Overview

Proven strategies for stakeholder management tailored for CFOs encompass the identification of key stakeholders, the establishment of clear communication channels, and the leveraging of technology for real-time engagement and feedback. These practices not only enhance relationships and trust but also align financial strategies with organizational goals. Consequently, they drive better financial performance and sustainable growth. Embracing these strategies is essential for CFOs aiming to foster robust stakeholder relationships and achieve long-term success.

Introduction

In the dynamic landscape of modern business, effective stakeholder management has emerged as a critical competency for Chief Financial Officers (CFOs). As organizations navigate complex relationships with various stakeholders—including investors, employees, and regulatory bodies—CFOs must adeptly balance diverse interests to drive financial performance and ensure organizational success. This article delves into the multifaceted world of stakeholder management from a CFO's perspective, exploring essential strategies for:

- Identifying key stakeholders

- Crafting tailored engagement plans

- Leveraging technology for enhanced communication

With a focus on real-time analytics and proactive feedback mechanisms, CFOs can foster collaboration and trust, ultimately leading to sustainable growth and improved business outcomes. Through insightful case studies and practical recommendations, this exploration highlights the indispensable role of stakeholder management in achieving both financial and social objectives.

Understanding Stakeholder Management: A CFO's Perspective

Stakeholder oversight involves the systematic identification, analysis, and engagement of individuals and groups with a vested interest in a company's operations and decisions. For CFOs, mastering this concept is essential, as it directly correlates with financial performance and overall organizational success. A study suggests that the favorable connection between ESG performance and company performance is predominantly influenced by environmental and social performance, underscoring the importance of engaging with interested parties to achieve financial success.

Effective management of involved parties necessitates employing strategies for stakeholder management to comprehend the varied interests and influences of these groups, including:

- Investors

- Employees

- Customers

- Regulatory bodies

The role of a CFO transcends traditional financial stewardship; it requires cultivating relationships and trust with these parties to encourage collaboration and propel strategic initiatives forward. Our team advocates for a shortened decision-making cycle throughout the turnaround process, enabling financial executives to take decisive actions that preserve business value.

We utilize a client dashboard that provides real-time business analytics, facilitating continuous performance monitoring and informed decision-making. As Jim Eckenrode, Managing Director at Deloitte Services LP, wisely observed, "Fortune favors the bold," emphasizing the significance of decisive action in engaging with parties of interest.

Moreover, we continually monitor the success of our strategies through real-time business analytics, ensuring ongoing business performance monitoring and relationship-building. By emphasizing the oversight of involved parties, financial officers can ensure that their fiscal strategies align with broader organizational goals, employing strategies for stakeholder management to promote better results and enduring growth. Furthermore, our team collaboratively identifies underlying business issues and creates actionable plans while rigorously testing every hypothesis to maximize returns on invested capital.

The case study of Dr. Engr Moses Musaazi, a social entrepreneur in Uganda, demonstrates how creative involvement from interested parties can significantly influence social enterprises, providing valuable insights for financial executives seeking to enhance their strategies. This approach not only aligns with conventional financial measures but also improves the efficiency and impact of social enterprises, broadening the scope of interest group oversight.

