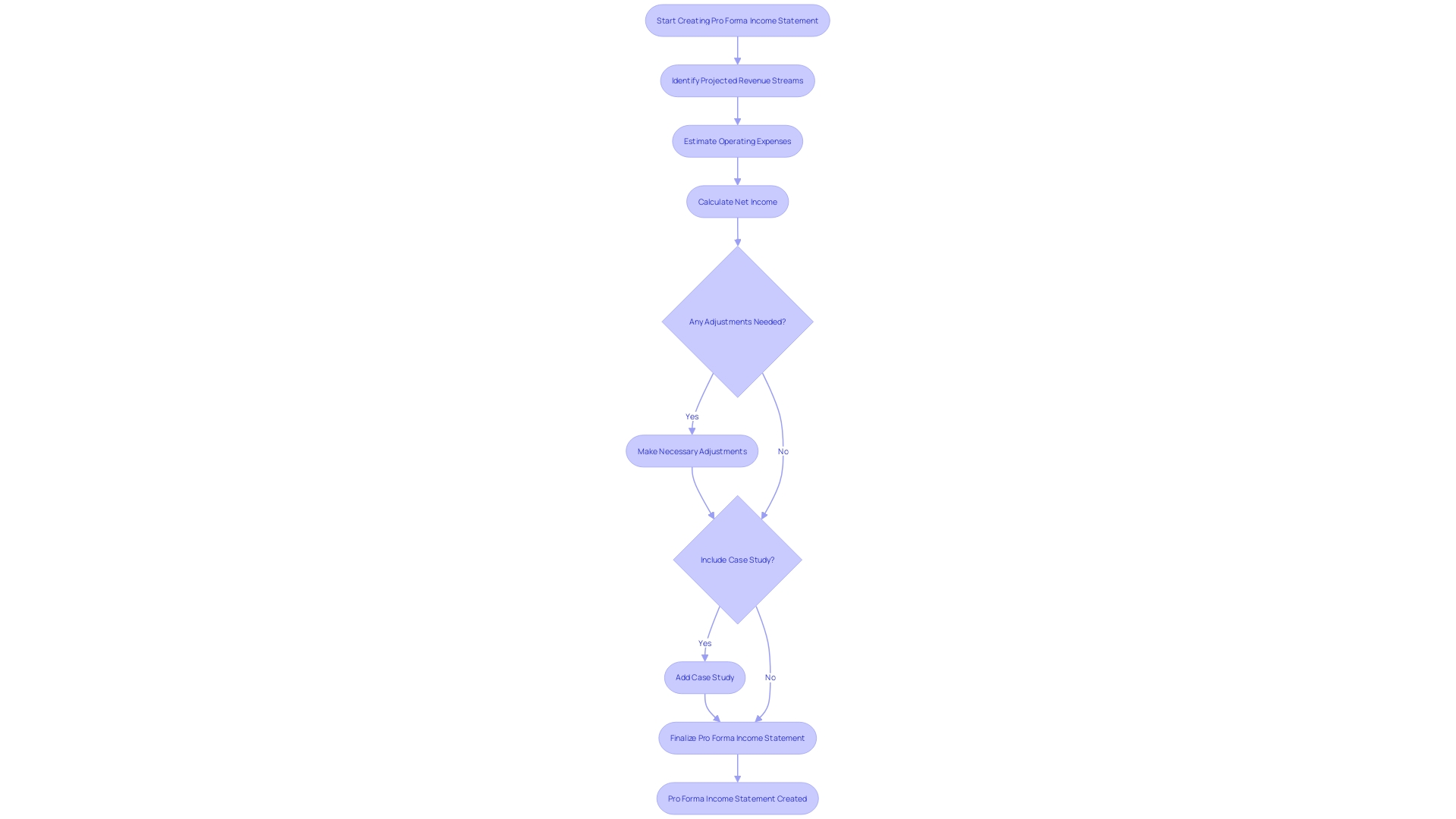

Pro Forma Income Statement: A Step-by-Step Guide

Crafting a pro forma income statement is a fundamental exercise for a company to anticipate financial performance in the coming periods. This predictive document starts with projecting your revenue streams, which provides the bedrock for modeling the expected financial activities.