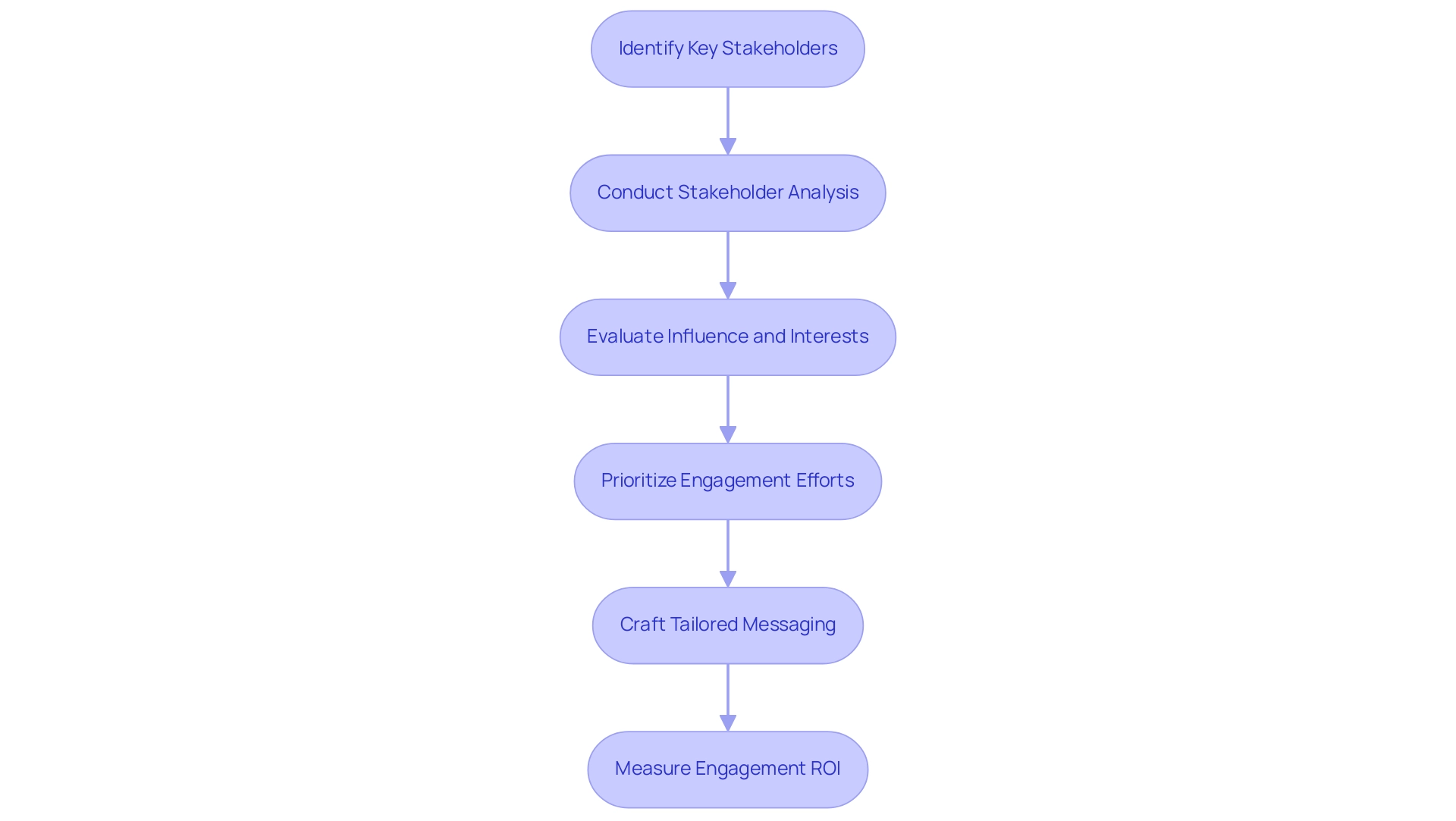

Identifying and Analyzing Key Stakeholders

To effectively manage interested parties, CFOs must first identify their key individuals. This group includes not only those with direct financial interests—such as investors and board members—but also employees, customers, suppliers, and the broader community. A recent study involving 320 respondents from the Ghanaian mining industry underscores that effective strategies for stakeholder management are vital for achieving organizational goals and minimizing relationship severances, particularly during critical processes like business succession.

Once interested parties are identified, conducting a thorough analysis becomes essential. This analysis evaluates each party's influence, interest, and potential impact on the organization. Tools such as power-interest grids are invaluable for categorizing relevant parties based on their level of influence and the significance of their interests.

By grasping these dynamics, CFOs can prioritize their engagement efforts and customize their strategies for stakeholder management to address the unique needs and concerns of each interested party. For instance, while investors may prioritize financial returns, employees often focus on job security and workplace culture. Acknowledging these differing priorities is crucial for fostering strong relationships. As one specialist pointed out, "39% of social media users desire prompt replies," which highlights the importance of rapid and efficient interaction tactics among all involved parties.

This underscores the necessity of crafting tailored messaging that aligns with strategies for stakeholder management, resonating with each group’s unique concerns and expectations.

Moreover, the concept of Engagement ROI, which evaluates the costs and benefits of participant involvement, emphasizes the importance of measuring communication quality, task completion rates, and alignment with project goals. By leveraging real-time analytics and streamlined decision-making processes, organizations can enhance their strategies for stakeholder management, manage risks effectively, and improve overall project outcomes. Specifically, the insights gained from real-time analytics can inform CFOs on how well participants are engaged and whether their needs are being met, allowing for decisive actions to be taken when necessary.

Utilizing a client dashboard for ongoing performance monitoring can offer these insights, reinforcing the significance of a shortened decision-making cycle in addressing the needs of interested parties. This comprehensive method for analyzing involved parties not only aids in identifying key individuals but also strengthens the foundation for sustainable organizational success.

Crafting an Effective Stakeholder Management Strategy

An effective strategy for stakeholder management consists of several crucial elements that CFOs must prioritize. First, defining clear objectives for participant engagement is essential, ensuring alignment with the overarching business strategy. This alignment not only clarifies the purpose of engagement but also enhances the likelihood of achieving desired outcomes.

In fact, among all low-performing companies, only 36% of teams are successfully completing projects, underscoring the critical role of effective management of involved parties in project success.

Next, establishing robust communication protocols is vital. These protocols should outline how and when involved parties will be engaged, incorporating regular updates, feedback sessions, and opportunities for open dialogue. Considering that 39% of social media users anticipate prompt replies, it is essential for financial leaders to implement swift tactics that address all interest groups. This need for speed in interaction is essential for maintaining engagement and trust.

Leveraging technology plays a significant role in facilitating effective interaction and engagement. Utilizing management software can simplify the monitoring of interactions and feedback, enabling financial executives to respond swiftly and efficiently. This technological integration is particularly important as studies indicate that most users engage with an app for only 3-7 days; if their experience is not impressive, retention becomes challenging. This emphasizes the significance of sustaining engagement with interested parties over time through ongoing communication and relationship management.

Moreover, identifying underlying business issues, developing strategic plans, and continuously monitoring performance with real-time analytics through a client dashboard can further enhance relationships with those involved. By employing a pragmatic approach to data, financial executives can test every hypothesis to maximize returns on invested capital, both in the short and long term. Consistently assessing and improving strategies for stakeholder management based on feedback and changing situations is vital.

By proactively managing these relationships, CFOs can employ strategies for stakeholder management to foster trust and collaboration, which are critical for navigating challenges and achieving financial goals. The popularity of methodologies like Scrum, embraced by 71% of US companies employing Agile frameworks, emphasizes the effectiveness of organized approaches in engaging parties, underscoring the necessity for ongoing enhancement and adjustment in strategies for stakeholder management. Furthermore, for every $1 invested in UX, there is a potential return of $100, equating to a 9,900% return, illustrating the financial advantages of investing in strategies for stakeholder management.

This iterative process of 'Decide & Execute' and 'Update & Adjust' ensures that management of interested parties remains dynamic and responsive to changing business needs.

Establishing Clear Communication Channels with Stakeholders

Implementing strategies for stakeholder management necessitates the establishment of clear dialogue pathways with involved parties, a vital component for fostering transparency and trust. CFOs should formulate comprehensive strategies for stakeholder management that delineate the frequency, format, and content of interactions with interested parties. This plan may encompass regular financial updates, newsletters, and dedicated meetings with key stakeholders to ensure consistent engagement, particularly in today's fast-paced business environment.