Differentiating from a historical income statement, a pro forma version considers potential adjustments such as new contracts or changes in the market environment. After forecasting sales, the next step narrows in on the expenses; this includes cost of goods sold, operating expenses, and possibly interest and taxes, depending on the comprehensive nature of your analysis.

Throughout this estimation phase, it is crucial to keep in mind the Pay Yourself First (PYF) principle--ensuring that returns are allocated appropriately, supporting the financial health of the business owner. As the final touchstone, the net income projection culminates from deducting the anticipated expenses from the projected revenues.

This figure tells the tale of potential profitability and cash viability, which is invaluable for strategic decision-making. Inclusion of a relevant case study can elucidate the pro forma's practical application, illustrating a previous problem, the applied methodology, and quantifiable outcomes, such as improved cash flow or profitability. To underscore the importance of this exercise, insights offered by the Global State of Business Analysis Report become relevant. Data indicates a heightened engagement with such strategic tools as professionals across varied industries aim to comprehend and steer their operations amid evolving business landscapes. The statement of change in equity, often accompanying the pro forma income statement, provides an additional lens by which to gauge the strategic movements affecting shareholder value—making it essential to not only consider the immediate operational cash flows but also the broader financial implications.

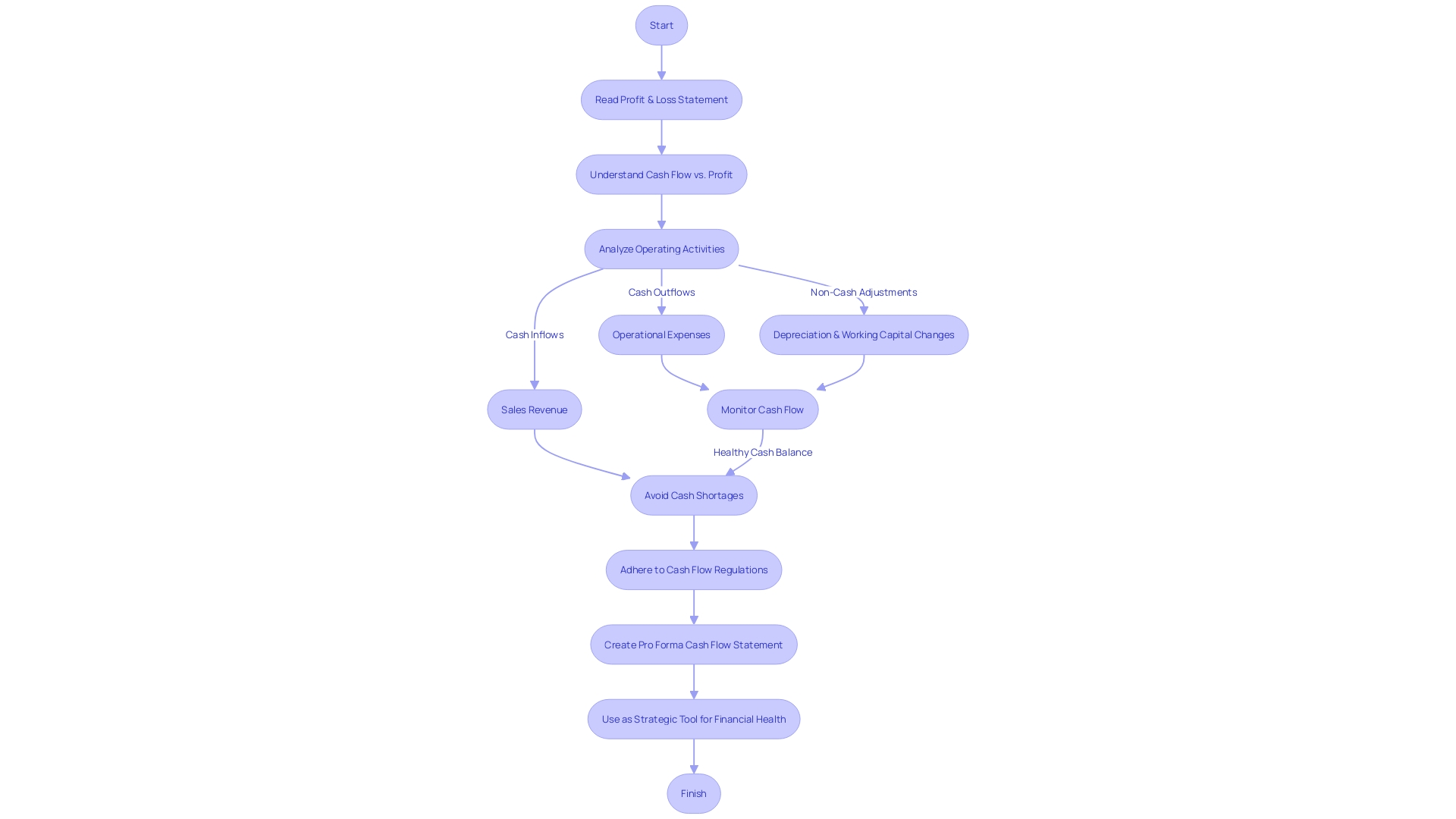

Pro Forma Cash Flow Statement: Importance and Examples

Understanding the dynamics of the pro forma cash flow statement is essential for companies to manage their financial health. It serves not just as a ledger of cash transactions but as a strategic tool, elucidating the cash inflows from sales or services and outflows from expenses and investments.

Key components of this financial report include operating activities, which represent the core business operations. They track the cash generated by sales and account for expenses as well as non-cash items such as depreciation, allowing for a thorough analysis of the business's core profitability.

For example, a case study from the Chiba Prefecture, where a client pursued an Akiya property, underscores the cash flow implications of significant transactions. Starting with an initial payment of ¥220,000, every subsequent expense and income in the project needed to be detailed for precise cash flow forecasting.

It reflects the importance of capturing all financial activities, from property acquisition to renovation costs, in the cash flow statement for clear-cut financial decision-making. Moreover, regulations such as the U.S. requirement for businesses to report cash transactions over $10,000 via Form 8300 emphasize the necessity for transparency and accuracy in cash flow reporting.

It's not simply about legality; it's about maintaining a clear picture of business transactions, thereby avoiding the devastating consequences of cash shortages. With every cash transaction impacting the company's liquidity, the pro forma cash flow statement becomes indispensable in avoiding such financial pitfalls. Insights from financial experts highlight that mastering cash flow management can forge a pathway to sustainable profits. It's not just the steady influx or outgo of funds that matters but also preempting cash shortages and ensuring a healthy financial balance. In this light, the pro forma cash flow statement is a beacon, guiding businesses through the tumultuous waters of financial planning and strategic investment.

Real-World Applications of Pro Forma Financial Statements

Pro forma financial statements are a distinctive tool that businesses utilize to forecast future financial health. A pivotal component lies within the cash flow statement, a robust report documenting a firm's internal monetary movement.

Not only does it track cash influx from operational activities and external financial inputs, but it also covers the exodus tied to various business undertakings and investment channels. Analyzing this statement is key to determining whether a company can sustain its operations through generated cash or if it has to tap into external funding, shedding light on its cash management and fiscal stability.

The statement of change in equity, also referred to as the statement of retained earnings, provides a granular look at variations in a firm’s equity throughout an accounting cycle. It reveals how decisions such as net earnings distribution and dividend allocations impact shareholder value.

This insight is invaluable in illustrating the direct financial outcomes of strategic business maneuvers. Additionally, a comprehensive financial report—which includes the balance sheet and income statement—furnishes stakeholders with a transparent view into the company's finances. These reports make it notably easier to evaluate assets, liabilities, and net income, essentially painting a vivid picture of a firm's overall financial condition. Compliance with international standards assures the reliability of these financial documents, which serve as the foundation for smart strategy development. To understand the full potential of pro forma statements, consider delving into financial report examples that deftly convey complex financial data.