Given that interaction with colleagues occupies 72% of the work week, the integration of digital tools, such as webinars and collaborative platforms, can significantly enhance engagement with interested parties, ensuring they receive timely and relevant information. Furthermore, it is crucial for CFOs to promote bidirectional dialogue, allowing participants to express their concerns and provide feedback. This approach not only fortifies relationships but also generates valuable insights that can inform strategies for stakeholder management and strategic decision-making.

For instance, during economic downturns, transparent communication regarding challenges and recovery plans can sustain investor confidence and support. As noted by Nadege Minois, a Project Management Consultant, 'Project managers who prioritize open and transparent dialogue foster an environment of trust, collaboration, and innovation, allowing teams to navigate challenges and seize opportunities with confidence.' This underscores the importance of efficient dialogue pathways in managing interested parties, especially in 2025, when 85% of employees utilize various messaging devices at work.

Moreover, leveraging real-time analytics through tools like client dashboards can augment strategies for stakeholder management by enhancing the monitoring of business performance and providing interested parties with up-to-date insights into the organization's health. A recent analysis from the State of the Sector report revealed that while emails are the most frequently employed means of communication, they are not always the most effective. Conversely, live events and manager meetings have proven to be highly effective communication methods, indicating that businesses should diversify their communication strategies to improve engagement with stakeholders.

Additionally, a shortened decision-making cycle is essential during the turnaround process, empowering CFOs to act decisively and promptly. This agile approach not only aids in addressing immediate challenges but also fosters a proactive environment where participants feel informed and engaged. This is further supported by the case study titled 'Workplace Interaction Channels Usage and Effectiveness,' which emphasizes the necessity for organizations to assess and adapt their strategies in response to these insights.

Managing Stakeholder Expectations for Successful Outcomes

Effectively managing participant expectations is contingent upon robust strategies for stakeholder management, which necessitate proactive engagement and transparent communication, particularly in the realm of real-time analytics. Chief Financial Officers must set realistic expectations from the outset by explicitly defining goals, timelines, and potential challenges. By 2025, with the average B2B sales process extending 25% longer than five years prior and involving diverse decision-makers, financial executives are tasked with the challenge of ensuring that participants remain informed and aligned with the organization's objectives.

Our team's commitment to a shortened decision-making cycle during the turnaround process empowers financial leaders to take decisive action to uphold business integrity. Regular updates on progress and any necessary adjustments to the initial plan are critical strategies for stakeholder management, as they help mitigate confusion and cultivate trust among involved parties. The 'Update & Adjust' process is essential, facilitating timely modifications based on feedback and performance data.

Addressing concerns or misconceptions promptly is crucial to prevent escalation into conflicts. By fostering a culture of openness and transparency, financial leaders can instill a sense of value and understanding among interested parties, ultimately resulting in heightened support for stakeholder management strategies. For example, during a financial restructuring, effectively communicating the rationale and anticipated outcomes can significantly alleviate anxiety among employees and investors alike.

Annemarie Bufe, a Content Manager, underscores the significance of first impressions, stating, 'It takes less than 500ms, or even just 50ms, to make a good first impression.' This highlights the imperative for financial leaders to communicate clearly and confidently from the outset. To forge a powerful initial impression, financial leaders can implement stakeholder management strategies by crafting clear and impactful messages that resonate with the interests and concerns of those involved.

Furthermore, our client dashboard facilitates continuous monitoring of business performance, delivering real-time analytics that assist in diagnosing business health and informing relationship-building strategies. For instance, the dashboard tracks key performance indicators such as revenue growth, customer satisfaction scores, and operational efficiency metrics, enabling financial executives to make informed decisions. Case studies reveal that firms investing in ongoing, customized training for their sales teams experience substantial returns on investment, and this continual enhancement in interaction strategies encompasses stakeholder management, ensuring that financial executives are equipped to engage effectively.

Moreover, with 87% of sales representatives believing that face-to-face client engagement remains essential, personal interaction is a vital component of relationship oversight. Additionally, as 56% of sales experts leverage social media to identify new prospects, financial executives should embrace contemporary communication techniques to refine their engagement strategies.