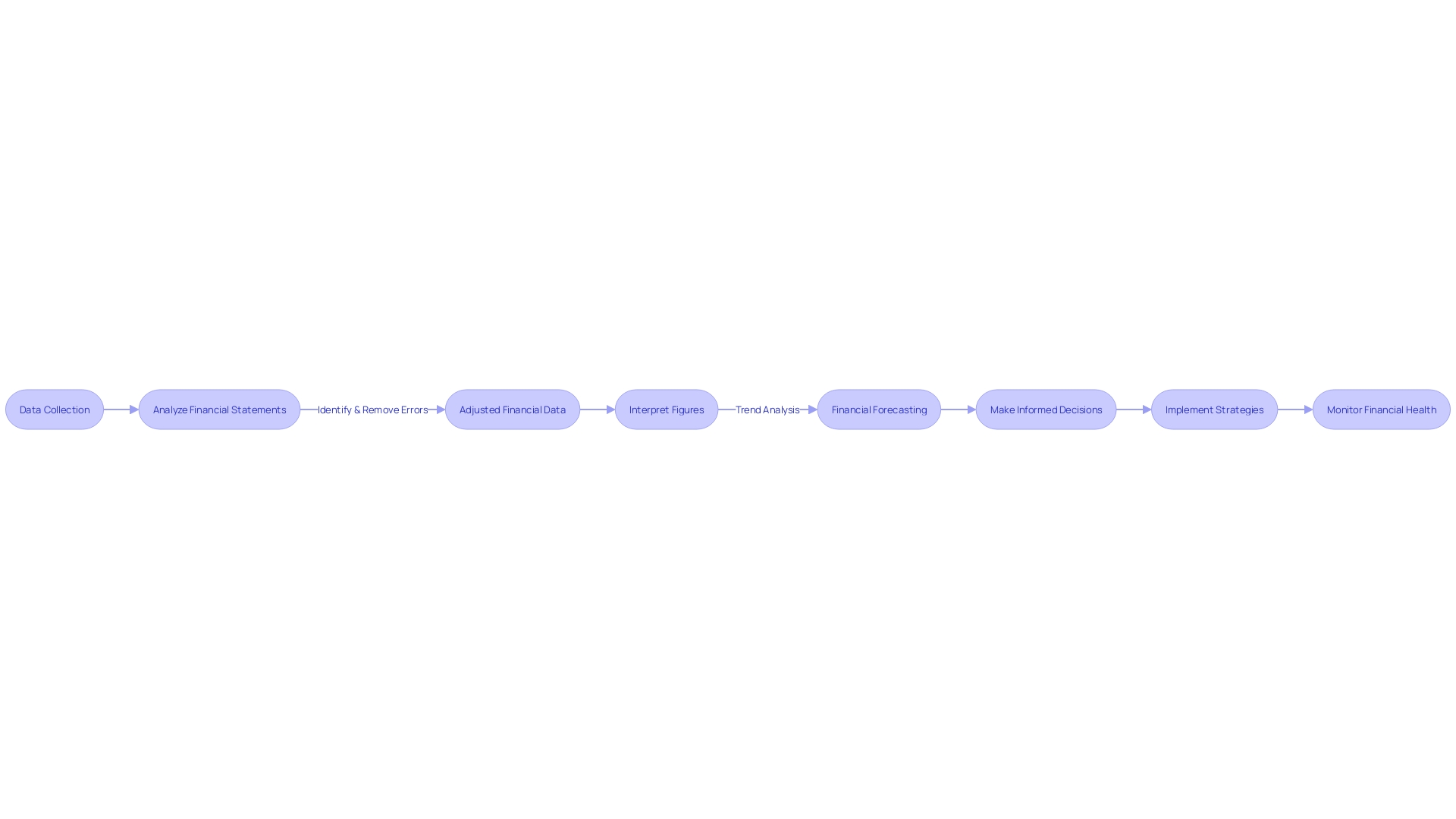

Best Practices for Preparing Pro Forma Financial Statements

When compiling pro forma financial statements, precision and dependability are paramount. These statements are not mere representations but analytical tools that provide a glimpse into an organization's financial trajectory. For instance, consider the importance of cash flow statements: they weave a story of money's journey through a business, charting every cash inflow from daily operations to external funding and every outflow from regular business activities to strategic investments.