Implementing Feedback Mechanisms for Continuous Improvement

Implementing feedback mechanisms is essential for fostering continuous improvement in strategies for stakeholder management. Chief financial officers must prioritize establishing regular touchpoints for collecting feedback from interested parties by utilizing strategies for stakeholder management, including methods such as surveys, interviews, and dedicated feedback sessions. This proactive approach yields valuable insights into participant perceptions and satisfaction levels, enabling financial leaders to identify areas requiring improvement and adjust their strategies for stakeholder management accordingly.

Continuous engagement efforts are critical strategies for stakeholder management to sustain participant involvement and satisfaction, ensuring that individuals feel valued and heard.

For instance, if interested parties express concerns about the frequency of interactions, CFOs can implement strategies for stakeholder management to adjust their engagement and provide more regular updates, supported by real-time analytics from the client dashboard that track participant sentiment and engagement levels. Moreover, cultivating a culture of feedback serves as one of the key strategies for stakeholder management, encouraging participants to express their thoughts candidly, which in turn strengthens relationships and promotes enhanced collaboration.

Anuj Nandurkar, a Business Analyst at Accolite Digital, emphasizes the importance of this approach: "Creating a feedback loop for involved parties is essential for maintaining ongoing communication and ensuring that their needs, concerns, and suggestions are continuously addressed throughout the project lifecycle."

By actively seeking and responding to feedback, CFOs not only demonstrate their commitment to engaging with interested parties but also implement strategies for stakeholder management that lay the groundwork for continuous improvement and a shortened decision-making cycle. This strategy is especially significant in 2025, as organizations increasingly acknowledge the value of involving lower voice and value contributors in high-impact projects, fostering growth and satisfaction across the board. The case study titled 'Balancing Diverse Interests' illustrates that navigating diverse expectations requires clear communication and a commitment to transparency.

Investing in robust feedback loops supported by real-time business analytics is one of the key strategies for stakeholder management, leading to project success and satisfaction among involved parties, ultimately fostering a culture of trust and collaborative problem-solving. This aligns with the understanding that the success of a project is subjective, driven by relationships and reputation, further underscoring the importance of feedback from involved parties.

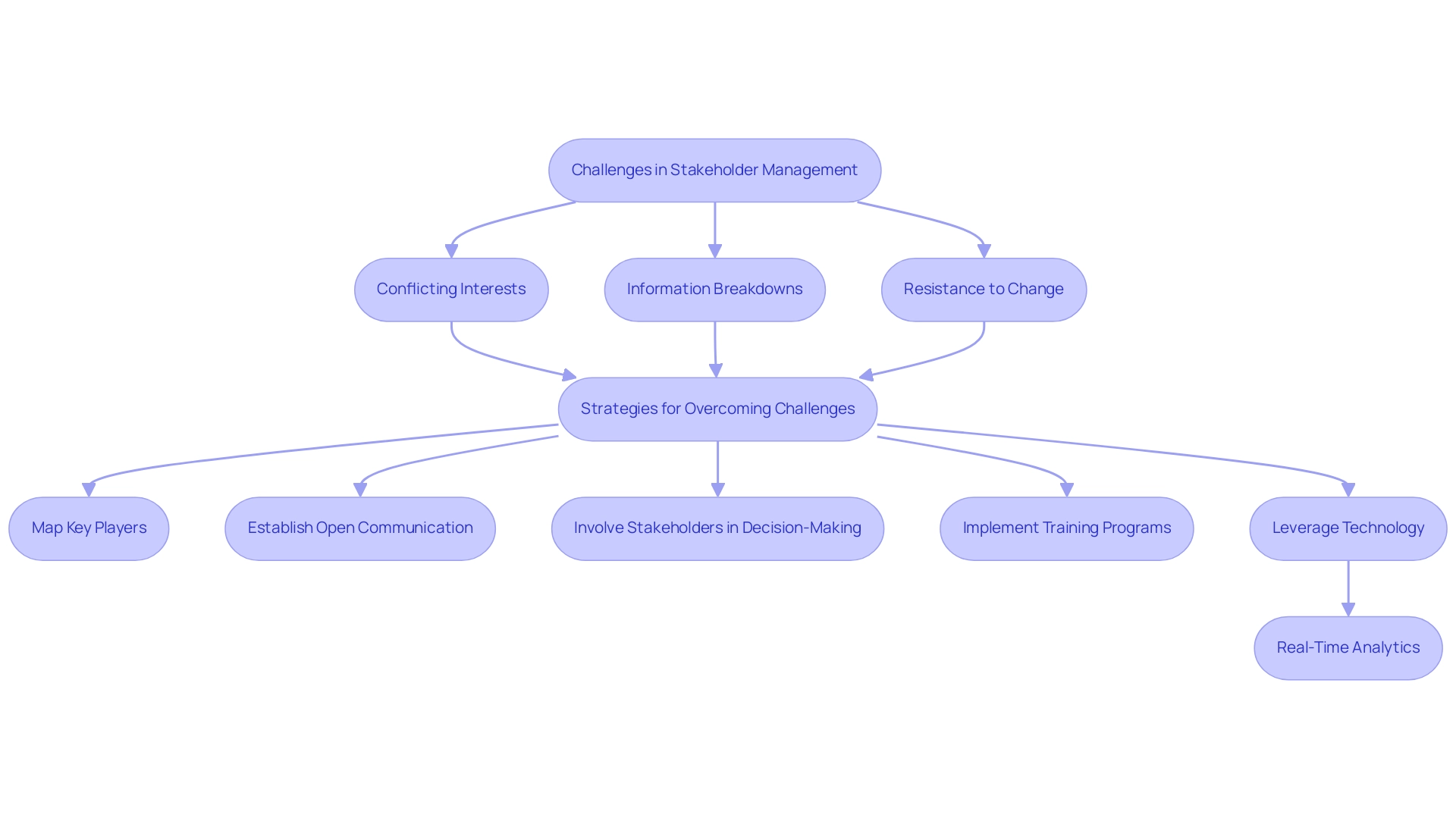

Overcoming Common Challenges in Stakeholder Management

Financial executives frequently face significant challenges in managing relationships, including conflicting interests, information breakdowns, and resistance to change. To effectively navigate these obstacles, it is crucial to implement robust strategies for stakeholder management. One effective approach is mapping key players, enabling CFOs to identify and comprehend the diverse interests and influences at play within their organization.

This early identification of potential conflicts facilitates timely interventions.

Moreover, establishing open communication channels is essential for the effective implementation of stakeholder management strategies, allowing concerns to be addressed before they escalate into larger issues. Involving interested parties in the decision-making process is vital for effective stakeholder management, as it fosters transparency and mitigates resistance to change by providing a sense of ownership over outcomes. For instance, during a significant organizational transition, engaging key participants in discussions about the changes can lead to increased buy-in and support.

Statistics reveal that high-performing organizations are more likely to implement formal project training programs, with 85% offering such training compared to only 38% of low-performing organizations. This underscores the importance of equipping teams with the necessary skills to manage relationships effectively. Additionally, 61% of high-performing organizations provide leadership training, further emphasizing the necessity for skill enhancement in engaging with stakeholders.

As Cirtuo aptly states, "Organizations that prioritize engagement with interested parties are better positioned to create strategies for stakeholder management that align with organizational goals and deliver value."

Leveraging technology is increasingly vital in implementing stakeholder management strategies. For example, real-time business analytics through client dashboards can assist financial leaders in continuously monitoring the success of their initiatives and operationalizing lessons learned from past turnaround experiences. A practical illustration of this is showcased in the case study titled "Be Ready When Conditions Change," where Decision Lens utilizes AI to assess various scenarios and their impacts on organizational goals.