These statements allow us to discern whether a company sustains itself on its revenues or leans on borrowed capital. With that in mind, the preparation of pro forma financial statements must involve meticulous data analysis, encompassing the elimination of errors to ensure accuracy and transforming data for efficient scrutiny. A balanced approach to transformation and reduction of data not only streamlines analysis but avoids the pitfalls of misinterpreting figures, like the misleading bid/ask bounce effect where price fluctuations could misdirect readers.

Additionally, the report puts a spotlight on the company's financial health through the statement of change in equity, also known as retained earnings statement. This reflects shifts in a company's equity that reveal financial decisions affecting shareholder value, such as net profits or losses and dividend distributions. Coupling these insights with robust financial forecasting techniques, pro forma financial statements can become a cogent narrative of an organization's potential and help stakeholders make informed, strategic decisions.

Common Mistakes to Avoid in Pro Forma Financial Statements

In the realm of financial forecasting, pro forma financial statements stand as beacons, guiding stakeholders through the fiscal implications of business decisions. However, their accuracy hinges on a meticulous understanding of cash flows and equity changes. To avoid missteps, it's paramount to encompass the full spectrum of cash activities, including operational earnings and external investments.

Such extensive coverage unveils whether operational prowess or financial leverage is fueling the enterprise. Within the arteries of the cash flow statement, one uncovers the company's mastery over its financial lifelines, ensuring operational activities generate sustainable cash flows, not merely external capital injections. The statement of change in equity, or the statement of retained earnings, serves as a magnifying glass on shareholder equity's fluctuating landscape.

This financial chapter reveals the narratives of profit reinvestment or distribution, painting a vivid picture of how the company's financial strategies resonate with shareholder interests. Together, these documents form a triptych of fiscal truth, alongside the balance sheet and income statement, under the vigilant eye of standards such as the International Financial Reporting Standards and the Generally Accepted Accounting Principles. By delving into our expertly curated set of 15 financial report examples, one gains the acumen to navigate the complexities of financial data and best practices in crafting pro forma statements to represent the true financial portrait of a company.

Conclusion

In conclusion, pro forma financial information is a powerful tool for strategic financial planning. It allows businesses to project their future performance based on hypothetical scenarios, while adhering to regulations and compliance.

By creating comprehensive pro forma financial statements, including the balance sheet, income statement, and cash flow statement, businesses can gain insights into their financial trajectory, operational efficiency, and strategic foresight. Crafting a pro forma balance sheet provides a blueprint for stability and success, aligning assets, liabilities, and shareholder equity to support short, medium, and long-term objectives.

The pro forma income statement anticipates financial performance by projecting revenue streams and assessing potential profitability. Real-world case studies exemplify practical applications, such as improved cash flow and profitability.

The pro forma cash flow statement is essential for managing financial health and guiding decision-making. It reveals core profitability, emphasizes transparency and accuracy, and supports effective cash flow management.

These pro forma financial statements have real-world applications, enabling businesses to forecast financial health, assess cash management, and provide stakeholders with a transparent view of the company's finances. To prepare accurate pro forma financial statements, businesses must prioritize precision and dependability. Meticulous data analysis, elimination of errors, and understanding the statement of change in equity are necessary for accurate forecasting. In summary, pro forma financial information empowers CFOs and financial planning professionals to make informed, strategic decisions. By following best practices, businesses can harness the power of pro forma statements to navigate the complexities of financial planning and drive their financial future.