This approach allows for real-time budget monitoring and enables organizations to track expenditures against planned budgets, facilitating corrective actions to avoid financial discrepancies.

To further enhance decision-making, financial leaders should embrace a culture of testing hypotheses, enabling them to evaluate the effectiveness of their strategies before full implementation. By anticipating and addressing these challenges, CFOs can navigate the complexities of management with greater efficacy, ultimately leading to improved organizational outcomes. Furthermore, a commitment to operationalizing lessons learned throughout the turnaround process is crucial for developing strong, lasting relationships with stakeholders.

Conclusion

Effective stakeholder management stands as a pivotal competency for CFOs navigating the complexities of modern business. By identifying key stakeholders and understanding their diverse interests, CFOs can craft tailored engagement strategies that promote collaboration and trust. Moreover, leveraging technology—such as real-time analytics and client dashboards—enhances communication and ensures that stakeholder needs are continuously addressed.

Establishing clear communication channels and implementing feedback mechanisms are critical for fostering transparency and aligning expectations. Proactive engagement mitigates conflicts and resistance, while ongoing feedback allows organizations to adapt and refine their strategies dynamically. The importance of cultivating a culture of openness cannot be overstated, as it lays the foundation for strong relationships and supports successful organizational outcomes.

In conclusion, the role of stakeholder management in achieving financial and social objectives is indispensable. As CFOs embrace these strategies, they not only drive financial performance but also contribute to sustainable growth and organizational success. By prioritizing effective stakeholder engagement, organizations can navigate challenges with confidence, ensuring that all voices are heard and valued in the decision-making process. The path to success lies in a commitment to continuous improvement and the strategic alignment of stakeholder interests with broader business goals.

Frequently Asked Questions

What is stakeholder oversight?

Stakeholder oversight involves the systematic identification, analysis, and engagement of individuals and groups with a vested interest in a company's operations and decisions. It is crucial for CFOs as it directly correlates with financial performance and overall organizational success.

Why is stakeholder engagement important for financial performance?

Engaging with stakeholders is essential as it influences a company's ESG (Environmental, Social, and Governance) performance, which in turn affects overall company performance. Effective engagement helps achieve financial success by aligning the interests of various parties.

Who are the key stakeholders that CFOs should manage?

Key stakeholders include investors, employees, customers, and regulatory bodies. Understanding their varied interests and influences is critical for effective stakeholder management.

What role does a CFO play in stakeholder management?

A CFO's role extends beyond traditional financial stewardship to include cultivating relationships and trust with stakeholders, encouraging collaboration, and propelling strategic initiatives forward.

How can real-time business analytics assist CFOs in stakeholder management?

Real-time business analytics facilitate continuous performance monitoring and informed decision-making, allowing CFOs to engage effectively with stakeholders and ensure that fiscal strategies align with organizational goals.

What is the significance of a shortened decision-making cycle in stakeholder management?

A shortened decision-making cycle enables financial executives to take decisive actions that preserve business value and respond promptly to the needs of stakeholders.

How does stakeholder analysis benefit organizations during critical processes?

Conducting a thorough analysis of stakeholders helps identify their influence, interests, and potential impacts, which is vital for achieving organizational goals and minimizing relationship severances, especially during processes like business succession.

What is Engagement ROI and why is it important?

Engagement ROI evaluates the costs and benefits of participant involvement, emphasizing the importance of measuring communication quality and alignment with project goals. It helps organizations manage risks effectively and improve overall project outcomes.

How can tailored messaging improve stakeholder relationships?

Crafting tailored messaging that resonates with the unique concerns and expectations of each stakeholder group fosters strong relationships and enhances engagement by addressing their specific needs.

What insights can CFOs gain from utilizing a client dashboard for stakeholder management?

A client dashboard provides ongoing performance monitoring insights, helping CFOs understand how well stakeholders are engaged and whether their needs are being met, thus allowing for timely and decisive actions.